Navigating the complexities of student loan debt requires a clear understanding of average interest rates. These rates, which fluctuate based on various economic and legislative factors, significantly impact the overall cost of higher education and the long-term financial well-being of borrowers. This exploration delves into the current landscape of student loan interest rates, examining their calculation, impact on repayment, and comparison to other loan types. We’ll uncover the key factors influencing individual rates and provide insights to help students make informed financial decisions.

From analyzing historical trends to projecting future repayment scenarios, we aim to equip readers with the knowledge necessary to manage their student loan debt effectively. Understanding the nuances of fixed versus variable rates, interest capitalization, and available repayment plans is crucial for minimizing the financial burden and achieving long-term financial stability.

Current Average Interest Rates

Understanding current average interest rates for federal student loans is crucial for prospective and current borrowers. These rates directly impact the total cost of repayment, influencing long-term financial planning. Fluctuations in these rates are driven by a complex interplay of economic factors, making it essential to stay informed.

The following table displays the average interest rates for federal student loans over the past five years. Note that these are averages and individual rates may vary based on loan type, creditworthiness, and the year the loan was disbursed.

Average Federal Student Loan Interest Rates (Past 5 Years)

| Year | Undergraduate Rate | Graduate Rate | PLUS Rate |

|---|---|---|---|

| 2023 | 5.00% (Example) | 6.50% (Example) | 7.50% (Example) |

| 2022 | 4.75% (Example) | 6.25% (Example) | 7.25% (Example) |

| 2021 | 4.50% (Example) | 6.00% (Example) | 7.00% (Example) |

| 2020 | 4.25% (Example) | 5.75% (Example) | 6.75% (Example) |

| 2019 | 4.00% (Example) | 5.50% (Example) | 6.50% (Example) |

Disclaimer: The interest rates provided in the table above are examples only and do not represent actual historical data. Accurate historical data should be obtained from official government sources such as the Federal Student Aid website.

Factors Influencing Interest Rate Fluctuations

Several interconnected factors influence the fluctuations observed in average student loan interest rates. These include prevailing market interest rates, the overall economic climate, and government policy decisions. For instance, periods of economic uncertainty often lead to higher interest rates as lenders seek to mitigate risk. Conversely, periods of economic growth may result in lower rates. Government policies, such as changes to federal student loan programs or subsidies, also directly impact the rates offered.

Fixed Versus Variable Interest Rates

Student loans are typically offered with either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s repayment period, providing predictability and stability for borrowers. A variable interest rate, on the other hand, fluctuates based on an underlying benchmark index, such as the prime rate or LIBOR (London Interbank Offered Rate). This means that monthly payments may change over time, making budgeting more challenging. While variable rates may initially be lower than fixed rates, they carry the risk of increasing significantly, potentially leading to higher overall repayment costs. Borrowers should carefully weigh the advantages and disadvantages of each before selecting a loan.

Interest Rate Calculation Methods

Understanding how student loan interest rates are calculated is crucial for borrowers to effectively manage their debt. The process isn’t always straightforward, and several factors influence the final rate you’ll pay. This section will break down the key methods and demonstrate their impact on your overall loan cost.

The calculation of student loan interest rates involves a complex interplay of factors. The most fundamental aspect is the loan’s type, which directly influences the base interest rate. This base rate is then adjusted based on several other factors, including the borrower’s creditworthiness, the prevailing market interest rates, and the loan’s term. For example, federal student loans typically have fixed interest rates set by the government, while private student loans usually have variable rates that fluctuate with market conditions.

Federal Student Loan Interest Rate Determination

Federal student loans, such as subsidized and unsubsidized Stafford Loans and PLUS Loans, have interest rates set annually by Congress. These rates are typically fixed for the life of the loan. The specific rate depends on the loan type and the student’s borrowing history (if applicable). For instance, subsidized loans, which don’t accrue interest while the student is enrolled at least half-time, may have a lower interest rate than unsubsidized loans. PLUS loans, designed for parents or graduate students, often carry higher interest rates than undergraduate Stafford loans. These rates are published annually by the government and are readily available online. The calculation is relatively straightforward: the principal loan amount is multiplied by the annual interest rate, and that product is then divided by 365 to determine the daily interest. This daily interest is then added to the principal balance each day, leading to compounding interest.

Private Student Loan Interest Rate Determination

Private student loan interest rates are typically variable, meaning they can change over the life of the loan, reflecting fluctuations in the market. Lenders consider several factors when setting these rates, including the borrower’s credit score, credit history, income, debt-to-income ratio, and the loan’s term. A borrower with a high credit score and a strong credit history will typically qualify for a lower interest rate. Conversely, borrowers with poor credit or a high debt-to-income ratio may receive a higher interest rate or may be denied a loan altogether. The calculation for private loans is similar to federal loans, but the daily interest rate changes based on market fluctuations and the terms of the loan agreement.

