Navigating the complexities of student loan debt can feel overwhelming, but understanding student loan consolidation rates is a crucial step towards financial freedom. Consolidation offers the potential to simplify repayment by combining multiple loans into a single, manageable payment. However, the process involves careful consideration of interest rates, repayment terms, and the long-term financial implications. This guide will equip you with the knowledge to make informed decisions about consolidating your student loans and achieving a more sustainable repayment plan.

We’ll explore the various factors that influence consolidation rates, including your credit score, the types of loans you’re consolidating, and the lender you choose. We’ll also delve into the differences between government and private consolidation programs, helping you weigh the advantages and disadvantages of each. Finally, we’ll address potential hidden fees and provide a checklist to ensure you understand all the costs involved before committing to a consolidation plan.

Understanding Student Loan Consolidation

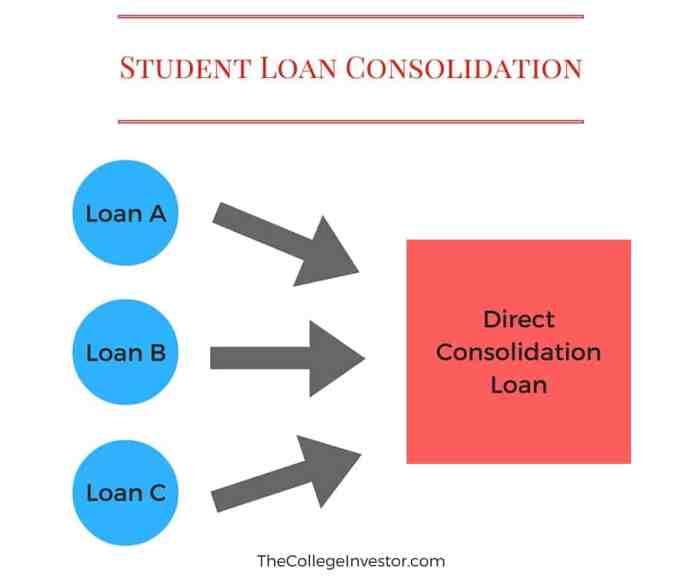

Student loan consolidation is a process that combines multiple federal student loans into a single, new loan. This simplifies repayment by reducing the number of monthly payments and potentially lowering your monthly payment amount. However, it’s crucial to understand the implications before making a decision.

The Process of Student Loan Consolidation

The consolidation process typically involves applying through a government program, such as the Direct Consolidation Loan program. You’ll need to gather information about your existing loans, including loan numbers and lenders. Once you apply, the government will assess your eligibility and, if approved, issue a new loan that pays off your existing loans. Your new loan will have a single monthly payment, interest rate, and repayment schedule. The entire process can take several weeks or even months.

Benefits of Consolidating Student Loans

Consolidating student loans offers several potential advantages. A primary benefit is simplification; managing one loan is significantly easier than juggling multiple loans with varying interest rates and due dates. Consolidation can also result in a lower monthly payment, making repayment more manageable. Furthermore, it can simplify the repayment process by providing a single point of contact for all your student loan payments. Finally, for eligible borrowers, consolidation can switch you to an income-driven repayment plan, which can significantly reduce monthly payments based on your income and family size.

Drawbacks of Consolidating Student Loans

While consolidation offers benefits, it’s essential to consider the potential drawbacks. A major concern is the potential for a longer repayment period. While your monthly payments might be lower, you could end up paying more interest over the life of the loan due to the extended repayment term. Consolidation can also affect your eligibility for certain loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), which requires specific loan types and repayment plans. Finally, consolidating private student loans may not always result in significant savings, and may even lead to a higher overall interest paid compared to managing those loans individually.

Examples of Consolidation Programs

The primary federal student loan consolidation program is the Direct Consolidation Loan program. This program allows borrowers to combine multiple federal student loans into a single Direct Consolidation Loan. This loan is serviced by the Department of Education and offers various repayment options. Private lenders also offer consolidation options, but these often come with higher interest rates and less favorable terms compared to federal programs. It’s generally recommended to explore federal options first before considering private consolidation.

