Navigating the complexities of student loans can feel overwhelming, especially with the significant role the Education Department plays in their disbursement, management, and repayment. This guide delves into the intricacies of student loan programs, exploring the various repayment plans, forgiveness options, and the potential long-term financial and psychological impacts of student loan debt. We’ll examine the Education Department’s responsibilities and explore strategies for effective debt management.

From understanding eligibility criteria for forgiveness programs to navigating the process of repayment and addressing the consequences of default, this resource aims to provide clarity and empower borrowers to make informed decisions about their student loan journey. We will also consider the impact of recent legislative changes on student loan policies and their effects on borrowers and the department itself.

Student Loan Forgiveness Programs

Student loan forgiveness programs, offered by the U.S. Department of Education, aim to alleviate the burden of student loan debt for eligible borrowers. These programs have evolved over time, reflecting changing economic conditions and policy priorities. Understanding the various programs and their eligibility criteria is crucial for borrowers seeking debt relief.

History of Student Loan Forgiveness Programs

The history of federal student loan forgiveness programs is relatively recent. While some forms of loan cancellation existed earlier, targeted and comprehensive programs emerged more prominently in the late 20th and early 21st centuries. Early programs often focused on specific professions, such as teaching or public service, incentivizing individuals to pursue careers in critical areas. The expansion and evolution of these programs have been driven by a combination of factors, including rising student loan debt levels, concerns about affordability of higher education, and a desire to address workforce shortages in certain sectors. The specifics of program design and eligibility requirements have varied over time, reflecting shifts in policy priorities and budgetary considerations.

Comparison of Student Loan Forgiveness Programs

Several types of student loan forgiveness programs exist, each with its own eligibility requirements and benefits. Some programs, like Public Service Loan Forgiveness (PSLF), target borrowers working in public service jobs, while others, such as Income-Driven Repayment (IDR) plans, offer loan forgiveness based on income and repayment history. Key differences lie in the professions covered, the income thresholds, and the length of time required for forgiveness. Some programs may offer complete loan forgiveness, while others only reduce the overall debt. Understanding these distinctions is crucial for borrowers to determine which program, if any, best suits their individual circumstances.

Eligibility Criteria for Major Student Loan Forgiveness Programs

Eligibility for student loan forgiveness programs varies significantly. Factors considered often include the type of loan, the borrower’s occupation, income level, and repayment history. Meeting all eligibility requirements is crucial for successful application and forgiveness. Failure to meet even one requirement can result in ineligibility. Furthermore, the application process itself can be complex, requiring meticulous documentation and adherence to specific deadlines. Careful review of program guidelines and requirements is paramount.

Student Loan Forgiveness Program Details

| Program Name | Eligibility Requirements | Forgiveness Amount | Application Process |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Work full-time for a qualifying government or non-profit organization; make 120 qualifying monthly payments under an eligible repayment plan. | Remaining balance of eligible Direct Loans | Apply through the Federal Student Aid website; requires meticulous documentation of employment and payments. |

| Teacher Loan Forgiveness | Teach full-time for five complete and consecutive academic years in a low-income school or educational service agency; meet specific income requirements. | Up to $17,500 of eligible Direct Subsidized and Unsubsidized Loans | Apply through the Federal Student Aid website; requires documentation of employment and service. |

| Income-Driven Repayment (IDR) Plans | Vary by plan; generally based on income and family size. Forgiveness after 20-25 years of payments (depending on the plan). | Remaining balance after 20-25 years of payments | Select an IDR plan through your loan servicer; requires annual income recertification. |

| Perkins Loan Cancellation | Work in specific public service jobs; meet specific requirements. (Program is no longer available for new borrowers). | Varies depending on the type of service and length of service. | Application through the institution that originally awarded the loan. (Program is no longer available for new borrowers). |

The Role of the Education Department in Student Loan Management

The U.S. Department of Education plays a crucial role in the lifecycle of federal student loans, from disbursement to repayment and beyond. Its responsibilities are multifaceted and directly impact millions of borrowers across the nation. Understanding the Department’s involvement is key to navigating the complexities of student loan financing.

