Navigating the complexities of student loan accounts can feel daunting, especially after the excitement of graduation fades. This guide provides a clear and concise overview of everything you need to know, from understanding different loan types and managing repayment strategies to addressing potential issues and planning for your long-term financial future. We’ll demystify the process, empowering you to take control of your student loan debt and build a strong financial foundation.

Whether you’re a recent graduate facing your first loan payment or a seasoned borrower seeking to optimize your repayment plan, this resource offers practical advice and actionable steps to help you effectively manage your student loans account and achieve your financial goals. We’ll cover key aspects such as interest rates, repayment options, loan deferment, and the impact of student loan debt on your credit score. Understanding these elements is crucial for making informed decisions and avoiding potential pitfalls.

Understanding Student Loan Accounts

Navigating the world of student loans can feel overwhelming, but understanding the different types and their features is crucial for responsible borrowing and repayment. This section clarifies the key differences between federal and private loans, highlighting interest rates and repayment options to help you make informed decisions.

Types of Student Loan Accounts

Student loans are broadly categorized into federal and private loans. Federal loans are offered by the U.S. government, while private loans are provided by banks, credit unions, and other financial institutions. Each type has distinct advantages and disadvantages.

Federal Student Loans

Federal student loans offer several benefits, including fixed interest rates (which remain the same throughout the loan term), various repayment plans, and potential for income-driven repayment options. They often have more favorable terms than private loans, especially for borrowers with limited credit history. Specific federal loan programs include Direct Subsidized Loans (for undergraduate students demonstrating financial need), Direct Unsubsidized Loans (available to undergraduate and graduate students, regardless of need), and Direct PLUS Loans (for graduate students and parents of undergraduate students). The interest rates on federal loans are set annually by the government and are generally lower than those on private loans.

Private Student Loans

Private student loans are offered by private lenders and are often subject to variable interest rates, meaning the interest rate can fluctuate over the life of the loan, potentially increasing your overall repayment cost. Eligibility for private loans typically depends on creditworthiness, co-signers may be required, and the repayment terms can be less flexible compared to federal loans. Private loans can be more challenging to manage if you face financial hardship, as they may not offer the same income-driven repayment options as federal loans.

Interest Rates and Repayment Options

Interest rates and repayment options significantly impact the overall cost and manageability of your student loans. Federal loans generally have lower, fixed interest rates, making them more predictable. Private loan interest rates can be higher and variable, leading to uncertainty in monthly payments. Repayment options vary depending on the loan type. Federal loans offer various plans, including standard repayment, graduated repayment, extended repayment, and income-driven repayment plans. Private loans typically offer fewer options, often limited to standard repayment plans.

Fixed vs. Variable Interest Rates

The choice between a fixed and variable interest rate significantly influences the predictability of your monthly payments and the total cost of borrowing.

| Feature | Fixed Interest Rate | Variable Interest Rate |

|---|---|---|

| Interest Rate | Stays the same throughout the loan term | Fluctuates based on market conditions |

| Predictability | High; consistent monthly payments | Low; monthly payments can change |

| Risk | Lower risk of higher payments | Higher risk of increased payments |

| Long-term cost | Generally more predictable and potentially lower overall cost | Potentially higher overall cost due to rate fluctuations |

Managing Student Loan Debt

Successfully navigating student loan repayment requires a proactive and organized approach. Understanding your loan details, developing a realistic budget, and choosing the right repayment plan are crucial steps toward becoming debt-free. This section will Artikel strategies to help you effectively manage your student loan debt.

Effective Student Loan Repayment Planning Strategies

Effective repayment planning begins with understanding your total loan amount, interest rates, and repayment terms for each loan. Consolidating multiple loans into a single loan can simplify management and potentially lower your monthly payment, although it might increase the total interest paid over the life of the loan. Prioritizing high-interest loans for faster repayment can significantly reduce overall interest costs. Automating payments ensures consistent on-time payments, preventing late fees and negative impacts on your credit score. Regularly reviewing your progress and adjusting your strategy as needed ensures you stay on track. Finally, exploring options like refinancing, which might offer lower interest rates, should be considered but requires careful evaluation of the terms.

Sample Budget Incorporating Student Loan Payments

Creating a comprehensive budget is essential for successful student loan repayment. This example illustrates a monthly budget incorporating student loan payments:

| Income | Amount |

|---|---|

| Net Monthly Salary | $3000 |

| Expenses | Amount |

| Rent/Mortgage | $1000 |

| Utilities | $200 |

| Groceries | $300 |

| Transportation | $200 |

| Student Loan Payment | $500 |

| Other Expenses (Entertainment, Savings, etc.) | $800 |

| Total Expenses | $3000 |

This is a simplified example; individual budgets will vary significantly based on income and expenses. The key is to accurately track all income and expenses to identify areas for potential savings and allocate sufficient funds for student loan payments.

