Navigating the complexities of student loan programs can feel overwhelming, but understanding the available options and employing effective strategies can significantly reduce the financial burden of higher education. This guide explores various federal and private student loan programs, outlining eligibility requirements, interest rates, and repayment plans. We’ll delve into practical strategies for minimizing debt accumulation, including maximizing scholarships and grants, and creating a responsible college budget.

Beyond minimizing initial debt, we’ll examine repayment options, including income-driven plans and refinancing, along with the potential benefits and risks involved. We’ll also discuss the role of government initiatives and policies in shaping student loan affordability and explore the long-term financial implications of student loan debt on major life decisions. Finally, we’ll emphasize the importance of financial literacy and responsible financial planning to ensure long-term financial well-being.

Strategies for Saving on Student Loans

Navigating the complexities of higher education financing requires a proactive approach to minimize student loan debt. By implementing effective strategies throughout your college years, you can significantly reduce your future financial burden and graduate with greater financial freedom. This section Artikels practical steps to achieve this goal.

Minimizing student loan debt accumulation requires careful planning and execution. Effective strategies focus on maximizing financial aid, reducing living expenses, and exploring alternative funding sources. A well-defined plan, coupled with consistent effort, can dramatically impact your overall loan burden.

Maximizing Financial Aid

Securing scholarships, grants, and work-study opportunities is crucial for reducing reliance on loans. Scholarships are merit-based awards that don’t need to be repaid. Grants, like scholarships, are also forms of financial aid that do not require repayment, often based on financial need. Work-study programs offer part-time employment opportunities on campus, providing income to cover educational expenses. Colleges and universities typically offer a wide array of these opportunities; proactive research and diligent application are key to securing this valuable funding. For example, the Pell Grant program provides substantial funding to eligible undergraduate students with exceptional financial need. Many private organizations also offer scholarships based on academic achievement, extracurricular involvement, or specific interests.

Budgeting for College

Creating a realistic budget is essential for controlling expenses and minimizing the need for loans. A sample budget might allocate funds for tuition, fees, housing (including rent or dorm costs), food, transportation, books, and personal expenses. A student aiming to minimize loan debt should prioritize essential expenses and actively seek ways to reduce discretionary spending. For example, choosing affordable housing options, cooking meals at home instead of eating out frequently, and utilizing free campus resources can significantly reduce overall costs. Tracking expenses using budgeting apps or spreadsheets can help maintain awareness of spending habits and identify areas for potential savings. A sample budget could look like this:

| Category | Monthly Allocation |

|---|---|

| Tuition & Fees | $1000 |

| Housing | $500 |

| Food | $300 |

| Transportation | $100 |

| Books & Supplies | $50 |

| Personal Expenses | $150 |

| Total | $2100 |

Note: This is a sample budget and actual amounts will vary based on individual circumstances and location.

Successful Strategies Employed by Students

Many students have successfully reduced their loan burden through various strategies. For instance, some students opt for community college for their first two years, transferring to a four-year university later to save on tuition costs. Others choose to attend in-state universities, which often have lower tuition rates than out-of-state institutions. Living at home while attending college, if feasible, is another effective way to minimize expenses. Furthermore, some students supplement their income through part-time jobs, internships, or freelance work, reducing their dependence on loans. One student, for example, secured a part-time job at the campus library while maintaining a full course load, earning enough to cover most of their living expenses. Another student successfully secured multiple scholarships, reducing their need for loans considerably.

Repayment and Refinancing Options

Navigating student loan repayment can feel overwhelming, but understanding your options is crucial for managing your debt effectively and minimizing long-term financial strain. Choosing the right repayment plan and considering refinancing can significantly impact your monthly payments and overall repayment timeline.

Standard Repayment Plan

The standard repayment plan is the most straightforward option. Borrowers typically make fixed monthly payments over a 10-year period. This plan offers predictability and the quickest path to becoming debt-free. However, monthly payments can be substantial, potentially impacting borrowers’ budgets, especially those with high loan balances. The advantage lies in its simplicity and shorter repayment period, while the disadvantage is the potentially high monthly payment burden.

Extended Repayment Plan

For those struggling with high monthly payments under the standard plan, the extended repayment plan offers longer repayment terms, typically up to 25 years. This lowers the monthly payment amount, making it more manageable for borrowers with limited income. However, the extended repayment period means paying significantly more in interest over the life of the loan. The advantage is reduced monthly payments, offering financial breathing room; the disadvantage is the substantially increased total interest paid.

