Navigating the complexities of student loan debt can feel overwhelming, but with careful planning and a proactive approach, you can manage your finances effectively and achieve your long-term financial goals. This guide provides a roadmap to understanding student loan types, budgeting strategies, repayment options, and the importance of building good financial habits. We’ll explore various avenues for securing financial aid and scholarships, while also addressing the legal aspects of student loans and the potential impact on future financial decisions.

From understanding federal versus private loans and the factors influencing interest rates, to exploring income-driven repayment plans and loan refinancing, we aim to equip you with the knowledge and tools to make informed decisions. We’ll delve into creating a realistic budget, building an emergency fund, and minimizing unnecessary expenses, all while highlighting the significance of responsible financial management for a secure future.

Understanding Student Loan Debt

Navigating the complexities of student loan debt can feel overwhelming, but understanding the different types of loans, interest rates, and repayment options is crucial for effective financial planning. This section will provide a clear overview of these key aspects to help you make informed decisions about your student loan repayment strategy.

Federal vs. Private Student Loans

Federal student loans are offered by the U.S. government and generally offer more borrower protections than private loans. These protections include flexible repayment plans, income-driven repayment options, and deferment or forbearance in times of financial hardship. Private student loans, on the other hand, are offered by banks, credit unions, and other private lenders. They often have higher interest rates and fewer borrower protections than federal loans. Eligibility for federal loans is determined by financial need and enrollment status, while private loan eligibility is based primarily on creditworthiness.

Factors Influencing Student Loan Interest Rates

Several factors influence the interest rate you’ll pay on your student loans. For federal loans, the interest rate is determined by the loan type and the year the loan was disbursed. Interest rates on federal loans are generally fixed for the life of the loan. For private loans, interest rates are variable or fixed and are influenced by your credit score, credit history, the loan amount, and the repayment term. A higher credit score and a shorter repayment term will typically result in a lower interest rate. Additionally, the prevailing economic conditions can affect interest rates on both federal and private loans. For example, a period of high inflation might lead to higher interest rates.

Common Student Loan Repayment Plans

Several repayment plans are available for federal student loans, offering different approaches to managing your debt. The Standard Repayment Plan involves fixed monthly payments over 10 years. Graduated Repayment Plans start with lower payments that gradually increase over time. Extended Repayment Plans allow for longer repayment periods (up to 25 years), resulting in lower monthly payments but higher overall interest costs. Income-Driven Repayment (IDR) Plans base your monthly payments on your income and family size, offering more flexibility for borrowers with lower incomes. These plans can lead to loan forgiveness after 20 or 25 years, depending on the specific plan. Private loan repayment plans typically offer fewer options, usually a fixed monthly payment over a set term.

Comparison of Student Loan Repayment Plans

| Repayment Plan | Monthly Payment | Repayment Period | Pros | Cons |

|---|---|---|---|---|

| Standard Repayment | Fixed, higher | 10 years | Faster payoff, less total interest paid | Higher monthly payments |

| Graduated Repayment | Starts low, increases | 10 years | Lower initial payments | Payments increase significantly over time |

| Extended Repayment | Lower | Up to 25 years | Lower monthly payments | Higher total interest paid |

| Income-Driven Repayment | Variable, based on income | 20-25 years (potential forgiveness) | Affordability, potential forgiveness | Longer repayment period, potential for higher total interest |

Budgeting and Financial Planning for Students

Managing finances effectively is crucial for students, especially those navigating student loan debt. A well-structured budget, combined with smart financial strategies, can significantly reduce stress and improve your overall financial well-being throughout your academic journey and beyond. This section will explore practical budgeting and financial planning techniques specifically tailored to the needs of students.

