Navigating the complex world of student loans can feel overwhelming, especially when the goal is securing the lowest possible interest rate. This crucial element significantly impacts the overall cost of your education and subsequent repayment burden. Understanding the various factors influencing interest rates—from your credit score to the type of loan—is key to making informed decisions and minimizing long-term financial strain.

This guide provides a comprehensive overview of strategies to secure the best possible terms on your student loans. We’ll delve into the differences between federal and private loans, explore various repayment plans, and highlight the importance of understanding associated fees. Ultimately, the aim is to empower you with the knowledge to make smart financial choices and achieve your educational goals without unnecessary financial hardship.

Understanding Interest Rates on Student Loans

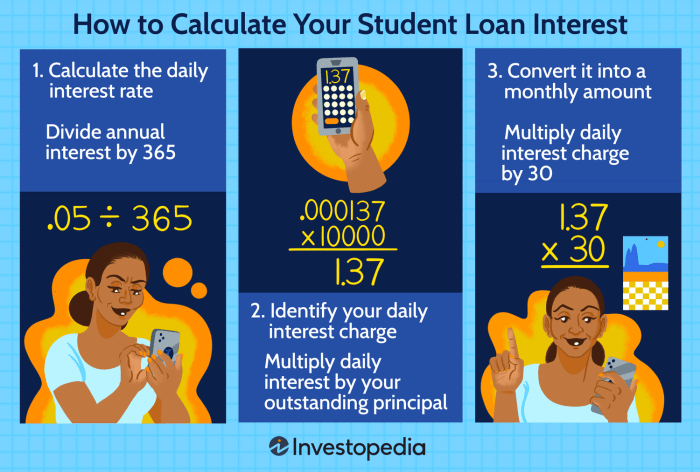

Securing funding for higher education often involves navigating the complexities of student loans. Understanding the interest rates associated with these loans is crucial for making informed financial decisions and minimizing long-term debt. This section will delve into the key factors influencing interest rates, the differences between fixed and variable rates, and a comparison of rates offered by various lenders.

Factors Influencing Student Loan Interest Rates

Several factors contribute to the interest rate you’ll receive on your student loan. Credit history plays a significant role; a strong credit history generally leads to lower rates. The type of loan (federal vs. private) also significantly impacts the interest rate. Federal loans typically offer more favorable rates, especially for undergraduate students, while private loan rates are often higher and vary more based on individual creditworthiness. The loan term also affects the interest rate; longer repayment terms might result in higher rates. Finally, the lender’s current market conditions and their risk assessment of the borrower influence the interest rate offered.

Fixed vs. Variable Interest Rates

Student loans can come with either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, providing predictable monthly payments. A variable interest rate, on the other hand, fluctuates based on an underlying benchmark index, such as the prime rate or LIBOR. This means your monthly payments could change over time, potentially increasing or decreasing depending on market conditions. While variable rates might start lower than fixed rates, the uncertainty of future payments makes fixed rates a more predictable and often preferred option for many borrowers.

Federal vs. Private Student Loan Interest Rates

Federal student loans generally offer lower interest rates compared to private loans. These rates are set by the government and are typically more favorable, particularly for undergraduate students with good academic standing. Furthermore, federal loans often include additional benefits such as income-driven repayment plans and loan forgiveness programs. Private student loans, offered by banks and credit unions, have rates that are determined by the lender’s assessment of the borrower’s creditworthiness. Individuals with strong credit scores will typically qualify for lower rates, while those with weaker credit histories may face significantly higher interest rates and potentially stricter eligibility requirements.

Comparison of Student Loan Lenders

The following table compares the interest rates, repayment options, and fees of four common student loan lenders. Note that these rates are examples and can vary depending on individual circumstances and market conditions. It is crucial to always check the lender’s website for the most up-to-date information.

| Lender | Interest Rate (Example – Variable) | Repayment Options | Fees |

|---|---|---|---|

| Federal Direct Loan (Example) | 3.73% – 7.54% (Undergraduate) | Standard, Graduated, Extended, Income-Driven | Origination Fees (vary by loan type) |

| Sallie Mae (Example) | Variable: 6.74% – 13.99% | Fixed-term, Variable-term | Late payment fees, origination fees (may apply) |

| Discover (Example) | Variable: 6.49% – 14.99% | Fixed-term, Variable-term | Late payment fees, processing fees (may apply) |

| Wells Fargo (Example) | Variable: 6.99% – 13.99% | Fixed-term, Variable-term | Late payment fees, origination fees (may apply) |

Identifying Loans with the Lowest Interest Rates

Securing the lowest possible interest rate on your student loans is crucial for minimizing your overall borrowing costs. A lower interest rate translates to less money paid in interest over the life of the loan, allowing you to pay off your debt faster and potentially save thousands of dollars. This section Artikels strategies to help you achieve this goal.

