The pursuit of higher education often necessitates financial assistance, and understanding the nuances of student loan programs is crucial for prospective and current students. Subsidized student loans, a vital component of the federal student aid system, offer a unique pathway to funding your education, but navigating their intricacies can be challenging. This guide delves into the complexities of subsidized student loans, providing a clear and comprehensive overview to empower you with the knowledge needed to make informed financial decisions.

From eligibility criteria and interest accrual to repayment plans and long-term financial implications, we’ll unravel the essential aspects of subsidized loans, comparing them to their unsubsidized counterparts. We will also explore alternative funding options and offer practical strategies for effective budgeting and debt management. Our goal is to equip you with the tools and understanding necessary to successfully manage your student loan journey.

Definition and Eligibility Criteria for Subsidized Student Loans

Subsidized student loans are a form of financial aid offered by the U.S. government to help students pay for college. A key characteristic distinguishing them from unsubsidized loans is that the government pays the interest on the loan while the student is enrolled in school at least half-time, during grace periods, and during certain deferment periods. This means that the loan balance doesn’t grow during these periods, unlike unsubsidized loans where interest accrues from the moment the loan is disbursed.

Eligibility Requirements for Subsidized Federal Student Loans

To be eligible for a subsidized federal student loan, students must meet several criteria. These requirements ensure that federal funds are allocated to those who demonstrate the greatest financial need. Generally, students must be pursuing a degree or certificate at an eligible institution, maintain satisfactory academic progress, and complete the Free Application for Federal Student Aid (FAFSA). Demonstrated financial need, as determined by the FAFSA, is a crucial factor in eligibility for subsidized loans. Specific requirements can vary slightly depending on the type of loan and the institution. It’s essential to contact the financial aid office of the prospective college or university for the most accurate and up-to-date information.

