Navigating the complexities of student loan debt while simultaneously building a secure retirement can feel like a daunting task. Many young adults find themselves facing a difficult choice: prioritize immediate debt repayment or invest in their long-term financial future. This exploration delves into the intricate relationship between student loans and 401(k) contributions, examining the challenges, strategies, and innovative solutions available to those striving for financial well-being.

We’ll investigate how government policies impact both student loan repayment and retirement savings, offering a comprehensive overview of the financial planning strategies needed to successfully manage both. The psychological toll of student loan debt on retirement planning will also be addressed, providing practical coping mechanisms and resources for navigating this complex emotional landscape. Ultimately, the goal is to empower individuals to make informed decisions and build a secure financial future despite the burden of student loan debt.

The Impact of Student Loan Debt on 401(k) Contributions

Student loan debt has become a significant financial burden for many young adults, impacting various aspects of their financial lives, most notably their ability to save for retirement. The high monthly payments often leave little room for other savings, including contributions to a 401(k) retirement plan. This consequently delays the accumulation of retirement funds and potentially compromises future financial security.

The correlation between high student loan debt and reduced 401(k) contributions is strong. Individuals burdened with substantial loan repayments often find themselves prioritizing immediate debt reduction over long-term savings. This is a rational, albeit potentially detrimental, response to financial pressure. The immediate need to manage debt overshadows the long-term benefits of retirement savings, leading to a delay or reduction in 401(k) contributions.

Student Loan Payments and Retirement Savings

The impact of student loan payments on retirement savings is multifaceted. For instance, a recent graduate with $50,000 in student loan debt at a 6% interest rate might face monthly payments of around $300. This significant monthly expense reduces disposable income, making it challenging to allocate funds towards a 401(k). If they were able to contribute even a modest 5% of their salary to their 401(k) – let’s say $200 a month – the total monthly debt burden would increase significantly, making it difficult to meet other financial obligations. The longer this pattern continues, the less time and opportunity there is to benefit from compound interest in their 401(k). This illustrates how seemingly manageable individual payments can accumulate to severely impact the ability to save for retirement.

Strategies for Balancing Student Loan Repayment and 401(k) Contributions

Several strategies can help individuals balance student loan repayment and 401(k) contributions. Prioritizing contributions, even if small, can leverage employer matching programs, maximizing the return on investment. Exploring income-driven repayment plans for student loans can lower monthly payments, freeing up funds for retirement savings. Additionally, budgeting and creating a realistic financial plan are crucial to determining the optimal allocation of funds between immediate debt and long-term savings. Negotiating lower interest rates on student loans could also free up funds for retirement contributions.

Hypothetical Budget Allocation

Consider a hypothetical budget for a young professional with a monthly income of $4,000, $300 in student loan payments, and a goal of saving for retirement. A possible allocation might be:

| Category | Amount |

|---|---|

| Student Loan Payments | $300 |

| 401(k) Contributions (including employer match) | $250 |

| Rent/Mortgage | $1200 |

| Utilities | $200 |

| Groceries | $400 |

| Transportation | $250 |

| Other Expenses | $400 |

This budget demonstrates a balance between debt repayment and retirement savings, although it requires careful financial management and potentially some lifestyle adjustments. This is just an example, and the ideal allocation will vary greatly depending on individual circumstances. The key is to prioritize both debt repayment and retirement savings, even if it means making smaller contributions than ideal.

Government Policies and Their Influence on Student Loans and Retirement Savings

Government policies significantly impact both student loan repayment and the ability of young adults to contribute meaningfully to their 401(k)s. These policies, often intertwined and complex, create a landscape where financial decisions regarding education and retirement are heavily influenced by external factors. Understanding these influences is crucial for both policymakers and individuals navigating these critical financial choices.

The current landscape of government student loan programs and their interaction with retirement savings reveals a complex interplay of incentives and disincentives. For example, income-driven repayment plans, while offering short-term relief, may prolong the debt burden, potentially delaying or reducing contributions to retirement accounts. Conversely, tax advantages associated with 401(k) contributions can be less impactful for individuals struggling under significant student loan debt.

