Navigating the complex world of student loan debt is a significant challenge for millions. Student loan startups are emerging as innovative solutions, offering alternative repayment plans and technological advancements to alleviate the burden. This exploration delves into the multifaceted landscape of these businesses, examining their market position, financial models, technological integrations, regulatory considerations, and strategies for customer acquisition and retention. We’ll also consider their broader social impact and contribution to improved financial literacy.

The student loan market is a dynamic and rapidly evolving sector, characterized by both significant opportunities and considerable challenges. Understanding the intricacies of this space is crucial for both aspiring entrepreneurs and individuals seeking effective debt management solutions. This overview aims to provide a comprehensive understanding of the key aspects of student loan startups, from their business models and funding strategies to their regulatory compliance and social responsibility.

Market Analysis of the Student Loan Startup Landscape

The student loan refinancing market is a dynamic and rapidly evolving sector, presenting significant opportunities and challenges for startups. Driven by persistently high student debt levels and fluctuating interest rates, this market offers considerable potential for growth and innovation. Understanding the competitive landscape and employing effective marketing strategies are crucial for success in this space.

Current Size and Growth Trajectory of the Student Loan Refinancing Market

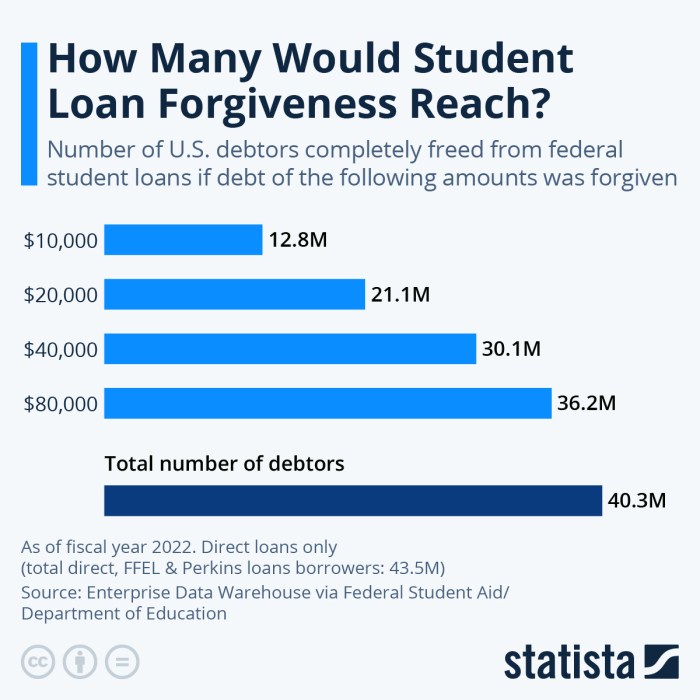

The student loan refinancing market has experienced substantial growth in recent years, fueled by increasing student loan debt and the desire among borrowers to secure lower interest rates. While precise figures fluctuate based on economic conditions and regulatory changes, market analysis reports consistently indicate a multi-billion dollar market with a projected continued expansion. Factors contributing to this growth include the increasing availability of online refinancing platforms, competitive interest rates offered by lenders, and a growing awareness among borrowers of the potential cost savings associated with refinancing. For example, credible market research firms like Statista and IBISWorld provide regular updates on market size and forecasts, offering valuable insights into the growth trajectory.

Key Competitors and Business Model Comparisons

Three prominent competitors in the student loan refinancing startup space are Earnest, SoFi, and CommonBond. Each employs a slightly different business model, focusing on various aspects of the borrower experience.

Earnest emphasizes a personalized approach, using sophisticated algorithms to assess creditworthiness and offer customized loan terms. Their business model centers on providing a streamlined and user-friendly online platform, coupled with strong customer service. SoFi, on the other hand, takes a more holistic approach, offering not only student loan refinancing but also other financial products and services, such as personal loans and investment accounts. This bundled approach aims to foster customer loyalty and increase revenue streams. CommonBond differentiates itself through its social impact mission, emphasizing its commitment to charitable giving and ethical lending practices. This resonates with borrowers who prioritize social responsibility alongside financial benefits.

