Navigating the complexities of higher education financing often involves exploring various loan options. For parents eager to support their children’s academic pursuits, the Parent PLUS loan presents a significant avenue for funding. This guide delves into the intricacies of Parent PLUS loans, offering a clear understanding of eligibility requirements, interest rates, repayment plans, and potential financial implications. We aim to equip parents with the knowledge needed to make informed decisions regarding this substantial financial commitment.

From understanding eligibility criteria and comparing interest rates to exploring alternative financing options and managing potential debt, we cover all the essential aspects of Parent PLUS loans. We also address common concerns and provide practical strategies for successful loan management, ensuring parents can confidently support their children’s education without compromising their own financial well-being.

Parent PLUS Loan Eligibility Requirements

Securing a Parent PLUS Loan requires meeting specific criteria established by the Federal government. Understanding these requirements is crucial for parents seeking to finance their child’s higher education. This section details the eligibility standards, application process, and a comparison with other federal student loan programs.

Income Limitations

There are no specific income limitations to qualify for a Parent PLUS loan. However, your credit history will be thoroughly reviewed, and a denial may occur if your credit report reveals adverse information. The Department of Education assesses creditworthiness, not income, as the primary factor. While income isn’t directly a barrier to eligibility, it indirectly influences your ability to repay the loan. A higher income generally indicates a greater capacity to manage loan repayments.

Credit History Requirements

A favorable credit history is a fundamental requirement for Parent PLUS loan approval. The Department of Education will review your credit report for negative factors such as bankruptcies, foreclosures, tax liens, and a history of late or missed payments. Applicants with adverse credit history may be denied, though they may be able to obtain a loan with an endorser. It’s essential to maintain a positive credit history to increase the likelihood of approval.

Parent PLUS Loan Application Process

The application process for a Parent PLUS loan involves several steps.

- Complete the FAFSA: The Free Application for Federal Student Aid (FAFSA) is the first step. This application gathers necessary financial information about both the student and parent. The information provided on the FAFSA determines eligibility for federal student aid, including Parent PLUS loans.

- Submit the Parent PLUS Loan Application: After completing the FAFSA, you will receive a notification indicating your eligibility for a Parent PLUS loan. If eligible, you must complete the Parent PLUS loan application through the Federal Student Aid website.

- Credit Check: Your credit history will be reviewed as part of the application process. The Department of Education will access your credit report to assess your creditworthiness.

- Loan Approval or Denial: Based on your credit history, your application will either be approved or denied. If approved, you’ll receive notification of the loan amount and terms.

- Loan Disbursement: Once approved, the loan funds will be disbursed directly to the educational institution to cover your child’s educational expenses.

Comparison of Federal Student Loan Programs

The following table compares the Parent PLUS loan with other federal student loan programs:

| Loan Program | Borrower | Credit Check Required? | Maximum Loan Amount |

|---|---|---|---|

| Parent PLUS Loan | Parent | Yes | Cost of attendance minus other financial aid |

| Direct Subsidized Loan | Student | No | Varies by school and year |

| Direct Unsubsidized Loan | Student | No | Varies by school and year |

Interest Rates and Fees Associated with Parent PLUS Loans

Understanding the financial implications of a Parent PLUS loan is crucial for responsible borrowing. This section details the interest rates and fees associated with these loans, allowing you to make informed decisions about managing your loan repayment. We will also compare these costs to other federal student loan options.

Parent PLUS loans, like other federal student loans, have variable interest rates. The interest rate is determined at the time the loan is disbursed and remains fixed for the life of the loan. It’s important to note that these rates are set by the government and can change annually. Therefore, it is advisable to check the official Federal Student Aid website for the most up-to-date interest rate information before applying.

Current Interest Rates and Origination Fees

The interest rate for Parent PLUS loans is typically higher than other federal student loan options, such as subsidized and unsubsidized Stafford loans. This reflects the higher risk associated with these loans. In addition to interest, Parent PLUS loans also include an origination fee, which is deducted from the loan amount at disbursement. This fee covers the administrative costs associated with processing the loan. The exact percentage of the origination fee can vary but is typically a fixed percentage of the loan amount.

