The decision between a variable and fixed-rate student loan can feel like navigating a complex maze. Understanding the nuances of interest rate fluctuations and their long-term impact on your finances is crucial for making an informed choice. This guide will illuminate the key differences, helping you weigh the potential benefits and risks associated with each loan type, ultimately empowering you to select the best option for your individual circumstances.

Choosing between a variable and fixed interest rate significantly impacts the overall cost of your student loan. Variable rates fluctuate with market conditions, offering potential savings if rates decline but exposing you to higher payments if they rise. Fixed rates provide predictable monthly payments, offering stability and allowing for better budgeting, though they might result in paying slightly more interest overall compared to a consistently low variable rate.

Understanding Interest Rates

Choosing between a variable and a fixed interest rate for your student loan is a crucial decision that significantly impacts your overall repayment cost. Understanding the nuances of each type of interest rate is essential for making an informed choice. This section will clarify the differences and help you assess which option best aligns with your financial situation and risk tolerance.

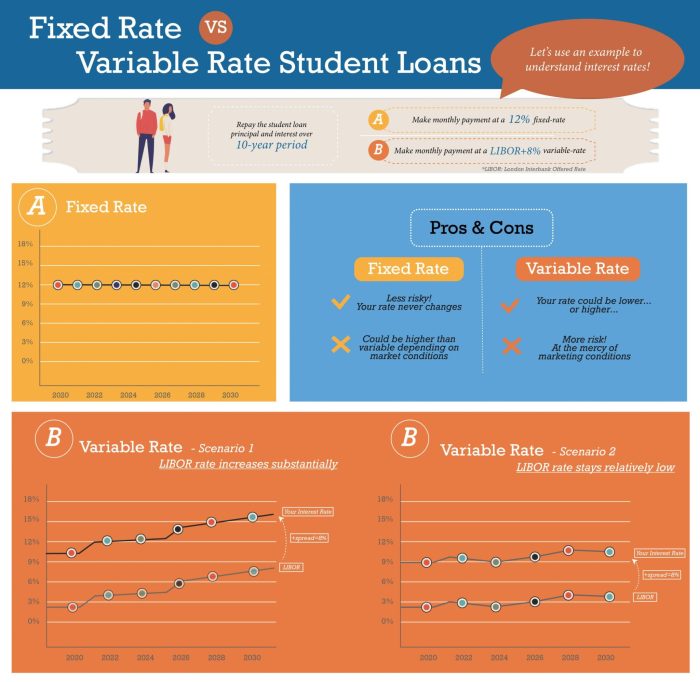

The primary difference lies in how the interest rate fluctuates over the life of the loan. A fixed interest rate remains constant throughout the loan’s term, providing predictable monthly payments. Conversely, a variable interest rate changes periodically, typically based on an underlying index, such as the prime rate or LIBOR (although LIBOR is being phased out). This means your monthly payments could increase or decrease depending on market conditions.

Variable Interest Rate Factors

Several factors influence the fluctuations of variable interest rates on student loans. These factors are largely outside the borrower’s control and reflect broader economic trends. Key influences include the prevailing interest rate set by the Federal Reserve, the performance of the overall economy, and the specific index to which the loan’s rate is tied. Changes in these factors can lead to adjustments in the interest rate applied to your loan, potentially affecting your monthly payments and the total amount you repay. For example, an increase in the Federal Reserve’s target rate would typically lead to a rise in variable student loan interest rates.

Variable Rate Changes Over Time

Let’s illustrate how variable rates can change. Imagine a student loan with an initial variable interest rate of 5%. Over the course of a year, this rate might increase to 6% due to rising inflation and subsequent increases in the prime rate. In the following year, if economic conditions improve and the Fed lowers rates, the interest rate on the loan could decrease to 5.5%. These fluctuations are unpredictable and depend entirely on the market conditions and the specific index used to determine the interest rate. This contrasts sharply with a fixed-rate loan, where the rate remains consistently at the agreed-upon percentage throughout the loan term.

Variable vs. Fixed Rate Loan Cost Comparison

The following table compares the potential cost of a $20,000 student loan with a 10-year repayment period under both variable and fixed interest rate scenarios. These are illustrative examples, and actual results may vary based on the specific loan terms and market conditions.

| Scenario | Year 1 Interest Rate | Year 5 Interest Rate | Year 10 Interest Rate | Total Interest Paid |

|---|---|---|---|---|

| Variable Rate (Initial 5%) | 5% | 6% | 7% | $6,500 (estimated) |

| Fixed Rate (6%) | 6% | 6% | 6% | $7,200 |

Loan Repayment Scenarios

Understanding how student loan repayment works is crucial for effective financial planning. Different repayment plans, coupled with variable or fixed interest rates, significantly impact the total cost of your loan. This section will explore various repayment scenarios to illustrate these differences.

