Navigating the complexities of student loan repayment can be daunting, but understanding potential tax benefits like the student loan interest deduction can significantly ease the financial burden. This guide provides a clear and concise overview of the eligibility criteria, calculation methods, and overall impact of this valuable deduction, empowering you to make informed decisions about your tax obligations.

This resource delves into the intricacies of claiming the student loan interest deduction, covering everything from determining your eligibility based on adjusted gross income (AGI) and loan type to understanding the necessary documentation and record-keeping practices. We’ll explore how this deduction interacts with other student tax benefits and examine the potential impact of future tax law changes. Through illustrative examples and clear explanations, we aim to demystify the process and empower you to maximize your tax savings.

Eligibility Criteria for Student Loan Interest Deduction

Claiming the student loan interest deduction can significantly reduce your tax burden, but understanding the eligibility requirements is crucial. This section Artikels the criteria you must meet to qualify for this deduction. Failure to meet these requirements will prevent you from claiming the deduction on your tax return.

Student Loan Types that Qualify

The deduction applies only to interest paid on qualified education loans. These are loans taken out to pay for higher education expenses for yourself, your spouse, or a dependent. This includes undergraduate, graduate, and professional degree programs. Loans used for other purposes, such as personal expenses or non-educational costs, do not qualify. It’s important to note that the loan must be used to pay for qualified education expenses at an eligible educational institution. This generally means an institution that is accredited and authorized to participate in federal student aid programs.

Adjusted Gross Income (AGI) Limits

The amount of student loan interest you can deduct is dependent on your Modified Adjusted Gross Income (MAGI). Your MAGI is your adjusted gross income (AGI) with certain deductions added back in. The maximum deduction is $2,500. However, the ability to deduct the full amount depends on your MAGI. If your MAGI exceeds a certain threshold, the deduction is phased out. The specific AGI limits vary depending on your filing status. Exceeding these limits will result in a reduced or no deduction.

Determining Eligibility Based on Income

To determine your eligibility, you need to first calculate your MAGI. This involves starting with your AGI from your tax return and making adjustments as specified by the IRS instructions. Once you have your MAGI, compare it to the applicable AGI limits for your filing status (as shown in the table below). If your MAGI is below the limit, you can deduct the full amount of student loan interest paid. If it falls within the phaseout range, your deduction will be reduced. If your MAGI is above the phaseout range, you won’t be able to claim the deduction.

AGI Limits by Filing Status

| Filing Status | AGI Limit for Full Deduction | AGI Phaseout Range (Single/Head of Household) | AGI Phaseout Range (Married Filing Jointly/Qualifying Surviving Spouse) |

|---|---|---|---|

| Single | $70,000 | $70,000 – $85,000 | N/A |

| Married Filing Jointly | $140,000 | N/A | $140,000 – $170,000 |

| Head of Household | $85,000 | $85,000 – $100,000 | N/A |

| Married Filing Separately | $35,000 | $35,000 – $42,500 | N/A |

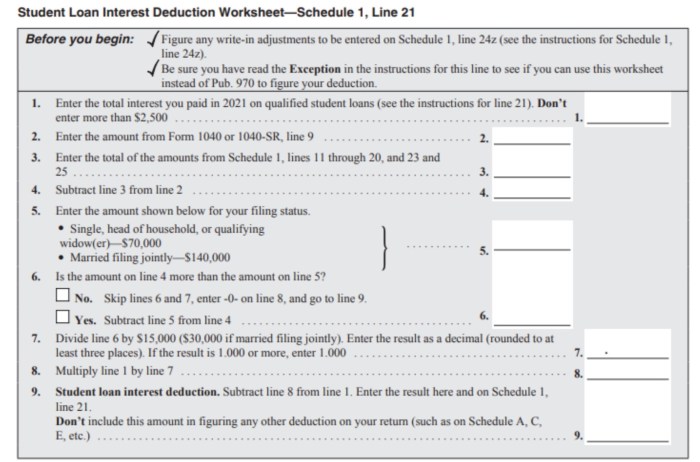

Calculating the Deductible Amount

Determining the amount of student loan interest you can deduct requires understanding your adjusted gross income (AGI) and the actual interest you paid during the tax year. The deduction is limited, and the process involves several steps to ensure you claim the correct amount.

