Navigating the complex world of student loan debt can feel overwhelming, but understanding your options is key to financial freedom. Refinancing your student loans offers the potential for significant savings through lower interest rates and streamlined repayment plans. This guide explores the intricacies of student loan interest rate refinancing, empowering you to make informed decisions about your financial future.

This process involves replacing your existing student loans with a new loan from a different lender, often at a more favorable interest rate. However, it’s crucial to carefully weigh the benefits against potential drawbacks before proceeding. Understanding the factors influencing interest rates, eligibility requirements, and the long-term financial implications is paramount to making a successful decision.

Understanding Student Loan Interest Rates

Navigating the world of student loan refinancing can feel overwhelming, but understanding the intricacies of interest rates is a crucial first step. This section will clarify the factors influencing these rates, the differences between fixed and variable options, and provide a comparison of rates offered by various lenders. Armed with this knowledge, you can make informed decisions about refinancing your student loans.

Factors Influencing Student Loan Interest Rates

Several factors contribute to the interest rate you’ll receive on your student loan refinance. These factors are assessed by lenders to determine your creditworthiness and the associated risk of lending to you. Key factors include your credit score, credit history, debt-to-income ratio, loan amount, and the type of loan (federal vs. private). A higher credit score and a lower debt-to-income ratio generally lead to lower interest rates, reflecting a lower perceived risk for the lender. The loan amount itself can also play a role; larger loan amounts might carry slightly higher rates in some cases. Finally, the type of loan is a significant factor, with federal loans typically offering lower rates than private loans due to government backing.

Fixed Versus Variable Interest Rates

The choice between a fixed and a variable interest rate is a significant one. A fixed interest rate remains constant throughout the loan’s life, providing predictability in your monthly payments. A variable interest rate, on the other hand, fluctuates based on market indexes, such as the prime rate or LIBOR (although LIBOR is being phased out). While a variable rate might start lower than a fixed rate, it could increase significantly over time, leading to unpredictable and potentially higher overall costs. The best choice depends on your risk tolerance and financial outlook. If you prefer stability and predictability, a fixed rate is generally recommended.

Comparison of Interest Rates Offered by Various Lenders

Different lenders offer varying interest rates on student loan refinancing. These variations reflect their individual risk assessments and market positioning. Some lenders may focus on borrowers with excellent credit, offering highly competitive rates, while others may cater to a broader range of credit profiles, resulting in potentially higher rates. It’s crucial to shop around and compare offers from multiple lenders before making a decision. Factors like lender fees and customer service should also be considered alongside the interest rate. Remember, the lowest interest rate isn’t always the best deal if other fees or terms are unfavorable.

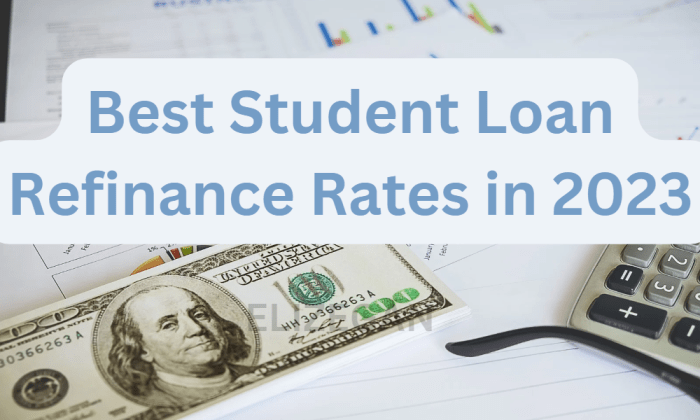

Interest Rate Comparison Table: Federal vs. Private Loans

The following table offers a sample comparison of interest rates for federal and private student loans. Keep in mind that these rates are illustrative and can vary depending on the lender, borrower profile, and prevailing market conditions. Always check with individual lenders for the most up-to-date information.

| Lender | Loan Type | Interest Rate Range (%) | Repayment Terms (Years) |

|---|---|---|---|

| Example Federal Lender (e.g., Federal Government) | Federal Direct Consolidation Loan | 4.00 – 7.00 | 10-20 |

| Example Private Lender A | Private Student Loan Refinancing | 5.50 – 9.00 | 5-15 |

| Example Private Lender B | Private Student Loan Refinancing | 6.00 – 10.00 | 5-15 |

| Example Private Lender C | Private Student Loan Refinancing | 4.50 – 8.50 | 5-10 |

The Refinance Process

Refinancing your student loans can be a complex but potentially rewarding process. It involves replacing your existing student loan(s) with a new loan, often at a lower interest rate, potentially saving you significant money over the life of the loan. Understanding the steps involved, eligibility requirements, and necessary documentation is crucial for a smooth and successful refinance.

