Navigating the complex world of student loan debt is a significant challenge for many, and Reddit provides a unique platform for borrowers to share their experiences, strategies, and concerns. This analysis delves into the collective sentiment surrounding student loan interest on Reddit, examining the prevalent themes, repayment approaches, and the impact of government policies. We explore both the financial and emotional repercussions of high interest rates, offering insights into the diverse perspectives and challenges faced by those grappling with student loan debt.

From discussions on federal versus private loan options and their associated interest rates to the psychological toll of managing substantial debt, this exploration offers a comprehensive overview of the issues highlighted within the Reddit community. We analyze successful and unsuccessful repayment strategies, offering a balanced perspective on the complexities of student loan repayment and the importance of proactive financial planning.

Reddit Sentiment Analysis: Student Loan Interest

Reddit discussions surrounding student loan interest reveal a predominantly negative sentiment. Users frequently express frustration, anxiety, and anger regarding the high cost of borrowing and the perceived lack of support from lenders and government institutions. While some positive comments exist, focusing on successful repayment strategies or advocacy efforts, they are significantly outnumbered by expressions of hardship and financial strain.

Overall Sentiment and Common Themes

The overwhelming sentiment expressed on Reddit regarding student loan interest is overwhelmingly negative. Discussions are dominated by concerns about high interest rates, the difficulty of repayment, and the long-term financial burden imposed by student loan debt. Common themes include the feeling of being trapped in a cycle of debt, the impact of interest capitalization, and the lack of accessible and affordable repayment options. Many users express feelings of helplessness and hopelessness regarding their ability to manage their debt. The discussion often extends to broader societal critiques of the higher education system and its financing structures.

Categorization of Posts by Emotional Tone

The following table categorizes Reddit posts based on their emotional tone, providing examples and associated user feelings. It’s important to note that these are broad generalizations, and individual posts often contain a mix of emotions. The frequency data is an approximation based on observing numerous Reddit threads and is not derived from a formally conducted sentiment analysis study.

| Sentiment | Frequency | Example Post Snippet | Associated User Feelings |

|---|---|---|---|

| Negative | 80% | Frustration, anxiety, hopelessness, helplessness, anger, despair | |

| Neutral | 15% | Uncertainty, pragmatism, cautious optimism, determination | |

| Positive | 5% | Relief, accomplishment, happiness, pride, hope |

Repayment Strategies and Experiences

Navigating student loan repayment can be a daunting task, especially when high interest rates are involved. Reddit discussions reveal a wide range of strategies employed by borrowers, some successful and others less so. Understanding these approaches and their outcomes offers valuable insight into managing student loan debt effectively. This section will explore various repayment strategies discussed within the Reddit community, highlighting both successful and unsuccessful experiences.

Many Reddit users grapple with the significant impact of accumulating interest on their loan balances. The sheer weight of compounding interest often leads to feelings of overwhelm and frustration, making effective repayment planning crucial. Understanding the different repayment options and their implications is key to navigating this complex financial landscape.

Successful Repayment Strategies

Redditors who successfully managed their student loan debt often shared strategies centered around aggressive repayment and strategic planning. These strategies, while demanding, often resulted in significant long-term savings.

- High-Income Repayment: Several users reported prioritizing high-income jobs post-graduation to accelerate their repayment. This allowed them to make larger than minimum payments, significantly reducing the total interest paid over the life of the loan. One user described working 60-hour weeks in a demanding but well-paying role specifically to tackle their debt aggressively.

- Debt Avalanche Method: This method involves focusing on paying off the loan with the highest interest rate first, regardless of the loan balance. Redditors who employed this strategy often reported feeling a greater sense of accomplishment as they saw a quicker reduction in their overall interest burden. This psychological benefit can be significant in maintaining motivation throughout the repayment process.

- Refinancing: Many users successfully refinanced their loans to secure lower interest rates. This strategy requires careful research and comparison shopping, but it can lead to substantial savings over the long term. One user described saving thousands of dollars by refinancing their federal loans with a private lender offering a significantly lower interest rate.

