Navigating the complex world of student loans can feel overwhelming, but understanding the different types of loans, application processes, repayment options, and potential pitfalls is crucial for financial success. This guide provides a comprehensive overview of student loans, from federal and private options to loan forgiveness programs and strategies for managing debt effectively. We’ll explore the various factors to consider when choosing a loan, highlighting the potential benefits and drawbacks of each choice to empower you with the knowledge needed to make informed decisions about your educational financing.

We delve into the practical aspects of applying for student loans, offering step-by-step instructions and tips to increase your chances of approval. The guide also addresses the importance of responsible repayment, providing strategies for budgeting, managing debt, and understanding the consequences of default. Furthermore, we’ll examine common student loan scams and offer guidance on protecting yourself from fraudulent activities. Ultimately, this resource aims to equip you with the tools and knowledge necessary to successfully manage your student loan journey.

Types of Student Loans

Choosing the right student loan is crucial for financing your education. Understanding the differences between federal and private loans is essential to making informed decisions about your financial future. This section will Artikel the key features of each type, helping you navigate the complexities of student loan financing.

Federal Student Loans

Federal student loans are offered by the U.S. government. They generally offer more borrower protections and flexible repayment options compared to private loans. Eligibility is determined based on financial need (for subsidized loans), enrollment status, and citizenship or eligible non-citizen status. Specific eligibility requirements vary depending on the type of federal loan.

Types of Federal Student Loans

Several types of federal student loans exist, each with its own characteristics. These include Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for parents and graduate students), and Direct Consolidation Loans.

Interest Rates and Repayment Terms for Federal Student Loans

Interest rates for federal student loans are set annually by the government and are generally lower than those for private loans. Repayment terms are flexible, offering options such as standard repayment plans, graduated repayment plans, extended repayment plans, and income-driven repayment plans. Income-driven repayment plans adjust monthly payments based on income and family size.

Loan Forgiveness Programs for Federal Student Loans

Several loan forgiveness programs exist for federal student loans, particularly for those working in public service or specific fields. These programs can partially or fully forgive the remaining loan balance after meeting specific requirements, such as a certain number of years of employment in a qualifying field. Examples include the Public Service Loan Forgiveness (PSLF) program and the Teacher Loan Forgiveness program.

Private Student Loans

Private student loans are offered by banks, credit unions, and other private lenders. Eligibility for private loans is generally based on creditworthiness, income, and sometimes a co-signer. Students with limited or no credit history may find it difficult to qualify for private loans without a co-signer.

Interest Rates and Repayment Terms for Private Student Loans

Interest rates for private student loans are variable and typically higher than those for federal loans. Repayment terms are usually fixed, but may vary depending on the lender and the borrower’s creditworthiness. Options for deferment or forbearance may be available, but are often less flexible than those offered for federal loans.

Loan Forgiveness Programs for Private Student Loans

Private student loans generally do not offer government-sponsored loan forgiveness programs. While some lenders may offer hardship programs or other assistance, these are typically less comprehensive than federal loan forgiveness options.

Advantages and Disadvantages of Federal vs. Private Student Loans

Choosing between federal and private student loans requires careful consideration of the advantages and disadvantages of each.

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Generally lower | Generally higher, variable |

| Repayment Options | More flexible, income-driven plans available | Less flexible, typically fixed |

| Loan Forgiveness | Government programs available | Generally not available |

| Eligibility | Based on enrollment and citizenship | Based on creditworthiness and income |

Applying for Student Loans

Securing funding for higher education often involves navigating the complexities of student loans. Understanding the application process, whether for federal or private loans, is crucial for a successful outcome. This section Artikels the steps involved in applying for both types of loans and offers tips to increase your chances of approval.

