Navigating the complex landscape of student loan interest rates can feel overwhelming. Understanding these rates is crucial for effective financial planning, impacting not only the immediate cost of education but also long-term debt management. This guide provides a clear overview of current rates, calculation methods, repayment options, and strategies for minimizing the overall financial burden. We’ll explore both federal and private loan options, highlighting key differences and providing valuable resources to help you make informed decisions.

From understanding how interest accrues and the implications of different repayment plans to comparing federal and private loan options and exploring strategies for minimizing debt, this guide provides a comprehensive overview of the factors affecting your student loan payments. We’ll delve into the historical trends of interest rates, empowering you to anticipate future changes and make the best choices for your financial future.

Current Student Loan Interest Rates

Understanding current student loan interest rates is crucial for prospective and current borrowers. These rates directly impact the total cost of a college education and the repayment burden faced by students after graduation. Fluctuations in these rates are influenced by several economic factors, and a historical perspective can provide valuable context.

Federal Student Loan Interest Rates by Loan Type

The interest rates for federal student loans vary depending on the loan type, the borrower’s creditworthiness (in the case of PLUS loans), and the loan disbursement date. These rates are set annually by the government and are generally lower than private loan interest rates.

| Loan Type | Interest Rate (Example – These rates are subject to change. Check the official Federal Student Aid website for the most up-to-date information.) | Repayment Plan Options | Notes |

|---|---|---|---|

| Subsidized Federal Stafford Loan | 4.99% (Example) | Standard, Graduated, Extended, Income-Driven | Interest does not accrue while the borrower is in school at least half-time. |

| Unsubsidized Federal Stafford Loan | 4.99% (Example) | Standard, Graduated, Extended, Income-Driven | Interest accrues while the borrower is in school. |

| Federal PLUS Loan (Graduate/Parent) | 7.54% (Example) | Standard, Graduated, Extended | Higher interest rate due to credit check; borrowers with poor credit may face even higher rates. |

Factors Influencing Federal Student Loan Interest Rates

Several key factors contribute to the determination of federal student loan interest rates. These factors are interconnected and reflect broader economic conditions.

The most significant influence is the prevailing interest rate environment in the broader economy. When interest rates are low, the cost of borrowing for the government (and therefore for students) is also low. Conversely, rising interest rates generally lead to higher student loan rates. Government fiscal policy also plays a role; changes in government spending and borrowing can affect the overall cost of borrowing. Finally, while not a direct determinant, the overall demand for student loans can indirectly influence rates. High demand may put upward pressure on rates, although this effect is typically secondary to macroeconomic factors.

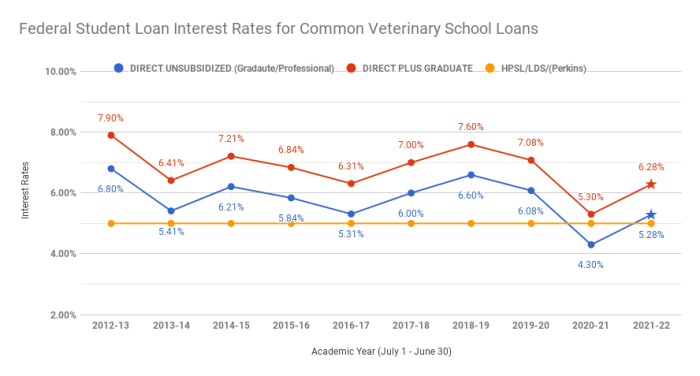

Historical Trend of Student Loan Interest Rates (Past 10 Years)

Examining the historical trend of student loan interest rates over the past decade reveals significant fluctuations. These changes are directly correlated with shifts in broader economic conditions, including periods of economic expansion and recession.