The calculation of your student loan interest deduction involves comparing your actual student loan interest paid against your adjusted gross income (AGI) and the annual maximum deduction limit. The deduction is limited to the lesser of the amount of interest you paid during the year or the maximum allowable deduction based on your AGI.

Student Loan Interest Deduction Calculation

To calculate your deduction, you’ll first need to determine your total student loan interest paid during the tax year. This information is usually found on Form 1098-E, Student Loan Interest Statement. Next, you need your Adjusted Gross Income (AGI) from your tax return. The maximum deduction amount is dependent on your AGI. For the 2023 tax year, the maximum deduction is $2,500, but this can be reduced if your AGI exceeds a certain threshold. The IRS provides updated AGI thresholds annually; consult the latest IRS publications for the most current information.

Examples of Student Loan Interest Deduction Calculations

Let’s illustrate with a couple of examples:

Example 1: Sarah paid $1,800 in student loan interest and has an AGI of $70,000. Assuming the maximum deduction for her AGI is $2,500 (check the current IRS guidelines to verify), her student loan interest deduction is $1,800, as this is less than the maximum allowed.

Example 2: John paid $3,000 in student loan interest and has an AGI of $85,000. Let’s assume the maximum deduction for his AGI is $2,500 (again, check the current IRS guidelines). In this case, his deduction is limited to $2,500, even though he paid more.

Determining the Maximum Deductible Amount

The maximum amount you can deduct is determined by your AGI and is subject to change annually. The IRS publishes tables outlining the maximum deduction based on AGI brackets. It’s crucial to refer to the most up-to-date IRS publications to ensure you are using the correct figures for the tax year in question. Failure to do so could result in an inaccurate deduction.

Flowchart for Calculating the Student Loan Interest Deduction

The following flowchart Artikels the steps to calculate your student loan interest deduction:

[Imagine a flowchart here. The flowchart would begin with a box labeled “Start.” The next box would ask “What is your total student loan interest paid?”. This would lead to two boxes: one for “Interest Paid” (which would have a space to write in the amount) and another for “Proceed to next step.” The next box would ask “What is your Adjusted Gross Income (AGI)?” This would lead to two boxes: one for “AGI” (with a space to write in the amount) and another for “Proceed to next step.” The next box would ask “What is the maximum allowable deduction based on your AGI (consult IRS Publication)?” This would lead to two boxes: one for “Maximum Deduction” (with a space to write in the amount) and another for “Proceed to next step.” The next box would state “Compare Interest Paid to Maximum Deduction.” This would lead to two boxes: one for “Interest Paid Maximum Deduction” (leading to a box saying “Deduction = Maximum Deduction”). Finally, a box labeled “End” would complete the flowchart.]

Documentation and Record Keeping

Claiming the student loan interest deduction requires meticulous record-keeping. The IRS needs proof you actually paid the interest and how much. Failing to maintain proper documentation could result in a denied deduction, costing you valuable tax savings. This section Artikels the necessary documents and best practices for ensuring a smooth and successful claim.

Proper documentation is crucial for successfully claiming the student loan interest deduction. The IRS requires sufficient evidence to verify your payments and the amount you can deduct. Accurate record-keeping not only simplifies the tax filing process but also protects you from potential audits and disputes. Maintaining organized records is a proactive approach to ensure your claim is processed efficiently and accurately.

Necessary Documents for Student Loan Interest Deduction

To support your student loan interest deduction claim, you’ll need several key documents. These documents provide irrefutable proof of your payments and the relevant loan details. Gather these documents well in advance of tax season to avoid last-minute stress.

- Form 1098-E, Student Loan Interest Statement: This form is issued by your lender and reports the total amount of student loan interest you paid during the tax year. It’s the most important document for your claim.

- Loan Documents: Keep copies of your loan agreements, promissory notes, and any other paperwork related to your student loans. These documents verify the existence of the loans and their terms.

- Payment Records: Maintain records of all your student loan payments, including bank statements, cancelled checks, or online payment confirmations. These documents corroborate the amounts reported on Form 1098-E.

- Tax Return from the Previous Year (if applicable): If you’ve claimed this deduction in previous years, having your previous tax return can be helpful for comparison and continuity.

