The crushing weight of student loan debt without a stable income source presents a daunting challenge for many. This situation, often born from unforeseen circumstances or career transitions, can leave individuals feeling overwhelmed and lost. This guide explores the complexities of managing student loans when income is limited, offering practical strategies and resources to help navigate this difficult financial terrain.

We’ll delve into available government assistance programs, effective debt management techniques, and crucial steps for long-term financial planning. Understanding the emotional impact of this financial burden is also key, and we’ll address strategies for maintaining mental well-being throughout the process. Ultimately, our goal is to empower you with the knowledge and tools needed to regain control of your financial future.

Understanding the “Student Loan No Income” Situation

Navigating student loan debt is challenging enough, but the situation becomes significantly more precarious when coupled with a lack of income. This scenario presents a unique set of obstacles and requires a nuanced understanding of the contributing factors and potential consequences. Individuals facing this predicament often struggle to meet even basic needs, let alone make progress towards loan repayment.

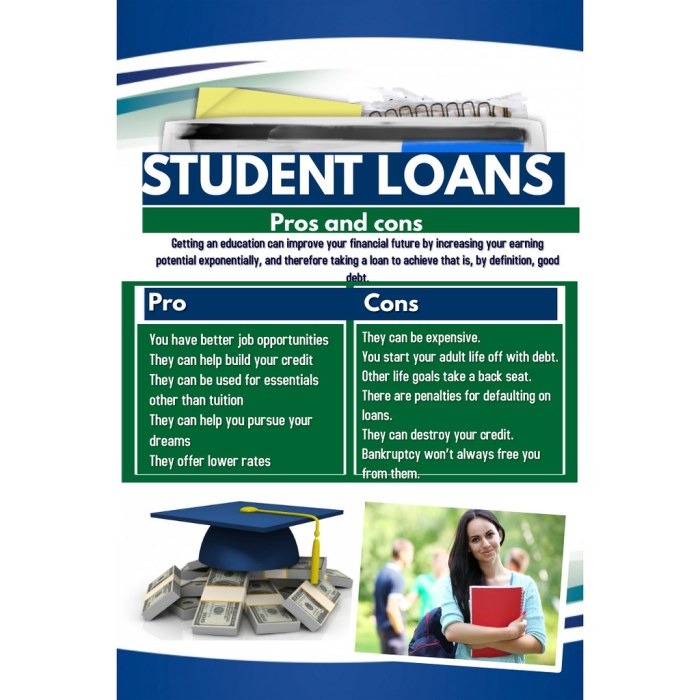

The challenges faced by individuals with student loan debt and no income are multifaceted and severe. The most immediate concern is the inability to meet living expenses. Rent, utilities, food, and transportation all become significant burdens when there is no income stream to cover them. This can lead to a cycle of debt accumulation, as individuals may resort to high-interest loans or credit cards to cover essential costs, further exacerbating their financial situation. The psychological toll is also substantial, with many experiencing significant stress, anxiety, and even depression due to the overwhelming financial pressure. Furthermore, the lack of income can hinder their ability to build credit, buy a home, or pursue other financial goals. The inability to repay loans can result in damaged credit scores, wage garnishment, and even legal action.

Reasons for Student Loan Debt with No Income

Several factors can contribute to the unfortunate situation of having significant student loan debt without a corresponding income. These factors often intertwine, creating a complex web of circumstances. For example, recent graduates may struggle to find employment in their chosen field, especially in competitive job markets. Others may face unexpected life events such as illness, injury, or family emergencies, resulting in job loss or reduced work hours. Some individuals may have made career choices that, while personally fulfilling, do not offer high-paying jobs immediately after graduation. Furthermore, the increasing cost of higher education often leads to larger loan amounts, making it more difficult to manage debt even with a stable income.

Examples of Scenarios Leading to This Situation

Several common scenarios illustrate this challenging situation. A recent college graduate with a degree in the arts may struggle to find a high-paying job immediately after graduation, leaving them with substantial student loan debt and limited income. Alternatively, a person who invested in further education to change careers may face unemployment during the transition period, leading to financial hardship. Another example could be an individual who experienced a major illness or injury, resulting in job loss and an inability to meet their loan repayment obligations. Finally, a student who took on substantial loans to pursue a graduate degree may find themselves in a competitive job market with limited opportunities for employment.

