Navigating the complexities of student loan financing can feel overwhelming, especially with the ever-changing landscape of interest rates. Understanding the nuances of federal and private loan options is crucial for making informed decisions that impact your financial future. This guide provides a clear overview of student loan rates for the 2024-2025 academic year, equipping you with the knowledge to choose the best path forward.

We will explore the differences between federal and private loans, examining interest rate variations based on loan type, creditworthiness, and economic factors. We’ll also delve into strategies for managing student loan debt effectively, from minimizing borrowing to exploring refinancing options. Ultimately, our goal is to empower you to make confident financial choices that align with your academic and career aspirations.

Federal Student Loan Rates for 2024-2025

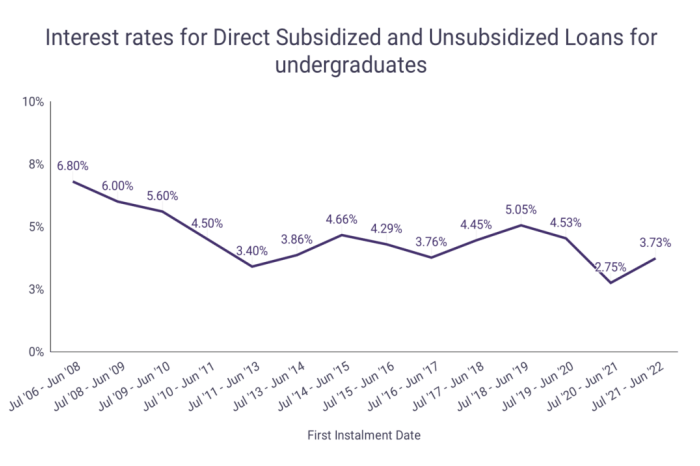

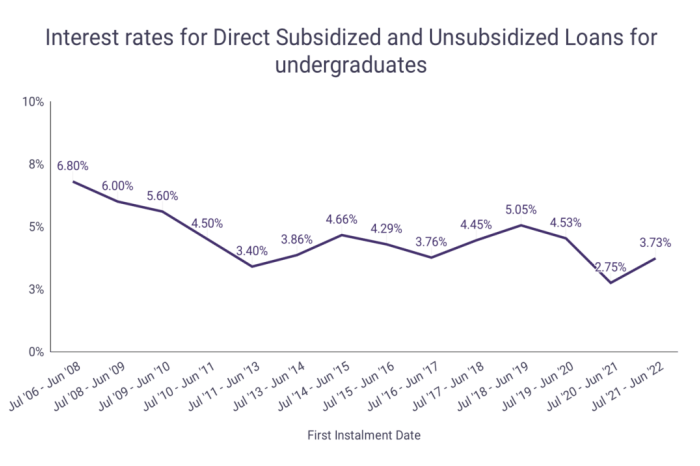

Understanding federal student loan interest rates is crucial for prospective and current students. These rates directly impact the total cost of your education and the amount you’ll need to repay after graduation. The rates for the 2024-2025 academic year are set annually and are subject to change based on economic factors.

Federal Student Loan Rate Details for 2024-2025

The interest rates for federal student loans are determined by the government and are generally lower than private loan rates. These rates vary depending on the type of loan, the student’s status (undergraduate or graduate), and the loan program. It’s important to note that these rates are subject to change and should be confirmed with official government sources before making any financial decisions. For the purposes of this overview, we will use the rates published by the U.S. Department of Education in the fall of 2023 for the 2024-2025 academic year. (Note: These are example rates and may not reflect the actual final rates. Always check with the official government source for the most up-to-date information).

