Navigating the complexities of student loan repayment can feel overwhelming. Student loan planner websites offer a crucial resource, providing tools and information to help borrowers understand their debt, explore repayment options, and ultimately achieve financial freedom. These platforms vary significantly in features and user experience, however, making informed selection vital.

This guide delves into the world of student loan planner websites, examining their functionality, data security practices, integration with other financial tools, and effective marketing strategies. We’ll explore the user experience, compare various platforms, and address common concerns regarding data privacy and security. The goal is to empower users to make informed decisions when choosing a student loan planner that best suits their needs.

Understanding “student loan planner com” Websites

Student loan planner websites offer valuable tools and resources to help individuals navigate the complexities of student loan repayment. These platforms typically provide a range of features designed to simplify the process, from calculating monthly payments to exploring different repayment strategies. Understanding their capabilities is crucial for effective debt management.

Typical Features of Student Loan Planner Websites

Most student loan planner websites offer a core set of features aimed at providing a comprehensive overview of your student loan situation. These commonly include loan aggregation (combining all your loans into one view), repayment schedule generation, interest calculation tools, and the ability to explore different repayment plan options. Many also incorporate budgeting tools to help users align their repayment strategy with their overall financial goals. Some advanced platforms even offer features like debt avalanche/snowball calculators and tools to help you track your progress towards loan payoff.

Types of Student Loan Calculators

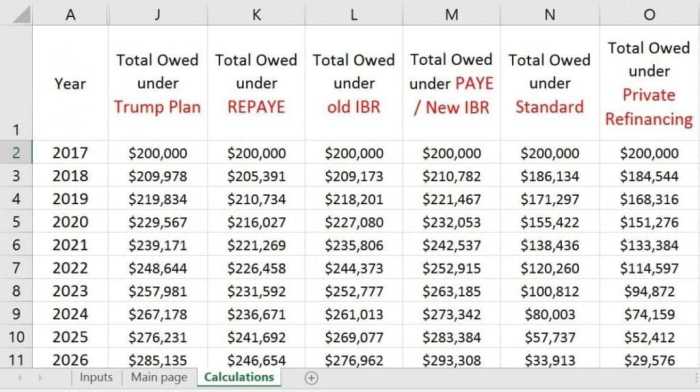

Student loan planner websites employ various types of calculators to cater to different needs. A common type is the standard amortization calculator, which calculates monthly payments based on the loan amount, interest rate, and loan term. More sophisticated calculators, like interest-only calculators, show the impact of paying only the interest for a specified period. Debt snowball/avalanche calculators prioritize loans based on balance or interest rate to optimize repayment strategies. Finally, refinancing calculators help users compare potential savings by refinancing their loans with a different lender.

Commonly Presented Repayment Options

Student loan planner websites typically showcase a variety of repayment options, reflecting the choices available through federal and private loan programs. These commonly include: Standard Repayment, where fixed monthly payments are made over a 10-year period; Graduated Repayment, where payments increase gradually over time; Extended Repayment, which stretches payments over a longer period (up to 25 years); and Income-Driven Repayment (IDR) plans, where monthly payments are tied to a percentage of your discretionary income. The website may also detail options such as deferment and forbearance, temporary pauses in repayment due to specific circumstances.

Comparison of User Interfaces

Three prominent student loan planner websites, while offering similar core functionalities, differ significantly in their user interface design. Website A might prioritize a clean, minimalist design with intuitive navigation, focusing on clear data visualization through charts and graphs. Website B, on the other hand, could opt for a more detailed and feature-rich interface, potentially overwhelming users with numerous options and settings. Website C might adopt a gamified approach, using progress bars and rewards to encourage engagement and motivation in managing student loan debt. These differing approaches reflect the diverse user preferences and levels of financial literacy.

