Navigating the world of student loans can feel overwhelming, especially for undergraduates facing the prospect of higher education costs. Understanding the various options available – from federal loans with their subsidized and unsubsidized distinctions to the complexities of private loans – is crucial for making informed financial decisions. This guide explores the landscape of student loan options, providing a clear overview of eligibility, application processes, repayment plans, and the long-term implications of borrowing for higher education.

This comprehensive resource aims to demystify the process, empowering undergraduates to make responsible choices that align with their financial goals and long-term well-being. We’ll cover everything from comparing interest rates and fees to exploring alternative funding sources and managing debt effectively. By the end, you’ll have a solid understanding of how to finance your education responsibly and confidently.

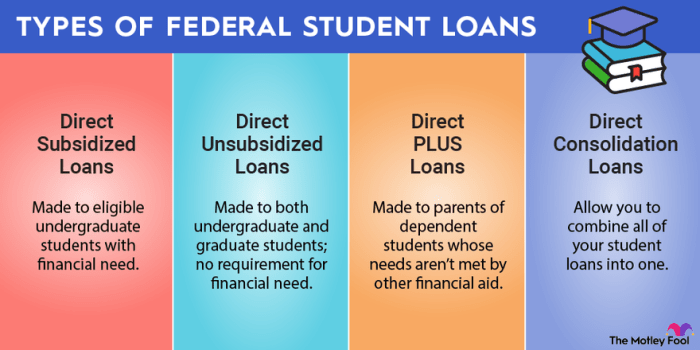

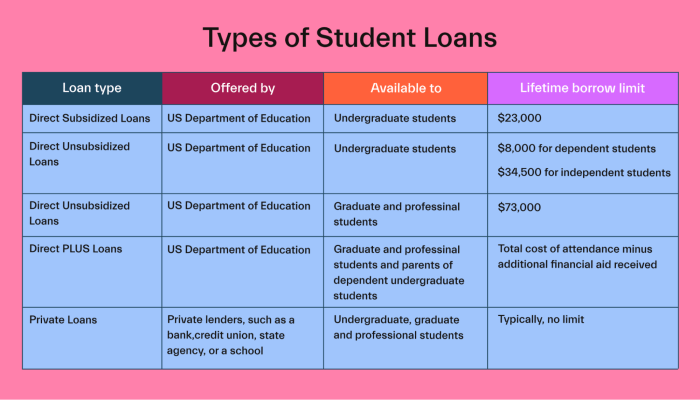

Types of Student Loans

Navigating the world of student loans can feel overwhelming, but understanding the key differences between the various options is crucial for making informed financial decisions. This section will clarify the distinctions between federal and private loans, and delve into the specifics of subsidized and unsubsidized federal loans, along with examples of private loan providers.

Federal vs. Private Student Loans

Federal student loans are offered by the U.S. government and generally offer more borrower protections and flexible repayment options compared to private loans. Private loans, on the other hand, are provided by banks, credit unions, and other private lenders. Federal loans typically have lower interest rates and more forgiving repayment plans, particularly for those facing financial hardship. Eligibility for federal loans is based on financial need and enrollment status, while private loan eligibility is primarily determined by creditworthiness and co-signer availability. The application process for federal loans is often simpler and more streamlined than for private loans.

Subsidized vs. Unsubsidized Federal Loans

Both subsidized and unsubsidized federal loans are offered by the government, but they differ significantly in how interest accrues. With subsidized loans, the government pays the interest while you’re in school at least half-time, during grace periods, and during periods of deferment. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed, even while you are enrolled in school. This means that borrowers of unsubsidized loans will owe a larger amount at the end of their studies, as the interest is added to the principal balance. Eligibility for subsidized loans is based on financial need, while unsubsidized loans are available to all eligible students regardless of financial need.

Examples of Private Loan Providers and Lending Terms

Several private lenders offer student loans, each with its own set of terms and conditions. Examples include Sallie Mae, Discover Student Loans, and Citizens Bank. These lenders typically consider factors such as credit history, income, and co-signer availability when determining interest rates and loan amounts. Interest rates on private loans tend to be higher than those on federal loans, and repayment terms may be less flexible. Some private lenders may offer additional features, such as loan forgiveness programs or rewards for on-time payments, but these should be carefully evaluated.