| Year | Subsidized Stafford Loan Rate (Example – Approximate Average) | Unsubsidized Stafford Loan Rate (Example – Approximate Average) | PLUS Loan Rate (Example – Approximate Average) |

|---|---|---|---|

| 2014 | 4.66% | 4.66% | 7.21% |

| 2015 | 4.29% | 4.29% | 6.84% |

| 2016 | 3.76% | 3.76% | 6.31% |

| 2017 | 3.76% | 3.76% | 6.31% |

| 2018 | 4.53% | 4.53% | 7.08% |

| 2019 | 4.53% | 4.53% | 7.08% |

| 2020 | 4.53% | 4.53% | 7.08% |

| 2021 | 2.75% | 2.75% | 5.3% |

| 2022 | 5.0% | 5.0% | 7.54% |

| 2023 | 4.99% | 4.99% | 7.54% |

*(Note: These are example rates and may not reflect the exact rates for all periods. Refer to official government sources for precise historical data.)*

Interest Rate Calculation and Accrual

Understanding how interest is calculated on your student loans is crucial for effective financial planning. The process isn’t always straightforward, as different loan types employ varying methods, and understanding these nuances can significantly impact your repayment strategy and overall cost.

Interest on student loans is typically calculated using simple interest, though the frequency of compounding can vary. Simple interest is calculated by multiplying the principal loan amount by the annual interest rate and then dividing by the number of payment periods in a year. For example, a $10,000 loan with a 5% annual interest rate, compounded monthly, would accrue (10000 * 0.05) / 12 = $41.67 in interest each month. This amount is added to the principal balance, and interest for the next month is calculated on this slightly higher amount. This is known as compounding. The more frequently interest compounds (daily, monthly, quarterly), the faster your debt grows.

Simple Interest Calculation

Simple interest is calculated using a straightforward formula: Interest = Principal x Rate x Time. The principal is the original loan amount, the rate is the annual interest rate (expressed as a decimal), and the time is the length of the loan period (typically in years). For example, a $20,000 loan at 6% interest over 10 years would accrue $12,000 in simple interest (20000 x 0.06 x 10 = 12000). However, this is a simplification, as most student loans use compounding interest.

Compound Interest Calculation and Capitalization

Most student loans utilize compound interest, meaning interest accrues not only on the principal but also on the accumulated interest. This process accelerates debt growth. Capitalization, a key element of compound interest, occurs when accumulated interest is added to the principal balance. This increases the principal amount on which future interest is calculated, resulting in a larger overall debt. For example, if interest is capitalized annually, the interest accrued during the first year is added to the principal balance at the end of the year, and the next year’s interest is calculated on this larger amount.

Step-by-Step Guide to Calculating Total Interest Paid

To illustrate, let’s consider a $10,000 loan with a 7% annual interest rate, compounded annually, over a 5-year repayment period. We’ll assume a simple amortization schedule for simplicity (in reality, loan repayment schedules are more complex).

1. Determine the Annual Interest: Calculate the annual interest by multiplying the principal by the annual interest rate: 10000 * 0.07 = $700.

2. Calculate the Total Interest for Each Year: For year one, the interest is $700. For year two, the interest is calculated on the new principal (original principal + year 1 interest). This process continues for each year. Note that in a real-world scenario, you would also be making payments, reducing the principal and thus the interest accrued. However, to keep this example simple, we’re ignoring payments for this illustrative calculation.

3. Sum the Annual Interest: Add up the interest accrued each year to find the total interest paid over the loan’s lifetime.

It’s important to note that this is a simplified calculation. Actual interest calculations often involve more complex amortization schedules, which take into account regular payments and their impact on the principal balance. Using online loan calculators or consulting with a financial advisor provides a more accurate assessment.

Repayment Plans and Interest

Understanding the different repayment plans available for student loans is crucial for minimizing the total interest paid and managing your debt effectively. The choice of plan significantly impacts your monthly payments and the overall cost of your loan. This section will compare various plans and illustrate how extra payments can accelerate repayment.

