Navigating the complexities of student loan repayment can feel overwhelming. This guide provides a practical approach to managing your debt effectively through the power of spreadsheets. We’ll explore various spreadsheet designs, essential formulas, and advanced features to help you gain a clear understanding of your repayment journey and make informed financial decisions.

From creating a simple amortization schedule to incorporating advanced features like loan forgiveness programs and inflation adjustments, we’ll cover everything you need to know to build a personalized student loan spreadsheet. This will empower you to visualize your repayment progress, compare different repayment plans, and ultimately, achieve financial freedom sooner.

Types of Student Loan Spreadsheets

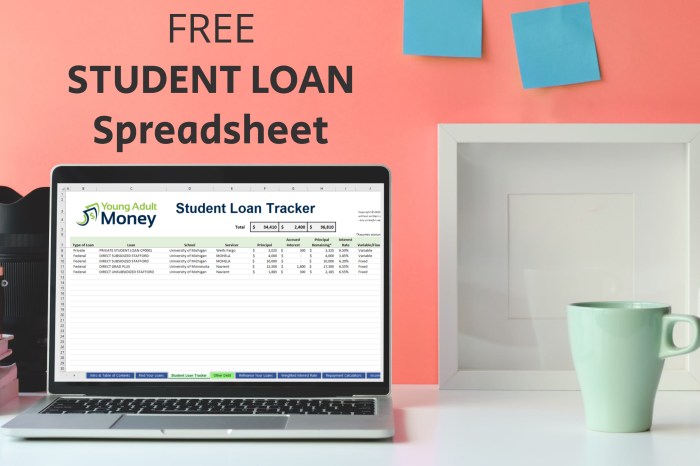

Student loan spreadsheets are invaluable tools for managing and tracking the repayment of student loan debt. Their design and functionality can vary significantly depending on individual needs and the complexity of the loan portfolio. Choosing the right type of spreadsheet can greatly simplify the repayment process and help borrowers stay organized and on track.

Different spreadsheet designs cater to specific needs, from tracking a single loan’s amortization to managing multiple loans with varying interest rates and repayment plans. The level of detail and the features included depend heavily on the user’s requirements and comfort level with spreadsheet software.

Simple Student Loan Amortization Spreadsheet

A basic amortization spreadsheet tracks the principal, interest, and remaining balance of a loan over time. This type of spreadsheet is ideal for those with a single student loan and a straightforward repayment plan. It helps visualize the repayment process and provides a clear picture of how much is owed at each point in time. The following table provides a simple example:

| Month | Payment | Principal | Interest | Remaining Balance |

|---|---|---|---|---|

| 1 | $200 | $150 | $50 | $9850 |

| 2 | $200 | $151 | $49 | $9700 |

| 3 | $200 | $152 | $48 | $9548 |

This table shows a simplified example. A full amortization schedule would extend over the entire loan term, showing the breakdown of each payment. The formulas used to calculate principal, interest, and remaining balance would be embedded within the spreadsheet.

Spreadsheet Designs for Various Loan Types

Spreadsheets can be customized to accommodate the complexities of various loan types, including federal and private loans, as well as subsidized and unsubsidized loans.

The key differences lie in how interest accrues and whether the government subsidizes interest payments during certain periods, such as while the borrower is in school or during a grace period. Tracking these differences accurately requires a spreadsheet with appropriate features.

- Federal Loans: These spreadsheets often include fields for tracking loan type (e.g., Stafford, Perkins, PLUS), interest rate, repayment plan (e.g., standard, graduated, income-driven), and forgiveness programs.

- Private Loans: These spreadsheets might incorporate features for tracking variable interest rates, different lenders, and potentially more complex repayment terms.

- Subsidized Loans: Spreadsheets for subsidized loans would need to account for periods where the government pays the interest, ensuring accurate calculation of the principal balance.

- Unsubsidized Loans: Spreadsheets for unsubsidized loans would reflect interest accrual throughout the loan’s life, regardless of the borrower’s enrollment status.

Single Loan vs. Multiple Loan Spreadsheets

The primary difference between spreadsheets designed for single versus multiple loans lies in their scalability and organization.

A single-loan spreadsheet is straightforward, focusing on a single loan’s amortization schedule. Managing multiple loans necessitates a more complex design to track different interest rates, repayment plans, and due dates effectively. The complexity increases significantly as the number of loans grows.