Comparison of Consolidation Options

| Feature | Federal Direct Consolidation Loan | Private Loan Consolidation | No Consolidation |

|---|---|---|---|

| Interest Rate | Weighted average of existing loans | Variable or fixed, typically higher than federal rates | Varies across existing loans |

| Repayment Terms | Up to 30 years (depending on loan type and repayment plan) | Varies by lender | Varies across existing loans |

| Fees | Typically none | May include origination fees | None |

| Loan Forgiveness Programs | Eligibility may be impacted | Generally not eligible for federal loan forgiveness programs | Eligibility depends on existing loan types and repayment plans |

Factors Affecting Consolidation Rates

Student loan consolidation can offer a simplified repayment plan, but the interest rate you ultimately receive is crucial. Several factors interact to determine your final consolidated loan rate, significantly impacting your overall repayment costs. Understanding these factors is essential for making informed decisions.

Several key factors influence the interest rate on your consolidated student loan. These factors are often intertwined, making it challenging to isolate the effect of any single element. However, understanding their individual contributions helps borrowers anticipate their potential rate.

Credit Score Impact on Consolidation Rates

Your credit score plays a significant role in determining the interest rate you’ll receive on a consolidated loan. Lenders use your credit history to assess your risk as a borrower. A higher credit score, reflecting responsible financial behavior, typically results in a lower interest rate, as lenders perceive you as a lower-risk borrower. Conversely, a lower credit score may lead to a higher interest rate, reflecting a greater perceived risk of default. For example, a borrower with a credit score above 750 might qualify for a significantly lower interest rate compared to a borrower with a score below 600. The difference can amount to several percentage points over the life of the loan, leading to substantial savings or added costs.

Loan Type’s Influence on Interest Rates

The types of federal student loans being consolidated directly impact the resulting interest rate. Consolidation typically uses a weighted average of the interest rates of the individual loans. This means that the proportion of each loan type within the total loan amount affects the final rate. For instance, a borrower with a larger proportion of higher-interest graduate PLUS loans will generally have a higher consolidated interest rate than a borrower with predominantly lower-interest subsidized loans. Understanding the interest rates of your individual loans before consolidation is crucial for predicting the outcome.

Interest Rate Comparison Across Lenders

Different lenders offer varying interest rates for student loan consolidation. These variations arise from several factors, including the lender’s risk assessment practices, prevailing market conditions, and the lender’s specific lending criteria. It’s advisable to compare rates from multiple lenders before choosing a consolidation loan. For instance, a credit union might offer more favorable rates than a large national bank, or a lender specializing in student loan refinancing may have competitive options. Shopping around and comparing offers allows borrowers to secure the most advantageous interest rate possible. Remember that the advertised rate is often only part of the story; carefully review all fees and terms to get a complete picture.

Calculating and Comparing Rates

Consolidating your student loans can simplify your repayment process, but understanding how to calculate and compare rates is crucial to securing the best deal. This section will guide you through the process of determining your monthly payments after consolidation and effectively comparing different loan offers to make an informed decision.

Calculating Monthly Payments After Consolidation

After consolidating your loans, your new monthly payment will depend on several factors: your total loan amount, your new interest rate, and the loan term (length of repayment). A common method for calculating monthly payments is using the following formula:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

* M = Monthly payment

* P = Principal loan amount (total loan balance after consolidation)

* i = Monthly interest rate (annual interest rate divided by 12)

* n = Total number of payments (loan term in years multiplied by 12)

For example, if you consolidate $30,000 in loans at a 6% annual interest rate with a 10-year repayment term, your monthly payment would be approximately $322. This calculation can be easily performed using online loan calculators readily available from various financial institutions or independent websites. Remember that these are estimates, and your actual payment may vary slightly.

Comparing Different Consolidation Loan Offers

When comparing consolidation loan offers, consider the following key aspects: interest rate, fees, repayment terms, and lender reputation. Lower interest rates directly translate to lower monthly payments and less interest paid over the life of the loan. However, be wary of lenders charging high upfront fees or hidden costs, which can offset the benefits of a lower interest rate. A longer repayment term will lower your monthly payment but increase the total interest paid. Finally, choose a reputable lender with a proven track record of customer satisfaction.

A Step-by-Step Guide for Evaluating Consolidation Rate Options

1. Gather your loan information: Compile details of all your existing student loans, including balances, interest rates, and lenders.

2. Check your credit score: Your credit score significantly impacts the interest rate you’ll qualify for. Obtain a free credit report to review your score and identify any areas for improvement.

3. Shop around for lenders: Compare offers from multiple lenders, focusing on interest rates, fees, and repayment terms. Don’t hesitate to use online loan comparison tools.

4. Calculate your monthly payments: Use the formula mentioned above or an online calculator to estimate your monthly payments for each offer.

5. Analyze the total cost: Consider the total interest you’ll pay over the life of the loan, not just the monthly payment.