Federal Student Loan Application

The primary pathway to federal student loans is through the Free Application for Federal Student Aid (FAFSA). Completing the FAFSA accurately and efficiently is the first and most important step. This application gathers information about your financial situation and family income to determine your eligibility for federal aid, including grants, scholarships, and loans. The FAFSA data is used by your chosen colleges and the federal government to calculate your financial need and determine your loan eligibility. After submitting the FAFSA, you will receive a Student Aid Report (SAR) summarizing the information provided and your eligibility for federal student aid. You will then need to accept your loan offer through your chosen college’s financial aid portal. Following acceptance, the funds are usually disbursed directly to the college to cover tuition and fees.

Private Student Loan Application

Private student loans, offered by banks and other financial institutions, are an alternative funding source. The application process for private loans typically involves a more rigorous credit check than federal loans. Because lenders assess the risk of lending to students with limited or no credit history, many students require a co-signer—typically a parent or guardian—with established credit to improve their chances of approval. The application usually requires providing detailed financial information, including income, debt, and credit history. Lenders will review this information to determine your creditworthiness and set interest rates and loan terms. Interest rates on private loans tend to be higher than those on federal loans and may vary depending on the applicant’s credit score and the lender’s policies.

Improving Loan Approval Chances

Several strategies can significantly improve your chances of loan approval. Maintaining a good credit history (if applying for private loans) is paramount. This includes paying bills on time and keeping credit utilization low. For private loans, having a co-signer with good credit can substantially increase your approval odds. Completing the FAFSA accurately and thoroughly is also vital for maximizing federal loan eligibility. Furthermore, ensuring you accurately report your income and assets on both federal and private loan applications is critical. Inaccurate or incomplete information can lead to delays or rejection. Finally, shopping around and comparing offers from multiple lenders, especially for private loans, can help you secure the most favorable terms.

Step-by-Step Guide to Applying for Student Loans

- Complete the FAFSA: Gather necessary financial documents and complete the FAFSA form online at studentaid.gov. Review your Student Aid Report (SAR) carefully for accuracy.

- Explore Federal Loan Options: Review your eligibility for federal student loans, including subsidized and unsubsidized loans, based on your SAR.

- Research Private Loan Options: If needed, compare offers from various private lenders, considering interest rates, fees, and repayment terms. Understand the requirements for co-signers.

- Submit Applications: Submit your federal and/or private loan applications according to the lender’s instructions. Provide all required documentation accurately and completely.

- Accept Loan Offers: Once approved, carefully review the loan terms and accept the loan offers through your college’s financial aid portal or the private lender’s platform.

- Understand Repayment Options: Familiarize yourself with the repayment options available for your loans, including repayment plans and deferment options.

Repaying Student Loans

Successfully navigating student loan repayment requires understanding the available options and implementing effective strategies. The process can seem daunting, but with careful planning and proactive management, you can significantly reduce the burden and achieve financial freedom sooner. This section will Artikel various repayment plans, debt management techniques, and the consequences of default, empowering you to make informed decisions.

Repayment Plan Options

Several repayment plans are designed to cater to different financial situations and income levels. Choosing the right plan is crucial for managing your debt effectively. These plans offer varying payment amounts, durations, and interest accrual implications. Careful consideration of your current financial standing and future income projections is essential for selecting the most suitable option.

- Standard Repayment Plan: This is the most common plan, typically involving fixed monthly payments over a 10-year period. It offers a predictable payment schedule but may result in higher total interest paid compared to other plans.

- Graduated Repayment Plan: Payments start low and gradually increase over time, making it easier to manage in the early stages of your career when income may be lower. However, you’ll pay more interest in the long run.

- Extended Repayment Plan: This plan stretches payments over a longer period (up to 25 years), resulting in lower monthly payments but significantly higher overall interest costs.

- Income-Driven Repayment (IDR) Plans: These plans, such as the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), and Pay As You Earn (PAYE) plans, base your monthly payment on your income and family size. Payments are typically lower, and any remaining balance may be forgiven after 20 or 25 years, depending on the plan. However, eligibility criteria apply.

