Navigating the complex world of student loans can feel overwhelming, especially when faced with varying interest rates. Understanding these rates is crucial for minimizing long-term debt and ensuring financial stability after graduation. This guide will equip you with the knowledge and strategies to secure the lowest possible interest rate on your student loans, empowering you to make informed decisions about your financial future.

From exploring federal and private loan options to understanding the impact of your credit score and employing effective repayment strategies, we’ll cover essential aspects of securing the best possible terms. We’ll delve into the nuances of fixed versus variable rates, the benefits of subsidized loans, and the potential advantages of refinancing. By the end, you’ll have a clear roadmap to navigate the student loan landscape and achieve your financial goals.

Understanding Student Loan Interest Rates

Navigating the world of student loans requires a clear understanding of interest rates, as they significantly impact the total cost of your education. Interest rates determine how much extra you’ll pay beyond the principal loan amount. This section will clarify the key factors influencing these rates and illustrate how different rate types and capitalization affect your repayment.

Factors Influencing Student Loan Interest Rates

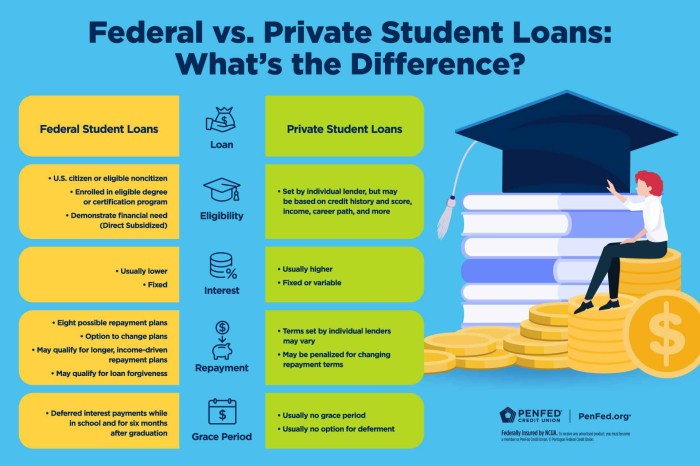

Several factors contribute to the interest rate you’ll receive on your student loans. These factors vary depending on whether your loan is federal or private. For federal loans, your credit history typically doesn’t play a role, while for private loans, it’s a significant determinant. Key factors include the type of loan (federal subsidized or unsubsidized, private), the lender’s cost of borrowing, prevailing market interest rates, and, for private loans, your creditworthiness (credit score, debt-to-income ratio). The government sets interest rates for federal student loans, while private lenders set their own rates based on a variety of factors. Generally, lower credit scores lead to higher interest rates for private loans.

Fixed Versus Variable Interest Rates

Student loans can come with either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, making it easier to budget and predict your monthly payments. A variable interest rate fluctuates based on market conditions, meaning your monthly payments could change over time. While a variable rate might start lower than a fixed rate, it carries the risk of increasing significantly, potentially leading to higher total repayment costs. For example, if a variable rate starts at 5% and increases to 7% after a year, your monthly payment will be higher. Fixed rates offer predictability and stability, while variable rates offer the potential for lower initial payments but increased risk.

Interest Capitalization

Interest capitalization is the process of adding accumulated interest to the principal loan balance. This increases the total amount you owe and, consequently, the interest you’ll pay over the life of the loan. For example, imagine you have a $10,000 loan with a 5% interest rate. If interest capitalizes annually, at the end of the first year, the accumulated interest ($500) is added to the principal, making your new principal $10,500. Subsequent interest calculations are based on this higher amount, leading to a larger overall interest payment. Understanding how and when interest capitalizes is crucial for managing your loan costs effectively.