Comparison of Loan Features

| Loan Type | Interest Rate | Repayment Options | Fees |

|---|---|---|---|

| Federal Subsidized Loan | Variable, set by the government; generally lower than private loans | Standard, income-driven repayment, extended repayment, graduated repayment, and others | Origination fees (typically a small percentage of the loan amount) |

| Federal Unsubsidized Loan | Variable, set by the government; generally lower than private loans | Standard, income-driven repayment, extended repayment, graduated repayment, and others | Origination fees (typically a small percentage of the loan amount) |

| Private Loan (Example: Sallie Mae) | Variable or fixed; typically higher than federal loans; varies based on creditworthiness | Standard, may offer some variations depending on the lender | May include origination fees, late payment fees, and other charges |

| Private Loan (Example: Discover) | Variable or fixed; typically higher than federal loans; varies based on creditworthiness | Standard, may offer some variations depending on the lender | May include origination fees, late payment fees, and other charges |

Loan Amounts and Repayment Plans

Understanding the maximum loan amount you can borrow and the various repayment options available is crucial for responsible student loan management. This section clarifies these key aspects, enabling you to make informed decisions about financing your education.

Factors Determining Maximum Loan Amounts for Undergraduates

Several factors influence the maximum amount an undergraduate student can borrow. These include the student’s cost of attendance (COA), which encompasses tuition, fees, room and board, and other living expenses; the student’s year in school (freshman, sophomore, junior, senior); and the student’s dependency status (dependent or independent). Federal student loans have annual and aggregate borrowing limits. For example, dependent undergraduate students may have lower borrowing limits than independent students. Additionally, the student’s financial need, as determined by the Free Application for Federal Student Aid (FAFSA), plays a significant role in determining the amount of subsidized loans they may qualify for. Unsubsidized loans, on the other hand, are available regardless of financial need, up to the maximum borrowing limits.

Federal Student Loan Repayment Plans

The federal government offers several repayment plans for student loans, each with its own advantages and disadvantages. Choosing the right plan depends on your individual financial circumstances and repayment goals.

Comparison of Federal Student Loan Repayment Plans

The following table compares the key features of several common federal student loan repayment plans. Note that specific terms and conditions may change, so always refer to the official government website for the most up-to-date information.

| Repayment Plan | Monthly Payment | Loan Term | Advantages | Disadvantages |

|---|---|---|---|---|

| Standard Repayment Plan | Fixed monthly payment over 10 years | 10 years | Predictable payments, relatively short repayment period | Higher monthly payments than other plans, may be difficult for some borrowers |

| Graduated Repayment Plan | Payments start low and gradually increase over time | 10 years | Lower initial payments, helpful for those with limited income early in their careers | Payments increase significantly over time, potentially becoming unaffordable later |

| Extended Repayment Plan | Lower monthly payments over a longer period | Up to 25 years | Lower monthly payments, making repayment more manageable | Longer repayment period, leading to significantly higher total interest paid |

| Income-Driven Repayment (IDR) Plans | Monthly payment based on income and family size | Up to 20 or 25 years | Payments are affordable based on income, potential for loan forgiveness after 20 or 25 years | Longer repayment period, may result in higher total interest paid |

Sample Repayment Schedule

The following is a simplified example illustrating the impact of different repayment plans on total interest paid. This example assumes a $30,000 loan with a 5% interest rate. Actual results will vary based on loan amount, interest rate, and specific repayment plan terms.

| Repayment Plan | Monthly Payment (approx.) | Loan Term (years) | Total Interest Paid (approx.) |

|---|---|---|---|

| Standard | $316 | 10 | $11,000 |

| Graduated | Starts at ~$200, increases gradually | 10 | $11,500 |

| Extended | ~$126 | 25 | $21,000 |

| IDR (example) | Varies based on income | 20-25 | Varies significantly |

This is a simplified illustration. Actual repayment amounts and total interest paid will vary based on several factors, including interest rate fluctuations and individual financial circumstances. Always consult with a financial advisor for personalized guidance.

Interest Rates and Fees

Understanding interest rates and fees is crucial for responsible student loan borrowing. These costs significantly impact the total amount you’ll repay, so it’s essential to be well-informed before taking out loans. This section will clarify how these costs are determined and their potential impact on your overall debt.

Federal Student Loan Interest Rates

Federal student loan interest rates are set by the government and generally vary depending on the loan type (e.g., subsidized, unsubsidized, PLUS loans), the loan’s disbursement date, and the borrower’s creditworthiness (for PLUS loans). Unlike private loans, federal loan interest rates are not based on individual credit scores. The rates are typically fixed for the life of the loan, meaning your monthly payment will remain consistent. The government publishes the interest rates annually, making it straightforward to find current rates on the Federal Student Aid website. For example, in a recent year, the interest rate for a subsidized undergraduate Stafford loan might have been around 4.99%, while unsubsidized loans had a slightly higher rate.