Repayment Plan Comparison

The interest implications of different repayment plans vary considerably depending on your income, loan amount, and financial goals. The following table compares three common plans: Standard, Graduated, and Income-Driven. Note that specific details may vary depending on your loan servicer and loan type.

| Repayment Plan | Monthly Payment | Interest Accrual | Pros & Cons |

|---|---|---|---|

| Standard | Fixed, typically higher initially | Lower overall due to faster repayment | Pros: Pays off loan quickly, lower total interest. Cons: Higher initial payments may be difficult to manage. |

| Graduated | Starts low, increases gradually | Higher overall due to longer repayment period | Pros: Easier to manage initially. Cons: Higher total interest paid, longer repayment period. |

| Income-Driven (e.g., ICR, PAYE, REPAYE) | Based on income and family size | Potentially high due to extended repayment period, but often lower monthly payments | Pros: Affordable monthly payments. Cons: Longer repayment period, potential for higher total interest, may require recertification of income annually. |

Extra Payments and Their Impact

Making extra payments on your student loans, even small amounts, can significantly reduce the total interest paid and shorten the repayment timeline. This is because extra payments are first applied to the principal balance, reducing the amount of interest that accrues in subsequent months.

For example, consider a $30,000 loan with a 5% interest rate and a 10-year repayment plan. Making an extra $100 payment each month could save you thousands of dollars in interest and potentially pay off the loan years ahead of schedule. The exact savings will depend on the loan’s terms and the amount of the extra payment.

Scenario: Choosing a Repayment Plan

Imagine Sarah, a recent graduate with a $40,000 loan and a starting salary of $45,000. A standard repayment plan might result in high monthly payments that strain her budget. A graduated plan offers lower initial payments, easing the financial burden during her early career. However, a significant increase in later payments is anticipated. An income-driven plan, tailored to her income, offers the most manageable monthly payments, allowing her to comfortably repay the loan while maintaining a reasonable standard of living. While the income-driven plan might result in paying slightly more interest over the life of the loan, the reduced financial stress and the ability to allocate funds to other financial goals, such as saving for a down payment on a house, could outweigh this cost. In Sarah’s case, the long-term benefits of an income-driven plan align well with her current financial situation.

Private Student Loan Interest Rates

Private student loans offer an alternative funding source for higher education, but understanding their interest rates is crucial for responsible borrowing. These rates are typically higher than federal student loan rates and are determined by a variety of factors specific to the lender and the borrower. This section will explore current rates, compare them to federal loans, and detail the factors influencing rate determination.

Unlike federal student loans, which offer standardized interest rates based on factors like loan type and repayment plan, private student loan interest rates vary significantly among lenders. These rates are influenced by creditworthiness, the type of loan, and current market conditions. It’s essential to compare offers from multiple lenders to secure the most favorable terms.

Comparison of Current Private Student Loan Interest Rates

It’s important to note that private student loan interest rates are dynamic and change frequently based on market conditions and lender policies. The following are examples and should not be considered current rates. Always check directly with the lender for the most up-to-date information.

- Lender A: Example Rate: 7.5% – 13% variable APR. This range reflects the variability based on credit score and other factors.

- Lender B: Example Rate: 6.0% – 11% fixed APR. A fixed rate offers predictability, while the range demonstrates the impact of creditworthiness.

- Lender C: Example Rate: 8.0% – 14% variable APR. This illustrates the significant difference in rates available depending on the borrower’s profile and the lender’s risk assessment.

Key Differences Between Federal and Private Student Loan Interest Rates and Terms

Federal and private student loans differ significantly in their interest rates and terms. Understanding these differences is vital for making informed borrowing decisions.

- Interest Rates: Federal student loan interest rates are generally lower than private loan rates. Federal rates are set by the government and are often subsidized, meaning the government pays the interest during certain periods (e.g., while the student is in school). Private loan rates are set by the lender and are typically variable or fixed, reflecting the lender’s assessment of the borrower’s credit risk.

- Repayment Options: Federal loans offer a variety of income-driven repayment plans, designed to make monthly payments more manageable. Private loans typically have fewer repayment options, and the terms may be less flexible.

- Loan Forgiveness Programs: Federal student loans may be eligible for loan forgiveness programs under certain circumstances (e.g., public service loan forgiveness). Private loans generally do not offer such programs.

- Credit Requirements: Federal student loans generally do not require a credit check (with the exception of PLUS loans). Private student loans usually require a credit check, and a strong credit history is often necessary to qualify for favorable rates.

Factors Influencing Private Student Loan Interest Rates

Lenders use several factors to determine the interest rate they offer on a private student loan. A lower credit score will typically lead to a higher interest rate.

