Navigating the complexities of UK student loan repayments can feel daunting, especially with the ever-shifting landscape of interest rates. Understanding these rates is crucial for planning your financial future after graduation. This guide delves into the current rates, historical trends, and future projections, offering a clear picture of how interest impacts your debt and what strategies you can employ to manage it effectively. We’ll also compare the UK system with those in other countries, providing valuable context and perspective.

From the intricacies of different loan plans and repayment periods to the influence of government policy and economic factors, we aim to provide a comprehensive overview, empowering you to make informed decisions about your student loan journey. We’ll explore the impact of compounding interest and offer practical advice on minimizing your long-term repayment costs.

Current UK Student Loan Interest Rates

Understanding the interest rates applied to UK student loans is crucial for effective financial planning. The system is complex, varying based on the type of loan and the prevailing economic conditions. This section will clarify the current structure and influencing factors.

Current Interest Rate Structure for Different Student Loan Plans

The interest rate applied to your student loan depends on several factors, primarily the type of plan under which the loan was taken out and the prevailing Bank of England base rate. Different loan plans have different interest rate calculation methods. For example, loans taken out in England and Wales typically follow a different rate structure than those in Scotland or Northern Ireland. It’s vital to check the specific details relevant to your individual loan plan.

Factors Influencing Student Loan Interest Rate Changes

Student loan interest rates are not static; they fluctuate. The most significant factor is the Bank of England base rate. This rate acts as a benchmark for other interest rates in the UK economy. Increases in the base rate generally lead to corresponding increases in student loan interest rates, while decreases have the opposite effect. However, the relationship isn’t always directly proportional; the government may adjust the rate independently to align with broader fiscal policy goals. Inflation also plays a role, as higher inflation often leads to higher interest rates to manage the economy.

Comparison of Interest Rates Across Different Repayment Plans

While there isn’t a multitude of distinct repayment *plans* in the sense of different repayment schedules, the interest rate applied varies significantly depending on the *type* of student loan (Plan 1, Plan 2 etc.). This difference is based on when the loan was taken out and your income level. For instance, older Plan 1 loans may have a different interest rate calculation compared to newer Plan 2 loans. Furthermore, the interest rate will vary year on year, depending on the Bank of England base rate.

Student Loan Interest Rate Table

| Plan Name | Interest Rate (as of October 26, 2023 – *This is an example and should be verified with official sources*) | Repayment Period | Annual Cost Example (Illustrative) |

|---|---|---|---|

| Plan 1 (Example – Older Loan) | 6.1% (Illustrative – Check official sources for the current rate) | Up to 30 years | £610 on a £10,000 loan (Illustrative – Actual cost depends on loan amount and repayment schedule) |

| Plan 2 (Example – Newer Loan) | 6.1% (Illustrative – Check official sources for the current rate) | Up to 30 years | £610 on a £10,000 loan (Illustrative – Actual cost depends on loan amount and repayment schedule) |

| Postgraduate Loan (Example) | 6.1% (Illustrative – Check official sources for the current rate) | Up to 30 years | £610 on a £10,000 loan (Illustrative – Actual cost depends on loan amount and repayment schedule) |

*Note: The interest rates and annual cost examples provided are illustrative only and are subject to change. Always refer to the official government website for the most up-to-date information.*

Historical Trends in UK Student Loan Interest Rates

The UK’s student loan interest rate system has undergone significant changes over the past decade, impacting millions of borrowers. Understanding these historical trends is crucial for comprehending the current system and its potential future trajectory. Fluctuations have been influenced by various economic factors and government policy decisions, resulting in a complex picture of borrowing costs for students.

Over the past decade, UK student loan interest rates have exhibited considerable volatility, closely mirroring – though not always directly correlating with – wider economic conditions, particularly inflation. Initially, rates were linked to the Retail Price Index (RPI) plus a variable margin, resulting in periods of relatively high interest charges. However, subsequent government interventions have led to a more complex system with different rates applied depending on the repayment plan and the borrower’s earnings. This has created a dynamic landscape, making it difficult to predict future interest rate movements with complete certainty.

