The debate surrounding student loan write-off has intensified, sparking considerable discussion about its potential economic, social, and political consequences. This comprehensive analysis delves into the multifaceted implications of widespread student loan forgiveness, exploring both its potential benefits and drawbacks. We will examine the short-term and long-term economic effects, the impact on social mobility and educational attainment, and the complex political considerations that shape this critical policy issue.

Understanding the various perspectives on student loan write-off requires a nuanced examination of its potential effects on different segments of society. From the impact on GDP growth and inflation to its influence on access to higher education and mental health outcomes, the consequences are far-reaching and demand careful consideration. This analysis aims to provide a balanced overview, exploring not only the potential benefits but also the potential pitfalls of such a sweeping policy change.

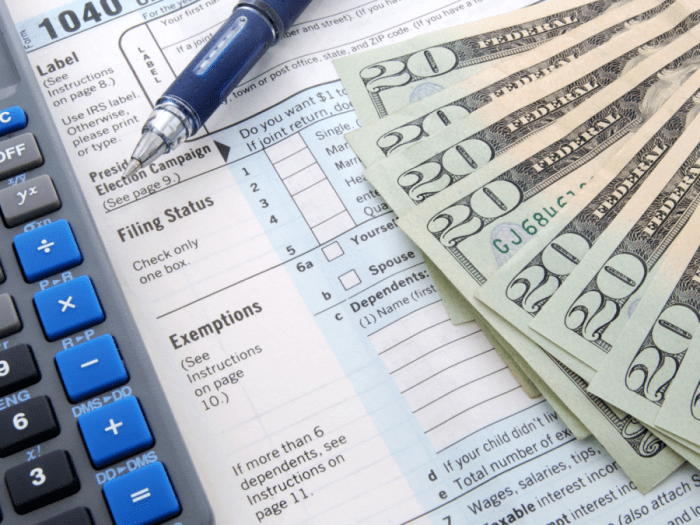

The Economic Impact of Student Loan Write-Offs

The widespread debate surrounding student loan forgiveness necessitates a thorough examination of its potential economic consequences. A large-scale write-off would inject significant capital into the economy, impacting various sectors and potentially triggering both positive and negative ripple effects. Understanding these impacts, both short-term and long-term, is crucial for informed policymaking.

Short-Term Economic Effects of Student Loan Write-Offs

A large-scale student loan write-off would immediately increase disposable income for millions of borrowers. This influx of cash could stimulate consumer spending, boosting demand for goods and services. Businesses might experience increased sales and revenue, potentially leading to job creation in the short term. However, this surge in demand could also contribute to inflationary pressures, particularly if the supply side of the economy struggles to keep pace. Furthermore, the immediate cost to the federal government would be substantial, potentially requiring adjustments to other government programs or an increase in the national debt. The impact would vary based on the size and scope of the write-off. A targeted approach, for example, focusing on lower-income borrowers, might have a different impact than a universal write-off.

Long-Term Economic Effects of Student Loan Write-Offs

The long-term effects are more complex and less predictable. Increased consumer spending could lead to sustained economic growth, but the extent of this growth depends on how borrowers utilize their newfound disposable income. If the money is primarily used for consumption rather than investment, the long-term growth benefits might be limited. Furthermore, the potential inflationary pressures from increased demand could persist, eroding purchasing power and potentially hindering future economic expansion. The impact on the national debt and government spending priorities would also play a significant role in shaping the long-term economic landscape. For instance, increased government borrowing could lead to higher interest rates, impacting investment and potentially slowing economic growth.

Economic Consequences of a Write-Off Compared to Alternatives

Alternative solutions to the student debt crisis include income-driven repayment plans, loan refinancing programs, and targeted debt relief for specific groups. These alternatives aim to address the problem without the immediate and potentially disruptive economic shock of a large-scale write-off. Income-driven repayment plans, for example, can make student loan payments more manageable without requiring immediate forgiveness, thus avoiding the potential inflationary pressures associated with a write-off. Refinancing programs can lower interest rates, making repayment more affordable without impacting the national debt. Targeted relief, focusing on borrowers facing specific hardships, offers a more focused approach, minimizing the overall economic impact compared to a universal write-off. The choice between a write-off and alternative solutions involves a trade-off between immediate economic stimulus and potential long-term consequences.