Importance of Accurate Record-Keeping for Student Loan Interest Payments

Maintaining accurate records is paramount for several reasons. First, it simplifies the tax preparation process. Having all your documents organized makes it easier for you or your tax professional to complete your return accurately and efficiently. Second, accurate records protect you against potential audits. The IRS may request documentation to verify your claim; having organized records ensures a smooth audit process. Finally, accurate records prevent disputes and potential penalties. If your records are unclear or incomplete, it could lead to delays, denials, or even penalties.

Best Practices for Organizing and Storing Student Loan Payment Records

Effective organization is key to managing your student loan payment records. Consider these best practices to streamline the process and minimize the risk of losing crucial information.

- Digital Organization: Use a secure cloud storage service or a dedicated folder on your computer to store digital copies of your documents. This ensures easy access and protection against physical loss.

- Physical Organization: If you prefer physical copies, use a filing system with clearly labeled folders. Consider using a fire-safe filing cabinet to protect your documents from damage.

- Regular Review: Periodically review your records to ensure everything is accurate and up-to-date. This proactive approach helps catch any errors early on.

- Data Backup: Regularly back up your digital records to prevent data loss due to hardware failure or other unforeseen events.

Sample Checklist of Documents Needed for Filing a Tax Return with the Student Loan Interest Deduction

Before filing your tax return, use this checklist to ensure you have all the necessary documents:

- Form 1098-E (Student Loan Interest Statement)

- Copies of student loan agreements and promissory notes

- Records of all student loan payments (bank statements, cancelled checks, online payment confirmations)

- Tax return from the previous year (if applicable)

- Your Social Security number

Impact of Tax Deduction on Overall Tax Liability

The student loan interest deduction can significantly reduce a taxpayer’s overall tax liability, potentially saving hundreds or even thousands of dollars annually. The amount of savings depends on several factors, most importantly the taxpayer’s adjusted gross income (AGI) and the amount of student loan interest paid. Understanding how this deduction impacts your tax bill is crucial for effective tax planning.

The deduction works by allowing you to reduce your taxable income by the amount of student loan interest you paid during the year. This directly lowers your tax bill, as you pay taxes on a smaller amount of income. The impact varies based on your tax bracket; higher earners in higher tax brackets will see a greater reduction in their overall tax liability compared to those in lower brackets.

Tax Savings at Different Income Levels

The following table illustrates the potential tax savings from the student loan interest deduction for various income levels. These are illustrative examples and do not constitute financial advice. Actual savings will depend on individual circumstances and the applicable tax laws for the given year. The calculations assume a standard deduction and no other itemized deductions that might influence the overall tax liability.

| Adjusted Gross Income (AGI) | Student Loan Interest Paid | Tax Liability Without Deduction | Tax Liability With Deduction | Tax Savings |

|---|---|---|---|---|

| $50,000 | $2,500 | $6,000 | $5,000 | $1,000 |

| $75,000 | $2,500 | $10,000 | $8,500 | $1,500 |

| $100,000 | $2,500 | $15,000 | $12,500 | $2,500 |

Examples of Tax Liability Reduction

Let’s consider two taxpayers, both paying $2,000 in student loan interest. Taxpayer A has an AGI of $40,000, while Taxpayer B has an AGI of $80,000. Due to the progressive nature of the tax system, Taxpayer B, who is in a higher tax bracket, will see a larger reduction in their tax liability, even though both paid the same amount of student loan interest. The exact amount of savings will depend on the applicable tax rates for the given tax year. For illustrative purposes, let’s assume Taxpayer A’s tax liability is reduced by $600, while Taxpayer B’s is reduced by $800. This demonstrates that the benefit of the deduction is not uniform across all income levels. The higher your income, the greater the potential savings.

Comparison with Other Tax Benefits for Students

Choosing the best tax strategy can significantly impact a student’s overall tax liability. While the student loan interest deduction offers relief on loan payments, other tax benefits specifically designed for education might prove more advantageous depending on individual circumstances. This section compares the student loan interest deduction with the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC), highlighting their eligibility requirements and benefits to help you determine which option best suits your situation.

The student loan interest deduction, AOTC, and LLC each offer unique advantages, focusing on different aspects of educational expenses. Understanding their nuances is crucial for maximizing tax savings.