The Relationship Between Inflation and Student Loan Interest Rates

The relationship between inflation and student loan interest rates has been indirect but noticeable. Historically, when inflation rose, so did student loan interest rates, reflecting the government’s aim to maintain the real value of the loan portfolio. However, this direct correlation has not always held true. Government policy changes, including the introduction of income-contingent repayment plans and the capping of interest rates at specific levels, have at times decoupled interest rate adjustments from immediate inflationary pressures. For example, during periods of high inflation, the government might choose to cap interest rate increases to protect borrowers from excessively high repayment burdens. Conversely, during periods of low inflation, rates might remain above the rate of inflation for revenue generation purposes.

Significant Policy Changes Impacting Student Loan Interest Rates

Several key policy changes have significantly impacted UK student loan interest rates. The shift from a fixed rate system to a variable rate system tied to RPI plus a margin was a pivotal moment. Subsequent changes included adjustments to the margin added to RPI, the introduction of different interest rates for different loan types (e.g., postgraduate loans), and the implementation of income-contingent repayment plans. Furthermore, the government’s decisions regarding the specific index used (shifting from RPI to CPIH) also had a direct impact on the calculated interest. These policy adjustments reflect the government’s evolving approach to student finance, balancing the need to fund higher education with concerns about affordability for borrowers.

Graphical Representation of Historical Interest Rate Trends

A line graph illustrating the historical trend of UK student loan interest rates would show a fluctuating pattern over the past decade. The x-axis would represent the year (e.g., 2013-2023), and the y-axis would represent the interest rate (as a percentage). The graph would display a line showing the annual average interest rate for each year. For example, a hypothetical data point might show an average interest rate of 3.5% in 2018, increasing to 4.2% in 2019, then decreasing to 3.8% in 2020, and so on. The graph would visually demonstrate periods of higher and lower interest rates, highlighting the volatility and the impact of policy changes over time. The line would not be consistently upward or downward sloping, reflecting the fluctuating nature of interest rates in response to economic conditions and government interventions. The graph would also ideally include annotations to highlight significant policy changes, providing a clear visual link between policy and the resulting interest rate fluctuations.

Impact of Interest Rates on Student Loan Repayments

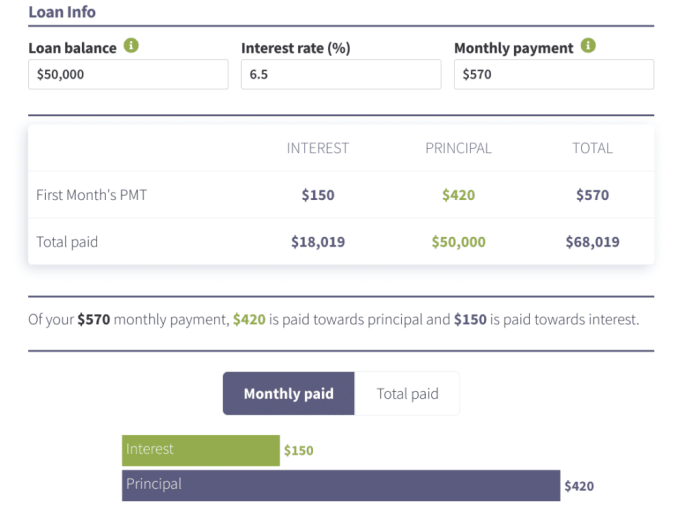

Understanding how interest rates affect student loan repayments is crucial for effective financial planning. The interest rate applied to your loan directly impacts the total amount you’ll ultimately repay, significantly influencing your long-term financial health. Higher interest rates mean you’ll pay more overall, while lower rates lead to lower total repayment costs.

The effect of different interest rates on the total repayment amount is substantial. Even small variations in interest rates can accumulate over the loan’s lifespan, resulting in a considerable difference in the final repayment figure. This is primarily due to the compounding effect of interest, where interest is calculated not only on the principal loan amount but also on the accumulated interest.

Interest Rate Impact on Total Repayment

Consider two scenarios: a £20,000 loan repaid over 30 years. In scenario A, the interest rate is 3%, while in scenario B, it’s 6%. While the monthly payments might seem only slightly higher in scenario B initially, the total interest paid over the 30-year period would be significantly greater. Scenario B would result in a much larger total repayment amount due to the higher interest rate. The precise figures would require a loan repayment calculator considering the specific repayment plan, but the principle of significantly increased total cost with higher interest is undeniable.