The total amount repaid on a student loan depends on two primary factors: the interest rate and the repayment period. Fixed-rate loans offer predictable monthly payments, while variable-rate loans have fluctuating payments based on market interest rate changes. Let’s examine how these factors influence repayment.

Fixed-Rate Loan Repayment Scenarios

With a fixed-rate loan, your monthly payment remains consistent throughout the loan term. This predictability allows for easier budgeting. Consider two scenarios: a 10-year repayment and a 20-year repayment plan, both with a fixed interest rate of 5% on a $30,000 loan. The 10-year plan would result in higher monthly payments but significantly lower total interest paid compared to the 20-year plan. For example, the 10-year plan might involve a monthly payment around $330, resulting in approximately $10,000 in total interest, while the 20-year plan might have a monthly payment around $190 but a total interest exceeding $20,000.

Variable-Rate Loan Repayment Scenarios

Variable-rate loans present a different picture. Your monthly payment can fluctuate depending on market interest rate changes. Using the same $30,000 loan example, if the initial interest rate is 4% and rises to 6% over the loan term, your monthly payments will increase accordingly. A 10-year repayment plan might start with a lower monthly payment than the fixed-rate example but could become higher than the fixed-rate plan if interest rates rise substantially. Similarly, a 20-year plan will also be affected by interest rate fluctuations, making accurate prediction of total interest paid more difficult.

Comparison of Total Interest Paid

The following table illustrates a simplified comparison of total interest paid under different scenarios. Note that these are illustrative examples and actual amounts will vary based on the specific loan terms and interest rate fluctuations for variable-rate loans. Real-world calculations require specialized loan amortization calculators.

| Loan Type | Repayment Period | Approximate Total Interest Paid |

|---|---|---|

| Fixed-Rate (5%) | 10 years | $10,000 |

| Fixed-Rate (5%) | 20 years | $20,000+ |

| Variable-Rate (4%-6%) | 10 years | $10,000 – $15,000 (estimated range) |

| Variable-Rate (4%-6%) | 20 years | $20,000+ (estimated range, potentially higher than fixed-rate) |

Advantages and Disadvantages of Repayment Plans

Choosing between a 10-year and 20-year repayment plan involves weighing the advantages and disadvantages of each. The shorter repayment period offers significant long-term savings on interest, but it requires higher monthly payments.

- 10-Year Repayment Plan: Advantages – Lower total interest paid, quicker debt elimination; Disadvantages – Higher monthly payments, potentially tighter budget constraints.

- 20-Year Repayment Plan: Advantages – Lower monthly payments, easier budgeting; Disadvantages – Higher total interest paid, longer debt repayment period.

Impact of Early Repayment

Early repayment, regardless of whether you have a fixed or variable-rate loan, significantly reduces the total interest paid. With a fixed-rate loan, the savings are easily calculable as the interest rate is constant. With a variable-rate loan, the savings depend on the prevailing interest rate at the time of early repayment and the remaining loan term. However, even with variable rates, early repayment is always advantageous. For example, paying an extra $100 per month consistently will reduce the loan’s lifespan and total interest, regardless of rate fluctuations.

Financial Risk Assessment

Choosing between a variable-rate and a fixed-rate student loan involves carefully considering the potential financial risks. Understanding these risks and how to mitigate them is crucial for responsible borrowing and long-term financial well-being. This section will explore the inherent risks of variable-rate loans and offer strategies to manage them, ultimately helping you determine which loan type best suits your circumstances.

Variable-Rate Loan Risks

Variable-rate student loans offer lower initial interest rates, but this advantage comes with the risk of unpredictable interest rate fluctuations. These fluctuations directly impact your monthly payments and the total amount you repay over the life of the loan. A significant increase in interest rates could lead to substantially higher monthly payments, potentially straining your budget and making repayment more challenging. Furthermore, the uncertainty makes long-term financial planning more difficult, as you cannot accurately predict your future loan payments.

Mitigating Variable-Rate Loan Risks

Several strategies can help mitigate the risks associated with variable-rate student loans. Careful budgeting and financial planning are essential. Creating a budget that accounts for potential interest rate increases allows you to adjust your spending accordingly and maintain financial stability. Consider building an emergency fund to cover unexpected expenses or potential payment increases. Another strategy is to explore options for refinancing your loan to a fixed-rate loan if interest rates rise significantly. This can lock in a predictable payment amount and provide financial security. Finally, understanding the terms and conditions of your loan, including any caps on interest rate increases, is crucial for managing expectations and mitigating risk.

