Navigating the complex world of student loans can feel overwhelming, especially when understanding the nuances of federal Direct Loans. This guide aims to demystify the process, providing clear explanations of loan types, application procedures, repayment options, and strategies for effective debt management. Whether you’re a prospective borrower or already managing student loan debt, this resource offers valuable insights to help you make informed decisions and achieve your financial goals.

From understanding the differences between subsidized and unsubsidized loans to exploring various repayment plans and loan forgiveness programs, we cover the essential aspects of Direct Student Loans. We’ll also delve into the potential long-term financial implications of borrowing and offer practical advice on minimizing the burden of student loan debt.

Types of Direct Student Loans

Understanding the different types of federal student loans is crucial for planning your education financing. This section will clarify the distinctions between subsidized and unsubsidized loans, outlining eligibility criteria and key features to help you make informed decisions.

Subsidized and Unsubsidized Federal Student Loans

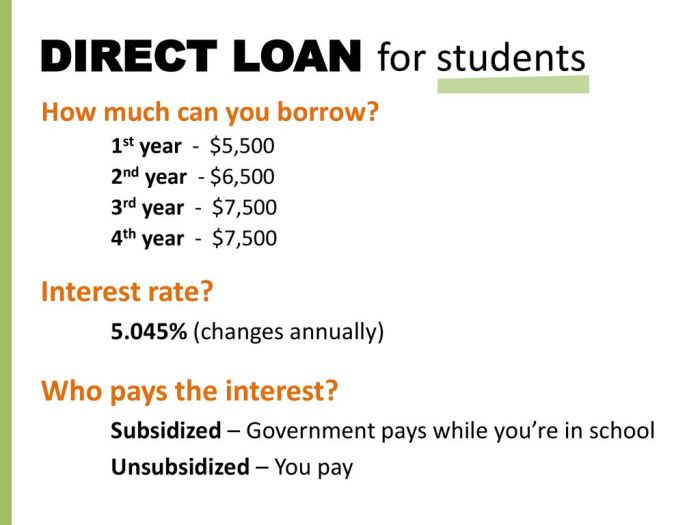

The primary difference between subsidized and unsubsidized federal student loans lies in whether the government pays the interest while you’re in school, during grace periods, and during periods of deferment. Subsidized loans offer this benefit, while unsubsidized loans do not. This distinction significantly impacts the total cost of your loan.

Eligibility Requirements for Subsidized Direct Loans

To be eligible for a subsidized Direct Loan, you must demonstrate financial need. This is determined by the Free Application for Federal Student Aid (FAFSA), which assesses your family’s income and other financial factors. You must also be pursuing a degree or certificate at an eligible institution, maintain satisfactory academic progress, and be a U.S. citizen or eligible non-citizen. Furthermore, you must be enrolled at least half-time.

Eligibility Requirements for Unsubsidized Direct Loans

Eligibility for unsubsidized Direct Loans is less stringent. While financial need is not a requirement, you must still be enrolled at least half-time at an eligible institution, maintain satisfactory academic progress, and be a U.S. citizen or eligible non-citizen. Unlike subsidized loans, your credit history is not a factor in eligibility.

Comparison of Subsidized and Unsubsidized Direct Loans

| Feature | Subsidized Loan | Unsubsidized Loan |

|---|---|---|

| Interest Accrual During School | Government pays interest | Interest accrues |

| Interest Accrual During Grace Period | Government pays interest | Interest accrues |

| Interest Accrual During Deferment | Government pays interest | Interest accrues |

| Financial Need Requirement | Yes | No |

| Credit Check | No | No |

| Repayment Options | Standard, extended, graduated, income-driven | Standard, extended, graduated, income-driven |

| Grace Period | 6 months after graduation or leaving school | 6 months after graduation or leaving school |

| Interest Rate | Variable, set annually by the government | Variable, set annually by the government |

Applying for Direct Student Loans

Securing federal student aid is a crucial step in financing your higher education. The process, while involving several steps, is designed to be straightforward and accessible. Understanding the application process for Direct Student Loans, including completing the FAFSA and accepting loan offers, is key to successfully funding your education.

Completing the Free Application for Federal Student Aid (FAFSA)

The Free Application for Federal Student Aid (FAFSA) is the gateway to federal student aid, including Direct Loans. Accurate and timely completion is vital. The FAFSA gathers information about your financial situation to determine your eligibility for federal student aid. This information is used to calculate your Expected Family Contribution (EFC), a number that helps determine your financial need.

- Gather Required Information: Before starting, collect essential documents such as Social Security numbers, federal tax returns, W-2s, and bank statements for both you and your parents (if you are a dependent student).

