Navigating the complexities of higher education financing often leaves prospective students and parents grappling with numerous loan options. Two prominent choices, student loans and Parent PLUS loans, each present unique eligibility criteria, interest rates, and repayment structures. Understanding the nuances of each is crucial for making informed decisions that align with individual financial circumstances and long-term goals. This guide aims to illuminate the key differences between these two loan types, empowering you to choose the best path for your educational journey.

This comparison will delve into the eligibility requirements, interest rates and fees, repayment options, loan forgiveness possibilities, credit score impact, tax implications, and long-term financial planning considerations associated with both student and Parent PLUS loans. By carefully examining these factors, you can make a well-informed decision that minimizes financial strain and maximizes the benefits of higher education.

Eligibility Requirements

Understanding the eligibility requirements for student loans and Parent PLUS loans is crucial for prospective borrowers. Both loan types have distinct criteria, impacting who can access them and the terms they receive. This section will clarify these differences and guide you through the application process for each.

Student Loan Eligibility

Eligibility for federal student loans hinges primarily on enrollment status and the completion of the Free Application for Federal Student Aid (FAFSA). Applicants must be enrolled or accepted for enrollment at least half-time in a degree or certificate program at an eligible institution. They must also be a U.S. citizen or eligible non-citizen, possess a valid Social Security number, and maintain satisfactory academic progress. There are no credit history requirements for federal student loans. The amount a student can borrow depends on their year in school, dependency status, and the cost of attendance.

Parent PLUS Loan Eligibility

Parent PLUS loans, designed to help parents finance their children’s education, have stricter eligibility requirements than student loans. Parents must be a U.S. citizen or eligible non-citizen, have a valid Social Security number, and be the biological or adoptive parent of a dependent student enrolled at least half-time in an eligible educational program. Crucially, they must undergo a credit check, and a negative credit history can result in loan denial. Specific credit requirements vary but generally involve an absence of serious credit delinquencies or bankruptcies within the recent past. The application process includes providing income information; income limitations do not directly disqualify applicants, but a high debt-to-income ratio might affect approval.

Application Process: Student Loans

1. Complete the FAFSA: This application determines your eligibility for federal student aid, including student loans.

2. Receive your Student Aid Report (SAR): This report summarizes your FAFSA information and indicates your eligibility for federal aid.

3. Accept your loan offer: Your school will provide you with a loan offer outlining the terms and conditions. You will need to electronically accept the loan offer.

4. Complete Master Promissory Note (MPN): This legally binding document confirms your agreement to repay the loan.

5. Loan funds are disbursed: The funds are disbursed directly to your school to cover tuition and fees.

Application Process: Parent PLUS Loans

1. Complete the FAFSA: The student must complete the FAFSA so the parent can be considered for a Parent PLUS loan.

2. Complete the Parent PLUS Loan application: This application requires providing detailed financial and credit information.

3. Credit check: The Department of Education will conduct a credit check to assess creditworthiness.

4. Loan approval or denial: You will receive notification regarding your loan application status. If approved, you will need to complete a Master Promissory Note.

5. Loan funds are disbursed: Similar to student loans, the funds are disbursed to the school.

Eligibility Factors Comparison

| Factor | Student Loans | Parent PLUS Loans |

|---|---|---|

| Credit Check | No | Yes |

| Income Limitations | Indirect (based on FAFSA data and cost of attendance) | Indirect (high debt-to-income ratio may impact approval) |

| Enrollment Status | Enrolled at least half-time | Dependent student enrolled at least half-time |

| Citizenship | U.S. citizen or eligible non-citizen | U.S. citizen or eligible non-citizen |