Impact of Student Loan Debt with No Income Across Age Groups

The impact of this situation varies significantly depending on the borrower’s age. Younger borrowers may have more time to recover financially, while older borrowers may face more severe consequences.

| Borrower Age | Income Level | Loan Amount | Debt-to-Income Ratio |

|---|---|---|---|

| 22-25 | $0 – $20,000 | $50,000 – $100,000 | >100% |

| 26-35 | $20,000 – $40,000 | $75,000 – $150,000 | >100% |

| 36-45 | $40,000 – $60,000 | $100,000 – $200,000 | >100% |

| 45+ | Variable | Variable | Variable, often high |

Available Government Programs and Assistance

Navigating the complexities of student loan repayment with no income can feel overwhelming, but several government programs offer potential relief. Understanding eligibility criteria and the nuances of different repayment plans is crucial for borrowers in this situation. This section details the key federal programs designed to assist individuals facing financial hardship due to a lack of income.

Federal Student Loan Programs for Borrowers with No Income

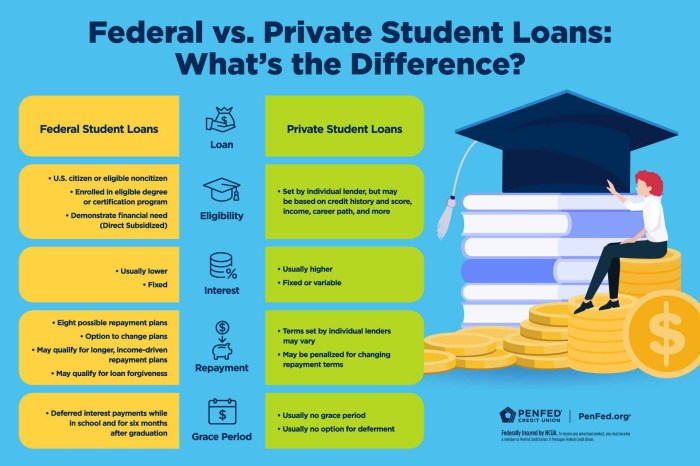

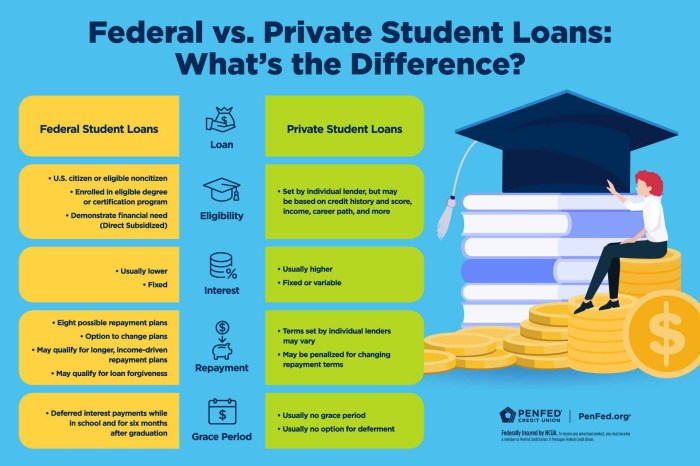

Eligibility for federal student loan programs hinges on several factors, including the type of loan held (Direct Loans, FFEL, etc.), the borrower’s financial circumstances (demonstrated lack of income), and the completion of required documentation. While there isn’t a specific program solely for those with zero income, several programs offer flexible repayment options that can be beneficial. The key is demonstrating financial hardship through thorough documentation. This typically involves providing proof of income (or lack thereof) via tax returns, pay stubs, or other official financial statements. Furthermore, borrowers might need to complete a detailed application form outlining their financial situation and demonstrating their need for assistance.

Income-Driven Repayment (IDR) Plans

Income-Driven Repayment plans adjust monthly payments based on your income and family size. Several plans exist, each with its own specific formulas and eligibility requirements. These plans are designed to make student loan repayment more manageable during periods of low or no income. However, it’s important to note that while these plans lower monthly payments, they often extend the repayment period, potentially leading to higher total interest paid over the life of the loan.

Income-Driven Repayment Plan Details: A Comparison

The following table compares several common IDR plans. Note that specific details and eligibility requirements can change, so it’s essential to consult the official government website for the most up-to-date information.

| Plan Name | Eligibility | Payment Calculation | Benefits | Drawbacks |

|---|---|---|---|---|

| Income-Based Repayment (IBR) | Direct Loans | Based on discretionary income and family size | Lower monthly payments, potential for loan forgiveness after 20 or 25 years | Longer repayment period, higher total interest paid |

| Pay As You Earn (PAYE) | Direct Loans | Based on discretionary income and family size | Lower monthly payments, potential for loan forgiveness after 20 years | Longer repayment period, higher total interest paid |

| Revised Pay As You Earn (REPAYE) | Direct and FFEL Loans (under certain conditions) | Based on discretionary income and family size | Lower monthly payments, potential for loan forgiveness after 20 or 25 years | Longer repayment period, higher total interest paid |

| Income-Contingent Repayment (ICR) | Direct and FFEL Loans | Based on income and loan amount | Lower monthly payments | Longer repayment period, potentially higher total interest paid |

Application Process Flowchart

The application process involves several steps, and it’s recommended to carefully review all requirements before beginning. The flowchart below visually Artikels the typical process.