Projected Impacts Under Different Write-Off Scenarios

| Scenario | GDP Impact (Percentage Change) | Inflation (Percentage Change) | Consumer Spending (Percentage Change) |

|---|---|---|---|

| Complete Write-Off | +1.5% – +3% (Short-term), +0.5% – +1% (Long-term) | +1% – +3% (Short-term), +0.5% – +1% (Long-term) | +2% – +4% (Short-term), +1% – +2% (Long-term) |

| Targeted Write-Off (Low-income borrowers) | +0.5% – +1.5% (Short-term), +0.25% – +0.75% (Long-term) | +0.5% – +1.5% (Short-term), +0.25% – +0.75% (Long-term) | +1% – +2% (Short-term), +0.5% – +1% (Long-term) |

| No Write-Off (Alternative solutions implemented) | +0.25% – +0.75% (Long-term) | Stable to slightly increased | +0.5% – +1% (Long-term) |

The Social Impact of Student Loan Write-Offs

The cancellation or substantial reduction of student loan debt would have profound and multifaceted effects on American society, extending far beyond the immediate financial relief for borrowers. These impacts touch upon social mobility, educational choices, mental health, and even broader issues of social equity, creating a complex landscape of potential benefits and unforeseen challenges.

Student Loan Write-Offs and Social Mobility

A significant student loan write-off could dramatically improve social mobility for many Americans. Currently, crippling debt often prevents graduates from pursuing entrepreneurial ventures, purchasing homes, or investing in their future, effectively trapping them in a lower socioeconomic bracket despite their educational attainment. For example, a recent study by the Brookings Institution showed that high student loan debt significantly reduced the likelihood of homeownership among young adults, a key indicator of upward mobility. By eliminating this debt burden, individuals would have greater financial freedom to pursue opportunities that lead to higher earning potential and improved living standards, thereby increasing their chances of climbing the socioeconomic ladder.

Impact of Write-Offs on Educational Attainment and Career Choices

Student loan debt significantly influences educational choices and career paths. The fear of accumulating insurmountable debt can discourage students from pursuing higher education or specific fields of study, particularly those with lower earning potential but potentially higher societal value, such as teaching or social work. A write-off could incentivize students to pursue their passions without the overwhelming weight of future financial obligations. This could lead to a more diverse and skilled workforce, benefiting society as a whole. For instance, more individuals might consider pursuing advanced degrees in fields like environmental science or public health, potentially addressing critical societal needs.

Student Loan Debt and Mental Health

The constant stress and anxiety associated with substantial student loan debt significantly impact borrowers’ mental health and well-being. Studies have linked high levels of student loan debt to increased rates of depression, anxiety, and other mental health issues. The weight of this debt can lead to feelings of hopelessness and powerlessness, affecting relationships, productivity, and overall quality of life. A write-off could alleviate this significant stressor, potentially leading to improved mental health outcomes for millions of Americans. The positive effects on mental health could translate to increased productivity and engagement in various aspects of life.

Potential Unintended Consequences on Social Equity

While a student loan write-off offers significant potential benefits, it’s crucial to acknowledge potential unintended consequences regarding social equity. The distribution of benefits might not be uniform across all demographics. For instance, those who already benefited from significant family wealth and support might have accumulated less debt and thus receive a proportionally smaller benefit compared to those from lower-income backgrounds who relied more heavily on loans. Careful consideration and targeted policies are necessary to mitigate these potential disparities and ensure that the benefits are equitably distributed across various socioeconomic groups. A robust and transparent system for distribution is vital to ensure the program’s effectiveness and fairness.

Political and Policy Considerations of Student Loan Write-Offs

Student loan forgiveness is a highly contentious political issue, sparking intense debate among policymakers, economists, and the public. The arguments for and against often reflect differing ideological perspectives on the role of government intervention in the economy and social responsibility. Understanding these competing viewpoints is crucial for navigating the complex policy landscape surrounding student debt.