Interest Rates and Fees

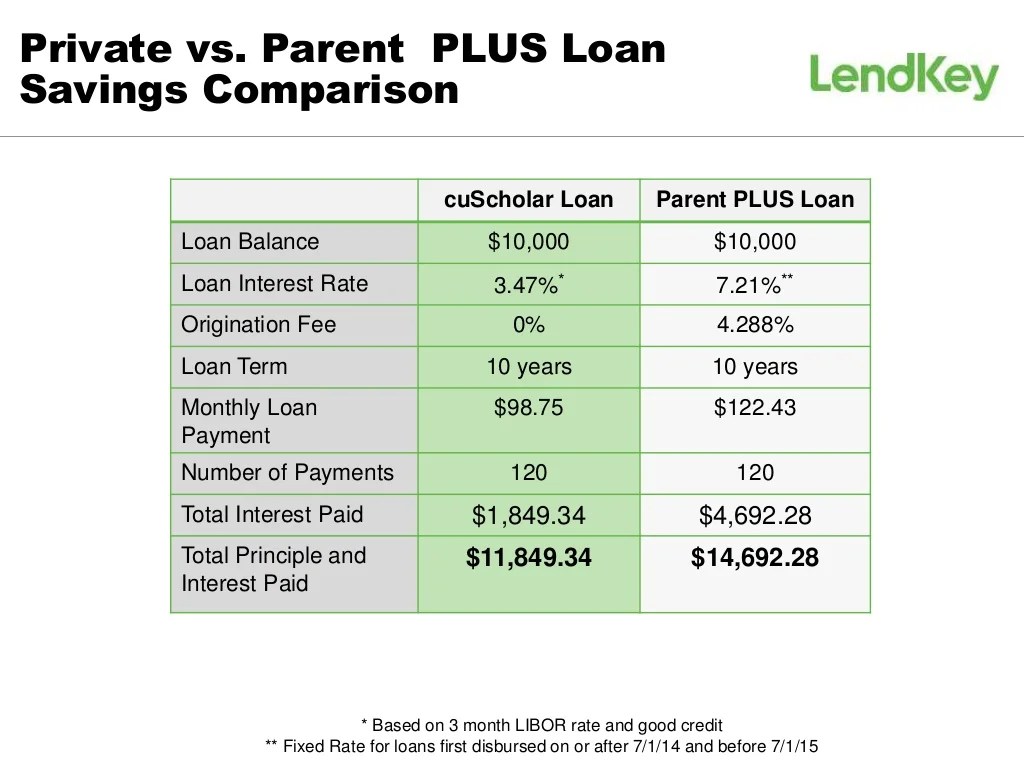

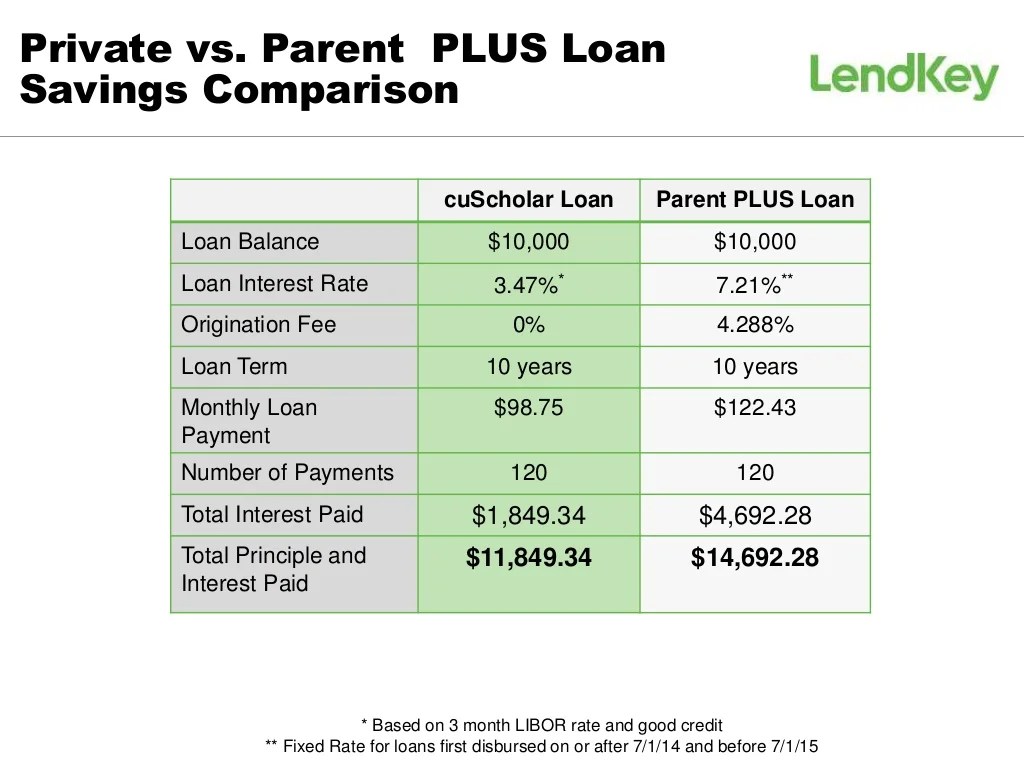

Understanding the interest rates and fees associated with student loans and Parent PLUS loans is crucial for effective financial planning. These costs significantly impact the total amount you’ll repay over the life of the loan. Variations in interest rates and fees exist, depending on several factors. This section will provide a clear comparison to help you make informed decisions.