Benefits and Drawbacks of Different Repayment Plans

Several repayment plans are available, each with its own advantages and disadvantages.

Standard Repayment plans offer fixed monthly payments over a 10-year period. The benefit is a relatively short repayment timeframe, leading to lower total interest paid. However, the monthly payments can be high, potentially straining one’s budget.

Income-driven repayment plans (IDR) adjust monthly payments based on your income and family size. The benefit is lower monthly payments, making repayment more manageable, especially during periods of lower income. However, repayment periods are often longer, potentially leading to higher total interest paid over the life of the loan. Specific IDR plans (like PAYE, REPAYE, IBR) have varying eligibility criteria and payment calculation methods.

Implications of Loan Deferment and Forbearance

Loan deferment and forbearance temporarily postpone or reduce student loan payments. Deferment typically applies to specific circumstances like unemployment or return to school, and interest may or may not accrue depending on the loan type. Forbearance is generally granted for temporary financial hardship, and interest usually accrues, adding to the total loan amount. Both options offer short-term relief but can prolong the repayment period and increase the total interest paid. It’s crucial to understand the implications before utilizing either option and to explore them only as a last resort. They should not be considered long-term solutions.

Student Loan Account Access and Information

Accessing and managing your student loan account information is crucial for responsible debt repayment. Understanding how to navigate your online account, update your personal details, and contact your servicer will ensure a smooth repayment process. This section details the necessary steps and procedures.

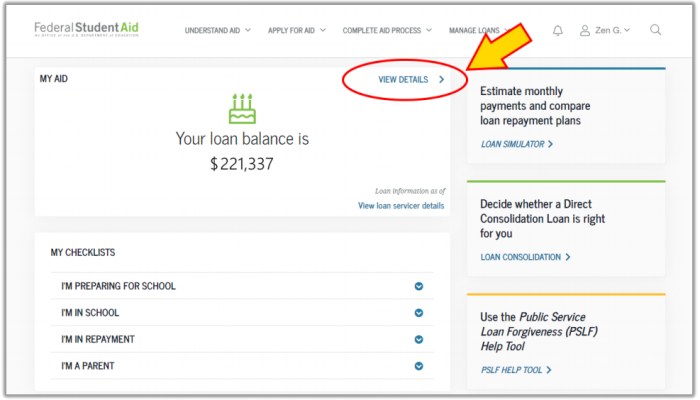

Accessing Student Loan Account Information Online

Most student loan servicers provide online account access portals. To access your account, you typically need your Federal Student Aid (FSA) ID or your loan servicer’s assigned username and password. Once logged in, you can view your loan balance, payment history, interest rates, and repayment schedule. Many portals also offer tools to calculate repayment amounts under different plans and provide resources for managing your debt. If you have forgotten your login credentials, most servicers provide a password reset option, usually involving answering security questions or receiving a verification code via email or phone. Navigation within the online portal is generally intuitive, with clear labeling and easily accessible information.

Updating Personal Information

Keeping your personal information up-to-date is vital to ensure accurate communication and avoid delays in processing payments or other important information. This typically involves accessing your online account, locating a section labeled “Personal Information,” “Profile,” or something similar. You can then update your address, phone number, and email address. Some servicers may require verification of the changes, such as providing documentation for address changes. It is important to make these updates promptly, as outdated information can lead to missed payments or difficulties in contacting you.

Contacting Your Loan Servicer

Several methods are available for contacting your loan servicer. Most servicers provide a toll-free phone number prominently displayed on their website and account statements. Many also offer email support, allowing you to send inquiries and receive responses via email. Some servicers may provide a live chat feature on their website for immediate assistance with simple questions. Finally, many servicers maintain a physical mailing address where you can send written correspondence. Choosing the best method depends on your preference and the urgency of your inquiry; phone calls are often best for immediate assistance, while email may be more suitable for non-urgent matters.

Setting Up Automatic Payments

Automating your student loan payments offers several advantages, including convenience and the avoidance of late fees. The process usually involves logging into your online account, navigating to the payment section, and selecting the “automatic payments” or “recurring payments” option. You’ll need to provide your bank account information, including account number and routing number. You’ll also need to specify the payment amount and frequency (e.g., monthly). Many servicers allow you to adjust or cancel automatic payments online at any time. Confirming your payment setup is essential; check your account regularly to ensure payments are being deducted as scheduled. Setting up automatic payments can simplify the repayment process and contribute to timely payments.