[Imagine a flowchart here. The flowchart would begin with “Determine Eligibility for IDR Plans,” branching to “Gather Necessary Documentation (Tax Returns, Pay Stubs, etc.),” then to “Complete the Application Online (StudentAid.gov),” followed by “Submit Application,” and finally “Await Processing and Notification.” There would likely be feedback loops for missing information or application corrections.]

Strategies for Managing Student Loan Debt with No Income

Navigating student loan debt with no income presents significant challenges, but proactive strategies can help alleviate the burden and prevent further financial hardship. Understanding your options and actively engaging with your lenders is crucial. This section Artikels several approaches to manage your debt effectively during periods of unemployment or low income.

Negotiating with Lenders for Repayment Plan Modifications

Negotiating with your student loan lenders is a vital first step. Direct communication is key. Clearly explain your current financial situation, providing documentation such as pay stubs (if applicable), proof of unemployment benefits, or other evidence of your hardship. Explore options like income-driven repayment (IDR) plans, which calculate your monthly payments based on your income and family size. These plans often result in lower monthly payments and potentially loan forgiveness after a certain period. Be prepared to provide detailed financial information and be persistent in your communication. Remember to keep detailed records of all communication with your lenders. For example, you might negotiate a temporary reduction in your monthly payment amount or an extension of the repayment period.

Exploring Deferment and Forbearance Options

Deferment and forbearance are temporary pauses on your student loan payments. Deferment is typically granted for specific reasons, such as unemployment or enrollment in school, while forbearance is often granted due to financial hardship. However, interest may still accrue on most federal loans during both deferment and forbearance, potentially increasing your total debt over time. Understanding the implications of interest capitalization—when accrued interest is added to the principal balance—is crucial. For example, if you defer your loans for a year, the interest accrued during that year will be added to your principal balance, leading to higher payments in the future. It’s important to carefully weigh the short-term benefits of pausing payments against the potential long-term costs. Before choosing either option, thoroughly review the terms and conditions to avoid unexpected consequences.

Comparing Long-Term Implications of Debt Management Strategies

Different debt management strategies have significantly varying long-term consequences. For instance, income-driven repayment plans offer lower monthly payments but extend the repayment period, potentially leading to more interest paid over the life of the loan. Deferment or forbearance provides immediate relief from payments, but the accumulating interest can significantly increase the total debt burden. Loan consolidation can simplify repayment by combining multiple loans into one, but it may not necessarily lower your interest rate or monthly payment. The best strategy depends on your individual financial circumstances and long-term goals. Consider consulting with a financial advisor to create a personalized plan that aligns with your financial situation and future aspirations. For example, someone with a low, stable income might benefit from an IDR plan, while someone expecting a significant income increase in the near future might choose to prioritize paying down their debt aggressively, even if it means higher monthly payments.

Resources for Borrowers Facing Financial Hardship

Several resources can provide assistance to borrowers facing financial hardship. The National Foundation for Credit Counseling (NFCC) offers free or low-cost credit counseling services, including debt management plans. The U.S. Department of Education’s website provides comprehensive information on federal student loan programs, repayment options, and hardship assistance. Your loan servicer can also provide guidance on available repayment options and hardship programs. Additionally, local non-profit organizations and community resources may offer financial assistance or counseling. It’s essential to explore all available options and leverage the resources available to you to navigate your financial challenges effectively.

The Psychological and Emotional Impact of Student Loan Debt

Navigating significant student loan debt with limited income can take a considerable toll on mental and emotional well-being. The constant worry about repayment, the feeling of being trapped in a cycle of debt, and the pressure to find solutions can lead to a range of negative consequences, impacting not only financial stability but also overall quality of life. Understanding these impacts is crucial for developing effective coping strategies and seeking appropriate support.

The emotional burden of substantial student loan debt with insufficient income can manifest in various ways. Anxiety and depression are common, stemming from the overwhelming feeling of financial insecurity and the uncertainty of the future. Stress levels can become chronically elevated, impacting sleep, appetite, and overall physical health. Relationships with family and friends may suffer as individuals struggle to cope with their financial burdens, leading to feelings of isolation and shame. Furthermore, the constant pressure to find solutions can lead to feelings of hopelessness and even despair. This pervasive sense of financial strain can significantly impact self-esteem and confidence, hindering personal and professional growth.