Both student loans and Parent PLUS loans have variable interest rates, meaning the rate can change over the life of the loan. These rates are set by the government and are subject to change each year. For the most current rates, it’s always best to check the official Federal Student Aid website. However, we can discuss the general factors that influence these rates.

Interest Rate Variations

Several factors influence the interest rates for both student and Parent PLUS loans. For federal student loans, the interest rate is often tied to the 10-year Treasury note, plus a fixed margin. This means that changes in market interest rates directly affect the interest rate on your loan. Parent PLUS loans generally have a higher interest rate than student loans, reflecting the higher risk associated with lending to a parent. The creditworthiness of the borrower (the student for student loans, and the parent for Parent PLUS loans) also plays a significant role. A borrower with a strong credit history may be eligible for a lower interest rate. Finally, the type of loan (subsidized vs. unsubsidized for student loans) also affects the interest rate; subsidized loans may have lower rates due to government subsidies.

Fees Associated with Student and Parent PLUS Loans

Origination fees are common for both student and Parent PLUS loans. These fees are a percentage of the loan amount and are deducted from the loan proceeds before the funds are disbursed to the borrower or the school. The exact percentage varies depending on the loan type and the year the loan was originated. There are no other significant fees associated with these federal loan programs. However, it is important to be aware of potential private lender fees if you are considering private student loans, which are not covered here.

Comparative Cost of Borrowing

The following table illustrates the total cost of borrowing over various loan terms, assuming a fixed interest rate for simplicity. Remember that actual costs can vary depending on the specific interest rate applied to your loan. This table serves as an example only and should not be used for precise financial planning. Always consult official sources and financial advisors for personalized advice.

| Loan Type | Loan Amount | Interest Rate (Example) | Loan Term (Years) | Total Repayment |

|---|---|---|---|---|

| Federal Student Loan | $10,000 | 5% | 10 | $12,577.89 |

| Federal Student Loan | $10,000 | 5% | 15 | $14,186.72 |

| Parent PLUS Loan | $10,000 | 7% | 10 | $14,025.52 |

| Parent PLUS Loan | $10,000 | 7% | 15 | $16,326.59 |

Repayment Options

Understanding your repayment options is crucial for effectively managing both student loans and Parent PLUS loans. The available plans vary in terms of monthly payment amounts, repayment periods, and overall cost. Choosing the right plan depends on your individual financial circumstances and long-term goals. Let’s explore the key differences and provide examples to illustrate potential monthly payment scenarios.

Standard Repayment Plan

The Standard Repayment Plan is a fixed monthly payment plan that typically amortizes the loan over 10 years. This means that the loan is paid off in full within a decade. The monthly payment is calculated based on the loan amount, interest rate, and loan term. For example, a $30,000 student loan with a 5% interest rate would have an estimated monthly payment of approximately $330. A $30,000 Parent PLUS loan with a 7% interest rate would have a higher monthly payment, approximately $360. These are estimates and actual payments may vary slightly depending on the specific lender and loan terms.

Extended Repayment Plan

The Extended Repayment Plan offers a longer repayment period, typically 25 years, resulting in lower monthly payments. This plan can provide financial relief, especially for borrowers with higher loan balances. However, it also leads to paying significantly more interest over the life of the loan. Using the same examples, the monthly payment for a $30,000 student loan with a 5% interest rate on an extended plan would be approximately $165, while the Parent PLUS loan with a 7% interest rate would have a monthly payment around $190. While lower monthly payments are appealing, remember the total interest paid will be substantially higher.

Graduated Repayment Plan

A Graduated Repayment Plan starts with lower monthly payments that gradually increase over time. This option can be beneficial for borrowers anticipating increased income in the future. However, the lower initial payments may not cover the accruing interest, potentially leading to a larger loan balance over time. It’s important to carefully consider your income projections when choosing this option. Specific payment amounts would depend heavily on the borrower’s income and projected income growth, making precise examples difficult without individual financial information.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) tie your monthly payment to your income and family size. These plans are designed to make repayment more manageable, particularly for borrowers with lower incomes. There are several types of IDR plans (e.g., ICR, PAYE, REPAYE,IBR), each with its own specific eligibility requirements and payment calculations. Because these plans are income-based, providing specific examples is not possible without individual income and family size data. However, it’s important to note that while these plans offer lower monthly payments, they often extend the repayment period significantly, leading to higher total interest paid over the life of the loan.

