Navigating the complex landscape of student loan debt requires understanding the historical context of interest rates. This analysis explores the fluctuations in student loan rates over time, examining the interplay of economic factors, government policies, and the various types of loans available. We’ll delve into the historical trends, the impact of economic shifts, and the role of government intervention, providing a comprehensive overview to help you better understand this crucial aspect of higher education financing.

From the earliest available data to present-day realities, we’ll trace the evolution of interest rates for both federal and private student loans. This exploration will reveal how economic conditions like inflation and recessions have influenced these rates, and how government policies have shaped the affordability and accessibility of higher education. Understanding this historical context is crucial for current and prospective borrowers alike, enabling informed decision-making and financial planning.

Historical Trends in Student Loan Rates

Understanding the historical trends in student loan interest rates is crucial for comprehending the current landscape of higher education financing in the United States. Fluctuations in these rates directly impact the affordability of college and the overall debt burden carried by students. This section will delve into a detailed timeline of these rates, highlighting key legislative changes and economic factors influencing their movement.

A Timeline of Student Loan Interest Rates

Tracking student loan interest rates requires examining both federal and private loan markets. Federal loans, backed by the government, generally offer lower rates than private loans, which are subject to market forces and individual creditworthiness. The following overview traces the evolution of these rates, acknowledging that precise historical data for earlier periods can be challenging to obtain comprehensively. Before the 1970s, federal student loan programs were less standardized, making direct rate comparisons difficult.

| Year | Federal Rate (Average) | Private Rate (Average) | Major Events |

|---|---|---|---|

| 1970s-early 1980s | Varied widely, generally low | Data scarce, likely higher than federal rates | Early federal student loan programs established; limited standardization |

| Mid-1980s-1990s | Gradual increase, influenced by general interest rate trends | Generally higher than federal rates, fluctuating with market conditions | Expansion of federal loan programs; increasing tuition costs |

| 2000s | Relatively stable, with some fluctuations | Significant variations depending on creditworthiness and market conditions | Increased competition among private lenders; rise in student loan debt |

| 2008-2010 | Decreased due to economic recession and Federal Reserve actions | Sharp increase followed by a decline, reflecting the economic downturn | The Great Recession; government intervention in financial markets |

| 2010s | Varied based on loan type and economic conditions; some periods of increase, some of decrease | Fluctuated based on economic conditions and lender policies | Changes in federal loan programs; continued rise in tuition; increased regulatory scrutiny of private lenders |

| 2020-Present | Historically low rates due to pandemic-related economic policies | Rates varied depending on economic conditions and lender policies | COVID-19 pandemic; government forbearance programs; economic stimulus packages |

Comparison of Federal and Private Student Loan Rates

Throughout history, federal student loan interest rates have generally been lower than those for private student loans. This difference stems from the inherent risk associated with each loan type. Federal loans carry less risk for lenders because of government backing, allowing for lower interest rates. Private loans, on the other hand, are subject to market fluctuations and the creditworthiness of the borrower, leading to higher rates to compensate for the increased risk. The gap between federal and private rates has fluctuated over time, widening during periods of economic uncertainty and narrowing during periods of economic stability.

Significant Rate Increases and Decreases

Several periods stand out for significant changes in student loan interest rates. The economic recession of 2008-2010 led to a decrease in federal rates as the Federal Reserve lowered interest rates to stimulate the economy. Conversely, periods of economic expansion often saw increases in rates, reflecting broader market trends. Legislative changes, such as those impacting the calculation of federal student loan interest rates, have also had a notable impact. For example, changes in the way the interest rate is indexed to market rates can result in substantial increases or decreases in the cost of borrowing.

Impact of Economic Factors on Student Loan Rates

Student loan interest rates are not set in isolation; they are intricately linked to broader economic conditions. Understanding this relationship is crucial for both borrowers and lenders, as it directly impacts the cost of higher education and the overall financial health of the economy. Several key economic factors significantly influence the fluctuations we see in student loan interest rates.

The interplay between economic forces and student loan rates is complex, involving the interaction of various governmental policies, market conditions, and the overall health of the economy. These factors influence the cost of borrowing for both the government and private lenders, ultimately determining the interest rates offered to students.