Unsuccessful Repayment Strategies

Conversely, some strategies discussed on Reddit proved less effective, often leading to increased financial stress and prolonged repayment periods.

- Minimum Payment Only: Numerous users expressed regret at only making minimum payments, highlighting the significant impact of compounding interest over time. This approach often resulted in paying substantially more in interest than the principal loan amount, extending the repayment period considerably.

- Ignoring the Debt: Some Redditors admitted to initially ignoring their student loans, a strategy that almost universally led to negative consequences, including collection agencies and damaged credit scores. The compounding interest quickly escalated their debt, creating a significant financial burden.

- Consolidation Without Careful Planning: While loan consolidation can simplify repayment, some users found that they consolidated loans without adequately researching the terms and interest rates of the new loan. This resulted in a potentially higher interest rate or longer repayment period than their original loans, ultimately costing them more.

Anecdotal Evidence of High Interest Rate Impact

One anonymous user shared their experience of struggling with a high-interest private loan. They initially made minimum payments, believing they could catch up later. However, the compounding interest quickly overwhelmed them, causing significant financial stress and impacting their ability to save for a down payment on a house. Another user described having to delay graduate school due to the weight of their high-interest student loans, highlighting the opportunity cost associated with high interest rates.

Comparison of Loan Types and Interest Rates

Understanding the differences between federal and private student loans, and the factors influencing their interest rates, is crucial for responsible financial planning. Choosing the right loan type can significantly impact your overall repayment burden and long-term financial health. This section will compare and contrast these loan types, focusing on interest rates and repayment implications.

Federal student loans and private student loans differ significantly in their interest rate structures and eligibility requirements. Federal loans, offered by the U.S. government, generally have fixed interest rates that are set annually and are usually lower than private loan interest rates. Private loans, on the other hand, are offered by banks and credit unions, and their interest rates are variable and often significantly higher, influenced by market conditions and the borrower’s creditworthiness.

Federal vs. Private Loan Interest Rates

Federal student loan interest rates are typically lower than private student loan interest rates. The exact rate for federal loans varies depending on the loan type (e.g., subsidized or unsubsidized Stafford loans, PLUS loans), the borrower’s credit history (in the case of PLUS loans), and the loan disbursement year. Private loan interest rates are determined by a variety of factors including the borrower’s credit score, credit history, income, debt-to-income ratio, and the loan term. Borrowers with excellent credit scores and a strong financial history can secure lower interest rates on private loans, but rates can be substantially higher for those with less-than-perfect credit.

Factors Influencing Student Loan Interest Rates

Several factors influence the interest rates charged on student loans. For federal loans, the interest rate is primarily determined by the type of loan and the year the loan was disbursed. For private loans, the borrower’s creditworthiness plays a significant role. A higher credit score typically results in a lower interest rate. Other factors include the loan amount, the loan term (shorter terms often come with higher interest rates), and the presence of a co-signer (a co-signer with good credit can help secure a lower rate). The prevailing economic conditions, specifically interest rate trends in the overall market, also influence private loan rates.

Long-Term Financial Implications of Varying Interest Rates

The interest rate on a student loan directly impacts the total cost of borrowing. A seemingly small difference in interest rates can lead to a substantial increase in the total amount repaid over the life of the loan. For example, a 5% interest rate on a $50,000 loan over 10 years results in significantly less total interest paid compared to a 10% interest rate on the same loan. This difference compounds over time, making the choice of loan type and careful consideration of interest rates critical for long-term financial well-being. High interest rates can delay other financial goals like homeownership, retirement savings, and investing.

