Navigating the complex world of student loans can feel overwhelming. Understanding interest rates and repayment options is crucial for long-term financial well-being. A student loan rate calculator is an invaluable tool that empowers borrowers to make informed decisions, compare different loan scenarios, and plan for a successful repayment journey. This guide will demystify the process, providing a comprehensive overview of how these calculators work and how to effectively utilize them.

We’ll explore the various factors that influence your interest rate, from your credit history and loan type to the repayment plan you choose. We’ll also delve into the long-term financial implications of different repayment strategies, helping you to choose a plan that aligns with your individual financial circumstances. By the end of this guide, you’ll be equipped with the knowledge and tools necessary to confidently manage your student loan debt.

Understanding Student Loan Rate Calculators

Student loan rate calculators are invaluable tools for prospective and current borrowers. They provide a quick and easy way to estimate monthly payments, total interest paid, and the overall cost of a student loan, helping borrowers make informed financial decisions. Understanding how these calculators work and the nuances of different loan types is crucial for effective financial planning.

Student loan rate calculators function by taking various inputs from the user, such as the loan amount, interest rate, loan term, and repayment plan, to calculate the estimated monthly payment and total cost of the loan. They utilize standard loan amortization formulas to determine these figures. The accuracy of the results depends on the accuracy of the input data provided by the user.

Types of Student Loans and Rate Calculation

Student loans are broadly categorized into federal and private loans. Federal loans, offered by the U.S. government, typically have fixed interest rates determined by the government based on market conditions and the type of loan (e.g., subsidized or unsubsidized). These rates are generally lower than private loan rates. Private loans, on the other hand, are offered by banks and other financial institutions, and their interest rates are variable or fixed, determined by the lender based on factors like the borrower’s creditworthiness, credit history, and the loan amount. The interest rate is often expressed as an annual percentage rate (APR). The calculation involves applying the interest rate to the principal loan amount over the loan term to determine the total interest accrued.

Using a Student Loan Rate Calculator: A Step-by-Step Guide

Using a student loan rate calculator is straightforward. Generally, the process involves these steps:

1. Find a reputable calculator: Many online resources offer free student loan calculators. Ensure the calculator is from a trusted source.

2. Enter loan details: Provide the necessary information, including the loan amount, interest rate (if known), loan term (in years or months), and the type of loan (federal or private). Some calculators may also ask for additional information, such as your credit score (for private loan estimates) or the repayment plan you intend to use.

3. Review the results: The calculator will display your estimated monthly payment, total interest paid over the loan term, and the total amount you will repay. Carefully review these figures to understand the potential cost of your loan.

4. Compare different scenarios: Experiment with different loan amounts, interest rates, and loan terms to see how these changes impact your monthly payment and total cost. This allows for exploring different borrowing strategies.

Comparison of Student Loan Rate Calculators

| Calculator Name | Features | Pros | Cons |

|---|---|---|---|

| Calculator A (Example) | Loan amount, interest rate, loan term, repayment plan options, amortization schedule | User-friendly interface, detailed results | Limited loan type options |

| Calculator B (Example) | Loan amount, interest rate, loan term, credit score input (for private loans), debt-to-income ratio analysis | Comprehensive features, personalized results | More complex interface |

| Calculator C (Example) | Loan amount, interest rate, loan term, various repayment scenarios, federal loan type selection | Focus on federal loans, clear and concise results | Limited options for private loans |

Factors Affecting Student Loan Interest Rates

Understanding the factors that influence your student loan interest rate is crucial for planning your finances. The rate you’re offered directly impacts the total cost of your education, so it’s important to be informed about the key variables involved. These rates are not static; they fluctuate based on various elements related to both the loan itself and your personal financial standing.

Several key factors interact to determine the interest rate you’ll receive on your student loans. These factors can be broadly categorized into those related to the loan itself and those related to the borrower’s creditworthiness. Understanding these nuances can help you secure a more favorable interest rate.