- Create an FSA ID: You and your parents (if applicable) will need an FSA ID, a username and password used to access and sign your FAFSA. This ensures the security and integrity of your application.

- Complete the FAFSA Online: Access the FAFSA website (studentaid.gov) and carefully complete the application. Double-check all information for accuracy, as errors can delay processing.

- Submit the FAFSA: Once completed, review your application thoroughly and submit it electronically. You will receive a Student Aid Report (SAR) confirming receipt and outlining your eligibility.

- Follow Up: Monitor your SAR for any requests for additional information. Respond promptly to ensure timely processing of your application.

Accepting a Direct Student Loan Offer

After submitting your FAFSA and being accepted to your chosen institution, you will receive a financial aid offer. This offer may include Direct Subsidized Loans, Direct Unsubsidized Loans, or both. Carefully review the terms and conditions of your loan offer before accepting.

- Review Your Award Letter: Your award letter will detail the types and amounts of loans offered. Pay close attention to the interest rates, repayment terms, and any fees associated with the loans.

- Determine Your Loan Need: Consider your overall educational expenses and other sources of funding before accepting the full amount offered. Borrowing only what you need is crucial for responsible financial management.

- Complete the Master Promissory Note (MPN): You will need to sign a Master Promissory Note (MPN) electronically, agreeing to the terms and conditions of your loan. This is a legally binding agreement.

- Complete Entrance Counseling: Before receiving your first loan disbursement, you’ll need to complete entrance counseling. This online session provides information on loan repayment, rights and responsibilities, and managing your student loan debt.

Accessing and Managing Your Student Loan Account Online

The National Student Loan Data System (NSLDS) and your school’s financial aid portal provide online access to your student loan account information. Regularly reviewing your account is essential for responsible loan management.

- Locate Your Account Information: Access your account through the NSLDS website or your school’s student portal. You will likely need your FSA ID to log in.

- Review Loan Details: Check your loan balance, interest rate, repayment schedule, and any outstanding fees. Ensure all information is accurate and reflects your understanding of the loan terms.

- Make Payments: If you are in repayment, make timely payments to avoid late fees and negative impacts on your credit score. Explore various payment options available to you.

- Update Contact Information: Keep your contact information current in your online account to ensure you receive important updates and notifications.

Repayment Plans for Direct Student Loans

Choosing the right repayment plan is crucial for managing your student loan debt effectively. Different plans offer varying monthly payment amounts and repayment timelines, each with its own set of advantages and disadvantages. Understanding these options will help you select the plan that best aligns with your financial situation and goals.

The federal government offers several repayment plans for Direct Student Loans, each designed to cater to different borrowers’ financial circumstances and preferences. Careful consideration of your income, expenses, and long-term financial goals is essential in making an informed decision.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most borrowers. It involves fixed monthly payments over a 10-year period. This plan offers the shortest repayment timeline, resulting in less interest paid overall. However, the fixed monthly payments might be higher than other plans, potentially straining your budget.

Graduated Repayment Plan

The Graduated Repayment Plan features lower monthly payments initially, which gradually increase over a 10-year period. This option can be beneficial for borrowers anticipating increased income in the future. However, the lower initial payments mean you’ll pay more interest overall compared to the Standard Repayment Plan, and the increasing payments can become challenging to manage later on.

Extended Repayment Plan

This plan extends the repayment period to up to 25 years, significantly reducing your monthly payments. This can provide immediate financial relief, but it comes at the cost of paying substantially more interest over the life of the loan. This plan is generally suitable for borrowers with higher loan balances or those facing financial hardship.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) link your monthly payments to your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans typically result in lower monthly payments, making them more manageable for borrowers with limited incomes. However, they often extend the repayment period beyond 10 years, potentially leading to higher total interest paid. Furthermore, remaining balances may be forgiven after a specific period, but this forgiveness is considered taxable income.

Comparison of Repayment Plans

The following table summarizes the key features and provides illustrative monthly payment examples. Remember that actual payments will depend on your loan amount, interest rate, and specific plan chosen. These examples are for illustrative purposes only and may not reflect your exact situation.

| Repayment Plan | Repayment Period | Payment Characteristics | Example Monthly Payment ($10,000 Loan) |

|---|---|---|---|

| Standard | 10 years | Fixed monthly payments | ~$100 |

| Graduated | 10 years | Payments increase gradually | ~$75 (initially), increasing over time |

| Extended | Up to 25 years | Lower fixed monthly payments | ~$40 (approximately, depending on loan term) |

| Income-Driven (Example) | Up to 20-25 years | Based on income and family size | Varies greatly depending on income |

Managing Student Loan Debt

Successfully navigating student loan repayment requires proactive planning and a solid understanding of available resources. Effective management minimizes financial strain and prevents serious long-term consequences. This section Artikels strategies for budgeting, addresses the risks of default, and highlights support available to borrowers facing hardship.