The refinance process generally involves several key steps, from initial research and comparison shopping to final loan disbursement. Eligibility depends on factors such as credit score, income, and debt-to-income ratio. Gathering the required documents beforehand streamlines the application process considerably.

Steps Involved in Refinancing Student Loans

Successfully refinancing your student loans requires a methodical approach. Following a structured process increases your chances of securing favorable terms and a smooth transition.

- Research and Compare Lenders: Begin by researching different lenders offering student loan refinancing. Compare interest rates, fees, repayment terms, and other features to find the best option for your financial situation. Consider both online lenders and traditional banks.

- Check Your Credit Report: Before applying, review your credit report to identify and correct any errors. A higher credit score typically qualifies you for better interest rates.

- Gather Required Documents: Collect all necessary documents, including proof of income, employment history, and student loan details. Having these ready speeds up the application process.

- Complete the Application: Carefully complete the lender’s application, providing accurate and complete information. Inaccuracies can delay or even deny your application.

- Review and Accept Loan Terms: Once approved, thoroughly review the loan terms before accepting the offer. Understand the interest rate, repayment schedule, and any associated fees.

- Loan Disbursement: After accepting the offer, the lender will disburse the funds to pay off your existing student loans. This typically takes several weeks.

Eligibility Criteria for Student Loan Refinancing

Lenders use various criteria to assess eligibility for student loan refinancing. Meeting these requirements increases your chances of approval and securing a favorable interest rate.

- Credit Score: Most lenders require a minimum credit score, typically above 660-680. A higher score usually results in a lower interest rate.

- Debt-to-Income Ratio (DTI): Your DTI, which compares your monthly debt payments to your gross monthly income, is a key factor. A lower DTI generally improves your chances of approval.

- Income and Employment History: Lenders assess your income and employment stability to ensure you can make timely payments. Consistent employment history is beneficial.

- Type and Amount of Student Loan Debt: The type of student loans you have (federal or private) and the total amount of debt influence eligibility. Some lenders may specialize in refinancing certain types of loans.

- Co-signer (Optional): If you don’t meet the eligibility criteria on your own, a co-signer with good credit can improve your chances of approval.

Required Documents for Application

Having the necessary documents readily available simplifies and accelerates the application process. Being prepared minimizes delays and increases the likelihood of a successful refinance.

- Government-issued Photo ID: A driver’s license or passport is typically required for verification.

- Social Security Number (SSN): Your SSN is needed for identity verification and credit check.

- Proof of Income: Pay stubs, W-2 forms, or tax returns can be used to demonstrate your income.

- Student Loan Information: Details about your existing student loans, including loan amounts, interest rates, and lenders.

- Bank Statements: These may be requested to verify your financial stability and account information.

Step-by-Step Guide for Borrowers

A well-defined plan makes the refinancing process more manageable and less stressful. This guide provides a clear roadmap for borrowers considering refinancing.

- Assess Your Current Loans: Review your existing student loan details, including interest rates, balances, and repayment terms.

- Research Refinancing Options: Compare offers from different lenders, focusing on interest rates, fees, and repayment terms.

- Check Your Credit Score and Report: Improve your credit score if necessary and correct any errors on your credit report.

- Gather Required Documentation: Collect all necessary documents to streamline the application process.

- Complete and Submit the Application: Carefully complete the lender’s application and submit it along with the required documents.

- Review Loan Terms and Accept Offer: Thoroughly review the loan agreement before accepting the offer.

- Monitor Loan Payments: Make timely payments to maintain a good credit history.

Benefits and Drawbacks of Refinancing

Refinancing your student loans can be a significant financial decision, offering the potential for substantial savings but also carrying inherent risks. A thorough understanding of both the advantages and disadvantages is crucial before proceeding. This section will explore these aspects, enabling you to make an informed choice aligned with your individual financial circumstances.