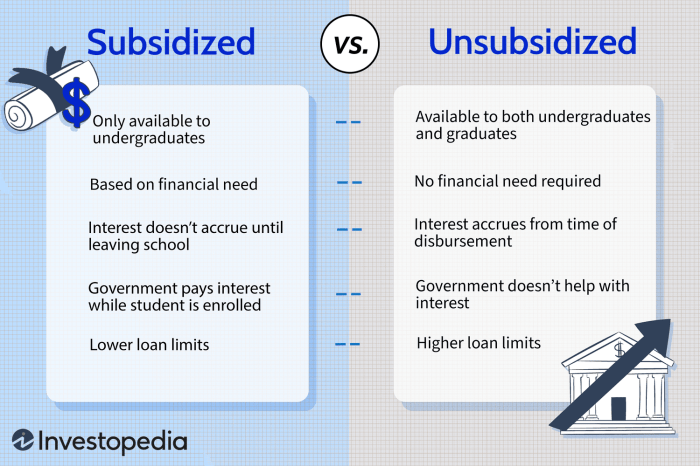

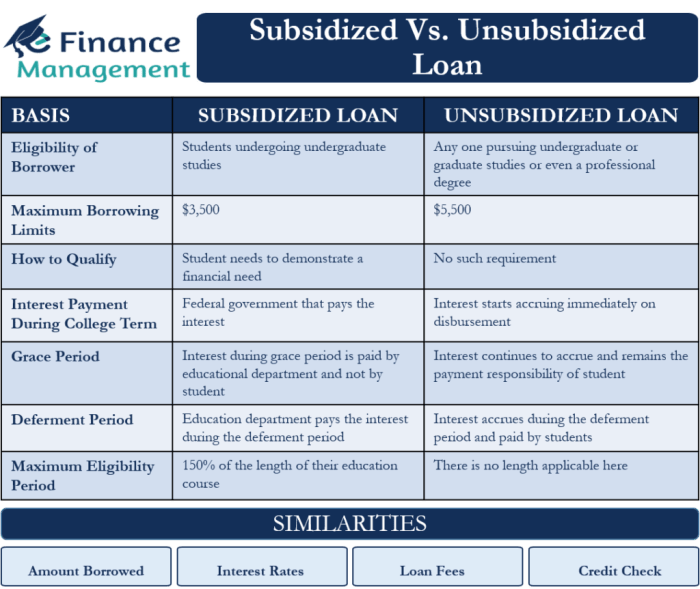

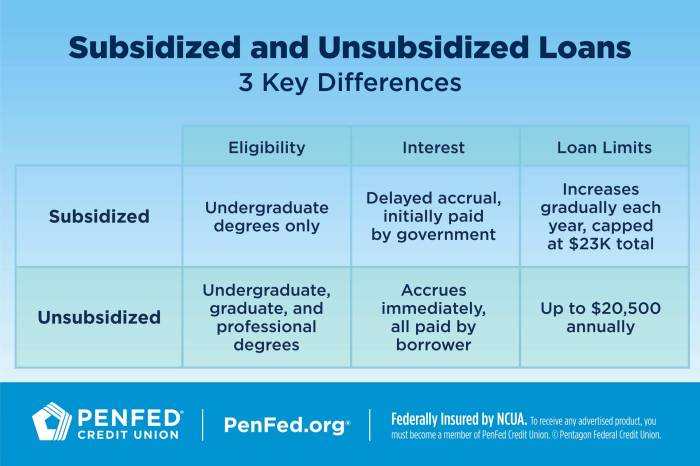

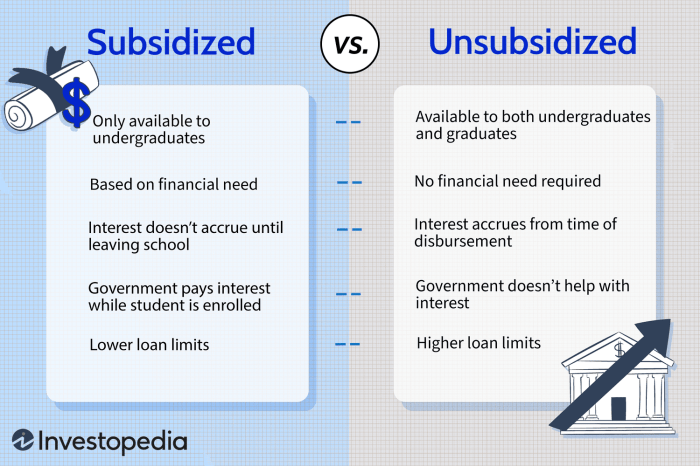

Subsidized vs. Unsubsidized Loans: A Comparison

The primary difference between subsidized and unsubsidized loans lies in the interest accrual. As mentioned earlier, the government pays the interest on subsidized loans during certain periods, whereas interest accrues on unsubsidized loans from the time of disbursement. This difference can significantly impact the total amount owed upon graduation. Unsubsidized loans are generally available to students regardless of financial need, while subsidized loans are primarily for students with demonstrated financial need. This means students receiving unsubsidized loans will have a larger overall loan amount than those with subsidized loans, even if they borrow the same initial amount.

| Feature | Subsidized Loan | Unsubsidized Loan |

|---|---|---|

| Interest Accrual During School | Government pays interest | Interest accrues |

| Financial Need Requirement | Required | Not Required |

| Loan Amount | Generally lower | Generally higher |

| Total Repayment Amount | Potentially lower | Potentially higher |

Interest Accrual and Repayment Plans

Understanding how interest accrues on your subsidized student loan and the various repayment options available is crucial for effective financial planning. This section details the interest accrual process during your studies and Artikels the different repayment plans you can choose from once you graduate or leave school.

Interest Accrual on Subsidized Loans During In-School Period

Subsidized federal student loans are unique in that the government pays the interest that accrues while you are enrolled at least half-time in school, during grace periods, and during periods of deferment. This means you won’t owe any additional interest on the principal loan amount until after your grace period ends. However, it is important to remember that the interest is still accruing and added to the principal. Failing to make payments during the repayment period will increase the total amount you ultimately owe.

Repayment Plan Options

Several repayment plans are available for subsidized federal student loans, each with its own terms and conditions. Choosing the right plan depends on your individual financial circumstances and repayment goals.

Comparison of Repayment Plan Options

Different repayment plans offer varying monthly payments, loan terms, and overall interest paid. Understanding these differences is key to making an informed decision. Shorter repayment periods typically lead to higher monthly payments but lower total interest paid, while longer periods result in lower monthly payments but higher overall interest costs. Consider your income and expenses when selecting a plan.

| Repayment Plan | Monthly Payment | Loan Term | Total Interest Paid |

|---|---|---|---|

| Standard Repayment Plan | Fixed, based on loan amount and interest rate | 10 years | Varies depending on loan amount and interest rate |

| Graduated Repayment Plan | Starts low and increases over time | 10 years | Generally higher than Standard Plan due to longer time at lower payments |

| Extended Repayment Plan | Lower monthly payments | Up to 25 years | Significantly higher total interest paid due to longer repayment period |

| Income-Driven Repayment (IDR) Plans | Based on income and family size | 20-25 years | Can result in loan forgiveness after 20-25 years, but total interest paid can be very high |

Impact on Student Budgeting and Financial Planning

Successfully navigating the financial landscape of higher education requires careful budgeting and planning, especially when considering student loan debt. Understanding the implications of subsidized student loans on your overall financial health is crucial for responsible money management during and after your studies. This section will explore strategies for incorporating loan payments into your budget, potential financial challenges, and advice for responsible borrowing and debt management.

