Navigating the complexities of student loan repayment can feel overwhelming, but understanding available tax benefits, like the Student Loan Interest Tax Credit, can significantly alleviate the burden. This guide provides a clear and concise overview of the credit, helping you determine eligibility, calculate potential savings, and effectively claim the credit on your tax return. We’ll explore the intricacies of the credit, including income limitations, qualifying loan types, and the process of claiming it, ultimately empowering you to maximize your tax benefits.

From eligibility requirements and calculation methods to claiming the credit and its impact on your overall tax liability, we will cover all the essential aspects. We’ll also delve into recent changes, potential future implications, and alternative strategies for managing student loan debt, offering a holistic approach to financial planning for students and recent graduates.

Eligibility Requirements for the Student Loan Interest Tax Credit

The Student Loan Interest Deduction allows eligible taxpayers to deduct the amount they paid in student loan interest during the tax year. This deduction can reduce your taxable income and, consequently, your tax liability. Understanding the eligibility requirements is crucial to ensure you can claim this valuable credit.

Adjusted Gross Income (AGI) Limitations

The amount of student loan interest you can deduct is dependent on your Modified Adjusted Gross Income (MAGI). The MAGI is calculated similarly to your AGI but with certain adjustments. For the 2023 tax year, the maximum student loan interest deduction is $2,500. However, the phaseout begins at a certain MAGI threshold and is completely phased out at a higher threshold. These thresholds vary depending on your filing status. For single filers and those married filing separately, the phaseout begins at $70,000 and is completely phased out at $85,000. For married filing jointly and qualifying widow(er)s, the phaseout begins at $140,000 and is completely phased out at $170,000. It’s important to note that these thresholds can change yearly, so always refer to the most current IRS guidelines.

Student Loan Status Requirements

To be eligible for the student loan interest deduction, the loan must be used to pay for qualified education expenses. This includes tuition, fees, and other expenses required for enrollment or attendance at an eligible educational institution. The loan must be a qualified education loan, which generally includes federal student loans, private student loans, and loans from other educational institutions. The loan must be taken out by you, the taxpayer, or on your behalf by a family member. You must also be legally obligated to repay the loan. Finally, you must be paying interest on the loan; the deduction doesn’t apply to the principal amount.

Determining Eligibility: Hypothetical Scenarios

Let’s examine a few scenarios to illustrate eligibility:

Scenario 1: Sarah is single, paid $1,500 in student loan interest, and has a MAGI of $60,000. Since her MAGI is below the phaseout threshold of $70,000, she is eligible for the full $1,500 deduction.

Scenario 2: John and Mary are married filing jointly, paid $2,000 in student loan interest, and have a MAGI of $150,000. Their MAGI falls within the phaseout range ($140,000 – $170,000), so their deduction will be reduced. The exact amount of the reduction would need to be calculated based on the IRS’s phaseout rules.

Scenario 3: David is single, paid $2,500 in student loan interest, and has a MAGI of $90,000. His MAGI exceeds the phaseout limit of $85,000, therefore he is not eligible for the student loan interest deduction.

Eligibility Summary Table

| Income Level | Maximum Credit | Filing Status | Eligibility |

|---|---|---|---|

| $60,000 | Up to $2,500 (depending on interest paid) | Single | Eligible |

| $150,000 | Partially eligible (reduced credit) | Married Filing Jointly | Partially Eligible |

| $90,000 | $0 | Single | Not Eligible |

| $130,000 | Up to $2,500 (depending on interest paid) | Married Filing Jointly | Eligible |

Calculating the Student Loan Interest Tax Credit

Determining the amount of your student loan interest tax credit involves a straightforward calculation based on the actual interest you paid during the tax year and your modified adjusted gross income (MAGI). Understanding this calculation is crucial for maximizing your tax benefits.

The Student Loan Interest Tax Credit Formula

The student loan interest tax credit is calculated using a simple formula. The maximum credit amount is dependent on your modified adjusted gross income (MAGI). The formula is:

Credit Amount = (Actual Student Loan Interest Paid) x (Applicable Credit Rate)

The applicable credit rate is determined by your MAGI, as detailed below.

Determining the Maximum Qualifying Interest

The maximum amount of student loan interest that qualifies for the credit is $2,500 annually. This means that even if you paid more than $2,500 in student loan interest during the year, you can only claim a credit on the first $2,500.

Examples of Student Loan Interest Tax Credit Calculations

Here are three examples illustrating the calculation process with varying levels of interest paid and MAGI levels. For simplicity, we’ll assume a single filing status. Remember, actual rates may vary based on IRS guidelines and are subject to change.

Example 1: John paid $1,000 in student loan interest and has a MAGI placing him in the 100% credit rate bracket. His credit is calculated as: $1,000 (Interest Paid) x 100% (Credit Rate) = $1,000 (Credit Amount).