Long-Term Repayment Costs Under Various Interest Rate Scenarios

The long-term cost implications of different interest rates are substantial. A lower interest rate, even by a small percentage, can translate into thousands of pounds saved over the life of the loan. For example, a 1% difference in interest rates on a £30,000 loan over 25 years could easily result in a difference of several thousand pounds in total repayment. This emphasizes the importance of understanding the interest rate structure and seeking options to potentially minimize interest costs.

Impact of Interest Compounding on Student Loan Debt

Interest compounding is the process where interest is added to the principal amount, and subsequent interest calculations are based on the increased principal plus accumulated interest. This means that the longer the loan term, the more significant the impact of compounding. Let’s illustrate: imagine a £10,000 loan with a 5% annual interest rate. In the first year, the interest is £500. In the second year, the interest is calculated on £10,500 (principal + year one interest), resulting in more than £500 interest. This effect continues year after year, significantly increasing the total interest paid over time. The longer the repayment period, the more pronounced this effect becomes.

Strategies for Minimizing Interest Rate Impact

Understanding strategies to minimize the impact of interest rates is vital. A well-informed approach can lead to substantial savings.

- Prioritize Higher Repayments: Making larger than minimum repayments reduces the principal amount faster, lowering the overall interest paid.

- Explore Repayment Plans: Investigate different repayment plans offered by the government or lenders, comparing their interest rate implications and overall repayment costs.

- Consolidate Loans: Combining multiple student loans into a single loan may potentially offer a lower interest rate.

- Consider Overpayments Strategically: Assess the benefits of overpaying during periods of higher disposable income.

Comparison with Other Countries’ Student Loan Systems

The UK’s student loan system, while often debated, is unique in its structure and differs significantly from those in other developed nations. Understanding these differences provides valuable context for assessing the advantages and disadvantages of the UK approach. A comparative analysis with systems in countries like the USA, Canada, and Australia reveals a diverse landscape of student finance.

The key differences lie not only in interest rate structures but also in loan amounts, repayment thresholds, and ultimately, the likelihood of complete debt forgiveness. These factors, combined with varying economic contexts, significantly impact the long-term financial burden on graduates.