The Education Department’s responsibilities regarding student loan disbursement involve ensuring funds are correctly and efficiently distributed to eligible students. This includes verifying student eligibility, confirming enrollment at accredited institutions, and processing loan applications. The department works closely with lending institutions, such as banks and credit unions, to facilitate the timely transfer of funds to students. They also monitor these institutions to ensure compliance with federal regulations and protect students from predatory lending practices.

Student Loan Repayment Management Process

The Education Department manages student loan repayments through a multi-stage process. First, upon graduation or leaving school, borrowers enter a grace period, typically six months, before repayment begins. During this time, borrowers can explore repayment options and consolidate loans if needed. Next, the Department calculates the monthly payment based on the loan amount, interest rate, and chosen repayment plan. Borrowers then make monthly payments directly to their loan servicer, a company contracted by the Department to manage loan accounts. The Department monitors repayment activity, ensuring borrowers remain compliant. Finally, the Department tracks loan balances, processes payments, and manages defaults. If a borrower defaults, the Department initiates collection efforts, which may include wage garnishment or tax refund offset.

Examples of Department Interaction with Borrowers

The Education Department interacts with student loan borrowers in several ways. For example, borrowers receive regular statements from their loan servicers detailing their account balance, payment history, and upcoming payments. The Department also provides resources and information through its website and call centers to assist borrowers with questions about repayment plans, loan forgiveness programs, and other related issues. In cases of hardship, borrowers can contact the Department to request forbearance or deferment, temporarily suspending or reducing their payments. Additionally, the Department communicates with borrowers regarding changes in their loan terms, such as interest rate adjustments or changes in their loan servicer. These interactions aim to keep borrowers informed and provide support throughout the repayment process.

Key Functions of the Education Department Concerning Student Loans

The Department’s involvement extends beyond disbursement and repayment. Here are some key functions:

- Loan Origination: Overseeing the process by which students obtain federal student loans.

- Loan Servicing: Contracting and overseeing loan servicers to manage borrower accounts.

- Repayment Plan Management: Offering various repayment plans to meet borrowers’ individual financial circumstances.

- Default Prevention and Collection: Implementing strategies to prevent loan defaults and managing collection efforts when necessary.

- Policy Development and Enforcement: Creating and enforcing regulations to protect borrowers and ensure the integrity of the federal student loan program.

- Borrower Assistance: Providing resources and support to borrowers facing financial difficulties or needing assistance with their loans.