Strategies for Effective Student Loan Debt Management

Effective management of student loan debt requires a proactive and organized approach. Combining financial discipline with strategic planning can significantly reduce the stress and financial burden associated with repayment. Consider these key strategies to optimize your repayment journey.

- Create a Realistic Budget: Tracking income and expenses is paramount. Allocate a specific amount each month towards loan repayment, ensuring it aligns with your overall financial goals and lifestyle.

- Prioritize High-Interest Loans: Focus on repaying loans with the highest interest rates first to minimize the overall interest paid. This strategy, known as the avalanche method, can save you considerable money in the long run.

- Explore Loan Refinancing: If interest rates have dropped since you initially took out your loans, refinancing could lower your monthly payments and reduce the total interest paid. Compare offers from multiple lenders before making a decision.

- Consider Loan Consolidation: Combining multiple loans into a single loan can simplify repayment and potentially lower your monthly payment, although this may not always result in lower overall interest paid.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe financial consequences that can significantly impact your credit score and future financial opportunities. Understanding these ramifications is crucial to ensuring timely repayment.

- Damaged Credit Score: A default will severely damage your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future.

- Wage Garnishment: The government can garnish your wages to recover the defaulted amount. This means a portion of your paycheck will be automatically deducted to repay the loan.

- Tax Refund Offset: Your federal tax refund can be seized to repay the defaulted loan.

- Difficulty Obtaining Government Benefits: Defaulting on student loans can impact your eligibility for certain government benefits and programs.

Budgeting Techniques for Student Loan Repayment

Effective budgeting is crucial for successful student loan repayment. Implementing these techniques will help you allocate funds effectively and stay on track.

- 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Adjust this based on your specific financial situation.

- Zero-Based Budgeting: Assign every dollar of your income to a specific expense category, ensuring all funds are accounted for. This promotes financial awareness and helps you identify areas for potential savings.

- Envelope System: Allocate cash for specific expense categories into separate envelopes. This provides a visual representation of your spending and prevents overspending.

Student Loan Forgiveness Programs

Student loan forgiveness programs offer the possibility of eliminating a portion or all of your student loan debt under specific circumstances. These programs are designed to alleviate the financial burden of student loans, particularly for individuals pursuing careers in public service or experiencing significant financial hardship. Eligibility criteria, application processes, and the overall benefits vary considerably depending on the specific program. Understanding these nuances is crucial for borrowers hoping to benefit from loan forgiveness.

Eligibility Requirements for Student Loan Forgiveness Programs

Eligibility for student loan forgiveness programs hinges on several factors, including the type of loan, the borrower’s occupation, and their income. For example, the Public Service Loan Forgiveness (PSLF) program requires borrowers to work full-time for a qualifying government or non-profit organization and make 120 qualifying monthly payments under an income-driven repayment plan. Other programs, like the Teacher Loan Forgiveness program, focus on specific professions and have their own unique eligibility requirements related to teaching experience and location. Income-based repayment plans often tie forgiveness to income levels and the length of repayment. It’s critical to carefully review the specific requirements of each program to determine eligibility.

Application Process for Student Loan Forgiveness Programs

The application process for student loan forgiveness programs can be complex and time-consuming. Generally, it involves completing an application form, providing documentation to verify employment, income, and loan details, and potentially undergoing an audit process. For the PSLF program, for instance, borrowers must consolidate their federal loans into a Direct Consolidation Loan and meticulously track their qualifying payments. Failure to meet all requirements, including accurate documentation, can result in application denial. Regularly checking your loan servicer’s website and contacting them directly for updates is advisable throughout the process.

Comparison of Benefits and Limitations of Different Forgiveness Options

Different student loan forgiveness programs offer varying levels of benefits and come with their own set of limitations. While PSLF can lead to complete loan forgiveness after 120 qualifying payments, it requires consistent employment in a qualifying role for an extended period. Teacher Loan Forgiveness offers a more limited amount of forgiveness, but it may be a more attainable goal for some individuals. Income-driven repayment plans offer gradual loan reduction over time, but the total amount forgiven might be less than under other programs, and the length of repayment could be extended significantly. The trade-offs between the amount of forgiveness and the time commitment should be carefully considered.