Comparison with Other Federal Student Loan Options

A direct comparison of interest rates highlights the cost differences between Parent PLUS loans and other federal loan programs. For example, subsidized Stafford loans often have lower interest rates than Parent PLUS loans because they are designed for students who demonstrate financial need. Unsubsidized Stafford loans may have slightly higher interest rates than subsidized loans but are available to students regardless of financial need. Direct PLUS loans for graduate students also carry their own set of interest rates, often higher than undergraduate loans. It is essential to compare all available options to choose the most financially suitable path.

Illustrative Example of Total Loan Cost Over Different Repayment Periods

The following table demonstrates how the total cost of a Parent PLUS loan can vary depending on the repayment period. This illustrates the impact of interest accumulation over time. Remember that these figures are examples and the actual cost will depend on the loan amount, interest rate, and chosen repayment plan. The longer the repayment period, the more interest will accrue, increasing the total cost of the loan.

| Loan Amount | Interest Rate (Example) | 10-Year Repayment Total Cost | 20-Year Repayment Total Cost |

|---|---|---|---|

| $20,000 | 7% | $25,000 (approx.) | $32,000 (approx.) |

| $30,000 | 7% | $37,500 (approx.) | $48,000 (approx.) |

| $40,000 | 7% | $50,000 (approx.) | $64,000 (approx.) |

Disclaimer: These figures are estimations and do not include potential late payment fees or other charges. Actual costs may vary. Consult the official Federal Student Aid website for the most accurate and up-to-date information.

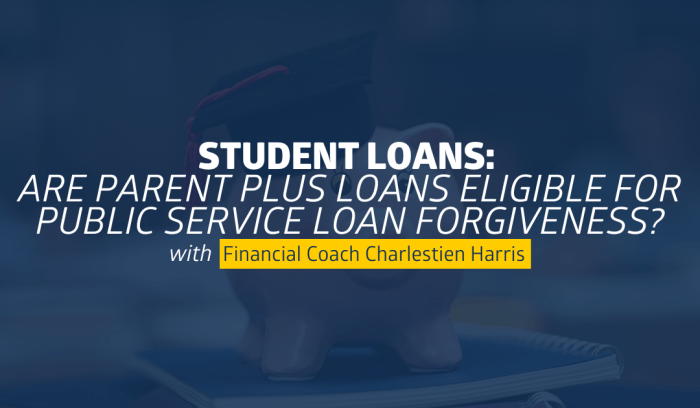

Repayment Options and Plans for Parent PLUS Loans

Understanding your repayment options is crucial for effectively managing your Parent PLUS loan. Several plans are available, each with its own advantages and disadvantages, allowing you to tailor your repayment strategy to your financial circumstances. Choosing the right plan can significantly impact your monthly payments and overall repayment period.

Standard Repayment Plan

The standard repayment plan is the default option for Parent PLUS loans. Under this plan, your payments are fixed, typically spread over 10 years. The monthly payment amount is calculated based on your loan balance and interest rate. While straightforward, this plan may result in higher monthly payments compared to income-driven repayment plans. It offers the advantage of a predictable payment schedule and a relatively shorter repayment period, leading to quicker loan payoff. However, the fixed monthly payment might be challenging for borrowers with fluctuating incomes.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payment based on your income and family size. These plans are designed to make repayment more manageable, especially during periods of financial hardship. Several IDR plans are available, including the Income-Driven Repayment (IDR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Based Repayment (IBR) plans. Eligibility requirements vary slightly between plans, but generally involve demonstrating your income and family size to the loan servicer. The key benefit of IDR plans is lower monthly payments, potentially making repayment more feasible. However, a significant drawback is that IDR plans generally extend the repayment period, resulting in paying more interest over the life of the loan.

- Standard Repayment Plan: Fixed monthly payments over 10 years. Advantages: Predictable payments, shorter repayment period. Disadvantages: Potentially higher monthly payments.

- Income-Driven Repayment (IDR) Plans: Monthly payments adjusted based on income and family size. Advantages: Lower monthly payments, more manageable repayment. Disadvantages: Longer repayment period, higher total interest paid.

Potential Impacts of Parent PLUS Loans on Borrowers’ Finances

Taking out a Parent PLUS loan can significantly impact a parent’s financial well-being, both in the short and long term. Understanding these potential effects is crucial for making informed borrowing decisions. This section will explore the key financial implications, offering strategies for effective debt management.

