Securing student loans often hinges on more than just good grades and a promising future; strong references play a crucial role in the application process. This guide delves into the world of student loan references, exploring the different types available, their relative importance, and strategies for obtaining and crafting compelling letters of support. We’ll cover everything from identifying suitable references to addressing potential challenges, ensuring you have the best possible chance of loan approval.

Understanding the nuances of reference letters can significantly impact your loan application. From personal testimonials to professional endorsements, each type carries a different weight with lenders. This guide will provide a clear framework for navigating this essential aspect of the student loan journey, equipping you with the knowledge and tools to succeed.

Types of Student Loan References

Securing a student loan often involves providing references to bolster your application. Lenders use these references to assess your credibility and likelihood of repaying the loan. Different types of references carry varying degrees of weight, depending on the information they provide and the relationship the referee has with the applicant. Understanding these nuances is crucial for a successful loan application.

Student loan references can broadly be categorized into personal, professional, and academic references. Each type offers a unique perspective on your character, financial responsibility, and academic standing. The information provided by each reference type is carefully considered by lenders to determine the applicant’s overall risk profile.

Personal References

Personal references typically come from individuals who have known you for an extended period and can attest to your character and reliability. These references should ideally be individuals who can vouch for your responsible financial behavior, such as consistent bill payments or responsible budgeting habits. They should be able to speak to your trustworthiness and your commitment to fulfilling your obligations. While not as heavily weighted as professional references, strong personal references demonstrate a level of personal responsibility that lenders value. A weak or non-existent personal reference section can raise concerns about the applicant’s character and commitment.

Professional References

Professional references, from employers or supervisors, provide insight into your work ethic, stability, and earning potential. This type of reference is often given more weight by lenders, as it directly addresses your ability to repay the loan through consistent employment and income. The information included should detail your job title, length of employment, salary, and a statement about your reliability and work performance. A positive professional reference from a stable employer significantly strengthens a loan application, demonstrating a capacity for consistent income generation.

Academic References

Academic references, usually from professors or academic advisors, are particularly relevant for students still pursuing their education or recent graduates. These references focus on your academic performance, dedication to studies, and overall potential. The information should include your GPA, attendance record, and the referee’s assessment of your academic capabilities and commitment. While not directly addressing repayment capacity like professional references, strong academic references demonstrate a commitment to long-term goals, which indirectly contributes to a positive perception of your creditworthiness.

| Type | Information Included | Credibility | Example |

|---|---|---|---|

| Personal Reference | Character, reliability, responsible financial behavior, length of acquaintance | Moderate | “I have known John for 10 years and can attest to his responsible nature. He consistently manages his finances well.” |

| Professional Reference | Job title, length of employment, salary, work ethic, reliability | High | “Jane has worked at Acme Corp for 5 years as a Software Engineer, earning $80,000 annually. She is a reliable and dedicated employee.” |

| Academic Reference | GPA, attendance record, academic performance, commitment to studies | Moderate to High (depending on the applicant’s stage of education) | “Sarah consistently demonstrated high academic achievement in my advanced mathematics course, maintaining a 4.0 GPA and active class participation.” |

Importance of Strong References

Strong references are crucial for a successful student loan application. Lenders rely heavily on these references to assess your credibility and likelihood of repaying the loan. They provide an independent perspective on your character, financial responsibility, and overall suitability for borrowing. A strong reference can significantly increase your chances of approval, while a weak one can severely hinder your application.

Your references act as a form of validation for the information you’ve provided in your application. They offer lenders a degree of assurance that you are a responsible individual who will honor your financial commitments. A lender is far more likely to approve a loan for an applicant who has demonstrably strong references than one who does not.

Positive Impacts of Strong References on Loan Approval

Strong references can positively influence a lender’s decision in several ways. For instance, a reference who can attest to your consistent employment history, responsible financial management, and strong academic performance significantly strengthens your application. A positive reference letter detailing these attributes can sway a lender’s opinion in your favor, especially if your credit history is limited or less than perfect. Conversely, a reference who speaks highly of your character and commitment to meeting obligations provides a reassuring endorsement that adds weight to your application. A strong reference can even help negotiate better loan terms, such as a lower interest rate or more favorable repayment schedule. Imagine a scenario where two applicants have similar credit scores and academic backgrounds, but one has several strong references while the other does not; the applicant with strong references is significantly more likely to secure loan approval.

