Navigating the complexities of student loan repayment after graduation can feel overwhelming. The transition from student to working professional is already a significant adjustment, and the added burden of substantial debt can create considerable financial pressure. Understanding the various loan types, repayment plans, and available resources is crucial for successful debt management and achieving long-term financial well-being. This guide offers a comprehensive overview, equipping graduates with the knowledge and strategies to confidently tackle their post-graduation loan obligations.

This exploration delves into the intricacies of federal and private student loans, comparing interest rates, repayment terms, and eligibility criteria. We’ll examine various repayment strategies, including standard, graduated, extended, and income-driven plans, weighing their respective pros and cons. Furthermore, we’ll address the impact of student loan debt on major life decisions, such as homeownership, family planning, and retirement savings, providing practical advice for minimizing financial strain and maximizing long-term financial success.

Types of Student Loans with Post-Graduation Repayment

Understanding the different types of student loans available is crucial for effective financial planning after graduation. Choosing the right loan can significantly impact your repayment journey, affecting your monthly payments and overall debt burden. This section Artikels the key differences between federal and private student loans, focusing on repayment plans that commence after graduation.

Federal student loans and private student loans represent the two primary categories available to students pursuing higher education in the United States. They differ significantly in terms of eligibility, interest rates, repayment options, and the level of government oversight and protection offered to borrowers.

Federal Student Loans

Federal student loans are offered by the U.S. government through various programs. These loans generally offer more borrower protections and flexible repayment options compared to private loans. Examples include Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans. Eligibility is based on financial need (for subsidized loans) and enrollment status, with credit checks not typically required. Interest rates are fixed and generally lower than private loan rates. Repayment typically begins six months after graduation or leaving school.

Private Student Loans

Private student loans are offered by banks, credit unions, and other financial institutions. Unlike federal loans, private loan eligibility is heavily dependent on creditworthiness. Borrowers typically need a co-signer with good credit if they lack a sufficient credit history. Interest rates are variable or fixed, and generally higher than federal loan rates. Repayment terms and options vary significantly depending on the lender.

Comparison of Loan Types

The following table compares four common types of student loans, highlighting key differences in interest rates, repayment options, and deferment/forbearance availability. Note that interest rates and specific repayment plans are subject to change based on market conditions and lender policies.

| Loan Name | Interest Rate Type | Repayment Options | Deferment/Forbearance Availability |

|---|---|---|---|

| Direct Subsidized Loan (Federal) | Fixed | Standard, Graduated, Extended, Income-Driven Repayment (IDR) | Yes, under specific circumstances |

| Direct Unsubsidized Loan (Federal) | Fixed | Standard, Graduated, Extended, Income-Driven Repayment (IDR) | Yes, under specific circumstances |

| Direct PLUS Loan (Federal) | Fixed | Standard, Extended | Yes, under specific circumstances |

| Private Student Loan (Example) | Fixed or Variable | Standard, potentially others depending on lender | May be available, but less common and terms vary greatly |

Repayment Plans and Options

Navigating the world of student loan repayment can feel overwhelming, but understanding the various repayment plans available is crucial for effective debt management. Choosing the right plan significantly impacts your monthly budget, the total interest paid over the life of the loan, and even the possibility of loan forgiveness. This section Artikels the common repayment options and their key features to help you make an informed decision.

Choosing the right repayment plan is a crucial step in managing your student loan debt effectively. Different plans offer varying monthly payments, total interest paid, and loan forgiveness possibilities. Careful consideration of your financial situation is essential to select the most suitable option.

Standard Repayment Plan

The standard repayment plan is a straightforward option where you repay your loan over a fixed period, typically 10 years. Payments remain consistent throughout the repayment term. This plan offers predictability in budgeting but may result in higher monthly payments compared to other options. A significant advantage is that it typically leads to the lowest total interest paid over the life of the loan due to its shorter repayment period. However, the higher monthly payments might present a challenge for borrowers with limited post-graduation income.

Graduated Repayment Plan

In a graduated repayment plan, your monthly payments start low and gradually increase over time, usually annually. This can be beneficial during the initial years after graduation when income is typically lower. However, it’s important to note that the total interest paid will likely be higher than with a standard plan because you’re paying off less principal in the early years. While more manageable initially, the increasing payments can become challenging later on.