Example 2: Sarah paid $2,200 in student loan interest and has a MAGI placing her in the 100% credit rate bracket. Her credit is calculated as: $2,200 (Interest Paid) x 100% (Credit Rate) = $2,200 (Credit Amount).

Example 3: Maria paid $3,000 in student loan interest, but her MAGI places her in the 100% credit rate bracket. Because the maximum qualifying interest is $2,500, her calculation is: $2,500 (Maximum Qualifying Interest) x 100% (Credit Rate) = $2,500 (Credit Amount).

Flowchart Illustrating the Calculation Process

The following flowchart visually represents the steps involved in calculating the student loan interest tax credit.

[Flowchart Description] The flowchart begins with a decision point: “Did you pay student loan interest?”. If no, the process ends. If yes, the next step is to determine the amount of student loan interest paid. This amount is then compared to the $2,500 maximum. If the interest paid is less than or equal to $2,500, that amount is used. If the interest paid exceeds $2,500, the amount is capped at $2,500. Next, the modified adjusted gross income (MAGI) is determined to find the applicable credit rate (this would involve referencing the appropriate IRS tables). Finally, the credit amount is calculated by multiplying the qualifying interest amount by the applicable credit rate. The result is the student loan interest tax credit.

Claiming the Student Loan Interest Tax Credit on Tax Returns

Successfully claiming the Student Loan Interest Tax Credit requires understanding the process and properly completing the necessary tax forms. This section Artikels the steps involved in claiming the credit, ensuring you receive the maximum benefit allowed.

Claiming the Credit on Form 8863 (Education Credits)

To claim the student loan interest deduction, you’ll need to use Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits). While primarily used for education credits, it also houses the section for claiming the student loan interest deduction. You will need to complete Part III, which specifically addresses this credit. This part requires you to enter the total amount of student loan interest you paid during the tax year. Accurate record-keeping is crucial for this step. Remember to keep your documentation readily available for any potential audit.

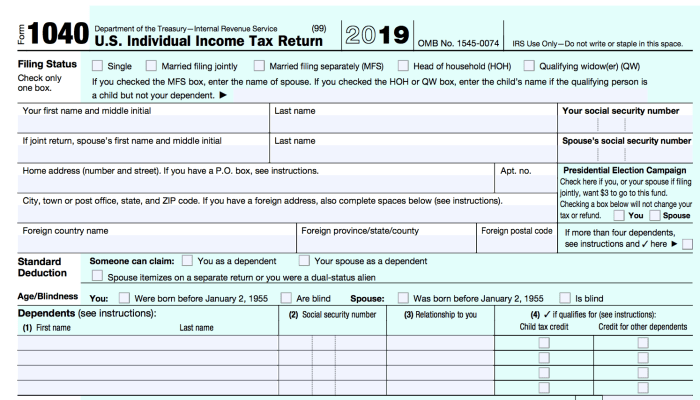

Reporting the Credit on Form 1040

After calculating the student loan interest deduction on Form 8863, the final amount will be transferred to your Form 1040, U.S. Individual Income Tax Return. Specifically, the total amount of the deduction will be entered on line 34, “Adjusted Gross Income (AGI),” as a reduction to your AGI. This reduction lowers your taxable income, leading to a smaller tax liability.

Required Documentation for Supporting the Claimed Credit

Maintaining comprehensive records is essential for successfully claiming the student loan interest deduction. You will need documentation to substantiate the amount of interest paid. This typically includes Form 1098-E, Student Loan Interest Statement, which your lender is required to provide if you paid $600 or more in student loan interest during the year. If you paid less than $600, you will need to obtain documentation directly from your lender showing the total amount of interest paid during the tax year. Keeping copies of your loan statements, payment confirmations, and any other relevant financial documents related to your student loans throughout the year is highly recommended.

Claiming the Credit: Single Filers vs. Married Couples Filing Jointly

The process of claiming the student loan interest deduction is largely the same for both single filers and married couples filing jointly. The key difference lies in the eligibility requirements and the maximum amount of interest that can be deducted. While the maximum deduction is the same ($2,500) regardless of filing status, the eligibility requirements might differ based on adjusted gross income (AGI). For example, a married couple filing jointly would have a higher AGI threshold compared to a single filer before they are no longer eligible for the deduction. Both single filers and married couples filing jointly must use Form 8863 and report the deduction on Form 1040, line 34. The only significant difference lies in their respective AGI limits for qualification. Always refer to the most up-to-date IRS guidelines for the specific AGI thresholds for your filing status.

Impact of the Student Loan Interest Tax Credit on Tax Liability

The Student Loan Interest Tax Credit can significantly reduce your annual tax liability, offering substantial savings for eligible taxpayers. The amount of savings depends on several factors, including the amount of interest paid, your modified adjusted gross income (MAGI), and your filing status. Understanding how this credit interacts with other deductions and credits is crucial for maximizing your tax benefits.