Income-Driven Repayment Plans

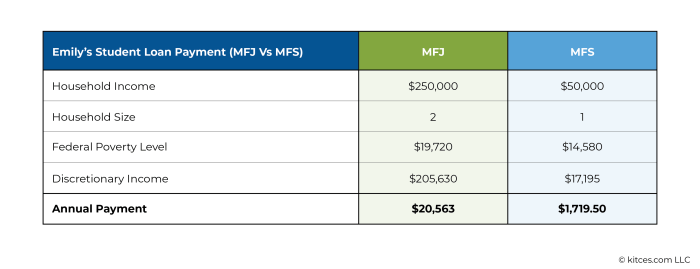

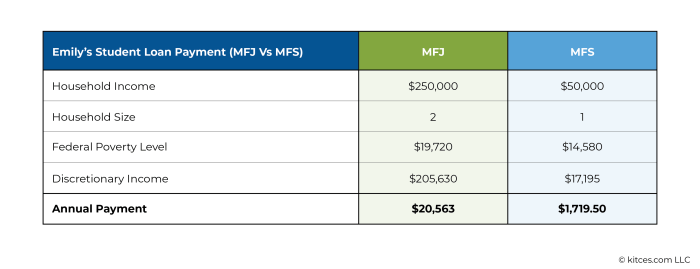

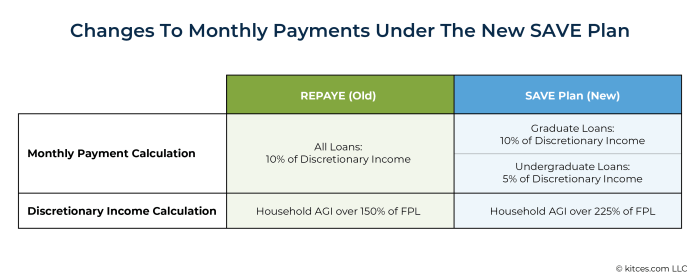

Income-driven repayment (IDR) plans tie monthly payments to a borrower’s income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans offer lower monthly payments, particularly beneficial for borrowers with low incomes or high debt-to-income ratios. However, IDR plans often result in longer repayment periods (potentially 20-25 years) and may lead to higher total interest paid. The advantage is affordability and flexibility based on income fluctuations; the disadvantage is a potentially much longer repayment period and higher overall interest costs. For example, a borrower earning a modest salary might see their monthly payments reduced significantly under an IDR plan, but this would come at the cost of a longer repayment timeline and increased interest accrual.

Student Loan Refinancing

Student loan refinancing involves replacing your existing federal or private student loans with a new loan from a private lender. This often results in a lower interest rate, potentially reducing your monthly payment and the total amount paid over the life of the loan. To be eligible, borrowers generally need a good credit score and stable income. The process involves applying with a private lender, providing financial information, and undergoing a credit check. The lender will then assess your application and offer a new loan with terms that reflect your creditworthiness.

Risks and Benefits of Refinancing

Refinancing can significantly reduce monthly payments and save money on interest, particularly if you qualify for a significantly lower interest rate. However, it’s important to weigh the potential risks. Refinancing federal loans into private loans means losing access to federal protections, such as income-driven repayment plans and loan forgiveness programs. Additionally, refinancing locks in your interest rate, meaning you won’t benefit from future interest rate drops. A careful analysis of your current loan terms, your creditworthiness, and your long-term financial goals is crucial before pursuing refinancing. For example, a borrower with excellent credit might secure a substantially lower interest rate, saving thousands over the life of the loan, but a borrower with poor credit might not qualify or receive a rate that offers substantial savings.

Government Initiatives and Support

Government intervention plays a significant role in shaping the student loan landscape, influencing both the accessibility and affordability of higher education. Various programs and policies are designed to alleviate the burden of student loan debt and encourage responsible borrowing. Understanding these initiatives is crucial for students and borrowers seeking to navigate the complexities of repayment.

Government policies significantly impact student loan interest rates and repayment terms. These policies are often influenced by economic conditions and the overall goals of the government regarding higher education access and affordability. Changes in interest rates, repayment plans, and forgiveness programs directly affect borrowers’ monthly payments and overall debt burden.

Federal Student Loan Programs

The federal government offers several loan programs designed to make higher education more accessible. These programs often come with more favorable interest rates and repayment options than private loans. The availability and specifics of these programs can vary over time. Understanding the nuances of these programs is key to selecting the most appropriate financing option.