Extended Repayment Plan

This plan extends the repayment period beyond the standard 10 years, usually up to 25 years. This significantly lowers your monthly payments, making it more manageable for borrowers with lower incomes or multiple loans. However, the extended repayment period leads to substantially higher total interest paid over the loan’s lifetime. This plan might be a suitable option for those prioritizing affordability over minimizing interest costs. For example, a borrower with a $50,000 loan might find a 25-year plan significantly reduces their monthly burden compared to a 10-year plan, though it increases the total interest paid by several thousand dollars.

Income-Driven Repayment (IDR) Plans

Income-driven repayment plans link your monthly payments to your income and family size. Several IDR plans exist, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans offer lower monthly payments, often making them more affordable in the short term, especially for borrowers with lower incomes. After a set number of years (often 20 or 25), any remaining loan balance might be forgiven under certain circumstances. However, the lower payments result in a longer repayment period and significantly higher total interest paid compared to other plans. Also, the loan forgiveness aspect is contingent upon meeting specific requirements, which can be complex and may change over time. For instance, a teacher with a low income might find an IDR plan incredibly beneficial due to the potentially lower monthly payments and the possibility of loan forgiveness after a significant period of teaching.

Steps to Selecting a Repayment Plan

Before selecting a repayment plan, carefully consider the following:

- Assess your current income and expenses: Determine your monthly disposable income after essential expenses. This will help you understand how much you can realistically afford to pay monthly.

- Estimate your future income: Consider your career path and projected income growth. This will help you anticipate whether your monthly payments will remain manageable in the future.

- Compare the total interest paid under different plans: Use loan calculators to determine the total cost of each plan over its lifetime. This allows you to weigh the benefits of lower monthly payments against the increased interest costs.

- Consider loan forgiveness possibilities: If eligible for an IDR plan, understand the requirements for loan forgiveness and the potential impact on your long-term finances.

- Consult a financial advisor: A financial advisor can help you evaluate your financial situation and recommend the most appropriate repayment plan based on your individual circumstances.

Interest Rates and Accrual

Understanding interest rates and how they accrue on your student loans is crucial for effective financial planning after graduation. The total amount you ultimately repay significantly depends on these factors, potentially impacting your financial stability for years to come. This section will detail how these rates are determined and the implications of interest capitalization.

Interest rates for student loans are influenced by several factors. The prime interest rate, a benchmark rate set by the Federal Reserve, plays a key role. This rate affects the overall cost of borrowing for lenders, who then adjust their student loan rates accordingly. Other factors include the type of loan (federal or private), the borrower’s creditworthiness (for private loans), and the prevailing market conditions. Federal student loans generally offer lower, fixed interest rates, while private loans often have variable rates that can fluctuate over the life of the loan, potentially increasing the overall repayment amount. The loan’s term (length of repayment) also influences the interest rate; longer repayment periods often come with slightly higher rates.

Interest Rate Determination and Total Borrowing Cost

The interest rate directly impacts the total cost of borrowing. A higher interest rate means you pay more in interest over the life of the loan, increasing the total amount repaid. For example, consider two loans of $20,000, one with a 5% interest rate and another with a 7% interest rate, both with a 10-year repayment term. The loan with the 7% interest rate will result in significantly higher total interest payments compared to the 5% loan, even though the principal amount is the same. This difference can amount to thousands of dollars over the repayment period. This illustrates the importance of comparing interest rates when selecting a student loan.

Interest Capitalization

Interest capitalization is the process of adding accumulated unpaid interest to the principal loan balance. This typically occurs when a borrower is in deferment or forbearance, periods where payments are temporarily suspended. The capitalized interest then accrues interest itself, leading to a larger loan balance and higher total repayment costs. For instance, if a borrower has $10,000 in outstanding loan principal and $1,000 in accrued unpaid interest, capitalization would increase the principal to $11,000, on which future interest will be calculated. This compounding effect can dramatically increase the total amount owed over time.