Summary of Key Features of Different Student Loan Forgiveness Programs

| Program Name | Eligibility Requirements | Application Process | Benefits & Limitations |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Full-time employment with qualifying employer, 120 qualifying payments under an income-driven repayment plan | Consolidate loans, track payments, submit application | Complete loan forgiveness; requires long-term commitment to qualifying employment |

| Teacher Loan Forgiveness | Full-time teaching at a low-income school for five complete and consecutive academic years | Submit application with proof of employment and teaching experience | Forgiveness of up to $17,500; limited amount of forgiveness; specific employment requirements |

| Income-Driven Repayment (IDR) Plans | Varying income thresholds; specific loan types | Enroll in an IDR plan; regular income recertification | Gradual loan reduction; potential for forgiveness after a specified period; longer repayment terms |

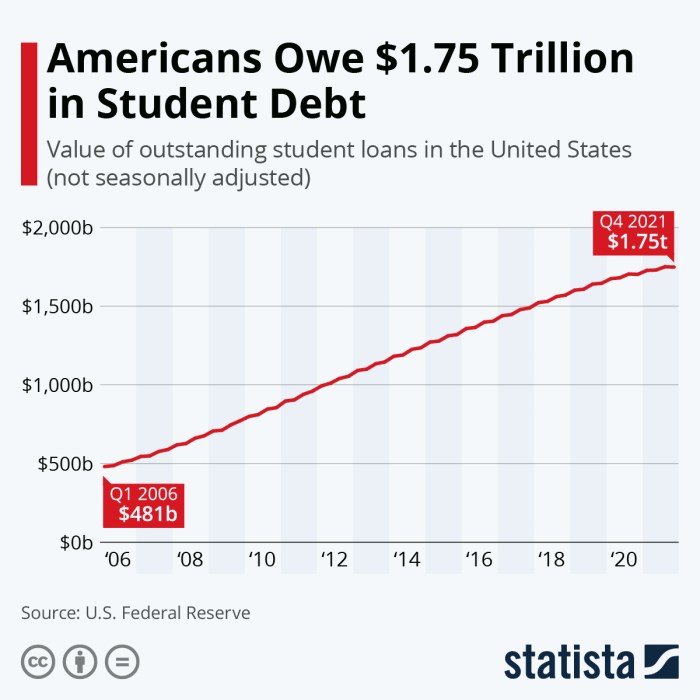

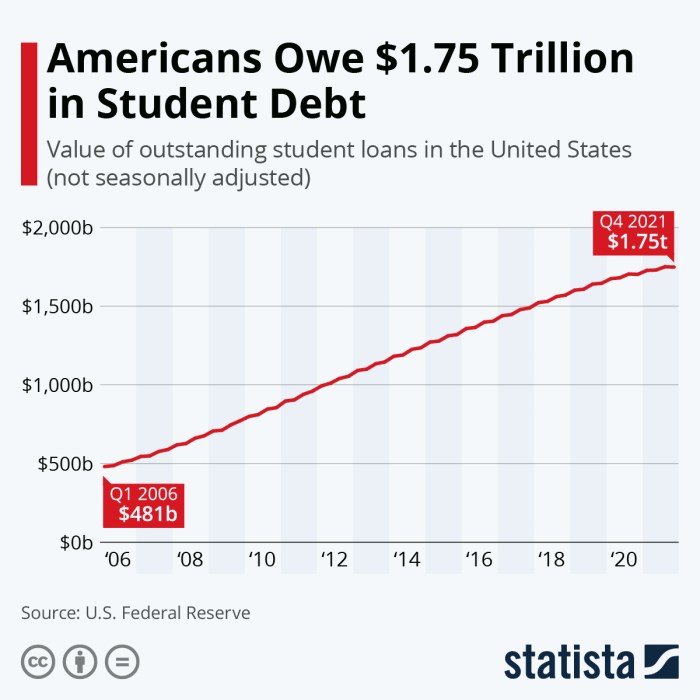

The Impact of Student Loan Debt

Student loan debt can significantly impact an individual’s financial well-being for many years after graduation. The weight of these loans can affect major life decisions and create long-term financial constraints, influencing everything from housing choices to family planning. Understanding these potential impacts is crucial for effective financial planning and mitigation strategies.

