Navigating the complexities of higher education financing often involves exploring various loan options, and for many families, Parent PLUS loans become a crucial consideration. This guide delves into the intricacies of Parent PLUS loans, providing a comprehensive overview of eligibility, financial implications, and strategies for responsible management. We’ll examine the relationship between parents and students in the context of shared financial responsibility, exploring potential challenges and offering solutions for effective communication and collaborative planning.

From understanding interest rates and repayment plans to exploring alternative funding sources and navigating legal aspects, this resource aims to empower parents and students with the knowledge they need to make informed decisions. We will also address common concerns and provide practical advice to ensure a smoother financial journey throughout the higher education process.

Understanding Parent PLUS Loans

Parent PLUS Loans are federal student loans available to parents of dependent undergraduate students to help cover their child’s education expenses. These loans offer a valuable financial resource, but it’s crucial to understand the terms and conditions before borrowing. This section will provide a comprehensive overview of Parent PLUS Loans, covering eligibility, costs, the application process, and a comparison with other loan options.

Parent PLUS Loan Eligibility Criteria

To be eligible for a Parent PLUS loan, the parent must be a U.S. citizen or eligible non-citizen, have a Social Security number, and not have an adverse credit history. An adverse credit history generally includes bankruptcies, foreclosures, or a history of delinquent payments. However, the Department of Education may still approve the loan even with adverse credit history if the parent can demonstrate extenuating circumstances. The parent must also be the biological or adoptive parent of the dependent undergraduate student, or be the student’s legal guardian. The student must be enrolled at least half-time in a degree or certificate program at a participating school. Finally, the parent must complete a Master Promissory Note (MPN) agreeing to repay the loan.

Parent PLUS Loan Interest Rates and Fees

Parent PLUS loan interest rates are fixed and determined annually by the federal government. These rates are typically higher than those for subsidized and unsubsidized federal student loans. The interest rate is applied to the principal balance from the time the loan is disbursed. In addition to the interest rate, there is an origination fee, which is a percentage of the loan amount and is deducted from the loan disbursement. This fee is non-refundable. Both the interest rate and origination fee can impact the overall cost of the loan. Borrowers should factor these costs into their budget.

Applying for a Parent PLUS Loan

Applying for a Parent PLUS loan is a straightforward process that can be completed online through the Federal Student Aid website (studentaid.gov). The process typically involves these steps:

- Complete the Free Application for Federal Student Aid (FAFSA).

- Submit the Parent PLUS Loan application through the FAFSA website.

- Complete a credit check.

- Receive notification of loan approval or denial.

- Sign a Master Promissory Note (MPN).

- The loan proceeds are disbursed to the student’s school.

Comparison of Parent PLUS Loans with Other Student Loan Options

Parent PLUS loans are one of several options available to finance a student’s education. They differ from other options in terms of interest rates, eligibility requirements, and repayment terms. Other options include federal subsidized and unsubsidized loans, which are available directly to students, and private student loans, which are offered by banks and other financial institutions. Each option has its advantages and disadvantages, and the best choice depends on individual circumstances.

Parent PLUS Loan Terms Compared to Federal Direct Unsubsidized Loans

| Feature | Parent PLUS Loan | Federal Direct Unsubsidized Loan | Difference |

|---|---|---|---|

| Borrower | Parent | Student | Different borrowers |

| Credit Check | Required | Not required | Creditworthiness impacts eligibility |

| Interest Rate | Generally higher | Generally lower | Interest rate variation |

| Fees | Origination fee | Origination fee | Similar fee structure |

The Parent-Student Relationship and Loan Impact

Taking out a Parent PLUS loan can significantly impact the parent-student relationship, introducing both financial and emotional complexities. Open communication and a shared understanding of responsibilities are crucial for navigating these challenges successfully and maintaining a healthy family dynamic. The financial burden can strain relationships if not handled proactively and collaboratively.

Parent PLUS loans, while intended to help students access higher education, can create a delicate balance within families. The financial responsibility shifts from the student primarily to the parent, which can alter the power dynamic and create potential for conflict. The added stress of significant debt can affect communication patterns, leading to misunderstandings and resentment if not addressed appropriately. This is especially true when unexpected financial difficulties arise, forcing families to re-evaluate their budgeting and spending habits.

Challenges in the Parent-Student Relationship

Parent PLUS loans can introduce several challenges to the parent-student dynamic. Financial disagreements regarding repayment strategies, differing expectations about the student’s contribution post-graduation, and the overall strain of managing significant debt can lead to friction. Parents may feel resentful if they perceive the student as not taking their educational responsibilities seriously, while students might feel pressured or controlled by their parents’ financial involvement. These tensions can manifest in arguments, strained communication, and even resentment that extends beyond the repayment period. For example, a family might experience conflict if the student’s spending habits don’t align with the parents’ efforts to manage loan repayments.