Refinancing student loans primarily aims to reduce your monthly payments and overall interest costs. This is achieved by securing a new loan with a lower interest rate than your current loans, effectively replacing your existing debt. However, it’s essential to weigh these potential benefits against the potential drawbacks before making a decision.

Lower Interest Rates and Simplified Payments

One of the most attractive benefits of refinancing is the potential for significantly lower interest rates. Many private lenders offer rates that undercut those of federal student loans, particularly in a competitive lending environment. This translates to lower monthly payments and substantial long-term savings on interest. For example, refinancing from a 7% interest rate to a 4% interest rate on a $50,000 loan could save thousands of dollars over the life of the loan. The simplification of payments is another key benefit; consolidating multiple loans into a single, manageable payment stream can greatly improve financial organization and reduce administrative burden.

Loss of Federal Loan Benefits and Increased Risk

A primary drawback of refinancing is the potential loss of federal loan benefits. Federal student loans often come with protections such as income-driven repayment plans, deferment options during periods of financial hardship, and forgiveness programs for certain professions. Refinancing with a private lender typically forfeits these protections. Moreover, refinancing introduces increased risk. If your financial situation deteriorates, you may lose the safety net provided by federal loan programs. Furthermore, private lenders may have stricter eligibility requirements and less flexible repayment options compared to federal programs.

Long-Term Financial Implications

The long-term financial implications of refinancing depend heavily on individual circumstances and market conditions. If interest rates remain low or decrease further, refinancing can lead to substantial savings over the life of the loan. However, if interest rates rise significantly after refinancing, you might end up paying more in the long run compared to keeping your original federal loans. Careful consideration of prevailing interest rate trends and your own financial projections is crucial in determining the long-term viability of refinancing. For example, someone with a high credit score and stable income in a low-interest-rate environment might see significant benefits, while someone with a lower credit score or fluctuating income might be better served by keeping their federal loans.

Pros and Cons of Refinancing

| Pros | Cons |

|---|---|

| Lower interest rates resulting in lower monthly payments and significant long-term savings. | Loss of federal student loan benefits such as income-driven repayment plans and deferment options. |

| Simplified payment structure with a single monthly payment. | Increased risk associated with private lenders and their stricter eligibility requirements. |

| Potential for a shorter loan repayment term. | Higher risk of default if financial circumstances change. |

| Improved financial organization and reduced administrative burden. | Potential for higher interest rates in the future if rates rise after refinancing. |

Lender Comparison

Choosing the right lender for student loan refinancing is crucial, as interest rates, fees, and repayment terms can significantly impact your overall cost. A thorough comparison of different lenders is essential before making a decision. This section will analyze several prominent lenders, highlighting their key features and helping you navigate the selection process.

Lenders offer diverse terms and conditions, influencing the attractiveness of their refinancing options. Factors such as interest rates, loan amounts, repayment periods, and fees vary considerably. Understanding these differences is paramount to selecting a lender that aligns with your financial situation and goals.

Interest Rates and Fees

Interest rates are a primary factor in determining the cost of refinancing. They are usually expressed as an annual percentage rate (APR), which includes the interest rate plus any fees. Lenders often offer a range of APRs based on creditworthiness, loan amount, and other factors. Fees, such as origination fees or prepayment penalties, can also add to the overall cost. For example, Lender A might offer a lower APR but a higher origination fee compared to Lender B, making the overall cost comparable. It’s crucial to compare the total cost of the loan, not just the interest rate alone.

Repayment Terms and Loan Amounts

Repayment terms, typically ranging from 5 to 20 years, influence your monthly payments and the total interest paid over the life of the loan. Shorter terms result in higher monthly payments but lower overall interest, while longer terms result in lower monthly payments but higher overall interest. Loan amounts vary depending on the lender and the borrower’s creditworthiness and income. Some lenders may offer refinancing for a wider range of loan types, including federal and private loans. For instance, Lender C might specialize in refinancing only federal loans, while Lender D might accept both federal and private loans.

Customer Reviews and Ratings

Online reviews and ratings from reputable sources provide valuable insights into a lender’s customer service, responsiveness, and overall experience. Websites like Trustpilot, Yelp, and the Better Business Bureau (BBB) offer platforms for borrowers to share their experiences. Positive reviews often highlight smooth processes, helpful customer support, and efficient loan disbursement. Negative reviews might point to issues such as long processing times, unresponsive customer service, or hidden fees. Analyzing these reviews helps identify lenders with a strong track record of customer satisfaction.

