Navigating the world of student loan refinancing can feel overwhelming, especially when considering fixed interest rates. Understanding the nuances of fixed-rate refinancing is crucial for borrowers seeking to manage their debt effectively and potentially save money over the life of their loan. This guide explores the factors influencing these rates, compares lender offers, and provides strategies to help you secure the best possible terms.

From assessing your creditworthiness and understanding the impact of loan amounts and repayment terms to comparing lenders and negotiating rates, we’ll equip you with the knowledge to make informed decisions. We’ll also delve into potential risks and offer a step-by-step guide to ensure a smooth refinancing process. Ultimately, our goal is to empower you to confidently navigate this important financial decision.

Understanding Student Loan Refinancing

Student loan refinancing is the process of replacing your existing student loans with a new loan from a different lender, often at a lower interest rate. This can potentially save you money on interest payments over the life of your loan. The process involves applying with a new lender, providing documentation of your income and existing loans, and undergoing a credit check. Once approved, your new lender will pay off your existing loans, and you’ll begin making payments on your new, refinanced loan.

The Process of Student Loan Refinancing

The refinancing process typically begins with comparing offers from multiple lenders. You’ll need to gather your financial information, including your credit score, income, and details of your existing student loans. Each lender will have its own application process, which usually involves submitting documentation and undergoing a credit check. Upon approval, the lender will pay off your existing loans and you’ll start making payments on the new loan. The entire process can take several weeks, depending on the lender and the complexity of your financial situation.

Benefits and Drawbacks of Refinancing Student Loans

Refinancing can offer significant advantages, primarily lower interest rates leading to reduced monthly payments and overall interest paid. It can also simplify repayment by consolidating multiple loans into a single monthly payment. However, refinancing also carries risks. You might lose benefits associated with federal student loans, such as income-driven repayment plans and loan forgiveness programs. Furthermore, a lower interest rate may not always materialize, and if your credit score worsens after refinancing, you could end up with less favorable terms.

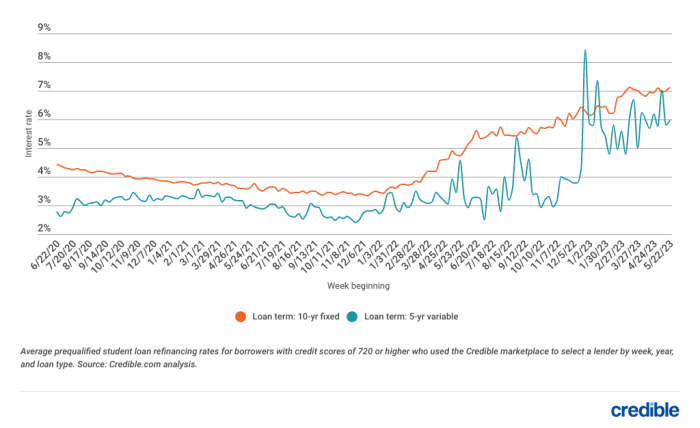

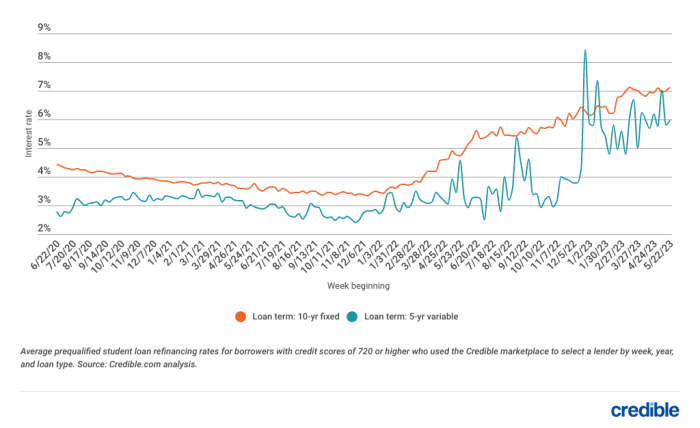

Fixed-Rate vs. Variable-Rate Refinancing

Fixed-rate refinancing offers predictable monthly payments because the interest rate remains constant throughout the loan term. This provides stability and allows for better budgeting. Variable-rate refinancing, on the other hand, has an interest rate that fluctuates based on market conditions. While initially, the rate might be lower than a fixed rate, it can increase significantly, leading to unpredictable and potentially higher monthly payments over time. Choosing between fixed and variable depends on your risk tolerance and financial goals. A fixed rate offers more certainty, while a variable rate might offer lower initial payments but comes with greater risk.