6. Read the fine print: Carefully review the terms and conditions of each loan offer before making a decision.

7. Choose the best option: Select the loan offer that best suits your financial situation and repayment goals, balancing interest rate, fees, and repayment term.

Comparison Table of Lenders and Their Rates

| Lender | Annual Interest Rate (Example) | Fees (Example) | Repayment Terms (Example) |

|---|---|---|---|

| Lender A | 5.5% | $0 | 5-15 years |

| Lender B | 6.0% | $100 | 10-20 years |

| Lender C | 6.5% | $0 | 5-10 years |

| Lender D | 7.0% | $50 | 10 years fixed |

*Note: The interest rates, fees, and repayment terms provided in the table are examples only and may vary depending on individual circumstances and lender policies. Always check with the lender for the most up-to-date information.*

The Role of Income and Debt

Student loan consolidation can significantly impact your financial future, but your eligibility and the resulting interest rates are heavily influenced by your income and existing debt levels. Understanding this interplay is crucial for making informed decisions about consolidation. Lenders assess your financial profile to determine your risk and ability to repay the consolidated loan.

Income levels directly affect your eligibility for various consolidation programs. Higher incomes generally indicate a greater capacity to repay the loan, making you a less risky borrower. This often translates to more favorable interest rates and potentially more lenient eligibility requirements. Conversely, lower incomes may necessitate a co-signer or result in higher interest rates to offset the increased perceived risk. The specific income thresholds vary depending on the lender and the type of consolidation program.

Income’s Influence on Consolidation Eligibility

Lenders use income verification to assess your ability to manage monthly payments. A consistent, verifiable income stream is essential for approval. Self-employment or inconsistent income sources can make the process more challenging, potentially requiring additional documentation or impacting the interest rate offered. For example, an applicant with a stable, high income from a long-term position at a reputable company will likely qualify for better rates than someone with a fluctuating income from freelance work, even if their total annual income is similar. The stability and verifiability of the income are key factors.

Existing Debt’s Impact on Approval and Interest Rates

Your existing debt burden significantly influences the lender’s assessment of your risk. A high debt-to-income ratio (DTI) – the percentage of your monthly income allocated to debt payments – suggests a higher risk of default. Lenders may be hesitant to approve your consolidation application or offer less favorable interest rates if your DTI is too high. They might require a higher down payment or demand a shorter repayment period to mitigate their risk. For instance, an applicant with several high-interest credit cards and a substantial auto loan in addition to their student loans will likely face higher interest rates on their consolidated loan compared to someone with a clean credit history and minimal existing debt.

Scenarios with Varying Income and Debt Levels

Let’s consider three hypothetical scenarios:

* Scenario 1: High Income, Low Debt: An applicant earning $100,000 annually with minimal existing debt will likely qualify for the best interest rates and terms due to low risk.

* Scenario 2: Moderate Income, Moderate Debt: An applicant earning $60,000 annually with a moderate debt load might qualify, but possibly at a higher interest rate reflecting the increased risk. A co-signer might be required to improve approval chances.

* Scenario 3: Low Income, High Debt: An applicant earning $40,000 annually with significant existing debt might face difficulty in securing approval for consolidation unless they can significantly improve their DTI or secure a co-signer.

Strategies for Improving Consolidation Eligibility

Before applying for student loan consolidation, consider these strategies to improve your eligibility and secure better rates:

Improving your financial standing before applying is crucial. This involves:

- Reducing existing debt: Pay down high-interest credit cards and other loans to lower your DTI.

- Increasing your income: Seek a higher-paying job or explore additional income streams.

- Improving your credit score: Pay bills on time and maintain a good credit history.

- Seeking a co-signer: If you have a low income or high debt, a co-signer with good credit can significantly improve your chances of approval.

- Exploring government programs: Federal consolidation programs may offer more lenient eligibility requirements than private lenders.

Government vs. Private Consolidation

Choosing between government and private student loan consolidation involves careful consideration of several key factors. The right choice depends heavily on your individual financial situation, risk tolerance, and long-term goals. Both options offer the benefit of simplifying repayment, but differ significantly in terms of rates, fees, and eligibility requirements.

Government Student Loan Consolidation Programs

The federal government offers a direct consolidation loan program. This program allows borrowers to combine multiple federal student loans (Direct Loans, Federal Family Education Loans, etc.) into a single, new Direct Consolidation Loan. This simplifies repayment by reducing the number of monthly payments and potentially lowering the overall monthly payment amount, though it won’t necessarily lower the total interest paid.