Potential Issues with Student Loan Accounts

Navigating the world of student loans can be challenging, and unfortunately, problems can arise. Understanding potential issues and how to address them proactively is crucial for responsible debt management. This section Artikels common difficulties encountered by students and provides guidance on resolving them.

Billing Errors and Discrepancies

Inaccurate billing information is a common frustration. This can manifest as incorrect interest calculations, misapplied payments, or discrepancies between the amount owed and the statement balance. To resolve these issues, carefully review your monthly statement (detailed below). If you identify an error, contact your loan servicer immediately. Provide them with specific details of the discrepancy, including dates, amounts, and any supporting documentation. Keep records of all communication with your servicer, including dates, times, and the names of the individuals you spoke with. Most servicers have a dedicated department for resolving billing disputes; persistence and clear documentation are key to a successful resolution.

Loan Default and its Consequences

Loan default occurs when you fail to make payments for a specified period (typically 90 days). The consequences are severe and can significantly impact your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Default can also lead to wage garnishment, tax refund offset, and damage to your credit history. To avoid default, create a budget, explore repayment options offered by your servicer (such as income-driven repayment plans), and communicate with your servicer if you anticipate difficulties making payments. They may offer forbearance or deferment, temporary pauses in payments under specific circumstances. If you’re already in default, contact your servicer immediately to discuss rehabilitation programs. These programs may involve making a series of on-time payments to reinstate your loan in good standing.

Understanding Your Monthly Student Loan Statement

Your monthly statement is a vital tool for managing your student loan debt. It provides a detailed summary of your account activity, including: the current loan balance, the amount of principal and interest paid, the minimum payment due, the payment due date, and any fees or penalties. Understanding each component is critical. For example, the “principal” represents the original amount borrowed, while “interest” is the cost of borrowing money. A typical statement will also show your payment history, highlighting on-time and late payments. Review your statement carefully each month to ensure accuracy and to track your progress towards paying off your loans. If you have multiple loans, the statement will usually break down the details for each loan separately. Contacting your loan servicer for clarification if anything is unclear is always advisable.

Long-Term Financial Planning with Student Loans

Successfully navigating student loan debt requires integrating repayment strategies into your broader long-term financial goals. Failing to do so can significantly hinder your progress toward major life milestones like homeownership and retirement. Understanding the long-term implications of your student loan debt is crucial for making informed financial decisions.

Student loan repayment is a significant financial commitment that demands careful planning. The amount you borrow, the interest rate, and your repayment plan all influence your overall financial health and ability to achieve your long-term goals. Strategic planning can help you manage your debt effectively and avoid potential pitfalls.

Impact of Student Loan Debt on Credit Scores

Student loan debt significantly impacts your credit score. On-time payments consistently demonstrate responsible credit management, positively affecting your score. Conversely, missed or late payments can severely damage your credit rating, making it harder to secure loans, rent an apartment, or even get certain jobs. Lenders use your credit score to assess your risk, and a lower score typically results in higher interest rates on future loans, increasing the overall cost of borrowing. Maintaining a good credit score through diligent student loan repayment is therefore a critical aspect of long-term financial planning.

Student Loan Debt’s Influence on Major Financial Decisions

Student loan debt can substantially influence major financial decisions, particularly homeownership and investing. Lenders consider your debt-to-income ratio (DTI) when evaluating mortgage applications. A high DTI, largely influenced by student loan payments, can reduce your borrowing power and limit your options for purchasing a home. Similarly, significant student loan payments may restrict your ability to save and invest for retirement or other long-term goals. For example, someone with substantial student loan debt might need to delay investing in a retirement account or choose a less aggressive investment strategy due to limited disposable income. The same applies to other major purchases like a car. A high DTI might make it difficult to secure a loan with favorable terms, or might necessitate a smaller, less expensive purchase.

Steps to Effectively Manage Student Loan Debt After Graduation

Effective management of student loan debt after graduation requires a proactive approach. It’s not simply about making payments; it’s about strategically planning your repayment to minimize the long-term financial burden.

The following steps provide a framework for managing your student loans effectively:

- Understand Your Loans: Know the terms of each loan (interest rate, repayment plan, etc.).

- Create a Realistic Budget: Track your income and expenses to determine how much you can afford to allocate toward loan repayment.

- Explore Repayment Options: Research different repayment plans (e.g., standard, extended, income-driven) to find one that fits your financial situation.