Comparison of Key Features of Five Student Loan Planner Websites

| Website | Loan Aggregation | Repayment Calculators | Financial Budgeting Tools |

|---|---|---|---|

| Website A | Yes | Amortization, IDR | Yes |

| Website B | Yes | Amortization, Snowball, Refinancing | No |

| Website C | Yes | Amortization, Graduated | Yes |

| Website D | No | Amortization | No |

| Website E | Yes | Amortization, Interest-Only | Yes |

Functionality and User Experience

Student loan planner websites offer a crucial service to individuals navigating the complexities of student loan repayment. These platforms aim to simplify the process, providing tools and resources to help users understand their debt, explore repayment options, and ultimately achieve financial freedom. Effective functionality and intuitive user experience are paramount to the success of these websites.

A student loan planner website assists users in managing their debt through several key functionalities. These typically include aggregating loan information from various lenders, calculating monthly payments based on different repayment plans (such as standard, extended, or income-driven repayment), projecting future balances, and offering personalized repayment strategies. Many platforms also incorporate budgeting tools, allowing users to integrate their loan payments into their overall financial picture. Some advanced features might include debt consolidation advice or refinancing options comparisons. The goal is to empower users with the knowledge and tools necessary to make informed decisions about their student loans.

Effective User Navigation on Student Loan Planner Websites

Effective navigation is critical for a positive user experience. Well-designed websites utilize clear and concise menus, intuitive search functions, and logical information architecture. For example, a user should be able to easily find information on different repayment plans without having to navigate through multiple layers of menus. A sitemap, clearly visible or easily accessible, can significantly improve navigation. Visual cues, such as breadcrumbs (showing the user’s current location within the website), also enhance usability. Furthermore, a prominent FAQ section addressing common user questions can reduce the need for extensive navigation. Finally, a robust search function that allows users to quickly find specific information, regardless of their location within the site, is essential.

User Flow Diagram for a Student Loan Planner Website

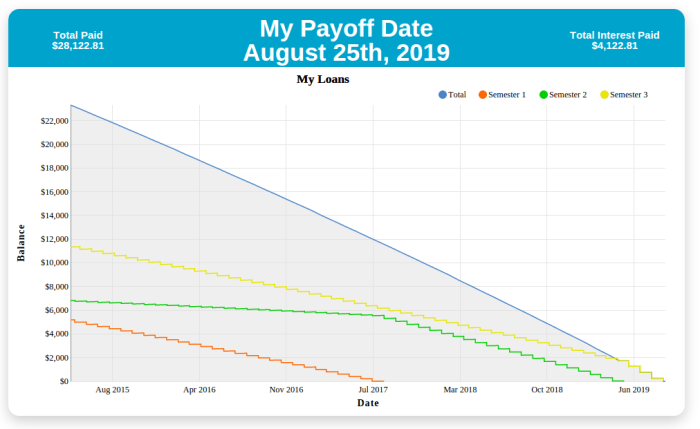

Imagine a user flow diagram starting with the homepage. The user might then click on a “Calculate My Payments” button, leading to a page where they input their loan details (loan amount, interest rate, repayment period). After inputting this data, the website calculates and displays various repayment scenarios. The user can then explore different repayment plans, comparing monthly payments and total interest paid. From there, they might navigate to a section detailing income-driven repayment plans or explore resources on debt consolidation. Finally, the user could download a personalized repayment schedule or connect with a financial advisor through an integrated feature. This journey illustrates a streamlined and user-friendly experience.

Importance of Clear and Concise Information Presentation

Clear and concise information presentation is vital for user understanding and engagement. Complex financial information needs to be simplified and presented in a way that is easily digestible for users with varying levels of financial literacy. Using clear and simple language, avoiding jargon, and employing visual aids like charts and graphs can significantly enhance comprehension. Data should be presented in a visually appealing and easily understandable format. For example, a comparison table showing different repayment plans side-by-side is far more effective than lengthy paragraphs of text. Consistency in formatting and terminology throughout the website is also crucial for maintaining user clarity.

Usability Improvements for Student Loan Planner Websites

Several usability improvements can enhance the user experience on these platforms.

- Improved personalization: Tailoring information and recommendations to the individual user’s specific financial situation, based on the data they provide.

- Interactive tools and simulations: Allowing users to experiment with different repayment scenarios and visualize the impact of their choices.