Spreadsheets for multiple loans often incorporate features such as: separate sections for each loan, summary tables showing total debt, and advanced filtering/sorting capabilities to organize and analyze the data efficiently. They might also include functions to calculate total monthly payments and visualize the overall repayment progress across all loans.

Key Features of a Student Loan Spreadsheet

A well-designed student loan spreadsheet is an invaluable tool for managing and tracking debt repayment. It provides a clear, organized overview of your loans, allowing for informed decision-making and proactive debt reduction strategies. Beyond simple data entry, a powerful spreadsheet incorporates key features and formulas to accurately reflect your financial reality and project future outcomes.

A robust student loan spreadsheet needs several key features to effectively manage your debt. Accurate calculations are paramount, and visual representations can significantly aid in understanding your progress and planning your repayment strategy.

Essential Formulas for Interest Calculation and Balance Updates

Accurate interest calculation is crucial for effective debt management. The spreadsheet should employ formulas that correctly compute accrued interest based on the loan’s interest rate, principal balance, and payment schedule. For simple interest calculations (less common for student loans), the formula is: Interest = Principal * Rate * Time. However, most student loans use compound interest, calculated more frequently (daily, monthly). For compound interest, a more complex formula, often implemented iteratively within a spreadsheet, is needed. This typically involves calculating the interest accrued for each period (e.g., month), adding it to the principal, and then using the new principal balance to calculate interest for the next period. A spreadsheet can easily handle this iterative process, providing a precise balance update for each payment period. For example, a cell might contain a formula like this (simplified illustration): =PreviousBalance + (PreviousBalance * MonthlyInterestRate) - PaymentAmount. This formula calculates the new balance after considering interest accrual and payment. The accuracy of these calculations directly impacts the reliability of repayment projections.

Tracking Payments, Extra Payments, and Interest Rate Changes

The spreadsheet must effectively track all payments made towards each loan. This includes scheduled payments and any extra payments applied to reduce the principal balance faster. Separate columns for each type of payment help maintain clarity and allow for easy analysis. Additionally, the spreadsheet should account for potential interest rate changes, a common occurrence with student loans. A dedicated column or section should track the current interest rate for each loan, allowing the spreadsheet to automatically recalculate interest based on these changes. This dynamic adjustment ensures the spreadsheet remains a current and reliable representation of the loan status. Failure to account for these changes can lead to inaccurate projections and ineffective repayment planning.

Visual Representations of Loan Repayment Progress

Visualizations significantly enhance the understanding and interpretation of loan repayment data. Several chart types are particularly effective in this context. A line chart can display the balance of each loan over time, clearly illustrating the progress of repayment. The X-axis represents time (months or years), and the Y-axis represents the outstanding loan balance. Multiple lines can represent different loans, allowing for a side-by-side comparison of repayment progress. A bar chart can effectively compare the initial loan amounts to the remaining balances, providing a visual representation of the proportion of debt already repaid. Furthermore, a pie chart can illustrate the distribution of debt across different loans, offering a quick overview of the relative size of each loan. These charts, integrated directly into the spreadsheet, provide a dynamic and intuitive way to monitor progress, identify areas needing attention, and track the overall effectiveness of the repayment strategy.

Creating a Student Loan Spreadsheet from Scratch

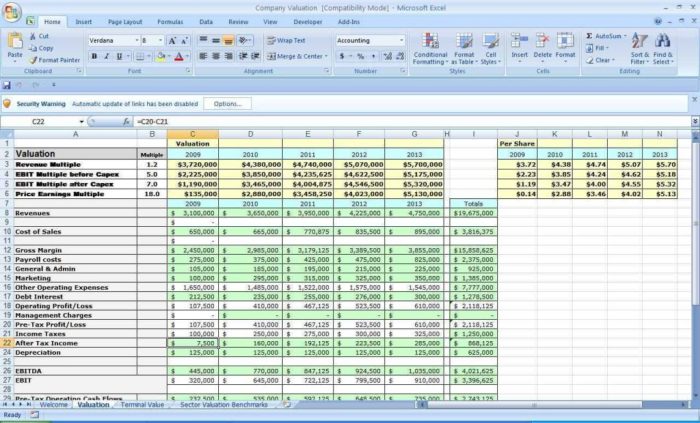

Building a student loan spreadsheet can significantly simplify the process of managing your debt. A well-designed spreadsheet allows you to track payments, visualize your progress, and explore different repayment strategies. This section provides a step-by-step guide to creating a basic student loan spreadsheet using a program like Google Sheets or Microsoft Excel.