Sample Monthly Budget for a Student with Student Loan Debt

A realistic budget should account for all income and expenses. The following is an example of a monthly budget for a student with a monthly student loan payment of $200 and a part-time job earning $1000 per month. Remember, this is a template; your specific budget will vary based on your individual circumstances.

| Income | Amount ($) |

|---|---|

| Part-time Job | 1000 |

| Expenses | Amount ($) |

| Rent/Housing | 500 |

| Groceries | 200 |

| Utilities (Electricity, Internet) | 100 |

| Transportation | 150 |

| Student Loan Payment | 200 |

| Books/Supplies | 50 |

| Personal Care | 50 |

| Entertainment | 100 |

| Savings (Emergency Fund) | 150 |

| Total Expenses | 1600 |

| Net Income (Income – Expenses) | -600 |

This example shows a negative net income, indicating the student needs to adjust their budget or increase their income to avoid accumulating debt beyond their student loans.

Strategies for Tracking Income and Expenses Effectively

Accurate tracking of income and expenses is essential for effective budgeting. Several methods can help students monitor their finances. Using budgeting apps, spreadsheets, or even a simple notebook can provide a clear picture of spending habits.

Effective tracking allows for informed decision-making regarding spending priorities and helps identify areas where savings are possible. For example, a student tracking expenses might discover they are spending more on eating out than planned, leading them to prioritize home-cooked meals.

The Importance of Creating an Emergency Fund

An emergency fund acts as a financial safety net, providing a cushion against unexpected expenses like medical bills or car repairs. Aim to save at least three to six months’ worth of living expenses in an easily accessible account. Even small, regular contributions add up over time. For the student in the sample budget, this would mean saving at least $1800-$3600. Having an emergency fund reduces the need to borrow money or fall further into debt during unexpected crises.

Tips for Minimizing Unnecessary Expenses While in School

Students often have limited funds, so minimizing unnecessary expenses is crucial. Several strategies can help reduce spending without sacrificing quality of life.

This includes exploring affordable transportation options like biking or using public transport, utilizing student discounts where available, and carefully considering purchases before making them. Preparing meals at home instead of eating out frequently, limiting entertainment spending, and buying used textbooks are also effective cost-saving measures.

Exploring Loan Repayment Strategies

Navigating student loan repayment can feel overwhelming, but understanding your options and planning strategically can significantly impact your financial future. This section will explore various repayment strategies, helping you make informed decisions based on your individual circumstances. Careful consideration of these options is crucial for minimizing long-term debt and maximizing your financial well-being.

Income-Driven Repayment Plans

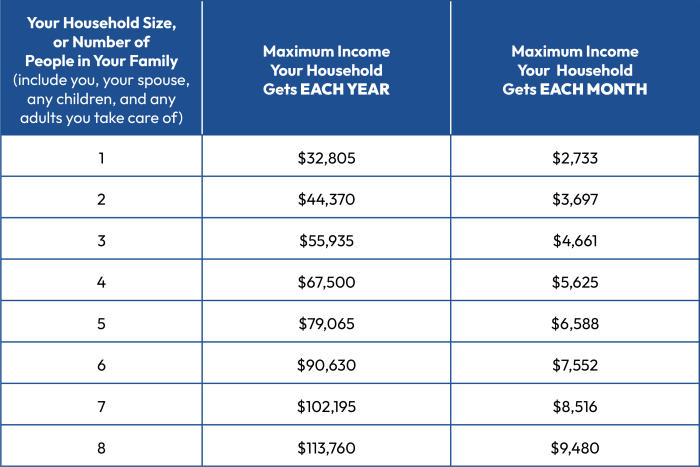

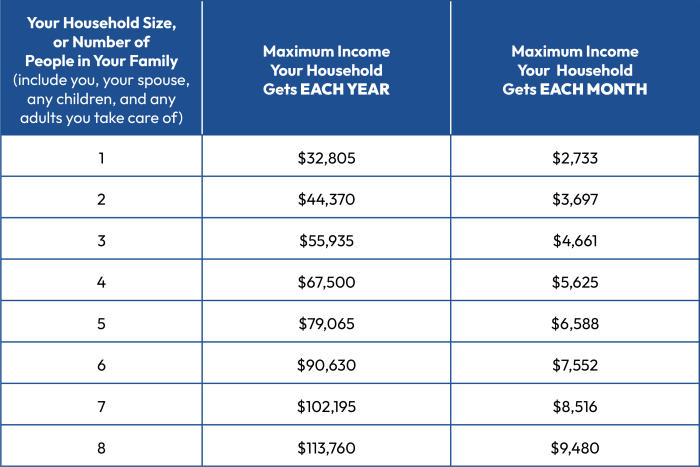

Income-driven repayment (IDR) plans link your monthly student loan payments to your income and family size. Several federal IDR plans exist, each with slightly different eligibility requirements and payment calculations. Choosing the right plan depends on your current financial situation and long-term goals.