Impact of Student Loan Debt on Borrowers

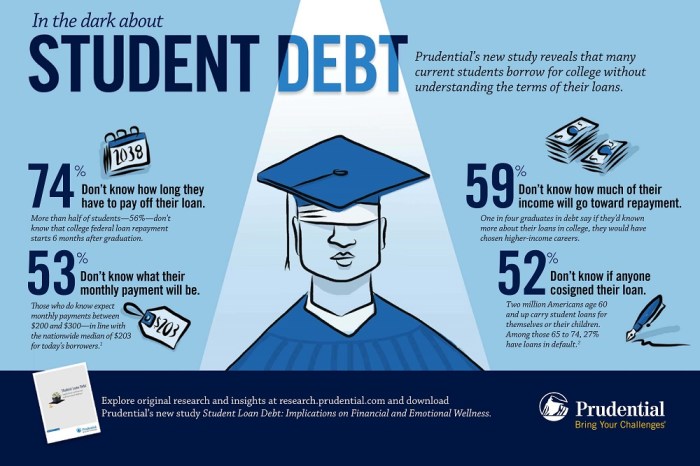

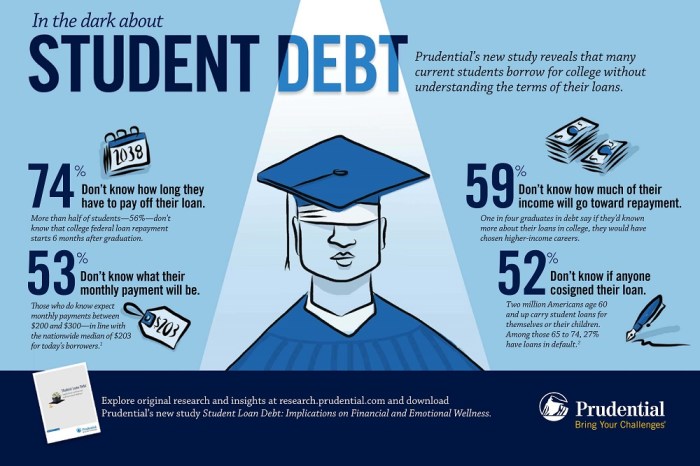

Student loan debt significantly impacts borrowers’ financial well-being and overall quality of life, extending far beyond the repayment period. The consequences are multifaceted, affecting not only financial stability but also mental and emotional health. Understanding these impacts is crucial for developing effective strategies for debt management and promoting responsible borrowing practices.

Long-Term Financial Consequences of Significant Student Loan Debt

High student loan debt can severely restrict financial opportunities for years, even decades. Borrowers may face difficulties in saving for retirement, purchasing a home, starting a family, or investing in other crucial life goals. The consistent monthly payments can consume a substantial portion of income, leaving little room for financial emergencies or discretionary spending. This can lead to a cycle of debt, where borrowers struggle to accumulate wealth and build financial security. For example, someone with $100,000 in student loan debt at a 7% interest rate could spend decades repaying the loan, significantly impacting their ability to save for a down payment on a house or invest in their future.

Psychological Effects of Student Loan Debt on Borrowers

The burden of significant student loan debt can have profound psychological effects. Many borrowers experience high levels of stress, anxiety, and depression. The constant worry about repayment, coupled with the feeling of being financially trapped, can lead to significant mental health challenges. This stress can impact relationships, career choices, and overall life satisfaction. Studies have shown a correlation between high student loan debt and increased rates of mental health issues among young adults. The pressure to succeed financially to repay these loans can also lead to feelings of inadequacy and self-doubt.

Strategies for Managing and Reducing Student Loan Debt

Several strategies can help borrowers manage and reduce their student loan debt. These include exploring income-driven repayment plans, which adjust monthly payments based on income and family size. Consolidation can simplify repayment by combining multiple loans into a single payment. Refinancing can potentially lower the interest rate, reducing the overall cost of the loan. Furthermore, borrowers can explore options such as forbearance or deferment in times of financial hardship, though these options should be used cautiously as they can increase the total amount owed. Finally, actively budgeting and prioritizing debt repayment can help borrowers gain control of their finances and accelerate the repayment process.

Visual Representation of Student Loan Repayment Stages

Imagine a bar graph. The horizontal axis represents the years of repayment, divided into stages: initial repayment (years 1-3), mid-repayment (years 4-7), and final repayment (years 8+). The vertical axis represents the percentage of the total loan balance remaining. The bar for initial repayment would be relatively high, showing a slow decrease in the loan balance due to high interest payments. The mid-repayment bar would show a steeper decline, as principal payments become more significant. The final repayment bar would be the shortest, reflecting a rapid reduction in the balance as the loan nears completion. Each bar could be color-coded, with darker shades representing higher interest payments and lighter shades indicating greater principal repayment. This visual representation clearly illustrates how the financial impact of student loan debt changes over time.

Student Loan Repayment Plans

Navigating the complexities of student loan repayment can feel overwhelming. Fortunately, the Department of Education offers a variety of repayment plans designed to help borrowers manage their debt effectively. Understanding the differences between these plans is crucial for choosing the option that best aligns with your individual financial circumstances. This section will compare and contrast several key repayment plans, highlighting their advantages and disadvantages to aid in informed decision-making.

Standard Repayment Plan

The Standard Repayment Plan is the default plan for most federal student loans. It typically involves fixed monthly payments over a 10-year period. This plan is straightforward and predictable, making it a good option for borrowers who prioritize a shorter repayment timeline and lower overall interest costs.

Extended Repayment Plan

The Extended Repayment Plan offers longer repayment terms, stretching payments out over a period of up to 25 years. This plan significantly reduces monthly payments, making it more manageable for borrowers with limited income. However, it also leads to higher overall interest costs due to the extended repayment period. This option might be suitable for borrowers prioritizing affordability over speed of repayment. For example, a borrower with a high loan balance and a lower income might find this plan more manageable than the Standard plan.