Managing Mental Well-being During Financial Hardship

Maintaining mental well-being during periods of financial hardship requires a proactive and multifaceted approach. Prioritizing self-care activities, such as regular exercise, sufficient sleep, and a healthy diet, can help mitigate the negative impacts of stress. Engaging in activities that promote relaxation and stress reduction, like meditation, yoga, or spending time in nature, are also beneficial. Building and maintaining a strong support network of family, friends, or support groups is essential for sharing burdens and receiving emotional support. Open communication with loved ones about financial struggles can alleviate feelings of isolation and shame, fostering a sense of shared understanding and support. Practicing mindfulness and gratitude can shift focus from anxieties about the future to appreciating present moments and resources.

Seeking Professional Support

Recognizing the limitations of self-help strategies and seeking professional support is a crucial step in managing the psychological and emotional impact of student loan debt. Financial counselors can provide guidance on debt management strategies, budgeting, and exploring options for repayment assistance. Therapists or counselors can offer a safe and supportive space to process emotions, develop coping mechanisms, and address underlying mental health concerns such as anxiety or depression. These professionals can provide valuable tools and techniques for managing stress, improving coping skills, and building resilience in the face of financial challenges. It is important to remember that seeking professional help is a sign of strength, not weakness, and can significantly improve overall well-being.

Coping Mechanisms for Stress Related to Student Loan Debt

It’s vital to develop healthy coping mechanisms to navigate the stress associated with student loan debt. The following strategies can help manage overwhelming feelings and promote a sense of control:

- Create a realistic budget and stick to it. This provides a sense of control over finances and reduces financial anxiety.

- Explore all available repayment options, including income-driven repayment plans. Understanding options can reduce feelings of helplessness.

- Practice mindfulness and meditation techniques to manage stress and anxiety.

- Engage in regular physical activity to release endorphins and improve mood.

- Connect with supportive friends, family, or support groups to share your burden and reduce feelings of isolation.

- Prioritize self-care activities, such as hobbies or relaxation techniques, to reduce stress and boost well-being.

- Seek professional help from a financial counselor or therapist when needed.

Long-Term Financial Planning for Individuals with Student Loan Debt

Navigating student loan debt with limited income can feel overwhelming, but proactive long-term financial planning is crucial for eventual debt elimination and achieving financial stability. A well-structured plan, coupled with realistic budgeting, provides a roadmap to a more secure financial future. This involves prioritizing essential expenses, strategically managing debt repayments, and consistently building good financial habits.

Creating a realistic budget, even with a limited income, is the cornerstone of successful long-term financial planning. It provides a clear picture of your income and expenses, allowing you to identify areas for potential savings and allocate funds effectively towards debt repayment. Without a budget, it’s difficult to track progress and make informed financial decisions. A detailed budget helps visualize where your money is going, revealing potential areas for cost reduction.

Developing a Long-Term Financial Plan

A comprehensive long-term financial plan should incorporate several key elements. First, accurately assess your current financial situation, including total student loan debt, interest rates, and monthly payments. Next, establish realistic short-term and long-term financial goals. Short-term goals might include increasing your emergency fund or reducing high-interest debt. Long-term goals could involve eliminating student loan debt completely, saving for a down payment on a house, or investing for retirement. Finally, create a detailed action plan outlining the steps needed to achieve these goals, including specific strategies for debt repayment and savings. This plan should be regularly reviewed and adjusted as needed to reflect changes in your financial circumstances. For example, if you receive a raise, you could allocate a portion of the additional income towards accelerated debt repayment.

Effective Budgeting Techniques and Financial Literacy Resources

Several budgeting techniques can help manage expenses effectively. The 50/30/20 rule is a popular method, allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. Zero-based budgeting involves allocating every dollar of your income to a specific expense category, ensuring that all income is accounted for. Envelope budgeting involves physically placing cash into envelopes designated for different expense categories, helping to visually track spending. Numerous free online resources, such as the Consumer Financial Protection Bureau (CFPB) website and the National Foundation for Credit Counseling (NFCC), provide valuable financial literacy information and budgeting tools. These resources offer guidance on creating a budget, managing debt, and improving overall financial well-being. They also provide educational materials and workshops that can enhance financial literacy.