Comparison of 2024-2025 and 2023-2024 Rates

The following table compares the interest rates for various federal student loan programs for the 2024-2025 academic year with those of the previous year. This comparison allows for an understanding of any increases or decreases in borrowing costs.

| Loan Type | 2024-2025 Rate (Example) | 2023-2024 Rate (Example) | Change |

|---|---|---|---|

| Direct Subsidized Loan (Undergraduate) | 5.0% | 4.5% | +0.5% |

| Direct Unsubsidized Loan (Undergraduate) | 7.0% | 6.5% | +0.5% |

| Direct Subsidized Loan (Graduate) | 7.5% | 7.0% | +0.5% |

| Direct Unsubsidized Loan (Graduate) | 8.5% | 8.0% | +0.5% |

| Grad PLUS Loan | 9.5% | 9.0% | +0.5% |

Factors Influencing Federal Student Loan Interest Rates

Several factors contribute to the setting of federal student loan interest rates. These rates are not arbitrary but are influenced by broader economic conditions. The primary influence is the 10-year Treasury note yield, a benchmark interest rate reflecting the cost of borrowing for the U.S. government. Other factors include the administration’s fiscal policy and overall economic forecasts. Changes in inflation rates, economic growth projections, and the overall market conditions can also influence the rates. For instance, during periods of high inflation, the government might increase interest rates to curb borrowing and control inflation. Conversely, during economic downturns, lower rates might be set to stimulate borrowing and economic activity. The government also considers the need to balance affordability for students with the financial health of the student loan program itself.

Private Student Loan Rates for 2024-2025

Private student loans offer an alternative funding source for higher education, but understanding their rates and terms is crucial before borrowing. Unlike federal loans, private loan rates are variable and depend heavily on the borrower’s creditworthiness and the lender’s current market conditions. This means rates can fluctuate significantly, making it essential to shop around and compare offers.

Private student loan interest rates for 2024-2025 are expected to remain somewhat elevated compared to recent historical lows, reflecting the overall economic climate. While precise figures vary greatly depending on the lender and the borrower’s financial profile, a reasonable estimate for the range would be from approximately 6% to 15% for variable-rate loans, with fixed-rate loans possibly sitting slightly higher. Borrowers with excellent credit scores and strong co-signers will likely secure rates closer to the lower end of this spectrum. Conversely, those with limited or damaged credit history might face rates at the higher end or may even be denied a loan.

Comparison of Private and Federal Student Loan Terms

The key differences between private and federal student loans significantly impact the borrowing experience. Careful consideration of these differences is vital in making informed decisions.

- Interest Rates: Federal student loan interest rates are typically lower and are set by the government. Private loan interest rates are variable and generally higher, influenced by credit scores and market conditions.

- Repayment Options: Federal loans offer various repayment plans, including income-driven repayment options that adjust payments based on income. Private loans generally offer fewer repayment options, often with less flexibility.

- Loan Forgiveness Programs: Federal student loans may qualify for loan forgiveness programs under certain circumstances (e.g., public service). Private loans do not typically offer such programs.

- Deferment and Forbearance: Federal loans allow for deferment or forbearance in times of financial hardship, temporarily suspending or reducing payments. Private lenders may offer similar options, but these are often less generous and more difficult to obtain.

- Credit Check Requirements: Federal loans generally have less stringent credit requirements compared to private loans. Private lenders typically conduct thorough credit checks, and a poor credit history may significantly impact approval or result in higher interest rates.

Risks and Benefits of Private Student Loans

Borrowing from private lenders presents both advantages and disadvantages. Understanding these aspects is essential for responsible borrowing.

- Benefits: Private loans can supplement federal loan amounts, allowing students to cover additional educational expenses. Some private lenders may offer more flexible repayment terms in specific situations, although this is not always the case.

- Risks: Higher interest rates compared to federal loans can significantly increase the total cost of borrowing over the loan’s lifetime. The lack of government protections and flexible repayment options can create financial difficulties if unexpected circumstances arise. Borrowers with poor credit may face loan denial or extremely high interest rates.

Factors Affecting Student Loan Rates

Securing student loans, whether federal or private, involves understanding the various factors influencing the interest rates you’ll face. These rates directly impact the total cost of your education, so careful consideration is crucial. The interest rate determines how much extra you’ll pay beyond the principal loan amount.