Impact of Parent PLUS Loans on Credit Scores

A Parent PLUS loan, like any other loan, is reported to credit bureaus. Late or missed payments can negatively affect a parent’s credit score, potentially making it harder to obtain future loans (like a mortgage or car loan) or even impacting their ability to secure favorable interest rates on other credit products. Conversely, consistent on-time payments can positively contribute to a parent’s credit history. The impact on credit score depends on the payment history and the overall credit profile of the borrower. For instance, a parent with an already excellent credit score might see a minimal impact from a Parent PLUS loan, whereas a parent with a poor credit history might experience a more significant negative impact from even minor payment issues.

Long-Term Financial Implications of Parent PLUS Loans

The long-term financial implications of Parent PLUS loans extend beyond the immediate repayment period. The interest accrued over the loan’s lifetime can substantially increase the total amount owed, leading to a significantly higher repayment burden. This can strain a parent’s budget for years, potentially delaying major financial goals such as retirement savings, home improvements, or even their children’s future education expenses. For example, a $50,000 Parent PLUS loan with a 7% interest rate could easily balloon to over $75,000 or more depending on the repayment plan chosen and the loan’s duration. This increased debt can limit financial flexibility and create significant financial stress.

Strategies for Managing Parent PLUS Loan Debt Effectively

Effective management of Parent PLUS loan debt requires proactive planning and disciplined execution. Several strategies can help mitigate the financial burden. These include exploring different repayment plans (such as income-driven repayment, if available), budgeting carefully to prioritize loan payments, and considering refinancing options if interest rates fall. Additionally, parents should actively monitor their loan account, ensuring accurate billing and promptly reporting any discrepancies. For instance, creating a detailed budget that specifically allocates funds for the loan payment each month is crucial. Regularly reviewing the loan statement to ensure accuracy and to track progress towards repayment can also be beneficial. Careful financial planning is essential to prevent the loan from becoming overwhelming.

Managing Parent PLUS Loan Repayment Challenges: A Flowchart

The following flowchart Artikels the steps a parent should take when facing Parent PLUS loan repayment challenges:

[Descriptive Text of Flowchart]

Imagine a flowchart with the following steps:

Start: Facing Parent PLUS Loan Repayment Challenges?

Decision 1: Can you make your current payments?

* Yes: Continue making payments as scheduled. Regularly review your budget and loan terms.

* No: Proceed to Decision 2.

Decision 2: Can you temporarily reduce expenses or increase income?

* Yes: Implement budget adjustments and explore additional income sources. Re-evaluate your ability to make payments. If still unable, proceed to Decision 3.

* No: Proceed to Decision 3.

Decision 3: Contact your loan servicer.

* Discuss options: Deferment, forbearance, income-driven repayment plans, or hardship options.

End: Implement the chosen solution and monitor your progress. Regularly review your financial situation and adjust your strategy as needed.

Alternatives to Parent PLUS Loans for Funding Education

Securing funding for higher education can be a significant challenge. While Parent PLUS loans offer a readily available option, they come with considerable financial obligations. Exploring alternative financing strategies can lead to a more manageable financial burden and potentially better long-term outcomes. Understanding the various options available allows parents to make informed decisions that best suit their individual circumstances.

Scholarships and Grants

Scholarships and grants represent a crucial source of need-based and merit-based financial aid for higher education. Unlike loans, these funds do not need to be repaid. They significantly reduce the reliance on borrowing, thereby mitigating the long-term financial strain associated with student loan debt. Numerous organizations, including colleges, universities, private foundations, and corporations, offer a wide range of scholarships and grants based on various criteria, such as academic achievement, athletic ability, community involvement, or financial need.

529 Education Savings Plans

529 plans are tax-advantaged savings plans designed specifically for education expenses. Contributions grow tax-deferred, and withdrawals used for qualified education expenses are generally tax-free. These plans provide a disciplined approach to saving for college, allowing parents to contribute regularly and watch their investment grow over time. While not a direct replacement for loans in a crisis, they can substantially reduce the amount of borrowing required. The earlier contributions begin, the greater the potential for accumulating significant funds. For example, a family starting contributions early could accumulate enough to cover a considerable portion of tuition, reducing their dependence on Parent PLUS loans.