American Opportunity Tax Credit (AOTC) vs. Student Loan Interest Deduction

The AOTC is a credit, not a deduction, meaning it directly reduces your tax liability dollar for dollar. Unlike the student loan interest deduction, which applies to interest payments, the AOTC is for qualified education expenses such as tuition, fees, and books. It’s available for the first four years of post-secondary education and requires the student to be pursuing a degree or other credential at an eligible educational institution. The maximum credit is $2,500 per student, phased out based on modified adjusted gross income (MAGI). For example, a student with a MAGI below $80,000 (single filer) could receive the full $2,500 credit. However, a student with a MAGI above $90,000 (single filer) would not be eligible for the credit. The student loan interest deduction, on the other hand, has a maximum deduction of $2,500, but the amount deducted is dependent on the actual interest paid.

- AOTC Advantages: Larger potential tax savings (up to $2,500), applies to tuition and fees, can be more beneficial for students with higher education expenses.

- AOTC Disadvantages: Limited to the first four years of post-secondary education, income limitations, requires attending an eligible educational institution.

- Student Loan Interest Deduction Advantages: Applicable even after graduation, helps with loan repayment, no income limitations (up to a certain income threshold).

- Student Loan Interest Deduction Disadvantages: Maximum deduction is limited to the amount of interest paid, may be less beneficial for students with low interest payments.

Lifetime Learning Credit (LLC) vs. Student Loan Interest Deduction

The LLC is another education credit, but unlike the AOTC, it’s not limited to the first four years of college. It can be claimed for undergraduate, graduate, and professional degree programs, as well as for courses taken to improve job skills. The maximum credit is $2,000 per tax return, and the credit is nonrefundable, meaning it can reduce your tax liability to zero but not result in a refund. The phase-out for the LLC begins at a higher income level than the AOTC. The student loan interest deduction, again, is limited to the actual interest paid and applies only to student loan interest.

- LLC Advantages: Applicable for undergraduate and graduate studies, no limit on the number of years it can be claimed.

- LLC Disadvantages: Lower maximum credit ($2,000), nonrefundable, income limitations.

- Student Loan Interest Deduction Advantages: Helps manage student loan debt, no educational requirement, applicable after graduation.

- Student Loan Interest Deduction Disadvantages: Limited by the amount of interest paid, not as substantial a tax benefit as credits.

Scenario Examples

Scenario 1: A student in their first year of college pays $4,000 in tuition and $1,000 in student loan interest. The AOTC would likely be more beneficial, potentially saving them up to $2,500. The student loan interest deduction would only save them up to $1,000.

Scenario 2: A graduate student with no tuition expenses but $3,000 in student loan interest would benefit more from the student loan interest deduction, as they wouldn’t qualify for the AOTC or LLC.

Changes in Tax Laws Affecting the Deduction

The student loan interest deduction, while a valuable benefit for many, is not immune to the ebb and flow of tax law changes. Understanding these modifications is crucial for taxpayers to accurately calculate their deductions and plan for future tax liabilities. Recent legislative actions and proposed alterations have introduced complexities that require careful consideration.

The student loan interest deduction, like many tax provisions, is subject to change based on evolving economic conditions and policy priorities. These changes can affect both the eligibility requirements and the maximum amount that can be deducted. Tracking these modifications is essential for accurate tax preparation and financial planning.

Recent and Proposed Changes to the Student Loan Interest Deduction

The student loan interest deduction has remained relatively stable in recent years, but its future is subject to ongoing debate. While there haven’t been major overhauls recently, proposals for tax reform frequently include discussions regarding the deduction’s continuation, modification, or elimination. These proposals often center around concerns about the cost of the deduction to the federal government and its effectiveness in promoting access to higher education. For example, some proposals suggest modifying the income limits for eligibility or capping the maximum deductible amount. Others advocate for replacing the deduction with alternative forms of student financial aid. It’s important to monitor legislative developments closely to stay informed about potential changes.

Impact of Changes on Eligibility Criteria and Maximum Deductible Amount

Potential changes to the student loan interest deduction could significantly impact eligibility criteria. For instance, raising the adjusted gross income (AGI) limits would exclude more taxpayers from claiming the deduction. Similarly, lowering the AGI limits would make the deduction accessible to a wider range of taxpayers. Changes to the maximum deductible amount would directly affect the financial benefit received by eligible taxpayers. Reducing the maximum deduction would lessen the tax savings for individuals, while increasing it would provide greater relief. These changes would need to be carefully considered in light of their effect on the overall affordability and accessibility of higher education.

