The staggering weight of student loan debt in the United States casts a long shadow over the financial futures of millions. This comprehensive analysis delves into the current state of student loan totals, exploring the factors driving their relentless growth, and examining the profound impact on individuals and the economy. We will unravel the complex web of rising tuition costs, shifting borrowing habits, and evolving government policies that contribute to this pervasive issue.

From historical trends and demographic breakdowns to potential policy solutions, we aim to provide a clear and insightful understanding of this critical societal challenge. This exploration will illuminate the multifaceted nature of the student loan debt crisis, offering readers a nuanced perspective on its causes, consequences, and potential pathways toward resolution.

The Current State of Student Loan Debt

The weight of student loan debt in the United States is a significant economic and social issue, impacting millions of individuals and the overall financial health of the nation. Understanding the current state of this debt, its historical trends, and its breakdown across different loan types is crucial for developing effective solutions and policies.

The sheer scale of student loan debt in the US is staggering. It represents a considerable portion of the national debt and significantly influences individual financial well-being. This debt burden has far-reaching consequences, affecting everything from homeownership rates to retirement savings and overall economic growth.

Student Loan Debt Statistics

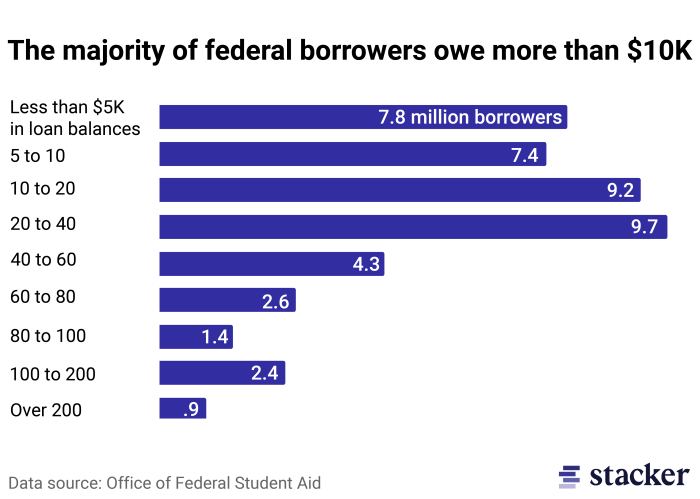

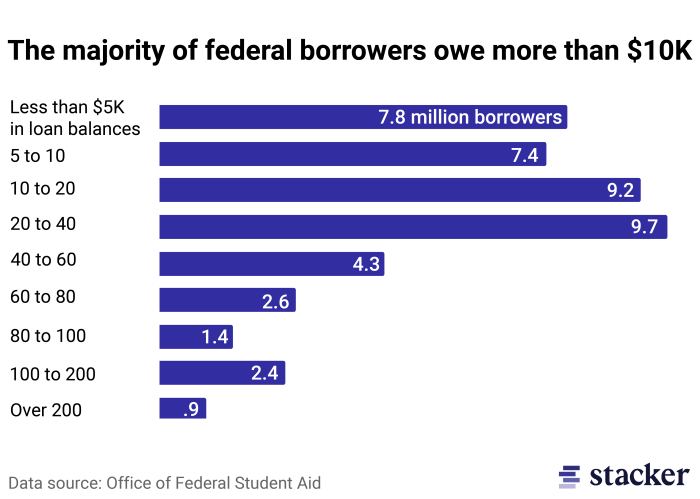

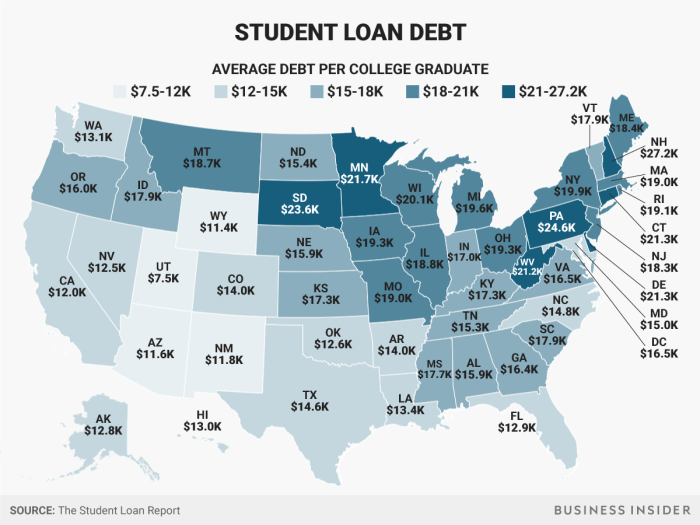

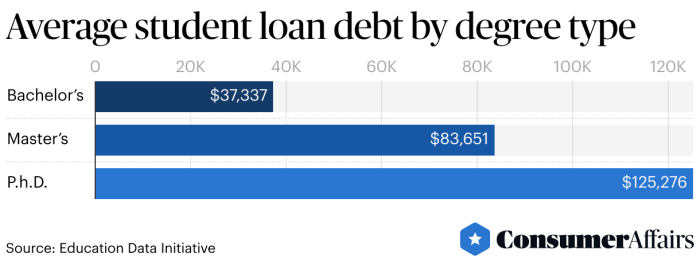

As of the end of 2022, the total amount of student loan debt outstanding in the United States exceeded $1.7 trillion. This represents a substantial increase from previous decades. The average debt per borrower is around $37,000, although this figure varies significantly depending on factors such as the degree pursued, the institution attended, and the borrower’s individual circumstances. This average debt can create significant financial strain, delaying major life decisions like homeownership and family planning.

Federal vs. Private Student Loans

The majority of student loan debt is comprised of federal student loans, which are offered by the government and typically come with more favorable repayment options and protections. Private student loans, on the other hand, are offered by banks and other private lenders. They often have higher interest rates and fewer borrower protections. The exact proportion varies year to year, but generally, federal loans make up a significantly larger portion of the total student loan debt, reflecting the government’s role in financing higher education.

Historical Trends in Student Loan Debt (2003-2022)

The following table illustrates the growth of student loan debt over the past two decades. Note that these figures are estimates and may vary slightly depending on the source. The data clearly shows a consistent upward trend, highlighting the increasing reliance on borrowing to finance higher education.