Finding the best interest rates requires proactive research and understanding of the factors influencing loan terms.

Strategies for Finding Low-Interest Student Loans

Several avenues exist for finding student loans with competitive interest rates. Federal student loans, typically offered through the government, often have lower interest rates than private loans. However, private loans might offer better terms based on your creditworthiness. Comparing offers from multiple lenders is essential. Utilize online loan comparison tools to streamline this process. These tools allow you to input your financial information and see offers from various lenders side-by-side, making it easy to identify the best rates available to you. Additionally, pre-qualifying for loans (which doesn’t impact your credit score) allows you to get a sense of the interest rates you are likely to receive before applying officially.

Impact of Credit Score on Interest Rate Eligibility

Your credit score plays a significant role in determining the interest rate you qualify for. Lenders view a higher credit score as an indicator of lower risk. A strong credit history demonstrates responsible financial behavior, making you a more attractive borrower. Individuals with excellent credit scores (750 or above) are typically eligible for the lowest interest rates. Conversely, a poor credit score (below 670) can result in significantly higher interest rates or even loan rejection. Improving your credit score before applying for student loans is highly advisable. This involves paying bills on time, maintaining low credit utilization, and avoiding new credit applications unnecessarily.

Role of Income and Co-signers in Securing Lower Rates

Your income level can influence your eligibility for lower interest rates. Lenders assess your ability to repay the loan, and a higher income demonstrates greater repayment capacity. A stable and consistent income stream significantly increases your chances of securing favorable loan terms.

In situations where an applicant’s income or credit history isn’t strong enough to qualify for the best rates, a co-signer can be beneficial. A co-signer is an individual with good credit who agrees to share responsibility for repaying the loan. Their strong credit history can offset the applicant’s weaker profile, leading to a lower interest rate. However, it’s crucial to remember that both the applicant and the co-signer are responsible for repayment, even if the applicant is the primary borrower.

Flowchart for Securing the Lowest Interest Rate

The following flowchart illustrates the steps involved in securing the lowest possible student loan interest rate:

[Imagine a flowchart here. The flowchart would start with “Assess your credit score.” If the score is good (750+), it branches to “Apply for federal loans and compare private loan offers.” If the score is fair (670-749), it branches to “Improve credit score and then apply.” If the score is poor (below 670), it branches to “Consider a co-signer and improve credit score before applying.”] The flowchart would visually represent the decision-making process, showing the path based on different credit scores and financial situations. The final box would be “Secure the loan with the lowest interest rate.”

Federal Student Loan Programs and Interest Rates

Navigating the world of federal student loans can feel overwhelming, but understanding the different programs and their associated interest rates is crucial for making informed borrowing decisions. This section will provide a clear overview of the major federal student loan programs, allowing you to compare their features and choose the best option for your financial needs. Remember that interest rates are subject to change annually, so always check the official Federal Student Aid website for the most up-to-date information.

The federal government offers several student loan programs, each with its own eligibility requirements and interest rate structure. These programs are designed to help students finance their education and are generally considered more favorable than private loans due to their borrower protections and often lower interest rates.

Direct Subsidized Loans

Direct Subsidized Loans are need-based loans offered to undergraduate students who demonstrate financial need. A key feature is that the government pays the interest on the loan while the borrower is in school at least half-time, during a grace period, and during periods of deferment. This means the principal balance doesn’t grow during these periods. The interest rate is fixed for the life of the loan. Eligibility is determined through the Free Application for Federal Student Aid (FAFSA).

Direct Unsubsidized Loans

Unlike subsidized loans, Direct Unsubsidized Loans are available to both undergraduate and graduate students regardless of financial need. Interest accrues on the loan from the time the loan is disbursed, even while the borrower is in school. This means the borrower is responsible for paying this accumulated interest. The interest rate is also fixed for the life of the loan.

