Navigating the complexities of student loan repayment can feel overwhelming, especially with the constant shifts in policy and interest rates. 2024 presents a landscape of potential changes, from proposed forgiveness plans to evolving repayment options. This guide provides a clear and concise overview of the key updates and considerations for student loan borrowers this year, empowering you to make informed decisions about your financial future.

Understanding the nuances of different repayment plans, the impact of fluctuating interest rates, and the latest legislative proposals is crucial for effective debt management. We’ll explore these aspects in detail, providing practical advice and resources to help you navigate this important financial journey.

Proposed 2024 Student Loan Forgiveness Plan Details

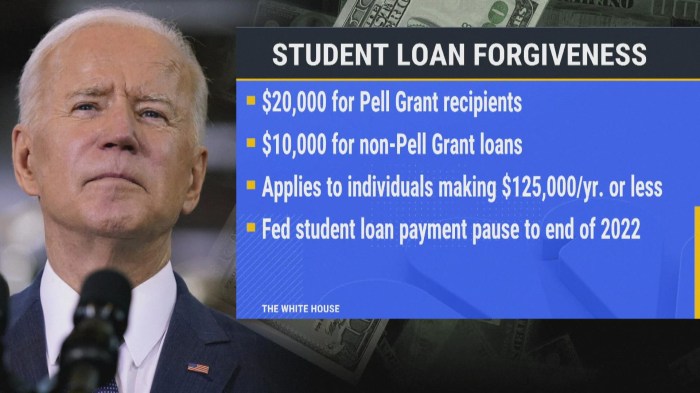

The details surrounding a potential 2024 student loan forgiveness plan remain fluid and subject to change depending on political and economic factors. However, based on current proposals and discussions, we can Artikel a potential framework for such a plan, acknowledging the inherent uncertainties. This analysis will focus on potential features, impacts, and comparisons to past initiatives.

Key Features of a Potential 2024 Student Loan Forgiveness Plan

Several proposals for student loan forgiveness have been discussed, each with varying eligibility requirements and forgiveness amounts. A hypothetical plan might include targeted forgiveness for specific borrowers, such as those with significant debt burdens or those who attended public institutions. The forgiveness amount could be a fixed dollar amount or a percentage of the total debt, potentially capped at a certain level. Eligibility might be determined by income, type of loan, or the borrower’s educational institution. The plan might also include provisions for income-driven repayment (IDR) adjustments, making monthly payments more manageable for borrowers.

Potential Economic Impact

The economic impact of a student loan forgiveness plan would be multifaceted and significant. For borrowers, it could provide immediate financial relief, boosting consumer spending and potentially stimulating economic growth. However, it could also lead to increased inflation if the freed-up funds are largely spent. For the government, the plan would represent a substantial cost, potentially adding to the national debt. The magnitude of this cost would depend on the plan’s scope and design. Economists offer differing predictions on the long-term effects, with some suggesting potential benefits in increased economic activity and others expressing concern about inflationary pressures and the impact on the national budget. For example, a similar plan might see a surge in consumer spending in the short term but also a gradual increase in inflation over several years.

Comparison to Previous Initiatives

Previous student loan forgiveness initiatives, such as the temporary pause on payments during the COVID-19 pandemic and the limited forgiveness programs under the American Rescue Plan, provide valuable case studies. These programs offer insights into the logistical challenges of implementing large-scale forgiveness plans and the potential economic consequences. Comparing the proposed 2024 plan to these past efforts allows for a more informed assessment of its feasibility and potential impact. Analyzing the successes and shortcomings of past initiatives is crucial for designing a more effective and sustainable future plan.

