The rising cost of higher education is a significant concern for many, and a key component is the ever-increasing interest on student loans. This impacts not only current students burdened with debt, but also the broader economic landscape. Understanding the current trends, government policies, and available alternatives is crucial for navigating this complex financial terrain.

This exploration delves into the recent surge in student loan interest rates, examining their historical context, the resulting financial strain on borrowers, and the potential long-term economic repercussions. We’ll also analyze government interventions, explore alternative financing options, and offer strategies for mitigating the impact of these rising costs.

The Current State of Student Loan Interest Rates

Student loan interest rates are a significant factor influencing the overall cost of higher education. Recent fluctuations have created uncertainty for borrowers, making it crucial to understand the current landscape and historical trends. This section provides an overview of recent changes and contributing factors.

Recent trends show a clear upward trajectory in student loan interest rates. After a period of historically low rates, largely influenced by government intervention during the COVID-19 pandemic, rates have begun to climb again, reflecting broader economic conditions.

Historical Overview of Student Loan Interest Rates (Past Decade)

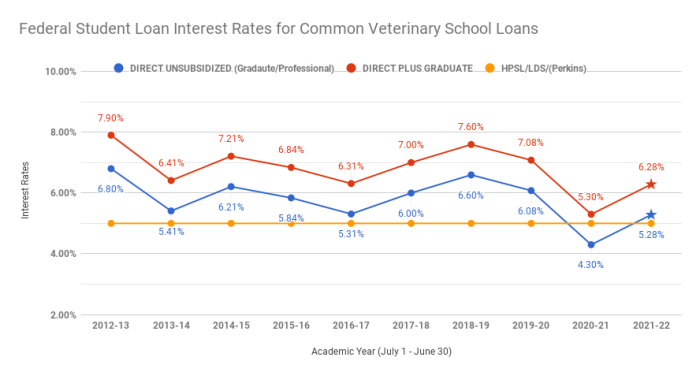

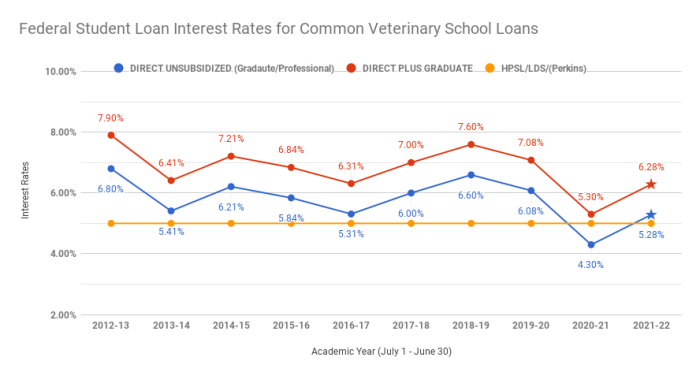

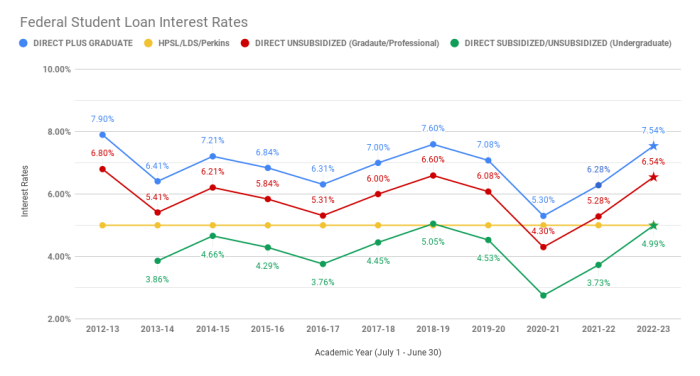

The past decade has witnessed significant variability in student loan interest rates. While precise figures depend on the loan type (subsidized or unsubsidized) and the specific year, a general trend emerges. Initially, rates were relatively low, influenced by post-recessionary monetary policies. However, these rates gradually increased, reaching higher levels in recent years, before temporarily decreasing during the pandemic pause.