Comparison Table of Three Major Lenders

| Lender | APR Range | Fees | Loan Amounts | Repayment Terms |

|---|---|---|---|---|

| Lender A (Example) | 6.00% – 14.00% | Origination Fee: 1% – 3% | $5,000 – $200,000 | 5 – 15 years |

| Lender B (Example) | 5.50% – 13.50% | Origination Fee: 0% – 2% | $10,000 – $150,000 | 7 – 20 years |

| Lender C (Example) | 6.50% – 15.00% | No origination fee, but prepayment penalty may apply | $5,000 – $100,000 | 10 – 15 years |

Impact on Credit Score

Refinancing your student loans can have a noticeable impact on your credit score, both in the short and long term. Understanding these effects is crucial for making informed decisions and mitigating potential negative consequences. The process involves a hard credit inquiry and changes to your credit utilization, both of which influence your creditworthiness.

Refinancing generally involves a hard inquiry on your credit report. This inquiry temporarily lowers your credit score, typically by a few points. However, this impact is usually minimal and short-lived, typically fading within a few months. More significantly, the refinancing process itself might alter your credit utilization ratio – the percentage of available credit you’re using. If you consolidate multiple loans with varying interest rates into a single loan, your overall credit utilization might decrease, potentially boosting your score. Conversely, if you refinance for a larger loan amount, increasing your overall debt, your credit utilization could increase, potentially lowering your score.

Credit Score Changes During Refinancing

A hard inquiry from a lender during the application process will temporarily lower your credit score. This is a standard practice for any loan application. The impact is usually small, but it’s important to be aware of it. Simultaneously, the change in your credit utilization will have a more lasting effect. If the refinance reduces your overall debt, your credit utilization ratio will likely improve, leading to a higher credit score over time. However, if you increase your debt by refinancing, your credit utilization ratio will worsen, potentially lowering your score. The timing of the refinance application relative to other credit inquiries should also be considered, as multiple inquiries within a short period can have a more significant cumulative effect.

Strategies for Maintaining a Good Credit Score

Maintaining a good credit score during and after refinancing requires proactive steps. Before applying, check your credit report for errors and work to improve your credit score if necessary. This will improve your chances of securing favorable terms. Shop around and compare offers from multiple lenders to avoid unnecessary hard inquiries. Once you’ve chosen a lender, stick to your repayment plan diligently to avoid late payments, which can negatively impact your score. Keeping your credit utilization low is also key to maintaining a good credit score; aim for under 30% of your available credit.

Credit Score and Interest Rate Relationship

Your credit score directly influences the interest rate you’ll receive on your refinanced loan. Lenders use your credit score to assess your risk. A higher credit score indicates lower risk, leading to lower interest rates. Conversely, a lower credit score signifies higher risk, resulting in higher interest rates.

For example, let’s say two borrowers, Alice and Bob, are applying for a student loan refinance. Alice has an excellent credit score of 780, while Bob has a fair credit score of 680. Alice might qualify for an interest rate of 4%, while Bob might receive a rate of 7%. This 3% difference in interest rates can significantly impact the total cost of their loans over the repayment period. This example highlights the importance of maintaining a good credit score to secure the most favorable interest rates on refinanced student loans.

Repayment Options and Strategies

Refinancing your student loans can significantly impact your monthly payments and overall repayment timeline. Understanding the available repayment options and developing a sound repayment strategy are crucial for successfully managing your debt and achieving financial freedom. Choosing the right option depends on your financial situation, risk tolerance, and long-term goals.

Refinancing typically offers choices between fixed-rate and variable-rate loans, along with the flexibility to adjust your loan term. Each option presents unique advantages and disadvantages that should be carefully considered. Effective repayment strategies involve a combination of mindful budgeting, disciplined saving, and potentially employing debt reduction techniques like the avalanche or snowball method.