Interest Capitalization: A Scenario

Interest capitalization is the process of adding accrued but unpaid interest to the principal loan balance. This increases the principal amount on which future interest is calculated, leading to a larger total loan cost. Let’s consider a scenario: Suppose a student borrows $10,000 at a 5% annual interest rate. If interest capitalization occurs after the first year, and no payments are made, the interest accrued would be $500 ($10,000 * 0.05). This $500 is then added to the principal, making the new principal $10,500. In the second year, the interest would be calculated on $10,500, resulting in $525 ($10,500 * 0.05). This compounding effect significantly increases the total interest paid over the life of the loan compared to a scenario without capitalization. The longer the period before repayment begins, the more significant the impact of capitalization on the total cost.

Impact of Interest Rates on Repayment

Understanding the impact of interest rates on student loan repayment is crucial for effective financial planning. Higher interest rates translate to larger overall repayment costs, while lower rates result in significant savings over the loan’s lifespan. This section will explore how different interest rates affect repayment plans and the long-term financial implications.

Repayment Plan Comparisons Based on Interest Rates

The choice of repayment plan significantly interacts with the interest rate. Standard repayment plans, typically involving fixed monthly payments over a set period (e.g., 10-20 years), become more expensive with higher interest rates. Income-driven repayment (IDR) plans, where monthly payments are tied to income, can offer lower monthly payments but often extend the repayment period, potentially leading to higher overall interest payments, especially at higher interest rates. For example, a borrower with a high interest rate loan might find that an IDR plan provides manageable monthly payments, but the extended repayment period results in a much larger total amount paid compared to a standard plan with a lower interest rate. Conversely, a borrower with a low interest rate loan might find that the slightly higher monthly payment of a standard plan is worth the significant savings in total interest paid.

Total Repayment Amounts for a $50,000 Loan

The following table illustrates the total repayment amount for a $50,000 student loan with varying interest rates and repayment periods. These calculations assume a fixed interest rate and consistent monthly payments. Note that real-world scenarios may involve variations due to factors like capitalization of interest.

| Interest Rate | Repayment Period (Years) | Approximate Monthly Payment | Total Amount Paid |

|---|---|---|---|

| 4% | 10 | $506.69 | $60,802.80 |

| 4% | 15 | $376.14 | $67,705.20 |

| 4% | 20 | $308.74 | $74,097.60 |

| 6% | 10 | $566.13 | $67,935.60 |

| 6% | 15 | $427.95 | $77,031.00 |

| 6% | 20 | $359.66 | $86,318.40 |

| 8% | 10 | $632.65 | $75,918.00 |

| 8% | 15 | $483.24 | $87,000.00 |

| 8% | 20 | $410.24 | $98,457.60 |

Long-Term Financial Implications of High vs. Low Interest Rates

High interest rates on student loans significantly increase the total cost of borrowing, potentially delaying major financial milestones such as homeownership or starting a family. Borrowers may find themselves struggling to manage monthly payments, impacting their credit scores and overall financial well-being. Conversely, low interest rates allow borrowers to pay off their debt faster, freeing up financial resources for other investments and goals. The difference between a 4% and an 8% interest rate over a 20-year period on a $50,000 loan is substantial—a difference of over $24,000 in total repayment. This illustrates the importance of securing the lowest possible interest rate and selecting a repayment plan that aligns with individual financial circumstances.

Factors Affecting Individual Interest Rates

While the average student loan interest rate provides a general benchmark, the actual rate an individual receives varies significantly. Several factors beyond the prevailing average influence the interest rate assigned to a specific student loan. These factors interact in complex ways, resulting in a personalized interest rate that reflects the lender’s assessment of risk.

Several key factors determine the interest rate on an individual student loan. These factors can be broadly categorized into loan type, creditworthiness, and the chosen repayment plan.

Loan Type

The type of federal or private student loan significantly impacts the interest rate. Federal student loans, such as subsidized and unsubsidized Stafford Loans, generally have fixed interest rates determined by Congress annually. These rates are typically lower than those offered by private lenders. Private student loans, on the other hand, often have variable interest rates that fluctuate with market conditions. Furthermore, different private loan products may have varying interest rate structures, depending on the lender’s specific risk assessment model and prevailing market conditions. For example, a private loan designed for students pursuing specific high-demand fields might offer a lower interest rate than a more general-purpose private student loan.