Comparison of Current and Past Interest Rates

A direct comparison of current rates to those from previous years highlights the recent increase. For example, a comparison between the average unsubsidized undergraduate loan rate in 2013 and the current rate reveals a notable difference, often exceeding several percentage points. This increase translates to a substantial difference in the total amount repaid over the loan’s lifespan.

Factors Contributing to the Current Increase in Interest Rates

Several factors contribute to the current rise in student loan interest rates. Primarily, the Federal Reserve’s actions to combat inflation play a significant role. Increased interest rates across the board affect the cost of borrowing for all sectors, including student loans. Government policies regarding student loan programs also influence rates, as changes in funding mechanisms and eligibility criteria can impact the overall cost.

Student Loan Interest Rate Data (2013-2023 – Illustrative Example)

The following table provides an illustrative example of how student loan interest rates have changed over the past decade. Note that these figures are simplified for illustrative purposes and may not reflect the exact rates for all loan types or borrowers in every year. Actual rates vary based on factors such as credit history and loan type. Official data should be consulted for precise figures.

| Year | Rate Type | Interest Rate (%) | Relevant Changes |

|---|---|---|---|

| 2013 | Subsidized | 3.86 | Relatively low rate reflecting post-recessionary environment. |

| 2013 | Unsubsidized | 6.86 | Higher than subsidized rate, reflecting increased risk. |

| 2018 | Subsidized | 4.53 | Increase reflecting gradual economic recovery. |

| 2018 | Unsubsidized | 7.53 | Increase reflecting gradual economic recovery. |

| 2023 | Subsidized | 5.00 (Example) | Further increase due to Federal Reserve actions and inflation. |

| 2023 | Unsubsidized | 8.00 (Example) | Further increase due to Federal Reserve actions and inflation. |

Impact on Student Borrowers

The recent increase in student loan interest rates presents a significant challenge for current and prospective students. This rise directly impacts the overall cost of higher education, potentially making it less accessible and creating a heavier financial burden for those already struggling with debt. The consequences extend beyond simply higher monthly payments; they can affect long-term financial planning, career choices, and overall financial well-being.

The increased financial burden on student borrowers is multifaceted. For those currently enrolled, higher interest rates translate to a larger overall debt upon graduation. This means a longer repayment period and a greater total amount paid over the life of the loan. Future students face the prospect of starting their careers with significantly higher debt loads, potentially delaying major life milestones like homeownership or starting a family. The cumulative effect of these increased costs can have far-reaching implications on individuals’ financial security and economic mobility.

Consequences of Higher Interest Rates on Repayment Plans

Higher interest rates directly affect the affordability and feasibility of various repayment plans. Standard repayment plans, which typically span 10 years, will see a substantial increase in monthly payments. Income-driven repayment (IDR) plans, designed to tie monthly payments to a borrower’s income, will still result in higher total payments over the life of the loan due to the accumulating interest. Borrowers may find themselves struggling to manage their monthly payments, potentially leading to delinquency and negatively impacting their credit scores. For example, a borrower with a $50,000 loan at a 5% interest rate might have a monthly payment of approximately $550. If the interest rate rises to 7%, that monthly payment could jump to nearly $650, representing a significant increase in their monthly expenses.

Examples of Increased Monthly Payments

Let’s consider two scenarios. Scenario A involves a borrower with a $30,000 loan at a 5% interest rate, resulting in an estimated monthly payment of approximately $330 over a 10-year repayment period. Scenario B illustrates the same loan amount but with a 7% interest rate, increasing the monthly payment to roughly $380. This $50 difference might seem small, but it accumulates over the life of the loan and represents a significant increase in the total amount repaid. Furthermore, a borrower with a $100,000 loan will experience a far more dramatic increase in their monthly payments, potentially impacting their ability to meet other financial obligations.