Advantages of Government Consolidation

Government consolidation programs generally offer lower interest rates compared to private options, particularly for borrowers with strong credit histories. They also provide access to income-driven repayment plans, which can significantly reduce monthly payments based on income and family size. Finally, government loans offer consumer protections and safeguards not always present in private loan agreements.

Disadvantages of Government Consolidation

While government consolidation offers many benefits, it’s crucial to understand potential drawbacks. The interest rate on a Direct Consolidation Loan is a weighted average of the interest rates on the loans being consolidated. While this average might be lower than some individual loans, it’s unlikely to be significantly lower than the lowest rate you already have. Furthermore, consolidation might extend the repayment period, leading to a higher total interest paid over the life of the loan.

Example: Direct Consolidation Loan

The Direct Consolidation Loan program, administered by the U.S. Department of Education, is a prime example of a government consolidation option. Borrowers can combine eligible federal student loans into a single loan with a fixed interest rate. The interest rate is calculated as a weighted average of the interest rates on the consolidated loans, rounded up to the nearest one-eighth of a percent.

Private Student Loan Consolidation Programs

Private lenders offer consolidation options for both federal and private student loans. These programs typically involve refinancing your existing loans with a new loan from a private lender at a potentially lower interest rate. However, it’s important to note that these rates are often variable and depend on your credit score and other financial factors.

Advantages of Private Consolidation

Private consolidation can potentially offer lower interest rates than your existing loans, especially if you have a good credit score. This can lead to significant savings over the life of the loan. Some private lenders also offer flexible repayment options, including shorter repayment terms.

Disadvantages of Private Consolidation

Private consolidation programs often come with fees and may require a credit check. Borrowers with poor credit may not qualify for favorable rates, or may not qualify at all. Furthermore, private loans typically lack the consumer protections offered by federal loans, such as income-driven repayment plans.

Example: Private Refinancing Loan

Many private lenders, such as SoFi, Earnest, and Discover, offer student loan refinancing programs. These programs allow borrowers to consolidate both federal and private student loans into a single private loan with a potentially lower interest rate. The specific terms and conditions will vary depending on the lender and the borrower’s creditworthiness.

Decision-Making Flowchart

A flowchart illustrating the decision-making process would begin with the question: “Do you have a mix of federal and private student loans?”. If yes, a branch leads to “Consider private consolidation if you qualify for a lower interest rate and are comfortable with the loss of federal protections.” If no (only federal loans), a branch leads to “Consider federal consolidation to simplify payments, but be aware the interest rate may not significantly decrease.” Each branch would then lead to a decision box: “Proceed with consolidation?” with “Yes” leading to a “Consolidation Complete” end point and “No” leading to a “Maintain current loan structure” end point.

Long-Term Implications of Consolidation

Consolidating your student loans can significantly impact your long-term financial health, affecting everything from your monthly payments to your creditworthiness. Understanding these long-term implications is crucial before making a decision. While consolidation can simplify repayment, it’s not always the best financial strategy for everyone.

Consolidation alters your repayment schedule and can influence your credit score and future borrowing ability. The length of your repayment period, the interest rate applied, and your overall debt management strategy all play a significant role in determining the long-term outcome. A seemingly small difference in interest rates can translate into thousands of dollars in extra interest paid over the life of the loan.

Credit Score Impact

Consolidating your loans can impact your credit score in several ways. Initially, opening a new loan may slightly lower your score, as it increases your amount of debt and introduces a new account. However, if you consistently make on-time payments on your consolidated loan, your credit score will likely improve over time, as a single, manageable payment is easier to track and maintain than multiple individual payments. Conversely, missed payments on a consolidated loan will negatively and significantly affect your credit score, potentially more so than if you were managing multiple smaller loans with some payment delays.

Future Borrowing Capacity

Your credit score directly impacts your ability to borrow money in the future. A strong credit score, built through consistent on-time payments on your consolidated loan, will make it easier to secure loans for a mortgage, car, or other significant purchases with favorable interest rates. Conversely, a damaged credit score due to missed payments on a consolidated loan could severely restrict your borrowing options and result in higher interest rates on future loans. This could have a ripple effect, impacting your ability to purchase a home or a car.

Long-Term Financial Outcomes: Examples

Let’s consider two scenarios. In Scenario A, a borrower consolidates their loans at a lower interest rate, resulting in lower monthly payments and faster debt repayment. This leads to significant savings in interest paid over the life of the loan and allows for earlier financial freedom. Scenario B illustrates a borrower who consolidates at a higher interest rate or extends the repayment period. This results in higher overall interest payments and a longer repayment timeline, delaying financial independence. The difference between these scenarios can be substantial, potentially amounting to tens of thousands of dollars over the loan’s lifetime.

