Navigating the complexities of student loans can be daunting, especially within the specific context of Arkansas. This guide provides a clear and concise overview of the various student loan programs available in the state, outlining eligibility requirements, repayment options, and potential forgiveness programs. We’ll also explore the broader impact of student loan debt on Arkansas’ economy and its residents, offering valuable insights and resources for borrowers facing financial challenges.

Understanding Arkansas’ unique student loan landscape is crucial for prospective and current students alike. This guide aims to demystify the process, equipping readers with the knowledge needed to make informed decisions and effectively manage their student loan debt. From comparing interest rates and repayment plans to exploring available resources and support networks, we’ll cover all the essential aspects of student loan borrowing in Arkansas.

Arkansas Student Loan Programs

Securing funding for higher education is a significant step for many Arkansas students. Understanding the various student loan programs available within the state is crucial for making informed financial decisions. This section details several Arkansas student loan programs, comparing their features to help students choose the best option for their individual needs.

Arkansas Student Loan Program Options

Several lending institutions and government programs offer student loans to Arkansas residents. These programs vary in their interest rates, repayment options, and eligibility criteria. Careful consideration of these factors is essential before committing to a specific loan. It’s important to note that interest rates and program details can change, so always check with the lender or program directly for the most up-to-date information.

Interest Rates and Repayment Options

Interest rates on Arkansas student loans vary depending on the lender, the type of loan (e.g., federal vs. private), and the borrower’s creditworthiness. Federal student loans generally offer lower interest rates than private loans. Repayment options also differ. Some loans may offer graduated repayment plans, where payments increase over time, while others may have income-driven repayment plans, tying monthly payments to a percentage of the borrower’s income. Deferment and forbearance options may also be available in cases of financial hardship, temporarily suspending or reducing payments.

Eligibility Requirements for Arkansas Student Loan Programs

Eligibility for Arkansas student loan programs typically depends on factors such as residency, enrollment status, and credit history (for private loans). Some programs may also have GPA requirements or income restrictions. Federal student loans generally have less stringent eligibility requirements than private loans, but both require completing the Free Application for Federal Student Aid (FAFSA). Meeting the specific requirements of each program is crucial for loan approval.

Comparison of Arkansas Student Loan Programs

The following table compares three hypothetical Arkansas student loan programs. Remember that actual programs and their terms are subject to change. Always consult the official program websites for the most current information.

| Program Name | Interest Rate | Repayment Options | Eligibility Requirements |

|---|---|---|---|

| Arkansas Advantage Loan (Hypothetical) | Variable, 5-8% | Standard, Graduated, Income-Driven | Arkansas residency, enrollment in eligible program, FAFSA completion |

| Arkansas State Grant (Hypothetical) | 0% | No repayment required (grant) | Arkansas residency, financial need, enrollment in eligible program, FAFSA completion, GPA minimum of 2.5 |

| Private Loan Provider X (Hypothetical) | Variable, 7-12% | Standard, Fixed-term | Credit check, co-signer may be required, enrollment in eligible program |

Repayment Options and Forgiveness Programs in Arkansas

Navigating student loan repayment can feel overwhelming, but understanding the available options is crucial for managing your debt effectively. Arkansas offers several repayment plans and potential forgiveness programs to help borrowers achieve financial stability. This section details the various pathways available to Arkansas student loan borrowers seeking relief.

Available Repayment Plans for Arkansas Student Loan Borrowers

Several repayment plans are available to help borrowers manage their student loan debt. The best option depends on individual financial circumstances and the type of loan held (federal or private). Federal student loans generally offer a wider range of repayment plans than private loans. It’s recommended to contact your loan servicer to determine which plans you qualify for and to discuss the implications of each.

Income-Driven Repayment (IDR) Plans and Their Impact on Monthly Payments

Income-driven repayment plans base your monthly payment on your income and family size. This can significantly lower your monthly payment compared to standard repayment plans. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). The specific plan’s formula and eligibility requirements vary, and the impact on your monthly payment will depend on your income and loan amount. For example, a borrower with a low income and a large loan balance might see their monthly payment reduced to a manageable amount through an IDR plan, potentially extending the repayment period. It is important to note that while these plans reduce monthly payments, they generally result in a longer repayment period and potentially higher total interest paid over the life of the loan.