Impact of Current Government Policies on Student Loan Repayment and 401(k) Participation

Current government policies exhibit a mixed impact. Income-driven repayment plans (IDR) like PAYE and REPAYE offer lower monthly payments based on income, but often extend the repayment period significantly, leading to higher overall interest paid. This extended repayment period can delay the ability to save aggressively for retirement. Simultaneously, tax advantages offered for 401(k) contributions are often less beneficial to those struggling with high monthly student loan payments, as their disposable income is limited. This creates a scenario where the immediate need for student loan repayment often overshadows long-term retirement planning. For instance, a young professional with $100,000 in student loan debt and a $50,000 annual salary might prioritize minimum loan payments, leaving little to contribute to a 401(k), even with employer matching.

Comparison of Government Programs Assisting with Student Loan Repayment

Several government programs aim to assist with student loan repayment. The Public Service Loan Forgiveness (PSLF) program, for example, forgives the remaining balance of federal student loans after 120 qualifying monthly payments under an income-driven repayment plan for those working in public service. However, strict eligibility requirements and administrative complexities have limited its effectiveness. Other programs, like the Teacher Loan Forgiveness program, offer similar forgiveness but with more targeted eligibility criteria. These programs, while beneficial to qualifying individuals, don’t address the broader issue of the impact of student loan debt on overall retirement savings. The differences lie primarily in eligibility criteria and the types of employment covered.

Potential Policy Changes to Improve Retirement Savings Outcomes

Several policy changes could significantly improve retirement savings outcomes for individuals with student loan debt. One approach could involve expanding and simplifying existing income-driven repayment plans, ensuring greater accessibility and reducing administrative hurdles. Another avenue could involve integrating student loan repayment directly into retirement savings plans, perhaps allowing a portion of 401(k) contributions to be directed towards loan repayment with tax advantages. Furthermore, increasing employer-sponsored retirement plan contributions or providing tax credits specifically targeted at individuals with student loan debt could incentivize earlier and more significant retirement savings. This could be modeled on existing tax credits for retirement savings, but tailored to the unique circumstances of individuals burdened by student loan debt.

Long-Term Effects of Current Policies on Retirement Security of Young Adults

Current policies risk creating a generation of young adults facing significant financial insecurity in retirement. The prolonged repayment of student loan debt, coupled with limited opportunities to save for retirement, could lead to a significant shortfall in retirement savings. This could manifest in delayed retirement, reduced living standards in retirement, and increased reliance on government assistance programs. This potential for a substantial retirement savings gap among young adults highlights the need for proactive policy changes to address this growing concern. For example, a study by [insert reputable source and data here] could be used to illustrate the projected retirement savings shortfall for this demographic.

Financial Planning Strategies for Managing Student Loans and 401(k)s

Balancing student loan repayment with 401(k) contributions can feel daunting, but a well-structured financial plan can make it manageable. This section Artikels a step-by-step approach, considering various debt levels and offering practical resources to help navigate this crucial phase of financial life.

A Step-by-Step Financial Plan

Effective management requires a strategic approach. First, create a comprehensive budget outlining all income and expenses. This provides a clear picture of your financial situation, revealing areas where savings can be maximized. Next, determine your student loan repayment plan (standard, income-driven, etc.) and calculate the minimum monthly payment. Simultaneously, assess your 401(k) eligibility and employer matching contributions. Maximize employer matching contributions as this is essentially free money. Then, allocate remaining funds to your 401(k) contribution, aiming for a balance between debt reduction and retirement savings. Regularly review and adjust your plan based on changes in income, expenses, or debt. Finally, consider seeking professional financial advice for personalized guidance.