Graduated Repayment Plan

Under the Graduated Repayment Plan, monthly payments start low and gradually increase over time. This plan can be beneficial for borrowers who anticipate higher income in the future, as their payments will adjust accordingly. However, the increasing payments can become challenging to manage if income growth doesn’t keep pace. A recent graduate entering a career with anticipated salary increases could find this plan appealing initially.

Income-Driven Repayment Plans

Income-Driven Repayment (IDR) plans, including the Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR) plans, tie monthly payments to your income and family size. These plans are designed to make repayment more affordable for borrowers with low incomes. Payments are typically recalculated annually, and any remaining balance may be forgiven after a set number of years, depending on the specific plan. However, IDR plans often result in longer repayment periods and higher overall interest costs. A borrower experiencing a period of unemployment or low income would likely benefit significantly from an IDR plan.

Comparison of Student Loan Repayment Plans

| Plan Name | Payment Calculation Method | Eligibility Criteria | Potential Benefits/Drawbacks |

|---|---|---|---|

| Standard Repayment | Fixed monthly payments over 10 years | Most federal student loans | Benefits: Shorter repayment period, lower total interest. Drawbacks: Higher monthly payments. |

| Extended Repayment | Fixed monthly payments over up to 25 years | Most federal student loans | Benefits: Lower monthly payments. Drawbacks: Longer repayment period, higher total interest. |

| Graduated Repayment | Payments start low and gradually increase | Most federal student loans | Benefits: Lower initial payments. Drawbacks: Increasing payments can become challenging, potentially higher total interest. |

| Income-Driven Repayment (IBR, PAYE, REPAYE, ICR) | Based on income and family size | Most federal student loans | Benefits: Affordable monthly payments, potential loan forgiveness. Drawbacks: Longer repayment period, higher total interest. |

Student Loan Default and its Consequences

Student loan default occurs when a borrower fails to make payments on their federal student loans for a specified period. This seemingly simple act triggers a complex series of consequences impacting both the borrower’s financial well-being and their credit history. Understanding the process and repercussions is crucial for borrowers to avoid this serious situation.

The Process of Student Loan Default

The process of defaulting on a federal student loan begins with missed payments. After nine months of consecutive missed payments, the loan is considered to be in default. This triggers a series of actions by the loan servicer and ultimately, the Department of Education. The loan servicer will attempt to contact the borrower to arrange repayment, but if these attempts are unsuccessful, the loan is referred to the Department of Education. At this point, the loan is no longer eligible for deferment or forbearance options.

Consequences of Student Loan Default

The consequences of student loan default are severe and far-reaching. Defaulting on a student loan can significantly damage a borrower’s credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. It can also affect employment opportunities, as some employers conduct credit checks as part of the hiring process. Furthermore, the defaulted loan amount will continue to accrue interest, making the total debt owed even larger over time. The Department of Education may also pursue legal action to recover the debt.

Actions Taken by the Education Department

When a borrower defaults on their student loans, the Department of Education has several tools at its disposal to recover the debt. These include wage garnishment, tax refund offset, and referral to collection agencies. The Department may also pursue legal action, including lawsuits and wage garnishment orders. These actions are designed to recoup the money owed to the government. The severity of the actions taken often depends on the amount of the defaulted loan and the borrower’s repayment history.

Wage Garnishment and Tax Refund Offset

Wage garnishment is a process where a portion of a borrower’s wages is automatically deducted and sent to the Department of Education to repay the defaulted loan. The amount garnished is typically a percentage of the borrower’s disposable income. Tax refund offset is a similar process where the Department of Education intercepts a borrower’s federal tax refund to apply it towards their defaulted student loan debt. Both wage garnishment and tax refund offset are powerful tools used by the Department of Education to recover defaulted student loan debt and can significantly impact a borrower’s financial stability. For example, a borrower with a significant amount of defaulted debt might see a substantial portion of their wages garnished each month, impacting their ability to meet other financial obligations. Similarly, a tax refund offset could eliminate a significant portion of a borrower’s refund, impacting their ability to cover expenses.