| Year | Total Debt (Trillions USD) | Average Debt per Borrower (USD) | Percentage Change from Previous Year |

|---|---|---|---|

| 2003 | 0.4 | 18,000 | – |

| 2008 | 0.8 | 23,000 | 100% |

| 2013 | 1.2 | 29,000 | 50% |

| 2018 | 1.5 | 34,000 | 25% |

| 2022 | 1.7 | 37,000 | 13% |

Factors Contributing to Rising Student Loan Totals

The dramatic increase in student loan debt is a complex issue stemming from a confluence of factors. Understanding these contributing elements is crucial for developing effective strategies to mitigate the problem and ensure greater accessibility to higher education. This section will examine the key drivers behind the escalating student loan totals, focusing on their relative impact.

Several interconnected factors have significantly contributed to the surge in student loan debt. These factors interact and amplify each other, resulting in a situation where the cost of higher education consistently outpaces the ability of many students and families to finance it without significant borrowing.

Rising Tuition Costs

The escalating cost of tuition and fees at colleges and universities is arguably the most significant factor driving the increase in student loan debt. Tuition has been rising at a rate far exceeding inflation for several decades. This increase is not uniformly distributed across all institutions; private colleges and universities often have substantially higher tuition rates than public institutions. This disparity creates unequal access to higher education, pushing many students towards larger loan amounts to cover the cost of attendance. For example, the average tuition at a four-year private college has increased by over 150% in the last two decades, while the average family income has not kept pace. This forces students to rely increasingly on loans to bridge the financial gap.

Increased Enrollment in Higher Education

While rising tuition costs are a major factor, the increasing number of students pursuing higher education also plays a significant role. A growing population, coupled with a societal emphasis on obtaining a college degree for better career prospects, has led to a substantial rise in college enrollment. This increased demand, combined with the rising cost of tuition, naturally leads to a larger overall demand for student loans. The sheer volume of students needing financial assistance contributes substantially to the overall growth of student loan debt.

Changes in Financial Aid Availability and Borrowing Habits

Beyond tuition costs and enrollment, changes in financial aid availability and borrowing habits have also influenced the accumulation of student loan debt. While financial aid programs like Pell Grants exist to help students, the amount of aid available often falls short of covering the full cost of attendance, especially at more expensive institutions. Furthermore, the increasing ease of accessing student loans, combined with a lack of financial literacy among some students, has led to some borrowing more than necessary or taking on loans for less essential expenses. The rise of private student loans, which often carry higher interest rates, further exacerbates this issue.