Situations Favoring Fixed-Rate Loans

A fixed-rate student loan offers predictability and stability, making it a better option in certain situations. For example, if you anticipate a period of lower income or financial instability, a fixed-rate loan provides a consistent payment amount, reducing financial stress. Similarly, if you value financial predictability and prefer to avoid the uncertainty associated with fluctuating interest rates, a fixed-rate loan offers a clear and stable repayment plan. Individuals with a strong aversion to risk might also find fixed-rate loans more appealing due to their inherent predictability. For example, someone planning a family or major life purchase would benefit from the stability of knowing their loan payment will remain consistent.

Long-Term Financial Implications Comparison

The long-term financial implications of variable-rate and fixed-rate loans differ significantly. A variable-rate loan might offer lower initial payments, but these payments could increase substantially over time if interest rates rise. This can lead to a higher total repayment amount compared to a fixed-rate loan, even if the initial interest rate was lower. Conversely, a fixed-rate loan offers predictable payments and a known total repayment amount, simplifying long-term financial planning. Consider this example: A $50,000 variable-rate loan at 3% initially might increase to 6% after a few years, resulting in significantly higher payments and total interest paid compared to a $50,000 fixed-rate loan at 4.5% throughout the repayment period. The total interest paid and the length of the repayment period will differ depending on the interest rate fluctuation and the initial and final interest rates. This underscores the importance of considering your risk tolerance and long-term financial goals when choosing between these loan types.

Impact of Market Conditions

Understanding how market conditions influence your student loan payments is crucial, especially if you have a variable-rate loan. These loans, unlike fixed-rate loans, fluctuate with changes in the broader financial landscape, impacting your monthly payments and overall loan cost. This section will explore the relationship between market interest rates and your student loan payments, focusing on the role of the Federal Reserve and historical trends.

The most significant factor affecting variable-rate student loan payments is the market interest rate. Variable rates are typically tied to an index, such as the prime rate or LIBOR (though LIBOR is being phased out), plus a margin set by the lender. When market interest rates rise, so does the interest rate on your loan, leading to higher monthly payments. Conversely, when market interest rates fall, your payments will generally decrease. This dynamic makes budgeting and long-term financial planning more complex compared to fixed-rate loans.

The Federal Reserve’s Influence on Student Loan Interest Rates

The Federal Reserve (also known as the Fed), the central bank of the United States, plays a pivotal role in shaping interest rates through its monetary policy. The Fed uses tools like the federal funds rate (the target rate for overnight lending between banks) to influence the overall cost of borrowing. When the Fed raises the federal funds rate, it becomes more expensive for banks to borrow money, which, in turn, leads to higher interest rates for consumers, including those with variable-rate student loans. Conversely, lowering the federal funds rate typically results in lower interest rates across the board. The Fed’s actions are a significant, albeit indirect, driver of student loan interest rate fluctuations.

Historical Trends in Student Loan Interest Rates

Historically, student loan interest rates have shown considerable variability. During periods of economic expansion and low inflation, rates have generally trended downward. Conversely, times of economic uncertainty or high inflation have often seen rates rise. For example, the period following the 2008 financial crisis saw a significant decrease in interest rates, making student loans more affordable. However, in recent years, rates have experienced some upward pressure due to factors such as inflation and economic recovery efforts. Analyzing historical trends provides a context for understanding the potential future movements of variable-rate student loan interest rates.

Visual Representation of Market Interest Rates and Variable Student Loan Payments

Imagine a graph with two lines. The horizontal axis represents time (e.g., years), and the vertical axis represents the interest rate (percentage). One line represents the market interest rate (e.g., a benchmark rate like the prime rate), showing its ups and downs over time. This line might start relatively low, rise gradually, peak, and then fall again, reflecting typical market fluctuations. The second line represents the variable student loan interest rate. This line closely tracks the market interest rate line but is slightly above it due to the lender’s margin. The vertical distance between the two lines consistently represents this margin. When the market interest rate line rises, the student loan rate line rises proportionally, and vice-versa. This clearly illustrates how changes in the market directly impact the cost of borrowing for variable-rate student loans. The visual shows a direct correlation; a rise in the market rate causes a corresponding rise in the student loan rate, and a fall in the market rate causes a similar fall in the student loan rate.