Comparison Table: Student Loan Types

| Loan Type | Interest Rate Type | Typical Interest Rate Range (as of 2023, subject to change) | Repayment Terms |

|---|---|---|---|

| Federal Subsidized Stafford Loan | Fixed | Variable, check the Federal Student Aid website for current rates | Standard repayment plans, income-driven repayment plans, extended repayment plans |

| Federal Unsubsidized Stafford Loan | Fixed | Variable, check the Federal Student Aid website for current rates | Standard repayment plans, income-driven repayment plans, extended repayment plans |

| Federal PLUS Loan | Fixed | Variable, check the Federal Student Aid website for current rates | Standard repayment plans, income-driven repayment plans, extended repayment plans |

| Private Student Loan | Fixed or Variable | Highly variable, depending on creditworthiness; generally higher than federal loan rates | Varies by lender; typically standard repayment plans |

Government Policies and Regulations

Government policies significantly influence student loan interest rates and repayment options, impacting borrowers’ financial well-being and the overall economy. These policies are often the subject of intense debate, with varying perspectives on their effectiveness and fairness. Understanding these policies is crucial for navigating the complexities of student loan debt.

The federal government’s role in setting interest rates for federal student loans is paramount. These rates are not fixed but are typically tied to market indices, such as the 10-year Treasury note, with adjustments made annually or even semiannually. Changes in government policy, such as adjustments to these index rates or the introduction of new subsidy programs, directly affect the cost of borrowing for students. For instance, a policy decision to lower the index rate would translate to lower interest rates for borrowers, making repayment more manageable. Conversely, increases in the index rate lead to higher borrowing costs.

Impact of Government Policies on Interest Rates

Government policies, such as the establishment of income-driven repayment plans, influence the effective interest rate borrowers pay, even if the underlying index rate remains unchanged. Income-driven repayment plans, while designed to make repayment more affordable for low-income borrowers, often extend the repayment period, leading to a higher total interest paid over the life of the loan. This highlights the complex interplay between interest rate setting and repayment plan design. For example, a borrower might see a lower monthly payment under an income-driven plan, but they will ultimately pay significantly more in interest due to the extended repayment timeline. Conversely, policies that encourage faster repayment, such as loan forgiveness programs tied to specific public service careers, might lead to lower overall interest payments despite potentially higher initial monthly payments.

Analysis of Proposed Changes to Student Loan Interest Rates and Repayment Plans

Recent political discourse has featured various proposals aimed at reforming student loan programs. Some proposals advocate for permanently lowering interest rates on federal student loans, while others focus on expanding income-driven repayment plans or implementing loan forgiveness programs for specific groups of borrowers. The debate often centers around the financial feasibility of these proposals, their impact on the federal budget, and their potential effects on student borrowing behavior. For example, a proposal for widespread loan forgiveness might be seen as beneficial for current borrowers, but it could also lead to increased borrowing in the future as students might perceive less risk associated with accumulating debt. Similarly, proposals to significantly lower interest rates might reduce the immediate cost of borrowing but could strain the federal budget if not carefully managed.

Criticisms of Existing Government Policies Related to Student Loan Interest

A common criticism of existing government policies is the lack of transparency and complexity surrounding student loan interest rates and repayment plans. Many borrowers struggle to understand the intricacies of different loan types, interest rate calculations, and the implications of various repayment options. This lack of clarity can lead to borrowers making suboptimal choices that result in higher overall interest payments. Another frequent criticism revolves around the perceived inequities in the student loan system, with some arguing that the current system disproportionately burdens low-income and minority borrowers. The complexities of income-driven repayment plans, for example, can be difficult to navigate, and the long repayment periods can lead to significantly higher total interest payments, exacerbating financial burdens for already vulnerable populations.

Financial Advice and Resources

Navigating the complexities of student loan debt can feel overwhelming, but numerous resources and strategies are available to help borrowers effectively manage their repayments and minimize long-term financial strain. This section provides a compilation of frequently recommended resources and a step-by-step guide to facilitate a smoother repayment journey.

Reddit communities dedicated to personal finance and student loan repayment offer a wealth of collective wisdom and practical advice. Many users share their experiences, strategies, and recommended resources, creating a valuable support network for those facing similar challenges. Understanding and leveraging these resources can significantly improve a borrower’s ability to navigate the repayment process.