Credit Score and Credit History’s Impact on Private Student Loan Rates

Your credit score and history significantly affect private student loan interest rates. Lenders view a strong credit history (demonstrated by timely payments and responsible credit use) as a low-risk factor. A higher credit score typically translates to a lower interest rate, as lenders perceive less risk of default. Conversely, a poor credit history or a low credit score will likely result in a higher interest rate, or even loan denial. This is because lenders need to compensate for the increased risk associated with borrowers who have a history of missed or late payments. For students with limited or no credit history, having a co-signer with good credit can often mitigate this risk and secure a more favorable interest rate.

The Influence of Economic Conditions and Market Interest Rates

Prevailing economic conditions and overall market interest rates play a substantial role in shaping both federal and private student loan rates. When the Federal Reserve raises interest rates to combat inflation, for example, borrowing costs generally increase across the board. This means that both federal and private student loan rates are likely to rise. Conversely, periods of low inflation and lower interest rates generally lead to lower borrowing costs for students. These fluctuations are driven by the broader economic landscape and the supply and demand dynamics within the lending market. The prime rate, a benchmark interest rate used by banks, serves as a significant indicator of these changes and frequently influences the interest rates offered on student loans.

Repayment Plan Impact on Total Interest Paid

The repayment plan you choose significantly impacts the total interest you’ll pay over the life of your loan. Different plans involve varying monthly payments and loan durations. A standard repayment plan, characterized by fixed monthly payments over a set period (typically 10 years), leads to a faster loan payoff but often results in higher monthly payments. A graduated repayment plan, starting with lower monthly payments that gradually increase, offers more manageable initial payments but extends the loan term, leading to higher overall interest paid. Income-driven repayment plans, where monthly payments are tied to your income, offer lower monthly payments but typically extend the loan repayment period considerably, significantly increasing the total interest accrued over the loan’s lifetime.

| Repayment Plan | Loan Amount | Interest Rate | Total Interest Paid |

|---|---|---|---|

| Standard (10-year) | $20,000 | 5% | $4,600 (approx.) |

| Graduated (10-year) | $20,000 | 5% | $5,200 (approx.) |

| Income-Driven (20-year) | $20,000 | 5% | $8,000 (approx.) |

*Note: These are approximate figures and actual interest paid will vary based on specific loan terms and individual circumstances.*

Strategies for Managing Student Loan Debt

Navigating the complexities of student loan debt requires a proactive approach. Effective management begins well before graduation, focusing on minimizing borrowing and making informed decisions about loan selection and repayment. By employing smart strategies, students can significantly reduce their financial burden and pave the way for a more secure financial future.

Proactive planning and informed choices are crucial in managing student loan debt effectively. Understanding available options and implementing suitable strategies can significantly alleviate the financial pressure associated with student loans. This section Artikels key strategies for minimizing loan reliance and optimizing repayment.

Minimizing Loan Reliance and Reducing Borrowing Costs

Before taking out loans, explore all avenues for reducing your reliance on borrowed funds. This proactive approach can significantly lessen your long-term debt burden and associated interest payments.

- Maximize Grants and Scholarships: Aggressively pursue grants and scholarships from federal, state, and private sources. These funds don’t need to be repaid, offering a substantial reduction in overall borrowing needs.

- Work Part-Time or Full-Time: Earning money during your studies can significantly reduce the amount you need to borrow. Even part-time work can make a substantial difference.

- Attend a Less Expensive College: Consider the overall cost of attendance, including tuition, fees, and living expenses, when choosing a college. A less expensive option can dramatically decrease your loan requirements.

- Live at Home or in Affordable Housing: Reducing living expenses through living at home or choosing affordable housing options frees up more money for tuition and reduces the need for loans.

- Choose a Shorter Degree Program: Completing your degree in a shorter timeframe can save money on living expenses and reduce the total amount borrowed.

Comparing Loan Offers and Selecting Suitable Loan Options

When comparing loan offers, it’s crucial to focus on key factors that will impact your long-term repayment costs. Understanding the nuances of different loan types and their associated terms is paramount.