- Income-Based Repayment (IBR): Payments are calculated based on your discretionary income (income above a certain threshold) and loan balance. Generally, this plan offers lower monthly payments than standard repayment plans, but it may result in a longer repayment period and higher total interest paid.

- Pay As You Earn (PAYE): Similar to IBR, PAYE bases payments on your discretionary income, but it generally caps payments at 10% of your discretionary income. This can lead to lower monthly payments than IBR, but again, repayment could extend for a longer duration.

- Revised Pay As You Earn (REPAYE): REPAYE considers both undergraduate and graduate loans, potentially offering lower monthly payments than PAYE or IBR for borrowers with both types of loans. Like the other IDR plans, it extends the repayment period and may lead to greater overall interest payments.

- Income-Contingent Repayment (ICR): This plan’s monthly payment is calculated based on your income and family size, and the repayment period is capped at 25 years. It often results in higher monthly payments compared to PAYE or IBR, but the total interest paid could still be substantial.

Loan Refinancing

Loan refinancing involves replacing your existing student loans with a new loan from a private lender. This new loan often comes with a lower interest rate than your original loans, potentially saving you money on interest over the life of the loan. However, refinancing comes with potential drawbacks.

- Lower Interest Rates: Refinancing can significantly reduce your monthly payments and the total interest paid over time, if you qualify for a lower interest rate.

- Loss of Federal Benefits: Refinancing federal loans into private loans means you’ll lose access to federal repayment plans like IDR and potential forgiveness programs. This is a crucial factor to weigh carefully.

- Credit Score Impact: A strong credit score is essential for securing a favorable interest rate. Individuals with lower credit scores may face higher interest rates or may not be approved for refinancing.

Consequences of Loan Default

Failing to make your student loan payments can lead to severe financial consequences. Defaulting on your loans negatively impacts your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future.

- Damaged Credit Score: A default will significantly lower your credit score, affecting your ability to access credit for many years.

- Wage Garnishment: The government can garnish your wages to recover the defaulted loan amount.

- Tax Refund Offset: Your tax refund may be seized to repay the defaulted loan.

- Difficulty Obtaining Future Loans: A default makes it extremely difficult to secure future loans, including mortgages and auto loans.

Calculating Monthly Loan Payments

The monthly payment on a student loan can be calculated using the following formula:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

M = Monthly Payment

P = Principal Loan Amount

i = Monthly Interest Rate (Annual Interest Rate / 12)

n = Number of Months (Loan Term in Years * 12)

For example, a $20,000 loan at 5% annual interest over 10 years (120 months) would have a monthly payment of approximately $212.47. A higher interest rate, such as 7%, would increase the monthly payment to approximately $232.62 for the same loan amount and term. This demonstrates how interest rates significantly impact the overall cost of borrowing.

Seeking Financial Aid and Scholarships

Securing funding for your education is a crucial step in planning for your future. Exploring all available financial aid options, including scholarships and grants, can significantly reduce the overall cost of your education and minimize your reliance on student loans. This section details resources and the application process for maximizing your financial aid opportunities.

Resources for Finding Scholarships and Grants

Numerous organizations offer scholarships and grants to students based on merit, need, or specific criteria. Effectively searching for these opportunities requires a proactive approach and diligent research. Knowing where to look is half the battle.