401(k) Contribution Strategies Based on Student Loan Debt

The optimal 401(k) contribution rate depends heavily on the level of student loan debt. The following table illustrates different strategies:

| Student Loan Debt Level | Monthly Student Loan Payment | Recommended 401(k) Contribution (%) | Rationale |

|---|---|---|---|

| Low (e.g., less than $10,000) | Low | 10-15% (including employer match) | Prioritize both retirement and debt reduction. High contribution possible due to low debt burden. |

| Moderate (e.g., $10,000 – $50,000) | Moderate | 5-10% (including employer match) | Balance debt repayment with retirement savings. Focus on aggressive debt reduction while still securing employer match. |

| High (e.g., over $50,000) | High | At least employer match | Prioritize aggressive debt repayment. Focus on minimizing interest accumulation. Employer match ensures some retirement contribution. |

| Very High (e.g., over $100,000) | Very High | Employer match only | Concentrate heavily on debt reduction. Explore options like refinancing or income-driven repayment plans. |

Resources and Tools for Effective Financial Management

Several resources can assist in managing finances effectively. These tools provide budgeting assistance, debt tracking, and investment management capabilities. Examples include personal finance apps (Mint, YNAB), online budgeting tools (BudgetPulse), and financial literacy websites (Investopedia, Khan Academy). Many financial institutions also offer free or low-cost financial planning services to their customers. Utilizing these resources can significantly improve financial organization and decision-making.

Prioritizing Debt Repayment and Retirement Savings

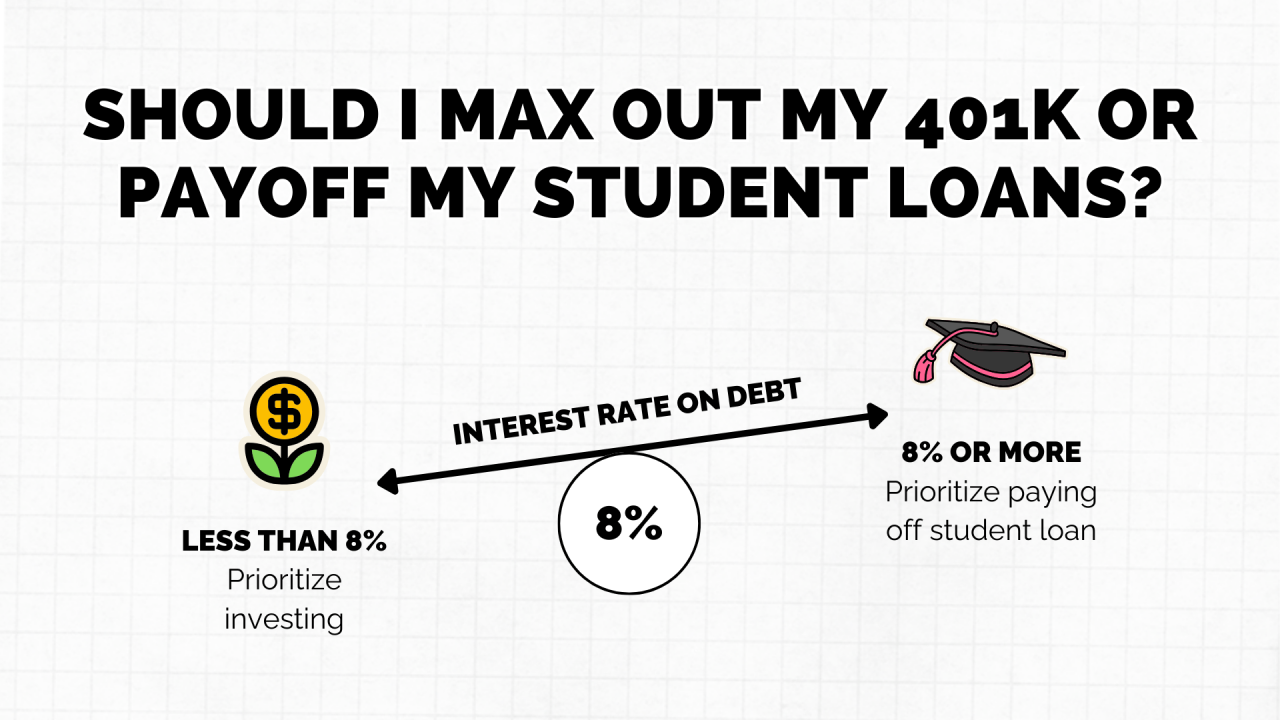

Prioritization depends on individual circumstances. High-interest debt, such as credit card debt, often demands quicker repayment to minimize interest charges. Student loans, typically carrying lower interest rates, might allow for a more balanced approach between debt repayment and 401(k) contributions. Factors like age, income, and risk tolerance also play a significant role. For example, younger individuals with higher earning potential might prioritize 401(k) contributions more aggressively due to the power of compound interest and longer investment horizon. Conversely, older individuals closer to retirement might prioritize debt reduction to ensure financial stability in their later years. Careful consideration of these factors is crucial for developing a personalized financial strategy.