Effective budgeting is crucial for managing student loan debt. Creating a realistic budget involves tracking income and expenses to identify areas for potential savings. This allows borrowers to allocate sufficient funds towards their loan payments while maintaining a comfortable standard of living. Prioritizing loan payments and exploring options for reducing monthly payments can further alleviate financial pressure. For example, consolidating multiple loans into a single loan with a lower interest rate can simplify repayment and potentially reduce the overall cost. Additionally, exploring income-driven repayment plans can tailor monthly payments to a borrower’s income level.

Strategies for Budgeting and Managing Student Loan Debt

Developing a comprehensive budget is the cornerstone of effective student loan management. This involves meticulously tracking all income sources and expenses to understand your current financial situation. Categorizing expenses helps identify areas where spending can be reduced. For instance, reducing discretionary spending on entertainment or dining out can free up funds for loan repayment. Creating a detailed budget, perhaps using a spreadsheet or budgeting app, allows for better visualization of cash flow and facilitates informed decision-making regarding loan repayment. Regularly reviewing and adjusting the budget ensures it remains relevant to changing circumstances. Tools like the federal government’s StudentAid.gov website offer resources and calculators to assist in budgeting and repayment planning.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe and far-reaching consequences. It damages credit scores, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, where a portion of a borrower’s wages is automatically deducted to repay the debt, is a common consequence. Tax refunds can also be seized to offset outstanding loan balances. Furthermore, default can lead to legal action, including lawsuits and potential wage garnishments. In extreme cases, it can impact future employment opportunities, particularly in fields requiring security clearances or professional licenses. The long-term financial repercussions of default significantly outweigh the short-term relief of avoiding payments. For instance, a defaulted loan could lead to thousands of dollars in additional fees and interest charges, drastically increasing the total amount owed.

Resources for Borrowers Facing Financial Hardship

Several resources are available to assist borrowers experiencing financial difficulties. Deferment or forbearance programs offer temporary pauses or reductions in loan payments, providing crucial breathing room during periods of financial instability. Income-driven repayment plans adjust monthly payments based on income and family size, making repayment more manageable. Loan consolidation can simplify repayment by combining multiple loans into a single loan with potentially more favorable terms. The federal government’s StudentAid.gov website offers comprehensive information on available repayment options and hardship programs. Additionally, non-profit credit counseling agencies provide free or low-cost guidance on managing debt and navigating repayment options. These agencies can help borrowers understand their options, create a repayment plan, and negotiate with lenders to avoid default. Seeking professional guidance can be invaluable in preventing long-term financial damage.

Interest Rates and Fees on Direct Student Loans

Understanding the interest rates and fees associated with your Direct Student Loans is crucial for effectively managing your loan debt. These costs significantly impact the total amount you’ll repay, so it’s important to be informed. This section details how these rates and fees are determined and provides a hypothetical scenario to illustrate their effect.

Interest rates for Direct Subsidized and Unsubsidized Loans are fixed for the life of the loan, meaning the rate doesn’t change once it’s set. However, the rate itself is determined by the U.S. Department of Education and is set annually for each loan period. These rates are typically influenced by prevailing market interest rates, but are ultimately set by the government. Direct PLUS loans, on the other hand, have a slightly different interest rate calculation, usually higher than undergraduate loans. The specific rate will depend on the loan’s disbursement date and the type of loan.

Direct Loan Origination Fees

Origination fees are upfront charges deducted from the total loan amount before you receive the funds. These fees help cover the costs of processing and administering the loans. The percentage of the origination fee varies depending on the loan type and the year the loan is disbursed. For example, a 1.057% origination fee on a $10,000 loan would result in a $105.70 fee deducted upfront, meaning the student receives $9,894.30. This fee is not interest, but rather a one-time charge for loan processing. It’s important to note that these fees are typically lower for subsidized loans compared to unsubsidized or PLUS loans.

Hypothetical Scenario: Impact of Interest Rates and Fees

Let’s consider two students, Alex and Ben, both borrowing $10,000 for undergraduate studies. Alex borrows a Direct Subsidized Loan with a 4% interest rate and a 1% origination fee. Ben borrows a Direct Unsubsidized Loan with a 6% interest rate and a 1.057% origination fee. Both loans are disbursed over 10 years.