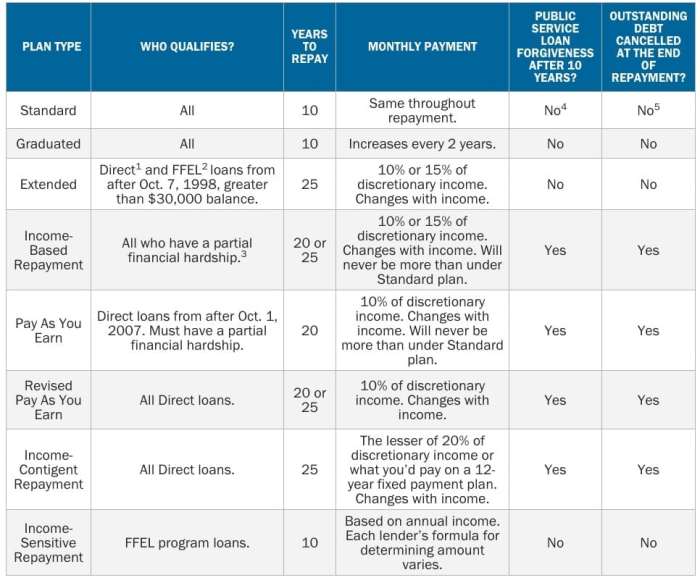

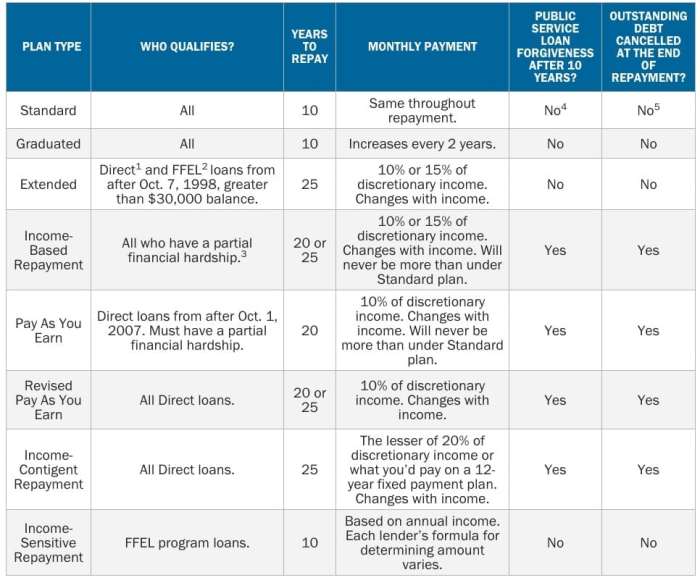

Student Loan Systems: A Cross-Country Comparison

This section details the key characteristics of student loan systems in the UK, USA, and Australia, highlighting the differences in interest rates, repayment mechanisms, and debt forgiveness policies. These differences stem from a combination of factors including differing government priorities, economic conditions, and the overall structure of higher education.

| Country | Interest Rate Type | Repayment Plan | Debt Forgiveness Policies |

|---|---|---|---|

| United Kingdom | Variable, linked to inflation plus a percentage. | Income-contingent repayment; loans are written off after a certain number of years if not fully repaid. | Loans are written off after a specified period (currently 30 years in most cases), regardless of the outstanding balance. |

| United States | Fixed or variable, depending on the loan type. | Income-driven repayment plans are available, but repayment terms can be longer and potentially lead to higher total interest paid. | Debt forgiveness programs exist (e.g., Public Service Loan Forgiveness), but eligibility requirements are stringent and the program has faced criticism for its complexity and effectiveness. |

| Australia | Variable, linked to the consumer price index. | Income-contingent repayment; loans are written off after a certain number of years if not fully repaid. | Loans are written off after a specified period (generally around 7 years if no income is earned) or after a longer period if income is earned. The exact details can be complex and depend on the type of loan and the individual’s circumstances. |

Advantages and Disadvantages of the UK System

The UK system’s income-contingent repayment offers a degree of protection to low-income earners, preventing excessive debt burdens. However, the variable interest rates, potentially rising significantly with inflation, can lead to unpredictable and substantial overall repayment costs. The lengthy write-off period also means graduates may carry debt for a significant portion of their working lives. Conversely, systems like Australia’s offer potentially faster debt forgiveness, while the US system, though complex, provides several repayment options, albeit often with less certainty regarding ultimate debt forgiveness. The choice of “best” system is highly dependent on individual circumstances and risk tolerance.

The Role of the Government in Setting Interest Rates

The UK government plays a pivotal role in determining the interest rates applied to student loans. This isn’t a purely market-driven process; rather, it’s a complex interplay of political considerations, economic forecasts, and social policy goals. Understanding this process is crucial for grasping the overall impact of student loan debt on individuals and the national economy.

The government sets and adjusts student loan interest rates primarily through legislation and annual budget announcements. These rates are not directly tied to prevailing market interest rates like commercial loans, but instead reflect a combination of factors designed to balance the government’s financial position with the needs of students and graduates. The specific mechanisms employed vary over time, often reflecting shifts in government priorities and economic circumstances.

Government Mechanisms for Managing Student Loan Interest Rates

The government employs several key mechanisms to manage student loan interest rates. These mechanisms aren’t static; they evolve in response to economic conditions and policy shifts. For instance, the government might choose to adjust the interest rate formula, linking it more closely to inflation or other economic indicators. Alternatively, it might opt for a more direct approach, setting a fixed rate for a specific period. The Treasury and Department for Education collaborate to determine the appropriate rate, balancing affordability for graduates with the need to recover loan costs. Regular reviews and consultations with stakeholders are integral to this process.

Political and Economic Factors Influencing Interest Rate Decisions

Numerous political and economic factors influence the government’s decisions regarding student loan interest rates. For example, during periods of economic austerity, the government might be inclined to increase interest rates to reduce the overall cost of the student loan scheme to the taxpayer. Conversely, during periods of economic growth, there might be more political pressure to keep rates low to ease the burden on graduates. Public opinion, as reflected in election manifestos and political debates, significantly impacts these decisions. Economic factors such as inflation rates, the overall level of government debt, and forecasts for future economic growth all play a significant role. A rising inflation rate, for example, could lead to an increase in the interest rate to ensure the real value of the loan isn’t eroded.