Incorporating subsidized loan payments into a student’s budget requires a proactive and organized approach. It’s not simply about paying the minimum; it’s about understanding the long-term implications of your borrowing and actively working to minimize its impact. This involves creating a realistic budget that accounts for all expenses, including tuition, housing, food, transportation, and of course, loan repayments. Failing to account for these payments can lead to significant financial strain and potentially impact your credit score.

Strategies for Incorporating Subsidized Loan Payments into a Student Budget

Creating a workable budget necessitates a clear understanding of your income and expenses. Start by listing all sources of income, including scholarships, grants, part-time jobs, and parental contributions. Then, meticulously list all your monthly expenses, categorizing them for better visualization and control. This will provide a clear picture of your financial situation and help you determine how much you can comfortably allocate towards loan repayments.

Once you have a clear picture of your income and expenses, you can start incorporating your loan payments. A helpful technique is to treat your loan payment like any other essential bill, such as rent or utilities. Schedule your payments on the same day as these bills to maintain consistency and avoid missing payments. Consider setting up automatic payments to ensure timely repayments and avoid late fees. Budgeting apps and spreadsheets can significantly aid in tracking your expenses and ensuring you stay on track with your repayment plan.

Potential Financial Challenges When Managing Subsidized Loans

Despite careful planning, students may encounter several financial challenges when managing subsidized loans. Unexpected expenses, such as medical bills or car repairs, can significantly disrupt a carefully crafted budget. Changes in employment status, including job loss or reduced working hours, can also impact a student’s ability to meet their loan repayment obligations. Furthermore, underestimating the total cost of education, including living expenses, can lead to increased reliance on loans and a higher debt burden.

Advice on Responsible Borrowing and Debt Management for Students

Responsible borrowing starts with careful planning and research. Before taking out any loans, understand the terms and conditions, including interest rates, repayment periods, and any associated fees. Compare loan options from different lenders to find the most favorable terms. Avoid borrowing more than you need, and prioritize scholarships and grants to minimize your loan burden. Regularly review your loan statements to track your progress and identify any potential issues.

Effective debt management requires a proactive approach. Consider creating a repayment plan that prioritizes higher-interest loans first. Explore options such as income-driven repayment plans, which adjust your monthly payments based on your income. Maintain open communication with your loan servicer, especially if you anticipate difficulties making your payments. Seeking financial counseling can provide valuable support and guidance in navigating the complexities of student loan debt.

Creating a Personal Budget that Accounts for Student Loan Repayments: A Step-by-Step Guide

Creating a budget is a crucial step in responsible financial management. The following steps provide a structured approach to incorporating student loan repayments:

- Track your income: List all sources of income (e.g., wages, scholarships, grants).

- List your expenses: Categorize your expenses (e.g., housing, food, transportation, entertainment, loan payments).

- Calculate your net income: Subtract your total expenses from your total income.

- Allocate for loan repayments: Include your monthly student loan payment as a fixed expense.

- Identify areas for savings: Analyze your spending habits and identify areas where you can reduce expenses.

- Review and adjust: Regularly review your budget and make adjustments as needed based on changes in income or expenses.

By following these steps and consistently monitoring your spending, you can create a budget that effectively manages your student loan repayments and promotes responsible financial habits.

Government Regulations and Loan Forgiveness Programs

The federal government plays a crucial role in overseeing subsidized student loans, ensuring fair lending practices and providing avenues for borrowers to manage their debt. This involves setting interest rates, establishing repayment plans, and implementing loan forgiveness programs. Understanding these regulations and programs is vital for students and borrowers to make informed decisions about their educational financing.

Government Oversight of Subsidized Student Loans

The U.S. Department of Education (ED) is the primary agency responsible for regulating the subsidized student loan program. This includes setting eligibility criteria, overseeing loan servicers, and enforcing consumer protection laws. The ED establishes the maximum interest rates for subsidized loans, ensuring they remain competitive while protecting both borrowers and the government’s financial interests. Regular audits and compliance checks are conducted to maintain the integrity of the program and prevent fraud. Furthermore, the ED provides resources and guidance to borrowers on managing their loans and navigating the repayment process. These regulations aim to create a transparent and accountable system, minimizing the risk of predatory lending practices and protecting borrowers from unfair or deceptive loan terms.