Inflation’s Effect on Student Loan Interest Rates

Inflation, the rate at which the general level of prices for goods and services is rising, and student loan interest rates often move in tandem. When inflation rises, the cost of borrowing increases for lenders, leading them to raise interest rates to compensate for the diminished purchasing power of future repayments. Conversely, during periods of low inflation or deflation, interest rates tend to decrease, making student loans more affordable. For example, the high inflation experienced in the late 1970s and early 1980s corresponded with significantly higher student loan interest rates compared to periods of lower inflation in subsequent decades.

Federal Reserve Monetary Policy’s Influence

The Federal Reserve (the Fed), the central bank of the United States, plays a pivotal role in shaping interest rates across the economy, including those for student loans. Through its monetary policy tools, primarily the federal funds rate (the target rate banks charge each other for overnight loans), the Fed influences the overall cost of borrowing. When the Fed raises the federal funds rate to combat inflation, other interest rates, including those for student loans, tend to follow suit. Conversely, lowering the federal funds rate during economic downturns aims to stimulate borrowing and economic activity, potentially leading to lower student loan rates. The 2008 financial crisis, for example, saw the Fed aggressively lower interest rates, which indirectly impacted student loan rates.

Economic Recessions and Booms: Their Impact on Student Loan Rates

Economic recessions significantly affect student loan interest rates. During a recession, lenders become more risk-averse, potentially leading to higher interest rates to compensate for increased default risk. Conversely, during economic booms, with lower unemployment and increased consumer confidence, lenders may be more willing to offer lower rates, reflecting reduced risk. The 2001 recession, for instance, saw a period of relatively higher student loan interest rates, while the subsequent economic expansion saw a period of generally lower rates (though this is a simplification and other factors were at play).

Correlation Between Economic Indicators and Student Loan Rate Changes

Understanding how specific economic indicators correlate with student loan rate changes is essential for informed decision-making.

- Unemployment Rate: A high unemployment rate generally leads to higher student loan interest rates due to increased default risk. Lenders anticipate a higher percentage of borrowers struggling to repay their loans.

- Inflation Rate: A higher inflation rate typically results in higher student loan interest rates, as lenders seek to protect their returns against the erosion of purchasing power caused by inflation.

- Gross Domestic Product (GDP) Growth: Strong GDP growth usually corresponds with lower student loan interest rates, as a healthy economy reduces the perceived risk of loan defaults.

- Government Bond Yields: Changes in government bond yields often influence student loan rates. When government bond yields rise, reflecting increased borrowing costs for the government, this can indirectly lead to higher student loan interest rates.

Types of Student Loans and Their Rate Variations

Understanding the different types of student loans and their associated interest rates is crucial for effective financial planning during and after your education. Interest rates significantly impact the total cost of borrowing, influencing repayment amounts and overall debt burden. This section will clarify the variations in interest rates across various loan types.

Federal Subsidized and Unsubsidized Loans

Subsidized and unsubsidized federal loans are both offered under the Stafford Loan program. The key difference lies in interest accrual. With subsidized loans, the government pays the interest while you’re in school at least half-time, during grace periods, and during deferment periods. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed, even while you are still in school. This means you’ll owe more at the end of your studies if you don’t pay the accrued interest during your studies. The interest rate for both subsidized and unsubsidized loans is generally the same for a given loan period, set by the government each year.

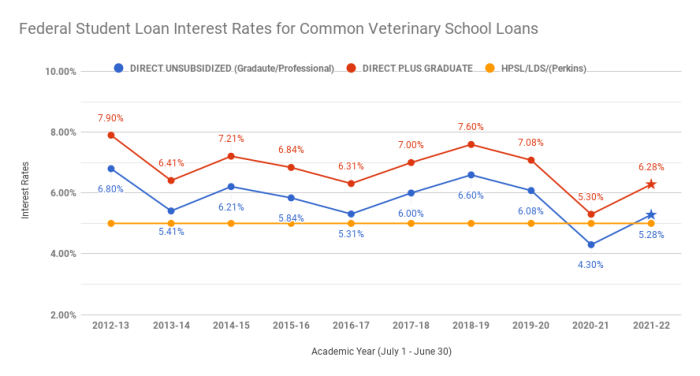

Federal Loan Program Rate Comparisons

Several federal loan programs exist, each with its own interest rate structure. Stafford Loans, as previously mentioned, are the most common, offering both subsidized and unsubsidized options. Perkins Loans, while less prevalent now, historically had lower, fixed interest rates than Stafford Loans. Parent PLUS loans, designed to help parents finance their children’s education, usually have higher interest rates than student loans. These differences reflect the varying levels of risk associated with each loan type. For example, PLUS loans, due to their higher risk, often have higher interest rates.