Consequences of Weak or Unreliable References

Conversely, weak or unreliable references can significantly damage your chances of securing a student loan. If your references are unable to verify your information, are hesitant to endorse your application, or provide negative feedback, it can lead to immediate rejection or a significant delay in the loan approval process. A lender might interpret this as a lack of trustworthiness or a potential risk, leading them to decline your application altogether. Furthermore, providing false or misleading information through your references can have serious consequences, potentially leading to legal repercussions. For example, if a reference provides inaccurate information to support your application and the lender discovers this, it could result in the loan being revoked and legal action taken against both the applicant and the reference.

Qualities of a Strong Reference

Choosing the right references is critical. A strong reference should possess several key qualities. They should be individuals who know you well, ideally for several years, and can attest to your character and financial responsibility.

A strong reference should be able to provide specific examples to support their statements. Vague statements about your “good character” are less convincing than concrete examples of your responsible behavior, such as consistently paying bills on time or managing a budget effectively. The reference should also be someone who is readily available to communicate with the lender and provide prompt responses to any inquiries. Finally, a strong reference should have a professional demeanor and maintain a positive and confident tone in their recommendation. They should convey a clear sense of your reliability and suitability for a student loan.

Finding and Selecting Appropriate References

Securing strong references is crucial for a successful student loan application. Lenders often view references as a validation of your character, responsibility, and ability to manage financial obligations. The selection process requires careful consideration and strategic planning to ensure your references effectively represent your capabilities and commitment.

Choosing the right references involves more than simply picking people you know. The most effective references are those who can speak convincingly to your character, financial responsibility, and ability to meet your commitments. Different types of relationships offer different perspectives and levels of insight, each carrying its own weight in the lender’s evaluation.

Strategies for Finding Suitable References

Identifying potential references requires a proactive approach. Begin by considering individuals who have observed your reliability and financial management skills over an extended period. This could include previous employers, professors, academic advisors, or even long-term mentors. Think about individuals who can attest to your consistent work ethic, responsible behavior, and ability to meet deadlines. Networking within your professional and academic circles can also uncover suitable candidates. Reach out to individuals you’ve worked closely with, explaining your need for a reference and highlighting the specific qualities they can vouch for.

Comparing Reference Selection Approaches Based on Relationship

Selecting references based on your relationship with them requires careful consideration of the perspective each person offers. A former employer can speak to your work ethic and reliability, while a professor might highlight your academic capabilities and dedication. A long-term mentor could provide a broader perspective on your character and overall development. Each relationship provides a unique lens through which your suitability for a loan can be viewed. It’s beneficial to diversify your references to present a well-rounded picture of your capabilities. Avoid solely relying on close family members, as their perspective might be viewed as less objective by lenders.

Step-by-Step Guide for Requesting References

A thoughtful and timely approach to requesting references significantly increases the likelihood of a positive response. Begin by compiling a list of potential references, considering their familiarity with your character and financial history. Next, contact each individual via email or phone, providing them with sufficient advance notice. Clearly explain the purpose of the reference, emphasizing the importance of their support to your application. Provide them with all necessary information, including deadlines, contact details, and a brief summary of your qualifications. Finally, express your gratitude for their time and consideration.

Communicating Applicant Qualifications and Needs to References

Effectively communicating your qualifications and needs is crucial to securing strong references. Provide your references with a comprehensive overview of your academic and professional achievements, highlighting relevant skills and experiences. Include a copy of your resume or curriculum vitae, along with a brief personal statement emphasizing your goals and commitment to repaying the loan. Clearly articulate your financial situation, including your current income, expenses, and the purpose of the loan. Emphasize your understanding of the loan terms and your commitment to meeting your repayment obligations. Offering your references the necessary information empowers them to provide a comprehensive and supportive reference.

