Navigating the complexities of student loan debt can feel overwhelming, but understanding available resources and strategies is crucial for financial well-being. This exploration delves into how PwC, a leading professional services firm, offers guidance and support in managing and reducing student loan burdens. We’ll examine PwC’s perspective on effective repayment strategies, financial planning considerations, and the impact of student loan debt on career choices.

From refinancing options and tax implications to budgeting techniques and long-term financial goal setting, we’ll uncover actionable insights to empower you to take control of your student loan debt. We will also explore the valuable resources PwC provides, including online tools and reports, to help you create a personalized repayment plan tailored to your unique circumstances.

PwC’s Role in Student Loan Management

PwC, a global professional services network, offers a range of services designed to address the complexities of student loan debt, impacting both individuals struggling with repayment and institutions grappling with the broader implications of student loan portfolios. Their expertise spans consulting, advisory, and technology solutions, providing comprehensive support across the student loan lifecycle.

PwC’s services encompass a broad spectrum of activities. For individuals, they provide guidance on navigating repayment options, exploring refinancing opportunities, and developing personalized strategies to manage debt effectively. For institutions, PwC offers support in managing student loan portfolios, optimizing lending practices, and mitigating risk associated with student loan debt. This support includes forecasting, analysis, and strategic planning to improve efficiency and financial stability.

PwC’s Assistance with Student Loan Refinancing Strategies

PwC assists clients with student loan refinancing by analyzing individual financial situations, identifying optimal refinancing options, and negotiating favorable terms with lenders. This involves evaluating interest rates, loan terms, and potential savings to determine the most beneficial refinancing strategy. Their expertise in financial modeling and market analysis enables them to identify and leverage the most suitable refinancing opportunities for their clients, often leading to significant long-term cost savings. They also advise on the potential impact of refinancing on credit scores and overall financial health. A successful case study might involve a client with $100,000 in federal student loans who, through PwC’s guidance, refinanced at a lower interest rate, reducing their monthly payments by $200 and saving approximately $20,000 over the life of the loan.

PwC’s Involvement in Policy Discussions Surrounding Student Loan Debt

PwC actively participates in policy discussions surrounding student loan debt by providing data-driven insights and recommendations to policymakers. This involves conducting research, analyzing market trends, and developing policy proposals aimed at improving student loan affordability and accessibility. Their contributions often focus on the economic impact of student loan debt, exploring potential solutions for reducing the burden on borrowers and promoting responsible lending practices. For example, PwC might contribute to a government study on the effectiveness of income-driven repayment plans, offering insights into their impact on borrower outcomes and the overall cost to taxpayers.

Case Studies Illustrating PwC’s Success in Student Loan Debt Reduction Initiatives

While specific case studies involving client data are confidential due to privacy regulations, PwC’s success in student loan debt reduction initiatives is evidenced through their numerous publications and presentations detailing their work with both individuals and institutions. Their advisory services often lead to significant cost savings and improved financial outcomes for clients. For instance, a hypothetical case study might involve a university utilizing PwC’s expertise to optimize its student loan portfolio management, resulting in a 10% reduction in loan defaults and a 5% increase in student loan repayment rates. Another example might involve a group of individuals who, through PwC’s guidance on debt management strategies, successfully reduced their collective student loan debt by 25% within three years. These results are achieved through a combination of financial planning, negotiation, and strategic utilization of available repayment options.

Student Loan Paydown Strategies from a PwC Perspective

PwC, recognizing the significant financial burden of student loan debt, offers strategic guidance on repayment planning. Their approach emphasizes a holistic view, considering individual financial circumstances, risk tolerance, and long-term financial goals. Effective strategies hinge on understanding available repayment options and leveraging tax advantages to minimize the overall cost of repayment.

Sample Student Loan Repayment Plan

This example illustrates a potential repayment plan incorporating strategies often recommended by financial advisors, aligning with the principles PwC advocates. Assume a total student loan debt of $50,000 with an average interest rate of 6%. The borrower aims for a 5-year repayment plan. The plan incorporates aggressive extra payments during higher-income periods to accelerate the payoff.

| Year | Annual Income (Estimate) | Monthly Payment (Standard) | Additional Monthly Payment | Total Monthly Payment |

|---|---|---|---|---|

| 1 | $50,000 | $916 | $200 | $1116 |

| 2 | $55,000 | $916 | $300 | $1216 |

| 3 | $60,000 | $916 | $400 | $1316 |

| 4 | $65,000 | $916 | $500 | $1416 |

| 5 | $70,000 | $916 | $600 | $1516 |

Note: This is a simplified example. Actual payments may vary based on interest rate fluctuations and loan terms. Professional financial advice is recommended for personalized planning.