Examples of Long-Term Financial Consequences

Let’s illustrate the long-term effects using specific scenarios. Imagine two graduates, both with $30,000 in student loan debt. Graduate A chooses a standard repayment plan with a 6% fixed interest rate and a 10-year repayment term. Graduate B opts for an extended repayment plan with a 7% fixed interest rate and a 20-year repayment term. While Graduate B enjoys lower monthly payments, they will pay significantly more in total interest over the life of the loan due to the longer repayment period and higher interest rate. Graduate A will pay off their loan sooner and pay less total interest, but will have higher monthly payments. This demonstrates the trade-off between monthly payment affordability and long-term cost savings. Careful consideration of these factors is essential when selecting a repayment plan.

Managing Student Loan Debt After Graduation

Graduating from college is a significant achievement, but the reality of student loan debt can quickly dampen the celebratory mood. Effectively managing this debt is crucial for building a stable financial future. This section Artikels strategies to navigate the complexities of repayment and build a plan for a debt-free life. Understanding your options and proactively managing your loans will significantly impact your long-term financial well-being.

Successfully managing student loan debt requires a multifaceted approach encompassing budgeting, strategic repayment planning, and exploring potential debt consolidation options. Prioritizing loan repayment while balancing other financial obligations is essential. A well-defined plan, tailored to your individual circumstances, is key to minimizing stress and achieving financial freedom sooner.

Budgeting and Creating a Repayment Schedule

Creating a realistic budget is the cornerstone of effective student loan management. This involves tracking your income and expenses to identify areas where you can reduce spending and allocate funds towards loan repayment. A detailed budget should include all income sources, essential expenses (rent, utilities, groceries), discretionary spending (entertainment, dining out), and, critically, your student loan payments. Once you have a clear picture of your financial landscape, you can develop a personalized repayment schedule that aligns with your budget and financial goals. This schedule should specify the amount you will pay towards each loan each month, factoring in any interest accrual.

Minimizing Interest Payments and Accelerating Loan Repayment

Minimizing interest payments and accelerating loan repayment are key goals. Several strategies can help achieve this. One effective approach is to make extra payments whenever possible. Even small additional payments can significantly reduce the overall interest paid and shorten the repayment period. Another strategy is to prioritize high-interest loans. By focusing on paying down the loans with the highest interest rates first, you’ll save money on interest in the long run. Consider refinancing your loans if you qualify for a lower interest rate. This can significantly reduce your monthly payments and total interest paid over the life of the loan. For example, if you have a $30,000 loan at 7% interest and refinance to a 5% interest rate, you could save thousands of dollars over the repayment period.

Creating a Personalized Student Loan Repayment Plan

Developing a personalized repayment plan involves a step-by-step process. First, gather all relevant information about your loans, including the principal balance, interest rate, and minimum monthly payment for each loan. Next, create a detailed budget, as previously discussed, to determine how much you can realistically afford to pay each month towards your loans. Then, decide on a repayment strategy, such as prioritizing high-interest loans or focusing on the smallest loans first (the snowball method). Finally, create a repayment schedule that Artikels your planned payments for each loan, and regularly review and adjust your plan as your financial situation changes. Consider using a spreadsheet or budgeting app to track your progress and ensure you stay on track. For example, a plan might allocate $500 per month to loan repayment, with $250 going towards the highest interest loan and $250 towards the loan with the smallest balance.

The Impact of Student Loan Debt on Post-Graduation Life

Graduating college with a significant amount of student loan debt can cast a long shadow over the early years of adulthood, impacting major life decisions and long-term financial well-being. The weight of these repayments can significantly alter a graduate’s trajectory, creating both immediate and long-term challenges. Understanding these potential impacts is crucial for effective financial planning and navigating this critical life stage.

The burden of student loan repayment can present numerous obstacles to achieving key life goals. The sheer cost of monthly payments can severely restrict a graduate’s ability to save and invest, hindering their ability to build a secure financial future.