Several online databases aggregate scholarship opportunities. Websites like Fastweb, Scholarships.com, and Peterson’s are excellent starting points. These platforms allow you to filter searches based on criteria such as major, GPA, ethnicity, and intended career path. Additionally, check directly with your prospective college or university’s financial aid office; they often maintain a list of institution-specific scholarships and grants. Don’t overlook local community organizations, professional associations related to your field of study, and even individual businesses that may offer scholarships to students. Finally, remember to check with your high school guidance counselor; they often have valuable connections and resources available to students.

Federal Student Aid Application Process

The Free Application for Federal Student Aid (FAFSA) is the gateway to federal grants, loans, and work-study programs. Completing the FAFSA accurately and on time is essential to securing federal financial aid. The application process is generally straightforward, but careful attention to detail is vital.

The FAFSA requires personal and financial information from both the student and their parents (if the student is a dependent). This information is used to determine the student’s Expected Family Contribution (EFC), a measure used to calculate the amount of federal aid for which the student is eligible. The EFC is not the amount of money you will receive; it’s a calculation used to determine your eligibility for need-based aid. Once the FAFSA is processed, you’ll receive a Student Aid Report (SAR) summarizing your information and eligibility for federal aid. You’ll then be able to see your eligibility for federal grants like the Pell Grant and federal student loans.

Eligibility Criteria for Financial Aid

Eligibility for financial aid varies depending on the type of aid and the awarding institution. Federal grants, such as the Pell Grant, are primarily need-based, considering factors like family income, assets, and family size. Merit-based scholarships, on the other hand, often reward academic achievement, extracurricular involvement, or specific talents. Some scholarships are need-based, others are merit-based, and many combine both factors. Eligibility requirements for each type of financial aid differ and can be complex, but understanding the basics is crucial.

For federal aid, factors like your dependency status (dependent or independent), your family’s income and tax information, and the number of people in your household are all taken into consideration. For merit-based scholarships, academic performance (GPA, standardized test scores), extracurricular activities, leadership roles, and community involvement are often key eligibility factors. Specific scholarships may have additional requirements, such as essays, letters of recommendation, or demonstrated financial need.

Completing the FAFSA Form: A Step-by-Step Guide

The FAFSA is an online application, accessible through the Federal Student Aid website (studentaid.gov). The process generally involves these key steps:

- Create an FSA ID: This is your personal username and password for accessing the FAFSA website and other federal student aid systems. Both the student and a parent will need an FSA ID if the student is a dependent.

- Gather Necessary Information: Collect your social security number, driver’s license (if applicable), tax information (W-2s, tax returns), and bank statements. If you are a dependent student, your parents will need to provide similar information.

- Complete the Application: Carefully answer all questions accurately and completely. Double-check your information before submitting. Any errors can delay the processing of your application.

- Review and Submit: Review your completed application carefully for accuracy. Once you are satisfied, submit your application electronically.

- Receive Your Student Aid Report (SAR): After submitting your FAFSA, you will receive a SAR, which confirms the information you provided and indicates your eligibility for federal student aid.

Long-Term Financial Goals and Planning

Successfully navigating student loan debt requires a long-term perspective that extends far beyond graduation. Planning for your financial future, starting now, will significantly impact your ability to achieve your goals and build a secure financial foundation. This involves considering how your current choices will affect your future financial stability, including major life decisions such as homeownership and investments.

Post-Graduation Financial Stability Strategies

Establishing financial stability after graduation requires proactive planning and responsible financial habits. This involves creating a realistic budget that accounts for loan repayments, living expenses, and potential savings goals. Prioritizing essential expenses and minimizing unnecessary spending is crucial. Furthermore, exploring career opportunities that align with your skills and financial aspirations is essential to ensure a sustainable income stream capable of managing debt and achieving future goals. Consider building an emergency fund to cover unexpected expenses and prevent further debt accumulation.

Building Good Credit

Good credit is essential for accessing favorable financial products and services in the future. It impacts interest rates on loans, credit card approvals, and even rental applications. Responsible credit card usage, timely loan repayments, and avoiding excessive debt are crucial steps in building a strong credit history. Monitoring your credit report regularly for inaccuracies and understanding your credit score are also important aspects of credit management. Building a good credit score early will open doors to better financial opportunities down the line, making significant life purchases more affordable and accessible.