Successful Marketing Strategies Employed by Student Loan Startups

Successful student loan startups have leveraged several effective marketing strategies to reach their target audiences. Content marketing, through blogs, educational resources, and social media engagement, plays a vital role in building brand awareness and establishing thought leadership. Targeted digital advertising campaigns on platforms like Google and social media networks are also crucial for driving traffic to refinancing applications. Furthermore, partnerships with universities, student organizations, and financial advisors expand reach and build credibility within the target demographic. For instance, SoFi’s extensive social media presence and content marketing efforts have been highly effective in attracting borrowers.

Comparison of Student Loan Repayment Plans Offered by Startups

The following table summarizes the strengths and weaknesses of different student loan repayment plans offered by various startups. Note that specific plan details can change; always consult the lender directly for the most up-to-date information.

| Startup Name | Repayment Plan Type | Key Features | Target Audience |

|---|---|---|---|

| Earnest | Fixed-rate, Variable-rate | Personalized rates, flexible repayment options, strong customer service | Borrowers with good to excellent credit |

| SoFi | Fixed-rate, Variable-rate | Competitive rates, additional financial services, strong community features | Borrowers seeking a comprehensive financial platform |

| CommonBond | Fixed-rate | Socially responsible lending, competitive rates, flexible repayment options | Borrowers who prioritize social impact |

Financial Models and Funding Strategies for Student Loan Startups

A successful student loan startup requires a robust financial model and a well-defined funding strategy. This involves projecting revenue streams, managing expenses, and securing sufficient capital to fuel growth and navigate potential challenges. Understanding the intricacies of these aspects is crucial for long-term sustainability and market competitiveness.

Hypothetical Financial Model for a Student Loan Startup

This model illustrates a simplified projection for a hypothetical student loan startup, focusing on key revenue and expense components. It’s important to note that actual figures will vary significantly based on market conditions, loan volume, and operational efficiency. Let’s assume our startup, “SmartLoans,” focuses on providing low-interest, income-share agreements (ISAs) to students.

| Year | Revenue (USD) | Expenses (USD) | Profit (USD) |

|---|---|---|---|

| 1 | 500,000 | 300,000 | 200,000 |

| 2 | 2,000,000 | 1,000,000 | 1,000,000 |

| 3 | 5,000,000 | 2,500,000 | 2,500,000 |

Revenue is projected based on the number of students enrolled in the ISA program and the average income share percentage. Expenses include technology infrastructure, marketing and sales, customer service, regulatory compliance, and administrative costs. Profitability is calculated as revenue minus expenses. This model assumes increasing market penetration and operational efficiency over time. These projections are estimations and would require further detailed financial modeling based on specific market research and operational plans.

Funding Options for Student Loan Startups

Securing funding is a critical step for any student loan startup. Several avenues exist, each with its own advantages and disadvantages.

Several funding options are available to student loan startups, each with its own set of considerations.

- Venture Capital: Venture capitalists invest significant capital in exchange for equity, providing substantial funding but also relinquishing a portion of ownership.

- Angel Investors: High-net-worth individuals invest in early-stage companies, offering smaller amounts of capital compared to venture capitalists but often providing valuable mentorship and industry connections.

- Crowdfunding: Platforms like Kickstarter or Indiegogo allow startups to raise funds from a large number of individuals, fostering community engagement but requiring a compelling marketing campaign to attract investors.

- Government Grants and Loans: Depending on the startup’s focus and social impact, government grants or subsidized loans can be secured, providing non-dilutive funding but usually requiring rigorous application processes.

- Debt Financing: Banks or other financial institutions may provide loans to startups, requiring repayment with interest but offering more control compared to equity financing.

Risks and Challenges in Securing Funding

The student loan market is competitive, and securing funding can be challenging. Startups face risks such as:

Several challenges can hinder a student loan startup’s ability to secure funding.

- High Regulatory Hurdles: The student loan industry is heavily regulated, requiring startups to navigate complex compliance requirements, which can be costly and time-consuming.

- Competition: Established players and new entrants create a competitive landscape, making it challenging to differentiate and attract investors.

- Economic Uncertainty: Economic downturns can negatively impact investor confidence, making it difficult to secure funding.