Strategies to Mitigate the Impact of Rising Interest Rates

Students can employ several strategies to mitigate the effects of rising interest rates. Careful budgeting and financial planning are crucial, allowing borrowers to prioritize loan repayment and track their spending habits. Exploring different repayment options, such as refinancing (if interest rates fall in the future) or income-driven repayment plans, can provide some relief. Additionally, consolidating multiple loans into a single loan with a potentially lower interest rate can simplify repayment and potentially reduce overall costs. Finally, seeking financial counseling from a reputable source can provide personalized guidance and support in navigating these challenges.

Resources for Students Facing Financial Hardship

It’s important to remember that students are not alone in facing these challenges. Several resources are available to provide support and guidance.

- Federal Student Aid (FSA): The FSA website offers comprehensive information on repayment plans, loan forgiveness programs, and other financial aid resources.

- National Foundation for Credit Counseling (NFCC): The NFCC provides free and low-cost credit counseling services, helping borrowers create a budget and develop a plan for managing their student loan debt.

- Your Loan Servicer: Contacting your loan servicer directly is crucial for understanding your repayment options and exploring potential hardship programs.

- Financial Aid Office at Your Institution: Your college or university’s financial aid office can offer personalized advice and support specific to your situation.

Government Policies and Regulations

Government policies play a significant role in shaping the student loan interest rate landscape. These policies, implemented at both the federal and state levels, directly influence the cost of borrowing for students and ultimately impact their ability to manage and repay their debt. Understanding these policies is crucial for both borrowers and policymakers alike.

The influence of government policies manifests in several ways. Firstly, the government’s direct lending programs, such as the Federal Direct Loan Program in the United States, set the benchmark interest rates for many student loans. Secondly, government regulations can influence private lenders, who often base their rates on the prevailing federal rates. Finally, government policies related to loan forgiveness, repayment plans, and other forms of debt relief indirectly impact the overall cost of borrowing by altering the risk profile for lenders.

Current Government Regulations on Student Loan Interest Rates

Current government regulations surrounding student loan interest rates are complex and vary depending on the loan type (e.g., subsidized vs. unsubsidized, graduate vs. undergraduate). For example, federal student loan interest rates are often tied to market indices, meaning they fluctuate with broader economic conditions. However, these rates are typically capped to prevent them from becoming excessively high. Furthermore, the government offers various income-driven repayment plans that adjust monthly payments based on borrowers’ income, effectively reducing the burden of high interest rates over the long term. These plans, while helpful, do not directly impact the underlying interest rate itself. Specific regulations also exist concerning the fees associated with student loans, which can add to the overall cost of borrowing.

Comparison of Government Approaches to Managing Student Loan Debt

Different governments employ diverse strategies to manage student loan debt. Some prioritize affordability by setting low interest rates and offering generous repayment options. Others focus on market-based approaches, allowing interest rates to fluctuate more freely. For instance, some countries might have a completely government-funded system with fixed, low rates, while others might rely heavily on private lenders with varying interest rates subject to market conditions and government regulations. A third approach might involve a hybrid system, combining government-backed loans with private options. Each approach has its strengths and weaknesses, impacting borrowers differently.

| Government Approach | Interest Rate Impact | Pros | Cons |

|---|---|---|---|

| Government-Funded System with Fixed Low Rates | Low and predictable rates | Increased affordability, predictable repayment | Potential for high government expenditure, limited flexibility |

| Market-Based Approach with Government Regulation | Fluctuating rates subject to market conditions and government caps | Market efficiency, potentially lower costs for government | Higher risk for borrowers, potential for high rates during economic downturns |

| Hybrid System (Government-backed and Private Loans) | Mix of fixed and fluctuating rates | Offers choices to borrowers, combines benefits of both approaches | Complexity, potential for inconsistencies in terms and conditions |