Prioritizing Essential Expenses While Managing Student Loan Repayments

Prioritizing essential expenses while managing student loan repayments requires careful consideration. Essential expenses, such as housing, food, transportation, and healthcare, should always take precedence. After covering these necessities, allocate as much as possible towards student loan repayments, particularly those with high interest rates. Consider exploring income-driven repayment plans, which adjust monthly payments based on your income and family size. These plans can lower monthly payments, making them more manageable in the short term, while potentially extending the repayment period. Additionally, explore options like refinancing your student loans to potentially secure a lower interest rate, reducing the overall cost of repayment. For instance, if your interest rate is 7%, refinancing to 4% can significantly reduce the total interest paid over the life of the loan.

Potential Legal and Ethical Considerations

Navigating the complexities of student loan debt, especially when facing no income, requires understanding the potential legal ramifications and ethical considerations for both borrowers and lenders. Failure to address these aspects can lead to severe consequences, impacting not only finances but also personal well-being. This section explores the legal implications of default, the potential benefits and risks of debt consolidation, and the ethical responsibilities of all parties involved.

Legal Implications of Student Loan Default

Defaulting on federal student loans triggers serious legal consequences. These can include wage garnishment, tax refund offset, and even the inability to obtain a government security clearance or professional licenses. The Department of Education can pursue legal action to recover the debt, potentially leading to lawsuits and judgments against the borrower. Private student loans often have similar, though potentially more aggressive, collection practices. The specific consequences vary depending on the type of loan and the lender’s policies, but the potential for significant financial and legal repercussions is substantial. For example, a defaulted loan could lead to a significant negative impact on a credit score, making it difficult to secure mortgages, car loans, or even rent an apartment.

Debt Consolidation: Benefits and Risks

Debt consolidation involves combining multiple loans into a single loan with potentially more favorable terms. This can simplify repayment by reducing the number of monthly payments and potentially lowering the overall interest rate. However, debt consolidation isn’t a guaranteed solution. Some consolidation options might offer lower monthly payments but extend the repayment period, ultimately leading to paying more interest over the life of the loan. It’s crucial to carefully compare the terms of different consolidation options and understand the long-term implications before making a decision. For instance, consolidating federal loans into a private loan could mean losing access to federal income-driven repayment plans and other borrower protections.

Ethical Considerations for Lenders and Borrowers

Ethical considerations are paramount in the student loan landscape. Lenders have an ethical responsibility to ensure borrowers fully understand the terms and implications of their loans before signing. Transparency in interest rates, fees, and repayment options is crucial. Borrowers, in turn, have an ethical obligation to make reasonable efforts to repay their loans according to the agreed-upon terms. However, when unforeseen circumstances such as job loss or illness create insurmountable financial hardship, open communication between borrowers and lenders is essential to explore potential solutions, such as forbearance or deferment. A lack of ethical consideration from either party can lead to severe financial consequences and erode trust in the lending system.

Legal Avenues for Individuals Facing Extreme Financial Hardship

Individuals facing extreme financial hardship due to student loan debt may explore several legal avenues. These could include seeking an income-driven repayment plan (IDR), applying for loan forgiveness programs (if eligible), or exploring bankruptcy options (though student loan discharge through bankruptcy is extremely difficult to achieve). It is advisable to consult with a qualified legal professional or a non-profit credit counseling agency to explore all available options and determine the best course of action based on individual circumstances. For example, the Public Service Loan Forgiveness (PSLF) program offers loan forgiveness after 10 years of qualifying payments for those working in public service, but strict eligibility requirements must be met.

Ending Remarks

Successfully managing student loan debt with no income requires a multifaceted approach encompassing strategic planning, resource utilization, and emotional resilience. While the path may seem arduous, understanding your options, proactively engaging with lenders, and prioritizing your mental health are crucial steps toward financial recovery. By combining practical strategies with a proactive mindset, you can navigate this challenge and build a secure financial future.

Questions and Answers

Can I get my student loans forgiven if I have no income?

Loan forgiveness is rare. However, income-driven repayment plans can lower monthly payments based on your income and family size, potentially leading to loan forgiveness after 20-25 years.

What happens if I can’t make my student loan payments?

Failing to make payments can result in delinquency, negatively impacting your credit score and potentially leading to wage garnishment or tax refund offset. Contact your loan servicer immediately to explore options like deferment or forbearance.

Are there any non-profit organizations that can help?

Yes, several non-profit organizations offer financial counseling and assistance to individuals struggling with student loan debt. Research local and national organizations for support.

What is the difference between deferment and forbearance?

Deferment temporarily suspends payments, and under certain circumstances, interest may not accrue. Forbearance also suspends payments, but interest typically continues to accrue, increasing the total loan amount.