Political Arguments For and Against Student Loan Forgiveness

The political arguments surrounding student loan forgiveness are deeply divided along partisan lines. Proponents, often from the left of the political spectrum, argue that widespread student loan debt hinders economic growth by limiting consumer spending and entrepreneurial activity. They emphasize the social justice aspect, highlighting the disproportionate impact of student debt on minority groups and low-income individuals. Forgiveness, they contend, would stimulate the economy and promote greater equity. Furthermore, they argue that the current system is unfair, as many students graduated with significant debt despite not securing high-paying jobs. Conversely, opponents, typically from the right, express concerns about the economic cost of widespread forgiveness, arguing that it would increase the national debt, potentially leading to inflation and higher taxes. They also raise questions of fairness, arguing that those who diligently repaid their loans or chose not to attend college would be unfairly penalized. Some suggest that targeted relief, such as income-driven repayment plans, is a more efficient and equitable approach. The debate often centers on the balance between economic stimulus, social equity, and fiscal responsibility.

Policy Proposals for Addressing Student Loan Debt

Several policy proposals aim to address the student loan debt crisis. These can be categorized into several approaches: complete forgiveness, targeted forgiveness, income-driven repayment reforms, and preventative measures.

Complete forgiveness involves wiping out all or a significant portion of existing student loan debt. This approach is the most radical and has the largest potential economic impact. Targeted forgiveness focuses on specific groups, such as borrowers from low-income backgrounds or those with specific types of loans. Income-driven repayment (IDR) reforms aim to make repayments more manageable by basing monthly payments on income. This approach does not eliminate debt but makes it more affordable. Preventative measures focus on addressing the root causes of student debt, such as rising tuition costs and a lack of affordable higher education options. These measures might include increased government funding for higher education, reforms to the financial aid system, and greater transparency in college pricing.

Comparison of Approaches Proposed by Various Political Parties

The Democratic Party generally favors more expansive approaches to student loan debt relief, often advocating for complete or targeted forgiveness, coupled with reforms to IDR plans. Republican proposals tend to favor more targeted approaches, such as IDR reforms or targeted forgiveness for specific groups, with a stronger emphasis on fiscal responsibility and avoiding widespread debt cancellation. The differences reflect fundamental disagreements about the role of government in addressing social and economic inequalities. For instance, while Democrats might see student loan forgiveness as a necessary investment in human capital and social equity, Republicans might view it as an inefficient use of taxpayer money and a potential disincentive to responsible borrowing. The debate highlights the contrasting political philosophies regarding the balance between social welfare and economic efficiency.

Hypothetical Policy Proposal for Student Loan Write-Offs

A hypothetical policy proposal could incorporate elements of targeted forgiveness and IDR reforms. This approach would balance economic concerns with social equity goals. The proposal could focus on forgiving a significant portion of student loan debt for borrowers from low-income backgrounds, while simultaneously implementing significant reforms to IDR plans to make them more accessible and effective for a wider range of borrowers. This approach would provide substantial relief to those most in need while minimizing the overall economic cost. For example, the proposal could forgive up to $20,000 in student loan debt for borrowers whose family income falls below a certain threshold, while simultaneously reducing the minimum monthly payment under IDR plans to a percentage of discretionary income, thereby making repayment more sustainable for a broader range of borrowers. This balanced approach could potentially alleviate the concerns of both sides of the political spectrum by offering targeted relief while implementing responsible and sustainable reforms to the student loan system.

The Impact on the Higher Education System

A student loan write-off would have profound and multifaceted effects on the higher education system in the United States, impacting tuition costs, institutional finances, and student incentives. Understanding these impacts is crucial for developing effective policy responses and ensuring the long-term health and accessibility of higher education.

The interconnectedness of these factors necessitates a careful consideration of both the short-term consequences and the long-term implications of such a sweeping policy change. A simplistic approach risks unintended negative consequences, while a thoughtful strategy could potentially leverage this opportunity to reform the system for the better.

Tuition Cost Adjustments

A widespread student loan forgiveness program could potentially lead to increased tuition costs. If institutions anticipate a greater willingness of students to take on debt (due to the possibility of future forgiveness), they might raise tuition prices, negating some of the benefits of the write-off. This is because the perceived risk of borrowing is reduced, potentially leading to increased demand and, subsequently, increased prices. Historically, we’ve seen this dynamic play out in other markets; when access to credit expands, prices often follow suit. The extent of this increase would depend on factors such as the elasticity of demand for higher education and the competitive landscape among institutions.

