Navigating the complex landscape of student loan repayment can feel daunting, but understanding your options is the first step towards financial freedom. This guide unravels the intricacies of various repayment plans, offering clear explanations and practical strategies to manage your debt effectively. We’ll explore everything from income-driven repayment options to loan forgiveness programs, empowering you to make informed decisions about your financial future.

From choosing the right repayment plan to budgeting effectively and avoiding common pitfalls, we aim to provide a holistic understanding of the student loan repayment journey. We’ll also delve into the long-term implications of student loan debt on major life decisions and offer resources to help you navigate challenges and achieve your financial goals.

Understanding Student Loan Repayment Plans

Navigating the complexities of student loan repayment can feel overwhelming. Choosing the right repayment plan is crucial for managing your debt effectively and minimizing long-term costs. This section Artikels the various repayment plans available, highlighting their key features and helping you make an informed decision.

Types of Student Loan Repayment Plans

The U.S. Department of Education offers several repayment plans designed to cater to different financial situations and repayment preferences. Understanding the nuances of each plan is key to selecting the best option for your circumstances. These plans generally fall into a few categories, including Income-Driven Repayment (IDR) plans, Standard Repayment, and Graduated Repayment.

Income-Driven Repayment (IDR) Plans

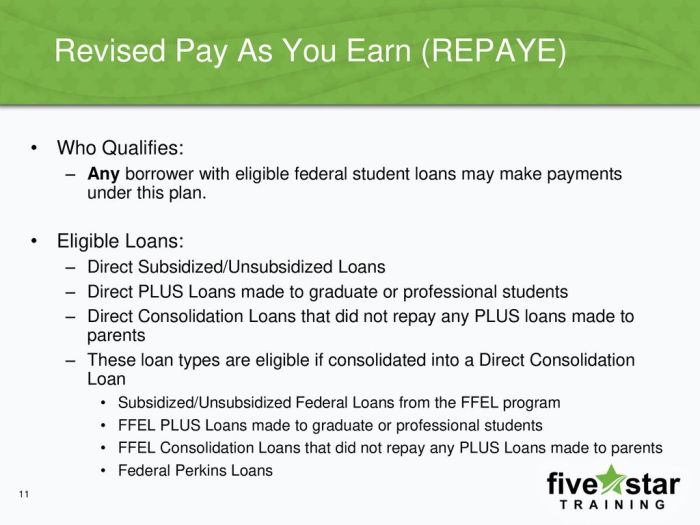

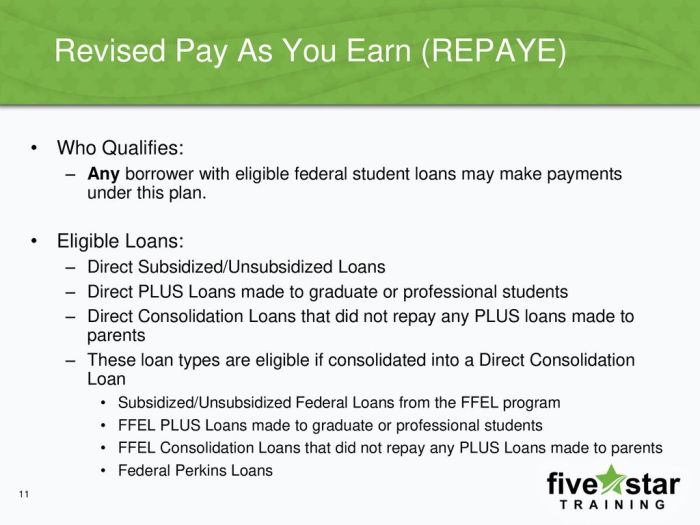

IDR plans base your monthly payment on your income and family size. This means that during periods of lower income, your payments will be lower, offering flexibility and potentially preventing delinquency. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Each plan has slightly different eligibility requirements and payment calculation formulas. A significant advantage is the potential for loan forgiveness after a set number of qualifying payments (typically 20 or 25 years), though the forgiven amount may be considered taxable income. However, the extended repayment period often leads to higher overall interest payments compared to other plans.

Standard Repayment Plan

This plan offers fixed monthly payments over a 10-year period. It’s a straightforward option with predictable payments, making budgeting easier. The advantage is that you’ll pay off your loans faster than with IDR plans, minimizing the total interest paid. However, the fixed monthly payments can be challenging if your income is unstable or low. There is no loan forgiveness option with this plan.

Graduated Repayment Plan

The graduated repayment plan starts with lower monthly payments that gradually increase over time. This can be beneficial in the early years after graduation when income is typically lower. The payments increase annually, typically by a fixed percentage, until the loan is repaid. Like the standard plan, there’s no loan forgiveness; however, the lower initial payments can ease the financial burden in the early stages of repayment. While offering some flexibility, the increasing payments can become burdensome later in the repayment period.