Credit History’s Impact on Interest Rates

A borrower’s credit history significantly impacts their student loan interest rate, especially for private loans. Lenders use credit scores to assess the risk of lending money. A higher credit score, indicating responsible borrowing and repayment behavior, typically results in a lower interest rate. Conversely, a lower credit score, often associated with missed payments or high debt, may lead to a higher interest rate or even loan denial. For example, a borrower with an excellent credit score might qualify for a rate several percentage points lower than a borrower with a poor credit history. This difference can accumulate to thousands of dollars in extra interest payments over the loan’s lifespan. Lenders consider factors like payment history, debt-to-income ratio, and length of credit history when assessing creditworthiness.

Federal vs. Private Student Loan Interest Rates

Federal and private student loans differ significantly in how their interest rates are determined. Federal student loan interest rates are typically set by the government and are often lower than private loan rates. These rates can vary based on the type of federal loan (e.g., subsidized vs. unsubsidized) and the loan’s disbursement year. Private student loans, on the other hand, are offered by banks and other financial institutions. Their interest rates are determined by market conditions and the borrower’s creditworthiness, resulting in a wider range of rates and often higher costs compared to federal loans. For instance, a subsidized federal loan might have a fixed rate of 4%, while a comparable private loan could have a variable rate ranging from 6% to 10% depending on the borrower’s credit profile.

Loan Type and Repayment Plan Influence on Interest Rates

The type of student loan and the chosen repayment plan also influence the interest rate. Different loan types, such as subsidized and unsubsidized federal loans, often carry different interest rates. Subsidized loans typically have lower rates because the government pays the interest while the borrower is in school. Unsubsidized loans accrue interest during this period, increasing the total amount owed. Similarly, the repayment plan can affect the overall cost. While longer repayment plans reduce monthly payments, they often lead to higher total interest paid over the life of the loan. A shorter repayment plan, while requiring higher monthly payments, results in less interest paid overall.

Flowchart Illustrating Student Loan Interest Rate Determination

The following flowchart visually represents the process of determining a student loan interest rate:

[Diagram description: The flowchart begins with a “Start” box. It then branches into two paths: “Federal Loan” and “Private Loan.” The “Federal Loan” path leads to a box indicating that the interest rate is determined by the government based on factors such as loan type and disbursement year. This path ends in a “Rate Determined” box. The “Private Loan” path leads to a series of boxes representing the assessment of credit score, loan amount, and other factors. This path then converges with the “Federal Loan” path at the “Rate Determined” box, which finally leads to an “End” box. ]

Repayment Scenarios and Their Impact

Choosing a student loan repayment plan significantly impacts your overall borrowing cost. Understanding the different options and their long-term financial implications is crucial for effective financial planning. This section will explore various repayment scenarios, illustrating how different plans affect total interest paid and long-term financial health.

Standard Repayment Plan

The standard repayment plan typically involves fixed monthly payments over a 10-year period. This plan offers predictable payments, but it often results in higher monthly payments compared to other options. The benefit lies in paying off the loan faster, minimizing the total interest paid. For example, a $30,000 loan at 5% interest would require approximately $320 monthly payments under a standard 10-year plan, resulting in a total repayment of approximately $38,400. This contrasts with extended repayment plans, which may lower monthly payments but increase the total interest paid over the life of the loan.

Extended Repayment Plan

Extended repayment plans stretch the repayment period, typically to 25 years. This lowers monthly payments, making them more manageable in the short term. However, the extended repayment period leads to significantly higher total interest paid. Using the same $30,000 loan at 5% interest, a 25-year plan would reduce monthly payments to approximately $160, but the total repayment would increase to around $48,000, reflecting a much higher total interest cost.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) adjust monthly payments based on your income and family size. These plans offer lower monthly payments during periods of lower income, but they typically extend the repayment period beyond the standard 10 years. The total interest paid can be substantial, especially if your income remains low for a significant portion of the repayment period. The specific calculation varies based on the type of IDR plan (e.g., PAYE, REPAYE, IBR). The long-term impact is a potentially longer repayment period and increased total interest paid compared to standard repayment, but provides more flexibility during periods of financial hardship.