Federal Student Loans (for the Student)

While Parent PLUS loans are for parents, students themselves can also apply for federal student loans. These loans are generally offered at lower interest rates than Parent PLUS loans and may offer more flexible repayment options. The student’s credit history doesn’t impact the eligibility, making them a viable alternative if the parent’s credit score is poor. However, the student will be responsible for repaying the loan, which might impact their post-graduation financial planning.

Working and Saving

A proactive approach involving diligent saving and part-time work can significantly contribute towards college expenses. This method, while demanding, reduces reliance on loans and fosters financial responsibility. Parents can contribute to savings accounts specifically designated for college tuition, while students can take part-time jobs to contribute to their educational costs. The combined effort can considerably lessen the need for substantial borrowing. For instance, consistent saving over several years, coupled with part-time earnings, can accumulate a considerable sum, reducing the need for loans.

Comparison of Funding Options

| Funding Option | Repayment | Interest Rate | Eligibility |

|---|---|---|---|

| Parent PLUS Loan | Yes | Variable, generally higher | Parent’s creditworthiness |

| Scholarships/Grants | No | N/A | Academic merit, financial need, etc. |

| 529 Plan | No (for qualified expenses) | Variable, depends on investment choices | Anyone can contribute |

| Federal Student Loans (for Student) | Yes | Variable, generally lower than Parent PLUS | Student’s enrollment status |

| Working and Saving | No | N/A | Personal effort and discipline |

Understanding the Loan Consolidation Process for Parent PLUS Loans

Consolidating your Parent PLUS loans can simplify your repayment process by combining multiple loans into a single one. This can lead to a more manageable monthly payment, although it’s crucial to understand the potential implications before proceeding. This section details the process, benefits, drawbacks, and application steps involved in consolidating Parent PLUS loans.

Parent PLUS Loan Consolidation Process

The process of consolidating Parent PLUS loans involves combining them with other eligible federal student loans, such as those from the Federal Family Education Loan (FFEL) program or Direct Loan program. This is done through the Federal Student Aid website. The consolidated loan will then have a new interest rate, repayment plan, and loan terms. It’s important to note that only federal student loans can be consolidated; private loans are not eligible for this process.

Benefits of Consolidating Parent PLUS Loans

Consolidation can offer several advantages. A single monthly payment simplifies budgeting and reduces the administrative burden of managing multiple loans. A lower monthly payment might be achievable through choosing an extended repayment plan, although this typically increases the total interest paid over the life of the loan. Additionally, borrowers might benefit from a fixed interest rate, providing predictability in their monthly payments. For example, if a parent has three Parent PLUS loans with varying interest rates, consolidation could replace these with a single loan with a weighted average interest rate, potentially leading to long-term savings.

Drawbacks of Consolidating Parent PLUS Loans

While consolidation offers benefits, potential drawbacks exist. Extending the repayment period through a longer repayment plan will likely result in paying more interest overall. The new interest rate, while potentially fixed, may be higher than the lowest interest rate among the original loans. Furthermore, consolidating loans may lose access to certain repayment options or benefits associated with the original loans, such as income-driven repayment plans, which are usually only available for the borrower’s own student loans.

Step-by-Step Guide to Applying for Loan Consolidation

Applying for Parent PLUS loan consolidation is generally straightforward. First, gather all necessary loan information, including loan numbers and balances. Next, visit the Federal Student Aid website and complete the Direct Consolidation Loan application. This application requires personal and financial information. After submission, the application is processed, and a new loan is created, combining all eligible loans. Finally, the lender will provide details about the new loan terms, including the interest rate, monthly payment, and repayment schedule.

Impact of Consolidation on Repayment Cost: Hypothetical Examples

Let’s consider two hypothetical examples to illustrate the impact of consolidation on repayment cost.

Example 1: A parent has two Parent PLUS loans: one with a $10,000 balance at 7% interest and another with a $5,000 balance at 6% interest. Consolidating these loans might result in a single loan with a weighted average interest rate of approximately 6.67%. Depending on the chosen repayment plan, the total interest paid might be higher or lower than the combined interest paid on the original loans. A longer repayment term could lower monthly payments but increase total interest.