Comparison of Repayment Plans

The following table summarizes the key features of four common repayment plans:

| Plan Name | Monthly Payment Calculation | Loan Forgiveness Eligibility | Total Repayment Time |

|---|---|---|---|

| Standard Repayment | Fixed amount over 10 years | No | 10 years |

| Graduated Repayment | Starts low, increases annually | No | 10 years |

| Income-Based Repayment (IBR) | Based on income and family size | Yes (after 20 or 25 years) | 20 or 25 years |

| Pay As You Earn (PAYE) | Based on income and family size | Yes (after 20 years) | 20 years |

Navigating the Repayment Process

Successfully managing your student loan repayment requires a proactive approach and a clear understanding of the process. This section will guide you through the key steps involved in repayment, from enrollment to maintaining consistent payments. Failing to understand these steps can lead to significant financial consequences.

Enrolling in a Student Loan Repayment Plan

The enrollment process typically begins after you leave school. Your loan servicer will contact you with information about your loans and available repayment plans. You’ll need to select a plan that best fits your budget and financial circumstances. This often involves logging into your servicer’s online portal, reviewing your loan details, and choosing a repayment plan from the options provided. You’ll likely need to provide some personal information and possibly confirm your employment status to determine your eligibility for certain plans. Once you’ve selected a plan, you’ll need to confirm your choice and agree to the terms and conditions. Following these steps will ensure you are officially enrolled and making progress towards paying off your student loans.

Understanding Your Loan Servicer

Your loan servicer is the company responsible for managing your student loans. They handle billing, payment processing, and communication regarding your account. It is crucial to understand who your servicer is and how to contact them. Their contact information, including phone numbers, email addresses, and mailing addresses, should be readily available on their website or on your loan documents. Regularly checking your account online through your servicer’s portal is also recommended. Keeping accurate records of your servicer’s contact details is vital for prompt communication and efficient resolution of any issues that may arise. For example, if you experience a billing error or need to change your payment method, having the correct contact information readily available will facilitate a smooth resolution.

Making On-Time Payments and Consequences of Late or Missed Payments

Making on-time payments is paramount to avoiding negative consequences. Late or missed payments can result in penalties, such as late fees and increased interest accrual. These fees can significantly increase the total amount you owe over time. Additionally, repeated late payments can negatively impact your credit score, making it more difficult to obtain loans or credit cards in the future. Some loan programs may even consider your payment history when determining your eligibility for income-driven repayment plans. To avoid these issues, set up automatic payments through your bank or your loan servicer’s website. This ensures consistent, timely payments and reduces the risk of missed deadlines. Maintaining a detailed payment record is also beneficial for tracking your progress and identifying any potential discrepancies.

Common Mistakes to Avoid During Repayment

It’s important to be aware of common pitfalls to avoid during the repayment process.

- Ignoring your loan servicer’s communications.

- Failing to understand your repayment plan terms and conditions.

- Not tracking your payments and loan balance regularly.

- Missing payments or making late payments.

- Not exploring different repayment plan options to find the most suitable one.

- Failing to update your contact information with your loan servicer.

Avoiding these mistakes will help ensure a smoother and more efficient repayment journey.

Managing Student Loan Debt

Successfully navigating student loan repayment requires a proactive and organized approach to personal finance. Effective budgeting and financial literacy are crucial tools for managing debt and achieving long-term financial well-being. This section will explore practical strategies and resources to help you effectively manage your student loan debt.

Effective budgeting is the cornerstone of successful student loan repayment. It involves creating a detailed plan that tracks your income and expenses, allowing you to identify areas where you can save money and allocate funds towards your loan payments. This process not only helps you meet your loan obligations but also builds a foundation for future financial stability.

Budgeting Strategies and Tools

Creating a budget involves carefully tracking your income and expenses. Start by listing all your sources of income, including your salary, any part-time jobs, or other income streams. Then, meticulously list all your expenses, categorizing them into necessities (rent, utilities, groceries) and discretionary spending (entertainment, dining out). Many free budgeting apps and spreadsheets can simplify this process. For example, Mint and Personal Capital offer comprehensive tracking features, providing insights into your spending habits and suggesting areas for potential savings. Using a simple spreadsheet program like Microsoft Excel or Google Sheets allows for customized budget creation and tracking. These tools can help visualize your financial situation and make informed decisions about your spending. Consider the 50/30/20 budgeting rule: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

Resources for Borrowers Facing Repayment Challenges

Borrowers struggling with student loan repayment have access to several resources. The National Foundation for Credit Counseling (NFCC) offers free and low-cost credit counseling services, helping individuals create personalized debt management plans. They can also negotiate with lenders on your behalf to potentially reduce your monthly payments or interest rates. Your loan servicer is another valuable resource; they can provide information about repayment plans, deferments, and forbearances. The Federal Student Aid website (studentaid.gov) offers a wealth of information on repayment options, financial literacy resources, and tools to manage your student loans effectively. Finally, many non-profit organizations and community centers offer free financial literacy workshops and counseling sessions to help individuals manage their debt.