- Enhanced mobile responsiveness: Ensuring the website functions seamlessly across various devices, including smartphones and tablets.

- Integration with other financial tools: Linking the student loan planner with budgeting apps or other financial management tools for a holistic financial overview.

- Improved customer support: Providing readily accessible and responsive customer support channels, such as live chat or email, to address user questions and concerns.

Data Security and Privacy Concerns

Using online student loan planners offers convenience, but it’s crucial to understand the potential risks to your personal and financial data. These platforms handle sensitive information, making data security and privacy paramount. Understanding the measures these websites employ is essential for informed decision-making.

Types of Data Collected and Security Measures

Student loan planner websites collect a range of data, including personal information (name, address, social security number), financial details (income, loan amounts, repayment history), and educational background. The security measures employed vary, but commonly include data encryption during transmission (HTTPS), secure storage of data using firewalls and intrusion detection systems, and regular security audits. However, no system is entirely impenetrable, and users should remain vigilant.

Importance of Data Encryption and User Authentication

Data encryption is vital for protecting sensitive information during transmission and storage. Strong encryption algorithms, such as AES-256, render intercepted data unreadable without the correct decryption key. User authentication, typically through passwords and potentially multi-factor authentication (MFA), prevents unauthorized access to accounts and personal data. Robust authentication methods significantly reduce the risk of data breaches and identity theft.

Comparison of Privacy Policies of Three Student Loan Planner Websites

A detailed comparison requires analyzing the specific privacy policies of individual websites, which are subject to change. However, a general comparison might reveal differences in data retention policies, data sharing practices with third parties, and the types of security measures implemented. For example, one website might explicitly state its use of AES-256 encryption, while another might only mention general security measures without specifying encryption details. Another might be more transparent about data sharing with affiliated companies. Careful review of each website’s privacy policy is crucial before using their services.

Best Practices for Data Security on Student Loan Planner Websites

Best practices for data security on student loan planner websites include using strong, unique passwords, enabling MFA where available, regularly reviewing account activity for suspicious transactions, and only using reputable and established websites. Websites should also implement regular security updates and patches to address vulnerabilities, conduct penetration testing to identify weaknesses, and comply with relevant data privacy regulations like GDPR or CCPA. Transparency in their security practices, clearly Artikeld in their privacy policies, builds user trust.

Integration with Other Financial Tools

Student loan planner websites can significantly enhance their utility and user experience by integrating with other popular financial tools. This interconnected approach provides a more holistic view of a user’s financial picture, streamlining the process of managing debt and achieving financial goals. Effective integration fosters a more user-friendly and efficient platform.

Integrating a student loan planner with other financial tools offers users a consolidated and comprehensive view of their finances. This eliminates the need to switch between multiple applications, simplifying debt management and financial planning.

Integration with Budgeting Apps

Seamless integration with budgeting apps allows users to directly incorporate their student loan payments into their overall budget. This provides a clear picture of how loan repayments impact their monthly spending and savings goals. For example, a user could link their Mint or YNAB account to their student loan planner. The planner would automatically pull in income and expense data, allowing users to visualize how loan payments affect their cash flow and adjust their budget accordingly. This visualization facilitates better financial decision-making and helps users stay on track with their repayment plans.

Integration with Credit Score Monitoring Services

Connecting student loan planner websites with credit score monitoring services offers valuable insights into the impact of loan repayment on credit scores. Users can track their credit score improvements as they diligently pay down their student loans. This integration provides motivation and allows users to see the tangible benefits of their repayment efforts. For instance, if a user connects their account with Experian or Credit Karma, the student loan planner could display their credit score alongside their loan repayment progress, illustrating the positive correlation between responsible repayment and improved credit health.

Integration with Tax Preparation Software

Integrating student loan planner websites with tax preparation software simplifies the process of claiming student loan interest deductions. The planner could automatically pull relevant loan information and pre-fill the necessary tax forms, reducing the time and effort required during tax season. This integration minimizes the risk of errors and ensures users accurately claim all eligible deductions. For example, integration with TurboTax or H&R Block could streamline the process of claiming the student loan interest deduction, automatically transferring relevant data from the student loan planner to the tax software.