Challenges in Achieving Major Life Goals

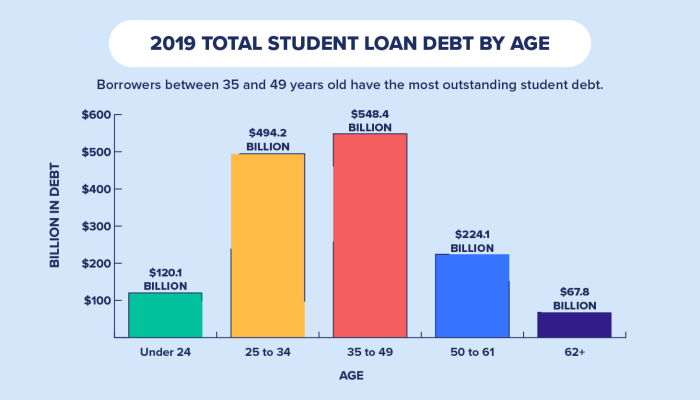

Student loan debt often makes it difficult to save for significant milestones such as purchasing a home. The substantial down payment required for a mortgage, coupled with ongoing loan repayments, can delay homeownership for years, potentially pushing graduates into higher-cost rental markets for extended periods. Similarly, starting a family can be postponed or made significantly more stressful due to the financial strain of loan repayments, childcare costs, and other family expenses. Investing for retirement is often put on hold, as graduates prioritize immediate loan repayments over long-term savings, potentially leading to a shortfall in retirement funds later in life. For example, a graduate with $50,000 in student loan debt at a 6% interest rate, making minimum monthly payments, could find themselves significantly behind in their retirement savings compared to a debt-free peer.

Impact on Career Choices and Overall Financial Well-being

The pressure of student loan debt can also influence career choices. Graduates may prioritize higher-paying jobs, even if they are less fulfilling, to accelerate loan repayment. This can lead to career dissatisfaction and reduced overall well-being. Conversely, graduates may avoid higher-paying jobs in fields requiring further education or training, fearing additional debt accumulation. The constant stress associated with managing student loan debt can negatively impact mental health and overall financial well-being, affecting decision-making abilities and long-term financial planning. The mental health effects are real and measurable; studies have shown a correlation between high student loan debt and increased stress and anxiety levels.

Long-Term Financial Implications of High Student Loan Balances

Carrying a large student loan balance for an extended period has significant long-term financial implications. The accumulation of interest can dramatically increase the total amount owed, leading to a snowball effect where the principal balance remains stubbornly high. For instance, a $100,000 loan at 7% interest, with only minimum payments made, could take over 20 years to repay, and the total amount paid could exceed $180,000. This prolonged repayment period can delay other financial goals, such as purchasing a home, investing, and building wealth, ultimately impacting long-term financial security. The longer the repayment period, the more interest is accrued, meaning the graduate pays significantly more than the initial loan amount. This financial burden can severely limit future opportunities and significantly impact long-term financial stability.

Government Programs and Assistance

Navigating the complexities of student loan repayment can be daunting, but several government programs are designed to ease the burden and provide much-needed assistance to borrowers. These programs offer various avenues for managing debt, from income-driven repayment plans to loan forgiveness options. Understanding these resources is crucial for graduates aiming to responsibly manage their student loan debt.

The federal government plays a significant role in supporting student loan borrowers through a variety of programs and initiatives. These programs aim to make repayment more manageable and, in some cases, even eliminate the debt entirely. Key aspects include income-driven repayment plans, which adjust monthly payments based on income and family size, and loan forgiveness programs, which offer partial or complete debt cancellation under specific circumstances. These initiatives are designed to help borrowers avoid delinquency and default, ultimately contributing to their financial stability.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are designed to make student loan repayment more affordable by basing monthly payments on your income and family size. Several IDR plans exist, each with its own eligibility criteria and payment calculation methods. These plans typically offer lower monthly payments than standard repayment plans, but the overall repayment period is often extended, leading to higher total interest paid over the life of the loan. However, the reduced monthly burden can significantly improve affordability and prevent borrowers from falling behind on payments. Examples include the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), and Income-Contingent Repayment (ICR) plans.

Loan Forgiveness Programs

Several federal loan forgiveness programs offer partial or complete loan cancellation after meeting specific requirements. These programs often target borrowers working in public service or those who have made consistent payments under an IDR plan for a specified period. For example, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of federal student loans after 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying employer. Eligibility criteria for these programs can be complex, so careful review of the requirements is essential. Other programs, such as the Teacher Loan Forgiveness program, cater to specific professions.

Other Forms of Financial Assistance

Beyond IDR plans and loan forgiveness programs, other forms of government assistance can help borrowers manage their student loan debt. These might include deferment or forbearance options, which temporarily postpone payments during periods of financial hardship. However, it’s crucial to understand that interest may still accrue during deferment or forbearance periods, potentially increasing the total loan amount owed. Additionally, some government agencies offer resources and counseling services to assist borrowers in navigating their repayment options and creating a manageable repayment strategy.