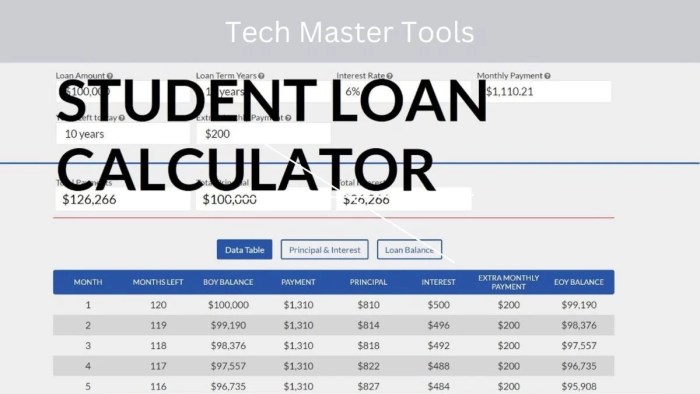

Loan Amortization and its Impact on Monthly Payments

Loan amortization is the process of gradually paying off a loan over time through scheduled payments. Each payment comprises a portion of the principal (the original loan amount) and interest. In the early stages of repayment, a larger portion of each payment goes towards interest, while a smaller portion goes towards principal. As the loan progresses, the proportion shifts, with more of each payment applied to the principal. This explains why the total interest paid can be significantly higher with extended repayment periods. A key formula used in loan amortization calculations is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

M = Monthly Payment

P = Principal Loan Amount

i = Monthly Interest Rate (Annual Interest Rate / 12)

n = Number of Months

This formula highlights the interplay between the principal, interest rate, and loan term in determining monthly payments. A higher interest rate or longer loan term leads to higher monthly payments.

Comparison of Total Borrowing Costs

| Repayment Plan | Loan Amount | Interest Rate | Total Repayment |

|---|---|---|---|

| Standard (10-year) | $30,000 | 5% | ~$38,400 |

| Extended (25-year) | $30,000 | 5% | ~$48,000 |

| Income-Driven (Variable) | $30,000 | 5% | ~$45,000 – $55,000 (Estimate, highly dependent on income) |

Choosing the Right Repayment Plan

Selecting the optimal student loan repayment plan is crucial for managing your debt effectively and minimizing long-term financial strain. The best plan depends heavily on your individual financial situation, income, and long-term goals. Careful consideration of various factors is essential to avoid potential pitfalls and ensure a manageable repayment journey.

Understanding your financial circumstances is paramount in choosing a suitable repayment plan. This involves assessing your current income, expenses, and overall debt load. Factors such as your employment stability and anticipated future income also play a significant role. A thorough understanding of these aspects allows you to accurately evaluate your capacity for monthly payments and choose a plan that aligns with your capabilities. For example, a recent graduate with a low starting salary might benefit from an income-driven repayment plan, while someone with a stable, higher income might find a standard repayment plan more suitable.

Using a Student Loan Rate Calculator to Estimate Monthly Payments

Student loan rate calculators are invaluable tools for estimating monthly payments under different repayment scenarios. These calculators typically require inputting the total loan amount, interest rate, and loan term. By altering these variables, you can explore the impact of different repayment plans on your monthly payments and total interest paid. For instance, if you input a $50,000 loan at a 5% interest rate, a standard 10-year repayment plan might show a monthly payment of approximately $530, while a 20-year plan would result in a lower monthly payment, around $340, but with significantly higher total interest paid over the life of the loan. Experimenting with these inputs allows you to visualize the trade-offs between monthly payments and total interest costs, helping you make an informed decision.

Factors to Consider When Choosing a Repayment Plan

Choosing a repayment plan requires careful consideration of several key factors. The right plan depends on your unique financial situation and goals.

- Monthly Payment Amount: Can you comfortably afford the monthly payment without compromising your other financial obligations?

- Loan Term Length: A shorter loan term means higher monthly payments but less total interest paid. A longer term means lower monthly payments but more total interest paid.

- Interest Rate: A lower interest rate will reduce the total amount you pay over the life of the loan.

- Income-Driven Repayment Plans: These plans base your monthly payment on your income and family size, potentially offering lower monthly payments, but often extending the repayment period.

- Forbearance and Deferment Options: Understanding the availability and implications of these options in case of financial hardship is essential.