Projected Repayment Timeline Visualization

Imagine two bar graphs. The first represents the repayment timeline without consolidation. Multiple bars of varying heights and lengths represent individual loans with different interest rates and repayment periods. The second graph shows the consolidated loan. A single, longer bar represents the consolidated loan’s repayment schedule, potentially longer or shorter than the combined length of the individual loans in the first graph, depending on the consolidation terms. The difference in the total area under the bars represents the total interest paid in each scenario, visually demonstrating the impact of consolidation on the total cost of repayment. The total height of the bars represents the total amount repaid, which is usually higher with consolidation due to accumulated interest.

Hidden Fees and Charges

Student loan consolidation, while offering the potential for simplified repayment, can sometimes come with unexpected costs. Understanding these hidden fees is crucial to making an informed decision and avoiding unpleasant surprises down the line. Failing to account for all associated charges can significantly impact your overall savings and potentially negate the benefits of consolidation.

Understanding all associated costs is paramount because it allows for a truly accurate comparison of different consolidation options. By factoring in all fees, you can determine the true cost of consolidation and choose the option that best aligns with your financial goals. Ignoring these hidden costs can lead to a higher total repayment amount than anticipated, undermining the very purpose of consolidating your loans.

Examples of Common Hidden Fees

Several types of fees can be associated with student loan consolidation. These fees can vary depending on the lender and the type of consolidation loan. It’s essential to carefully review the loan documents to identify all applicable charges.

- Origination Fees: These are upfront fees charged by the lender for processing your consolidation application. These fees can range from a percentage of the loan amount to a fixed dollar amount. For example, a lender might charge a 1% origination fee on a $20,000 loan, resulting in a $200 fee.

- Application Fees: Some lenders may charge a separate application fee for submitting your consolidation request. This fee is usually a fixed amount, but it can add to your overall costs.

- Prepayment Penalties: While less common with federal consolidation loans, some private lenders may impose penalties if you pay off your loan early. These penalties can be a percentage of the remaining balance or a fixed dollar amount. Understanding whether a prepayment penalty exists is crucial, especially if you anticipate having extra funds available for early repayment.

- Late Payment Fees: Late payment fees are charged if you miss a payment on your consolidated loan. These fees can vary, but they can quickly add up if you experience multiple late payments.

Checklist for Reviewing a Consolidation Agreement

Before signing any student loan consolidation agreement, it is crucial to meticulously review the terms and conditions. Overlooking even seemingly minor details can lead to significant financial consequences. Use the following checklist to ensure you are fully informed.

- Interest Rate: Carefully review the interest rate and understand how it is calculated (fixed or variable).

- Fees: Identify all fees, including origination fees, application fees, late payment fees, and any potential prepayment penalties.

- Loan Term: Examine the length of the loan term and how it impacts your monthly payment and total interest paid.

- Repayment Schedule: Understand the repayment schedule and ensure it aligns with your budget and financial capabilities.

- Disbursement Details: Confirm how and when the funds will be disbursed to your previous lenders.

- Contact Information: Verify that the lender’s contact information is clearly stated in the agreement.

Ending Remarks

Successfully navigating student loan consolidation requires a thorough understanding of the process and a careful evaluation of your individual financial situation. By considering the factors discussed – interest rates, credit score, loan types, and potential hidden fees – you can make an informed decision that aligns with your long-term financial goals. Remember to compare offers from multiple lenders, both government and private, before making a commitment. Taking the time to thoroughly research and understand your options will empower you to create a repayment plan that leads to financial stability and peace of mind.

Expert Answers

What is the average interest rate for student loan consolidation?

The average interest rate varies significantly depending on your credit score, loan type, and the lender. It’s crucial to shop around and compare rates from multiple lenders.

Can I consolidate private and federal student loans together?

Generally, you can’t consolidate federal and private loans into a single federal loan. However, some private lenders offer consolidation options that may include both federal and private loans.

Will consolidating my loans affect my credit score?

The impact on your credit score is complex and depends on various factors. A hard credit inquiry during the application process can temporarily lower your score, but responsible repayment of the consolidated loan can positively affect your score over time.

How long does the student loan consolidation process take?

The timeline varies depending on the lender and the complexity of your loan situation. It can typically range from a few weeks to several months.