The long-term financial implications of student loan debt extend far beyond the repayment period. High monthly payments can restrict an individual’s ability to save for retirement, invest in other opportunities, or build emergency funds. This can lead to a cycle of debt, making it difficult to achieve financial stability and independence. The interest accrued over time can also substantially increase the total amount owed, compounding the financial burden. For example, a $30,000 loan at a 6% interest rate could easily balloon to over $40,000 within 10 years, even with consistent payments.

Student Loan Debt’s Influence on Major Life Decisions

Student loan debt often plays a significant role in delaying or altering major life decisions. The financial burden can make homeownership seem unattainable, especially in competitive housing markets. The monthly loan payments, coupled with mortgage payments, property taxes, and insurance, can quickly exceed a borrower’s budget. Similarly, starting a family can be postponed or approached differently due to the financial constraints imposed by student loan repayments. The costs associated with childcare, healthcare, and other family expenses add further pressure, making it challenging to balance financial obligations. For instance, a young couple with substantial student loan debt may delay having children or opt for smaller living arrangements to manage their expenses.

Minimizing the Long-Term Effects of Student Loan Debt

Several strategies can help minimize the long-term impact of student loan debt. Careful budgeting and financial planning are essential, focusing on creating a realistic repayment plan and prioritizing debt reduction. Exploring options like income-driven repayment plans or refinancing loans with lower interest rates can significantly reduce the overall cost and monthly payments. Furthermore, building a strong credit score is vital, as it opens doors to better financial opportunities in the future. Prioritizing savings and investing, even in small amounts, can help build financial security and create a buffer against unexpected expenses. For example, setting aside a small portion of income each month for an emergency fund can provide a safety net during unforeseen circumstances.

Examples of the Financial Burden of Student Loans

The financial burden of student loans varies greatly depending on the loan amount, interest rate, and repayment plan. However, numerous real-life examples illustrate the significant impact. Individuals struggling to make minimum payments may experience wage garnishment or damage to their credit score, making it difficult to secure loans or rent an apartment. Families may postpone retirement savings or forgo essential expenses to meet their loan obligations. Some individuals may even declare bankruptcy, though this is a last resort with serious long-term consequences. A recent study indicated that a substantial percentage of borrowers are still paying off their student loans well into their 40s and 50s, highlighting the prolonged financial strain.

Student Loan Scams and Fraud

Navigating the student loan process can be complex, making individuals vulnerable to scams and fraudulent activities. Understanding common tactics and protective measures is crucial to avoid financial hardship and protect your personal information. This section Artikels prevalent scams, preventative strategies, and reporting resources.

Common Student Loan Scams

Several deceptive practices target student loan borrowers. These include schemes promising loan forgiveness in exchange for upfront fees, unsolicited offers for loan consolidation or refinancing with inflated interest rates, and phishing attempts to obtain sensitive personal and financial information. False promises of guaranteed loan approval without proper credit checks are also common. For example, a fraudulent company might claim to have a secret method to erase student loan debt quickly, requiring a substantial upfront payment. Another common scam involves fake websites mimicking legitimate student loan providers, prompting users to submit their personal information which is then used for identity theft.