- Credit Score and History: A higher credit score indicates lower risk to the lender, resulting in a lower interest rate. A poor credit history may lead to a higher rate or even loan denial.

- Debt-to-Income Ratio: This ratio compares a borrower’s monthly debt payments to their monthly income. A higher ratio suggests greater financial strain, increasing the perceived risk to the lender.

- Co-signer: Having a co-signer with good credit can significantly improve the chances of securing a lower interest rate. The co-signer assumes responsibility for the loan if the borrower defaults.

- Loan Amount and Type: Larger loan amounts may carry higher interest rates due to increased risk. The type of loan (e.g., undergraduate vs. graduate) can also influence the rate.

- Market Interest Rates: Prevailing interest rates in the overall financial market influence the rates lenders offer. When market rates are high, private student loan rates tend to be higher as well.

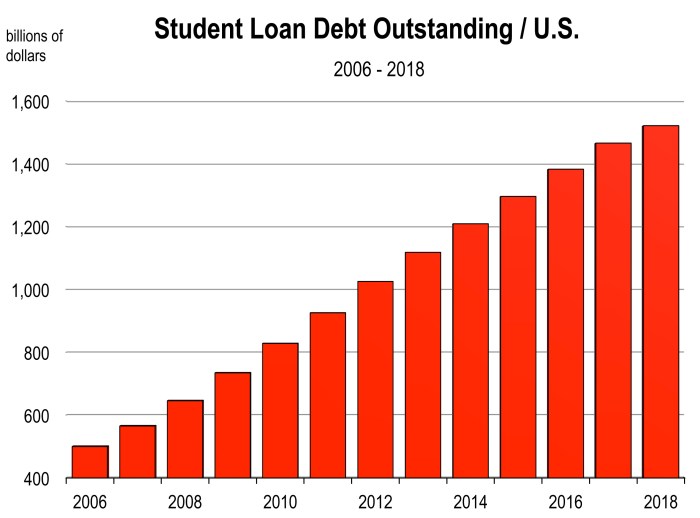

Impact of Interest Rates on Student Loan Debt

Understanding the impact of interest rates on your student loans is crucial for effective financial planning. The interest rate significantly affects the total cost of your education, influencing how much you ultimately repay and for how long. Even small differences in interest rates can accumulate to substantial amounts over the life of the loan.

The interest rate determines the cost of borrowing money. A higher interest rate means you’ll pay more in interest charges over the repayment period, increasing the overall amount you need to repay. Conversely, a lower interest rate will result in lower interest payments and a smaller total repayment amount. This impact is magnified over longer repayment periods.

Long-Term Impact of Varying Interest Rates

The following table illustrates how different interest rates can affect the total interest paid on a $30,000 loan over a 10-year and a 20-year repayment period. These are simplified examples and do not account for potential changes in interest rates during the repayment period or additional fees.

| Interest Rate | 10-Year Repayment: Total Interest Paid | 20-Year Repayment: Total Interest Paid |

|---|---|---|

| 4% | $5,676 | $14,484 |

| 6% | $8,894 | $23,347 |

| 8% | $12,457 | $33,722 |

As you can see, even a small difference in the interest rate (e.g., from 4% to 6%) leads to a significant increase in the total interest paid, especially over a longer repayment period. The longer the loan term, the more interest accrues.

Strategies for Minimizing the Impact of High Interest Rates

Several strategies can help mitigate the effects of high interest rates on student loan debt. Prioritizing these approaches can lead to substantial long-term savings.

Making extra principal payments whenever possible can significantly reduce the total interest paid and shorten the repayment period. Even small additional payments consistently made can have a remarkable effect over time. Another effective strategy is refinancing your loans to a lower interest rate if available. This requires careful consideration of the terms and conditions offered by various lenders. Finally, exploring income-driven repayment plans may provide temporary relief by lowering monthly payments, though it may extend the repayment period and increase the overall interest paid.