Situations Where Refinancing is Beneficial

Refinancing can be particularly advantageous for borrowers with good credit scores and stable income who are seeking to lower their interest rates. For example, someone with a high credit score who initially took out student loans at a high interest rate during a period of economic uncertainty could significantly benefit from refinancing to a lower rate. Another example would be someone with multiple student loans wanting to consolidate them into one manageable monthly payment. However, it’s crucial to assess the potential loss of federal loan benefits before proceeding.

Comparison of Lenders’ Fixed Rates for Student Loan Refinancing

| Lender | Fixed Rate Range (APR) | Minimum Credit Score | Loan Term Options |

|---|---|---|---|

| Lender A | 5.00% – 7.50% | 680 | 5, 10, 15 years |

| Lender B | 4.50% – 8.00% | 660 | 3, 5, 7 years |

| Lender C | 5.50% – 9.00% | 700 | 10, 15, 20 years |

| Lender D | 4.00% – 7.00% | 720 | 5, 10 years |

*Note: These rates are hypothetical examples and may not reflect current market conditions. Always check with individual lenders for the most up-to-date information.*

Factors Affecting Fixed Rates

Securing a favorable fixed interest rate on your student loan refinance is crucial for minimizing your overall borrowing costs. Several interconnected factors influence the rate you’ll receive, and understanding these factors empowers you to make informed decisions and potentially negotiate a better deal. Let’s explore the key elements that lenders consider when determining your fixed refinance rate.

Credit Score Impact on Interest Rates

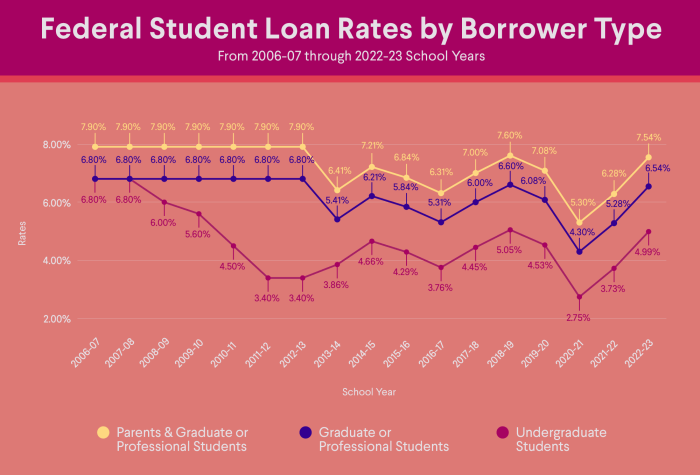

Your credit score is arguably the most significant factor determining your refinance rate. Lenders view a higher credit score as an indicator of lower risk. A higher score (generally above 700) typically translates to a lower interest rate because lenders perceive you as a more reliable borrower less likely to default on your loan. Conversely, a lower credit score indicates a higher risk of default, leading to a higher interest rate to compensate the lender for that increased risk. For example, a borrower with a credit score of 750 might qualify for a rate of 6%, while a borrower with a 650 score might receive a rate closer to 8% or higher, depending on other factors. Improving your credit score before applying for refinancing is a proactive step towards securing a better rate.

Loan Amount and Repayment Term’s Influence

The amount you’re refinancing and the repayment term you choose also play a role in shaping your fixed rate. Generally, larger loan amounts can sometimes result in slightly higher interest rates due to the increased risk for the lender. Similarly, longer repayment terms (e.g., 20 years versus 10 years) might also lead to a higher rate, as the lender is exposed to risk for a more extended period. Conversely, shorter repayment terms often come with lower interest rates as the lender’s risk is reduced. For instance, refinancing a $50,000 loan over 10 years might yield a lower rate than refinancing the same amount over 20 years.