- Proof of Concept: Demonstrating a viable business model and a clear path to profitability is crucial for attracting investors, requiring robust market research and a strong management team.

Examples of Successful Fundraising Strategies

Several successful student loan startups have employed effective fundraising strategies. For example, companies focusing on innovative financing models, such as income-share agreements, have attracted significant investor interest due to their potential to disrupt the traditional student loan market. Strong emphasis on technology and data analytics, coupled with a clear value proposition for both students and investors, has also proven effective in securing funding. Building a strong network of mentors and advisors can also significantly increase a startup’s chances of attracting funding. Companies that successfully demonstrate a strong understanding of the regulatory environment and a commitment to ethical lending practices are more likely to gain the trust of investors.

Technological Innovations in the Student Loan Management Sector

The student loan industry is undergoing a significant transformation driven by technological advancements. Startups are leveraging innovative technologies to streamline processes, enhance customer experience, and improve risk management. This section explores key technological innovations shaping the future of student loan management.

Innovative Technologies Improving Efficiency and Customer Experience

Three prominent technologies currently employed by student loan startups to boost efficiency and customer satisfaction are AI-powered chatbots, personalized mobile applications, and blockchain technology for secure data management. AI-powered chatbots provide instant support, answering common queries and guiding users through the repayment process 24/7, reducing the burden on human customer service representatives. Personalized mobile applications offer tailored repayment plans, budgeting tools, and progress tracking, empowering borrowers with greater control and transparency. Blockchain technology ensures secure and transparent data management, enhancing the security and integrity of loan information, while simultaneously simplifying the verification process for lenders.

AI and Machine Learning Integration for Personalized Repayment and Risk Assessment

Integrating AI and machine learning into a student loan management platform offers significant advantages. AI algorithms can analyze vast datasets of borrower information—including income, expenses, credit history, and educational background—to create personalized repayment plans tailored to individual financial situations. This personalization improves borrower adherence and reduces the risk of default. Furthermore, machine learning models can assess risk more accurately than traditional methods, identifying potential defaulters early on and enabling proactive intervention strategies. For example, a system could flag borrowers exhibiting financial stress patterns based on spending habits and income fluctuations, allowing for early intervention such as offering debt consolidation options or counseling services.

Comparison of Technological Solutions for Automating Student Loan Repayment Processes

Several technological solutions exist for automating student loan repayment processes. Automated clearing house (ACH) transfers provide a seamless and efficient method for recurring payments. API integrations with banking platforms allow for automatic deductions from borrower accounts, eliminating manual payment entry. While ACH transfers are a reliable method for scheduled payments, API integrations offer a more comprehensive approach, enabling dynamic adjustments to repayment amounts based on income fluctuations or financial hardship. Both methods, however, rely on the borrower’s active participation and consistent banking information. A third option, employer-sponsored payroll deduction programs, removes the burden of manual payment from the borrower altogether, streamlining the process for both borrower and lender.

Technological Challenges Faced by Student Loan Startups and Proposed Solutions

Student loan startups face several technological challenges. Data security is paramount; robust cybersecurity measures, including encryption and multi-factor authentication, are crucial to protect sensitive borrower data from breaches. Maintaining compliance with evolving regulations necessitates the implementation of automated compliance monitoring systems. Scalability is also critical; cloud-based infrastructure can adapt to growing user bases and data volumes, preventing performance bottlenecks. Finally, the integration of disparate data sources, such as credit bureaus and educational institutions, requires the development of standardized APIs and data exchange protocols. Addressing these challenges proactively is vital for the success and sustainability of student loan startups.

Regulatory Compliance and Legal Considerations for Student Loan Startups

Navigating the complex regulatory landscape is crucial for the success and longevity of any student loan startup. Failure to comply with relevant laws and regulations can lead to significant financial penalties, reputational damage, and even legal action. This section Artikels key regulatory requirements and legal considerations specific to this sector.

Key Regulatory Requirements and Legal Considerations

Student loan startups must adhere to a multifaceted regulatory framework encompassing federal and state laws, as well as industry-specific guidelines. These regulations often cover areas such as licensing, consumer protection, data privacy, and debt collection practices. For example, the Truth in Lending Act (TILA) dictates specific disclosure requirements for loan terms, while the Fair Debt Collection Practices Act (FDCPA) strictly regulates how debt collectors interact with borrowers. State-level regulations may also impose additional licensing or operational requirements. Understanding and complying with these regulations is paramount to avoiding legal issues.