Choosing the Right Loan Type

Selecting between a variable and a fixed-rate student loan is a crucial decision impacting your finances for years to come. Understanding the nuances of each type is essential to making an informed choice that aligns with your individual financial situation and risk tolerance. This section will compare and contrast these loan types, providing a framework to help you navigate this important decision.

Variable and fixed-rate student loans differ fundamentally in how their interest rates are determined. A fixed-rate loan maintains a consistent interest rate throughout the loan’s term, providing predictable monthly payments. In contrast, a variable-rate loan’s interest rate fluctuates based on an underlying benchmark rate, such as the prime rate or LIBOR (although LIBOR is being phased out). This fluctuating rate can lead to unpredictable monthly payments, potentially increasing or decreasing over time.

Variable vs. Fixed-Rate Loan Benefits

The choice between a variable and fixed-rate loan hinges on a careful weighing of their respective advantages and disadvantages. A fixed-rate loan offers the predictability of consistent monthly payments, making budgeting easier. However, if interest rates fall significantly after you’ve secured a fixed-rate loan, you might miss out on potential savings. Conversely, a variable-rate loan offers the potential for lower initial payments if interest rates are low, but carries the risk of substantially higher payments if rates rise unexpectedly. The ideal choice depends entirely on your individual circumstances and risk tolerance.

Factors to Consider When Selecting a Student Loan Type

Several key factors should inform your decision. A comprehensive assessment of these elements will significantly improve the likelihood of selecting the loan type best suited to your needs.

- Current Interest Rates: Compare the current fixed and variable rates offered. Consider the projected trajectory of interest rates based on economic forecasts. If rates are expected to rise, a fixed rate may be more advantageous.

- Loan Term Length: Longer loan terms increase the overall interest paid. With variable rates, a longer term magnifies the potential impact of rate increases.

- Risk Tolerance: Assess your comfort level with fluctuating payments. If you prefer predictable budgeting, a fixed rate is generally safer.

- Financial Stability: Evaluate your current and projected income and expenses. If your income is unstable, a fixed rate may provide greater financial security.

- Repayment Strategy: Consider your planned repayment strategy. Will you aggressively pay down the loan or make minimum payments? A variable rate might be more attractive if you anticipate paying off the loan quickly.

Decision-Making Flowchart for Choosing Between Variable and Fixed-Rate Loans

The following flowchart illustrates a logical decision-making process. Remember, this is a guideline, and your specific circumstances may require adjustments.

[Imagine a flowchart here. The flowchart would start with a decision point: “Are interest rates expected to rise significantly?”. If yes, it branches to “Choose Fixed-Rate Loan”. If no, it branches to another decision point: “Is predictable budgeting crucial?”. If yes, it branches to “Choose Fixed-Rate Loan”. If no, it branches to “Choose Variable-Rate Loan”. A final box would say “Loan Application”.]

Influence of Individual Financial Circumstances

Individual financial situations significantly influence the optimal loan type. For example, a recent graduate with a stable, high-income job and a low tolerance for risk might favor a fixed-rate loan to ensure predictable monthly payments. Conversely, a graduate anticipating a period of lower income or with a higher risk tolerance might opt for a variable-rate loan, hoping to benefit from potentially lower initial interest rates. A person with a high debt-to-income ratio might find a fixed rate preferable for its predictability.

Final Summary

Ultimately, the choice between a student loan with a variable or fixed interest rate hinges on your risk tolerance, financial forecasting abilities, and long-term financial goals. While variable rates offer potential for lower costs, the inherent uncertainty demands careful consideration. A fixed rate provides predictability and stability, offering peace of mind even if it comes at a slightly higher overall cost. By carefully weighing the advantages and disadvantages Artikeld in this guide, you can make a well-informed decision that aligns with your unique financial situation and future aspirations.

Commonly Asked Questions

What happens if I lose my job while on a variable-rate student loan?

Losing your job can significantly impact your ability to make student loan payments, regardless of whether your loan has a variable or fixed rate. Explore options like deferment or forbearance with your loan servicer. Contacting them promptly is crucial to avoid default.

Can I switch from a variable-rate loan to a fixed-rate loan?

This is generally not possible. The interest rate type is determined at the time you take out the loan. However, refinancing your loan with a different lender might offer the option of a fixed rate.

How often do variable interest rates change on student loans?

The frequency of changes varies by lender, but it’s typically monthly or quarterly. Your loan documents will specify the exact schedule.

Are there any tax benefits associated with student loan interest payments?

Yes, in some countries (like the US), you may be able to deduct a portion of your student loan interest payments from your taxable income, subject to certain limitations and income thresholds. Consult a tax professional for specific guidance.