Frequently Recommended Financial Advice and Resources

Several resources consistently emerge as valuable tools for managing student loan debt within Reddit communities. These range from government websites offering repayment plans to budgeting apps and financial literacy websites.

- StudentAid.gov: The official website of the U.S. Department of Education’s Federal Student Aid, offering information on repayment plans, loan forgiveness programs, and other crucial details.

- National Foundation for Credit Counseling (NFCC): A non-profit organization providing credit counseling and debt management services, including assistance with student loan repayment.

- NerdWallet, Investopedia, and Khan Academy: These websites offer valuable resources on personal finance topics, including budgeting, debt management, and investing, which are all relevant to managing student loans effectively.

- Mint, YNAB (You Need A Budget), and Personal Capital: These budgeting apps help users track their spending, create budgets, and monitor their financial progress, facilitating better debt management.

Step-by-Step Guide to Effective Student Loan Repayment

A structured approach to student loan repayment significantly improves the chances of successful debt management. This step-by-step guide provides a framework for tackling this challenge.

- Understand Your Loans: Gather all your loan information, including loan servicers, interest rates, and repayment schedules. Consolidating multiple loans into a single payment can simplify management.

- Create a Realistic Budget: Track your income and expenses to identify areas for potential savings. Allocate a specific amount towards your student loan payments each month.

- Explore Repayment Options: Research different repayment plans offered by your loan servicer, such as standard, extended, graduated, or income-driven repayment plans. Choose the plan that best suits your financial situation.

- Prioritize High-Interest Loans: Focus on paying down loans with the highest interest rates first to minimize the total interest paid over time. This strategy is known as the avalanche method.

- Automate Payments: Set up automatic payments to ensure consistent and timely repayments, avoiding late fees and negative impacts on your credit score.

- Seek Professional Advice: If you are struggling to manage your student loan debt, consider consulting a financial advisor or credit counselor for personalized guidance.

- Monitor Progress Regularly: Track your loan balance and repayment progress regularly. Adjust your budget or repayment strategy as needed to stay on track.

Common Questions and Answers Regarding Student Loan Interest

Understanding how student loan interest works is crucial for effective repayment planning. This section addresses common questions and provides clear answers.

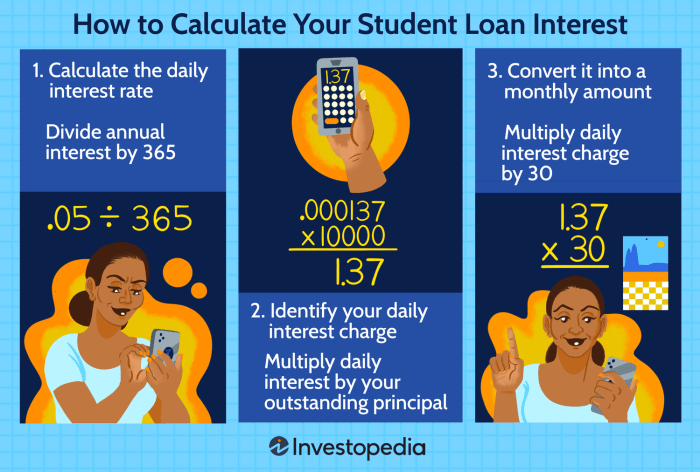

- How is student loan interest calculated? Student loan interest is typically calculated daily on the outstanding principal balance and capitalized (added to the principal) periodically, depending on the loan type and servicer. This means that interest accrues even if you are not making payments, leading to a larger overall debt.

- What are the different types of student loan interest rates? Student loans can have fixed or variable interest rates. Fixed rates remain constant throughout the loan term, while variable rates fluctuate based on market conditions. Variable rates can lead to unpredictable payments.