Spreadsheet Setup and Data Entry

Begin by creating a new spreadsheet. The first row should contain headers for relevant information. Essential columns include: Loan Name, Lender, Original Loan Amount, Interest Rate (as a decimal, e.g., 0.05 for 5%), Loan Term (in months), Current Balance, Minimum Monthly Payment, Payment Due Date, and Payment Amount. Subsequent rows will represent each individual loan. Enter your loan details accurately into the corresponding columns. For example, if you have a loan from Sallie Mae for $10,000 with a 5% interest rate and a 10-year term, you’d enter “Sallie Mae” in the Loan Name column, 10000 in the Original Loan Amount column, 0.05 in the Interest Rate column, and 120 in the Loan Term column.

Calculating Interest and Remaining Balance

The next step involves calculating the monthly interest and remaining balance for each loan. This requires using spreadsheet formulas. For simplicity, we’ll assume a simple interest calculation (though more sophisticated methods exist). The monthly interest can be calculated using the formula: =Current Balance * Interest Rate / 12. The new balance after a payment is calculated as: =Current Balance + Monthly Interest - Payment Amount. These formulas should be entered into appropriate columns and then copied down to apply to all your loans.

Conditional Formatting for Visual Cues

Conditional formatting is a powerful tool for highlighting important data. For instance, you can highlight rows where the payment due date is within the next 7 days by selecting the Payment Due Date column, choosing “Conditional formatting,” and setting a rule based on the date. Similarly, you can highlight rows where the current balance is below a certain threshold, indicating progress towards paying off your loans. You can also use color-coding to visually represent the risk level of different loans based on interest rate. For example, loans with interest rates above a certain threshold might be highlighted in red.

Error Checks and Data Validation

Incorporating error checks helps prevent inaccuracies. One crucial check is to ensure that the sum of all minimum monthly payments does not exceed your available budget. You can easily perform this check using the SUM() function. Another valuable check involves verifying that the calculated remaining balance never exceeds the original loan amount, indicating a potential error in your formulas. Data validation can be used to prevent incorrect data entry, such as ensuring that interest rates are entered as decimals between 0 and 1.

Advanced Features and Customization

A basic student loan spreadsheet provides a valuable overview of your debt. However, incorporating advanced features significantly enhances its utility, allowing for more sophisticated analysis and personalized financial planning. This section explores ways to elevate your spreadsheet’s capabilities, providing a more comprehensive and accurate picture of your long-term repayment strategy.

Loan Forgiveness Program Tracking

This section details a method for incorporating loan forgiveness programs into your student loan repayment projections. Tracking these programs is crucial, as they can significantly reduce your overall debt burden and alter your repayment timeline. Within your spreadsheet, dedicate a section to list relevant forgiveness programs (e.g., Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness). For each program, include columns for eligibility criteria, required documentation, and the potential impact on your monthly payments and total repayment amount. You can then use formulas to dynamically adjust your repayment schedule based on the projected forgiveness amounts and timelines. For example, if you qualify for PSLF after 10 years of qualifying payments, a formula could calculate the remaining balance after forgiveness and recalculate the remaining repayment period. This provides a realistic picture of your repayment journey, factoring in potential benefits.

Inflation Adjustment in Long-Term Projections

Student loan repayment often spans many years. Failing to account for inflation can lead to inaccurate projections. Incorporating inflation adjustments into your spreadsheet ensures your projections reflect the changing value of money over time. You can achieve this by using a formula that applies an annual inflation rate to your projected future payments. For example, assuming a 3% annual inflation rate, you can use a formula like this: Future Payment = Current Payment * (1 + Inflation Rate)^Number of Years. This will provide a more realistic picture of your future payment amounts in today’s dollars, allowing for better financial planning. Consider using historical inflation data as a basis for your projections, or consult economic forecasts for a more informed estimate. Remember to clearly label your calculations and specify the inflation rate used for transparency and accuracy.