Consequences of Late or Missed Payments

Failing to make timely student loan payments has severe consequences. Late payments result in the accumulation of additional interest charges, increasing the total debt. Furthermore, late payments can negatively impact your credit score, making it harder to obtain loans or credit in the future. In some cases, lenders may charge late payment penalties, further adding to the overall cost. Repeated late payments could lead to loan default, which can have serious financial and legal repercussions, including wage garnishment or tax refund offset.

Resources for Understanding Interest Rates

Navigating the world of student loan interest rates can be confusing. Understanding the various rates, how they’re calculated, and what they mean for your repayment is crucial for effective financial planning. Fortunately, several reliable resources offer clear and accessible information. Utilizing these resources can empower you to make informed decisions about your student loans.

Understanding the information provided by these resources requires careful attention to detail. It’s essential to differentiate between fixed and variable rates, understand the impact of capitalization, and know how different repayment plans affect your overall interest payments. This section will Artikel key resources and guide you through interpreting the information they provide.

Reliable Sources of Information on Student Loan Interest Rates

Finding accurate and up-to-date information is paramount. The following list provides reputable sources for student loan interest rate information, categorized for clarity.

- Federal Student Aid (FSA): This website, managed by the U.S. Department of Education, is the primary source for information on federal student loans. It provides details on current interest rates for various federal loan programs (like Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans), explains how interest rates are determined, and Artikels the different repayment plans available. You can find information on interest rate calculations and accrual, as well as loan forgiveness programs.

- National Student Loan Data System (NSLDS): NSLDS is a central database that allows you to access information about your federal student loans. While it doesn’t directly provide interest rate information in the same way FSA does, it shows your loan details, including the interest rate assigned to each loan. This is essential for tracking your specific loan terms.

- Consumer Financial Protection Bureau (CFPB): The CFPB offers resources to help consumers understand various financial products, including student loans. While they don’t specify current interest rates directly, they provide valuable information on loan terms, avoiding predatory lending practices, and understanding your rights as a borrower. Their resources are focused on consumer protection and responsible borrowing practices.

Interpreting Interest Rate Information

Understanding the information presented on these websites and your loan documents requires careful attention to several key elements:

- Fixed vs. Variable Interest Rates: Fixed rates remain constant throughout the life of your loan, while variable rates fluctuate based on market conditions. Understanding this distinction is crucial for budgeting and long-term financial planning. A fixed rate offers predictability, while a variable rate could lead to lower initial payments but higher payments later.

- Annual Percentage Rate (APR): The APR represents the annual cost of borrowing, including interest and any fees. It’s crucial to compare APRs when considering different loan options. A lower APR generally means lower overall borrowing costs. For example, a loan with a 5% APR will be less expensive than one with a 7% APR, assuming all other factors are equal.

- Interest Capitalization: This refers to the process of adding unpaid interest to the principal loan balance. Understanding when and how capitalization occurs is crucial for accurately calculating your total loan cost. For instance, if your interest capitalizes annually, the interest accrued during the first year will be added to your principal balance in the second year, increasing the amount of interest accrued in subsequent years.

- Repayment Plan Details: Different repayment plans (standard, graduated, income-driven, etc.) have different payment amounts and timelines, significantly impacting the total interest paid over the life of the loan. Carefully review the terms of each plan to determine the best option for your financial situation. For example, an income-driven repayment plan might have lower monthly payments but extend the repayment period, resulting in higher total interest paid over time.

Final Thoughts

Successfully managing student loan debt requires a proactive approach and a thorough understanding of interest rates. By carefully considering the information presented here—including current rates, calculation methods, repayment plan options, and strategies for minimizing interest—you can take control of your financial future. Remember to utilize the provided resources to stay informed and make the best choices for your unique circumstances. Proactive planning and informed decisions are key to navigating the complexities of student loan repayment successfully.

FAQs

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or while in deferment. Unsubsidized loans accrue interest during these periods.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing can lower your interest rate, but it often involves switching from a federal to a private loan, potentially losing federal protections.

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in loan default, with serious consequences.

How often are student loan interest rates adjusted?

Federal student loan interest rates are typically set annually and may vary based on the loan type and the index used for rate calculations.

Where can I find my current student loan interest rate?

Your loan servicer’s website or your monthly statement will show your current interest rate and other relevant loan details.