Co-signers’ Effect on Fixed Rates

Adding a co-signer with excellent credit can significantly improve your chances of securing a lower fixed rate. A co-signer essentially shares the responsibility for repayment. Their strong credit history mitigates the lender’s risk, allowing them to offer a more favorable interest rate. The lender considers the co-signer’s creditworthiness alongside the borrower’s, effectively averaging the risk. A borrower with a less-than-perfect credit score might see their rate drop considerably by including a co-signer with an excellent credit history. However, it’s important to note that the co-signer remains financially responsible for the loan even if the borrower defaults.

Controllable Factors for Lower Rates

Several factors are within your control and can positively influence your refinance rate. Improving your credit score is paramount. This involves paying bills on time, keeping credit utilization low, and avoiding opening new accounts unnecessarily. Additionally, carefully selecting a repayment term that balances affordability with a lower interest rate is crucial. Shop around and compare offers from multiple lenders, as rates can vary considerably. Finally, if possible, consider adding a co-signer with a strong credit history to further reduce your risk profile and potentially secure a more favorable interest rate.

Comparing Lenders and Their Offers

Choosing the right student loan refinance lender is crucial for securing the best possible interest rate and repayment terms. This section will compare the fixed-rate offerings of three major lenders, highlighting key differences to aid in your decision-making process. Remember that rates and terms are subject to change, so always verify directly with the lender before making any decisions.

Direct comparison of lenders allows borrowers to identify the most advantageous option based on their individual financial situations and loan needs. Analyzing APRs, fees, and other associated costs is vital for determining the overall cost of the loan and optimizing potential savings.

Lender Offer Comparison

The following table compares the fixed-rate offerings of three hypothetical lenders – Lender A, Lender B, and Lender C. Note: These are illustrative examples and do not represent actual offers from specific lenders. Always check current rates and terms directly with the lenders.

| Lender | APR (Example: 6.5%) | Origination Fee (Example: 1%) | Prepayment Penalty | Other Fees |

|---|---|---|---|---|

| Lender A | 6.5% | 1% of loan amount | None | None |

| Lender B | 7.0% | 0% | Yes (1% of remaining balance) | Late payment fee ($25) |

| Lender C | 6.8% | 0.5% of loan amount | None | Annual servicing fee ($50) |

Potential Savings Examples

Let’s assume a $30,000 loan with a 10-year repayment term. The total cost of the loan, including interest and fees, will vary significantly across lenders.

For example, with Lender A (6.5% APR and 1% origination fee), the total cost might be approximately $39,000, while Lender B (7.0% APR, no origination fee, but a prepayment penalty) might cost around $40,500 if paid in full within the 10-year term, and Lender C (6.8% APR and 0.5% origination fee, plus an annual fee) might cost approximately $39,750. These are illustrative examples and actual costs will depend on the precise terms and repayment schedule.

Calculating Total Loan Cost

The total cost of a loan is calculated by summing the principal loan amount, total interest paid, and all applicable fees. A simple formula is not sufficient to accurately capture all potential costs, particularly those related to prepayment penalties or variable fees.

Total Loan Cost = Principal + Total Interest Paid + All Fees

To determine the total interest paid, you need to consider the loan’s amortization schedule, which details the principal and interest components of each payment over the loan’s life. Many online calculators are available to help you determine this based on the specific loan terms offered by the lender.

Refinancing Strategies and Considerations

Securing the most favorable fixed interest rate for your student loan refinancing requires a strategic approach. This involves careful planning, diligent research, and a proactive engagement with lenders. Understanding various strategies and considerations will empower you to make informed decisions and potentially save thousands of dollars over the life of your loans.

Strategies for Finding the Best Fixed Rate

Finding the best fixed rate involves a multi-pronged approach. First, you need to improve your credit score as much as possible before applying. A higher credit score typically translates to lower interest rates. Secondly, actively compare offers from multiple lenders. Don’t rely on just one lender’s quote; shop around to find the most competitive rates. Finally, consider the total cost of the loan, not just the interest rate. Factors like fees and prepayment penalties can significantly impact the overall cost.