Private Student Loan Interest Rate Factors

Private student loans, offered by banks and credit unions, operate differently than federal loans. Interest rates are not set by the government but are determined by several factors, primarily the borrower’s creditworthiness. A higher credit score typically results in a lower interest rate, reflecting lower perceived risk to the lender. The loan term also plays a role; longer loan terms generally result in higher interest rates, as the lender faces greater risk over a longer period. Other factors such as the type of school attended and the co-signer’s credit history can also affect the interest rate.

Summary Table of Student Loan Interest Rates

| Loan Type | Interest Rate Type | Rate Factors | Average Rate Range (Example – rates vary by year) |

|---|---|---|---|

| Federal Subsidized Stafford Loan | Fixed | Set annually by the government | 3-7% |

| Federal Unsubsidized Stafford Loan | Fixed | Set annually by the government | 3-7% |

| Federal Perkins Loan | Fixed | Historically lower than Stafford Loans | 5% (Historically) |

| Federal Parent PLUS Loan | Fixed | Based on parent’s creditworthiness | 7-10% |

| Private Student Loan | Variable or Fixed | Borrower’s credit score, loan term, co-signer credit (if applicable) | 5-15% |

The Role of Government Policy on Student Loan Rates

Government policy significantly influences the affordability and accessibility of higher education by directly impacting student loan rates. Legislation and regulatory actions determine not only the interest rates borrowers face but also the overall level of student loan debt accumulated across the nation. Understanding these government interventions is crucial to analyzing the current state of student loan debt and formulating effective solutions.