Comparison of Interest Rates Across Loan Types

The following table compares typical interest rates for different types of student loans. Keep in mind that these are examples and actual rates can vary depending on the lender, your creditworthiness (for private loans), and the current economic climate.

| Loan Type | Interest Rate Type | Typical Interest Rate Range (%) | Notes |

|---|---|---|---|

| Federal Subsidized Loan | Fixed | 4-7 | Interest does not accrue while in school |

| Federal Unsubsidized Loan | Fixed | 4-7 | Interest accrues while in school |

| Private Student Loan | Fixed or Variable | 5-12+ | Rates vary greatly based on creditworthiness |

Identifying Loans with the Lowest Interest Rates

Securing the lowest possible interest rate on your student loans is crucial for minimizing your overall borrowing costs. Understanding the different loan programs and their associated interest rates is the first step towards achieving this goal. This section will guide you through identifying loans with the lowest interest rates, focusing on federal student loan programs.

Finding the most current information on student loan interest rates requires utilizing reliable sources. While rates can change, understanding the general landscape is key to informed decision-making.

Resources for Finding Current Student Loan Interest Rate Information

The official source for federal student loan interest rates is the U.S. Department of Education. Their website provides detailed information on current rates for each loan program. Additionally, many reputable financial websites and student loan servicers publish updated rate information, often providing comparison tools to help borrowers assess their options. Always verify information from multiple sources to ensure accuracy. Be aware that rates are subject to change, typically annually.

Comparison of Interest Rates Offered by Various Federal Student Loan Programs

Federal student loan programs generally offer lower interest rates than private loans. The specific rate for each loan type varies depending on the loan program and the borrower’s creditworthiness (for unsubsidized loans). For example, Direct Subsidized Loans often have lower rates than Direct Unsubsidized Loans, and the rates for both fluctuate with market conditions. Graduate PLUS loans typically carry a higher interest rate than undergraduate loans. It’s essential to compare the rates of each program to determine the most cost-effective option. You can find this information on the Federal Student Aid website.

Eligibility Requirements for the Lowest Interest Rate Options

Eligibility for the lowest interest rate options often depends on several factors, including the type of loan, your credit history (if applicable), and your educational status. Direct Subsidized Loans, which often have the lowest rates, typically require students to demonstrate financial need. Maintaining good academic standing can also influence eligibility for certain loan programs and potentially better interest rates. Specific eligibility criteria can be found on the Federal Student Aid website. It is crucial to carefully review these requirements to determine your eligibility for the lowest interest rate loans.

Flowchart for Securing the Lowest Possible Interest Rate

The following flowchart illustrates the steps to take in order to secure the lowest possible student loan interest rate:

[A visual flowchart would be inserted here. The flowchart would begin with a box labeled “Determine your financial need and eligibility for subsidized loans.” This would branch to “Apply for Direct Subsidized Loans” and “Apply for Direct Unsubsidized Loans”. Each of these branches would then lead to “Compare interest rates from different lenders” and then “Choose the loan with the lowest interest rate and best terms.” Finally, there would be a box indicating “Complete the loan application and accept the loan offer.” The flowchart would visually represent the decision-making process, showing the various paths and considerations.]

Strategies for Reducing Interest Payments

Managing student loan debt effectively often involves minimizing interest payments. High interest rates can significantly increase the total amount you repay, extending the repayment period and impacting your financial future. Fortunately, several strategies can help reduce these costs. This section explores practical methods to lower your interest burden and accelerate your debt repayment journey.

Refinancing Student Loans

Refinancing involves replacing your existing student loans with a new loan from a different lender, often at a lower interest rate. This is particularly beneficial if interest rates have fallen since you initially took out your loans or if you’ve improved your credit score. To refinance, you’ll need to shop around for lenders offering competitive rates, compare their terms and fees, and carefully review the loan documents before signing. Be aware that refinancing federal loans into private loans means losing access to federal repayment programs like income-driven repayment plans. For example, a borrower with a 7% interest rate on $50,000 in federal student loans might find a private lender offering a 4% rate, significantly reducing their monthly payments and overall interest paid.