Provisions of a Hypothetical 2024 Student Loan Forgiveness Plan

| Provision | Description | Eligibility Criteria | Estimated Impact |

|---|---|---|---|

| Targeted Loan Forgiveness | Forgiveness of a portion of student loan debt | Borrowers with loans exceeding $50,000 and income below a certain threshold. | Reduced debt for millions of borrowers; potential increase in consumer spending; increased national debt. |

| IDR Reform | Changes to income-driven repayment plans | All federal student loan borrowers | Lower monthly payments for many borrowers; increased loan repayment time; potential reduction in loan defaults. |

| Public Service Loan Forgiveness (PSLF) Expansion | Expansion of eligibility for PSLF | Public service employees with federal student loans | Loan forgiveness for a larger segment of public servants; potential increased recruitment and retention in public service. |

Student Loan Repayment Options in 2024

Navigating the complexities of student loan repayment can feel overwhelming, but understanding the available options is crucial for long-term financial well-being. This section provides a comprehensive overview of repayment plans offered in 2024, highlighting their advantages and disadvantages to help you make informed decisions. Remember that specific details may be subject to change, so consulting the official federal student aid website is always recommended.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loans. It involves fixed monthly payments over a 10-year period. This plan offers the shortest repayment timeline, resulting in less total interest paid compared to income-driven plans. However, the fixed monthly payments can be quite high, potentially straining your budget, especially in the early years of your career.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) link your monthly payments to your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans generally result in lower monthly payments than the Standard plan, making them more manageable for borrowers with lower incomes. However, they typically extend the repayment period to 20 or 25 years, leading to higher total interest paid over the life of the loan. Furthermore, loan forgiveness may be possible after making payments for a specified period, depending on the specific plan.

Extended Repayment Plan

The Extended Repayment Plan offers a longer repayment period than the Standard plan, typically up to 25 years. This plan lowers your monthly payments compared to the Standard plan, providing more financial flexibility. However, similar to income-driven plans, extending the repayment period increases the total interest paid over the life of the loan. This plan is generally not eligible for loan forgiveness programs.

Comparison of Repayment Plans

The following table summarizes the key features of the different repayment plans. Note that the monthly payment calculation is an estimate and will vary based on individual loan amounts, interest rates, and income (for income-driven plans).

| Plan Name | Monthly Payment Calculation | Loan Forgiveness Eligibility | Total Interest Paid |

|---|---|---|---|

| Standard Repayment | Fixed amount over 10 years | No | Lowest |

| Income-Based Repayment (IBR) | Based on income and family size, up to 20-25 years | Yes, after 20-25 years | Higher than Standard |

| Pay As You Earn (PAYE) | Based on income and family size, up to 20 years | Yes, after 20 years | Higher than Standard |

| Revised Pay As You Earn (REPAYE) | Based on income and family size, up to 20-25 years | Yes, after 20-25 years | Higher than Standard |

| Income-Contingent Repayment (ICR) | Based on income and family size, up to 25 years | Yes, after 25 years | Highest |

| Extended Repayment | Fixed amount over up to 25 years | No | Higher than Standard |

Implications of Choosing a Repayment Plan on Long-Term Financial Health

Selecting the right repayment plan significantly impacts your long-term financial health. While lower monthly payments under IDR plans offer immediate relief, the extended repayment period and increased total interest can hinder long-term financial goals such as saving for a down payment on a house or investing. Conversely, the Standard Repayment Plan, while demanding higher initial payments, leads to faster debt elimination and less interest paid overall. Careful consideration of your current financial situation, income projections, and long-term financial aspirations is essential when choosing a repayment plan. For example, a recent graduate with a low starting salary might find an IDR plan more manageable initially, while a borrower with a higher income might opt for the Standard plan to minimize overall interest paid.

Impact of Interest Rates on Student Loan Debt in 2024

Understanding the impact of interest rates on student loan debt is crucial for borrowers navigating repayment in 2024. Fluctuations in interest rates directly affect the total cost of borrowing and the monthly payment burden. This section will examine current and projected rates, influencing factors, and illustrate the effect of varying rates on repayment.

Current and Projected Interest Rates for Federal Student Loans

Federal student loan interest rates are set annually and vary depending on the loan type (e.g., subsidized, unsubsidized, PLUS loans) and the loan disbursement date. For the 2023-2024 academic year, interest rates for new federal undergraduate loans ranged from 5.05% to 7.05%, with graduate loan rates higher. It’s important to note that these rates are subject to change, and projections for 2024 will depend on various economic factors, including inflation and Federal Reserve policy. While precise projections are difficult, analysts often look to the Federal Reserve’s target federal funds rate as an indicator of future trends in borrowing costs. A rise in the federal funds rate generally suggests that interest rates on federal student loans may also increase.