Repayment Option Comparison

The following table summarizes the key differences between the repayment plans discussed above. Note that specific terms and conditions may vary depending on the lender and type of loan.

| Repayment Plan | Loan Term | Payment Amount | Total Interest Paid |

|---|---|---|---|

| Standard | 10 years | Higher | Lower |

| Extended | 25 years | Lower | Higher |

| Graduated | 10 years | Starts low, increases | Variable, potentially high |

| Income-Driven | Variable, up to 20-25 years | Based on income | Potentially high |

Loan Forgiveness and Deferment

Navigating the complexities of student loan repayment can be challenging, particularly understanding the options available for loan forgiveness and deferment. Both federal student loans and Parent PLUS loans offer programs designed to provide temporary or permanent relief from repayment, but the specifics differ significantly. This section will Artikel the eligibility criteria, application processes, and potential benefits and drawbacks of these programs for each loan type.

Eligibility Requirements for Loan Forgiveness Programs

Loan forgiveness programs, while offering the potential for significant debt reduction, often have stringent eligibility requirements. These requirements vary depending on the specific program and the type of loan. For example, the Public Service Loan Forgiveness (PSLF) program, applicable to federal student loans (including Direct Subsidized, Unsubsidized, and Consolidation Loans), requires 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. Parent PLUS loans, however, are generally not eligible for PSLF. Other forgiveness programs, such as those based on teaching in underserved areas or working in specific public health professions, may have different eligibility criteria and may or may not apply to Parent PLUS loans. It’s crucial to carefully review the specific requirements of each program to determine eligibility.

Loan Deferment and Forbearance Application Process

Applying for deferment or forbearance involves contacting your loan servicer. Deferment temporarily suspends your loan payments, and in some cases, interest may not accrue (depending on the loan type and deferment reason). Forbearance also postpones payments but usually accrues interest, increasing the total loan amount owed. The application process typically involves completing a form provided by your loan servicer, documenting the reason for the request (e.g., unemployment, economic hardship, or medical reasons). Supporting documentation, such as proof of unemployment or medical bills, may be required. The approval process varies depending on the servicer and the reason for the request. Both federal student loans and Parent PLUS loans offer deferment and forbearance options, although the specific terms and conditions might differ.

Comparison of Loan Forgiveness and Deferment Benefits and Drawbacks

| Feature | Federal Student Loans | Parent PLUS Loans |

|—————–|—————————————————-|—————————————————–|

| Forgiveness | Eligible for programs like PSLF; potential for full forgiveness. | Limited forgiveness options; generally not eligible for PSLF. |

| Deferment/Forbearance | Options available; may or may not accrue interest. | Options available; interest usually accrues during forbearance. |

| Interest Rates | Generally lower than Parent PLUS loans. | Generally higher than federal student loans. |

| Repayment Options | More flexible repayment plans available. | Fewer flexible repayment options. |

Applying for Loan Forgiveness: A Flowchart

The process for applying for loan forgiveness can vary significantly depending on the specific program. However, a general flowchart can illustrate the key steps.

Step 1: Identify potential forgiveness programs based on your loan type and circumstances.

Step 2: Verify your eligibility for the chosen program(s) by carefully reviewing the specific requirements.

Step 3: Gather all necessary documentation to support your application (e.g., employment verification, income tax returns).

Step 4: Complete the application form provided by your loan servicer or the relevant government agency.

Step 5: Submit your completed application and supporting documentation.

Step 6: Monitor your application status and follow up with the servicer or agency if necessary.

Step 7: Once approved, carefully review the terms of the forgiveness agreement.

Impact on Credit Score

Student loans and Parent PLUS loans, while crucial for financing education, significantly impact a borrower’s credit score. Understanding this impact is vital for responsible borrowing and long-term financial health. Both loan types are installment loans, meaning they’re reported to credit bureaus and affect your credit profile. However, the specific impact depends on several factors, including repayment behavior and the loan’s size.

Responsible repayment behavior is crucial for maintaining a positive credit history. Consistent on-time payments demonstrate creditworthiness, positively influencing your credit score. Conversely, missed or late payments negatively affect your credit report, potentially leading to lower credit scores and impacting your ability to secure future loans or credit.