After deducting the origination fees, Alex receives $9,900 and Ben receives $9,894.30. Over the 10-year repayment period, assuming a standard repayment plan, Alex will pay significantly less in total interest than Ben, due to the lower interest rate. The difference in origination fees is minimal in this comparison. While the total cost for both loans will be higher than the initial loan amount due to accumulated interest, Ben’s higher interest rate results in a considerably larger total repayment amount. This demonstrates how interest rates and even small differences in origination fees can substantially influence the final cost of a student loan. Accurate calculation of the total cost, including interest and fees, is crucial for making informed financial decisions.

Loan Consolidation and Refinancing

Managing multiple student loans can be complex, involving different interest rates, repayment schedules, and loan servicers. Loan consolidation and refinancing offer potential solutions to simplify this process and potentially save money. However, it’s crucial to understand the nuances of each option before making a decision.

Loan consolidation involves combining multiple federal student loans into a single, new federal loan. This streamlines payments into one monthly bill, potentially simplifying your financial management. Refinancing, on the other hand, involves replacing your existing student loans—federal or private—with a new private loan from a lender like a bank or credit union. This can result in a lower interest rate, a shorter repayment term, or both, but it comes with its own set of considerations.

Direct Loan Consolidation

The process of consolidating multiple Direct federal student loans into a single Direct Consolidation Loan is relatively straightforward. Borrowers can apply online through the Federal Student Aid website. The application process involves providing information about your existing loans and choosing a repayment plan. Once approved, the new loan replaces your previous loans, and payments are made to the new loan servicer. The interest rate on a Direct Consolidation Loan is a weighted average of the interest rates on your existing loans, rounded up to the nearest one-eighth of a percent. This means you won’t necessarily get a lower interest rate, but you will simplify your payments.

Refinancing Student Loans: Benefits and Drawbacks

Refinancing student loans offers the potential for significant savings if you qualify for a lower interest rate. A lower rate can reduce your monthly payments and the total interest paid over the life of the loan. A shorter repayment term can also accelerate debt repayment, although this will increase your monthly payment. However, refinancing your federal student loans with a private lender means losing access to federal repayment programs, such as income-driven repayment plans and loan forgiveness programs. Additionally, private lenders have stricter eligibility requirements, and borrowers with poor credit may not qualify for the best rates.

Pros and Cons of Loan Consolidation and Refinancing

Understanding the advantages and disadvantages of both options is crucial for making an informed decision.

The following points highlight the key considerations:

- Loan Consolidation (Federal):

- Pros: Simplifies payments, potentially easier to manage, maintains access to federal repayment programs.

- Cons: May not lower interest rate, does not change loan terms significantly.

- Refinancing (Private):

- Pros: Potential for lower interest rates, shorter repayment terms, potentially lower monthly payments.

- Cons: Loss of federal repayment protections, stricter eligibility requirements, higher risk if you have poor credit, potential for higher fees.

Forgiveness and Cancellation Programs

Federal student loan forgiveness and cancellation programs offer borrowers the opportunity to have all or part of their student loan debt discharged. These programs are designed to alleviate the burden of student loan debt for individuals who meet specific criteria, often related to their employment in public service or their demonstrated financial hardship. Understanding these programs is crucial for borrowers seeking to manage their debt effectively.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) Program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. A qualifying employer includes government organizations or not-for-profit organizations. Eligibility requires employment by a qualifying employer and consistent on-time payments under an income-driven repayment plan. Successful completion of the program can significantly reduce or eliminate a borrower’s student loan debt, potentially saving tens of thousands of dollars.

Teacher Loan Forgiveness Program

This program provides forgiveness for qualified teachers who have completed five years of full-time teaching in a low-income school or educational service agency. The program forgives up to $17,500 of Direct Subsidized and Unsubsidized Loans, or Stafford Loans. Eligibility is contingent upon meeting the teaching requirements in a designated low-income school and maintaining continuous employment. This program can substantially reduce a teacher’s loan burden, making the profession more financially accessible.

Income-Driven Repayment (IDR) Plans and Forgiveness

Several income-driven repayment plans (IDR) exist, including Revised Pay As You Earn (REPAYE), Pay As You Earn (PAYE), Income-Based Repayment (IBR), and Income-Contingent Repayment (ICR). These plans calculate monthly payments based on your income and family size. After making payments for a specific period (typically 20 or 25 years, depending on the plan), any remaining loan balance may be forgiven. The forgiven amount is considered taxable income. These plans offer significant long-term debt reduction potential, but it’s important to understand the tax implications of loan forgiveness. For example, a borrower with a $50,000 loan balance might see a substantial reduction after 20 years of payments under an IDR plan, though the forgiven amount would be subject to taxation.

