Navigating the complexities of student loan repayment is a significant challenge for many graduates. Understanding the available tax benefits, such as the student loan interest tax deduction, can significantly alleviate this financial burden. This guide provides a clear and concise explanation of the deduction, coupled with a practical approach to utilizing a student loan interest tax deduction calculator to maximize your savings.

We’ll explore the eligibility criteria, calculation methods, and potential pitfalls to ensure you accurately claim this valuable deduction. Furthermore, we will compare this deduction to other student tax benefits, helping you make informed decisions about your financial planning. By the end, you’ll be equipped to confidently navigate the process and secure the maximum allowable deduction.

Understanding the Student Loan Interest Tax Deduction

The student loan interest tax deduction can provide significant tax relief for those repaying student loans. This deduction allows you to reduce your taxable income by the amount of interest you paid during the year, potentially lowering your overall tax bill. Understanding the eligibility requirements and limitations is crucial to maximizing this benefit.

Eligibility Requirements for the Student Loan Interest Deduction

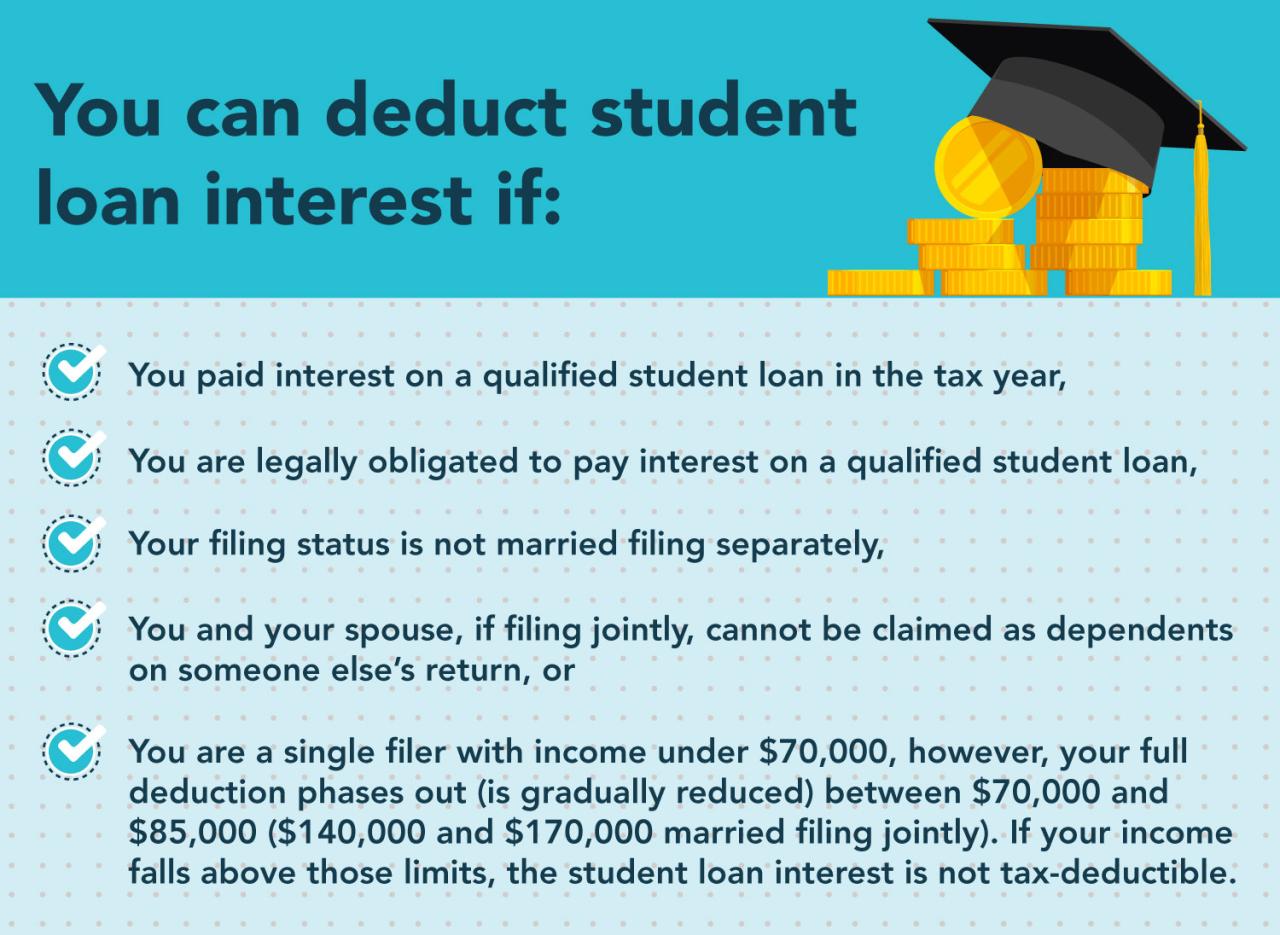

To claim the student loan interest deduction, you must meet several criteria. Firstly, the student loans must be taken out for yourself, your spouse, or a dependent. The loans must be used to pay for qualified education expenses, such as tuition, fees, and room and board. Importantly, you must be legally obligated to repay the loan, and the interest must be paid on a loan for higher education. Finally, your modified adjusted gross income (MAGI) must be below a certain threshold; this threshold varies depending on your filing status and the tax year. For example, in 2023, for single filers, the phaseout begins at $85,000 of MAGI.

Maximum Deduction Amount