- How can I reduce the amount of interest I pay? Making extra payments on your loans, refinancing to a lower interest rate, and choosing a repayment plan that minimizes interest capitalization are all effective strategies to reduce total interest paid.

- What happens if I don’t pay my student loans? Failure to make student loan payments can lead to late fees, damage to your credit score, wage garnishment, and even tax refund offset. In severe cases, it can result in default, with serious financial consequences.

Impact on Personal Finance and Well-being

The weight of high student loan interest extends far beyond the monetary; it significantly impacts the psychological and emotional well-being of borrowers, and profoundly affects their ability to achieve long-term financial goals. The constant pressure of debt repayment can create a pervasive sense of anxiety and stress, hindering overall financial health and life satisfaction.

High interest rates on student loans drastically reduce a borrower’s financial flexibility and ability to pursue other important life goals. The compounding effect of interest can quickly transform a manageable debt burden into an overwhelming obstacle, creating a vicious cycle of debt and delayed financial progress.

Psychological and Emotional Toll of High Student Loan Interest

The constant worry about student loan debt can lead to significant stress and anxiety. Borrowers may experience sleep disturbances, difficulty concentrating, and even depression. The feeling of being trapped in a cycle of debt can be debilitating, impacting relationships and overall quality of life. For example, a recent study by the American Psychological Association found a strong correlation between high levels of student loan debt and increased reports of stress, anxiety, and depression among young adults. The fear of default and the potential negative consequences on credit scores further exacerbates these feelings. This constant pressure can lead to avoidance behaviors, such as neglecting to check loan statements or engage in proactive financial planning.

Impact on Achieving Financial Goals

High student loan interest rates significantly impede borrowers’ ability to achieve major financial milestones. The substantial monthly payments often leave little room for saving for a down payment on a home, investing in retirement, or even building an emergency fund. For instance, a borrower with a $50,000 loan at 7% interest will pay significantly more in interest over the life of the loan than someone with the same loan amount at 3%, leaving less disposable income for other financial priorities. This can lead to delayed marriage, postponed parenthood, and an overall feeling of being behind their peers financially. The dream of homeownership may become unattainable, forcing individuals to continue renting and delaying the establishment of financial stability.

Impact on Overall Financial Well-being

The pervasive influence of student loan debt extends beyond individual financial goals, affecting overall financial well-being. The constant pressure of repayment can limit opportunities for career advancement, as individuals may be hesitant to accept jobs in different locations or industries due to the financial constraints of their loans. Furthermore, high levels of student loan debt can negatively impact credit scores, making it more difficult to secure loans for other purposes such as purchasing a car or starting a business. Consider a scenario where a young professional is burdened with significant student loan debt and subsequently denied a mortgage due to a low credit score. This not only prevents them from buying a home but also impacts their ability to build wealth through home equity. The overall impact on financial well-being includes limited savings, reduced investment opportunities, and increased financial vulnerability in unexpected circumstances.

Summary

Reddit’s vibrant community offers a powerful lens through which to examine the multifaceted challenges of student loan interest. The diverse experiences shared, ranging from successful repayment strategies to the emotional burden of high interest rates, underscore the critical need for transparent financial information and supportive resources. Understanding the collective sentiment and shared struggles on platforms like Reddit can inform both individual financial planning and broader policy discussions aimed at making student loan repayment more manageable and equitable for all borrowers.

Query Resolution

What is the best way to find relevant student loan information on Reddit?

Searching for subreddits dedicated to personal finance, student loans, or debt management is a good starting point. Using relevant s in the Reddit search bar will also yield helpful results.

Are there Reddit communities specifically for those with private student loans?

While there isn’t a dedicated subreddit solely for private student loans, many personal finance subreddits discuss both federal and private loan options and strategies. Using specific s like “private student loans” in your search can help filter results.

How can I determine if my student loan interest rate is high?

Compare your interest rate to current average rates for similar loan types. You can find this information on government websites or through financial comparison tools. Consider seeking advice from a financial advisor for a personalized assessment.