Hypothetical Policy to Alleviate Rising Interest Rates

One potential policy to alleviate the burden of rising interest rates is a government-backed interest rate subsidy program. This program could provide a fixed percentage reduction in the interest rate for all federal student loans, regardless of the borrower’s income or loan type. For example, the government could offer a 2% subsidy on all federal student loans, effectively lowering the interest rate by 2 percentage points. This would directly reduce the cost of borrowing for all students and could be funded through a combination of increased government spending and potential adjustments to other government programs. This policy would need careful consideration of its fiscal implications and potential unintended consequences. It aims to provide immediate and broad-based relief to borrowers facing the increasing pressure of higher interest rates.

Alternative Financing Options

Securing funding for higher education extends beyond federal student loans. Several alternative financing options exist, each with its own set of advantages, disadvantages, and associated risks. Understanding these alternatives is crucial for students seeking to manage the costs of their education effectively. Careful consideration of individual financial circumstances and long-term implications is paramount before committing to any specific financing method.

Private Student Loans

Private student loans are offered by banks, credit unions, and other private lenders. Unlike federal loans, they are not backed by the government, meaning the lender carries the risk of non-payment. This often results in stricter eligibility requirements and potentially higher interest rates.

Advantages and Disadvantages of Private Student Loans

Private student loans can sometimes offer larger loan amounts than federal loans, potentially covering the entire cost of tuition and living expenses. However, they typically come with variable interest rates, which can fluctuate based on market conditions, making repayment unpredictable. Additionally, private loan providers may not offer the same flexible repayment plans or income-driven repayment options as federal loan programs. Borrowers should carefully review the terms and conditions before signing any private loan agreement. Defaulting on a private student loan can severely damage a borrower’s credit score and have long-term financial repercussions.

Interest Rates and Repayment Terms of Private Student Loans

Interest rates on private student loans vary widely depending on the lender, the borrower’s creditworthiness, and the type of loan. They are generally higher than federal student loan interest rates. Repayment terms can range from 5 to 20 years, and borrowers may have the option of choosing a fixed or variable interest rate. Prepayment penalties are also common, potentially charging fees for paying off the loan early. For example, a borrower with excellent credit might secure a rate of 6%, while a borrower with poor credit might face a rate exceeding 12%. The exact terms are entirely dependent on the lender’s assessment of the applicant’s credit risk.

Risks and Benefits Associated with Private Student Loans

The primary benefit of a private student loan is the potential to cover educational costs not met by federal aid. However, the risks are significant. Higher interest rates, lack of government protections, and stricter eligibility requirements make private loans a less favorable option for many borrowers. It’s essential to thoroughly compare loan offers from multiple lenders and to understand the implications of borrowing before signing any agreement.

Key Considerations for Students Exploring Alternative Financing Options

Before committing to any alternative financing option, students should consider the following:

- Credit Score: A higher credit score typically results in lower interest rates and more favorable loan terms.

- Interest Rates and Fees: Compare interest rates, origination fees, and other charges across different lenders.

- Repayment Terms: Understand the repayment schedule, loan duration, and potential for prepayment penalties.

- Co-signer Requirements: Determine if a co-signer is needed and the implications for both the borrower and co-signer.

- Loan Forgiveness Programs: Check if the loan qualifies for any income-driven repayment plans or loan forgiveness programs.

- Financial Need: Borrow only the amount necessary to cover educational expenses and avoid unnecessary debt.

Other Alternative Financing Options

Beyond private student loans, other options include scholarships, grants, work-study programs, and family contributions. Scholarships and grants are forms of financial aid that do not need to be repaid. Work-study programs provide part-time employment opportunities to help offset educational costs. Family contributions, while not technically a loan, can significantly reduce the need for external financing. Each option should be carefully considered based on individual circumstances and availability.