The maximum amount you can deduct is $2,500 of student loan interest paid during the tax year. This limit applies regardless of how much interest you actually paid. Even if you paid more than $2,500 in interest, you can only deduct up to this maximum. It’s important to note that this deduction is an above-the-line deduction, meaning it’s deducted from your gross income before calculating your adjusted gross income (AGI). This can be beneficial as it reduces your taxable income more effectively than some itemized deductions.

Claiming the Student Loan Interest Deduction

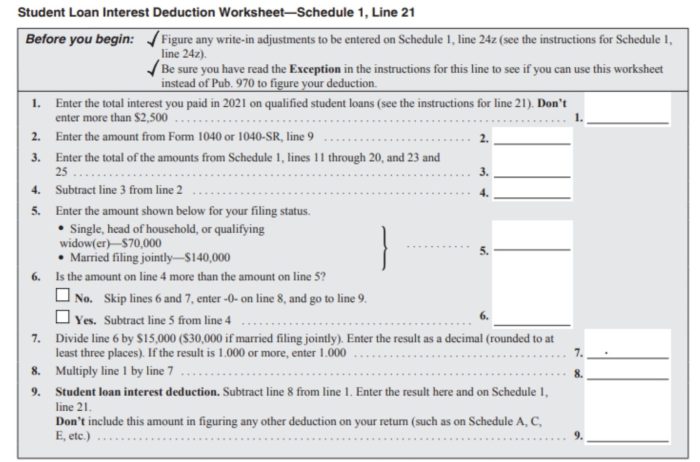

Claiming the deduction is relatively straightforward. You’ll need Form 1098-E, “Student Loan Interest Statement,” which your lender should provide by January 31st of the following year. This form reports the total amount of interest you paid during the year. You’ll then use Form 1040, Schedule 1 (Additional Income and Adjustments to Income), to report the deduction. Specifically, you will enter the amount from Form 1098-E on line 21 of Schedule 1. Remember to keep a copy of your Form 1098-E and any other supporting documentation for your records in case of an audit.

Situations Where the Deduction May Not Apply

There are several situations where the student loan interest deduction may not be applicable. For example, if the loan was used for purposes other than qualified education expenses (like purchasing a car), the interest wouldn’t be deductible. Similarly, if the loan is a parent PLUS loan taken out by a parent and not the student, the student themselves cannot claim the deduction. Finally, if your modified adjusted gross income (MAGI) exceeds the phaseout limit for your filing status, you may not be able to claim the full deduction or any deduction at all. For instance, a married couple filing jointly with a MAGI exceeding $170,000 in 2023 would not be able to claim the deduction. These income limits are adjusted annually for inflation.

Functionality of a Student Loan Interest Tax Deduction Calculator

A student loan interest tax deduction calculator simplifies the process of determining the amount of student loan interest you can deduct from your federal income tax. It automates the calculations required under IRS guidelines, saving taxpayers time and effort. Understanding its functionality is key to accurately claiming this deduction.