Implications of Privacy Laws on Data Handling

The handling of sensitive borrower data is subject to stringent privacy regulations, including the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in California. These laws grant individuals significant rights regarding their personal data, including the right to access, correct, and delete their information. Student loan startups must implement robust data security measures, obtain explicit consent for data processing, and establish clear procedures for handling data breaches. Failure to comply with these laws can result in substantial fines and legal repercussions. For instance, a data breach exposing sensitive borrower information could lead to significant financial losses and reputational damage, alongside legal action from affected individuals and regulatory bodies.

Potential Legal Risks Associated with Student Loan Servicing and Debt Collection

Student loan servicing and debt collection activities are particularly susceptible to legal risks. Improper servicing practices, such as inaccurate reporting to credit bureaus or failure to properly handle borrower inquiries, can lead to legal challenges. Similarly, aggressive or unlawful debt collection tactics can result in lawsuits and regulatory penalties. Startups must implement rigorous internal controls and training programs to ensure compliance with all applicable laws and regulations. This includes maintaining accurate records, providing clear and timely communication with borrowers, and adhering to strict protocols for debt collection activities. A real-life example would be a startup facing a class-action lawsuit for violating the FDCPA due to harassing phone calls to borrowers.

Essential Legal Documents for Operating a Student Loan Startup

Operating a student loan startup necessitates a comprehensive suite of legal documents. These include, but are not limited to, articles of incorporation or formation documents, operating agreements, loan agreements, privacy policies, terms of service, and data security policies. Furthermore, compliance with specific industry regulations may require additional documentation, such as licenses and permits. It is crucial to ensure that all legal documents are meticulously drafted and regularly reviewed to reflect any changes in applicable laws and regulations. Failure to have appropriate legal documentation in place can expose the startup to significant legal risks.

Customer Acquisition and Retention Strategies

Securing and retaining customers is paramount for any student loan startup’s success. A robust strategy encompassing diverse marketing channels, effective retention tactics, and a strong brand identity is crucial for sustainable growth and profitability. This section details key components of a comprehensive customer acquisition and retention plan.

Marketing Plan for Customer Acquisition

A multi-channel approach is essential for reaching the target audience effectively. This includes leveraging digital marketing strategies, such as search engine optimization (), social media marketing, and targeted online advertising, to reach potential borrowers directly. Simultaneously, strategic partnerships with universities, colleges, and student organizations provide access to a captive audience and build credibility. Collaborations with financial literacy organizations can also expand reach and establish the startup as a trusted resource.

Examples of Effective Customer Retention Strategies

Successful student loan companies often utilize personalized communication, proactive support, and loyalty programs to cultivate customer loyalty. For instance, personalized email campaigns reminding borrowers of upcoming payments or offering financial planning resources can significantly improve engagement. Proactive customer service, including addressing inquiries promptly and efficiently, demonstrates commitment and fosters positive relationships. Loyalty programs, such as discounts on future loans or access to exclusive financial resources, incentivize continued business and build long-term relationships. Some companies even offer financial wellness workshops or webinars as a value-added service.

Importance of Brand Identity and Reputation

A strong brand identity differentiates a student loan startup from competitors and builds trust with potential borrowers. This includes a clear brand message, consistent visual identity, and a positive online reputation. A strong brand identity instills confidence and assures borrowers that the company is reliable, trustworthy, and committed to their financial well-being. Positive reviews and testimonials from satisfied customers further strengthen the brand’s reputation and attract new borrowers. Conversely, negative experiences can severely damage reputation and hinder growth.

Role of Customer Service in Maintaining Loyalty and Reducing Churn

Exceptional customer service is crucial for reducing churn and fostering customer loyalty. This involves providing readily accessible support channels, such as phone, email, and live chat, with knowledgeable and responsive representatives. Proactive communication, such as regular updates on loan status and personalized financial advice, can address potential concerns before they escalate. Efficient and transparent processes, such as straightforward application procedures and clear communication regarding fees and interest rates, minimize frustration and build trust. Addressing customer complaints effectively and promptly is crucial for resolving issues and maintaining positive relationships. A well-trained and empathetic customer service team can turn negative experiences into opportunities to strengthen the customer relationship.