Direct PLUS Loans

Direct PLUS Loans are designed for graduate and professional students, as well as parents of dependent undergraduate students. These loans are credit-based, meaning the borrower must pass a credit check. If the borrower has an adverse credit history, they may still qualify for a PLUS loan but will need an endorser. Interest accrues on these loans from the time of disbursement. The interest rate is fixed for the life of the loan.

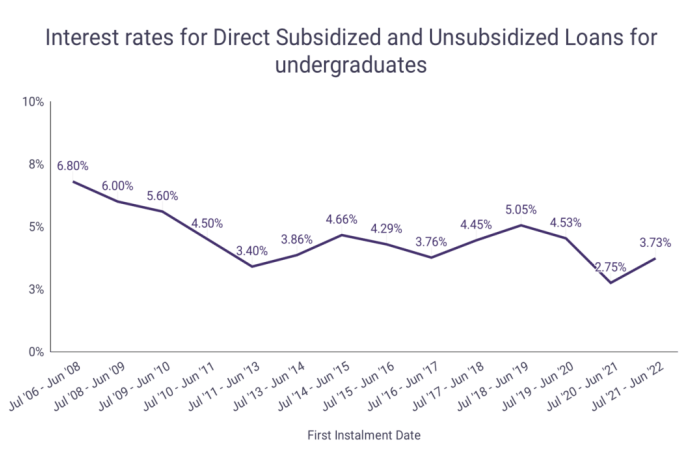

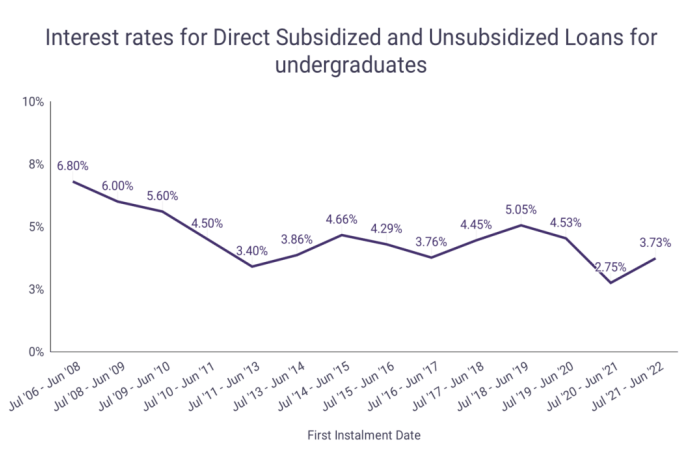

Comparison of Federal Student Loan Interest Rates

The interest rates for federal student loans are set annually by the government and vary depending on the loan type and the loan disbursement date. It’s important to note that these rates are subject to change. The following is a general comparison and should not be considered definitive; always refer to the official Federal Student Aid website for the most current rates.

- Direct Subsidized Loans: Typically have a lower interest rate than unsubsidized loans due to the interest subsidy.

- Direct Unsubsidized Loans: Generally have a slightly higher interest rate than subsidized loans.

- Direct PLUS Loans: Usually carry the highest interest rate among the federal loan programs.

Applying for Federal Student Loans and Securing the Lowest Possible Interest Rate

Applying for federal student loans begins with completing the FAFSA. This application determines your eligibility for federal aid, including student loans, grants, and work-study programs. Submitting the FAFSA early is crucial, as funding is often limited. To secure the lowest possible interest rate, it’s important to:

- Borrow only what you need: Avoid taking out more loans than necessary to cover your educational expenses.

- Maintain good academic standing: Some loan programs may have requirements for maintaining satisfactory academic progress to remain eligible.

- Explore all financial aid options: Grants, scholarships, and work-study can reduce your reliance on loans.

- Compare loan options carefully: Understand the terms and conditions of each loan before accepting it.

- Consider consolidating loans after graduation: This can simplify repayment and potentially lower your monthly payments, though it may not always lower your overall interest paid.

Private Student Loan Options and Interest Rates

Private student loans offer an alternative funding source for higher education, supplementing federal loans or covering costs not met by federal aid. Understanding their intricacies is crucial for making informed borrowing decisions. These loans are offered by private lenders, such as banks and credit unions, and come with varying terms and conditions.

Private student loans can be advantageous in certain situations, but they also present significant potential drawbacks. Careful consideration of both the benefits and risks is essential before committing to this type of borrowing.