Required Inputs

A typical student loan interest deduction calculator requires several key pieces of information from the user. These inputs allow the calculator to accurately perform the necessary calculations. Inaccurate input will result in an inaccurate deduction amount. Providing correct information is crucial.

- Adjusted Gross Income (AGI): This is your gross income minus certain deductions, as defined by the IRS. It’s a crucial factor because the deduction is limited based on your AGI.

- Total Student Loan Interest Paid: This is the total amount of interest you paid on qualified student loans during the tax year. It should include interest paid from all eligible loans.

- Loan Amount(s): While not always required, some calculators may ask for the total loan amount(s) to verify eligibility and perform additional calculations related to the deduction limit.

Calculations Performed

The calculator uses the provided inputs to determine the maximum deductible amount. The core calculation involves comparing the total interest paid against the AGI-based limit. The IRS sets an upper limit on the amount of student loan interest you can deduct, which is typically phased out as your AGI increases. The calculator takes this phase-out into account.

The calculation generally follows this pattern: Deductible Amount = Minimum (Total Interest Paid, AGI-Based Limit)

For example, if you paid $2,000 in student loan interest and your AGI-based limit is $2,500, the calculator would determine a deductible amount of $2,000. However, if your AGI-based limit was $1,500, the deductible amount would be $1,500.

Comparison of Online Calculators

Numerous online calculators are available, each with varying features and limitations. Some calculators may offer additional features like tax planning tools or personalized advice, while others may only provide the basic calculation. The accuracy of the calculations across different calculators is generally consistent, as they all rely on the same IRS guidelines, but the user experience and additional features can differ significantly. Some calculators might require creating an account, while others function as simple standalone tools. Features such as tax bracket calculation and the incorporation of other tax deductions could also be present.

Hypothetical Calculator User Interface

A simple student loan interest deduction calculator could have a user interface with the following elements:

| Input Field | Description |

|---|---|

| Adjusted Gross Income (AGI) | Numeric input field for AGI |

| Total Student Loan Interest Paid | Numeric input field for total interest paid |

| Calculate | Button to initiate the calculation |

Below the input fields, a clearly labeled section would display the calculated deductible amount. A brief explanation of the deduction limit based on the AGI would also be helpful. Error messages could alert users to invalid input, ensuring data accuracy.

Impact of Tax Laws and Income Levels

The student loan interest deduction, while seemingly straightforward, is significantly influenced by both prevailing tax laws and the filer’s adjusted gross income (AGI). Understanding these factors is crucial for accurately calculating the potential deduction. Changes in tax legislation can alter the maximum deduction amount, while income thresholds determine eligibility altogether.

The maximum amount you can deduct is capped, and this cap can change with tax law revisions. For example, Congress could decide to increase or decrease the maximum deduction allowed annually. Additionally, the rules surrounding who qualifies for the deduction and how much they can deduct could be modified through legislative action. These changes can impact the amount of tax savings an individual experiences.

Income Thresholds and Deduction Amounts

Eligibility for the student loan interest deduction is tied directly to your modified adjusted gross income (MAGI). If your MAGI exceeds a certain threshold, you may not be able to claim the full deduction, or any deduction at all. These thresholds are adjusted annually to account for inflation.

| Income Bracket (AGI) | Interest Paid | Deductible Amount | Notes |

|---|---|---|---|

| $70,000 – $85,000 (Single Filer) | $2,500 | $2,500 | Full deduction allowed within this bracket. |

| $85,001 – $90,000 (Single Filer) | $2,500 | Partial Deduction (Calculation Required) | Deduction is phased out; the exact amount depends on the specific AGI. |

| $150,000 – $170,000 (Married Filing Jointly) | $1,000 | $1,000 | Full deduction allowed within this bracket. |

| Above $170,000 (Married Filing Jointly) | $1,000 | $0 | No deduction allowed above this threshold. |

*Note: These are example figures and actual income thresholds and phase-out ranges vary annually. Consult the most recent IRS guidelines for precise current information.*

Visual Representation of Income and Maximum Deduction

Imagine a graph with the x-axis representing Adjusted Gross Income (AGI) and the y-axis representing the deductible amount of student loan interest. The graph would start at a point where the AGI is zero, and the deductible amount is at its maximum (the current annual limit). As the AGI increases, the deductible amount remains at its maximum until it reaches the lower threshold of the phase-out range. At this point, the line begins to slope downwards, gradually decreasing the deductible amount until it reaches zero at the upper threshold of the phase-out range. Beyond this upper threshold, the deductible amount remains at zero, regardless of the amount of interest paid. This visually demonstrates how the maximum deduction is directly affected by income levels, with a clear phase-out zone illustrating the gradual reduction in deduction as income rises. The slope of the line in the phase-out region would reflect the rate at which the deduction is reduced per dollar increase in AGI.