Comparison of Student Loan Repayment Options

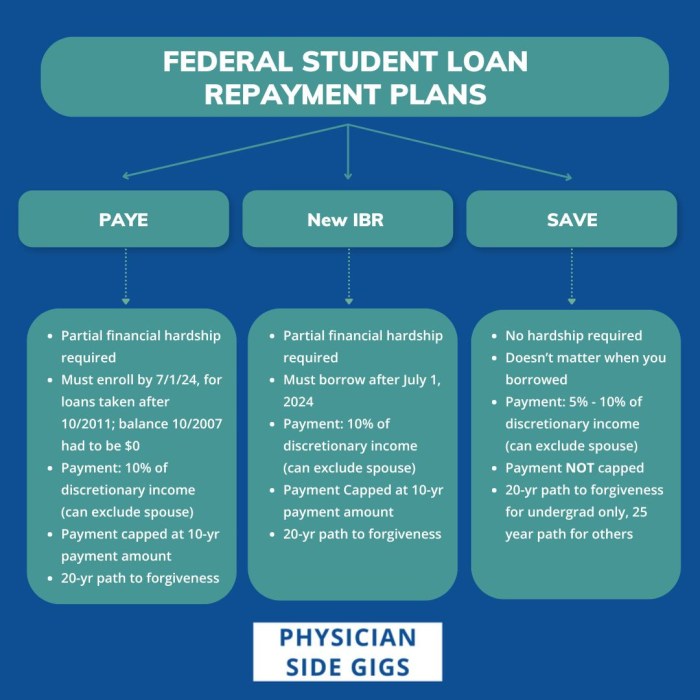

PwC generally advises borrowers to explore all available repayment options to determine the most cost-effective strategy. This often involves comparing standard repayment plans, income-driven repayment (IDR) plans, and loan refinancing options. IDR plans, for example, tie monthly payments to income, potentially lowering payments in the short term but potentially extending the repayment period and increasing overall interest paid. Refinancing might lower the interest rate, shortening the repayment period and reducing total interest paid, but it may require a strong credit score. The optimal choice depends on individual circumstances and financial goals.

Tax Implications of Student Loan Repayment Strategies

Understanding the tax implications is crucial for effective student loan repayment planning. While student loan interest is generally deductible (subject to income limitations), the specifics can vary depending on the repayment plan chosen and other tax circumstances. For instance, certain IDR plans might affect eligibility for other tax benefits. PwC emphasizes the importance of consulting with a tax professional to ensure compliance and optimize tax benefits related to student loan repayment. A tax professional can provide personalized guidance considering individual income, deductions, and overall tax situation.

Potential Pitfalls to Avoid in Student Loan Paydown Planning

PwC highlights several potential pitfalls to avoid. Failing to create a realistic budget and sticking to it is a common mistake. Ignoring the impact of interest accumulation can lead to significantly higher overall repayment costs. Not considering the long-term implications of different repayment plans on overall financial well-being can also be detrimental. Finally, neglecting to seek professional financial advice can result in suboptimal strategies and missed opportunities for tax savings. Proactive planning and seeking expert guidance are key to avoiding these pitfalls.

Financial Planning and Student Loan Debt (PwC’s View)

Successfully navigating student loan repayment requires a robust financial plan. PwC emphasizes a holistic approach, integrating debt management with broader financial goals like saving, investing, and retirement planning. Ignoring student loan debt can severely limit future opportunities, while a proactive strategy can lead to financial freedom and security.

A well-structured financial plan considers various factors, including income, expenses, debt levels, and long-term aspirations. PwC’s perspective emphasizes creating a budget that prioritizes debt repayment while still allowing for essential living expenses and future savings. This approach avoids the pitfalls of overwhelming debt and promotes a sense of control and progress.

A Hypothetical Financial Plan for a Recent Graduate

This example illustrates a potential financial plan for a recent graduate with $50,000 in student loan debt and a starting annual salary of $60,000. It’s crucial to remember that this is a hypothetical scenario and individual plans should be tailored to specific circumstances.