Late Payments and Defaults

Late payments and defaults on both student loans and Parent PLUS loans severely damage credit scores. A single missed payment can result in a significant drop, and repeated late payments can lead to further declines. Defaulting on a loan—failing to make payments for an extended period—has particularly devastating consequences. For instance, a 30-day late payment on a student loan might lower your score by 30-50 points, while a default could reduce your score by 100-150 points or more, depending on the credit scoring model and the severity of the delinquency. Similarly, a Parent PLUS loan default carries equally severe consequences, potentially resulting in a significant and lasting negative impact on the parent’s credit report. The negative impact is amplified by the fact that these loans are often for substantial amounts.

Long-Term Credit Implications

| Feature | Student Loan | Parent PLUS Loan | Overall Impact |

|---|---|---|---|

| Credit Reporting | Reported to credit bureaus; impacts credit score | Reported to credit bureaus; impacts credit score | Both significantly impact credit |

| On-Time Payments | Positive impact on credit score; builds credit history | Positive impact on credit score; builds credit history | Consistent payments improve creditworthiness |

| Late Payments | Negative impact; score reduction; potential collection actions | Negative impact; score reduction; potential collection actions | Significant negative impact; potential long-term consequences |

| Default | Severe negative impact; significant score reduction; potential wage garnishment | Severe negative impact; significant score reduction; potential wage garnishment | Extremely damaging; difficult to recover from |

| Loan Size | Impacts severity of negative consequences if defaulted | Often larger loan amounts; greater potential for negative impact | Larger loan amounts exacerbate the consequences of default |

Tax Implications

Understanding the tax implications of student loans, both for the borrower and, in the case of Parent PLUS loans, the parent, is crucial for effective financial planning. The tax code offers certain deductions and credits that can help offset the cost of higher education, but navigating these benefits requires careful attention to detail. The tax treatment of student loan interest and any potential tax benefits vary depending on several factors, including your filing status, income, and the type of loan.

Student Loan Interest Deduction

The student loan interest deduction allows taxpayers to deduct the amount of interest they paid on qualified student loans during the tax year. This deduction can reduce your taxable income, resulting in a lower tax bill. However, there are limitations. The maximum deduction is $2,500, and it’s phased out for higher income taxpayers. For example, for the 2023 tax year, the phaseout range for married couples filing jointly began at $180,000 of modified adjusted gross income (MAGI). The deduction is claimed on Form 1040, Schedule 1 (Additional Income and Adjustments to Income). It’s important to note that you must be legally obligated to repay the loan to claim the deduction; this means the loan must be in your name.

American Opportunity Tax Credit (AOTC) and Lifetime Learning Credit (LLC)

The AOTC and LLC are tax credits, not deductions, offering a more significant tax benefit than a deduction because they directly reduce your tax liability, dollar for dollar. The AOTC is for the first four years of undergraduate education, and it’s worth up to $2,500 per eligible student. The LLC is for undergraduate and graduate courses and offers a maximum credit of $2,000. Both credits have income limitations, and eligibility depends on factors like the student’s enrollment status and the type of institution attended. The credits are claimed using Form 8863 (Education Credits). These credits benefit the student borrower directly, not the parent in the case of a Parent PLUS loan.

Tax Implications of Parent PLUS Loans

Parent PLUS loans themselves do not offer any specific tax deductions or credits. The interest paid on a Parent PLUS loan is not deductible by the parent. However, the parent may be able to utilize other tax benefits related to education expenses, such as the AOTC or LLC if they are paying education expenses for a dependent child. The key difference lies in who claims the credit; the parent can only claim the credit if their child meets the eligibility requirements. The parent is not eligible for the student loan interest deduction because they are not the borrower.

Key Tax Considerations

- Student Loans: The student loan interest deduction can reduce your tax liability, but income limitations apply. The AOTC and LLC offer more significant tax benefits but have their own eligibility requirements.

- Parent PLUS Loans: No direct tax benefits are associated with Parent PLUS loans themselves. Parents may still be eligible for education tax credits (AOTC or LLC) if they are paying for their child’s education and the child meets the requirements.

- Record Keeping: Meticulously maintain records of all student loan interest payments and education expenses to accurately claim any applicable deductions or credits.

- Consult a Tax Professional: Tax laws are complex. Consulting with a tax professional can ensure you maximize your tax benefits and avoid potential penalties.