Legislative and Regulatory Changes Affecting Student Loans

The past decade has witnessed significant shifts in the landscape of student loan legislation and regulation in the United States, driven by factors such as rising tuition costs, increasing student loan debt burdens, and evolving economic conditions. These changes have profoundly impacted both borrowers and the Department of Education, necessitating ongoing adaptation and reform efforts.

The effects of these legislative and regulatory changes have been multifaceted and far-reaching. For borrowers, some changes have offered increased flexibility and relief, while others have introduced new complexities and challenges. For the Department of Education, these changes have necessitated significant adjustments in administrative procedures, resource allocation, and overall program management. The evolving legal and regulatory environment demands continuous monitoring and proactive strategies to ensure the effective and equitable administration of student loan programs.

Significant Legislative and Regulatory Changes

Several key legislative and regulatory actions have reshaped the student loan system. The passage of the Higher Education Act reauthorizations, for instance, have introduced modifications to loan programs, eligibility criteria, and repayment options. Furthermore, executive actions, such as those related to income-driven repayment plans and temporary payment pauses during periods of national emergency, have significantly altered the borrower experience. These actions, along with evolving court interpretations of existing laws, have created a dynamic environment for student loan administration and policymaking.

Effects on Borrowers and the Education Department

The impact of these changes on borrowers has been varied. Expanded income-driven repayment options have provided relief for some borrowers struggling with debt repayment, while others have faced increased complexity in navigating the different plan options and their implications. For the Department of Education, managing these changes has presented significant administrative challenges, requiring the development of new systems and processes to handle increased program complexity and fluctuating caseloads. The increased scrutiny and oversight associated with these changes have also added to the Department’s administrative burden.

Potential Future Changes in Student Loan Policies

Looking ahead, several potential changes in student loan policies are on the horizon. Discussions around loan forgiveness programs, further modifications to income-driven repayment plans, and potential reforms to the underlying structure of the student loan system are ongoing. These potential changes will likely involve considerations of affordability, equity, and the long-term sustainability of the student loan system. For example, there is ongoing debate about the potential for broader loan forgiveness initiatives, the expansion of income-driven repayment plans to encompass a wider range of borrowers, and the introduction of new mechanisms to promote responsible borrowing and financial literacy among students. These discussions often hinge on balancing the needs of borrowers with the fiscal implications for the federal government.

Timeline of Key Legislative and Regulatory Changes

A timeline of key legislative and regulatory changes could begin with the 2010 Higher Education Act reauthorization, highlighting its impact on loan programs. Subsequent years would then showcase the introduction and modifications of income-driven repayment plans, the impact of the 2013 and 2015 reauthorizations, and the various executive actions taken during the COVID-19 pandemic, including the temporary suspension of payments and interest accrual. Finally, the timeline would extend to the present, reflecting ongoing legislative debates and potential future policy adjustments. This timeline would effectively illustrate the evolution of student loan policy and its significant impact over the past decade.

Summary

Understanding the student loan landscape, particularly the Education Department’s involvement, is crucial for borrowers to successfully manage their debt and plan for their financial future. This guide has explored the key aspects of student loans, from forgiveness programs and repayment plans to the consequences of default and the ongoing impact of legislative changes. By gaining a comprehensive understanding of these elements, borrowers can navigate the complexities of student loan repayment with greater confidence and make informed choices that best serve their individual circumstances.

Key Questions Answered

What happens if I can’t make my student loan payments?

Contact your loan servicer immediately. They can help you explore options like deferment, forbearance, or income-driven repayment plans to avoid default.

How can I consolidate my student loans?

The Education Department offers Direct Consolidation Loans, which combine multiple federal student loans into a single loan with a new interest rate and repayment plan. Check the Federal Student Aid website for details.

What is the difference between a deferment and a forbearance?

A deferment temporarily suspends payments and may or may not accrue interest, depending on the type of deferment. A forbearance temporarily reduces or suspends payments, but interest usually continues to accrue.

Can I file for bankruptcy to discharge my student loans?

Discharging student loans through bankruptcy is extremely difficult and requires demonstrating undue hardship. It’s a complex legal process best addressed with legal counsel.