Potential Tax Savings from the Credit

The Student Loan Interest Tax Credit allows you to deduct a certain amount of the interest you paid on eligible student loans from your taxable income. This deduction is capped at $2,500 annually, meaning the maximum tax savings will depend on your marginal tax bracket. For example, a taxpayer in the 22% tax bracket could save up to $550 ($2,500 x 0.22) annually. The actual savings will be less if the interest paid is less than $2,500. It’s important to note that this credit is nonrefundable, meaning it can reduce your tax liability to zero, but you won’t receive any of the credit back as a refund.

Interaction with Other Tax Deductions and Credits

The Student Loan Interest Tax Credit can interact with other tax deductions and credits in several ways. It is calculated based on your modified adjusted gross income (MAGI), which is your adjusted gross income (AGI) with certain adjustments. This means other deductions and credits that affect your AGI can indirectly impact the amount of the student loan interest credit you can claim. For instance, a large itemized deduction could lower your AGI, potentially increasing the amount of the student loan interest credit you qualify for. However, the interaction is complex and depends on your specific tax situation. It’s advisable to consult a tax professional for personalized guidance.

Situations Where Claiming the Credit May Not Be Beneficial

While generally advantageous, there are situations where claiming the Student Loan Interest Tax Credit might not provide significant benefits. This is particularly true for taxpayers with very low incomes or those whose student loan interest payments are minimal. For example, if your tax liability is already very low or zero even before claiming the credit, the additional reduction provided by the credit will be insignificant. Similarly, if you only paid a small amount of student loan interest during the year, the resulting tax savings may be negligible compared to the effort of claiming the credit. Also, remember that this credit is only for interest paid; it does not cover the principal portion of your student loan payments.

Comparative Tax Liability with and Without the Credit

The following table illustrates the potential tax savings for different income levels, assuming a $2,500 student loan interest deduction and various tax brackets. These are illustrative examples only and do not constitute tax advice. Actual tax liability depends on individual circumstances and the applicable tax laws.

| Adjusted Gross Income (AGI) | Tax Bracket (Illustrative) | Tax Liability Without Credit | Tax Liability With Credit | Tax Savings |

|---|---|---|---|---|

| $40,000 | 12% | $4,000 | $3,700 | $300 |

| $60,000 | 22% | $8,000 | $7,450 | $550 |

| $80,000 | 24% | $12,000 | $11,400 | $600 |

| $100,000 | 24% | $16,000 | $15,400 | $600 |

Changes and Updates to the Student Loan Interest Tax Credit

The Student Loan Interest Tax Credit (SLITC), while seemingly straightforward, has undergone several modifications since its inception. Understanding these changes is crucial for taxpayers to accurately claim the credit and maximize their tax benefits. These alterations reflect evolving economic conditions, shifts in higher education financing, and adjustments to broader tax policy.

The SLITC, designed to alleviate the burden of student loan debt, hasn’t remained static. Its parameters, including the maximum amount of deductible interest and income limitations, have been adjusted over time, sometimes subtly, sometimes significantly, impacting the number of eligible taxpayers and the amount of the credit they can claim. These changes often reflect broader legislative priorities and economic considerations.

Historical Context and Evolution of the SLITC

The SLITC has a history stretching back to the late 1980s and early 1990s. Initially, the credit was relatively modest and had stricter eligibility requirements. Over time, Congress has expanded the credit’s reach and increased the maximum amount of deductible interest. This evolution is a reflection of growing awareness of the increasing cost of higher education and the associated burden of student loan debt. The credit has also been adjusted to align with other tax reforms and economic stimulus packages. For example, modifications during periods of economic recession have often aimed to provide greater tax relief to struggling borrowers.

Significant Modifications to the SLITC: A Timeline

The following timeline highlights some key adjustments to the SLITC’s parameters:

Understanding this timeline provides context for the current rules and helps anticipate potential future adjustments.

| Year | Significant Change | Impact on Taxpayers |

|---|---|---|

| 1998 | The SLITC was made permanent. | Provided greater certainty for taxpayers planning for student loan repayment. |

| 2001 | Income limitations were adjusted. | Affected the number of taxpayers eligible for the full credit. |

| 2009 | The maximum amount of deductible interest was temporarily increased as part of the American Recovery and Reinvestment Act. | Provided temporary relief to borrowers during the economic downturn. |

| 2018 | Tax Cuts and Jobs Act led to some minor changes, though not a significant overhaul. | Generally, the effect on taxpayers was minimal, mostly impacting those at higher income levels. |

Potential Future Implications of Changes to the SLITC

Predicting future changes to the SLITC is inherently speculative, but several factors could influence its future. The ever-increasing cost of higher education and the growing national student loan debt crisis could lead to calls for expansion of the credit, potentially increasing the maximum deductible interest or raising income limits. Conversely, budgetary concerns could lead to limitations on the credit, potentially reducing the maximum deduction or tightening eligibility criteria. Further, future tax reform legislation could significantly alter the credit’s structure, potentially integrating it into other tax provisions or even phasing it out entirely. For example, a future administration focused on fiscal conservatism might seek to reduce or eliminate tax credits to reduce the national deficit. Conversely, an administration focused on social programs might increase the credit to ease the burden of student loan debt.