In summary, the following factors contribute to the rising student loan totals, listed in order of perceived impact:

- Rising Tuition Costs: The primary driver, significantly outpacing inflation and income growth.

- Increased Enrollment in Higher Education: A larger pool of students needing financial assistance.

- Changes in Financial Aid Availability and Borrowing Habits: Insufficient aid and increased reliance on loans, often with less financial planning.

The Impact of Student Loan Debt on Individuals

The weight of student loan debt extends far beyond the monthly payment; it profoundly shapes the financial trajectory and life choices of borrowers. The burden can significantly hinder financial well-being, impacting major life milestones and long-term financial stability. Understanding these impacts is crucial for developing effective strategies to mitigate the effects of student loan debt.

The effects of high student loan debt are far-reaching and can significantly impact a borrower’s financial well-being. High monthly payments often leave little room for saving, investing, or addressing unexpected expenses. This can lead to a precarious financial situation, making it difficult to build wealth and achieve long-term financial goals. The persistent pressure of loan repayment can cause significant stress and anxiety, affecting mental and emotional health.

Impact on Homeownership

High student loan debt can make homeownership a distant dream for many borrowers. The large monthly payments reduce the amount of money available for a down payment and ongoing mortgage expenses. Lenders often consider student loan debt when assessing creditworthiness, potentially leading to higher interest rates or loan denials. The combination of high debt and stringent lending requirements can create a significant barrier to entry into the housing market, delaying or preventing homeownership altogether. This can have cascading effects, limiting access to wealth building through home equity and potentially impacting future financial stability.

Impact on Retirement Savings

Student loan repayment often takes precedence over retirement savings, especially in the early years of a career. The substantial monthly payments leave little disposable income for retirement contributions, delaying the accumulation of necessary funds. This can lead to a significant shortfall in retirement savings, potentially resulting in financial insecurity during retirement years. The longer one delays saving, the harder it becomes to catch up, further compounding the issue. For example, a borrower delaying retirement contributions for 10 years to prioritize student loan repayment will have significantly less time to accumulate the same retirement nest egg as someone who started saving earlier.

Impact on Overall Financial Stability

The constant pressure of student loan debt can significantly impact overall financial stability. Unexpected expenses, such as medical bills or car repairs, can quickly become overwhelming when a substantial portion of income is already allocated to loan repayment. This lack of financial flexibility can leave borrowers vulnerable to financial shocks and make it challenging to recover from unexpected setbacks. This vulnerability can perpetuate a cycle of debt, hindering the ability to build a secure financial future.

Impact on Major Life Decisions

Student loan debt can significantly influence major life decisions, such as marriage, starting a family, and career choices. The financial burden can delay marriage, as couples may postpone the commitment until their debt is manageable. Starting a family may also be delayed or altered, as the costs of raising children can be prohibitive when burdened by significant loan payments. Career choices may also be influenced, with borrowers potentially prioritizing higher-paying jobs, even if they are less fulfilling, to accelerate loan repayment.

Hypothetical Case Study: The Long-Term Financial Consequences of Significant Student Loan Debt

Consider Sarah, a recent graduate with $100,000 in student loan debt at a 7% interest rate. Her monthly payment is approximately $800. If she makes only the minimum payment, it will take her over 20 years to repay the loan, and she will pay over $100,000 in interest. During this period, she will likely struggle to save for a down payment on a home, contribute significantly to retirement savings, and potentially face financial instability due to unexpected expenses. In contrast, if she aggressively paid down her debt, perhaps through refinancing or additional income, she could save tens of thousands of dollars in interest and free up funds for other financial goals. This hypothetical example illustrates how student loan debt can have long-lasting and significant financial implications, impacting her ability to achieve major life goals and build long-term financial security.

The Impact of Student Loan Debt on the Economy

The burgeoning weight of student loan debt in many countries exerts a significant influence on macroeconomic indicators and the overall health of the economy. This impact extends beyond individual borrowers, affecting consumer spending, investment, and economic growth, with consequences that ripple through various sectors and demographic groups.