Impact of Student Loan Debt on Future Financial Decisions

Student loan debt can significantly impact major financial decisions. A high debt burden can limit your ability to save for a down payment on a house, impacting your ability to purchase property sooner. Similarly, significant loan repayments can reduce the amount you can allocate towards investments, potentially hindering long-term wealth accumulation. The interest paid on student loans represents a considerable financial burden, reducing disposable income that could otherwise be used for other investments or savings. Careful planning and budgeting are crucial to mitigate these potential negative impacts. For example, someone with a large student loan balance may need to delay buying a house or invest less aggressively compared to someone with minimal debt.

Long-Term Effects of Responsible vs. Irresponsible Student Loan Management

The following text-based illustration demonstrates the long-term impact of responsible versus irresponsible student loan management:

Scenario 1: Responsible Management

Year 1-5: Aggressive repayment plan, consistent budgeting, building emergency fund, establishing good credit.

Year 5-10: Debt-free, increased savings, investing in retirement accounts, exploring homeownership options.

Year 10-20: Homeownership achieved, significant investment portfolio, financial security.

Scenario 2: Irresponsible Management

Year 1-5: Minimum payments, inconsistent budgeting, high-interest debt accumulation, damaged credit score.

Year 5-10: High debt burden, limited savings, difficulty accessing favorable financial products, delayed major life decisions.

Year 10-20: Significant financial strain, limited investment opportunities, potential for financial instability.

Understanding the Legal Aspects of Student Loans

Navigating the world of student loans involves more than just understanding repayment plans; it requires a solid grasp of your legal rights and responsibilities as a borrower. This section will clarify key legal aspects, empowering you to manage your debt effectively and resolve any potential issues with your loan servicer.

Borrower Rights and Responsibilities

Understanding your rights and responsibilities as a student loan borrower is crucial for successful debt management. Borrowers have the right to accurate information regarding their loan terms, repayment options, and any applicable fees. They also have the right to fair and equitable treatment from their loan servicer. Conversely, borrowers have the responsibility to make timely payments according to their loan agreement, keep their contact information updated, and actively engage with their loan servicer to address any issues promptly. Failure to fulfill these responsibilities can lead to negative consequences, such as late payment fees, damage to credit score, and even default on the loan. It is important to carefully review all loan documents and understand the terms before signing.

Resolving Disputes with Loan Servicers

Disputes with loan servicers can arise from various issues, such as billing errors, incorrect payment applications, or difficulties in accessing loan information. The first step in resolving a dispute is usually contacting the loan servicer directly and attempting to resolve the matter amicably. Many servicers have dedicated customer service departments and internal dispute resolution processes. If direct communication fails to resolve the issue, borrowers can escalate the complaint to their loan guarantor or the U.S. Department of Education (ED). The ED’s Office of the Federal Student Aid (FSA) offers resources and guidance for navigating such disputes. In some cases, formal complaint processes or even legal action might be necessary. Documentation of all communication and attempts at resolution is highly recommended.

Student Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, designed to provide relief to borrowers under specific circumstances. These programs often have stringent eligibility requirements, such as working in public service or teaching in low-income schools. Examples include the Public Service Loan Forgiveness (PSLF) program and the Teacher Loan Forgiveness program. Eligibility criteria, application processes, and forgiveness amounts vary significantly depending on the specific program. It is vital to thoroughly research the eligibility requirements for each program before applying, as failure to meet all criteria can result in denial. The Department of Education’s website provides comprehensive information on available forgiveness programs.

Resources for Borrowers Facing Financial Hardship

Borrowers experiencing financial hardship may be eligible for various forms of assistance. These options might include deferment, forbearance, or income-driven repayment plans. Deferment temporarily postpones payments, while forbearance reduces or suspends payments for a specified period. Income-driven repayment plans adjust monthly payments based on income and family size. The specific options available will depend on the type of loan and the borrower’s circumstances. Contacting your loan servicer is the first step to explore available options. The National Foundation for Credit Counseling (NFCC) and other non-profit credit counseling agencies can provide free or low-cost assistance in navigating financial hardship and developing a debt management plan.