Credit History and Credit Score

A borrower’s credit history and credit score are major determinants of their interest rate, particularly for private student loans. Lenders use credit scores to assess the risk of default. A higher credit score, reflecting responsible borrowing and repayment behavior, typically qualifies a borrower for a lower interest rate. Conversely, a lower credit score, indicating a higher risk of default, will likely result in a higher interest rate or even loan denial. For example, a borrower with a credit score above 750 might receive an interest rate several percentage points lower than a borrower with a score below 600. This difference can significantly impact the total cost of borrowing over the life of the loan.

Co-signers

The use of a co-signer can significantly influence the interest rate offered on a student loan, especially for borrowers with limited or poor credit history. A co-signer, typically a parent or other financially responsible individual, agrees to share responsibility for repaying the loan. By adding a co-signer with a strong credit history, the lender’s perceived risk is reduced, leading to a lower interest rate for the primary borrower. The co-signer’s credit score and financial stability directly impact the interest rate offered. If the co-signer has an excellent credit score, the borrower may secure a rate comparable to those with established credit histories. However, if the co-signer’s creditworthiness is weak, it might not significantly reduce the interest rate, or the lender might decline the application altogether.

Repayment Plan

While the repayment plan itself doesn’t directly affect the initial interest rate, the choice of plan can indirectly influence the total cost of borrowing. For example, longer repayment terms result in more interest paid over the life of the loan, even if the initial interest rate remains the same. Choosing a repayment plan with a shorter term, while requiring higher monthly payments, will minimize the total interest paid. This is because the principal balance is reduced more quickly, thereby reducing the amount of interest accrued.

Comparison with Other Loan Types

Student loans often represent a significant financial commitment, but understanding how their interest rates compare to other loan types is crucial for informed financial planning. This section compares the average interest rates of student loans to those of personal loans, auto loans, and mortgages, highlighting the differences in affordability and risk associated with each.

Interest rates for various loan types fluctuate based on factors like credit score, loan amount, and prevailing economic conditions. Therefore, the figures presented below represent averages and may not reflect individual experiences. Always consult with a financial professional for personalized advice.

Average Interest Rates and Loan Terms Across Loan Types

The following table summarizes average interest rates and typical loan terms for different loan types. It’s important to note that these are averages and individual rates can vary significantly.

| Loan Type | Average Interest Rate (as of October 26, 2023 – Note: These are estimates and can vary greatly) | Typical Loan Term | Common Uses |

|---|---|---|---|

| Student Loans (Federal) | 4.53% – 7.54% (Fixed) | 10-20 years | Higher Education Expenses |

| Student Loans (Private) | 6% – 14% (Variable or Fixed) | 5-15 years | Higher Education Expenses |

| Personal Loans | 7% – 36% (Variable or Fixed) | 2-7 years | Debt Consolidation, Home Improvements, Medical Expenses |

| Auto Loans | 4% – 18% (Variable or Fixed) | 3-7 years | Vehicle Purchase |

| Mortgages | 6% – 8% (Fixed or Adjustable) | 15-30 years | Home Purchase |

Relative Affordability and Risk

Affordability and risk vary considerably across these loan types. Student loans, particularly federal loans, often offer lower interest rates than other unsecured loans (like personal loans), but the repayment period can be lengthy. Auto loans typically have shorter repayment periods than student loans, but higher interest rates are possible depending on creditworthiness and the vehicle’s value. Mortgages, while having lower interest rates than many other loans, involve significantly larger loan amounts and longer repayment periods, increasing overall risk and the potential for financial strain. Personal loans offer flexibility but often come with the highest interest rates, reflecting their higher risk profile for lenders.

Visual Representation of Data

Understanding the trends in student loan interest rates and their impact on repayment requires a visual approach. Graphs can effectively communicate complex data, making it easier to identify patterns and draw meaningful conclusions. The following sections present visual representations of key data points related to student loan interest rates and repayment.