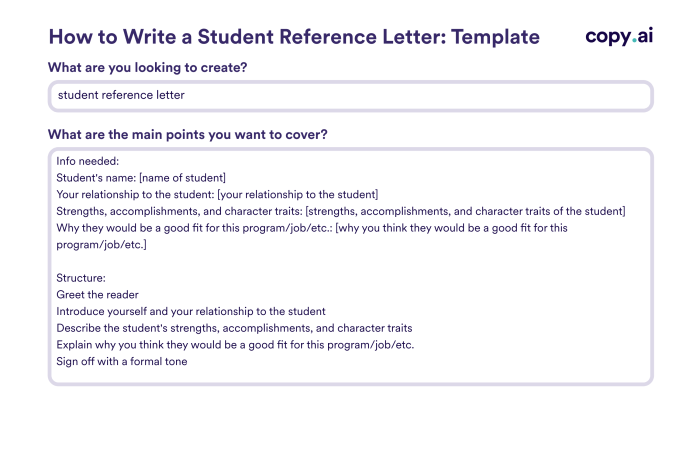

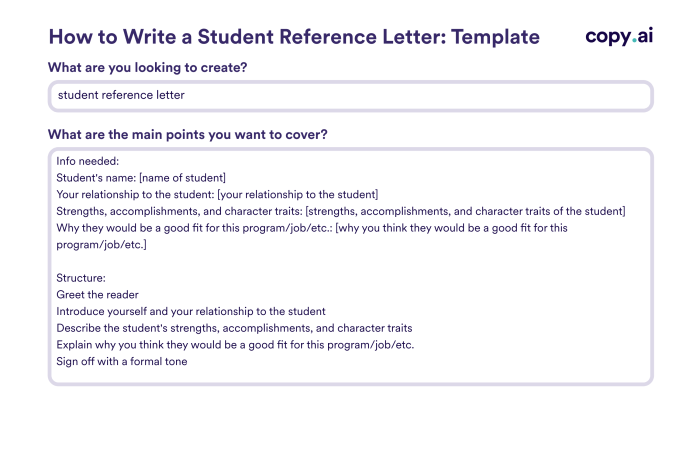

Crafting Effective Reference Letters

A well-crafted reference letter can significantly impact a student’s chances of securing a student loan. Lenders rely on these letters to gauge the applicant’s character, responsibility, and potential for repayment. A strong letter provides concrete evidence supporting the applicant’s suitability, while a weak letter can leave the lender with unanswered questions and concerns.

Effective reference letters go beyond generic statements of support. They offer specific examples and quantifiable achievements to demonstrate the applicant’s capabilities. They also tailor their content to the specific lender and loan program, highlighting aspects most relevant to the lender’s assessment criteria.

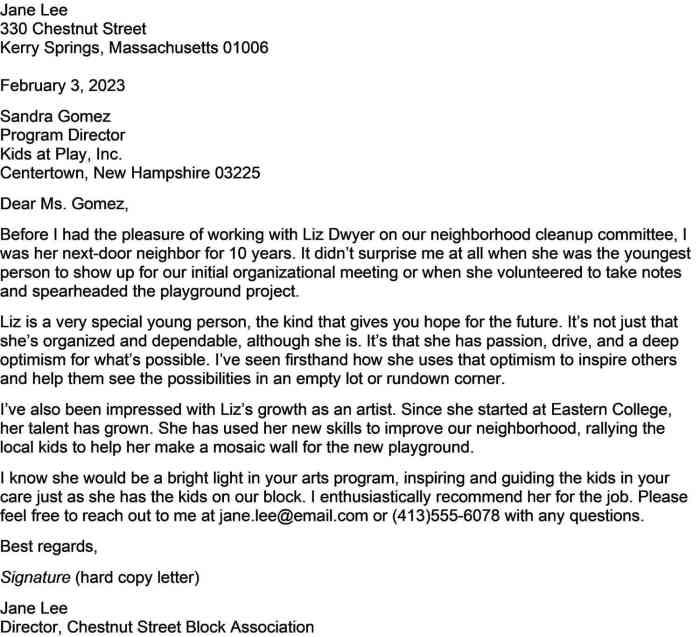

Examples of Effective and Ineffective Reference Letters

An effective reference letter might detail a student’s consistent academic performance, highlighting a GPA above 3.8 and specific achievements like dean’s list recognition or participation in relevant academic competitions. It might also mention the student’s strong work ethic, illustrated by holding a part-time job while maintaining excellent grades and extracurricular involvement. Conversely, an ineffective letter might simply state, “I recommend [student’s name] for this loan,” without providing any concrete evidence to support the recommendation. It might lack specific examples, quantifiable achievements, or relevant details about the applicant’s character and financial responsibility.