Criteria for Loan Forgiveness Programs

Several loan forgiveness programs exist for subsidized federal student loans, each with specific eligibility requirements. These programs generally target borrowers working in public service, those with disabilities, or those who have experienced significant financial hardship. For example, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of federal student loans after 120 qualifying monthly payments under an income-driven repayment plan while employed full-time by a qualifying government or non-profit organization. Teacher Loan Forgiveness provides partial loan forgiveness to teachers who have completed five years of full-time teaching in low-income schools or educational service agencies. Income-driven repayment plans, such as ICR, PAYE, REPAYE, and IBR, can lead to loan forgiveness after a set number of years, depending on income and loan balance. Meeting these specific criteria, which often involve both employment and repayment history, is crucial for loan forgiveness consideration.

Benefits and Limitations of Loan Forgiveness Programs

Loan forgiveness programs offer significant benefits to eligible borrowers, potentially eliminating substantial debt burdens and improving financial stability. This can lead to increased homeownership rates, improved credit scores, and reduced financial stress. However, these programs also have limitations. The stringent eligibility criteria can exclude many borrowers who face significant financial challenges. Furthermore, the process of applying for and obtaining loan forgiveness can be lengthy and complex, requiring meticulous documentation and persistent follow-up. Additionally, some argue that loan forgiveness programs may disincentivize responsible borrowing or contribute to increased tuition costs. A careful evaluation of individual circumstances and program requirements is necessary before relying on loan forgiveness as a primary strategy for debt management.

Government Websites and Resources

The importance of accessing accurate and up-to-date information from official government sources cannot be overstated. Misinformation can lead to missed opportunities or incorrect repayment strategies. The following websites provide comprehensive information on student loan programs and forgiveness options:

- StudentAid.gov: This website, managed by the Federal Student Aid office, offers a wealth of information on federal student aid, including subsidized loans, repayment plans, and loan forgiveness programs.

- Federal Student Aid (FSA) on the U.S. Department of Education website: This section of the ED website provides detailed information on federal student loan programs, including eligibility requirements, repayment options, and contact information.

- National Student Loan Data System (NSLDS): NSLDS provides access to your federal student loan information, including loan balances, repayment history, and servicer contact information.

Long-Term Financial Implications of Subsidized Loans

Subsidized student loans, while offering a crucial pathway to higher education, cast a long shadow into the future, influencing borrowers’ financial trajectories for years to come. Understanding these long-term implications is vital for making informed decisions and navigating the complexities of repayment. The impact extends beyond the immediate cost of tuition, affecting major life decisions such as homeownership, saving for retirement, and even starting a family.

The long-term financial impact of subsidized loans hinges on several factors, including the total amount borrowed, the interest rate, the chosen repayment plan, and the borrower’s post-graduation income. High loan balances coupled with extended repayment periods can lead to significantly higher overall costs due to accumulated interest. Conversely, aggressive repayment strategies, combined with responsible financial planning, can minimize the long-term debt burden and accelerate financial independence.

Strategies for Minimizing Long-Term Debt Burden

Minimizing the long-term burden of student loan debt requires a proactive and multifaceted approach. This involves strategic repayment planning, careful budgeting, and a commitment to financial literacy. Borrowers should explore different repayment options to find the best fit for their financial circumstances. Income-driven repayment plans, for example, can offer lower monthly payments, but may result in a longer repayment period and higher total interest paid. Conversely, aggressive repayment strategies, such as making extra payments or refinancing to a lower interest rate, can significantly reduce the total cost and shorten the repayment period.

The Importance of Financial Literacy in Managing Student Loan Debt

Financial literacy plays a pivotal role in successfully managing student loan debt. Understanding key financial concepts such as budgeting, interest rates, credit scores, and debt management strategies empowers borrowers to make informed decisions and avoid common pitfalls. A strong grasp of these concepts allows for effective planning, enabling borrowers to prioritize debt repayment while still meeting other financial goals. Resources such as online courses, workshops, and financial advisors can significantly enhance financial literacy and improve long-term financial outcomes.

Illustrative Scenarios of Long-Term Effects

Consider two graduates, both with $30,000 in subsidized student loans. Graduate A chooses a standard repayment plan with a 10-year term, while Graduate B opts for an income-driven repayment plan with a longer, 20-year term. Graduate A will have higher monthly payments but will pay significantly less interest over the life of the loan. Graduate B will have lower monthly payments, but will pay substantially more interest overall. This illustrates how different repayment strategies lead to vastly different long-term financial outcomes. Further, imagine Graduate C, who aggressively pays down their loans while maintaining a high savings rate, reaching financial independence sooner than Graduates A and B. This example underscores the power of proactive financial planning and debt management.