- Direct Subsidized Loans: These loans are available to undergraduate students who demonstrate financial need. The government pays the interest while the student is in school, during grace periods, and during deferment periods.

- Direct Unsubsidized Loans: These loans are available to undergraduate, graduate, and professional students, regardless of financial need. Interest accrues from the time the loan is disbursed.

- Direct PLUS Loans: These loans are available to graduate and professional students, and parents of undergraduate students, without a demonstrated need. Credit checks are required, and borrowers are responsible for all interest that accrues.

- Federal Perkins Loans: These need-based loans are offered by participating colleges and universities. They generally have lower interest rates than other federal loan programs.

Impact of Government Policies on Interest Rates and Repayment

Government policies directly influence the interest rates charged on federal student loans. For instance, Congress can set interest rates directly or establish formulas for calculating them. Changes in these policies can lead to significant differences in the total cost of borrowing for students. Similarly, government policies shape repayment options, including income-driven repayment plans, which tie monthly payments to a borrower’s income and family size. These plans can significantly reduce monthly payments, though it often results in a longer repayment period and potentially higher overall interest paid.

Examples of Successful Government Initiatives

Several government initiatives have demonstrated success in improving student loan affordability. One notable example is the expansion of income-driven repayment plans, which has provided crucial relief to many borrowers struggling with high debt payments. These plans have helped to avoid defaults and allow borrowers more flexibility in managing their debt. Another example includes programs aimed at loan forgiveness for borrowers working in public service or certain high-need professions, incentivizing careers in these fields and potentially reducing overall student debt. These programs demonstrate the government’s commitment to addressing the student loan debt crisis.

The Long-Term Impact of Student Loan Debt

Carrying significant student loan debt can cast a long shadow over an individual’s financial future, impacting not only their immediate spending habits but also their long-term financial well-being and major life decisions. The weight of repayment can significantly constrain financial flexibility and opportunities for years to come.

The cumulative effect of monthly loan payments, interest accrual, and the opportunity cost of that money being unavailable for other investments can be substantial. This impact extends beyond simply delaying gratification; it can fundamentally alter the trajectory of one’s financial life.

Financial Implications of Student Loan Debt

High student loan debt can severely restrict financial flexibility. Borrowers may find themselves constantly juggling payments, limiting their ability to save for retirement, invest in other opportunities, or build an emergency fund. This precarious financial situation leaves them vulnerable to unexpected expenses and financial setbacks. For example, a sudden job loss or medical emergency could become catastrophic, as limited savings and the ongoing burden of loan payments create a cascading effect of financial hardship. The constant pressure of debt can also lead to increased stress and anxiety, impacting overall well-being.

Impact on Major Life Decisions

Student loan debt significantly influences major life decisions, particularly homeownership and family planning. The high debt-to-income ratio resulting from student loans can make it difficult to qualify for a mortgage, delaying or preventing homeownership. Similarly, starting a family may be postponed or planned differently due to the financial constraints imposed by loan repayments. Many individuals find themselves prioritizing loan repayment over saving for a down payment, childcare expenses, or other family-related costs, leading to trade-offs and potential delays in achieving life goals. For instance, a couple might delay having children for several years to focus on aggressively paying down their loans, potentially altering their family planning timeline significantly.

Potential Financial Challenges

Individuals with high student loan debt face a variety of potential financial challenges. These include difficulty saving for retirement, reduced investment opportunities, limited access to credit, and increased susceptibility to financial stress and hardship. The inability to save adequately for retirement can lead to a lower quality of life in later years. Limited access to credit can restrict opportunities for homeownership, business ventures, or other investments. The constant worry about loan repayment can lead to chronic stress and anxiety, negatively impacting mental health and overall well-being. For example, a young professional might forgo investing in a retirement account to prioritize student loan repayment, potentially impacting their financial security in the long run.

Visual Representation of Long-Term Impact

Imagine a bar graph illustrating the net worth of three individuals at different life stages (age 30, 40, and 50) with varying levels of student loan debt. The x-axis represents age, and the y-axis represents net worth (assets minus liabilities, including student loan debt). The first bar represents an individual with no student loan debt; their net worth steadily increases over time, reflecting savings, investments, and asset accumulation. The second bar represents someone with moderate student loan debt; their net worth grows, but at a slower rate due to loan repayments. The third bar shows an individual with high student loan debt; their net worth remains significantly lower than the other two, reflecting the ongoing burden of loan payments and limited opportunities for savings and investment. This visual clearly demonstrates how different levels of student loan debt can significantly impact an individual’s long-term financial well-being, potentially leading to a substantial difference in net worth over their lifetime.