Total and Permanent Disability (TPD) Discharge

Borrowers who become totally and permanently disabled may be eligible for a discharge of their federal student loans. Documentation from a physician or other qualified medical professional is required to prove the disability. This program eliminates the debt entirely for borrowers facing significant health challenges, preventing further financial strain during a difficult time. The impact on the borrower is immediate and complete debt relief.

Death Discharge

In the event of a borrower’s death, their federal student loans are discharged. The lender will require documentation of the death, such as a death certificate. This provision prevents the debt from burdening the deceased borrower’s estate or family. The impact is a complete release of the debt obligation.

Impact of Direct Student Loans on Personal Finances

Taking out direct student loans can significantly impact your personal finances, both in the short-term and, more profoundly, over the long-term. Understanding these implications is crucial for responsible borrowing and effective financial planning. The weight of student loan debt can influence major life decisions and significantly shape your financial trajectory for years to come.

The long-term financial implications of student loan debt extend far beyond the monthly payment. The principal amount borrowed, coupled with accumulated interest, can represent a substantial financial burden that restricts opportunities and necessitates careful budgeting. This debt can delay major life milestones, such as homeownership or starting a family, and may even reduce the amount you can save for retirement. The consistent outflow of funds for loan repayment can significantly limit discretionary spending, impacting lifestyle choices and overall financial well-being.

Minimizing the Financial Burden of Student Loan Debt

Strategic planning and proactive management are key to minimizing the financial strain of student loans. Careful consideration of borrowing amounts, selection of repayment plans, and consistent budgeting are all crucial elements. Exploring options like income-driven repayment plans can provide more manageable monthly payments, although this may extend the loan repayment period and increase the total interest paid. Furthermore, actively seeking opportunities to increase income and reduce unnecessary expenses can free up more funds for loan repayment, accelerating the debt reduction process. Consistent and disciplined budgeting, coupled with regular loan payment monitoring, will help ensure that you stay on track and avoid late payment penalties.

Impact of Student Loan Debt on Long-Term Financial Goals

Consider this illustration: Imagine two individuals, both graduating with the same job offer. Individual A borrowed $50,000 in student loans, while Individual B borrowed only $10,000. Let’s visualize their financial futures. For Individual A, a significant portion of their early-career income will be dedicated to student loan repayments. This could delay their ability to save for a down payment on a home, potentially pushing back homeownership by several years. They might also have less disposable income to invest in retirement accounts, resulting in a smaller nest egg by retirement age. In contrast, Individual B, with a smaller loan burden, will have more financial flexibility. They can save for a down payment sooner, potentially becoming homeowners earlier, and contribute more substantially to retirement savings, potentially achieving a more comfortable retirement. This visual representation highlights the potential long-term consequences of differing levels of student loan debt. The chart below (described textually) compares their hypothetical financial situations:

| Category | Individual A ($50,000 Loan) | Individual B ($10,000 Loan) |

|—————–|————————————————-|————————————————-|

| Homeownership | Delayed by 5-7 years due to lower savings | Achieved within 3-5 years |

| Retirement Savings | Significantly lower by retirement age | Significantly higher by retirement age |

| Investment Potential | Limited due to higher loan payments | Greater due to lower loan payments |

| Disposable Income | Lower due to loan repayments | Higher due to lower loan repayments |

This simplified example illustrates the significant impact student loan debt can have on achieving long-term financial goals. The actual impact will vary depending on the individual’s loan amount, interest rate, repayment plan, and income.

Outcome Summary

Securing a college education often involves navigating the landscape of student loans. Understanding the intricacies of Direct Student Loans—from application to repayment and beyond—is crucial for responsible borrowing and long-term financial well-being. By utilizing the information presented here and actively managing your debt, you can pave the way for a brighter financial future. Remember to explore all available resources and seek professional advice when needed to create a personalized plan that aligns with your individual circumstances.

Answers to Common Questions

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in loan default, which has serious financial consequences.

Can I consolidate private and federal student loans together?

Generally, you cannot consolidate private and federal student loans into a single federal loan. However, you might be able to refinance both types of loans with a private lender.

What is the difference between forbearance and deferment?

Forbearance temporarily suspends or reduces your payments, but interest may still accrue. Deferment temporarily postpones your payments, and under certain circumstances, interest may not accrue.

Are there any income limits for loan forgiveness programs?

Yes, many loan forgiveness programs have income-based eligibility requirements. The specific limits vary depending on the program.