Advantages and Disadvantages of Private Student Loans

Private student loans can offer larger loan amounts than federal loans, potentially covering the full cost of attendance. However, they typically lack the borrower protections and flexible repayment options often associated with federal loans. For instance, private loans may not offer income-driven repayment plans or deferment options in times of financial hardship. Furthermore, interest rates on private loans are usually higher than those on federal loans, leading to greater overall borrowing costs. Finally, eligibility requirements for private loans can be more stringent, requiring a co-signer with good credit in many cases.

Interest Rates and Repayment Terms of Private Lenders

Interest rates for private student loans are variable and depend on several factors, including the borrower’s creditworthiness, the loan amount, and the repayment term. Shorter repayment terms generally result in higher monthly payments but lower overall interest costs, while longer terms reduce monthly payments but increase total interest paid. Some lenders offer fixed interest rates, protecting borrowers from fluctuating rates, while others offer variable rates that adjust periodically based on market conditions. Repayment options vary, with some lenders offering standard repayment plans, graduated repayment plans (where payments increase over time), and extended repayment plans.

Factors Influencing Private Student Loan Interest Rates

Several factors influence the interest rate a borrower receives on a private student loan. Credit history plays a significant role, with borrowers possessing strong credit scores typically securing lower rates. The loan amount also affects the interest rate; larger loan amounts may command higher rates due to increased risk for the lender. The borrower’s income and debt-to-income ratio are also considered, as these factors reflect the borrower’s ability to repay the loan. Finally, the presence of a co-signer with a good credit history can significantly lower the interest rate offered. The type of loan (e.g., undergraduate vs. graduate) can also influence the interest rate.

Comparison of Private Student Loan Lenders

The following table compares four hypothetical private student loan lenders. Remember that actual rates and terms can vary depending on individual circumstances. It is crucial to shop around and compare offers from multiple lenders before making a decision.

| Lender | Interest Rate (Variable) | Repayment Options | Fees |

|---|---|---|---|

| Lender A | 6.5% – 12% | Standard, Graduated | Origination fee: 1% |

| Lender B | 7% – 13% | Standard, Extended | Origination fee: 2%, Late payment fee: $25 |

| Lender C | 6% – 11% | Standard, Graduated, Income-Based | No origination fee, Late payment fee: $30 |

| Lender D | 7.5% – 14% | Standard | Origination fee: 0.5%, Prepayment penalty: 1% |

Repayment Strategies and Interest Rate Minimization

Choosing the right repayment strategy is crucial for minimizing the total cost of your student loans. Different plans offer varying repayment periods and monthly payments, significantly impacting the amount of interest you ultimately pay. Understanding these options and their implications allows for informed decision-making and potentially substantial savings.

Student Loan Repayment Plans

Several federal student loan repayment plans cater to different financial situations. The best choice depends on your income, expenses, and loan amount. Each plan offers a different balance between monthly payment affordability and total interest paid over the life of the loan.

- Standard Repayment Plan: This plan typically involves fixed monthly payments over 10 years. It’s the shortest repayment period, leading to the lowest total interest paid but potentially higher monthly payments.

- Extended Repayment Plan: This plan stretches payments over a longer period, usually up to 25 years, resulting in lower monthly payments but higher overall interest paid.

- Income-Driven Repayment (IDR) Plans: These plans (such as ICR, PAYE, REPAYE, and IBR) base your monthly payment on your income and family size. Monthly payments are typically lower, but the repayment period is longer, potentially leading to higher overall interest.

Impact of Repayment Plans on Total Interest Paid

The total interest paid significantly varies across repayment plans. A shorter repayment period, like the standard 10-year plan, minimizes interest accumulation. However, the higher monthly payments might be challenging for some borrowers. Conversely, longer repayment periods, such as those offered by extended repayment plans or IDR plans, reduce monthly payments but increase the total interest paid due to the extended borrowing time.

Strategies for Minimizing Total Interest Paid

Several strategies can help borrowers minimize the total interest paid on their student loans.

- Prioritize High-Interest Loans: Focus on paying off loans with the highest interest rates first, even if the balances are smaller. This reduces the overall interest burden faster.

- Make Extra Payments: Whenever possible, make extra payments beyond the minimum required. Even small additional payments can significantly reduce the loan’s lifespan and the total interest paid.