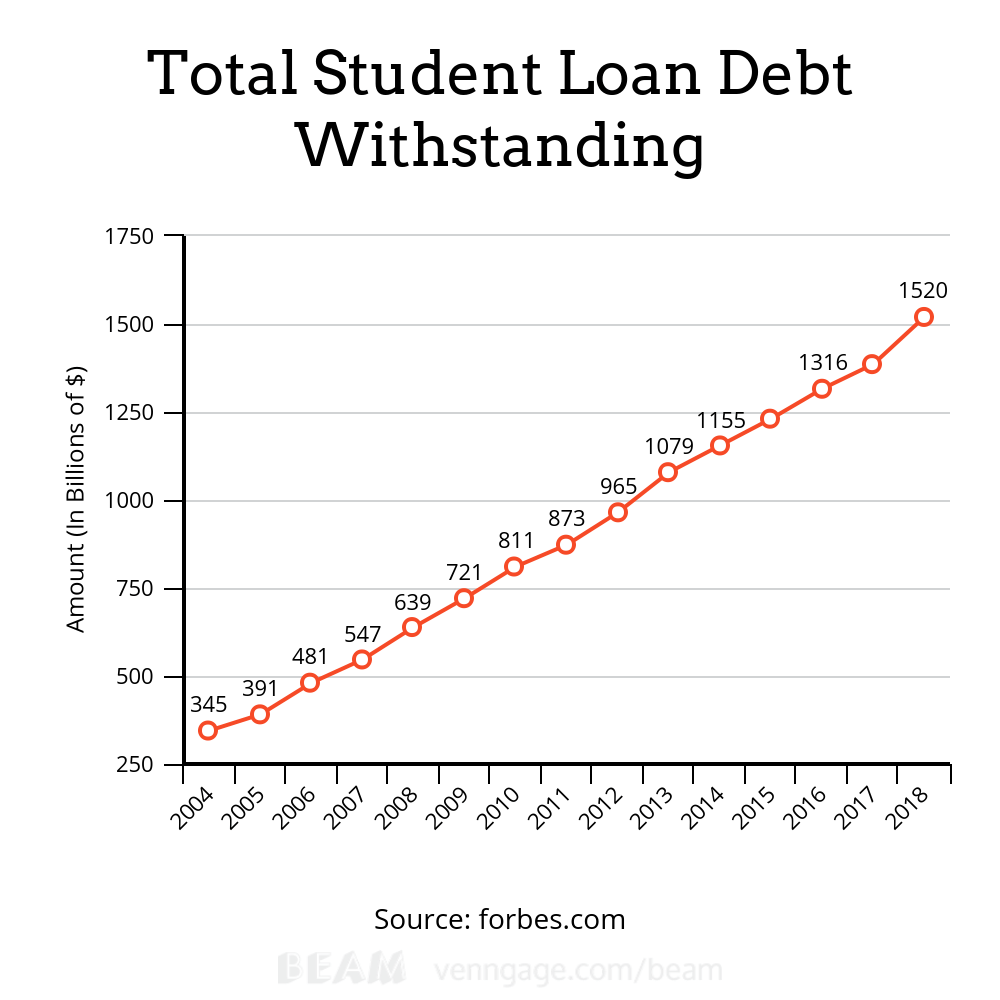

Government legislation has profoundly shaped the affordability of student loans over time. Initially, student loan programs were largely localized and lacked the standardization and federal backing seen today. The introduction of federal student loan programs, such as those under the Higher Education Act of 1965 and subsequent amendments, brought about greater accessibility and affordability through subsidized interest rates and loan guarantees. However, these policies have also contributed to the dramatic increase in student loan debt over the past few decades. The shift from primarily subsidized loans to a greater reliance on unsubsidized loans, for example, has increased the burden on borrowers.

Government Approaches to Student Loan Interest Rate Regulation

The federal government has employed various approaches to regulate student loan interest rates. Historically, interest rates were often fixed by legislation, providing borrowers with predictable repayment terms. However, more recent approaches have incorporated market-based mechanisms, such as tying interest rates to Treasury securities, leading to fluctuations in rates based on broader economic conditions. This approach introduces uncertainty for borrowers, as rates can rise or fall unexpectedly. A comparison of these approaches reveals that fixed rates offer greater predictability but potentially less responsiveness to market conditions, while market-based rates reflect prevailing economic circumstances but lack the stability of fixed rates.

Consequences of Government Intervention on Student Loan Debt Accumulation

Government intervention, or the lack thereof, significantly impacts student loan debt accumulation. Generous loan programs with low interest rates and flexible repayment options can lead to increased borrowing, as students may be more inclined to take out larger loans. Conversely, restrictive policies with high interest rates or limited loan amounts can deter borrowing and potentially reduce overall debt levels, but might also limit access to higher education. The expansion of federal loan programs, while increasing access, has undeniably contributed to the rise in student loan debt. Conversely, periods of reduced government involvement or stricter lending criteria have sometimes resulted in decreased borrowing, though this can also limit access to higher education for some individuals.

Key Government Policies and Their Effects on Student Loan Rates

The following bullet points illustrate the impact of specific government policies on student loan rates:

- Higher Education Act of 1965 and subsequent amendments: Established federal student loan programs, significantly increasing access to higher education but also contributing to the growth of student loan debt. These amendments introduced subsidized loans and loan guarantees, influencing rates directly.

- Shift from subsidized to unsubsidized loans: Increased the burden on borrowers by eliminating government interest subsidies, resulting in higher overall loan costs.

- Tying interest rates to Treasury securities: Introduced variability into student loan interest rates, creating uncertainty for borrowers and potentially increasing costs depending on market conditions.

- Income-Driven Repayment (IDR) plans: While not directly impacting interest rates, IDR plans influence affordability by lowering monthly payments, potentially leading to increased borrowing in the long run, although the overall debt burden remains unchanged.

- Loan forgiveness programs: While not affecting interest rates, these programs offer debt relief under specific circumstances, thereby indirectly impacting the cost of borrowing and the overall affordability of higher education. However, they often do not directly reduce student loan debt.