Financial Sustainability of Colleges and Universities

Student loan payments represent a significant revenue stream for many colleges and universities, particularly those that rely heavily on tuition revenue. A sudden loss of this income stream through a widespread write-off could jeopardize the financial stability of some institutions, especially those already facing budgetary challenges. This could lead to program cuts, staff reductions, and a decrease in the quality of education offered. For example, smaller, less well-endowed institutions might be disproportionately affected, potentially leading to closures or mergers.

Student Incentives for Higher Education

The impact of a write-off on student incentives is complex. While it could increase access to higher education for some, it could also alter the perceived cost-benefit analysis for prospective students. If students believe future loan forgiveness is likely, they might be less concerned about the overall cost of education and more willing to enroll in expensive programs, regardless of their post-graduation earning potential. Conversely, if the expectation of forgiveness is not met, or if the write-off is perceived as unfair or unsustainable, it could erode public trust in the higher education system.

Potential Higher Education System Reforms

Addressing affordability concerns within the higher education system requires a multi-pronged approach. Significant reforms are necessary to ensure equitable access to quality education while maintaining the financial sustainability of institutions.

The following reforms could mitigate the negative consequences of a student loan write-off and promote long-term affordability:

- Increased government funding for need-based financial aid: This would help to directly address the financial barriers faced by many prospective students, reducing reliance on loans.

- Greater transparency in college pricing and financial aid packages: This would empower students and families to make informed decisions about their education investments.

- Incentivizing institutions to control tuition costs: This could involve tying funding to demonstrable efforts to keep tuition increases in line with inflation or average income growth.

- Expansion of income-share agreements and other alternative financing models: These models could align student debt repayment with post-graduation earnings, reducing the risk of overwhelming debt burdens.

- Investment in community colleges and vocational training programs: This would provide students with affordable pathways to gain valuable skills and enter the workforce.

Alternative Solutions to the Student Loan Debt Crisis

Addressing the student loan debt crisis requires a multifaceted approach, moving beyond the binary choice of complete write-off or inaction. Several alternative strategies offer potential pathways to alleviate the burden on borrowers while mitigating broader economic consequences. These solutions focus on improving repayment structures, targeted relief, and preventative measures.

Income-Driven Repayment Plans, Loan Refinancing, and Targeted Debt Relief represent key alternative strategies. Their effectiveness varies depending on individual circumstances and broader economic conditions, highlighting the need for a comprehensive and adaptable approach.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust monthly payments based on a borrower’s income and family size. This approach aims to make repayments more manageable, preventing default and allowing borrowers to allocate more resources towards other essential needs. Several IDR plans exist, each with varying eligibility criteria and payment calculations. For example, the Revised Pay As You Earn (REPAYE) plan caps monthly payments at 10% of discretionary income, while the Income-Based Repayment (IBR) plan offers a similar structure but with different income thresholds and calculation methods. While IDR plans offer relief, their effectiveness is contingent on consistent income reporting and can lead to longer repayment periods, potentially resulting in higher total interest paid over the life of the loan. The complexity of these plans and the potential for unforeseen circumstances affecting income can also present challenges for borrowers.

Loan Refinancing

Loan refinancing allows borrowers to consolidate multiple student loans into a single loan with potentially lower interest rates. This can significantly reduce the overall cost of repayment, shortening the repayment period and decreasing the total interest paid. Private lenders typically offer refinancing options, and the eligibility criteria vary depending on the lender’s policies and the borrower’s creditworthiness. However, refinancing may not be suitable for all borrowers, particularly those with poor credit scores or those who qualify for income-driven repayment plans with more favorable terms. Additionally, refinancing federal loans into private loans can result in the loss of crucial borrower protections offered by the federal government, such as income-driven repayment options and loan forgiveness programs.

Targeted Debt Relief Programs

Targeted debt relief programs focus on specific demographics or types of borrowers facing significant hardship. This approach acknowledges that the student loan debt crisis disproportionately impacts certain groups, such as those from low-income backgrounds or those who attended for-profit colleges with poor outcomes. For instance, a program could provide partial or complete debt forgiveness for borrowers who attended institutions with high default rates or who meet specific income thresholds. The design and implementation of such programs require careful consideration of equity, cost-effectiveness, and the potential for unintended consequences. The challenge lies in defining criteria for eligibility that are both fair and effective in addressing the underlying causes of debt burden. Examples might include forgiveness for borrowers in specific public service professions after a set number of years of service, or debt reduction based on the borrower’s demonstrated inability to repay.