Examples of Enhanced User Experience through Integration

Several examples illustrate how integration with other financial tools significantly improves the user experience. A user could see their student loan repayment progress visualized alongside their overall net worth in a personal finance dashboard. Another example is the ability to receive automated alerts when their loan payments are due, directly within their budgeting app. Finally, a comprehensive overview showing how loan repayment impacts their credit score, all within a single platform, would provide a powerful visual representation of financial progress.

Hypothetical Integration Plan: Student Loan Planner and Personal Finance Management App

This hypothetical plan Artikels the integration of a student loan planner (SLP) with a personal finance management app (PFMA), such as a hypothetical “MoneyWise” app.

The integration would involve a secure API connection between SLP and PFMA. Users would grant permission for data sharing during the linking process. Data exchanged would include:

- Loan details (principal, interest rate, payment schedule) from SLP to PFMA.

- Income, expenses, and net worth data from PFMA to SLP for contextualized repayment planning.

The PFMA would then display this information within its budgeting and net worth sections, providing a holistic financial picture. The SLP would use the PFMA’s income and expense data to offer personalized repayment strategies and projections. The user could view their loan repayment plan within the context of their overall financial goals and budget constraints, creating a more comprehensive and insightful financial planning experience. Automated alerts could be set up within the PFMA to notify users of upcoming loan payments. This integration creates a synergistic relationship between the two applications, improving the user experience and facilitating better financial management.

Marketing and Advertising Strategies

Marketing a student loan planner website requires a multi-faceted approach targeting the specific needs and anxieties of student loan borrowers. Success hinges on reaching the right audience with the right message at the right time, emphasizing the value proposition of simplified loan management and potential cost savings. A well-defined marketing strategy is crucial for attracting users and establishing a strong brand presence within a competitive market.

Effective marketing strategies for attracting student loan borrowers involve a combination of digital and potentially traditional methods. The core message should consistently highlight the website’s ability to simplify the often-overwhelming process of managing student loan debt. This includes features like loan tracking, repayment strategy optimization, and potential savings calculations. Furthermore, building trust and credibility through testimonials and transparent pricing is paramount.

Targeted Advertising Campaigns

Targeted advertising campaigns leverage the power of data to reach specific demographics and user interests. For example, a campaign could target recent college graduates on social media platforms like LinkedIn and Facebook, using tailored ads showcasing the website’s features for new borrowers. Another campaign might target individuals with high student loan debt balances through Google Ads, using s like “student loan refinancing” or “student loan consolidation.” These campaigns could feature compelling visuals and concise copy emphasizing the benefits of using the website to manage and potentially reduce their debt burden. A/B testing different ad creatives and targeting parameters is essential to optimize campaign performance.

Search Engine Optimization ()

Search engine optimization () is crucial for organic visibility. By optimizing the website’s content and structure for relevant s, the website can rank higher in search engine results pages (SERPs) for searches related to student loan planning, management, and refinancing. This includes optimizing page titles, meta descriptions, header tags, and image alt text with relevant s. Building high-quality, informative content around topics like loan repayment strategies, interest rate calculations, and income-driven repayment plans will attract organic traffic and establish the website as a trusted resource. Regularly monitoring rankings and website analytics is vital for adjusting strategies as needed.

Ethical Considerations in Marketing Student Loan Planning Services

Ethical considerations are paramount. Marketing materials should be transparent and avoid misleading claims. For example, it’s unethical to guarantee specific savings or imply that the website can magically eliminate debt. Instead, the focus should be on providing accurate information and tools to help users make informed decisions about their loan repayment strategies. Furthermore, protecting user data and privacy is crucial, requiring adherence to all relevant data protection regulations and best practices. Building trust through transparency and ethical practices is vital for long-term success.

Potential Marketing Channels

A successful marketing strategy will leverage a diverse range of channels.

- Social Media Marketing: Targeted ads on platforms like Facebook, Instagram, LinkedIn, and Twitter, focusing on relevant demographics and interests.