Comparison with Other Tax Benefits for Students

Navigating the complexities of student loan repayment often involves exploring various tax benefits to lessen the financial burden. While the student loan interest deduction is a valuable tool, it’s crucial to understand how it compares to other student-focused tax credits, such as the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). Understanding these differences allows students to strategically maximize their tax savings.

The student loan interest deduction, AOTC, and LLC offer distinct advantages depending on individual circumstances, including income levels, education level, and filing status. Strategic planning, informed by a clear understanding of each benefit’s limitations and requirements, can significantly impact a student’s overall tax liability.

American Opportunity Tax Credit (AOTC) versus Student Loan Interest Deduction

The AOTC offers a maximum credit of $2,500 per eligible student for the first four years of higher education. This credit is partially refundable, meaning a portion can be received back as a refund even if it exceeds the taxpayer’s tax liability. In contrast, the student loan interest deduction is a deduction, reducing taxable income rather than directly reducing the tax owed. The maximum deduction is $2,500, but unlike the AOTC, it is *not* refundable.

Let’s consider two scenarios:

* Scenario 1: A student, John, is in his first year of college and has $2,000 in student loan interest. He also qualifies for the full AOTC. John benefits significantly from both the AOTC (reducing his tax liability by $2,500) and the student loan interest deduction (reducing his taxable income by $2,000, resulting in further tax savings).

* Scenario 2: Jane, a graduate student, has paid $1,500 in student loan interest but no longer qualifies for the AOTC because she has exceeded the four-year limit. Jane can only utilize the student loan interest deduction, receiving tax savings based solely on that deduction.

Lifetime Learning Credit (LLC) versus Student Loan Interest Deduction

The LLC offers a maximum credit of $2,000 per tax return, regardless of the number of years of study. Unlike the AOTC, it’s not limited to the first four years of college and can be used for undergraduate or graduate studies. However, the LLC is *non-refundable*. The student loan interest deduction, as previously discussed, is also a non-refundable deduction, and its maximum is $2,500.

Consider these scenarios:

* Scenario 3: Sarah, a graduate student pursuing a master’s degree, pays $2,200 in student loan interest and qualifies for the LLC. She benefits from both, although the LLC’s maximum is less than the potential student loan interest deduction. The combined savings could still be substantial.

* Scenario 4: Mark is pursuing a PhD and has exceeded the four-year limit for the AOTC. He has $1,000 in student loan interest and is utilizing the LLC. In this case, the combined benefits offer more significant savings than relying solely on the student loan interest deduction.

Key Differences between Student Loan Interest Deduction, AOTC, and LLC

The following table summarizes the key differences between these tax benefits:

- Tax Benefit Type: The student loan interest deduction is a deduction, while the AOTC and LLC are credits.

- Maximum Benefit: Student loan interest deduction: $2,500; AOTC: $2,500; LLC: $2,000.

- Eligibility Requirements: Each benefit has specific income and educational requirements. The AOTC, for instance, has stricter income limits than the LLC.

- Refundability: The AOTC is partially refundable; the student loan interest deduction and LLC are not refundable.

- Years of Eligibility: The AOTC is limited to the first four years of higher education, while the LLC can be claimed for undergraduate and graduate studies indefinitely.

Potential Errors and Misunderstandings

Accurately calculating the student loan interest deduction requires careful attention to detail. Many taxpayers make mistakes, leading to either under- or over-claiming the deduction, resulting in either missed savings or potential IRS scrutiny. Understanding common pitfalls and implementing preventative strategies is crucial for maximizing this tax benefit.