Applying for Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. These plans are offered by the federal government and can significantly lower your monthly payments, making them more manageable, especially during periods of lower income. The application process typically involves completing a form online through the student loan servicer’s website, providing documentation of your income and family size, and selecting a suitable IDR plan. There are several types of IDR plans, each with different eligibility requirements and payment calculation methods. For instance, the Revised Pay As You Earn (REPAYE) plan bases your monthly payment on 10% of your discretionary income. After a set period of qualifying payments (often 20 or 25 years), any remaining loan balance may be forgiven. However, this forgiven amount is considered taxable income.

Loan Consolidation

Consolidating your student loans combines multiple loans into a single loan with a new interest rate and repayment schedule. While this doesn’t always guarantee a lower interest rate, it simplifies your repayment process by reducing the number of payments you have to track. It can also potentially lower your monthly payment, depending on the new interest rate and the chosen repayment term. However, consolidation may extend the repayment period, leading to a higher total interest paid over the life of the loan if the new interest rate isn’t significantly lower. For example, consolidating multiple loans with varying interest rates (e.g., 5%, 6%, and 7%) into a single loan with a weighted average rate might result in a slightly lower monthly payment but a longer repayment period. The overall interest paid could be higher compared to aggressively paying down the highest interest rate loans first.

Strategies for Making Extra Payments

Making extra payments on your student loans can significantly reduce the principal balance and shorten the repayment period. Even small, consistent extra payments can make a big difference over time. Several methods can help incorporate extra payments into your budget. These might include:

- Setting up automatic payments for an amount slightly higher than your minimum payment.

- Making a single lump-sum payment annually using tax refunds or bonuses.

- Directing any unexpected income (e.g., side hustle earnings) towards student loan repayment.

- Rounding up your monthly payments to the nearest hundred or thousand dollars.

For example, adding just $50 to your monthly payment can save thousands of dollars in interest and significantly reduce the overall repayment time. The power of compounding interest works in your favor when you make extra payments, accelerating the payoff process. Consider using a student loan amortization calculator to visualize the impact of extra payments on your loan balance and interest paid.

The Impact of Credit Score and Financial History

Securing favorable student loan interest rates isn’t solely dependent on your academic achievements; your financial history plays a significant role. Lenders assess your creditworthiness to determine the risk associated with lending you money. A strong credit history often translates to lower interest rates, while a poor credit history can lead to higher rates or even loan denial.

Your credit score, a numerical representation of your creditworthiness, is a key factor lenders consider. A higher credit score indicates a lower risk of default, making you a more attractive borrower. Conversely, a low credit score suggests a higher risk, prompting lenders to charge higher interest rates to compensate for that increased risk. This is because lenders use credit scores to predict the likelihood of borrowers repaying their loans on time.

The Influence of Credit Score on Interest Rates

Lenders utilize a variety of credit scoring models, with the FICO score being one of the most prevalent. Generally, higher FICO scores (typically above 700) are associated with lower interest rates. Scores below 670 often result in higher rates or may even disqualify an applicant for certain loan programs. The exact impact varies among lenders and loan programs, but the trend is consistent: better credit scores lead to better loan terms. For instance, a borrower with a FICO score of 750 might qualify for a 4% interest rate on a federal student loan, while a borrower with a 620 score might receive a rate of 6% or higher. This difference can significantly impact the total cost of the loan over its lifetime.

The Role of Co-signers in Securing Lower Interest Rates

A co-signer is an individual who agrees to share responsibility for repaying a loan if the primary borrower defaults. By adding a co-signer with a strong credit history, borrowers with limited or weak credit histories can often secure lower interest rates. The co-signer’s excellent credit history essentially mitigates the risk for the lender, enabling them to offer more favorable terms. However, it’s crucial to remember that co-signing involves significant financial responsibility for the co-signer. If the primary borrower fails to make payments, the co-signer becomes liable for the entire debt.