Alternative Methods for Managing Student Loan Debt

Successfully navigating student loan debt often requires strategies beyond the student loan interest tax credit. Many options exist to help borrowers manage and reduce their debt burden, ultimately leading to financial freedom. Understanding these options and choosing the best approach depends on individual circumstances and financial goals.

Strategies for Reducing Student Loan Debt

Reducing student loan debt involves proactive measures to lower the principal amount owed and potentially decrease monthly payments. These strategies can significantly impact long-term financial health.

- Income-Driven Repayment (IDR) Plans: IDR plans adjust monthly payments based on your income and family size. Several plans exist, including the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE) plans. These plans can result in lower monthly payments, but it’s crucial to understand that they often extend the repayment period, leading to potentially higher total interest paid over the life of the loan.

- Student Loan Refinancing: Refinancing involves replacing your existing student loans with a new loan from a private lender, often at a lower interest rate. This can lead to lower monthly payments and faster debt payoff. However, refinancing may eliminate federal loan benefits like income-driven repayment plans and loan forgiveness programs.

- Debt Consolidation: Consolidating federal student loans combines multiple loans into a single loan, simplifying repayment. While this doesn’t necessarily lower your interest rate, it simplifies the repayment process and may offer a fixed interest rate. It’s important to compare interest rates and fees before consolidating.

- Increased Payments: Making extra payments on your student loans, even small amounts, can significantly reduce the principal and shorten the repayment period, ultimately saving on interest. Consider automating payments to ensure consistency.

- Budgeting and Financial Planning: Creating a detailed budget and developing a comprehensive financial plan are crucial steps in managing student loan debt effectively. Tracking expenses and identifying areas for savings can free up funds for extra loan payments.

Repayment Plan Comparison

Different repayment plans cater to varying financial situations and priorities. The best choice depends on individual income, debt amount, and long-term financial goals.

| Repayment Plan | Monthly Payment | Repayment Period | Interest Paid |

|---|---|---|---|

| Standard Repayment | Fixed, higher | 10 years | Lower |

| Extended Repayment | Lower | Up to 25 years | Higher |

| Income-Driven Repayment (IDR) | Variable, based on income | Up to 20-25 years | Potentially Higher |

Note: The table above provides a general comparison; actual payments and repayment periods will vary based on individual loan amounts and interest rates.

Resources for Financial Aid and Loan Forgiveness Programs

Several resources offer information and assistance in accessing financial aid and loan forgiveness programs. These programs can significantly reduce or eliminate student loan debt under specific circumstances.

- Federal Student Aid (FSA): The FSA website (studentaid.gov) provides comprehensive information on federal student loan programs, repayment plans, and forgiveness options.

- National Foundation for Credit Counseling (NFCC): The NFCC offers free and low-cost credit counseling services, including assistance with student loan management and debt reduction strategies.

- Your Loan Servicer: Your loan servicer can provide personalized information about your repayment options and available programs. Contacting them directly is essential for understanding your specific situation.

Final Summary

Successfully navigating the student loan repayment process often requires a multi-faceted approach. The Student Loan Interest Tax Credit is a valuable tool that can provide significant tax relief, but understanding its intricacies is crucial for maximizing its benefits. By carefully reviewing eligibility requirements, accurately calculating the credit amount, and properly claiming it on your tax return, you can substantially reduce your overall tax liability and accelerate your path towards financial freedom. Remember to explore alternative debt management strategies in conjunction with this credit to create a comprehensive financial plan tailored to your specific circumstances.

Q&A

Can I claim the credit if I’m still in school?

No, you must be paying interest on a qualified student loan and no longer be enrolled at least half-time in an eligible educational institution.

What if I paid off my student loan during the year? Can I still claim the credit?

Yes, you can claim the credit for the amount of interest you paid during the tax year, even if you paid off the loan completely.

Is there a limit to how much interest I can deduct?

Yes, the maximum amount of interest you can deduct is $2,500 per year, regardless of how much interest you actually paid.

What if my AGI is slightly above the limit?

The credit is phased out for higher income earners. You may still be eligible for a partial credit depending on how much your AGI exceeds the limit. Consult the IRS guidelines or a tax professional for precise calculations.