Key Components of a Strong Reference Letter

A strong student loan reference letter includes several key components. Firstly, it should clearly identify the recommender’s relationship with the applicant and the length of time they have known them. This establishes credibility and context for the assessment. Secondly, it should provide specific examples of the applicant’s responsible behavior and financial management skills. For instance, it could mention successful completion of a large project demonstrating organizational skills, or consistent timely repayment of personal loans. Quantifiable achievements are crucial; instead of stating “good work ethic,” the letter might say, “Consistently exceeded expectations in their part-time role at [Company Name], receiving a promotion after only six months.” Finally, the letter should explicitly state the recommender’s confidence in the applicant’s ability to repay the loan. This direct endorsement strengthens the application.

Tailoring the Reference Letter to the Specific Lender and Loan Program

Tailoring the letter is vital. Different lenders have different priorities. Some might focus heavily on academic performance, while others might prioritize work experience and financial responsibility. The reference letter should address these priorities directly. For example, if applying for a loan specifically designed for students pursuing STEM fields, the letter should emphasize relevant academic achievements and skills in those areas. Similarly, if the loan requires a demonstration of financial responsibility, the letter should provide specific examples showcasing the applicant’s budgeting and debt management capabilities.

Template for a Strong Student Loan Reference Letter

A strong reference letter typically follows a structured format.

Introduction: Begin by clearly stating your name, title, relationship to the applicant, and the duration of your acquaintance. Confirm you are writing in support of their student loan application.

Body Paragraphs (2-3): Provide specific examples illustrating the applicant’s:

- Academic performance (GPA, awards, relevant coursework)

- Work ethic and professional experience (responsibilities, achievements, promotions)

- Financial responsibility (budgeting skills, debt management, savings habits)

- Character and reliability (punctuality, commitment, problem-solving skills)

Conclusion: Reiterate your strong recommendation, emphasizing your confidence in the applicant’s ability to repay the loan. Offer contact information for verification. This final statement reinforces your support and provides a clear and concise summary of your assessment.

Addressing Potential Challenges with References

Securing strong references is crucial for a successful student loan application. However, the process isn’t always smooth. Applicants frequently encounter obstacles that can hinder their application. Understanding these challenges and developing proactive strategies to overcome them is essential for a positive outcome.

Applicants often face difficulties in obtaining references due to various factors, including the unavailability or reluctance of potential referees. Busy schedules, personal commitments, or a lack of familiarity with the student loan application process can lead to potential referees declining requests. Furthermore, a referee’s inability or unwillingness to provide a positive recommendation can also significantly impact the application. These situations necessitate careful planning and alternative strategies to ensure a successful application.

Unavailable or Reluctant References

Dealing with unavailable or reluctant references requires a proactive and understanding approach. Begin by selecting a broad pool of potential references well in advance of the application deadline. This allows sufficient time to contact them, explain the requirements, and address any concerns. When contacting potential referees, clearly Artikel the requirements of the reference letter, providing them with ample time to complete it without feeling rushed. A personalized email or phone call expressing the importance of their support can be more effective than a generic request. If a potential referee is unavailable or reluctant, politely thank them for their time and consider reaching out to another individual on your list. Persistence and clear communication are key to overcoming this challenge.

Handling Negative or Neutral Recommendations

Receiving a negative or neutral recommendation can be disheartening, but it’s important to approach the situation strategically. It’s unlikely a referee will explicitly provide a negative recommendation, but a lukewarm letter can be just as detrimental. Before requesting a reference, carefully consider the referee’s knowledge of your academic performance and personal qualities. If you’re unsure about a referee’s potential to write a strong letter, it’s best to select someone else. If a letter is received that isn’t strongly positive, you might consider requesting additional references to balance the less-than-stellar recommendation. This demonstrates your commitment to securing a comprehensive assessment of your capabilities. However, it is important to remember that honesty is key; do not attempt to pressure a referee into providing a positive recommendation if they cannot honestly do so.

Alternative Solutions for Reference Difficulties

Difficulties in obtaining sufficient references are not insurmountable. Several alternative solutions can be explored:

The following options can be considered if you face difficulties in securing the required references:

- Contacting Previous Employers: If you have relevant work experience, previous employers can offer valuable insight into your work ethic and responsibility.

- Seeking References from Professors or Mentors: Professors or mentors who have observed your academic abilities and character can provide strong academic references.

- Utilizing Academic Advisors: Academic advisors are familiar with your academic progress and can offer valuable perspectives.

- Providing Additional Supporting Documentation: Supplementing your application with strong transcripts, essays, or portfolios can compensate for a lack of references in certain situations.