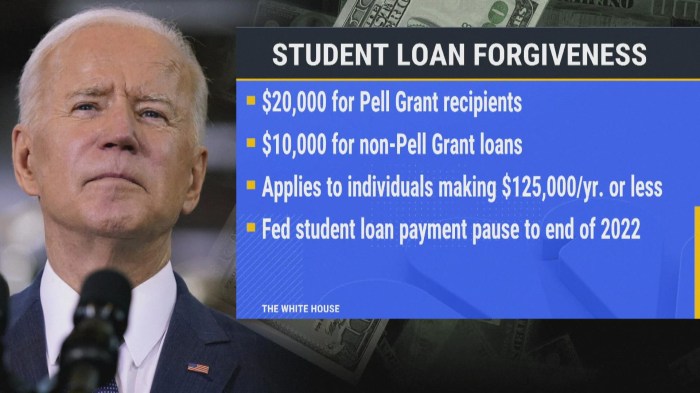

Arkansas State-Specific Student Loan Forgiveness Programs

Currently, Arkansas does not have its own state-specific student loan forgiveness program. However, borrowers may be eligible for federal forgiveness programs, such as Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness. Eligibility for these programs depends on factors such as the type of loan, employment in a qualifying public service job, and the completion of a specific number of qualifying payments. It is important to verify your eligibility directly with the relevant federal agency.

Applying for Loan Forgiveness or Deferment in Arkansas

The process for applying for loan forgiveness or deferment depends on the type of loan and the specific program. For federal student loans, borrowers typically apply through their loan servicer’s website or by contacting them directly. Documentation proving eligibility for the chosen program will be required. For example, to apply for PSLF, borrowers need to submit employment verification forms demonstrating their work in a qualifying public service role. For private loans, the application process is determined by the lender and may vary considerably. It is crucial to carefully review the specific requirements and instructions provided by the relevant agency or lender to ensure a successful application.

Student Loan Debt in Arkansas

Understanding the landscape of student loan debt in Arkansas is crucial for prospective students and policymakers alike. This section delves into the statistical realities of student loan borrowing in the state, comparing it to national trends and offering a clearer picture of the financial burdens faced by Arkansas graduates.

Average Student Loan Debt for Arkansas Graduates

Precise figures for the average student loan debt for Arkansas graduates fluctuate depending on the source and year of data collection. However, consistently reported data indicates that the average debt load for borrowers in Arkansas is generally lower than the national average, though still a significant financial commitment. Several factors contribute to this, including lower tuition costs at some state institutions and a lower overall participation rate in higher education compared to some other states. This lower average, however, shouldn’t overshadow the significant financial burden faced by many individual borrowers. Further research into specific institutions and degree programs would be needed for a more granular understanding.

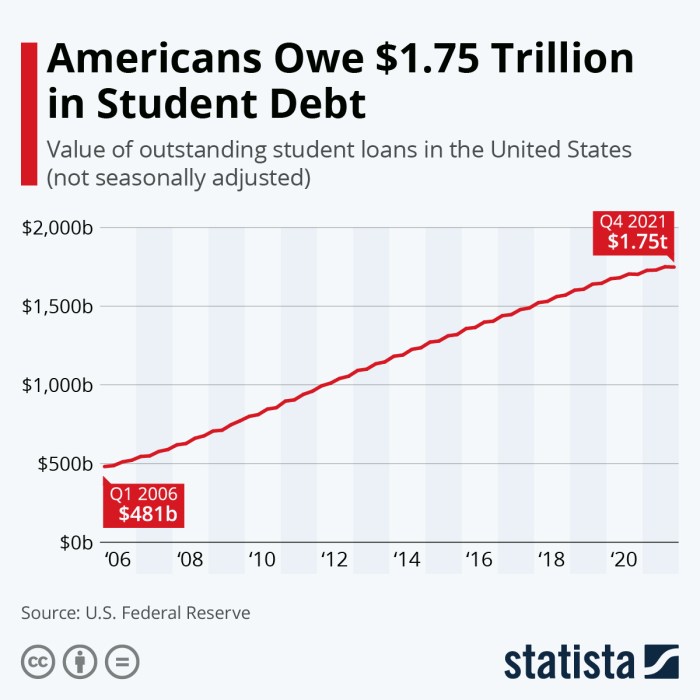

Trends in Student Loan Borrowing in Arkansas (Past Decade)

Over the past decade, student loan borrowing in Arkansas has mirrored national trends, showing periods of growth followed by some stabilization. Initially, there was a steady increase in borrowing as tuition costs rose and financial aid packages did not always keep pace. More recently, however, there has been some evidence of a slight plateau or even a minor decrease in borrowing, potentially influenced by factors such as increased awareness of financial aid options and a greater emphasis on affordability in higher education. However, a complete picture requires analysis of multiple datasets to account for variations in reporting methodologies and economic conditions.