Factors Influencing Interest Rate Changes

Several key factors influence changes in federal student loan interest rates. The most significant is the overall economic climate. High inflation, for example, often leads to higher interest rates as the Federal Reserve attempts to cool down the economy. Government fiscal policy also plays a role, as does the overall demand for borrowing. Increased demand can push rates higher, while decreased demand may lead to lower rates. Changes in legislation regarding student loan programs can also influence interest rates, though these are less frequent than economic factors.

Scenario Illustrating the Impact of Varying Interest Rates

The following table demonstrates how different interest rates and loan terms affect the total cost of a $50,000 student loan. These are illustrative examples, and actual repayment amounts will depend on the specific loan terms and repayment plan chosen.

| Interest Rate | Loan Term (Years) | Total Interest Paid | Total Repayment Amount |

|---|---|---|---|

| 5% | 10 | $12,765 | $62,765 |

| 7% | 10 | $17,680 | $67,680 |

| 5% | 15 | $20,180 | $70,180 |

| 7% | 15 | $29,300 | $79,300 |

Effect of Interest Rate Fluctuations on Monthly Payments

A change in interest rates directly impacts monthly payments. For example, a $50,000 loan at 5% interest over 10 years results in a monthly payment of approximately $523. However, increasing the interest rate to 7% while keeping the loan term constant raises the monthly payment to roughly $564 – a significant difference of $41 per month. Similarly, extending the loan term to 15 years at 5% reduces the monthly payment but increases the total interest paid significantly, as shown in the table above. Borrowers should carefully consider the long-term implications of interest rate changes on their monthly budget and overall repayment costs.

Navigating the Student Loan Application and Renewal Process in 2024

Applying for or renewing federal student loans in 2024 requires careful attention to detail and adherence to specific procedures. Understanding the process, necessary documentation, and timelines is crucial for a successful application. This section provides a step-by-step guide to help you navigate this process efficiently.

The federal student loan application and renewal process involves several key stages, each with specific requirements and deadlines. Failure to meet these requirements can lead to delays or rejection of your application. Careful planning and preparation are essential for a smooth process.

Federal Student Loan Application Process

The application process for federal student loans typically involves completing the Free Application for Federal Student Aid (FAFSA) form. This form collects information about your financial situation to determine your eligibility for federal student aid, including loans.

- Complete the FAFSA: This is the first and most crucial step. You’ll need your Social Security number, federal tax information (yours and your parents’, if you are a dependent student), and your high school records (including GPA and courses taken). The FAFSA website provides detailed instructions and helps you navigate the form. Submitting the FAFSA accurately and completely is paramount.

- Receive Your Student Aid Report (SAR): After submitting your FAFSA, you’ll receive a SAR summarizing your information and indicating your eligibility for federal aid. Review this report carefully for accuracy.

- Accept Your Loan Offer: Your school’s financial aid office will notify you of your loan offer. You’ll need to accept the offer through your student portal or by other designated methods provided by your institution. Be aware of the loan terms, interest rates, and repayment plans.

- Complete Master Promissory Note (MPN): For federal student loans, you’ll need to sign an MPN. This legally binds you to repay the loan according to the terms Artikeld. Read this document carefully before signing.

- Loan Funds Disbursed: Once all requirements are met, your loan funds will be disbursed to your school. The funds will be applied towards your tuition and fees, and any remaining amount may be disbursed to you directly.

Required Documentation for Federal Student Loan Applications

Gathering the necessary documents beforehand streamlines the application process significantly. Missing documentation can lead to processing delays.

- Social Security Number (SSN): This is essential for identifying you within the federal student aid system.

- Federal Income Tax Returns (and W-2s): These documents provide information about your and your parents’ (if applicable) income and tax liability.

- High School Transcripts: These are required to verify your academic history and eligibility for federal aid.

- Driver’s License or State-Issued ID: Used for verification purposes.

Federal Student Loan Renewal Process

Renewing your federal student loans usually involves completing the FAFSA annually, even if you’ve received loans in previous years. Your financial situation may change, affecting your eligibility for continued aid.