Consider these factors when comparing loan offers:

- Interest Rate: The interest rate determines the cost of borrowing. A lower interest rate will result in lower overall repayment costs. Look for the Annual Percentage Rate (APR) which includes all fees.

- Loan Fees: Some loans have origination fees or other charges. These fees add to the overall cost of the loan and should be factored into your comparison.

- Repayment Terms: Longer repayment terms result in lower monthly payments, but you’ll pay more interest over the life of the loan. Shorter terms mean higher monthly payments but less interest paid overall.

- Deferment and Forbearance Options: Understand the options available if you need to temporarily postpone payments. These options can provide flexibility but may impact your long-term repayment costs.

- Loan Forgiveness Programs: Explore whether the loan qualifies for any loan forgiveness programs, such as those for public service.

Refinancing Student Loans

Refinancing your student loans can be a viable strategy to potentially lower your interest rate and monthly payments. However, it’s crucial to carefully evaluate the pros and cons before making a decision.

Key considerations for refinancing include:

- Credit Score: A higher credit score generally qualifies you for better interest rates.

- Income: Lenders will assess your income to determine your ability to repay the loan.

- Debt-to-Income Ratio: A lower debt-to-income ratio improves your chances of securing a favorable refinance rate.

- New Interest Rate: Compare the new interest rate offered with your current rate. Refinancing is only beneficial if the new rate is significantly lower.

- New Loan Terms: Consider the impact of any changes to the loan term (length of repayment). A shorter term will lead to higher monthly payments but less interest paid overall.

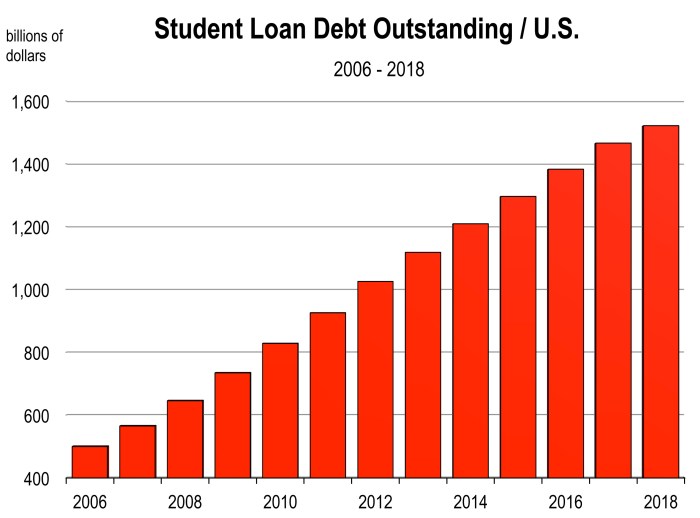

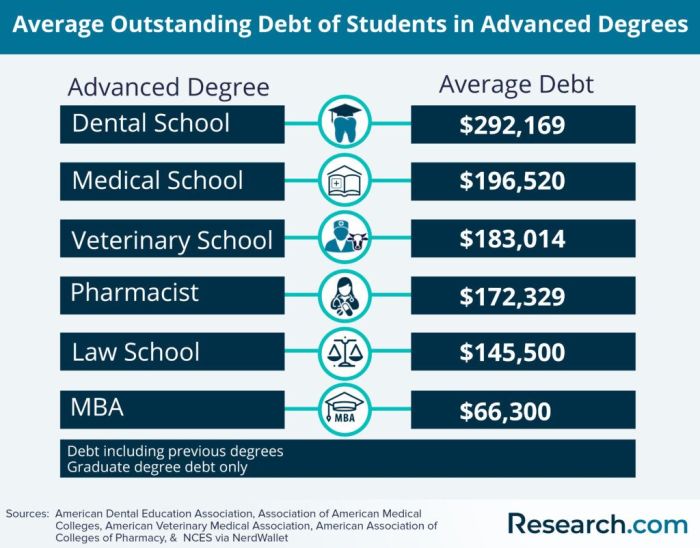

The Impact of Student Loan Rates on Students

Rising student loan interest rates significantly impact students’ financial well-being and long-term financial planning. The cost of higher education is already substantial, and increased interest rates exacerbate this burden, potentially leading to increased debt and longer repayment periods. This can have a ripple effect, influencing students’ ability to save for other life goals and affecting their overall financial security.