- Explaining the Situation to the Lender: In some cases, honestly explaining the situation to the lender and providing alternative supporting documents may be sufficient.

Illustrative Examples of Reference Letters

Reference letters play a crucial role in the student loan application process, providing lenders with valuable insights into the applicant’s character, academic performance, and overall suitability for a loan. The quality of these letters significantly impacts the lender’s decision. Below are three scenarios illustrating the varying effectiveness of reference letters.

Scenario 1: Strong Reference for a High-Achieving Student

This scenario features Sarah, a highly motivated computer science student with a consistently strong academic record. Her reference is Professor Davis, her advisor, who has known her for two years.

Professor Davis’s letter highlights Sarah’s exceptional academic abilities, her dedication to her studies, and her proactive approach to problem-solving. The letter specifically mentions Sarah’s consistent A grades in challenging courses, her active participation in relevant student clubs, and her leadership role in a university-sponsored software development project. Professor Davis also emphasizes Sarah’s strong work ethic and her responsible approach to managing her time and finances. The letter concludes with a strong recommendation, stating unequivocally that Sarah is a highly responsible individual and an excellent candidate for a student loan.

“Sarah consistently demonstrates exceptional academic ability and a remarkable work ethic. Her dedication to her studies and her leadership in the university’s software development project showcase her commitment and responsibility. I have no hesitation in recommending her for a student loan.”

Positive Aspects: Specific examples of Sarah’s achievements, detailed description of her character, and a clear and confident recommendation.

Negative Aspects: None readily apparent; this is a strong and effective reference letter.

Scenario 2: Weak Reference Due to Lack of Specificity

This scenario involves Michael, a student applying for a loan to fund his studies in marketing. His reference is Mr. Jones, his former employer at a local retail store.

Mr. Jones’s letter is brief and lacks specific details. While he states that Michael is a “good worker” and a “nice person,” he provides no concrete examples to support these claims. The letter fails to mention Michael’s academic performance or any relevant skills that might demonstrate his ability to manage a student loan responsibly. The overall tone is vague and unconvincing.

“Michael worked for me at [Store Name] for a year. He was a good worker and a nice person. I think he’ll do well.”

Positive Aspects: The letter is concise and positive in its overall sentiment.

Negative Aspects: Lack of specific examples, vague language, absence of information about academic performance or financial responsibility, and a weak overall recommendation.

Scenario 3: Reference Letter Showing Potential Conflicts of Interest

This scenario involves Emily, a student applying for a loan to finance her art studies. Her reference is her mother, who is also her primary financial supporter.

Emily’s mother’s letter expresses strong support for Emily’s application, but it lacks objectivity. The letter focuses heavily on Emily’s artistic talent and passion, neglecting to address her financial responsibility or academic performance. Moreover, the close familial relationship raises concerns about potential bias and lack of impartiality. The letter doesn’t offer any concrete examples of Emily’s ability to manage finances or her commitment to completing her studies.

“Emily is a wonderfully talented artist, and I am so proud of her. She deserves this loan to pursue her dreams. She works very hard at her art.”

Positive Aspects: The letter demonstrates strong emotional support for the applicant.

Negative Aspects: Lack of objectivity, absence of specific details regarding academic performance or financial responsibility, and a clear conflict of interest due to the close familial relationship, raising concerns about the letter’s credibility. The language is overly emotional and lacks concrete evidence.

Final Conclusion

Successfully navigating the student loan application process requires careful attention to detail, and securing strong references is paramount. By understanding the various types of references, their relative importance, and the strategies for obtaining and crafting compelling letters, you can significantly increase your chances of approval. Remember, a well-chosen and effectively communicated reference can speak volumes about your character and potential, making a lasting impression on lenders. This guide provides the foundation for building a strong support network to bolster your loan application.

Commonly Asked Questions

What if a potential reference is unavailable?

Explore alternative options such as professors, supervisors from previous jobs, or community leaders who can attest to your character and abilities.

How long should a reference letter be?

Aim for a concise yet comprehensive letter, typically one to two pages. Focus on specific examples and quantifiable achievements.

Can I use a family member as a reference?

While possible, lenders generally prefer professional or academic references. Family references may be considered less objective.

What if a reference is hesitant to write a strong letter?

Respectfully inquire about their concerns. If they cannot provide a positive recommendation, it’s best to seek an alternative reference.