Timeline of the Student Loan Interest Deduction

The student loan interest deduction has evolved over time, reflecting shifts in government policy toward higher education. While a precise historical timeline requires detailed research of legislative records, a general overview illustrates the key developments. The deduction’s initial form might have been introduced as a relatively modest benefit. Over the years, it has likely experienced periods of expansion (increased maximum deduction or broadened eligibility) and contraction (reduced maximum deduction or stricter eligibility requirements) in response to budgetary pressures or policy adjustments. Tracking the deduction’s evolution through legislative acts and tax code revisions provides valuable insight into its long-term impact on taxpayers. For example, the American Recovery and Reinvestment Act of 2009 might have temporarily increased the deduction or expanded eligibility.

Potential Future Implications for Taxpayers

Future changes to the student loan interest deduction could have several implications for taxpayers. For example, if the deduction were eliminated, taxpayers with student loan debt would face a higher tax burden. This could lead to decreased disposable income and potentially affect their ability to repay their loans. Conversely, changes that increase the deduction’s value could provide significant financial relief to students and recent graduates. These changes could also influence borrowing decisions, as individuals might be more or less inclined to take out student loans based on the tax benefits available. The potential impact on higher education access and affordability would need to be considered when evaluating any proposed changes to the deduction.

Illustrative Scenarios and Examples

Understanding how the student loan interest deduction works can be challenging. The following examples illustrate how different factors, such as income, loan amount, and repayment plan, affect the deduction and ultimately, a taxpayer’s tax liability. These scenarios are for illustrative purposes only and do not constitute tax advice. Consult a tax professional for personalized guidance.

Student Loan Interest Deduction Scenarios

The student loan interest deduction is subject to several limitations, including modified adjusted gross income (MAGI) limits and the maximum amount of interest that can be deducted. The following table presents several scenarios demonstrating the application of the deduction under varying circumstances. Note that these examples use simplified calculations and do not account for all possible tax situations.

| Scenario | MAGI | Student Loan Interest Paid | Deductible Interest | Tax Savings (Assuming a 22% Tax Bracket) |

|---|---|---|---|---|

| Single filer, low income | $40,000 | $1,500 | $1,500 | $330 |

| Married filing jointly, moderate income | $80,000 | $2,000 | $2,000 | $440 |

| Single filer, high income, exceeding MAGI limit | $100,000 | $2,500 | $0 (MAGI exceeds limit) | $0 |

| Single filer, low income, interest paid exceeds maximum deduction | $35,000 | $3,000 | $2,500 (Maximum deduction) | $550 |

Scenario Details and Explanations

The table above presents four distinct scenarios. Scenario 1 depicts a single filer with a low MAGI, allowing for a full deduction of the student loan interest paid. Scenario 2 shows a married couple filing jointly with a moderate MAGI, also eligible for a full deduction. Scenario 3 illustrates a single filer with a high MAGI exceeding the limit for the deduction, resulting in no deduction. Finally, Scenario 4 demonstrates a situation where the interest paid exceeds the annual maximum deduction limit, highlighting the limitation on the amount deductible. The tax savings are calculated based on a 22% marginal tax bracket; the actual savings will vary depending on the individual’s tax bracket. These scenarios demonstrate the importance of understanding both your MAGI and the maximum allowable deduction to accurately determine your potential tax benefits.

Final Thoughts

Successfully claiming the student loan interest deduction can provide substantial tax relief, reducing your overall tax liability and making a tangible difference in your repayment journey. By carefully reviewing your eligibility, accurately calculating the deductible amount, and maintaining meticulous records, you can confidently navigate the tax system and optimize your financial situation. Remember to stay informed about potential changes in tax laws that may affect this deduction in the future.

Essential FAQs

Can I deduct interest paid on private student loans?

Yes, provided you meet the eligibility criteria, including AGI limits and other requirements.

What if I paid off my student loans early? Can I still deduct the interest?

Yes, you can deduct the interest you paid during the tax year, regardless of when you paid off the loan in full.

Where do I claim the student loan interest deduction on my tax return?

You claim it on Form 1040, Schedule 1 (Additional Income and Adjustments to Income).

What happens if I exceed the maximum deductible amount?

You can only deduct up to the annual limit, even if you paid more interest than that.

My AGI is slightly above the limit. Are there any exceptions?

Unfortunately, there are no exceptions to the AGI limits. You will not be eligible if your AGI exceeds the threshold.