Comparison of Different Repayment Plans

Choosing the right repayment plan is critical for managing your student loans effectively. A powerful feature of your spreadsheet is the ability to compare different repayment plans side-by-side. This involves creating a table summarizing key characteristics of each plan.

| Repayment Plan | Monthly Payment | Repayment Period | Total Interest Paid | Forgiveness Eligibility |

|---|---|---|---|---|

| Standard Repayment | Fixed, higher monthly payment | 10 years | Potentially high | None |

| Graduated Repayment | Starts low, increases over time | 10 years | Potentially high | None |

| Income-Driven Repayment (IDR) | Based on income and family size | 20-25 years | Potentially high, but forgiveness possible | Potential for loan forgiveness after 20-25 years |

By populating this table with data specific to your loan amounts and interest rates, you can readily compare the financial implications of each plan, helping you make an informed decision that aligns with your financial situation and long-term goals. Remember that the actual figures will vary based on your individual loan details and income. Using formulas linked to your loan data will allow for dynamic updates as your circumstances change.

Data Visualization and Interpretation

Effectively visualizing your student loan data is crucial for understanding your repayment journey and making informed financial decisions. Visual representations can transform complex numerical data into easily digestible insights, allowing for a clearer picture of your loan’s trajectory and overall cost. This section will explore several visualization techniques and methods for interpreting the resulting data.

Data visualization helps to quickly identify trends and patterns within your loan repayment plan. For example, a simple bar chart can illustrate the proportion of your monthly payment allocated to principal versus interest, while a line graph can show how these proportions change over time. This allows you to easily see how your payments become increasingly more effective in reducing the principal balance as the loan matures.

Principal vs. Interest Payment Breakdown

A bar chart effectively displays the breakdown of principal and interest payments for each month or year of your repayment plan. Imagine a chart with the x-axis representing time (months or years) and the y-axis representing the dollar amount. Each bar would be split into two colored segments: one representing the principal payment and the other representing the interest payment. Initially, the interest segment would be significantly larger, gradually decreasing over time as the principal balance shrinks. Conversely, the principal segment would increase proportionally. This visual representation clearly showcases how the payment allocation shifts during the repayment period. A complementary line graph could plot the cumulative principal and interest paid over time, further emphasizing the changing proportions. This combined approach provides a comprehensive understanding of the repayment progress.

Total Loan Cost Across Different Repayment Scenarios

To represent the total cost of the loan under various repayment scenarios (e.g., standard, accelerated, income-driven), a table is highly effective. The table would list each repayment scenario as a row, with columns displaying the monthly payment amount, loan duration, and total cost (principal plus interest). This allows for a direct comparison of the financial implications of each scenario. For example, an accelerated repayment plan would show a higher monthly payment but a significantly lower total cost due to reduced interest accrual. A standard plan would have a lower monthly payment but a higher overall cost. An income-driven plan would show varying monthly payments based on income, resulting in a longer repayment period and potentially a higher total cost. By comparing these figures, you can choose the repayment option that best aligns with your financial goals and capabilities.

Total Interest Paid Over the Loan’s Lifetime

Several methods can effectively illustrate the total interest paid. A simple numerical value displayed prominently in your spreadsheet provides a clear and concise answer. However, to further emphasize the significance of this cost, you could also visualize it using a pie chart. The chart would consist of two segments: one representing the principal amount borrowed and the other representing the total interest paid. The relative sizes of these segments visually highlight the substantial proportion of the total repayment cost attributed to interest. Alternatively, a bar chart comparing the total interest paid across different repayment scenarios (as described above) can effectively illustrate the cost savings of accelerated repayment plans. This provides a clear and compelling visual representation of the financial benefits of different repayment strategies.

Last Recap

Mastering your student loan repayment doesn’t have to be a daunting task. By leveraging the power of a well-designed spreadsheet, you can gain valuable insights into your debt, optimize your repayment strategy, and ultimately, pave the way for a more secure financial future. Remember, proactive planning and informed decision-making are key to successfully managing your student loans.

Helpful Answers

What spreadsheet software is best for creating a student loan spreadsheet?

Both Microsoft Excel and Google Sheets are excellent choices, offering similar functionality and ease of use. The best option depends on your familiarity with the software and access to subscriptions.

How often should I update my student loan spreadsheet?

Ideally, update your spreadsheet after each payment to ensure accuracy. This allows for real-time tracking of your progress and helps you stay on top of your repayment plan.

Can I use a student loan spreadsheet to track multiple loans from different lenders?

Yes, many spreadsheet designs can accommodate multiple loans. You can either create separate sheets for each loan or consolidate them into a single sheet with clear distinctions for each lender and loan type.

What if my interest rate changes? How do I update the spreadsheet?

Most spreadsheets allow for easy updates to interest rates. Simply change the interest rate cell, and the spreadsheet will recalculate the remaining balance and future payments accordingly. Ensure your formulas are correctly referencing the interest rate cell.