Factors Contributing to a Strong Credit History

Building a strong credit history takes time and responsible financial behavior. Several key factors contribute to a positive credit profile. These include consistent on-time payments on all credit accounts (credit cards, loans, etc.), maintaining a low credit utilization ratio (the amount of credit used compared to the total credit available), and avoiding excessive applications for new credit within a short period. A long credit history, demonstrating consistent responsible behavior over many years, also weighs heavily in favor of a high credit score. Furthermore, having a diverse mix of credit accounts, such as a credit card and a student loan, can also positively influence credit scores.

Actions to Improve Credit Scores Before Applying for Loans

Improving your credit score before applying for student loans can significantly impact the interest rates you’ll receive. Taking proactive steps to enhance your credit profile can lead to considerable savings over the life of your loan.

Before applying for student loans, consider these actions:

- Pay all bills on time and in full: This is the single most important factor influencing your credit score. Consistent on-time payments demonstrate financial responsibility.

- Keep credit utilization low: Aim to use less than 30% of your available credit on each card. High utilization suggests financial strain and increases risk for lenders.

- Check your credit report for errors: Regularly review your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) and dispute any inaccuracies.

- Limit new credit applications: Applying for multiple credit accounts in a short time can negatively impact your score. Avoid unnecessary applications.

- Consider a secured credit card: If you lack a credit history, a secured credit card can help you build credit responsibly. You make a security deposit that serves as your credit limit.

Government Programs and Subsidized Loans

Navigating the world of federal student loan programs can feel overwhelming, but understanding the differences between subsidized and unsubsidized loans is crucial for minimizing your overall borrowing costs. Subsidized loans offer significant advantages, primarily the absence of accruing interest while you’re in school, and sometimes during grace periods. This section details the key aspects of these programs.

Federal student loan programs, primarily managed by the U.S. Department of Education, offer subsidized and unsubsidized loans to eligible students pursuing higher education. These loans differ significantly in their interest accrual and repayment terms, directly impacting the total cost of your education.

Subsidized Loan Programs Overview

The federal government offers subsidized loans through several programs, most notably the William D. Ford Federal Direct Loan Program. These loans are designed to assist students with demonstrated financial need. The key feature is that the government pays the interest on the loan while you are enrolled at least half-time in an eligible degree program, and often during a grace period after graduation. This means your loan balance doesn’t grow during these periods, saving you money in the long run. Eligibility is determined based on your Federal Student Aid (FAFSA) application, considering factors such as your family’s income and assets.

Subsidized vs. Unsubsidized Loan Interest Rates and Repayment Terms

Interest rates for both subsidized and unsubsidized federal student loans are set annually by the government. Subsidized loans typically have lower interest rates than unsubsidized loans, reflecting the reduced risk for the lender due to the government’s interest payment during certain periods. Repayment terms are generally similar, typically starting six months after graduation or leaving school (the grace period), with various repayment plans available (standard, graduated, extended, income-driven repayment). However, the total amount repaid will be less for subsidized loans due to the absence of interest accrual during the subsidy period. For example, a $10,000 subsidized loan with a 5% interest rate might cost significantly less than a $10,000 unsubsidized loan with a 6% interest rate over the same repayment period because interest won’t accrue during the subsidized period.

Eligibility Requirements for Subsidized Loan Programs

Eligibility for subsidized federal student loans hinges primarily on demonstrating financial need. This is determined through the Free Application for Federal Student Aid (FAFSA). The FAFSA collects information about your family’s income, assets, and other financial factors. The government uses this information to calculate your Expected Family Contribution (EFC), which is then compared to the cost of attendance at your chosen institution. If your EFC is lower than the cost of attendance, you may be eligible for subsidized loans. Additional eligibility criteria include maintaining satisfactory academic progress in your studies and being enrolled at least half-time in an eligible degree or certificate program at a participating institution. Furthermore, borrowers must be U.S. citizens or eligible non-citizens.