Example 2: A parent has three Parent PLUS loans totaling $25,000 with an average interest rate of 8%. Consolidating and opting for a longer repayment plan might reduce the monthly payment significantly. However, the total interest paid over the extended repayment period will likely exceed the total interest paid under the original loan terms. For instance, if the original repayment plan was 10 years, extending it to 20 years could significantly increase the total interest paid, even if the monthly payments are more manageable.

Defaulting on a Parent PLUS Loan

Defaulting on a Parent PLUS loan carries significant and long-lasting negative consequences. It can severely damage your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Furthermore, the government can take aggressive collection actions, including wage garnishment, tax refund offset, and even legal action. Understanding these consequences and the available resources is crucial for preventing or mitigating the impact of default.

Consequences of Parent PLUS Loan Default

Defaulting on a Parent PLUS loan results in a damaged credit history, impacting your credit score for years. This can lead to higher interest rates on future loans, difficulty securing a mortgage or auto loan, and potential rejection for credit cards or apartment rentals. The Department of Education may also pursue aggressive collection tactics, such as garnishing wages, seizing tax refunds, and referring the debt to collections agencies. These actions can cause significant financial hardship and stress. In some cases, default can lead to legal action, including lawsuits and wage garnishments. The severity of the consequences depends on the amount owed and the length of the default. For example, a default on a large loan amount will likely have a more significant impact than a default on a smaller loan.

Resources for Borrowers Facing Repayment Difficulties

Several resources are available to assist borrowers struggling to repay their Parent PLUS loans. The Department of Education offers various repayment plans, including income-driven repayment (IDR) plans, which base monthly payments on your income and family size. These plans can significantly lower your monthly payments, making them more manageable. Borrowers can also explore deferment or forbearance options, which temporarily postpone or reduce payments during times of financial hardship. Contacting your loan servicer directly is also crucial; they can provide personalized guidance and explore potential solutions tailored to your specific circumstances. They may be able to offer temporary payment adjustments or connect you with counseling services.

Loan Rehabilitation

Loan rehabilitation is a process that allows borrowers to restore their defaulted federal student loans to good standing. It involves making nine on-time payments within 20 months. Once completed, the default is removed from your credit report, and you may be eligible for certain benefits, such as access to federal student aid programs in the future. However, it’s important to note that while rehabilitation removes the default from your credit report, it does not erase the debt. You will still owe the original loan amount, plus any accrued interest and fees. The process requires consistent and timely payments, emphasizing the importance of commitment and planning.

Resources for Borrowers Facing Default or Delinquency

The following resources can provide valuable support and guidance to borrowers facing default or delinquency:

- National Student Loan Data System (NSLDS): Provides access to your federal student loan information, including loan servicer contact details.

- Your Loan Servicer: Your servicer is your primary point of contact for repayment options, and they can answer specific questions about your loan.

- StudentAid.gov: The official website for the U.S. Department of Education’s Federal Student Aid program offers comprehensive information on student loan repayment and options.

- Federal Student Aid Information Center: Provides phone support and answers questions about federal student aid.

- Nonprofit Credit Counseling Agencies: These agencies offer free or low-cost credit counseling and can help you create a budget and explore debt management strategies.

Final Conclusion

Securing your child’s education often requires a multifaceted approach to financing. While Parent PLUS loans can be a valuable tool, careful consideration of eligibility, interest rates, repayment options, and potential long-term financial effects is crucial. By understanding the intricacies of these loans and exploring alternative funding sources, parents can make well-informed decisions that align with their financial capabilities and long-term goals. Remember to explore all available resources and seek professional financial advice when needed to ensure a smooth and successful path towards higher education.

FAQ Resource

What happens if I can’t repay my Parent PLUS loan?

Failure to repay can result in negative credit impacts, wage garnishment, and tax refund offset. Contact the lender immediately to explore options like deferment, forbearance, or income-driven repayment plans.

Can I refinance my Parent PLUS loan?

While refinancing options exist, they often involve private lenders and may lose federal protections. Carefully weigh the pros and cons before refinancing.

How does a Parent PLUS loan affect my credit score?

Taking out and successfully repaying a Parent PLUS loan can positively impact your credit score. However, late or missed payments will negatively affect your credit.

What is the difference between a Parent PLUS loan and a direct subsidized loan?

A Parent PLUS loan is for parents borrowing on behalf of their child, while a direct subsidized loan is for the student themselves, and the government pays the interest while the student is enrolled at least half-time.