International Examples of Student Loan Debt Relief Programs

Several countries have implemented successful student loan debt relief programs, offering valuable insights into effective strategies. Australia, for example, has a system of income-contingent loans, where repayments are adjusted based on income. This approach aims to ensure affordability without compromising access to higher education. Similarly, the United Kingdom utilizes a system of graduate contributions, where graduates make regular payments based on their earnings after graduation. These models highlight the diverse approaches that can be employed to manage student loan debt, emphasizing the need for flexible and adaptable solutions tailored to the specific circumstances of each country’s higher education system and economic context. Analysis of these programs’ long-term impacts on access to higher education, economic mobility, and overall societal well-being can inform the development of more effective strategies in other contexts.

Visual Representation of Key Data Points

Visual representations are crucial for understanding the complex issue of student loan debt. Graphs and charts can effectively communicate the scale of the problem and highlight key trends, allowing for a more nuanced discussion of potential solutions. The following descriptions illustrate how data visualization can clarify the student loan debt crisis.

Growth of Student Loan Debt Over Time

A line graph would effectively illustrate the growth of student loan debt over time. The x-axis would represent years, spanning at least the last two decades to capture significant growth. The y-axis would represent the total amount of student loan debt outstanding, expressed in trillions of dollars. The line itself would show the upward trend, potentially highlighting periods of accelerated growth or slower increases. Key data points, such as years with significant policy changes or economic downturns, could be marked on the graph with annotations to show their correlation with debt growth. For instance, a sharp increase could be observed following the 2008 financial crisis, reflecting the increased reliance on student loans during periods of economic uncertainty. The overall visual would clearly demonstrate the exponential nature of student loan debt accumulation.

Average Student Loan Debt Across Educational Levels

A bar chart would be ideal for comparing average student loan debt across different educational levels. The x-axis would list the educational levels, such as associate’s degree, bachelor’s degree, master’s degree, and professional degrees (e.g., law, medicine). The y-axis would represent the average amount of student loan debt for graduates at each level. The height of each bar would visually represent the average debt, allowing for immediate comparison. This would likely show a positive correlation between the level of education pursued and the amount of debt incurred, with professional degrees often resulting in the highest average debt levels. Data sources such as the National Center for Education Statistics could provide the necessary figures for accurate representation.

Distribution of Student Loan Debt Across Age Groups and Income Brackets

A heatmap would effectively represent the distribution of student loan debt across different age groups and income brackets. The x-axis would represent age groups (e.g., 20-29, 30-39, 40-49, etc.), and the y-axis would represent income brackets (e.g., less than $30,000, $30,000-$50,000, $50,000-$75,000, etc.). Each cell in the heatmap would be colored according to the density of student loan debt within that specific age and income group. Darker colors would indicate higher concentrations of debt, while lighter colors would indicate lower concentrations. This visualization would reveal potential disparities in debt burden across different demographic groups, highlighting those most heavily affected by the crisis. For example, younger age groups and lower income brackets might show darker colors, indicating a higher concentration of student loan debt.

Closure

Ultimately, the decision regarding student loan write-off is a complex one, demanding a careful balancing of economic realities, social equity concerns, and political feasibility. While complete forgiveness offers the potential for immediate relief and enhanced social mobility, it also presents substantial economic risks. Alternative solutions, such as targeted debt relief or expanded income-driven repayment plans, merit serious consideration. A thorough understanding of these multifaceted aspects is crucial for informed policymaking and a productive national conversation about the future of higher education financing.

Frequently Asked Questions

What are income-driven repayment plans?

Income-driven repayment plans adjust monthly student loan payments based on your income and family size, potentially lowering monthly payments and extending the repayment period.

What is loan refinancing?

Loan refinancing involves replacing your existing student loans with a new loan, often at a lower interest rate, potentially reducing your overall repayment costs.

Who would benefit most from a student loan write-off?

Those with high levels of student loan debt, particularly those from lower socioeconomic backgrounds, would likely see the greatest immediate benefit, though the overall economic impacts are debated.

What are the potential negative consequences of a student loan write-off?

Potential negative consequences include increased inflation, a potential strain on the federal budget, and the possibility of future tuition increases.