Private Student Loan Interest Rates

Private student loan interest rates are determined by the lender based on several factors, including your credit history, credit score, co-signer (if applicable), the loan amount, and the loan term. Because they are based on individual creditworthiness, these rates can fluctuate and are often higher than federal loan rates. Borrowers with excellent credit and a co-signer with strong credit may qualify for lower interest rates. Conversely, borrowers with limited or poor credit history may face significantly higher rates, potentially exceeding 10%. For example, a student with a low credit score might receive an interest rate of 9% on a private loan, while a student with good credit and a co-signer might secure a rate closer to 6%.

Fees Associated with Student Loans

Several fees can be associated with student loans, adding to the overall cost.

Origination Fees

Federal student loans may include origination fees, which are deducted from the loan amount before the funds are disbursed to the borrower. These fees are typically a small percentage of the loan amount. For example, a $10,000 loan with a 1% origination fee would result in the borrower receiving $9,900. Private loans may or may not have origination fees, depending on the lender.

Late Payment Fees

Late payment fees are charged when a payment is not made by the due date. These fees vary depending on the lender and can significantly add to the total cost of the loan over time. Consistent on-time payments are crucial to avoid accumulating these fees. For example, a late payment fee could range from $25 to $50 or more, depending on the loan and the lender’s policy.

Impact of Interest Rates and Fees on Total Loan Cost

| Loan Amount | Interest Rate | Origination Fee | Loan Term (Years) | Total Cost (with fees) |

|---|---|---|---|---|

| $10,000 | 5% | $50 | 10 | $12,500 (approx.) |

| $10,000 | 8% | $0 | 10 | $14,600 (approx.) |

| $20,000 | 7% | $100 | 10 | $29,300 (approx.) |

*Note: These are simplified examples and do not include potential late payment fees. Actual costs will vary based on numerous factors.*

Loan Forgiveness and Deferment Options

Navigating the complexities of student loan repayment can be challenging. Fortunately, several programs offer loan forgiveness or temporary relief through deferment or forbearance, providing much-needed financial breathing room for borrowers facing hardship or pursuing specific careers. Understanding these options is crucial for responsible financial planning.

Loan forgiveness programs and deferment/forbearance options offer different paths to manage student loan debt. Loan forgiveness eliminates a portion or all of your loan balance, while deferment and forbearance temporarily postpone or reduce your monthly payments. Each option has specific eligibility criteria and consequences.

Loan Forgiveness Programs

Several federal and state programs offer loan forgiveness for borrowers working in public service or specific fields. These programs typically require a certain number of years of qualifying employment before loan forgiveness is granted. The amount of forgiveness varies depending on the program and the borrower’s circumstances. For example, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of your Direct Loans after you’ve made 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying employer. Similarly, some state programs offer loan forgiveness for teachers or other professionals working in underserved areas. These programs often have specific application processes and requirements that must be met.

Loan Deferment and Forbearance

Deferment and forbearance are temporary pauses or reductions in your student loan payments. Deferment postpones payments and may or may not accrue interest, depending on the type of loan and the reason for deferment. Forbearance reduces or suspends payments, but interest usually continues to accrue. Both options are typically granted for specific reasons, such as unemployment, economic hardship, or medical emergencies.

Applying for Deferment or Forbearance

The application process usually involves contacting your loan servicer and providing documentation to support your request. Required documentation may include proof of unemployment, medical bills, or other evidence of hardship. The servicer will review your application and determine if you are eligible for deferment or forbearance. Approval is not guaranteed, and the length of the deferment or forbearance period is determined on a case-by-case basis.

Conditions for Deferment or Forbearance

Eligibility for deferment or forbearance depends on your loan type and your circumstances. Common reasons for approval include unemployment, economic hardship, or a documented medical emergency. Specific requirements and documentation vary depending on the loan servicer and the type of loan. It’s important to carefully review the requirements and provide all necessary documentation to increase your chances of approval.

Financial Impact of Loan Forgiveness and Deferment

Loan forgiveness can significantly reduce or eliminate student loan debt, resulting in substantial long-term savings. For example, a borrower with $50,000 in student loans who qualifies for complete loan forgiveness would save $50,000 and avoid future interest payments. However, it’s important to note that loan forgiveness may have tax implications, as forgiven debt may be considered taxable income.

Deferment and forbearance provide temporary relief from monthly payments. While this can alleviate short-term financial stress, interest typically accrues during the deferment or forbearance period (except for certain types of deferment), potentially increasing the total amount owed over the life of the loan. For example, a borrower with a $20,000 loan at a 5% interest rate who defers payments for one year could accrue an additional $1,000 in interest. Therefore, it’s crucial to understand the potential long-term implications before opting for deferment or forbearance.