The macroeconomic effects of high student loan debt are multifaceted. Firstly, it directly impacts consumer spending. Individuals burdened with substantial loan repayments have less disposable income, leading to reduced consumption of goods and services. This decreased consumer demand can hinder economic growth, as businesses experience lower sales and subsequently reduce investment. Secondly, high student loan debt can suppress entrepreneurship. Young graduates, saddled with debt, may be less inclined to start businesses, opting for stable employment to manage their financial obligations, potentially stifling innovation and job creation. This dampening effect on entrepreneurial activity further reduces economic dynamism. Finally, the shadow of student loan debt can impact long-term investment decisions, as individuals prioritize debt repayment over saving and investing for the future. This reduced investment can have a negative impact on capital accumulation and overall economic growth.

Student Loan Debt’s Differential Impact Across Demographics

The impact of student loan debt is not uniformly distributed across demographic groups. Studies consistently show that minority borrowers and those from lower socioeconomic backgrounds disproportionately bear the burden of student loan debt. These groups often face higher interest rates, less access to financial literacy resources, and fewer opportunities for high-earning careers, making debt repayment a more significant challenge. For instance, Black borrowers often graduate with higher debt levels than white borrowers, even when controlling for factors such as college choice and major. This disparity exacerbates existing inequalities, perpetuating a cycle of financial hardship within these communities. Furthermore, women, particularly those pursuing higher education in fields traditionally associated with lower earning potential, may also experience a greater financial strain from student loan debt. These disparities highlight the need for targeted policies aimed at addressing the unequal distribution of student loan debt and its consequences.

Potential Implications of a Widespread Student Loan Default Crisis

A widespread student loan default crisis could have severe implications for the financial system. A significant increase in defaults would lead to substantial losses for lenders, including government agencies and private institutions. This could trigger a domino effect, impacting the stability of financial markets and potentially leading to a credit crunch, limiting access to credit for businesses and consumers alike. Moreover, a crisis could negatively affect the broader economy by further reducing consumer spending and investment, creating a vicious cycle of economic downturn. The scale of the potential damage depends on several factors, including the magnitude of defaults, the effectiveness of government intervention, and the resilience of the financial system. Historical examples, such as the subprime mortgage crisis, illustrate the potential for a seemingly contained financial problem to escalate into a major economic crisis with wide-ranging and long-lasting consequences. The potential for a widespread student loan default crisis necessitates proactive measures to mitigate the risk and ensure the stability of the financial system.

Potential Solutions and Policy Recommendations

Addressing the student loan debt crisis requires a multifaceted approach involving policy changes and individual financial responsibility. Several proposals aim to alleviate the burden, each with its own set of advantages and disadvantages. A comprehensive understanding of these proposals is crucial for informed policymaking.

Policy Proposals for Student Loan Debt Relief

The following table compares three distinct policy proposals designed to tackle the student loan debt crisis. These proposals represent a range of approaches, from targeted relief to broader systemic reforms. The estimated costs and potential impacts are inherently complex and subject to significant variability depending on economic conditions and implementation details. These figures should be considered illustrative rather than precise predictions.

| Proposal Name | Key Features | Estimated Cost | Potential Impact |

|---|---|---|---|

| Targeted Debt Cancellation | Forgives a specific amount of student loan debt for borrowers meeting certain criteria (e.g., income thresholds, loan type). | Estimates vary widely, ranging from hundreds of billions to trillions of dollars depending on the eligibility criteria. For example, a proposal to cancel $10,000 per borrower could cost over $300 billion. | Could provide immediate relief to millions of borrowers, potentially stimulating consumer spending. However, it might disproportionately benefit higher earners and could increase the national debt. It could also incentivize future borrowing. |

| Income-Driven Repayment Reform | Modifies existing income-driven repayment (IDR) plans to lower monthly payments and shorten repayment terms for borrowers. This could include expanding eligibility or reducing the percentage of income allocated to repayment. | The cost is difficult to precisely estimate, as it depends on the specifics of the reform. However, it is likely to be lower than broad debt cancellation, potentially in the tens of billions of dollars annually. | Could make repayment more manageable for struggling borrowers, preventing defaults and improving credit scores. However, it may not fully address the underlying issue of rising tuition costs and could extend the repayment period, leading to higher overall interest payments. |

| Increased Funding for Pell Grants and Affordable Higher Education | This approach focuses on preventing future debt accumulation by increasing federal funding for Pell Grants and promoting affordability initiatives like tuition freezes or caps at public colleges and universities. | The cost would depend on the scale of the funding increase. A significant investment could be in the hundreds of billions of dollars over several years. | This is a long-term solution that addresses the root cause of student debt. It would make higher education more accessible and affordable, reducing the reliance on loans and lowering future debt burdens. However, it requires significant upfront investment and may not provide immediate relief to current borrowers. |