Common errors often stem from misunderstandings regarding adjusted gross income (AGI) limitations, the definition of “qualified education loan interest,” and the proper documentation needed to support the deduction. Furthermore, changes in income or loan status throughout the year can complicate the calculation.

Incorrect AGI Calculation

The student loan interest deduction is subject to an AGI limitation. For the 2023 tax year, the deduction is phased out for single filers with modified AGI above $85,000 and for married couples filing jointly with modified AGI above $170,000. A common mistake is using the wrong AGI figure – for example, using gross income instead of modified AGI, or failing to account for all adjustments to income when calculating the modified AGI. This can lead to an incorrect determination of whether the deduction is even allowed, or a miscalculation of the deduction amount itself. For example, if a taxpayer incorrectly uses their gross income instead of their modified AGI, they may believe they qualify for the deduction when, in fact, they do not.

Misidentification of Qualified Education Loan Interest

Taxpayers must ensure that the interest they are deducting is actually from a “qualified education loan.” This refers to a loan taken out solely to pay for qualified education expenses, such as tuition, fees, room, and board. Interest paid on loans used for other purposes, even if indirectly related to education, is not deductible. A common error is including interest from loans used for non-educational purposes in the deduction calculation. For instance, a taxpayer might mistakenly include interest from a personal loan used to pay for living expenses while attending school.

Improper Documentation

Supporting documentation is crucial for claiming the student loan interest deduction. Taxpayers should retain Form 1098-E, which shows the amount of student loan interest paid during the year. Failure to keep this form, or to accurately record other relevant information, can lead to difficulty in substantiating the deduction during an audit. If a taxpayer cannot provide adequate documentation to support their claim, the IRS may disallow the deduction.

Consequences of Incorrectly Claiming the Deduction

Incorrectly claiming the student loan interest deduction can result in several consequences. Under-claiming results in lost tax savings, while over-claiming can lead to an amended tax return, penalties, and interest charges from the IRS. In severe cases, intentional misrepresentation could lead to more significant penalties. For example, a taxpayer who mistakenly overstates their deduction by $1,000 could face penalties and interest on the additional tax owed.

Strategies to Avoid Errors

To avoid errors, taxpayers should:

- Carefully review their Form 1098-E and compare it to their loan statements.

- Accurately calculate their modified AGI using IRS guidelines.

- Maintain meticulous records of all student loan payments and interest paid.

- Utilize tax preparation software or consult with a tax professional.

Flowchart for Accurate Calculation

A flowchart visualizing the calculation process would begin with determining if the taxpayer paid qualified education loan interest. Next, it would verify the taxpayer’s modified AGI against the applicable limits. If both conditions are met, the calculation proceeds to determine the deductible amount (up to the $2,500 maximum). If either condition isn’t met, the deduction is disallowed. The flowchart would highlight potential pitfalls at each step, such as incorrectly calculating AGI or misidentifying qualified interest. The final step would involve documenting the deduction on the tax return using the appropriate forms and schedules. A “no” answer at any decision point would lead to the conclusion of no deduction being claimed.

Last Point

Successfully claiming the student loan interest tax deduction requires careful attention to detail and a thorough understanding of the applicable regulations. Utilizing a reliable student loan interest tax deduction calculator can streamline the process and minimize the risk of errors. By combining a comprehensive understanding of the deduction with the practical application of a calculator, you can confidently maximize your tax savings and ease the financial strain of student loan repayment. Remember to review your tax situation annually and seek professional advice if needed.

Key Questions Answered

What happens if I overestimate my deduction?

Overestimating your deduction could result in owing additional taxes when you file, along with potential penalties and interest. Accurate calculation is crucial.

Can I deduct interest paid on loans for a parent’s education?

No, the student loan interest deduction only applies to interest paid on loans taken out for your own education.

Are there income limits for claiming this deduction?

Yes, there are modified adjusted gross income (MAGI) limits. The deduction may be phased out for higher earners. Consult the IRS guidelines for the current year’s limits.

What if I don’t itemize my deductions?

The student loan interest deduction is an itemized deduction. If you take the standard deduction, you cannot claim this deduction.

Where can I find a reliable student loan interest tax deduction calculator?

Several reputable financial websites and tax software programs offer these calculators. Always verify the source’s reliability before using any calculator.