- Complete the FAFSA Annually: The FAFSA must be completed each year you intend to receive federal student aid.

- Review Your Eligibility: After submitting your FAFSA, check your SAR for your updated eligibility for federal student aid.

- Contact Your School’s Financial Aid Office: If you have questions or need clarification about your eligibility or loan terms, contact your school’s financial aid office for assistance.

Tips for a Smooth Application Process

Careful planning and preparation are key to a successful application.

- Start Early: Begin the application process well in advance of deadlines to allow ample time for gathering documentation and addressing any issues.

- Maintain Accurate Records: Keep copies of all documents submitted, including your FAFSA, SAR, and MPN.

- Understand Loan Terms: Carefully review all loan documents and understand the terms, conditions, and repayment options before accepting any loan offers.

- Seek Assistance: If you need help with the application process, contact your school’s financial aid office or seek guidance from a trusted advisor.

Resources and Support for Student Loan Borrowers in 2024

Navigating the complexities of student loan repayment can be challenging. Fortunately, numerous resources and support systems are available to help borrowers manage their debt effectively and avoid potential financial hardship. Understanding these options is crucial for ensuring a smooth repayment journey.

Borrowers can access a wide range of assistance, from government-sponsored programs offering repayment plans and forgiveness options to non-profit organizations providing free financial counseling and debt management strategies. Financial advisors can also offer personalized guidance tailored to individual circumstances. This section will Artikel key resources and their services.

Government Resources

The federal government provides several crucial resources for student loan borrowers. These resources offer information, guidance, and support in managing repayment. The Department of Education’s website is the central hub for information regarding federal student loans.

| Resource Name | Description of Services | Contact Information | Website Address |

|---|---|---|---|

| StudentAid.gov | Provides information on federal student aid programs, repayment plans, loan forgiveness programs, and other resources for borrowers. | 1-800-4-FED-AID (1-800-433-3243) | studentaid.gov |

| Federal Student Aid (FSA) | Manages federal student loan programs and provides online tools and resources for borrowers to manage their accounts. | 1-800-4-FED-AID (1-800-433-3243) | studentaid.gov |

| National Student Loan Data System (NSLDS) | Provides a central database of student loan information, allowing borrowers to view their loan details from multiple lenders. | N/A – Access through StudentAid.gov | nslds.ed.gov |

Non-Profit Organizations

Many non-profit organizations offer free or low-cost financial counseling and debt management services specifically for student loan borrowers. These organizations provide valuable support in navigating repayment strategies and exploring options such as income-driven repayment plans.

| Resource Name | Description of Services | Contact Information | Website Address |

|---|---|---|---|

| National Foundation for Credit Counseling (NFCC) | Provides certified credit counselors who can help borrowers create a budget, manage debt, and explore repayment options. | (Vary by location – find a local office through their website) | nfcc.org |

| The Institute of Student Loan Advisors (TISLA) | Connects borrowers with student loan advisors who can provide personalized guidance and support. | (Information available on their website) | tisla.org |

Financial Advisors

While not exclusively focused on student loans, financial advisors can play a vital role in developing a comprehensive financial plan that incorporates student loan repayment strategies. They can help borrowers prioritize debt repayment, explore different repayment options, and integrate student loan management into their overall financial goals. It’s important to choose a fee-only advisor to avoid potential conflicts of interest.

Potential Legislative Changes Affecting Student Loans in 2024

The landscape of student loan repayment and forgiveness is constantly evolving, particularly given the significant economic and social impacts of student debt. While predicting precise legislative changes is challenging, several proposals and ongoing discussions offer clues about potential shifts in 2024. These changes could significantly affect borrowers’ repayment plans, forgiveness opportunities, and overall financial burdens.

The current student loan system, characterized by various repayment plans (Income-Driven Repayment, Standard Repayment, etc.) and limited forgiveness programs (Public Service Loan Forgiveness, Teacher Loan Forgiveness), faces ongoing scrutiny. Many argue the system is insufficiently responsive to the needs of borrowers facing economic hardship or pursuing public service careers. Proposed legislative changes aim to address these concerns, often with conflicting viewpoints on the best approach.