Calculating Total Loan Cost with and without Subsidies

Calculating the total cost of a loan with and without subsidies requires understanding the interest rate, loan amount, and repayment period. For a simplified example, let’s assume a $10,000 loan with a 5% annual interest rate over 10 years.

With Subsidies (assuming no interest accrual for 4 years): The interest calculation only applies to the remaining 6 years of the repayment period. Using a loan amortization calculator (easily found online), the total interest paid would be significantly less than the unsubsidized loan scenario.

Without Subsidies: Using the same loan amount, interest rate, and repayment period, an online loan amortization calculator will show the total interest paid over the entire 10 years. This total interest will be considerably higher than the subsidized loan example due to continuous interest accrual.

The difference between these two totals represents the significant savings afforded by subsidized loans. Precise calculations should be performed using a loan amortization calculator, inputting the specific loan details and considering any changes in interest rates over the repayment period.

Private Student Loan Options

Private student loans offer an alternative funding source for higher education, but understanding their intricacies is crucial before borrowing. Unlike federal loans, private loans are offered by banks, credit unions, and other financial institutions, each with its own lending criteria and terms. Careful consideration of interest rates, repayment plans, and potential risks is essential.

Factors Determining Private Student Loan Interest Rates

Several factors influence the interest rate a lender offers on a private student loan. Creditworthiness is paramount; individuals with higher credit scores and a strong financial history generally qualify for lower rates. The loan amount also plays a role; larger loans may come with higher interest rates due to increased risk for the lender. The loan term (length of repayment) can also affect the interest rate; longer repayment periods often mean higher rates to compensate the lender for the extended risk. Finally, the type of loan (e.g., undergraduate vs. graduate) and the presence of a co-signer can also influence the final interest rate. A co-signer with good credit can significantly lower the interest rate for a borrower with limited credit history.

Comparison of Private Student Loan Terms and Conditions

Private student loan terms and conditions vary significantly among lenders. Some lenders may offer variable interest rates, which fluctuate with market conditions, while others offer fixed interest rates, providing predictable monthly payments. Repayment plans also differ; some lenders offer flexible repayment options, such as graduated repayment or income-driven repayment, while others may only offer standard repayment plans. Furthermore, lenders may impose different fees, such as origination fees or late payment fees. It’s crucial to compare offers from multiple lenders to find the most favorable terms and conditions before committing to a loan. For example, one lender might offer a lower interest rate but a higher origination fee, while another might offer a slightly higher interest rate but no origination fee.

Risks Associated with Private Student Loans

Private student loans carry certain risks that are not present with federal student loans. One key risk is the lack of borrower protections. Federal student loans often offer various protections, such as income-driven repayment plans and loan forgiveness programs, which are typically absent in private student loans. Another risk is the potential for higher interest rates compared to federal loans, particularly for borrowers with less-than-perfect credit. Furthermore, private student loans may not offer the same flexibility in repayment options as federal loans, potentially leading to financial hardship if circumstances change. Finally, the inability to consolidate private loans with federal loans can complicate repayment management.

Key Differences Between Federal and Private Student Loans

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Generally lower, fixed or variable depending on the loan type | Generally higher, fixed or variable, depending on creditworthiness and market conditions |

| Loan Limits | Set by the government, varying based on factors like dependency status and year in school | Determined by the lender, based on creditworthiness and income |

| Repayment Options | Variety of repayment plans available, including income-driven repayment and deferment/forbearance options | Fewer repayment options, typically standard repayment plans |

| Borrower Protections | Strong borrower protections, including loan forgiveness programs under certain circumstances | Limited borrower protections; default can severely impact credit score |

Long-Term Financial Implications

Choosing a student loan with a seemingly small difference in interest rate can have significant long-term financial consequences. The cumulative effect of even a fraction of a percentage point higher interest rate can dramatically increase the total cost of your loan over its repayment period, impacting your ability to achieve other financial goals. Understanding these implications is crucial for responsible financial planning after graduation.