Financial Literacy and Planning

Successfully navigating student loan repayment requires a strong foundation in financial literacy. Understanding budgeting, credit management, and avoiding common pitfalls are crucial for responsible debt management and long-term financial well-being. This section will provide practical strategies to help you achieve financial stability while repaying your student loans.

The Importance of Financial Literacy in Student Loan Management

Financial literacy empowers students to make informed decisions regarding their student loan debt. A solid understanding of budgeting, credit scores, and repayment options allows for proactive planning and minimizes the risk of default or financial hardship. Without this knowledge, borrowers may struggle to create a manageable repayment plan, potentially leading to late payments, increased interest charges, and damage to their credit history. Proactive financial planning, informed by financial literacy, helps mitigate these risks and fosters a path towards financial independence.

Creating a Personal Budget for Student Loan Payments

A well-structured budget is the cornerstone of effective student loan management. This step-by-step guide Artikels the process:

- Track your income and expenses: For at least one month, meticulously record all sources of income (salary, part-time jobs, etc.) and all expenses (rent, groceries, transportation, entertainment, etc.). Use budgeting apps or spreadsheets to simplify this process.

- Categorize your expenses: Group expenses into categories (housing, food, transportation, debt payments, etc.) to identify areas for potential savings.

- Determine your net income: Subtract your total expenses from your total income to determine your net income (the money you have left after expenses).

- Allocate funds for student loan payments: Based on your repayment plan, allocate a specific amount from your net income to your student loan payments. Ensure this amount is consistent and realistic, factoring in other essential expenses.

- Identify areas for savings: Analyze your expense categories to identify areas where you can reduce spending without significantly impacting your lifestyle. Small changes can add up to substantial savings over time.

- Regularly review and adjust: Regularly review your budget and make adjustments as needed. Life circumstances change, and your budget should adapt accordingly.

Strategies for Building Good Credit While Repaying Student Loans

Responsible student loan repayment directly contributes to building a positive credit history. On-time payments demonstrate creditworthiness to lenders. Consider these strategies:

- Make on-time payments consistently: This is the single most important factor in building credit. Set up automatic payments to avoid missed payments.

- Keep credit utilization low: Avoid maxing out credit cards. A low credit utilization ratio (the amount of credit used compared to the total credit available) signals responsible credit management.

- Monitor your credit report: Regularly check your credit report for errors and inaccuracies. You are entitled to a free credit report annually from each of the three major credit bureaus (Equifax, Experian, and TransUnion).

Avoiding Common Student Loan Repayment Mistakes

Many borrowers make avoidable mistakes that can hinder their repayment journey. Understanding these pitfalls helps you avoid them:

- Ignoring your loans: Ignoring your student loans can lead to delinquency, negatively impacting your credit score and potentially resulting in wage garnishment or legal action.

- Failing to explore repayment options: Several repayment plans are available, including income-driven repayment plans. Exploring these options can significantly reduce monthly payments.

- Not budgeting effectively: Failing to create a realistic budget that incorporates student loan payments can lead to missed payments and financial stress.

- Ignoring rising interest rates: Understand how interest accrues and impacts your total repayment amount. Consider refinancing options to potentially lower your interest rate.

Last Word

Successfully managing student loan debt requires proactive planning and a thorough understanding of the available resources and strategies. By carefully considering the various loan programs, employing effective debt-reduction techniques, and making informed decisions regarding repayment and refinancing, students can pave the way for a brighter financial future. Remember, financial literacy is key to navigating the complexities of student loans and achieving long-term financial stability. Take control of your financial future – your future self will thank you.

Questions Often Asked

What is the difference between federal and private student loans?

Federal loans are offered by the government and typically have more borrower protections and flexible repayment options. Private loans are offered by banks and other financial institutions, often with higher interest rates and fewer protections.

Can I consolidate my student loans?

Yes, loan consolidation combines multiple loans into a single loan, potentially simplifying repayment. However, it may not always lower your interest rate.

What happens if I default on my student loans?

Defaulting on student loans can have severe consequences, including wage garnishment, tax refund offset, and damage to your credit score.

How can I improve my credit score while repaying student loans?

Make on-time payments consistently, keep credit utilization low, and maintain a diverse credit history (but avoid opening too many new accounts).