Strategies for Open Communication About Loan Responsibilities

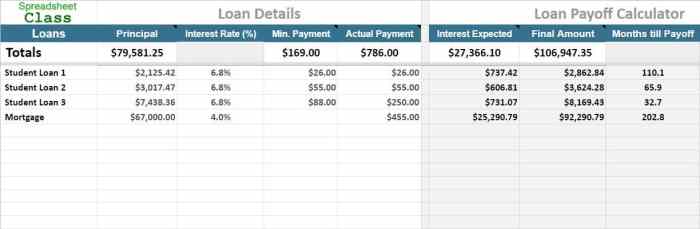

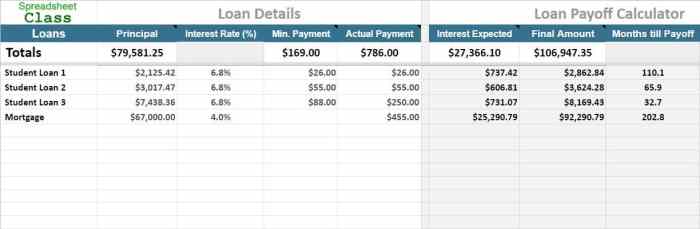

Establishing clear and open communication is vital to mitigating potential conflicts. Regular family meetings dedicated to discussing the loan’s progress, repayment plans, and the students’ financial contributions can foster transparency and shared responsibility. Creating a detailed budget that includes loan repayments, living expenses, and other financial obligations ensures both parents and students understand the financial implications and their respective roles. This process should involve collaborative decision-making, with both parties actively participating in developing a realistic and sustainable repayment plan. For instance, a family might create a shared spreadsheet to track loan payments, interest accrual, and the student’s contributions towards repayment.

Impact of Loan Debt on the Parent-Child Dynamic

The weight of significant loan debt can profoundly impact the parent-child relationship. It can create stress and anxiety for both parents and students, leading to increased conflict and tension. Parents might feel burdened by the financial responsibility, potentially impacting their own financial security and retirement plans. Students, in turn, may feel guilty about the financial strain on their parents, leading to feelings of pressure and obligation. This can strain the overall family dynamic, affecting other aspects of their relationship beyond finances. For example, a family might postpone vacations or other family events due to financial constraints imposed by the loan repayment schedule.

Creating a Shared Understanding of Financial Responsibilities

A shared understanding of financial responsibilities requires proactive steps. This includes creating a detailed budget that Artikels the loan repayment schedule, interest accrual, and each party’s contribution. Regularly reviewing this budget and adjusting it as needed promotes transparency and accountability. Open discussions about future financial goals, such as post-graduation employment plans and the student’s commitment to repayment, are crucial. Consider establishing a clear timeline for when the student will start contributing to loan repayment. This might involve setting a target date after graduation, outlining a percentage of their income dedicated to repayment, or establishing a specific amount to be paid monthly.

Tips for Fostering Healthy Communication About Finances

Open and honest communication is key to navigating the financial complexities of Parent PLUS loans and maintaining a healthy parent-student relationship. The following tips can help facilitate this process:

- Schedule regular family meetings to discuss financial matters.

- Create a shared budget and track expenses transparently.

- Establish clear expectations and responsibilities for loan repayment.

- Encourage open dialogue and active listening between parents and students.

- Seek professional financial advice if needed.

- Celebrate milestones achieved in loan repayment.

- Maintain empathy and understanding throughout the process.

Exploring Alternatives and Planning

Securing funding for higher education requires careful consideration of various options beyond Parent PLUS loans. A well-structured financial plan can significantly reduce reliance on loans and mitigate long-term financial burdens. This section explores alternative financing strategies and guides you through developing a comprehensive financial aid plan.

Comparison of Parent PLUS Loans and Alternative Financing Options

Parent PLUS loans offer a readily available source of funds, but they come with interest and repayment obligations. Alternative options, such as savings, scholarships, and grants, can significantly reduce or eliminate the need for borrowing. Savings provide upfront capital, while scholarships and grants offer non-repayable financial aid. The choice depends on the family’s financial situation and the student’s academic achievements and eligibility for various aid programs. A thorough comparison of costs, repayment terms, and eligibility criteria is crucial before making a decision.

Advantages and Disadvantages of Using Savings, Scholarships, or Grants

Using savings offers the advantage of avoiding debt and interest payments. However, it depletes existing resources, which may impact other financial goals. Scholarships and grants offer non-repayable funding, reducing the overall cost of education. However, competition for these awards can be intense, and eligibility requirements vary. The disadvantages of relying solely on savings or scholarships/grants include the potential for insufficient funding to cover the full cost of education, necessitating additional borrowing.