The Psychological Impact of Student Loan Debt on Retirement Planning

The weight of student loan debt can significantly impact an individual’s ability to prioritize and effectively plan for retirement. The constant pressure of loan repayments often overshadows long-term financial goals, creating a psychological barrier that hinders proactive retirement saving. This section explores the multifaceted ways student loan debt affects mental well-being and financial decision-making, ultimately impacting retirement preparedness.

The psychological burden of substantial student loan debt frequently manifests as heightened stress and anxiety. This chronic stress can impair cognitive function, making it difficult to focus on complex financial planning tasks like calculating retirement contributions or understanding investment strategies. Individuals may experience feelings of overwhelm and hopelessness, leading to procrastination and inaction regarding retirement savings. The sheer magnitude of the debt can feel insurmountable, fostering a sense of powerlessness and delaying any attempts at planning for the future. This is particularly true for those struggling to make ends meet, where even small amounts saved for retirement feel inaccessible.

Stress and Impaired Financial Decision-Making

Stress stemming from student loan debt can significantly impair financial decision-making. For example, individuals might opt for short-term financial gains over long-term stability, such as taking on high-interest debt to cover immediate expenses instead of contributing to a 401(k). The fear of not meeting monthly loan payments can lead to impulsive financial decisions, such as withdrawing from retirement savings or neglecting investment opportunities. The cognitive load associated with managing debt can also limit the mental capacity to engage in careful financial planning, increasing the likelihood of poor choices. A person might forgo contributing to their 401(k) because the monthly payment seems too high, even if they understand the long-term benefits of retirement savings. This immediate financial pressure often outweighs the long-term perspective of retirement planning.

Coping Mechanisms and Strategies

Developing effective coping mechanisms is crucial for mitigating the psychological impact of student loan debt on retirement planning. Prioritizing mental well-being is paramount; techniques such as mindfulness, meditation, or engaging in regular exercise can help manage stress levels. Seeking professional financial counseling provides personalized guidance on debt management strategies and retirement planning. Breaking down large financial goals into smaller, manageable steps can make the process feel less daunting. Creating a realistic budget that incorporates both loan repayments and retirement contributions is essential. This budget should reflect a balance between immediate needs and long-term goals. Furthermore, actively seeking support from friends, family, or support groups can provide emotional resilience and practical advice. Reframing the perspective on student loan debt – viewing it as a temporary challenge rather than a permanent burden – can improve mental outlook and motivation for long-term financial planning.

Resources for Financial and Mental Health Support

Accessing appropriate resources is vital for managing the psychological and financial challenges associated with student loan debt. A range of support is available to help individuals navigate this complex situation effectively.

- National Foundation for Credit Counseling (NFCC): Provides free and low-cost credit counseling services, including debt management plans and financial education.

- The National Alliance on Mental Illness (NAMI): Offers support groups and resources for individuals struggling with mental health issues related to financial stress.

- Your Employer’s Human Resources Department: Many employers offer employee assistance programs (EAPs) that provide access to counseling and financial planning services.

- Federal Student Aid (FSA): Provides information and resources on managing student loans, including repayment plans and options for loan forgiveness.

- Credit Unions and Local Banks: Often offer financial literacy workshops and individual consultations to help manage finances.

Innovative Solutions for Addressing Student Loan Debt and Retirement Savings

The dual burdens of student loan debt and inadequate retirement savings pose a significant challenge for many young adults. Innovative solutions are needed to alleviate this pressure and foster a more secure financial future. This section explores several approaches designed to bridge the gap between managing student loan repayment and actively contributing to retirement accounts.