Financial Literacy and Debt Management

Financial literacy plays a pivotal role in successful debt management. Understanding basic financial concepts, such as budgeting, saving, investing, and credit management, empowers you to make informed decisions about your finances. Developing strong financial literacy skills enables you to create a realistic budget, track your spending, and prioritize debt repayment effectively. It also helps you avoid accumulating further debt and build a strong financial foundation for the future. Resources such as online courses, books, and workshops can significantly improve your financial literacy and equip you with the knowledge and skills needed to manage your student loan debt effectively and build a secure financial future. For example, Khan Academy offers free online courses on personal finance, covering topics such as budgeting, saving, investing, and debt management.

Loan Forgiveness and Cancellation Programs

Navigating student loan repayment can be complex, but understanding the available forgiveness and cancellation programs is crucial for many borrowers. These programs offer the potential to significantly reduce or eliminate student loan debt under specific circumstances. This section will Artikel several key programs, their eligibility requirements, and application processes.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program is designed to forgive the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a government or non-profit organization. This program offers a significant opportunity for individuals dedicated to public service to alleviate their student loan burden.

Eligibility for PSLF requires employment by a qualifying government or 501(c)(3) non-profit organization, making 120 qualifying monthly payments under an income-driven repayment plan (IDR), and having Direct Loans. The application process involves completing an Employment Certification form annually, which your employer must certify, and submitting it through the PSLF website. Successfully completing the process can lead to the complete forgiveness of your remaining federal student loan debt.

Teacher Loan Forgiveness Program

The Teacher Loan Forgiveness program offers forgiveness of up to $17,500 on federal student loans for teachers who meet specific requirements. This program incentivizes individuals to pursue careers in education, a field often facing staffing challenges.

To be eligible, teachers must have taught full-time for at least five consecutive academic years in a low-income school or educational service agency. They must also hold a bachelor’s degree or higher and meet other requirements related to loan type and repayment status. The application process involves completing a form and submitting it to the Federal Student Aid website, along with supporting documentation, such as employment verification. Successful applicants can see a substantial reduction in their student loan debt.

Income-Driven Repayment (IDR) Plans and Forgiveness

While not a standalone forgiveness program, Income-Driven Repayment (IDR) plans can lead to loan forgiveness after a set period of time (typically 20 or 25 years). These plans calculate your monthly payment based on your income and family size, making payments more manageable. After the forgiveness period, any remaining loan balance may be forgiven.

Eligibility for IDR plans depends on your loan type and income. The application process involves selecting an IDR plan through the Federal Student Aid website and providing necessary income information. The potential benefit is lower monthly payments and eventual loan forgiveness, though this often comes after a significant period of repayment.

Comparison of Loan Forgiveness Programs

| Program | Eligibility Criteria | Application Process | Potential Benefits |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | 120 qualifying payments under an IDR plan while working full-time for a government or non-profit organization; Direct Loans | Annual Employment Certification form submission via the PSLF website | Complete forgiveness of remaining federal student loan debt |

| Teacher Loan Forgiveness | 5 consecutive years of full-time teaching at a low-income school or educational service agency; Bachelor’s degree or higher; qualifying loan type | Form submission to Federal Student Aid website with supporting documentation | Forgiveness of up to $17,500 in federal student loan debt |

| Income-Driven Repayment (IDR) Plans (leading to forgiveness) | Qualifying loan type; income-based payment calculation | Selecting an IDR plan through the Federal Student Aid website and providing income information | Lower monthly payments and eventual forgiveness of remaining balance after 20 or 25 years |

The Impact of Student Loan Debt on Personal Finance

Student loan debt can significantly impact various aspects of personal finance, extending far beyond the monthly payment. The weight of this debt can influence major life decisions, long-term financial stability, and even mental well-being. Understanding these effects is crucial for effective financial planning and mitigation strategies.

Long-Term Effects on Major Life Decisions

High student loan debt can delay or prevent major life milestones. For example, the substantial monthly payments can reduce the amount available for a down payment on a home, potentially delaying homeownership for years. Similarly, the financial burden can make starting a family more challenging, affecting decisions about childcare, education, and overall lifestyle choices. Investing, crucial for long-term wealth building, often takes a backseat as borrowers prioritize debt repayment. A person with $50,000 in student loan debt at a 6% interest rate might find that their monthly payments significantly reduce the amount they can contribute to retirement savings or other investments. This delay in investing can compound over time, resulting in a lower net worth in retirement compared to someone with less or no student loan debt.