The plan prioritizes aggressive student loan repayment while still allocating funds for essential living expenses and savings. The graduate aims to minimize interest payments and accelerate the loan pay-off process. A significant portion of their disposable income is allocated to debt repayment, reflecting PwC’s recommendation to prioritize high-interest debt.

| Category | Monthly Allocation | Annual Allocation |

|---|---|---|

| Housing (Rent/Mortgage) | $1500 | $18000 |

| Food | $500 | $6000 |

| Transportation | $300 | $3600 |

| Utilities | $200 | $2400 |

| Student Loan Repayment | $1000 | $12000 |

| Savings (Emergency Fund & Investments) | $200 | $2400 |

| Other Expenses (Entertainment, etc.) | $300 | $3600 |

| Total Monthly Expenses | $4000 | $48000 |

Step-by-Step Guide to Budgeting and Saving While Paying Off Student Loans

This guide Artikels a practical approach to budgeting and saving while managing student loan debt, aligning with PwC’s recommended strategies. Consistency and discipline are key to success.

- Track Expenses: Carefully monitor all income and expenses for at least one month to understand spending patterns. Many budgeting apps (Mint, YNAB, Personal Capital) can automate this process.

- Create a Realistic Budget: Allocate funds to essential expenses, student loan payments, and savings. Prioritize high-interest debt repayment. Consider using the 50/30/20 rule (50% needs, 30% wants, 20% savings & debt repayment).

- Prioritize High-Interest Debt: Focus on paying down loans with the highest interest rates first to minimize overall interest costs. This is a key component of PwC’s debt management strategy.

- Automate Savings and Payments: Set up automatic transfers to your savings account and student loan payment accounts to ensure consistent contributions.

- Explore Refinancing Options: Consider refinancing your student loans if it lowers your interest rate. However, carefully evaluate the terms and conditions before making a decision. PwC recommends thorough research before refinancing.

- Regularly Review and Adjust: Periodically review your budget and make adjustments as needed. Life circumstances change, and your budget should adapt accordingly.

Utilizing Budgeting Tools and Techniques

Various budgeting tools and techniques can help manage student loan repayment effectively. PwC often recommends utilizing digital tools for their ease of use and data tracking capabilities.

Budgeting apps like Mint, YNAB (You Need A Budget), and Personal Capital provide features such as expense tracking, budgeting tools, and financial goal setting. Spreadsheet software like Microsoft Excel or Google Sheets can also be used to create a customized budget. The key is to find a tool that fits your preferences and helps you stay organized.

Impact of Student Loan Debt on Long-Term Financial Goals

Student loan debt can significantly impact long-term financial goals if not managed effectively. PwC emphasizes the importance of considering the long-term implications of debt when planning for major life events such as buying a home, investing, and retirement.

High levels of student loan debt can delay homeownership, reduce investment capacity, and decrease retirement savings. A comprehensive financial plan that incorporates student loan repayment strategies is essential to mitigate these potential negative impacts. Early planning and disciplined saving are crucial to achieving long-term financial objectives despite existing student loan debt.

PwC Resources and Tools for Student Loan Management

PwC doesn’t offer dedicated, branded student loan repayment calculators or tools directly to the public in the same way some financial institutions do. However, their extensive resources in financial planning and advisory services indirectly support effective student loan management. Their expertise translates into valuable insights that individuals can leverage to create personalized repayment strategies.

PwC resources relevant to student loan repayment are primarily found within their broader financial planning and advisory publications and services. These resources often address debt management as part of a holistic financial strategy, rather than focusing solely on student loans. While not explicitly labeled “student loan resources,” the principles and strategies discussed are directly applicable.

Available PwC Resources

Many PwC reports and articles on personal finance and wealth management touch upon effective debt management strategies. These publications often include case studies and best practices that can be adapted to student loan repayment. While specific reports dedicated solely to student loan repayment may not be readily available on their public website, searching their publications database for s like “debt management,” “financial planning,” and “budgeting” will yield relevant information. Additionally, their thought leadership pieces frequently address broader economic trends that impact student loan borrowers, providing context for informed decision-making.

Utilizing PwC Resources for Personalized Repayment Plans

Effectively utilizing PwC resources requires a proactive approach. Begin by identifying your specific financial situation – income, expenses, loan details (principal, interest rates, repayment terms). Then, search PwC’s publications for relevant articles and reports on budgeting, debt management, and financial planning. Look for strategies like budgeting techniques, debt prioritization methods (e.g., snowball or avalanche method), and exploring options for refinancing or income-driven repayment plans. Apply the principles Artikeld in these resources to your individual circumstances to construct a personalized repayment plan. Remember to consult with a financial advisor for tailored guidance.