Innovative Student Loan Repayment Approaches to Encourage 401(k) Participation

Several innovative repayment models could incentivize 401(k) contributions. One promising approach is the integration of student loan payments directly into 401(k) plans. Employers could offer a program where a portion of employee contributions to the 401(k) is automatically allocated to student loan repayment, effectively reducing the monthly burden while simultaneously fostering retirement savings. Another approach involves creating income-driven repayment plans specifically tied to 401(k) contributions. Under this model, student loan payments would be adjusted based on the employee’s 401(k) contribution rate, potentially lowering payments for those saving more aggressively for retirement. This approach aligns incentives and rewards responsible financial planning.

Comparison of Student Loan Consolidation and Refinancing Methods

Consolidating or refinancing student loans can simplify repayment and potentially lower monthly payments. Consolidation combines multiple loans into a single loan, often with a fixed interest rate. This can simplify budgeting but may not always result in lower overall interest costs. Refinancing involves obtaining a new loan to pay off existing student loans, potentially securing a lower interest rate. The choice between consolidation and refinancing depends on individual circumstances, including interest rates, loan types, and creditworthiness. For example, borrowers with excellent credit might benefit significantly from refinancing to secure a lower interest rate, reducing their monthly payments and freeing up more funds for 401(k) contributions. Conversely, borrowers with less-than-perfect credit may find consolidation a more viable option, even if the interest rate doesn’t improve drastically.

Technological Solutions for Simplifying Financial Planning

Technology offers powerful tools to streamline financial planning for individuals juggling student loan debt and retirement savings. Automated budgeting apps can track income and expenses, automatically allocating funds to student loan payments and 401(k) contributions. Robo-advisors offer personalized investment advice and automated portfolio management, making investing more accessible to those with limited financial expertise. Sophisticated financial planning software can model different repayment scenarios and project the impact on retirement savings, helping individuals make informed decisions. For example, an app could simulate various 401k contribution levels and student loan repayment plans, showing the user a clear visual representation of their potential retirement savings at different ages, based on their current financial situation and chosen plan.

The Role of Financial Literacy Programs in Improving Retirement Savings

Financial literacy programs play a crucial role in equipping young adults with the knowledge and skills to manage their finances effectively. These programs can educate individuals on topics such as budgeting, debt management, investing, and retirement planning. By providing accessible and engaging resources, these programs empower young adults to make informed decisions about their financial future, increasing the likelihood of successful student loan repayment and adequate retirement savings. Effective programs often include interactive workshops, online resources, and one-on-one counseling sessions, catering to diverse learning styles and needs. For instance, a program might offer a workshop on budgeting techniques specifically tailored for graduates with student loan debt, followed by individual sessions to create personalized financial plans.

Ending Remarks

Successfully balancing student loan repayment and 401(k) contributions requires a multifaceted approach encompassing financial planning, understanding government policies, and addressing the psychological challenges involved. By implementing strategic budgeting, exploring available resources, and advocating for supportive policy changes, individuals can overcome the obstacles presented by student loan debt and build a strong foundation for a secure retirement. This journey necessitates proactive financial management, informed decision-making, and a commitment to long-term financial well-being.

Query Resolution

Can I contribute to a 401(k) while still paying off student loans?

Yes, absolutely. Even small contributions to a 401(k) can make a significant difference over time due to compounding interest. Prioritize what you can afford while balancing your student loan payments.

What if I can’t afford both student loan payments and 401(k) contributions?

Explore options like income-driven repayment plans for your student loans to lower your monthly payments, freeing up more funds for retirement savings. Consider also prioritizing high-interest debt first.

Are there tax advantages to contributing to a 401(k) while paying student loans?

Yes, contributions to a 401(k) are often tax-deductible, reducing your taxable income. Consult a financial advisor to fully understand the tax implications.

Should I refinance my student loans to lower my monthly payments?

Refinancing can be beneficial if you secure a lower interest rate. However, carefully weigh the pros and cons, considering any potential impact on your credit score and loan terms.