Consequences of Different Government Policies on Student Loan Debt

Different government policies on student loan interest rates have far-reaching consequences. Higher interest rates increase the overall cost of borrowing for students, potentially impacting their ability to repay their loans and hindering their financial stability in the long term. This can lead to a greater proportion of graduates struggling with debt, potentially affecting their ability to make major life decisions like buying a home or starting a family. Conversely, lower interest rates make loans more affordable but increase the financial burden on the taxpayer as the government receives less in repayments. This trade-off between affordability for graduates and fiscal responsibility for the government is a constant challenge in policymaking. For example, a decision to cap interest rates at a low level might lead to a larger overall amount of unrecovered debt over the long term, while a decision to increase interest rates could disproportionately impact lower-income graduates.

Future Projections of UK Student Loan Interest Rates

Predicting future UK student loan interest rates is inherently complex, depending on a multitude of interconnected economic and political factors. While precise forecasting is impossible, analysing current trends and likely future scenarios allows for a reasoned assessment of potential changes. This section explores possible future trajectories, influencing factors, and associated risks and opportunities.

Future interest rate movements will likely be influenced by several key factors. Inflation remains a primary driver, with high inflation generally leading to higher interest rates as the Bank of England attempts to control rising prices. Government fiscal policy, including spending priorities and overall economic growth, will also play a significant role. Changes in government policy regarding student loan repayment thresholds and the overall structure of the student loan system could also impact interest rates. Finally, broader global economic conditions and interest rate movements in other major economies will exert influence.

Factors Influencing Future Interest Rate Changes

The interaction of several economic indicators will shape future student loan interest rates. For example, a sustained period of high inflation might prompt the Bank of England to raise the base rate, which could indirectly affect the rate applied to student loans. Conversely, a period of low or negative economic growth could lead to lower interest rates as the government seeks to stimulate the economy. Changes to the Retail Price Index (RPI), the current benchmark for student loan interest calculations, could also have a direct impact on the rate borrowers face. Government decisions regarding the level of public spending and borrowing also influence interest rates; increased government borrowing might push interest rates upwards.

Potential Risks and Opportunities Associated with Future Interest Rate Scenarios

High and unpredictable interest rates pose a significant risk to student loan borrowers. Increased repayment burdens could strain personal finances and potentially delay homeownership or other major life goals. Conversely, lower interest rates create opportunities for borrowers, reducing the overall cost of their loans and potentially freeing up disposable income. The risk of a significant increase in rates could also impact the government’s long-term financial projections, as increased defaults might occur. The opportunity lies in the government potentially reducing rates to stimulate the economy and encourage spending.

A Plausible Scenario for Student Loan Interest Rates in the Next Five Years

One plausible scenario involves a period of fluctuating interest rates over the next five years. Initially, we might see rates remain relatively high due to persistent inflationary pressures. However, as inflation begins to moderate (potentially around 2025), the Bank of England may gradually reduce the base rate. This could lead to a slight decrease in student loan interest rates, but not necessarily a return to the historically low rates seen in previous years. This scenario assumes that the government maintains its current approach to student loan repayment and doesn’t introduce major structural changes to the system. This moderate fluctuation would reflect the uncertainty inherent in economic forecasting and the complex interplay of various economic factors. The actual outcome, however, will depend on the evolving economic landscape and government policy decisions.

Closure

Successfully managing student loan debt requires a proactive and informed approach. By understanding the current interest rate structure, historical trends, and potential future scenarios, you can develop a robust repayment strategy tailored to your individual circumstances. Remember to utilize the available resources and consider the strategies discussed to minimize the long-term impact of interest on your overall financial well-being. Proactive planning and informed decision-making are key to navigating the complexities of UK student loans successfully.

Popular Questions

What happens if I don’t repay my student loan?

Failure to repay your student loan can lead to debt collection actions, potentially affecting your credit rating and future borrowing opportunities.

Can I make overpayments on my student loan?

Yes, you can usually make overpayments on your student loan, reducing the overall amount you owe and the length of your repayment period.

How are student loan interest rates determined?

Interest rates are typically set by the UK government and are often linked to inflation and other economic indicators.

What if my circumstances change significantly (e.g., job loss)?

The government offers various support options for those experiencing financial hardship. Contact the Student Loans Company to discuss your individual circumstances.