The interest rate directly influences the total amount you’ll repay on your student loans. A higher interest rate means more of your monthly payments go towards interest rather than principal, extending the repayment period and increasing the overall cost. Conversely, a lower interest rate allows more of your payment to reduce the principal balance, leading to quicker repayment and substantial savings over the life of the loan. This impacts post-graduation financial planning by affecting your ability to save for a down payment on a house, invest in retirement, or even manage everyday expenses. For instance, someone with a $50,000 loan at 7% interest will pay significantly more in total interest over the life of the loan compared to someone with the same loan amount at 4% interest.

The Impact of Interest Rates on Post-Graduation Financial Planning

The choice of loan interest rate significantly impacts major life decisions after graduation. A higher interest rate can constrain your ability to save for a down payment on a home, forcing you to rent for longer periods or opt for a smaller, less desirable property. It can also reduce your ability to contribute meaningfully to retirement accounts, potentially delaying retirement or reducing the quality of life in your later years. Furthermore, higher monthly payments due to a higher interest rate can leave less disposable income for emergencies, investing, or simply enjoying life after paying off your student loans. A lower interest rate, conversely, provides more financial flexibility, allowing for earlier homeownership, more substantial retirement contributions, and greater financial security overall.

Understanding Loan Repayment Schedules and Their Impact on Budgeting

Understanding your loan repayment schedule, including the monthly payment amount, the loan term, and the total repayment cost, is crucial for effective budgeting. Different repayment plans, such as standard, graduated, or income-driven repayment, will have varying monthly payments and overall repayment timelines. A repayment schedule with a higher interest rate typically results in a longer repayment period and higher total interest paid, which must be factored into your post-graduation budget. For example, a standard 10-year repayment plan will have higher monthly payments but a shorter repayment period and lower total interest compared to a 20-year repayment plan, even if the interest rate is the same. Careful budgeting is crucial to ensure you can consistently meet your monthly loan payments while still managing other essential expenses.

Visual Representation of Total Loan Repayment Costs

Imagine two bar graphs. The horizontal axis represents the repayment period (e.g., in years). The vertical axis represents the total cost of the loan, including principal and interest. One bar graph represents a loan with a lower interest rate (e.g., 4%), showing a shorter bar representing the total repayment cost. The other bar graph represents a loan with a higher interest rate (e.g., 7%), showing a significantly taller bar representing a much higher total repayment cost over the same repayment period. The difference in height between the bars visually illustrates the substantial financial impact of even a seemingly small difference in interest rates over the loan’s lifespan. The longer the repayment period, the more pronounced this difference becomes.

Outcome Summary

Securing the lowest student loan interest rate requires proactive planning and a thorough understanding of available options. By carefully considering your eligibility for federal programs, building a strong credit history, and exploring refinancing opportunities, you can significantly reduce your overall borrowing costs. Remember, informed decision-making is key to minimizing your debt burden and achieving long-term financial success. Take the time to research and compare options, and don’t hesitate to seek professional financial advice if needed.

FAQ Compilation

What is the difference between subsidized and unsubsidized loans?

Subsidized loans have interest payments covered by the government while you’re in school (and sometimes during grace periods). Unsubsidized loans accrue interest from the moment they’re disbursed.

Can I refinance my student loans if I already have a loan?

Yes, refinancing can lower your interest rate, but it often involves switching from federal to private loans, which may have less favorable protections.

How does my credit score affect my interest rate?

A higher credit score typically qualifies you for lower interest rates on private loans. Federal loans generally don’t consider credit scores, but a poor credit history could impact eligibility for certain programs.

What are income-driven repayment plans?

Income-driven repayment plans base your monthly payments on your income and family size, potentially lowering your monthly payments but extending your repayment period.