The weight of high student loan debt can significantly influence post-graduation career choices and lifestyle decisions. Graduates may prioritize higher-paying jobs, even if they are less fulfilling, to accelerate loan repayment. This might lead to career paths that don’t align with their passions or long-term aspirations. Furthermore, high debt levels can limit choices regarding housing, transportation, and other essential aspects of life, potentially delaying major life events such as marriage or homeownership. For example, a graduate burdened with $100,000 in student loan debt might defer purchasing a home or starting a family until the debt is significantly reduced, impacting their life trajectory and overall happiness. This also restricts their ability to invest in other areas that could improve their future financial stability, such as retirement savings or starting a business.

The Effects of Rising Interest Rates on Financial Well-being

Rising interest rates directly translate to a larger total amount repaid over the life of the loan. A seemingly small increase in the interest rate can significantly increase the total amount owed over the repayment period, especially for those with substantial loan balances. This increased financial burden can lead to increased stress, impacting mental health and overall well-being. It can also affect a graduate’s ability to build savings, invest in their future, or pursue further education or professional development opportunities. For instance, a 1% increase in interest on a $50,000 loan could add thousands of dollars to the total repayment cost over 10 years.

Implications of High Student Loan Debt on Career Choices

High student loan debt often forces graduates to prioritize debt repayment over other financial goals. This can lead to career choices that maximize earning potential, even if they don’t align with personal interests or long-term career aspirations. Graduates might accept higher-paying but less fulfilling jobs to expedite loan repayment, potentially leading to career dissatisfaction and reduced job satisfaction. They might also delay pursuing further education or training opportunities due to the financial burden, limiting their career advancement potential. For example, a graduate with significant debt might forgo a lower-paying but personally fulfilling job in the arts to pursue a higher-paying position in finance, even if it’s not their ideal career path.

Available Resources for Managing Student Loan Debt

Managing student loan debt can be challenging, but several resources are available to help students navigate this process.

It’s crucial for students to understand the various repayment options available to them. Many resources can provide guidance on these options and help them choose the most suitable plan based on their individual financial circumstances.

- Federal Student Aid (FSA): The FSA website offers comprehensive information on federal student loans, repayment plans, and other resources. They provide tools and calculators to help estimate monthly payments and explore different repayment options.

- National Foundation for Credit Counseling (NFCC): The NFCC offers free and low-cost credit counseling services, including assistance with student loan debt management. They can help students create a budget, develop a repayment plan, and explore options for debt consolidation or refinancing.

- Student Loan Repayment Assistance Programs: Various programs offer assistance with student loan repayment, often based on income or employment in specific fields (e.g., public service loan forgiveness). These programs can significantly reduce the burden of student loan debt.

- Financial Aid Offices at Colleges and Universities: Many colleges and universities offer resources and guidance to their students on managing student loan debt, including workshops, individual counseling, and information on available repayment programs.

Closing Notes

Securing funding for higher education is a significant step, and understanding the implications of student loan rates is paramount. By carefully considering the factors discussed—from federal versus private loan options to the impact of credit history and economic conditions—you can make informed decisions that minimize long-term financial burden. Remember to actively manage your debt, explore repayment options, and utilize available resources to navigate this crucial financial journey successfully.

FAQ Insights

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.

Can I refinance my federal student loans?

Generally, refinancing federal student loans into private loans is possible, but it may eliminate eligibility for federal repayment plans and protections.

What factors influence private student loan rates besides credit score?

Factors such as co-signer availability, loan amount, and the lender’s current rates all influence private student loan rates.

What if I can’t afford my student loan payments?

Contact your lender immediately to explore options like deferment, forbearance, or income-driven repayment plans.