Fixed-Rate vs. Variable-Rate Loans

Fixed-rate loans offer predictable monthly payments, providing financial stability. The interest rate remains constant throughout the loan term, allowing for easier budgeting and long-term financial planning. Variable-rate loans, on the other hand, have interest rates that fluctuate based on market conditions. This can lead to lower initial payments, but also carries the risk of higher payments if interest rates rise. Choosing between a fixed or variable rate depends on your comfort level with potential interest rate fluctuations and your long-term financial outlook. If you prioritize predictability, a fixed-rate loan is generally preferred.

Extended Loan Terms

Extending the loan term lowers your monthly payment, making it more manageable in the short term. However, this also increases the total interest paid over the life of the loan. For example, refinancing a $50,000 loan from a 10-year term to a 15-year term will reduce your monthly payments but significantly increase the total interest paid. Carefully weigh the short-term convenience against the long-term cost.

Repayment Strategies

Effective repayment strategies focus on minimizing interest paid and accelerating debt repayment. The avalanche method prioritizes paying off the loan with the highest interest rate first, while the snowball method focuses on paying off the smallest loan first for psychological motivation. Both methods can be effective, depending on individual preferences and financial circumstances. Consistent, on-time payments are crucial to building a positive credit history and avoiding late payment fees.

Budgeting and Financial Management

After refinancing, creating a detailed budget is essential. Track all income and expenses to ensure your monthly payment fits comfortably within your financial plan. Consider automating payments to avoid missed payments and late fees. Building an emergency fund can provide a safety net for unexpected expenses, preventing you from falling behind on your loan payments. Regularly review your budget and adjust it as needed to maintain financial stability.

Sample Repayment Schedule

The following table illustrates different repayment scenarios for a $30,000 loan refinanced at 6% interest:

| Loan Term (Years) | Monthly Payment | Total Interest Paid | Total Repaid |

|---|---|---|---|

| 5 | $590 | $5,400 | $35,400 |

| 10 | $320 | $12,000 | $42,000 |

| 15 | $236 | $18,600 | $48,600 |

Note: These figures are for illustrative purposes only and do not account for potential changes in interest rates or other loan fees. Actual payments may vary.

Understanding the Fine Print

Refinancing your student loans can offer significant savings, but it’s crucial to understand the terms and conditions before signing any agreement. Overlooking crucial details in the fine print can lead to unexpected costs and complications down the line. This section will highlight key aspects to scrutinize carefully.

Common Terms and Conditions

Student loan refinance agreements typically include clauses related to interest rates, repayment terms, fees, and prepayment penalties. Interest rates are usually fixed or variable, affecting your monthly payments and overall cost. Repayment terms define the loan’s duration, influencing the monthly payment amount. Understanding these core elements is vital for making an informed decision. For example, a fixed-rate loan provides predictable monthly payments, while a variable-rate loan’s payments can fluctuate with market changes. The length of the repayment period, often ranging from 5 to 20 years, significantly impacts your monthly payment amount and total interest paid. Shorter repayment terms mean higher monthly payments but less interest paid overall.

Potential Fees and Charges

Several fees can be associated with refinancing. Origination fees are upfront charges levied by the lender to process your application. Late payment fees are incurred if you miss a payment. Prepayment penalties, although less common in student loan refinancing, can be charged if you pay off the loan early. These fees can vary significantly between lenders, impacting the overall cost of refinancing. For instance, an origination fee of 1% on a $50,000 loan would be $500. Late payment fees can range from $25 to $50 or more, depending on the lender and the severity of the delinquency. It’s essential to compare these fees across different lenders to identify the most cost-effective option.

Clauses Requiring Careful Review

Borrowers should pay close attention to clauses concerning changes in interest rates (for variable-rate loans), prepayment penalties, and default provisions. Understanding how interest rate adjustments are calculated and the potential impact on your monthly payments is crucial for variable-rate loans. Prepayment penalties can negate the benefits of refinancing if you plan to pay off the loan early. Default provisions Artikel the consequences of failing to make timely payments, including potential legal actions and damage to your credit score. Carefully reading and understanding these clauses will help you avoid unforeseen consequences.

Checklist of Key Elements Before Refinancing

Before proceeding with refinancing, consider the following:

- Compare interest rates and fees from multiple lenders: Don’t settle for the first offer you receive. Shop around and compare offers from various lenders to find the best terms.

- Review the loan terms and conditions carefully: Pay close attention to the fine print, including interest rate type, repayment terms, fees, and prepayment penalties.