The Importance of Comparing Multiple Offers

Comparing multiple offers from different lenders is crucial for securing the best possible interest rate. Each lender uses its own proprietary algorithms and risk assessment models, leading to variations in interest rate offers. By comparing at least three to five offers, you can identify the lender offering the lowest interest rate and the most favorable terms. This process is analogous to shopping for a car or any other significant purchase; you wouldn’t buy the first car you see without checking other options.

Implications of Choosing a Longer or Shorter Repayment Term

The length of your repayment term significantly impacts your monthly payment and the total interest paid. A shorter term means higher monthly payments but less interest paid overall. Conversely, a longer term results in lower monthly payments but significantly higher total interest paid. For example, a $50,000 loan at 6% interest over 10 years will have much higher monthly payments than the same loan over 20 years, but the total interest paid over 20 years will be substantially greater. Choosing the right term involves balancing affordability with long-term cost efficiency.

Negotiating a Lower Interest Rate

While it may not always be possible, negotiating a lower interest rate is a viable strategy. This often involves highlighting your strong credit history, high income, or a substantial down payment. You can also leverage competing offers from other lenders to negotiate a better deal. For instance, if Lender A offers a 6% rate, and Lender B offers 5.5%, you can present Lender A with Lender B’s offer as leverage to potentially secure a lower rate. Remember to be polite but firm during negotiations.

A Step-by-Step Guide to Student Loan Refinancing

The student loan refinancing process can be broken down into manageable steps. First, check your credit report and score. Next, gather your financial documents, including pay stubs and tax returns. Third, compare offers from multiple lenders. Fourth, choose a lender and complete the application process. Fifth, review the loan documents carefully before signing. Finally, monitor your loan account regularly to ensure accurate payments and account activity. Following these steps ensures a smooth and efficient refinancing experience.

Potential Risks and Precautions

Refinancing student loans can offer significant benefits, such as lower interest rates and monthly payments. However, it’s crucial to carefully weigh the potential risks before making a decision. Understanding these risks and taking appropriate precautions can help you avoid negative consequences and ensure a smooth refinancing process.

Refinancing involves replacing your existing student loans with a new loan from a different lender, often with different terms and conditions. This process carries inherent risks that need careful consideration. Failing to fully understand these risks could lead to financial hardship.

Understanding Loan Agreement Terms

The loan agreement is a legally binding contract outlining all the terms and conditions of your refinanced loan. Carefully reviewing this document is paramount. Pay close attention to the interest rate (both fixed and variable if applicable), repayment terms (loan duration, payment schedule), fees (origination fees, prepayment penalties), and any other stipulations. Understanding these details will help you make an informed decision and avoid unexpected costs or difficulties down the line. For example, a seemingly small difference in interest rate over the life of the loan can significantly impact the total amount you pay. Similarly, prepayment penalties can make it costly to pay off the loan early.

Consequences of Default

Defaulting on a refinanced student loan has serious repercussions. Unlike federal student loans, which offer various protections and repayment plans, private refinanced loans generally don’t. Defaulting can severely damage your credit score, making it difficult to obtain future loans, credit cards, or even rent an apartment. It can also lead to wage garnishment, bank levy, and collection agency involvement, making your financial situation considerably worse. In some cases, default may result in legal action.

Situations Where Refinancing May Not Be Ideal

Refinancing isn’t always the best solution. For instance, if you have federal student loans with income-driven repayment plans or loan forgiveness programs, refinancing might forfeit these benefits. Refinancing federal loans into private loans eliminates the protections offered by federal programs. Also, if your credit score is low, you might not qualify for favorable interest rates, negating the potential benefits of refinancing. Furthermore, if you anticipate needing to defer or forbear your payments in the near future due to unforeseen circumstances, refinancing might not be advisable.

Checklist Before Refinancing

Before proceeding with refinancing, it’s essential to follow a structured approach. This checklist can help ensure you’re making an informed and responsible decision.