Long-Term Economic Implications

The sustained increase in student loan interest rates carries significant long-term economic consequences, impacting not only individual borrowers but also the broader economy and future generations. These effects ripple through various sectors, influencing consumer behavior, economic growth, and societal well-being. Understanding these implications is crucial for developing effective policy responses.

The rising cost of borrowing for education directly affects consumer spending. With higher monthly payments, borrowers have less disposable income to allocate towards other goods and services, potentially dampening consumer demand and slowing economic growth. This reduced spending can have a cascading effect, impacting businesses reliant on consumer spending and potentially leading to slower job creation.

Impact on Consumer Spending and Economic Growth

Increased student loan debt burdens significantly constrain consumer spending. A substantial portion of a borrower’s income is diverted to loan repayments, leaving less for discretionary spending on things like housing, vehicles, or entertainment. This reduced consumer demand can translate into slower economic growth, particularly if a large segment of the population is heavily indebted. For instance, a scenario where a significant portion of millennials, a major consumer demographic, are struggling with substantial student loan repayments could lead to a sustained period of reduced consumer confidence and spending. This reduced demand can impact businesses, leading to slower growth and potential job losses.

Effects on Future Generations of Students

The escalating cost of higher education, fueled by rising interest rates, creates a challenging environment for future generations. Prospective students may face increased barriers to entry into higher education, potentially limiting their career opportunities and earning potential. The rising debt burden could also discourage individuals from pursuing higher education altogether, potentially impacting the nation’s overall human capital and future innovation. This could lead to a less skilled workforce and reduced economic competitiveness in the long run. A real-life example is the growing number of students choosing vocational training over four-year degrees due to the high cost and associated debt.

Societal Consequences of High Student Loan Debt

High student loan debt can have profound societal consequences. It can contribute to increased stress and anxiety among borrowers, impacting their mental and physical health. Delayed major life decisions, such as homeownership, marriage, and starting a family, are also common consequences of high debt burdens. Furthermore, the weight of student loan debt can disproportionately affect certain demographics, exacerbating existing social and economic inequalities. The long-term consequences include a potential increase in social unrest and a widening gap between the wealthy and those burdened by debt.

Long-Term Impact Visualization

A hypothetical graph illustrating the long-term impact of rising student loan interest rates on economic growth could be presented. The X-axis would represent time (in years), and the Y-axis would represent the annual GDP growth rate. One line would depict the projected GDP growth rate under a scenario of stable, low student loan interest rates, showing steady, moderate growth. A second line would show the projected GDP growth rate under a scenario of steadily rising student loan interest rates, demonstrating a clear downward trend in growth, particularly after a certain number of years (e.g., a noticeable decline starting after 5 years). Data points could be included to illustrate specific annual growth rates for each scenario. The graph would clearly illustrate the negative correlation between rising student loan interest rates and economic growth over time. For instance, the graph might show a 2.5% annual growth rate with stable interest rates, declining to 1.5% or even lower under the high-interest-rate scenario by year 10.

Final Wrap-Up

In conclusion, the increase in student loan interest rates presents a multifaceted challenge with significant implications for both individual borrowers and the overall economy. While government policies play a crucial role, proactive financial planning and exploring alternative funding avenues are essential for students to navigate this increasingly complex landscape. A comprehensive understanding of the issue, coupled with informed decision-making, is key to mitigating the long-term effects of rising student loan debt.

FAQ Guide

What factors contribute to fluctuating student loan interest rates?

Several factors influence rates, including overall market interest rates, government policies, and the specific loan program (e.g., subsidized vs. unsubsidized).

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing is a possibility, but it often involves private lenders and may come with its own set of risks and requirements. Carefully compare options before refinancing.

What happens if I can’t afford my student loan payments?

Several options exist, including deferment, forbearance, and income-driven repayment plans. Contact your loan servicer to explore available options.

Are there any government programs to help with student loan debt?

Yes, various government programs offer assistance, such as income-driven repayment plans and loan forgiveness programs for certain professions. Research these options to see if you qualify.