The Impact of Student Loan Debt on Credit Scores

Student loan debt, while a form of credit, can significantly impact credit scores if not managed properly. Consistent on-time payments positively influence credit scores. However, missed or late payments can severely damage credit scores, making it harder to secure loans, credit cards, or even rent an apartment in the future. High levels of debt relative to income (high debt-to-income ratio) also negatively impact credit scores. For instance, a borrower consistently making minimum payments on a large student loan balance might see their credit score negatively affected, even if they’re making payments on time. This could translate to higher interest rates on future loans, exacerbating the financial burden.

The Psychological Impact of Significant Student Loan Debt

The stress and anxiety associated with significant student loan debt are substantial. The constant pressure of repayment can lead to feelings of overwhelm, hopelessness, and even depression. This psychological burden can affect relationships, work performance, and overall quality of life. Many borrowers report feeling trapped by their debt, limiting their career choices or lifestyle decisions due to the financial constraints. The psychological impact is often overlooked, yet it’s a critical component of the overall burden of student loan debt. Financial counseling and stress-management techniques can be beneficial in addressing this aspect.

Mitigating the Negative Impacts of Student Loan Debt

Several strategies can help mitigate the negative impacts of student loan debt. Careful budgeting and financial planning are essential to manage monthly payments effectively. Exploring different repayment plans, such as income-driven repayment plans, can lower monthly payments and potentially extend the repayment period. Consolidating multiple loans into a single loan can simplify payments and potentially lower interest rates. Furthermore, actively seeking opportunities for loan forgiveness or cancellation programs, such as those available for public service workers or those who attended defrauded institutions, can significantly reduce or eliminate the debt. Finally, open communication with lenders regarding financial hardship can help borrowers avoid default and explore options for temporary payment reductions.

Visual Representation of Repayment Scenarios

Understanding how your student loan repayment will unfold is crucial for effective financial planning. Visual aids can significantly clarify the complexities of interest accrual and the impact of different repayment plans on your overall cost. This section provides descriptions of visual representations that illustrate these concepts.

Visualizing a typical repayment schedule involves charting the principal, interest, and total payment amounts over the loan’s lifespan. Imagine a line graph with time on the horizontal axis (in months or years) and the dollar amount on the vertical axis. Three lines would represent the principal paid (decreasing over time), the interest paid (initially high, then gradually decreasing), and the total payment (relatively consistent throughout the repayment period). The area between the total payment line and the principal paid line visually represents the total interest paid over the life of the loan. Early in the repayment period, a larger portion of the payment goes towards interest, while later, a larger portion goes towards the principal. This clearly demonstrates how interest accrual significantly increases the total cost of the loan beyond the initial principal amount. For example, a $30,000 loan with a 6% interest rate might cost $40,000 over 10 years due to accumulated interest, a difference vividly illustrated by the graph’s area.

Comparison of Repayment Plan Costs

A bar graph effectively compares the total cost of repayment under different repayment plans (e.g., Standard, Extended, Income-Driven). Each bar represents a repayment plan, with its height corresponding to the total amount paid over the loan’s lifetime. This allows for immediate visual comparison of the total cost under each plan. For instance, a bar graph could show that a Standard Repayment plan results in a total repayment of $40,000, while an Income-Driven Repayment plan might result in a total repayment of $50,000 over a longer period, but with lower monthly payments. However, the extended repayment period leads to higher total interest paid, as clearly demonstrated by the difference in bar heights. This visualization emphasizes the trade-offs between monthly payment amounts and the overall cost of the loan. The longer repayment periods often associated with income-driven plans result in higher total interest paid, despite lower monthly payments.

Final Summary

Successfully managing student loan debt requires proactive planning, financial literacy, and a clear understanding of available resources. By carefully considering your repayment options, budgeting effectively, and seeking assistance when needed, you can navigate this process confidently and pave the way for a secure financial future. Remember, taking control of your student loan repayment is an investment in your long-term well-being.

FAQ Section

What happens if I miss a student loan payment?

Missing payments can result in late fees, damage to your credit score, and potential loan default. Contact your loan servicer immediately if you anticipate difficulty making a payment to explore options like forbearance or deferment.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, it’s crucial to compare offers carefully and understand the terms before refinancing, as it may impact eligibility for certain forgiveness programs.

How do I consolidate my student loans?

Loan consolidation combines multiple federal student loans into a single loan, often simplifying repayment. This can streamline payments but may not always lower your interest rate.

What is the difference between forbearance and deferment?

Both temporarily suspend or reduce your payments. Forbearance is generally granted for temporary hardship, while deferment is often based on specific circumstances like returning to school or experiencing unemployment. Interest may still accrue during forbearance, unlike some deferment options.