Protecting Yourself from Student Loan Scams

Protecting yourself involves vigilance and informed decision-making. Always verify the legitimacy of any student loan provider or organization before sharing personal information. Never pay upfront fees for loan consolidation or forgiveness programs. Legitimate lenders do not require such payments. Be wary of unsolicited offers that sound too good to be true. Check the Federal Student Aid website (studentaid.gov) for information on approved lenders and programs. Furthermore, regularly monitor your credit report for any suspicious activity. This proactive approach allows for early detection of potential fraud.

Reporting Student Loan Fraud

If you suspect you’ve been a victim of a student loan scam, report it immediately to the appropriate authorities. You can file a complaint with the Federal Trade Commission (FTC) at ftc.gov or contact your state’s attorney general’s office. The Department of Education also has resources for reporting fraud related to federal student loans. Document all communication with suspicious individuals or organizations, including emails, letters, and phone records. This documentation will be invaluable in the investigation process.

Warning Signs of Student Loan Scams

Several warning signs can indicate a potential scam. These include unsolicited emails or phone calls promising quick loan forgiveness or consolidation, high-pressure sales tactics, requests for upfront fees, vague or misleading information about interest rates and repayment terms, and websites or communication that appear unprofessional or lack proper contact information. If you encounter any of these red flags, exercise extreme caution and thoroughly investigate the legitimacy of the offer before proceeding. For example, a website with numerous grammatical errors or a phone number that is difficult to verify should raise suspicion.

Visual Representation of Loan Repayment

Understanding the long-term financial implications of different student loan repayment plans is crucial for effective financial planning. A visual representation can effectively demonstrate how various repayment options impact the total interest paid over the loan’s lifetime. This aids in informed decision-making, allowing borrowers to choose the plan best suited to their financial circumstances.

This section describes a bar chart illustrating the total interest paid under different repayment plans for a hypothetical $30,000 student loan at a 6% fixed interest rate. The chart visually compares the standard repayment plan, an extended repayment plan, and an income-driven repayment plan. The data used is based on common repayment plan parameters and interest calculations. The visual representation helps borrowers understand the trade-offs between longer repayment periods and the total interest accrued.

Comparison of Repayment Plans and Total Interest Paid

The bar chart uses three distinct bars, each representing a different repayment plan: Standard, Extended, and Income-Driven. The horizontal axis labels each repayment plan, while the vertical axis represents the total interest paid in dollars. The height of each bar directly corresponds to the total interest paid under that specific plan. For example, the Standard Repayment plan, with a typical 10-year repayment period, might show a bar reaching $10,000, indicating the total interest paid over those ten years. The Extended Repayment plan, perhaps a 20-year plan, would likely have a taller bar, say $22,000, reflecting the higher total interest due to the longer repayment period. Finally, the Income-Driven Repayment plan, which adjusts payments based on income, might show a bar at $18,000, illustrating a total interest payment that falls between the Standard and Extended plans. This variation highlights the impact of payment schedule length and payment amount on the overall cost of the loan. The chart uses clear color-coding for easy differentiation of the plans and includes a legend clearly labeling each bar. Numerical values for total interest are displayed above each bar for precise comparison. The chart title clearly states the loan amount and interest rate used for the calculation.

Final Thoughts

Securing a higher education often requires financial planning and careful consideration of student loans. This guide has provided a roadmap through the complexities of student loan financing, covering various loan types, application processes, repayment strategies, and the importance of avoiding scams. By understanding the different options available and implementing effective debt management strategies, students can confidently pursue their educational goals while minimizing the long-term financial impact of student loan debt. Remember to research thoroughly, plan carefully, and seek professional advice when needed to make informed decisions that align with your individual financial circumstances.

FAQ Insights

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, or deferment. Unsubsidized loans accrue interest throughout these periods.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it often involves private lenders and may lose federal protections.

What happens if I default on my student loans?

Defaulting can result in wage garnishment, tax refund offset, and damage to your credit score. It can also make it difficult to obtain future loans or credit.

How can I find a reputable student loan counselor?

Check for affiliations with reputable organizations, verify licenses, and read reviews before engaging with any loan counselor.