Proposed Changes to Income-Driven Repayment (IDR) Plans

Several legislative proposals aim to reform IDR plans, making them more accessible and effective. Some proposals suggest lowering the percentage of discretionary income borrowers must contribute towards repayment, potentially reducing monthly payments and accelerating loan forgiveness. Others focus on simplifying the application process and streamlining eligibility requirements. For example, a hypothetical bill might propose reducing the required income contribution from 10% to 5% of discretionary income for borrowers with significant debt burdens. This would directly impact borrowers by lowering their monthly payments and potentially shortening their repayment period. The impact would be compared to the current system by analyzing the difference in monthly payments and total interest paid under both scenarios. The overall effect on borrowers’ financial well-being would be a key consideration.

Potential Adjustments to Student Loan Interest Rates

The interest rate applied to student loans directly influences the total amount borrowers repay. Legislative changes could involve adjusting the interest rate calculation methods, potentially linking them to inflation or other economic indicators. Alternatively, legislation might explore options for interest rate subsidies or caps, particularly for borrowers in specific financial circumstances. For instance, a proposed law could cap interest rates at a certain percentage, protecting borrowers from excessively high interest costs. This change would contrast with the existing system where interest rates fluctuate based on market conditions, potentially leading to more predictable and manageable payments for borrowers. The comparison would highlight the differences in total repayment costs under both scenarios, using specific examples of loan amounts and interest rates to illustrate the impact.

Legislative Efforts Concerning Loan Forgiveness Programs

Expansion or modification of existing loan forgiveness programs is another area of potential legislative activity. Proposals may focus on broadening eligibility criteria for existing programs, such as Public Service Loan Forgiveness (PSLF), or creating entirely new forgiveness initiatives targeted at specific professions or demographics. For example, a hypothetical bill might expand PSLF to include more non-profit organizations or increase the number of qualifying payments required for forgiveness. This would contrast with the current, often stringent, eligibility requirements of PSLF, potentially providing relief to a larger number of borrowers. The impact would be assessed by estimating the number of borrowers who would become eligible for forgiveness under the proposed changes and the resulting reduction in overall student loan debt. The analysis might also consider the fiscal implications of expanded forgiveness programs on the government.

Summary of Potential Legislative Changes and Implications

Predicting the exact legislative outcomes regarding student loans in 2024 remains challenging. However, potential changes center around improving IDR plans, adjusting interest rates, and modifying or expanding loan forgiveness programs. These changes aim to alleviate the financial burden on borrowers, but their specific impacts will depend on the details of the legislation enacted. A thorough analysis comparing proposed changes to the existing system is crucial for understanding their potential effects on individual borrowers and the overall student loan landscape. The long-term implications, both for borrowers and the government, require careful consideration.

“This bill seeks to amend the Higher Education Act of 1965 to improve the income-driven repayment system for federal student loans, making it more accessible and beneficial to borrowers.”

This hypothetical quote illustrates the kind of legislative language that might be used to introduce changes. The actual wording and details will vary depending on the specific proposals put forth.

Ultimate Conclusion

In conclusion, the 2024 student loan landscape offers both challenges and opportunities. By understanding the proposed forgiveness plans, available repayment options, and the influence of interest rates, borrowers can proactively manage their debt and plan for long-term financial well-being. Staying informed about legislative changes and utilizing available resources are key to navigating this evolving financial terrain successfully. Take control of your student loan journey and secure a brighter financial future.

FAQ Guide

What if I can’t afford my student loan payments?

Contact your loan servicer immediately. They can discuss options like income-driven repayment plans or deferment/forbearance.

Are private student loans included in any forgiveness programs?

Generally, no. Most forgiveness programs apply only to federal student loans.

How can I find a reputable financial advisor specializing in student loan debt?

Seek referrals from trusted sources, check online reviews, and verify their credentials with relevant professional organizations.

What is the difference between deferment and forbearance?

Deferment temporarily suspends payments and may stop interest accrual on certain loans. Forbearance temporarily suspends payments but usually allows interest to continue accruing.