Impact and Social Responsibility of Student Loan Startups

Student loan startups have the potential to significantly impact society by addressing the pervasive challenges of student debt and financial illiteracy. By offering innovative and accessible repayment options, they can empower borrowers to manage their debt effectively and achieve financial well-being, contributing to a more equitable and prosperous society. This section explores the positive social impact of such ventures, their role in tackling key issues, and opportunities for impactful partnerships.

A key positive social impact stems from the creation of affordable and accessible repayment options. Traditional student loan systems often lack flexibility, leaving borrowers struggling to manage repayments alongside other financial responsibilities. Startups can introduce innovative solutions such as income-driven repayment plans, flexible payment schedules, and financial counseling, directly addressing these challenges. This increased accessibility reduces the financial burden on borrowers, enabling them to focus on career development and personal growth without the constant stress of overwhelming debt.

Student Loan Startups and Debt Reduction Strategies

Student loan startups play a vital role in addressing the growing issue of student debt. They can do this through several key strategies. First, they offer more transparent and competitive interest rates, helping borrowers save money over the life of their loan. Second, they provide personalized financial advice and guidance, empowering borrowers to make informed decisions about their repayment strategies. Third, some startups offer debt consolidation services, simplifying the repayment process and potentially reducing the overall cost of borrowing. For example, a startup might leverage technology to analyze a borrower’s financial situation and recommend the most suitable repayment plan, significantly reducing the complexity and stress often associated with managing multiple loans. This proactive approach, combined with personalized guidance, can contribute significantly to reducing the overall student debt burden.

Partnerships to Enhance Social Impact

Strategic partnerships can significantly enhance the social impact of student loan startups. Collaborations with non-profit organizations focused on financial literacy and student support can expand reach and effectiveness. For example, a partnership with a national non-profit dedicated to financial literacy could provide borrowers with access to free workshops and online resources, supplementing the startup’s repayment services. Similarly, partnerships with educational institutions could integrate financial literacy programs into curricula, equipping students with the knowledge and skills to manage their finances effectively before they even graduate and incur debt. This collaborative approach ensures that borrowers receive comprehensive support throughout their borrowing and repayment journey.

Initiatives Promoting Financial Well-being

Many student loan companies are already implementing initiatives to promote the financial well-being of their customers. These initiatives often include providing access to free credit counseling, budgeting tools, and financial literacy resources. Some companies offer workshops and webinars on topics such as debt management, saving, and investing. Others integrate financial wellness features into their mobile apps, allowing borrowers to easily track their spending, set financial goals, and receive personalized advice. For instance, a student loan startup might offer a personalized budgeting tool integrated into its app, allowing borrowers to track expenses, allocate funds towards loan repayments, and identify areas where they can save money. Such proactive measures not only benefit individual borrowers but also contribute to broader financial stability within the community.

Final Conclusion

Student loan startups represent a powerful force for positive change in the higher education financing landscape. By leveraging technology, innovative repayment models, and a focus on customer experience, these companies are transforming how students manage and repay their loans. While challenges remain, the potential for positive social impact, financial inclusion, and improved financial literacy is significant. The continued growth and evolution of this sector promise to reshape the future of student debt management for the better.

Expert Answers

What is the average return on investment (ROI) for student loan startups?

ROI varies significantly depending on factors such as business model, market penetration, and funding secured. There’s no single average, and data is often proprietary.

How do student loan startups differ from traditional lenders?

Student loan startups often offer more flexible repayment options, personalized customer service, and utilize technology for streamlined processes, unlike traditional lenders who may have more rigid structures.

What are the biggest risks for a student loan startup?

Key risks include securing sufficient funding, navigating complex regulations, managing default rates, and competing with established lenders.

Are there any ethical considerations for student loan startups?

Yes, ethical considerations include transparent pricing, fair lending practices, responsible debt collection methods, and protecting customer data privacy.