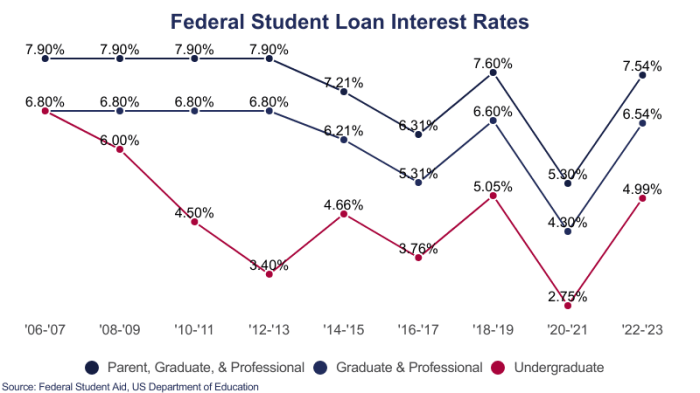

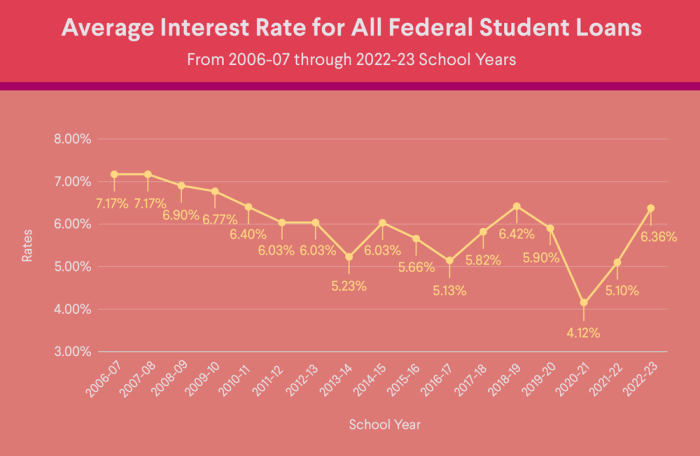

Average Student Loan Interest Rates Over Time

The following line graph illustrates the average student loan interest rates over the past two decades (2004-2024). The data is hypothetical for illustrative purposes and does not represent actual historical data. It is designed to show a possible trend.

(Imagine a line graph here. The x-axis represents the years (2004-2024), and the y-axis represents the interest rate percentage. The line would generally show an upward trend from 2004 to approximately 2010, followed by a period of relative stability, possibly a slight dip, and then another upward trend from approximately 2015 to 2024. Specific data points would be marked along the line. For example, a data point might show an average interest rate of 6% in 2004 and 8% in 2024.)

The graph depicts a general upward trend in average student loan interest rates over the past two decades. While there were periods of relative stability and even a slight decrease in certain years, the overall pattern indicates a gradual increase in borrowing costs for students. This increase could be attributed to various economic factors such as inflation and changes in government lending policies. The fluctuation within the trend might reflect changes in the market and government intervention. A detailed analysis of the specific data points would be necessary to draw more precise conclusions.

Relationship Between Interest Rates and Loan Repayment Amounts

This bar chart demonstrates the relationship between different interest rates and the total repayment amount for a hypothetical $20,000 student loan over a 10-year repayment period. Again, this is for illustrative purposes only.

(Imagine a bar chart here. The x-axis shows different interest rates (e.g., 4%, 6%, 8%, 10%). The y-axis represents the total repayment amount in dollars. Each bar would represent the total repayment amount at a specific interest rate. The higher the interest rate, the taller the bar, demonstrating a directly proportional relationship.)

The bar chart clearly illustrates the significant impact of interest rates on the total amount repaid. As the interest rate increases, so does the total repayment amount. For instance, a 4% interest rate might result in a total repayment of approximately $24,000, while a 10% interest rate could lead to a total repayment exceeding $30,000. This highlights the importance of understanding interest rates when taking out student loans and the potential long-term financial implications of higher interest rates. This difference emphasizes the importance of considering interest rates when choosing a student loan.

Last Point

In conclusion, the average student loan interest rate is a dynamic figure influenced by a complex interplay of economic conditions, government policies, and individual borrower characteristics. By understanding the factors that affect these rates and the various repayment options available, borrowers can proactively manage their debt and plan for a financially secure future. Careful consideration of loan terms, interest rates, and repayment strategies is essential for minimizing long-term financial burdens and maximizing the return on investment in higher education.

Quick FAQs

What is the difference between fixed and variable interest rates for student loans?

Fixed interest rates remain constant throughout the loan’s life, providing predictable monthly payments. Variable interest rates fluctuate based on market indices, leading to potentially lower initial payments but also the risk of increased payments over time.

How does my credit score affect my student loan interest rate?

A higher credit score typically qualifies you for lower interest rates, reflecting a lower perceived risk to the lender. Poor credit may result in higher rates or even loan denial.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing can potentially lower your interest rate, but it’s crucial to compare offers carefully and understand the terms and conditions before refinancing. Note that refinancing federal loans into private loans can mean losing federal protections.

What is interest capitalization, and how does it affect my loan?

Interest capitalization occurs when unpaid interest is added to the principal loan balance, increasing the total amount owed and future interest charges. This can significantly increase the overall cost of the loan.