Managing Student Loan Debt

Successfully navigating student loan repayment requires proactive planning and consistent effort. Understanding your loan terms, creating a realistic budget, and employing effective debt management strategies are crucial for minimizing financial stress and achieving timely repayment. Failing to do so can lead to late payments, increased interest accrual, and potentially severe financial consequences.

Managing your student loan debt effectively involves a multifaceted approach encompassing budgeting, repayment planning, and proactive monitoring of your loan accounts. This section will Artikel key strategies to help you successfully manage your student loan repayment and avoid common pitfalls.

Budgeting and Managing Student Loan Repayments

Creating a comprehensive budget is paramount to successful student loan repayment. This involves meticulously tracking your income and expenses, identifying areas where you can cut back, and allocating a specific amount each month towards your student loan payments. Consider using budgeting apps or spreadsheets to monitor your spending and ensure you stay on track. A realistic budget should accommodate not only your loan payments but also essential living expenses, savings goals, and any other financial obligations. For example, if your monthly income is $3000 and your essential expenses are $1500, you might allocate $500 towards student loan payments, leaving $1000 for savings and other needs. Adjusting this allocation based on your income and expenses is key to maintain a balanced budget.

Avoiding Late Payments and Managing Interest Accrual

Late payments can significantly impact your credit score and lead to increased interest charges. To avoid this, set up automatic payments from your checking account. This ensures timely payments regardless of your schedule. Understanding how interest accrues on your loans is also critical. Interest accrues daily on most loans, meaning that the longer you take to repay your loans, the more you will pay in interest overall. Explore strategies like making extra payments to reduce the principal balance and minimize the total interest paid over the life of the loan. For example, paying even an extra $50 a month can significantly reduce your total interest payments and shorten the repayment period.

Understanding Loan Terms and Repayment Schedules

Thoroughly understanding your loan terms and repayment schedule is fundamental to effective debt management. This includes knowing your interest rate, loan amount, repayment period, and any associated fees. Familiarize yourself with different repayment plans (standard, graduated, income-driven) to determine the most suitable option for your financial situation. Understanding these details will enable you to make informed decisions about your repayment strategy and avoid unexpected costs or surprises. For example, a longer repayment period might result in lower monthly payments, but it will also lead to a higher total interest paid over time. Conversely, a shorter repayment period may have higher monthly payments but will result in lower overall interest payments.

Practical Tips for Responsible Student Loan Management

Understanding your loan terms and repayment schedule is crucial for effective management. Before committing to a repayment plan, carefully review the terms and conditions to understand the implications.

- Set up automatic payments to avoid late fees and ensure consistent repayment.

- Create a realistic budget that prioritizes loan repayment alongside other essential expenses.

- Explore different repayment plans to find one that aligns with your financial situation.

- Consider making extra payments to reduce your principal balance and minimize interest accrual.

- Monitor your credit report regularly to ensure accuracy and identify any potential issues.

- Contact your loan servicer if you anticipate difficulty making payments to explore options like deferment or forbearance.

- Keep detailed records of all your loan-related transactions and communication with your servicer.

Alternatives to Traditional Loans

Securing funding for undergraduate education doesn’t solely rely on student loans. A diverse range of options exist, each with its own set of advantages and disadvantages. Careful consideration of these alternatives can significantly impact your financial future and reduce reliance on debt. Exploring these options proactively can lead to a more manageable and less stressful path towards completing your degree.

Beyond traditional loans, several avenues can help finance your education. These alternatives often involve less stringent repayment terms and can significantly lower overall borrowing. Understanding the nuances of each option is crucial in making informed decisions about your funding strategy.

Scholarships and Grants

Scholarships and grants represent a highly desirable form of financial aid because they don’t require repayment. Scholarships are typically awarded based on merit, while grants are often need-based. Numerous organizations, including colleges, universities, private foundations, and corporations, offer scholarships and grants to students pursuing undergraduate degrees. Diligent research and application are key to securing these valuable funds. Many online resources and college financial aid offices can assist in identifying potential opportunities.

Savings and Family Contributions

Utilizing personal savings or receiving financial support from family members can substantially reduce the need for loans. This approach offers significant long-term benefits, avoiding interest payments and the burden of loan repayment. However, the availability of these funds varies greatly among individuals and families. While relying on savings or family contributions can lessen the financial strain of higher education, it’s essential to consider the potential impact on other financial goals and family resources.