Long-Term Financial Planning

Navigating the complexities of student loan debt requires a long-term perspective. Understanding the potential financial implications of both student loans and Parent PLUS loans is crucial for building a secure financial future. Effective planning and strategic debt management are key to minimizing the long-term burden and maximizing your financial well-being.

Student loans and Parent PLUS loans, while offering access to education, carry significant long-term financial consequences. The interest accrued over time can substantially increase the total amount owed, impacting future savings, investments, and major life purchases like a home or starting a family. Careful consideration of repayment strategies and potential loan forgiveness programs is essential to mitigate these risks.

Long-Term Financial Implications of Student Loans

Taking on student loan debt can significantly impact your long-term financial health. The monthly payments can constrain your budget, limiting your ability to save for retirement, purchase a home, or invest in other opportunities. For example, a graduate with $50,000 in student loan debt at a 6% interest rate might face monthly payments exceeding $500, depending on the repayment plan chosen. This significant monthly outflow could delay major life milestones. Furthermore, high levels of student loan debt can negatively affect credit scores, potentially increasing interest rates on future loans for mortgages or car purchases.

Long-Term Financial Implications of Parent PLUS Loans

Parent PLUS loans, while intended to assist students, can also have lasting financial consequences for parents. The debt burden falls on the parents, potentially delaying their own retirement savings or forcing them to postpone other financial goals. Imagine a parent borrowing $100,000 for their child’s education. Even with a low interest rate, the total repayment amount, including interest, could easily exceed $150,000 over the loan term, impacting the parents’ financial stability in their later years. It is essential for parents to carefully assess their own financial situation before taking on this substantial debt.

Strategies for Managing Student Loan Debt Effectively

Effective student loan debt management requires a proactive approach. Creating a realistic budget that incorporates loan repayments is the first step. Exploring different repayment options, such as income-driven repayment plans, can help manage monthly payments. Consolidating multiple loans into a single loan can simplify repayment and potentially lower the overall interest rate. Additionally, making extra payments whenever possible can significantly reduce the total interest paid and shorten the repayment period. For example, even an extra $100 per month can save thousands of dollars in interest over the life of the loan.

Comparison of Long-Term Financial Consequences

The long-term financial consequences of student loans and Parent PLUS loans differ significantly. Student loans primarily impact the borrower’s financial future, while Parent PLUS loans affect the parents’ financial well-being. While both loan types can hinder long-term financial goals, the impact is distributed differently. Student loans might delay homeownership or retirement savings for the borrower, while Parent PLUS loans could postpone retirement or other financial goals for the parents. The magnitude of the impact depends on the loan amount, interest rate, repayment plan, and the borrowers’ and parents’ overall financial situations.

Impact of Different Repayment Strategies on Long-Term Financial Well-being

Consider two hypothetical scenarios: Scenario A: A borrower chooses a standard repayment plan with high monthly payments, paying off their debt quickly but limiting their ability to save for retirement. Scenario B: A borrower opts for an income-driven repayment plan with lower monthly payments, allowing for more savings but extending the repayment period and increasing overall interest paid. While Scenario A results in less interest paid and faster debt elimination, it might compromise long-term savings goals. Scenario B offers greater short-term financial flexibility but results in higher overall interest costs. The optimal strategy depends on individual financial priorities and risk tolerance.

Closing Notes

Choosing between a student loan and a Parent PLUS loan requires careful consideration of individual financial situations and long-term goals. While both options offer pathways to funding higher education, they differ significantly in eligibility, interest rates, repayment terms, and potential impact on credit scores. By thoroughly evaluating the information presented here, prospective borrowers can make an informed decision that best supports their educational aspirations and minimizes future financial burdens. Remember to explore all available options and seek professional financial advice when needed.

Common Queries

Can I refinance a Parent PLUS loan?

Yes, but refinancing options are typically limited compared to student loans. You may need a co-signer to qualify for better rates.

What happens if I default on a Parent PLUS loan?

Defaulting on a Parent PLUS loan can severely damage your credit score, impacting future borrowing opportunities. Wage garnishment and tax refund offset are potential consequences.

Are Parent PLUS loans subject to income-driven repayment plans?

No, Parent PLUS loans do not typically qualify for income-driven repayment plans. Repayment options are generally more limited.

Can I consolidate my Parent PLUS loan with my student loans?

Consolidation might be possible, potentially simplifying repayment, but it may not always result in lower interest rates. Consult a financial advisor.