- Assess your financial situation: Ensure you can comfortably afford the monthly payments before refinancing.

- Check your credit score: A higher credit score typically qualifies you for better interest rates.

- Understand the impact on your federal loan benefits: Refinancing typically means losing access to federal loan benefits, such as income-driven repayment plans and loan forgiveness programs.

Alternatives to Refinancing

Refinancing your student loans isn’t the only path to managing your debt. Several alternative strategies can help you navigate repayment, each with its own set of advantages and disadvantages. Choosing the right approach depends on your individual financial situation and long-term goals. Carefully considering all options before making a decision is crucial.

Exploring alternatives to refinancing allows you to consider options that might better suit your circumstances, particularly if you don’t qualify for refinancing or if the potential benefits don’t outweigh the risks. Understanding these alternatives empowers you to make an informed choice that aligns with your financial well-being.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. This can significantly lower your monthly payments, making them more manageable, especially during periods of lower income. However, IDR plans often extend your repayment period, leading to higher overall interest paid. For example, an individual earning a lower salary might find an IDR plan significantly reduces their monthly burden, even if it means paying more interest over the long term.

Deferment and Forbearance

Deferment and forbearance temporarily postpone your student loan payments. Deferment usually requires you to meet specific eligibility criteria, such as being enrolled in school or experiencing unemployment. Forbearance is generally granted at the lender’s discretion. While these options provide short-term relief, interest may still accrue during the deferment or forbearance period, increasing your total debt. This can lead to a larger balance to repay once the deferment or forbearance ends, potentially offsetting any short-term benefits.

Student Loan Consolidation

Consolidation combines multiple federal student loans into a single loan with a new interest rate and repayment plan. This simplifies repayment by reducing the number of payments you need to track. However, the new interest rate might not be lower than your current rates, and you might lose benefits associated with specific loan types. For instance, consolidating subsidized loans with unsubsidized loans could lead to higher interest payments in the long run.

Debt Management Strategies

Effective budgeting, prioritizing debt repayment, and exploring additional income sources can significantly improve your ability to manage student loan debt. Creating a detailed budget, identifying areas for savings, and aggressively paying down high-interest debt can accelerate repayment. For example, increasing your income through a side hustle or part-time job can provide extra funds for debt repayment, reducing the overall repayment time and interest paid.

Comparison of Debt Management Options

| Option | Pros | Cons |

|---|---|---|

| Refinancing | Lower monthly payments, potentially lower interest rate, simplified repayment | May not be available to everyone, potential impact on credit score, risk of losing borrower benefits |

| Income-Driven Repayment Plans | Lower monthly payments, more manageable budget | Longer repayment period, higher total interest paid |

| Deferment/Forbearance | Temporary payment relief | Interest may accrue, increasing total debt |

| Consolidation | Simplified repayment, single monthly payment | May not lower interest rate, potential loss of benefits |

| Debt Management Strategies | No additional fees, improves financial discipline | Requires significant effort and discipline, may not be enough for high debt |

Scenario Where Refinancing Might Not Be Best

Consider a borrower with a mix of federal and private student loans, some of which are subsidized. Refinancing might eliminate the benefits associated with subsidized federal loans, such as interest subsidies during periods of deferment. In this case, the potential benefits of a lower interest rate through refinancing could be outweighed by the loss of these crucial benefits, making alternative strategies more advantageous.

Last Word

Refinancing student loans can be a powerful tool for managing debt, but it requires careful consideration. By understanding the factors affecting interest rates, comparing lenders, and carefully reviewing the terms and conditions, you can make an informed decision that aligns with your financial goals. Remember to explore all available options and prioritize responsible debt management to achieve long-term financial stability.

FAQ Corner

What is the impact of a co-signer on my refinance application?

A co-signer can significantly improve your chances of approval, especially if you have a limited credit history or lower credit score. However, they assume responsibility for the loan if you default.

Can I refinance federal student loans?

While some private lenders offer refinancing options for federal loans, be aware that you’ll lose federal protections like income-driven repayment plans and potential loan forgiveness programs.

How long does the refinance process typically take?

The timeframe varies depending on the lender and your individual circumstances. It can range from a few weeks to several months.

What happens if I miss a payment after refinancing?

Missing payments can negatively impact your credit score and potentially lead to penalties or default, similar to any other loan.