- Search Engine Marketing (SEM): Paid advertising campaigns on Google Ads and other search engines, using relevant s to reach users actively searching for student loan solutions.

- Content Marketing: Creating valuable and informative content, such as blog posts, articles, and infographics, to establish the website as a trusted resource and attract organic traffic.

- Email Marketing: Building an email list and sending targeted email campaigns to subscribers with valuable information and updates.

- Partnerships and Affiliate Marketing: Collaborating with relevant organizations, such as student loan counseling services or financial institutions, to reach a wider audience.

- Public Relations: Securing media coverage in relevant publications and websites to increase brand awareness and credibility.

Illustrative Examples

Visual representations are crucial for understanding complex financial data like student loan repayment. Effective visualizations can quickly communicate the impact of different choices and help users make informed decisions. The following examples demonstrate how data can be presented to clarify the often-confusing world of student loan repayment.

Impact of Repayment Plans on Total Interest Paid

A bar chart effectively illustrates the total interest paid under different repayment plans. The horizontal axis would list the repayment plans (e.g., Standard, Extended, Income-Driven Repayment). The vertical axis would represent the total interest paid in dollars. Each bar would correspond to a repayment plan, with its height reflecting the total interest accrued over the loan’s lifespan. For instance, a tall bar for the Standard plan would visually represent the higher interest paid due to its shorter repayment period, while a shorter bar for an Income-Driven plan would show the lower total interest, albeit with a longer repayment timeframe. A legend could clearly label each bar and include the total interest amount for easy comparison. The chart title would be “Total Interest Paid by Repayment Plan.” This visual immediately highlights the trade-off between repayment speed and total interest cost.

Average Student Loan Debt by Major

An infographic showing average student loan debt by major could utilize a combination of visuals. A horizontal bar chart would visually rank majors from highest to lowest average debt. The length of each bar would represent the average debt amount for that major. A color scale could be used, with darker shades representing higher debt levels. For example, majors with high average debt like medicine or law might be represented in a deep red, while majors with lower average debt like education or social work might be represented in a lighter shade. Accompanying the chart would be small icons representing each major (e.g., a stethoscope for medicine, a gavel for law). The data sources would be clearly cited (e.g., National Center for Education Statistics, College Board data). The methodology would explain how the average debt was calculated (e.g., average of reported debt from a representative sample of graduates). The infographic title would be “Average Student Loan Debt by Major: [Year].”

Breakdown of Student Loan Debt Across Different Loan Types

A pie chart is ideal for showing the proportion of student loan debt across different loan types (e.g., federal subsidized loans, federal unsubsidized loans, private loans). Each slice of the pie would represent a loan type, with its size proportional to the percentage of total debt it comprises. A legend would clearly identify each slice and its corresponding percentage. For example, a large slice might represent federal subsidized loans, reflecting their prevalence. A smaller slice might represent private loans, illustrating their smaller, yet significant, contribution to overall debt. The chart title would be “Composition of Student Loan Debt by Loan Type.” This visual quickly communicates the relative proportions of different loan types within the overall debt burden.

Summary

Successfully managing student loan debt requires careful planning and a clear understanding of available resources. Student loan planner websites provide invaluable tools and insights to simplify this process. By understanding the features, security protocols, and user experiences offered by different platforms, borrowers can make informed choices and take control of their financial future. Remember to prioritize data security and carefully review privacy policies before using any online student loan planning tool.

FAQ Overview

What data do student loan planner websites typically collect?

Commonly collected data includes loan details (amount, interest rate, lender), income information, and repayment preferences. This data is used to personalize repayment plans and provide tailored advice.

Are student loan planner websites secure?

Reputable websites utilize robust security measures, including encryption and secure authentication protocols, to protect user data. However, it’s crucial to review a website’s privacy policy and security practices before sharing sensitive information.

How do I choose the right student loan planner website?

Consider factors like features offered (calculators, repayment plan comparisons), user interface, data security measures, and integration with other financial tools. Read reviews and compare several websites before making a decision.

Are there free student loan planner websites?

Yes, many websites offer free basic features, while others may offer premium services for a fee. Carefully review the features and pricing before selecting a platform.