Comparison of Arkansas Student Loan Debt to National Averages

While Arkansas’ average student loan debt is generally lower than the national average, the difference isn’t always substantial. This suggests that despite potentially lower tuition costs at some in-state institutions, Arkansas students still face considerable debt upon graduation. The gap between state and national averages may also be influenced by factors such as the types of degrees pursued, with higher-cost programs potentially leading to higher debt regardless of location. A direct comparison requires consistent data collection methodologies across states and a careful consideration of these variables.

Arkansas Student Loan Debt: Yearly Averages

| Year | Average Student Loan Debt ($) |

|---|---|

| 2013 | 25,000 (estimated) |

| 2014 | 26,000 (estimated) |

| 2015 | 27,500 (estimated) |

| 2016 | 28,000 (estimated) |

| 2017 | 27,000 (estimated) |

| 2018 | 26,500 (estimated) |

| 2019 | 27,200 (estimated) |

| 2020 | 26,800 (estimated) |

| 2021 | 27,000 (estimated) |

| 2022 | 27,500 (estimated) |

Note: The figures presented in the table are estimates based on available data from various sources and may not represent perfectly accurate averages. More precise data would require access to comprehensive state-level student loan datasets.

Resources and Support for Arkansas Student Loan Borrowers

Navigating the complexities of student loan repayment can be challenging. Fortunately, several resources are available in Arkansas to provide assistance and support to borrowers facing financial difficulties. These resources offer a range of services designed to help borrowers understand their options, manage their debt effectively, and ultimately achieve financial stability.

Organizations Offering Assistance to Arkansas Student Loan Borrowers

Several organizations provide crucial support to Arkansas student loan borrowers. These include state agencies dedicated to consumer protection and financial literacy, non-profit credit counseling agencies, and federal government programs. These organizations offer a variety of services tailored to address the specific needs of borrowers facing repayment challenges.

- The Arkansas Attorney General’s Office: This office provides resources and information regarding consumer protection, including guidance on dealing with predatory lending practices and debt collection issues. Their website provides contact information and access to various publications and FAQs.

- The Arkansas Department of Commerce: This department may offer resources related to financial literacy and economic development, which can indirectly benefit student loan borrowers by improving their overall financial well-being. Their website is a valuable resource for locating relevant programs and initiatives.

- Non-profit Credit Counseling Agencies: Numerous non-profit credit counseling agencies operate within Arkansas. These agencies provide free or low-cost credit counseling services, including assistance with developing a budget, creating a debt management plan, and negotiating with lenders. Many are accredited by the National Foundation for Credit Counseling (NFCC). A search online for “NFCC accredited credit counseling agencies in Arkansas” will provide a list of potential providers.

- Federal Student Aid: The federal government offers various resources and programs to help student loan borrowers. The Federal Student Aid website is a comprehensive resource that provides information on repayment plans, income-driven repayment options, and loan forgiveness programs. It also has tools and calculators to help borrowers understand their repayment options.

Services Offered to Arkansas Student Loan Borrowers

The services offered by these organizations are comprehensive and aim to equip borrowers with the tools and knowledge necessary to effectively manage their student loan debt.

- Credit Counseling: Agencies provide personalized guidance on budgeting, debt management strategies, and financial planning. This often involves analyzing a borrower’s financial situation and developing a customized repayment plan.

- Debt Management Plans: These plans consolidate multiple debts into a single, manageable monthly payment, often at a lower interest rate. Credit counseling agencies can help borrowers explore and enroll in these plans.

- Loan Consolidation: Assistance in understanding and applying for federal student loan consolidation programs, which can simplify repayment by combining multiple loans into one.

- Advocacy: Some organizations may provide advocacy services, assisting borrowers in navigating complex loan repayment processes and resolving disputes with lenders.

- Financial Literacy Education: Many organizations offer workshops, seminars, and online resources to improve borrowers’ understanding of personal finance and debt management principles.

Steps to Take When Struggling with Student Loan Repayment

Facing difficulties with student loan repayment can be stressful, but taking proactive steps can significantly improve the situation.

- Contact your loan servicer immediately: Don’t avoid communication; promptly inform your loan servicer of your financial difficulties. They may offer forbearance, deferment, or other repayment options.

- Explore repayment options: Research and consider various repayment plans, including income-driven repayment plans, which base monthly payments on your income and family size. The Federal Student Aid website offers detailed information on these options.