Comparison of Funding Options

A direct comparison highlights the key differences between traditional loans and alternative funding sources. This comparison emphasizes the importance of exploring all available options before committing to debt.

| Funding Option | Cost | Accessibility | Repayment Terms |

|---|---|---|---|

| Federal Student Loans | Interest accrues over time; repayment begins after graduation or leaving school. | Relatively high; application processes vary based on financial need. | Variable repayment plans available; potential for loan forgiveness programs. |

| Private Student Loans | Interest rates and terms vary widely; often higher interest rates than federal loans. | Accessibility depends on credit history and co-signer availability. | Repayment begins shortly after disbursement; repayment terms are typically fixed. |

| Scholarships | No cost; funds are provided as grants. | Highly competitive; varies based on merit, need, and specific criteria. | No repayment required. |

| Grants | No cost; funds are provided as grants. | Need-based; eligibility criteria vary by institution and program. | No repayment required. |

| Savings/Family Contributions | Variable; depends on the amount of savings or family contribution. | Highly variable; depends on individual circumstances. | No repayment required. |

Understanding the Long-Term Implications

Taking on student loan debt can significantly impact your financial future, extending far beyond your graduation date. Careful consideration of these long-term implications is crucial for responsible financial planning. Understanding the potential effects on your credit, borrowing power, and overall financial well-being is paramount to making informed decisions about financing your education.

Student loan debt can have a profound effect on your financial trajectory for many years. The weight of monthly payments can restrict your ability to save for other important life goals such as purchasing a home, investing, or building an emergency fund. Furthermore, the interest accrued over time can substantially increase the total amount you ultimately repay, potentially delaying significant financial milestones.

Impact on Credit Scores and Future Borrowing Capacity

Your credit score is a critical factor influencing your ability to secure loans and other forms of credit in the future. Missed or late student loan payments can negatively impact your credit score, making it more difficult and expensive to obtain mortgages, auto loans, or even credit cards. A lower credit score translates to higher interest rates on future loans, increasing the overall cost of borrowing. Conversely, consistent and timely student loan payments can help build a positive credit history, improving your creditworthiness and access to more favorable borrowing terms. For example, someone with a consistently excellent payment history might qualify for a lower interest rate on a mortgage compared to someone with a history of missed loan payments.

Planning for Repayment and Managing Debt Throughout One’s Career

Effective planning is key to successfully navigating student loan repayment. Creating a realistic budget that incorporates your loan payments is essential. Consider exploring different repayment plans, such as income-driven repayment options, which adjust your monthly payments based on your income and family size. Prioritizing high-interest loans for early repayment can minimize the total interest paid over the life of the loan. Regularly monitoring your loan balances and exploring options for refinancing or consolidation can also help streamline repayment and potentially reduce your overall costs. For instance, someone who consistently overpays their student loan each month can significantly shorten their repayment period and save on interest.

Visual Representation of Long-Term Repayment Scenarios

Imagine three lines on a graph representing different repayment strategies. The x-axis represents time (in years), and the y-axis represents the total amount owed. Line A shows a scenario where the borrower makes only the minimum payments. This line will slope downward gradually, remaining high for a long time, reflecting a significant accumulation of interest over many years. Line B represents a scenario where the borrower makes consistent, larger-than-minimum payments. This line slopes downward more steeply, showing a much quicker reduction in debt. Line C depicts aggressive repayment, with extra payments made whenever possible. This line shows a rapid decline in debt, reaching zero much sooner than the other two. This visualization illustrates how different repayment strategies lead to vastly different outcomes, highlighting the importance of proactive repayment planning.

Final Summary

Securing funding for higher education is a significant step, and understanding student loan options is paramount. By carefully considering federal versus private loans, exploring various repayment plans, and proactively managing debt, undergraduates can mitigate financial risks and pave the way for a successful future. Remember to thoroughly research all options, compare terms, and seek guidance when needed. Making informed decisions about student loans is an investment in your future financial well-being.

Popular Questions

What is the difference between a subsidized and unsubsidized federal loan?

With subsidized loans, the government pays the interest while you’re in school (at least half-time). Unsubsidized loans accrue interest from the moment the loan is disbursed, even while you’re studying.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payment. However, it often involves private lenders and may impact your eligibility for federal loan forgiveness programs.

What happens if I default on my student loans?

Defaulting on student loans has serious consequences, including damage to your credit score, wage garnishment, and potential tax refund offset. It’s crucial to contact your loan servicer immediately if you’re struggling to make payments.

What are some alternative funding options besides loans?

Scholarships, grants, work-study programs, and family contributions are all viable alternatives to solely relying on loans to fund your education.