Decision-Making Flowchart for Choosing Funding Sources

The following flowchart illustrates the decision-making process:

[Imagine a flowchart here. The flowchart would start with a decision box: “Sufficient Savings & Scholarships/Grants?”. A “Yes” branch would lead to a terminal box: “Utilize Savings & Scholarships/Grants”. A “No” branch would lead to a decision box: “Eligible for Parent PLUS Loan?”. A “Yes” branch would lead to a decision box: “Can afford Parent PLUS Loan Repayments?”. A “Yes” branch would lead to a terminal box: “Utilize Parent PLUS Loan”. A “No” branch would lead to a terminal box: “Explore Additional Funding Options (e.g., work-study, private loans)”.]

Examples of Financial Aid Resources

Numerous resources are available to help students and families secure financial aid. These include the Federal Student Aid website (studentaid.gov), which provides information on federal grants, loans, and work-study programs. Many colleges and universities have their own financial aid offices that can assist with applications and provide personalized guidance. Private organizations and foundations also offer scholarships based on various criteria, such as academic merit, extracurricular activities, and community involvement. State-sponsored programs may also provide additional funding opportunities. For instance, the Pell Grant is a need-based grant offered by the federal government, while many states offer merit-based scholarships for students attending in-state colleges and universities.

Steps in Creating a Comprehensive Financial Aid Plan

Developing a comprehensive financial aid plan involves several key steps: 1) Estimate the total cost of education, including tuition, fees, room and board, and other expenses. 2) Explore all available scholarships and grants, completing applications diligently and meeting deadlines. 3) Determine the family’s contribution, considering savings and other resources. 4) Evaluate the need for loans and compare the terms and conditions of different loan options. 5) Create a realistic budget that incorporates loan repayments, if necessary, to avoid overwhelming debt. 6) Regularly review and adjust the plan as needed, taking into account any changes in financial circumstances or educational plans. A well-structured plan, focusing on maximizing non-repayable aid and minimizing loan dependence, provides a sustainable pathway to higher education.

Legal and Regulatory Aspects

Understanding the legal framework surrounding Parent PLUS loans is crucial for both parents and students. This section Artikels the rights and responsibilities involved, the processes for addressing loan denials and defaults, and the options for managing the loan over time. Failure to understand these aspects can lead to significant financial and legal consequences.

Parent and Student Rights and Responsibilities

Borrowers under the Parent PLUS loan program have specific rights and responsibilities. Parents, as the borrowers, are legally obligated to repay the loan according to the terms agreed upon. This includes making timely payments and adhering to any stipulations Artikeld in the loan agreement. Students, while not legally responsible for repayment, have a moral obligation to assist their parents in managing the debt. This could involve contributing to payments if possible, tracking payment schedules, and keeping open communication about the loan’s status. Both parties should maintain accurate records of all loan-related documentation, including the promissory note and payment history. Failure to fulfill these responsibilities can lead to serious repercussions, such as default.

Appealing a Parent PLUS Loan Denial

The Department of Education may deny a Parent PLUS loan application for various reasons, including adverse credit history. However, borrowers have the right to appeal this denial. The appeal process typically involves providing documentation to support the borrower’s ability to repay the loan, such as evidence of improved credit standing or a co-signer willing to assume responsibility. The Department will review the appeal and make a determination based on the information provided. A well-documented and thoroughly explained appeal significantly increases the chances of a successful outcome. For example, providing evidence of a recent increase in income, coupled with a detailed repayment plan, strengthens the appeal.

Consequences of Loan Default

Defaulting on a Parent PLUS loan has severe consequences. These consequences can include damage to credit scores, wage garnishment, tax refund offset, and potential legal action. The Department of Education may pursue collection efforts aggressively, impacting the borrower’s financial standing for years to come. Furthermore, default can affect the student’s ability to receive future federal student aid. For instance, a parent who defaults on a Parent PLUS loan may hinder their child’s eligibility for future federal student loans.

Loan Consolidation and Refinancing

Loan consolidation combines multiple federal student loans into a single loan with a new repayment plan. Refinancing, on the other hand, involves replacing federal loans with a private loan, often at a lower interest rate. Both options can simplify repayment, but refinancing federal loans with private loans can lead to the loss of federal loan benefits, such as income-driven repayment plans. Careful consideration of the advantages and disadvantages of each option is necessary before making a decision. For example, consolidating federal loans preserves access to income-driven repayment plans, while refinancing with a private lender might offer a lower interest rate but eliminate this benefit.