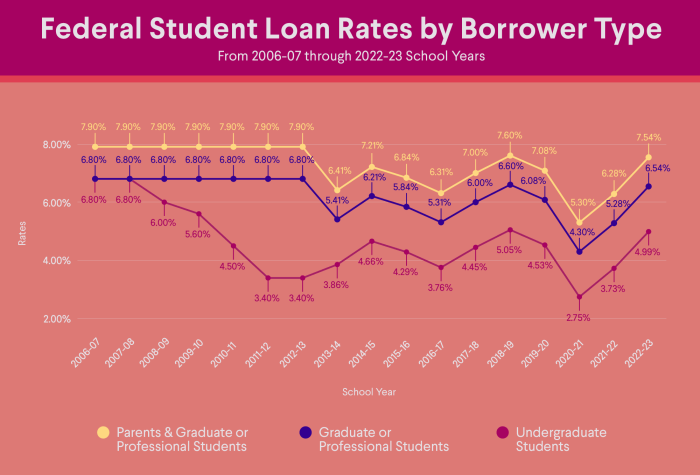

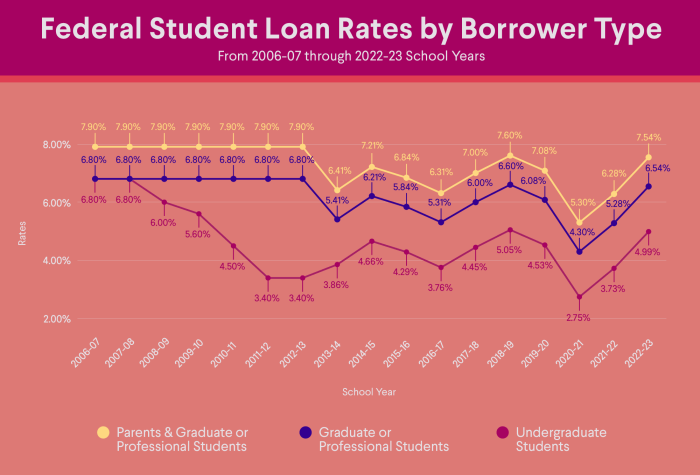

Visual Representation of Rate Changes

A visual representation of student loan interest rate trends over time offers a powerful way to understand the complexities of borrowing costs for higher education. By charting these rates, we can readily identify periods of significant change and appreciate the overall pattern of fluctuation. This allows for a deeper understanding of the factors influencing these rates and their ultimate impact on students.

A line graph is the most effective way to display the historical trajectory of student loan interest rates. The horizontal axis (x-axis) would represent time, typically spanning several decades to capture the long-term trend. Each point along this axis would correspond to a specific year or period. The vertical axis (y-axis) would represent the interest rate, expressed as a percentage. The line itself would connect the data points, illustrating the changes in interest rates over time.

Line Graph Depiction of Student Loan Interest Rate Fluctuations

The graph would reveal a dynamic picture, not a simple upward or downward trend. Initially, the line might show relatively stable rates, perhaps with minor fluctuations reflecting broader economic conditions. However, at certain points, the line would exhibit more dramatic shifts. For example, periods of economic recession or expansion would likely be marked by corresponding changes in the interest rate, with economic downturns often leading to lower rates and periods of strong economic growth sometimes resulting in higher rates. Furthermore, the introduction of new government policies or changes to existing loan programs could cause noticeable shifts in the trajectory of the line, indicating the influence of regulatory interventions on borrowing costs. Significant policy changes might be marked with annotations on the graph for clarity. The overall effect would be a visual narrative of the interplay between economic factors, government policy, and the resulting cost of student loans. The visual would powerfully illustrate how these rates have not remained constant, but rather have responded to a variety of external pressures. This visual representation serves as a compelling summary of the historical context surrounding student loan interest rates.

Final Wrap-Up

The journey through student loan interest rate history reveals a dynamic relationship between economic forces, government policy, and the cost of higher education. While rates have fluctuated significantly over time, understanding these trends and their underlying causes empowers individuals to make more informed choices about financing their education. By recognizing the historical patterns and the influence of various factors, borrowers can better navigate the complexities of student loan debt and plan for a more secure financial future.

FAQ Summary

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while the student is enrolled at least half-time, while unsubsidized loans accrue interest from the time the loan is disbursed.

How does my credit score affect private student loan rates?

A higher credit score generally results in lower interest rates on private student loans, as lenders perceive you as a lower risk.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing can potentially lower your interest rate, but it often involves consolidating multiple loans into a single new loan with a different lender. Be sure to compare offers carefully.

What is the impact of loan forgiveness programs on student loan rates?

Loan forgiveness programs don’t directly impact interest rates but can reduce the overall amount of debt owed, making the repayment process more manageable.