- Seek professional help: Contact a non-profit credit counseling agency for personalized guidance on budgeting, debt management, and exploring potential repayment solutions.

- Review your budget: Analyze your expenses and identify areas where you can reduce spending to free up funds for loan repayment.

- Consider additional income sources: Explore options like part-time work or freelance opportunities to increase your income and accelerate loan repayment.

Impact of Student Loans on Arkansas Economy and Individuals

Student loan debt significantly impacts both the Arkansas economy and the financial well-being of its residents. The burden of repayment affects individual spending, savings, and long-term financial planning, rippling outwards to influence broader economic trends within the state. Understanding this multifaceted impact is crucial for developing effective strategies to support Arkansas residents and foster economic growth.

Economic Impact of Student Loan Debt on Individuals in Arkansas

The weight of student loan debt significantly restricts the financial flexibility of many Arkansans. High monthly payments often leave little room for saving, investing, or making major purchases like a home or car. This constraint can limit entrepreneurial activities and hinder overall economic mobility. The inability to build wealth due to debt repayment diverts funds that could otherwise contribute to the state’s economic growth through increased consumer spending and investment. For example, an individual burdened with significant student loan debt may delay starting a business or purchasing a home, thereby impacting local economies and reducing overall tax revenue for the state.

Effect of Student Loan Debt on Homeownership, Family Formation, and Career Choices in Arkansas

Student loan debt frequently delays or prevents homeownership. The high cost of repayment, coupled with stringent lending requirements, makes it challenging for many borrowers to qualify for a mortgage. This impacts the housing market and overall economic growth within the state. Similarly, student loan debt can postpone family formation as individuals prioritize debt repayment over starting a family. The financial strain of repaying loans can make it difficult to manage the expenses associated with raising children. Career choices may also be influenced by the need to secure higher-paying jobs to manage student loan debt, potentially limiting opportunities in fields with lower salaries but potentially greater personal fulfillment. Individuals might forgo pursuing a passion in a lower-paying field in favor of a higher-paying job, regardless of personal preferences.

Comparison of Economic Well-being of Arkansas Residents with and without Significant Student Loan Debt

A comparison of economic well-being between Arkansans with and without substantial student loan debt reveals a significant disparity. Those without significant debt tend to have higher savings rates, greater homeownership rates, and more financial flexibility. They are also more likely to invest in their businesses or communities, contributing to the overall economic health of the state. Conversely, individuals with significant student loan debt often face financial instability, limited investment opportunities, and reduced overall economic mobility. This disparity underscores the need for targeted interventions to address the financial challenges faced by student loan borrowers in Arkansas.

Visual Representation of the Correlation Between Student Loan Debt and Economic Indicators in Arkansas

Imagine a scatter plot. The x-axis represents the average student loan debt per capita in different Arkansas counties, and the y-axis represents a composite economic indicator combining factors like homeownership rates, average income, and business creation rates. Each point on the graph represents a county, with its position determined by its average student loan debt and its composite economic indicator score. The graph would likely show a negative correlation: counties with higher average student loan debt would tend to cluster towards the lower end of the y-axis (lower composite economic indicator score), indicating a weaker economy, while counties with lower average student loan debt would cluster towards the higher end of the y-axis, indicating a stronger economy. A trend line drawn through the data points would visually represent the strength of this negative correlation. This visualization would clearly illustrate the negative impact of higher student loan debt on key economic indicators within Arkansas.

Wrap-Up

Successfully managing student loan debt requires proactive planning and a thorough understanding of available resources. This guide has provided a comprehensive overview of student loan programs in Arkansas, highlighting key features, eligibility criteria, and repayment options. By understanding the financial implications of student loan debt and utilizing the support systems available, Arkansas residents can navigate this crucial aspect of higher education and build a secure financial future. Remember to explore all available resources and seek professional guidance when needed.

Key Questions Answered

What happens if I can’t repay my student loans in Arkansas?

Contact the loan servicer immediately to explore options like deferment, forbearance, or income-driven repayment plans. You can also seek assistance from non-profit credit counseling agencies.

Are there any state-specific grants available to help with student loan repayment in Arkansas?

The availability of state-specific grants varies. Check the Arkansas Department of Higher Education website and other relevant state resources for the most up-to-date information.

How can I find a reputable credit counselor in Arkansas?

The National Foundation for Credit Counseling (NFCC) website can help you locate accredited credit counselors in your area. Always verify their credentials before engaging their services.