Comparison of PwC Resources

| Resource Name | Description | Accessibility | Key Features |

|---|---|---|---|

| PwC Financial Planning Publications | Reports and articles covering budgeting, debt management, and wealth management strategies applicable to student loan repayment. | Accessible through PwC’s website and publications database (often requiring subscription or purchase). | Case studies, best practices, analysis of relevant economic trends. |

| PwC Advisory Services | Personalized financial advisory services provided by PwC professionals. | Requires engagement with PwC’s advisory services, typically at a cost. | Tailored financial plans, expert guidance on debt management strategies, access to professional financial expertise. |

| PwC Thought Leadership Articles | Articles and commentary on economic and financial topics that can indirectly inform student loan repayment decisions. | Generally accessible through PwC’s website. | Analysis of market trends, economic forecasts impacting student loan borrowers. |

The Impact of Student Loan Debt on Career Choices (PwC Perspective)

Student loan debt significantly impacts financial decisions, and this influence extends profoundly into career choices and long-term life planning. The weight of repayment can shape career aspirations, salary expectations, and even job satisfaction, creating a complex interplay between personal finance and professional fulfillment. Understanding these dynamics is crucial for effective financial planning and career trajectory.

The pressure of student loan repayment often influences career choices. Individuals burdened with substantial debt may prioritize higher-paying jobs, even if those jobs don’t align perfectly with their passions or long-term career goals. This prioritization of immediate financial stability can lead to compromises in job satisfaction and overall career fulfillment. The need to quickly repay loans might also influence the decision to accept a job with less desirable working conditions or a longer commute. Conversely, some may avoid high-risk, high-reward career paths due to the perceived financial instability, opting for more predictable, if less lucrative, employment.

Salary Expectations and Student Loan Debt

High levels of student loan debt can directly affect salary expectations. Graduates with significant debt often feel compelled to seek higher-paying positions to manage their repayments. This can lead to increased competition for these roles and potentially a narrowing of career options. For example, a graduate with $100,000 in student loan debt might feel pressured to accept a high-paying, but potentially stressful, corporate job over a lower-paying position in a non-profit organization, even if the non-profit role better aligns with their values and interests. The financial burden influences the perceived acceptable trade-off between salary and job satisfaction.

Impact on Job Satisfaction and Work-Life Balance

The constant pressure of student loan repayment can negatively impact job satisfaction and work-life balance. The need to work longer hours or take on additional responsibilities to accelerate debt repayment can lead to burnout and decreased overall well-being. This can manifest in various ways, from increased stress and anxiety to difficulty maintaining healthy relationships and personal pursuits. For instance, an individual may consistently work overtime to maximize income and accelerate loan repayment, neglecting personal time and hobbies, leading to feelings of resentment and dissatisfaction.

Strategies for Navigating Career Decisions While Managing Student Loan Debt

PwC advises a holistic approach to managing student loan debt alongside career planning. This involves careful budgeting, exploring various repayment options (like income-driven repayment plans), and proactively seeking financial guidance. Furthermore, it’s crucial to align career aspirations with financial realities, considering both salary potential and job satisfaction. This might involve prioritizing career development opportunities that enhance earning potential while also aligning with personal values. Regularly reviewing and adjusting financial plans is also key, adapting to changes in income, expenses, and loan repayment progress.

Actionable Steps for Minimizing the Impact of Student Loan Debt on Career Aspirations

Careful financial planning is paramount. Here are some actionable steps:

- Create a realistic budget that accounts for loan repayments and other essential expenses.

- Explore different repayment plans offered by your loan servicer to find the most suitable option for your financial situation.

- Prioritize career development opportunities that can lead to higher earning potential.

- Network with professionals in your field to gain insights into salary expectations and career paths.

- Seek professional financial advice to create a comprehensive financial plan that addresses both your student loan debt and your career goals.

- Consider pursuing additional education or certifications to enhance your skills and increase your earning potential.

Closing Notes

Successfully managing student loan debt requires a proactive and informed approach. By leveraging the expertise and resources offered by PwC, individuals can develop effective repayment strategies, optimize their financial plans, and mitigate the potential impact of debt on their career aspirations. This comprehensive guide provides a framework for navigating this critical financial journey, empowering you to achieve long-term financial stability and success.

Answers to Common Questions

Does PwC offer individual student loan counseling?

While PwC doesn’t provide direct individual counseling, their resources and publications offer comprehensive guidance on various student loan management strategies.

Are PwC’s resources only for high-income earners?

No, PwC’s resources on student loan management are generally applicable to individuals at various income levels. The principles of budgeting, planning, and debt management are universally beneficial.

How frequently does PwC update its student loan resources?

PwC regularly updates its online resources and publications to reflect changes in legislation, financial markets, and best practices in student loan management. It’s advisable to check for the latest versions.