- Refinance Your Loans: If interest rates drop, refinancing your loans with a lower interest rate can lead to substantial savings over the loan’s life. However, carefully consider the terms and fees associated with refinancing.

- Consolidate Your Loans: Consolidating multiple loans into a single loan can simplify repayment and potentially secure a lower interest rate, depending on your creditworthiness and the market conditions.

Examples Illustrating Repayment Strategy Impact

Let’s consider two scenarios:

Scenario 1: A borrower with a $30,000 loan at 5% interest. Under the standard 10-year repayment plan, the monthly payment would be approximately $330, and the total interest paid would be around $10,000. Under an extended 25-year plan, the monthly payment would be approximately $160, but the total interest paid would increase to approximately $20,000.

Scenario 2: A borrower with the same loan but using an income-driven repayment plan. Assuming their income qualifies them for a lower monthly payment, let’s say $100. The repayment period would be significantly longer, potentially 20-30 years, and the total interest paid could easily exceed $20,000, or even higher, depending on income fluctuations over the extended repayment period. The long repayment period increases the overall interest paid despite the lower monthly payment.

Understanding Loan Fees and Their Impact

Student loan fees, while often overlooked, significantly impact the overall cost of borrowing. Understanding these fees and how they accumulate is crucial for making informed borrowing decisions and minimizing long-term expenses. Failing to account for these additional costs can lead to a higher total repayment amount than initially anticipated.

Understanding the various fees associated with student loans is essential for responsible financial planning. These fees can add considerably to the principal loan amount, ultimately increasing the total cost of your education.

Origination Fees

Origination fees are charges levied by the lender when your loan is processed and disbursed. These fees are typically a percentage of the loan amount and are deducted from the total loan disbursement. For example, a 1% origination fee on a $10,000 loan would result in a $100 fee, meaning you receive only $9,900. The impact of this fee is compounded over the life of the loan as interest is calculated on the full loan amount, not the reduced amount received. The effect of an origination fee is similar to paying a higher interest rate. A larger loan amount will naturally result in a larger origination fee. Federal student loans often have lower or no origination fees, making them a more cost-effective option compared to private loans which may charge substantial origination fees.

Late Payment Fees

Late payment fees are penalties incurred when a loan payment is not received by the lender by the due date. These fees can vary significantly depending on the lender and the loan type. While the amount of a single late payment fee might seem small, consistent late payments can quickly accumulate, leading to substantial additional costs. For instance, a $25 late fee per month on a loan with multiple missed payments could easily add hundreds of dollars to the total repayment amount. Furthermore, repeated late payments can negatively impact your credit score, potentially leading to higher interest rates on future loans.

Other Fees

Beyond origination and late payment fees, other fees might apply depending on the lender and loan terms. These could include fees for early repayment (though this is less common), returned payment fees (if a payment bounces), or fees associated with specific loan modification or deferment processes. It’s crucial to carefully review the loan agreement to understand all associated fees before signing.

Cumulative Effect of Fees on Total Loan Cost

To illustrate the cumulative impact of various fees, consider this example: A student takes out a $20,000 loan with a 5% origination fee ($1000), incurs three $25 late payment fees ($75), and faces a $50 returned payment fee. The total fees are $1125, increasing the effective loan amount to $21,125. This added cost will significantly increase the total interest paid over the loan’s lifespan. The longer the repayment period, the greater the cumulative impact of these fees on the overall cost.

Final Wrap-Up

Securing a student loan with the lowest interest rate requires diligent research and a clear understanding of your financial situation. By comparing lenders, understanding the nuances of federal and private loan programs, and strategically choosing a repayment plan, you can significantly reduce the overall cost of your education. Remember, proactive planning and informed decision-making are essential steps towards a financially responsible path to academic success. Take your time, explore your options, and choose wisely.

FAQ Compilation

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, or deferment. Unsubsidized loans accrue interest throughout your education.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing can lower your interest rate, but it typically involves switching from a federal to a private loan, potentially losing federal protections.

How does my credit score affect my interest rate?

A higher credit score generally qualifies you for lower interest rates on private student loans. Federal loans are less impacted by credit score.

What are income-driven repayment plans?

Income-driven repayment plans base your monthly payments on your income and family size, potentially resulting in lower monthly payments but longer repayment periods and higher total interest paid.