Government Programs Comparison Table

| Program Name | Eligibility Requirements | Benefits | Key Considerations |

|---|---|---|---|

| Income-Driven Repayment (IDR) Plans (e.g., REPAYE, IBR, ICR) | Federal student loans; meet income requirements | Lower monthly payments based on income; potential for loan forgiveness after 20-25 years | Longer repayment period; higher total interest paid |

| Public Service Loan Forgiveness (PSLF) | Federal student loans; work full-time for a qualifying employer; make 120 qualifying monthly payments under an IDR plan | Forgiveness of remaining loan balance | Strict eligibility requirements; requires consistent payments and employment |

| Teacher Loan Forgiveness | Federal student loans; teach full-time for five consecutive academic years in a low-income school or educational service agency | Forgiveness of up to $17,500 in loan debt | Specific employment requirements; limited to teachers |

Financial Literacy and Resources

Successfully navigating the complexities of student loan repayment requires a strong foundation in financial literacy. Understanding your loan terms, budgeting effectively, and exploring available resources are crucial steps towards responsible debt management and achieving long-term financial well-being. This section highlights valuable tools and programs designed to empower graduates in their financial journey.

Understanding your finances and the various options available to manage your student loan debt is paramount. Many resources are available to help you develop a comprehensive understanding of personal finance and effective debt management strategies. These resources provide valuable tools and support to help you make informed decisions and build a strong financial future.

Available Financial Literacy Programs and Educational Materials

Numerous organizations offer free or low-cost financial literacy programs tailored to recent graduates. These programs often cover budgeting, saving, investing, and debt management strategies specifically designed to address the unique challenges faced by young adults managing student loan debt. Many universities also offer workshops and counseling services as part of their career services departments. These programs frequently incorporate interactive exercises, case studies, and personalized guidance to help participants develop practical financial skills. The information provided is usually up-to-date and aligns with current financial best practices. For example, a program might include a budgeting worksheet that guides participants through tracking their income and expenses, identifying areas for potential savings, and developing a realistic repayment plan for their student loans.

Helpful Websites, Apps, and Organizations

Accessing reliable information and support is essential for effective student loan management. The following resources offer valuable tools and guidance:

- The National Foundation for Credit Counseling (NFCC): The NFCC offers free and low-cost credit counseling services, including assistance with developing a debt management plan and negotiating with lenders. They provide certified credit counselors who can offer personalized guidance based on your individual financial situation.

- StudentAid.gov: The official website for the U.S. Department of Education’s Federal Student Aid program provides comprehensive information on federal student loans, repayment plans, and available assistance programs. It’s a central hub for all things related to federal student loans.

- MyFedLoan: This is the loan servicer for many federal student loans. Their website offers tools to manage your account, track payments, and explore repayment options. It provides a personalized portal for managing your specific federal loans.

- Financial literacy apps: Many mobile applications, such as Mint, YNAB (You Need A Budget), and Personal Capital, offer budgeting tools, expense tracking, and financial planning features to help manage personal finances effectively. These apps provide convenient, accessible tools to monitor spending and track progress toward financial goals.

- Local credit unions and banks: Many local financial institutions offer free financial counseling and workshops to their members and the community. They often provide personalized advice and tailored solutions for managing debt.

Final Wrap-Up

Successfully managing student loan debt post-graduation requires proactive planning and informed decision-making. By understanding the nuances of different loan types, repayment options, and available government assistance programs, graduates can create a personalized repayment strategy aligned with their financial circumstances. Remember that seeking professional financial advice and utilizing available resources can significantly enhance your ability to navigate this crucial phase of life and build a secure financial future. Proactive management and informed choices are key to minimizing the long-term impact of student loan debt and achieving your financial goals.

Questions and Answers

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in loan default, with serious financial consequences.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it may also impact eligibility for government programs.

What is loan forgiveness?

Loan forgiveness programs, often tied to specific professions or public service, can eliminate a portion or all of your student loan debt.

How do I consolidate my student loans?

Consolidation combines multiple loans into a single loan, simplifying repayment but potentially altering your interest rate and repayment terms.