- Prioritize High-Interest Loans: Focus on paying down loans with the highest interest rates first to minimize overall interest paid.

- Automate Payments: Set up automatic payments to avoid late fees and maintain a good payment history.

- Consider Refinancing: Explore refinancing options if interest rates have dropped since you took out your loans.

- Monitor Your Credit Report: Regularly check your credit report for accuracy and identify any potential issues.

Resources for Student Loan Assistance

Navigating the complexities of student loan repayment can be daunting, but numerous resources exist to provide guidance and support. Understanding the available options and accessing appropriate assistance can significantly improve your financial well-being and streamline the repayment process. This section Artikels key resources, eligibility criteria for forgiveness programs, and the application process for income-driven repayment plans.

Reputable Organizations Offering Student Loan Counseling and Assistance

Several reputable non-profit organizations offer free or low-cost student loan counseling and assistance. These organizations provide valuable support in navigating repayment options, creating budgeting plans, and exploring potential debt relief programs. They act as an objective third party, helping borrowers understand their options without any financial incentive to recommend specific products.

- The National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit association of credit counseling agencies that offers various services, including student loan counseling. They can help you create a budget, explore repayment options, and consolidate your loans. They are accredited and adhere to strict ethical guidelines.

- The Student Loan Borrower Assistance Project (SLBAP): SLBAP provides free assistance to borrowers struggling with their student loans. They offer counseling, advocacy, and legal assistance. Their focus is on borrowers facing significant challenges, such as default or potential scams.

- Federal Student Aid (FSA): While not a counseling organization itself, FSA is a crucial resource for information and access to government programs. Their website provides a wealth of information on repayment plans, forgiveness programs, and other relevant topics.

Eligibility Requirements for Student Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, each with specific eligibility requirements. These programs generally aim to reduce or eliminate student loan debt for borrowers who meet specific criteria, such as working in public service or teaching in low-income schools. It is crucial to understand these requirements carefully before applying.

- Public Service Loan Forgiveness (PSLF): PSLF forgives the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. Qualifying employers include government organizations and certain non-profit organizations.

- Teacher Loan Forgiveness Program: This program forgives up to $17,500 of your federal student loans if you teach full-time for five complete and consecutive academic years in a low-income school or educational service agency. Specific requirements exist for the type of school and the definition of “low-income.”

- Income-Driven Repayment (IDR) Plans and Forgiveness: IDR plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), base your monthly payment on your income and family size. After a certain number of years (typically 20-25), any remaining balance may be forgiven. The amount forgiven may be considered taxable income.

Applying for Income-Driven Repayment Plans

The application process for income-driven repayment plans involves submitting your income and family size information to your loan servicer. This information is used to calculate your monthly payment. The process is generally straightforward but requires accurate and up-to-date information.

- Gather necessary documentation: This typically includes tax returns and proof of income.

- Contact your loan servicer: Your loan servicer will provide the application forms and instructions.

- Complete and submit the application: Ensure all information is accurate and complete.

- Monitor your account: After submitting the application, regularly check your account to ensure the changes have been made correctly.

Websites and Resources for Student Loan Assistance

Numerous websites and resources provide valuable information and support for students seeking help with their student loans. These resources offer tools, calculators, and guidance to help borrowers manage their debt effectively.

- Federal Student Aid (FSA): studentaid.gov

- National Foundation for Credit Counseling (NFCC): nfcc.org

- Consumer Financial Protection Bureau (CFPB): consumerfinance.gov

Last Point

Successfully managing your student loans account requires proactive planning, informed decision-making, and a commitment to long-term financial well-being. By understanding the various loan types, repayment options, and potential challenges, you can create a personalized strategy that aligns with your financial goals. Remember to leverage available resources, stay organized, and prioritize consistent communication with your loan servicer. Taking control of your student loan debt is a significant step towards achieving financial independence and security.

Q&A

What happens if I miss a student loan payment?

Missing a payment can lead to late fees, negatively impact your credit score, and potentially result in your loan going into default. Contact your loan servicer immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payment. However, it’s crucial to compare offers from different lenders and consider the terms carefully, as refinancing may extend your repayment period.

How do I consolidate my student loans?

Loan consolidation combines multiple student loans into a single loan with a new interest rate and repayment plan. This can simplify repayment, but it may not always lower your overall interest cost. Explore options through the federal government or private lenders.

What is loan forgiveness?

Loan forgiveness programs, often targeted towards specific professions or based on income, can eliminate a portion or all of your student loan debt. Eligibility requirements vary significantly; research programs to determine your suitability.