- Long-term Financial Goals: Consider how your student loan repayment plan aligns with other financial goals, such as saving for a down payment on a house or retirement.

Consequences of Defaulting on Student Loan Payments

Defaulting on student loan payments has serious consequences. These can include damage to your credit score, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. In severe cases, it can even lead to legal action. The impact on your financial well-being can be significant and long-lasting. It is crucial to prioritize responsible repayment to avoid these potentially devastating outcomes. For example, a defaulted loan can significantly hinder your ability to secure a mortgage or auto loan in the future, limiting your financial opportunities. Careful planning and proactive communication with your loan servicer can help you avoid default and maintain a healthy financial standing.

Visual Representation of Loan Repayment

Understanding the impact of different factors on your student loan repayment is crucial for effective financial planning. Visual aids can significantly improve this understanding by presenting complex data in an easily digestible format. This section explores two key visual representations: a graph illustrating the relationship between interest rate, loan amount, and total repayment cost, and a visual representation showing how a loan balance decreases over time under various repayment plans.

Graph Showing the Relationship Between Interest Rate, Loan Amount, and Total Repayment Cost

This 3D graph would display the total repayment cost on the Z-axis. The X-axis would represent the loan amount (e.g., ranging from $10,000 to $100,000), and the Y-axis would represent the interest rate (e.g., ranging from 3% to 10%). Each point on the graph would represent a unique combination of loan amount and interest rate, with its Z-coordinate indicating the total repayment cost calculated for a standard 10-year repayment plan. The graph would visually demonstrate how increasing either the loan amount or the interest rate dramatically increases the total repayment cost. For example, a point at ($50,000, 5%, $70,000) would represent a $50,000 loan at 5% interest resulting in a total repayment cost of $70,000. The graph’s surface would likely be curved upward, illustrating the non-linear relationship between these variables. A color gradient could be added to further emphasize the total cost, with darker colors representing higher repayment costs.

Visual Representation of Loan Balance Decrease Over Time Under Different Repayment Plans

This visual would be a line graph, with the X-axis representing time (in months or years) and the Y-axis representing the remaining loan balance. Multiple lines would be plotted on the graph, each representing a different repayment plan (e.g., standard 10-year plan, extended repayment plan, income-driven repayment plan). Each line would start at the initial loan amount and gradually decrease over time until it reaches zero. The slope of each line would represent the repayment speed, with steeper slopes indicating faster repayment. A legend would clearly identify each repayment plan represented by a line. For example, a line representing a standard 10-year repayment plan would show a relatively steep decline, while a line for an income-driven repayment plan might show a gentler, more gradual decrease over a longer period. The graph would clearly illustrate the trade-offs between repayment speed and monthly payment amounts associated with different repayment plans. Annotations could be added to highlight key milestones, such as the halfway point of repayment for each plan. This visual would allow for easy comparison of the different repayment options and help borrowers visualize their potential repayment journeys.

Final Summary

Mastering student loan repayment requires careful planning and a clear understanding of interest rates and repayment options. Utilizing a student loan rate calculator is a critical first step in this process. By understanding the factors that affect your interest rate and exploring various repayment scenarios, you can create a personalized repayment strategy that minimizes your overall cost and aligns with your financial goals. Remember, proactive planning and informed decision-making are key to achieving financial success after graduation.

FAQ Explained

What is the difference between federal and private student loans?

Federal student loans are offered by the government and typically have more favorable terms and repayment options than private loans, which are offered by banks and other financial institutions. Federal loans often have income-driven repayment plans and protections against default.

Can I use a student loan rate calculator before I even apply for a loan?

Yes! Calculators can help you estimate potential interest rates and monthly payments based on various loan amounts and repayment terms, allowing you to plan and budget effectively.

What happens if I default on my student loans?

Defaulting on student loans can have severe consequences, including damage to your credit score, wage garnishment, and potential legal action. It is crucial to explore all available repayment options and contact your loan servicer if you are struggling to make payments.

How often should I check my student loan rate calculator estimations?

It’s advisable to periodically review your estimations, especially if your financial situation changes significantly or if you’re considering refinancing your loans.