Alternatives to Subsidized Student Loans

Securing funding for higher education is a crucial step for many students. While subsidized student loans are a common option, they are not the only path. Exploring alternative funding sources can significantly impact a student’s financial well-being during and after college. This section Artikels several viable alternatives and compares their benefits and drawbacks against subsidized loans.

Overview of Alternative Funding Options

Several alternatives to subsidized student loans exist, each with its own set of advantages and disadvantages. These options can be broadly categorized into scholarships, grants, work-study programs, and savings/family contributions. Choosing the right mix of these options depends heavily on individual circumstances and financial situations. A careful evaluation of each option is crucial before committing to a specific funding plan.

Scholarships

Scholarships are essentially free money for education. They are awarded based on merit, talent, or financial need, and generally do not need to be repaid. Many scholarships are offered by colleges and universities, private organizations, and corporations. Some are highly competitive, requiring strong academic records and extracurricular involvement, while others may be more broadly accessible. For example, the Gates Millennium Scholars Program provides scholarships to outstanding minority students, while many smaller, local organizations offer scholarships based on specific criteria, such as academic major or community involvement. The advantages of scholarships are clear: they reduce the overall cost of education without adding to future debt. However, the competitive nature of many scholarships and the time and effort required to apply can be significant disadvantages.

Grants

Similar to scholarships, grants are forms of financial aid that do not need to be repaid. However, grants are typically awarded based on demonstrated financial need. The federal government offers several grant programs, such as the Pell Grant, which is available to undergraduate students with exceptional financial need. State governments and individual colleges also offer their own grant programs. The primary advantage of grants is the absence of repayment obligations. The disadvantage lies in the stringent eligibility requirements, often based on income and family size, which may exclude many students.

Work-Study Programs

Work-study programs are federally funded programs that provide part-time jobs to students with financial need. These jobs are often on campus, allowing students to balance work and studies. Earnings from work-study can be used to cover educational expenses, reducing reliance on loans. The advantages include earning income while gaining valuable work experience. The disadvantages include the limited number of available positions and the potential impact on academic performance if the workload becomes too demanding.

Savings and Family Contributions

Many families save for their children’s education through 529 plans, education savings accounts, or other investment vehicles. Family contributions can significantly reduce the need for loans. The advantage is that it avoids accruing debt. However, the disadvantage is that this relies on prior planning and sufficient family resources.

Comparison of Funding Options

| Funding Option | Repayment Required | Eligibility Criteria | Advantages | Disadvantages |

|---|---|---|---|---|

| Subsidized Student Loan | Yes | Enrollment in eligible program, financial need (often) | Access to funds for education, flexible repayment plans | Accumulates interest, debt burden |

| Scholarship | No | Merit, talent, financial need (varies) | Free money for education, no debt | Competitive, requires application process |

| Grant | No | Financial need | Free money for education, no debt | Strict eligibility requirements |

| Work-Study | No | Financial need, enrollment in eligible program | Earns income, gains work experience | Limited positions, potential impact on studies |

Outcome Summary

Securing a higher education is a significant investment, and understanding the landscape of student loan options is paramount. Subsidized student loans, while offering valuable benefits, require careful consideration and planning. By comprehending the eligibility requirements, repayment structures, and long-term financial implications, you can make informed decisions that align with your financial goals. Remember to explore all available resources, including government websites and financial advisors, to ensure you’re equipped to navigate this crucial aspect of your educational journey successfully. Responsible borrowing and proactive financial planning are key to minimizing long-term debt burdens and maximizing the return on your investment in education.

FAQs

What is the difference between subsidized and unsubsidized loans?

With subsidized loans, the government pays the interest while you’re in school (at least half-time) and during certain grace periods. Unsubsidized loans accrue interest from the moment the loan is disbursed, regardless of your enrollment status.

Can I lose my subsidized loan eligibility?

Yes. Eligibility depends on factors like your financial need, enrollment status (at least half-time), and academic progress. Failing to maintain satisfactory academic progress can result in the loss of eligibility.

What happens if I don’t repay my subsidized loan?

Failure to repay your loan can lead to serious consequences, including damage to your credit score, wage garnishment, and potential legal action. Contact your loan servicer immediately if you anticipate difficulties in repayment.

Are there any income-driven repayment plans for subsidized loans?

Yes, several income-driven repayment plans are available for federal student loans, including subsidized loans. These plans adjust your monthly payments based on your income and family size.