Relevant Federal Regulations

The Parent PLUS loan program is governed by various federal regulations. These regulations Artikel eligibility criteria, repayment terms, and the processes for managing the loan. Key regulations include the Higher Education Act of 1965, as amended, and related Department of Education regulations. Staying informed about these regulations is crucial for understanding the rights and responsibilities associated with the loan. Specific regulations are regularly updated and can be found on the Federal Student Aid website. These regulations are constantly reviewed and revised, necessitating regular review by borrowers to remain compliant.

Illustrative Scenarios

Understanding the impact of Parent PLUS loans requires examining both positive and negative scenarios. These examples illustrate the complexities involved and highlight the importance of careful planning and responsible borrowing.

By analyzing diverse situations, we can better grasp the potential benefits and drawbacks associated with Parent PLUS loans, ultimately aiding in informed decision-making.

Beneficial Parent PLUS Loan Scenario

The Miller family needed financial assistance for their daughter, Sarah, to attend a prestigious engineering program at a private university. Tuition, fees, and living expenses were significantly high. After exhausting other options, including scholarships and savings, they opted for a Parent PLUS loan. Sarah excelled in her studies, graduated with honors, and secured a high-paying job in her field. The Millers, through diligent budgeting and consistent repayment, successfully managed their loan and are now debt-free. This scenario demonstrates how a Parent PLUS loan, used responsibly and strategically, can enable a student to pursue a high-value education, leading to improved long-term financial prospects for both the student and the family.

Detrimental Parent PLUS Loan Scenario

The Garcia family took out a substantial Parent PLUS loan to cover their son, Miguel’s, college education at a less-selective university. Miguel struggled academically and eventually dropped out. The Garcia’s, already facing financial strain, now shoulder a large loan burden with no corresponding increase in Miguel’s earning potential. They find themselves facing financial hardship due to the loan repayments, impacting their retirement savings and overall financial well-being. This illustrates how a Parent PLUS loan, without careful consideration of the student’s academic preparedness and career prospects, can lead to significant financial difficulties for the family.

Navigating Parent PLUS Loan Repayment Challenges

The Johnson family faced unexpected challenges after securing a Parent PLUS loan for their twin daughters. A job loss shortly after loan disbursement significantly impacted their ability to make timely payments. They actively engaged with their loan servicer, exploring options like forbearance and income-driven repayment plans. They also diligently cut expenses and worked additional jobs to maintain payments. Although stressful, their proactive approach and open communication with their lender helped them avoid default and eventually manage their loan repayment successfully. This narrative highlights the importance of preparedness for unforeseen circumstances and the availability of assistance programs for borrowers facing hardship.

Impact of Responsible Financial Planning

The Rodriguez family meticulously planned for their son, David’s, college education. They began saving early, maximizing their contributions to 529 plans, and exploring scholarship opportunities. They used a Parent PLUS loan only as a supplemental funding source, ensuring the loan amount was manageable within their budget. Through consistent budgeting and disciplined repayment, they managed to pay off the loan ahead of schedule, minimizing interest accrual and avoiding financial strain. This exemplifies how responsible financial planning, coupled with a strategic approach to borrowing, can mitigate the risks and maximize the benefits of a Parent PLUS loan.

Successful Parent PLUS Loan Repayment Strategy

The Wilson family employed a disciplined approach to repay their Parent PLUS loan. They created a detailed budget, allocating a specific amount each month for loan repayment. They prioritized the loan repayment over other expenses, utilizing extra income from bonuses and tax refunds to accelerate the repayment process. They also consistently monitored their loan balance and interest rate, ensuring they remained informed and proactive. This illustrates a successful strategy combining financial discipline, strategic budgeting, and proactive loan management to achieve timely and efficient loan repayment.

Summary

Securing a higher education is a significant investment, and understanding the nuances of Parent PLUS loans is vital for both parents and students. By carefully considering eligibility, financial implications, and alternative options, families can create a responsible financial plan that minimizes long-term debt and strengthens the parent-child relationship. Open communication, proactive planning, and access to available resources are key to successfully navigating the complexities of Parent PLUS loans and ensuring a positive outcome for all involved.

Answers to Common Questions

What happens if I can’t repay my Parent PLUS loan?

Loan default can severely damage your credit score, leading to difficulty obtaining future loans and impacting your financial standing. Explore options like forbearance or deferment to avoid default.

Can I refinance my Parent PLUS loan?

Yes, refinancing options exist, potentially offering lower interest rates. However, be aware of the implications and carefully compare offers before refinancing.

Are there income-driven repayment plans for Parent PLUS loans?

While not all income-driven repayment plans are available for Parent PLUS loans, some options may be accessible depending on your specific circumstances. Check with your loan servicer for details.

What if my application for a Parent PLUS loan is denied?

You can appeal the denial, providing documentation to address the reasons for rejection. Review the denial letter carefully for specific instructions and required information.