Building Good Financial Habits

Developing strong financial habits is crucial for long-term financial well-being, especially after navigating the complexities of student loan repayment. These habits will not only help manage current debt but also build a secure financial future. Consistent and proactive financial management is key to achieving financial stability and independence.

Effective money management involves understanding your income and expenses, creating a budget, and sticking to it. It also means prioritizing saving and investing, even with limited funds. Learning to differentiate between needs and wants is another important component of responsible financial behavior. By adopting these practices early, you’ll build a strong foundation for future financial success.

Effective Money Management Techniques

Creating a budget is the cornerstone of effective money management. This involves tracking your income and expenses to understand where your money is going. Popular budgeting methods include the 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment), the zero-based budget (allocating every dollar), and using budgeting apps or spreadsheets. Regularly reviewing and adjusting your budget is essential to ensure it remains relevant to your changing circumstances. Consider using a budgeting app or spreadsheet to simplify the process and track progress. Consistency is key to success.

The Importance of Financial Literacy

Financial literacy empowers individuals to make informed financial decisions. It involves understanding fundamental concepts like budgeting, saving, investing, debt management, and credit scores. A strong foundation in financial literacy allows for better navigation of financial challenges, such as student loan repayment, and creates opportunities for wealth building. Without this knowledge, individuals may struggle to manage their finances effectively, potentially leading to debt accumulation and missed opportunities. The impact of financial literacy on long-term financial success cannot be overstated.

Resources for Improving Financial Knowledge

Numerous resources are available to enhance financial literacy. Many universities and colleges offer workshops, seminars, and online courses focused on personal finance. Non-profit organizations like the National Endowment for Financial Education (NEFE) provide free educational materials and resources. Government agencies such as the Consumer Financial Protection Bureau (CFPB) offer valuable information on consumer rights and financial products. Online platforms and websites provide a wealth of information, including articles, videos, and calculators, designed to educate individuals about various aspects of personal finance. Utilizing these resources can significantly improve one’s financial understanding and decision-making capabilities.

Recommended Financial Books and Websites

Accessing reliable information is crucial for improving financial literacy. Here are some recommended resources:

- Book: “The Total Money Makeover” by Dave Ramsey – A practical guide to debt elimination and financial freedom.

- Book: “Broke Millennial Takes on Investing” by Erin Lowry – A guide to investing for young adults.

- Website: Investopedia – A comprehensive resource for financial terms, concepts, and news.

- Website: Khan Academy – Offers free courses on personal finance topics.

- Website: Consumer Financial Protection Bureau (CFPB) – Provides information on consumer rights and financial products.

Outcome Summary

Successfully managing student loan debt requires a multifaceted approach that combines financial literacy, proactive planning, and a commitment to responsible financial habits. By understanding the various loan types, exploring different repayment strategies, and actively seeking financial aid, you can significantly reduce the burden of student loan debt and pave the way for a financially stable future. Remember that seeking professional financial advice can provide personalized guidance and support throughout your journey.

Question Bank

What is loan forgiveness?

Loan forgiveness programs, offered by the government or certain employers, can eliminate a portion or all of your student loan debt under specific circumstances, such as working in public service.

How can I improve my credit score?

Improving your credit score involves consistently making on-time payments, keeping your credit utilization low, and maintaining a diverse credit history. Regularly checking your credit report for errors is also crucial.

What happens if I default on my student loans?

Defaulting on student loans can have severe consequences, including wage garnishment, tax refund offset, and damage to your credit score, making it difficult to obtain loans or credit in the future.

Where can I find additional resources on financial literacy?

Numerous online resources, such as government websites (e.g., the Consumer Financial Protection Bureau), non-profit organizations, and educational institutions, offer valuable information and tools to enhance your financial literacy.