- Check your credit score: A higher credit score typically qualifies you for better interest rates.

- Compare lenders and their offers: Shop around to find the best terms and interest rates.

- Review loan agreement carefully: Understand all terms, fees, and conditions before signing.

- Assess your financial situation: Ensure you can comfortably afford the new monthly payments.

- Consider potential risks: Weigh the benefits against the potential downsides of refinancing.

- Explore alternative options: Consider income-driven repayment plans or other federal loan programs before refinancing federal loans.

Illustrative Examples

Understanding the benefits and potential drawbacks of student loan refinancing requires examining real-world scenarios. The following examples illustrate situations where refinancing proves advantageous and others where it may not be the best course of action.

Successful Refinancing Example

Consider Sarah, a recent graduate with $50,000 in federal student loans carrying an average interest rate of 6.8%. Facing high monthly payments, she researched refinancing options and found a lender offering a fixed rate of 4.5%. By refinancing, Sarah reduced her monthly payment by approximately $150, saving her thousands of dollars in interest over the life of the loan. Her improved credit score since graduation also contributed to her securing a lower interest rate. The reduced monthly payment allowed her to allocate more funds towards other financial goals, such as saving for a down payment on a house. This example highlights how refinancing can significantly improve a borrower’s financial situation, provided they qualify for a lower interest rate.

Unsuccessful Refinancing Example

Conversely, consider Mark, who also holds $50,000 in federal student loans, but his average interest rate is only 4%. He is considering refinancing to consolidate his loans, but the best offer he can find is a fixed rate of 4.2%. The slight reduction in interest rate is not significant enough to outweigh the potential drawbacks. Furthermore, Mark’s loans include federal protections like income-driven repayment plans, which he would lose if he refinanced with a private lender. Given the marginal interest rate improvement and the loss of federal protections, refinancing in Mark’s situation would likely be financially disadvantageous.

Visual Representation of Interest Paid Over Time

Imagine a bar graph. The horizontal axis represents the loan repayment period (e.g., in years). The vertical axis represents the total interest paid. Two bars are displayed for each year: one representing the interest paid on the original loan (6.8% in Sarah’s case) and another representing the interest paid on the refinanced loan (4.5% in Sarah’s case). The bars representing the original loan would be consistently taller than those representing the refinanced loan throughout the repayment period, visually demonstrating the significant interest savings achieved through refinancing. The difference in height between the bars would gradually decrease over time as the principal balance is reduced, but the refinanced loan’s bar would always remain shorter, clearly illustrating the cumulative interest savings. The total area under each set of bars would represent the total interest paid over the life of each loan, with the refinanced loan having a substantially smaller area.

Final Summary

Refinancing your student loans with a fixed rate offers a path towards potentially lower monthly payments and reduced overall interest costs. However, careful planning and research are essential. By understanding the factors that influence rates, comparing lender offers thoroughly, and considering potential risks, you can make an informed decision that aligns with your financial goals. Remember to shop around, compare terms, and don’t hesitate to negotiate for the best possible deal. Taking a proactive approach to refinancing can lead to significant long-term financial benefits.

FAQ Insights

What is the difference between fixed and variable interest rates for student loan refinancing?

Fixed rates remain consistent throughout the loan term, providing predictable monthly payments. Variable rates fluctuate based on market conditions, potentially leading to unpredictable payments.

How long does the student loan refinance process typically take?

The process can vary, but generally takes several weeks from application to loan disbursement. Factors like lender processing times and required documentation can affect the timeline.

Can I refinance federal student loans?

Yes, but refinancing federal loans means losing federal protections like income-driven repayment plans and potential forgiveness programs. Carefully weigh the pros and cons before refinancing federal debt.

What happens if I default on a refinanced student loan?

Defaulting on a refinanced student loan can severely damage your credit score, potentially leading to wage garnishment, lawsuits, and difficulty obtaining future loans.

What is APR and why is it important?

APR (Annual Percentage Rate) represents the total cost of borrowing, including interest and fees. Comparing APRs from different lenders allows for a more accurate comparison of loan costs.