Benefits and Drawbacks of Policy Interventions

Each policy proposal offers potential benefits while presenting significant challenges. Targeted debt cancellation, for example, offers immediate relief but may exacerbate income inequality and increase the national debt. Income-driven repayment reform offers a more targeted approach, potentially improving repayment affordability without the same level of immediate fiscal impact as broad cancellation, but may not fully solve the problem of high debt burdens. Increased funding for Pell Grants and affordable higher education is a long-term strategy requiring substantial investment, but it tackles the root cause of the problem and could prevent future debt crises. The optimal approach likely involves a combination of strategies tailored to address both the immediate crisis and long-term systemic issues.

Impact on Future Student Loan Totals

The chosen policy interventions will significantly affect future student loan totals. Broad debt cancellation would immediately reduce the outstanding balance, but without addressing underlying cost issues, future debt accumulation could still occur. Income-driven repayment reforms could lead to lower overall repayment amounts, reducing the total debt over time, but the impact depends on the specifics of the reforms. Investing in Pell Grants and affordable higher education is the most effective way to curb future debt accumulation by reducing the need for loans in the first place. This long-term approach, while requiring significant upfront investment, promises the most sustainable solution to the student loan debt crisis.

Visual Representation of Data

Data visualization is crucial for understanding the complex issue of student loan debt. By presenting the information graphically, we can readily grasp trends and patterns that might be obscured in textual data alone. The following descriptions illustrate how bar and pie charts can effectively communicate key aspects of the student loan debt crisis.

Growth of Student Loan Debt Over Time (Bar Chart)

This bar chart would visually depict the escalating total amount of student loan debt outstanding in the United States over a specific time period, for example, from 2000 to 2023. The horizontal axis (x-axis) would represent the year, while the vertical axis (y-axis) would represent the total student loan debt in trillions of dollars. Each bar would correspond to a year, with its height reflecting the total debt for that year. For instance, a bar for 2000 might show a height representing approximately $0.6 trillion, while the bar for 2023 would be significantly taller, reflecting the current total exceeding $1.7 trillion. The chart would include a clear title, labeled axes, and a legend indicating the units of measurement (trillions of USD). The chart’s visual representation would clearly illustrate the exponential growth of student loan debt over the past two decades.

Distribution of Student Loan Debt Across Loan Types (Pie Chart)

This pie chart would illustrate the proportion of total student loan debt attributed to different loan types. The entire circle would represent the total student loan debt. Each slice of the pie would correspond to a specific loan type, such as Federal Direct Subsidized Loans, Federal Direct Unsubsidized Loans, Federal Direct PLUS Loans (for parents and graduate students), and Private Student Loans. The size of each slice would be proportional to the percentage of the total debt it represents. For example, Federal Direct Unsubsidized Loans might constitute 40% of the total debt, represented by a large slice. Federal Direct Subsidized Loans might represent 30%, Federal Direct PLUS Loans 20%, and Private Student Loans 10%. Each slice would be clearly labeled with its corresponding loan type and percentage. The chart would also include a title and a legend clarifying the meaning of each slice. This visualization would provide a clear understanding of the relative distribution of debt across different loan categories.

Final Wrap-Up

The escalating burden of student loan totals presents a significant hurdle to individual financial well-being and national economic prosperity. While the challenge is substantial, understanding the multifaceted nature of this issue – from its historical context to its projected future impacts – is crucial. By exploring potential solutions and policy interventions, we can work towards a future where higher education is accessible without saddling future generations with crippling debt. Further research and open dialogue are essential to navigate this complex landscape and forge a more equitable path forward.

FAQ Compilation

What is the difference between federal and private student loans?

Federal loans are offered by the government and generally have more borrower protections and flexible repayment options. Private loans are offered by banks and other financial institutions and often have higher interest rates and stricter terms.

Can I consolidate my student loans?

Yes, loan consolidation combines multiple loans into a single loan, potentially simplifying repayment. However, it may not always lower your interest rate.

What happens if I default on my student loans?

Defaulting on student loans can have serious consequences, including wage garnishment, tax refund offset, and damage to your credit score. It can also make it difficult to obtain future loans or credit.

Are there income-driven repayment plans available?

Yes, several income-driven repayment plans adjust your monthly payments based on your income and family size. These plans may lead to loan forgiveness after a set period.