Navigating the complexities of federal student aid can feel overwhelming, but understanding the various loan types, application processes, and repayment options is crucial for securing a higher education. This guide provides a clear and concise overview of federal student loans, empowering students to make informed decisions about financing their education and managing their debt effectively. We’ll explore everything from eligibility requirements and repayment plans to loan forgiveness programs and alternative funding sources.

From the initial FAFSA application to long-term debt management strategies, we aim to demystify the process and equip you with the knowledge needed to successfully navigate the world of federal student loans. We’ll also delve into current trends and challenges within the system, providing context for the choices you’ll make.

Types of Federal Student Aid

Federal student aid plays a crucial role in making higher education accessible to millions of Americans. Understanding the different types of aid available is essential for students and families navigating the financial complexities of college. This section Artikels the various federal student loan programs, their eligibility requirements, and key features.

Federal Student Loan Programs

The federal government offers several loan programs designed to meet the diverse financial needs of students. These loans differ in their interest rates, repayment options, and eligibility criteria. Careful consideration of these factors is crucial in selecting the most appropriate loan for individual circumstances.

Subsidized and Unsubsidized Federal Stafford Loans

Subsidized Stafford Loans are need-based loans where the government pays the interest while the student is enrolled at least half-time, during grace periods, and during deferment periods. Unsubsidized Stafford Loans are not need-based; interest accrues from the time the loan is disbursed, regardless of the student’s enrollment status. Eligibility for both loan types is determined by completing the Free Application for Federal Student Aid (FAFSA). Factors such as financial need, enrollment status, and academic progress are considered.

Federal PLUS Loans

Federal PLUS Loans are available to parents of dependent undergraduate students (Parent PLUS Loans) and to graduate or professional students (Graduate PLUS Loans). Unlike Stafford Loans, PLUS Loans are credit-based. Borrowers must meet specific credit requirements to qualify. Interest rates are generally higher than Stafford Loans. A credit check is performed, and adverse credit history may lead to loan denial or require an endorser.

Federal Perkins Loans

Federal Perkins Loans are need-based loans offered by participating colleges and universities. These loans have a fixed, low interest rate and are generally offered to students with exceptional financial need. Availability varies depending on the institution’s participation and funding levels. The eligibility criteria are set by each participating institution, generally based on demonstrated financial need as determined through the FAFSA.

Comparison of Federal Student Loan Programs

| Loan Type | Interest Rate (Example – rates vary by year) | Eligibility | Repayment Plans |

|---|---|---|---|

| Subsidized Stafford Loan | Variable, set annually by the government | Demonstrated financial need, enrollment at least half-time | Standard, graduated, extended, income-driven |

| Unsubsidized Stafford Loan | Variable, set annually by the government | Enrollment at least half-time | Standard, graduated, extended, income-driven |

| Parent PLUS Loan | Variable, set annually by the government; higher than Stafford Loans | Credit check, parent of a dependent undergraduate student | Standard, graduated, extended |

| Graduate PLUS Loan | Variable, set annually by the government; higher than Stafford Loans | Credit check, graduate or professional student | Standard, graduated, extended |

| Perkins Loan | Fixed, low rate set by the government | Exceptional financial need, institutional eligibility | Standard, graduated, extended |

Applying for Federal Student Aid

Securing federal student aid is a crucial step in financing your higher education. The process, while seemingly complex, is manageable with careful planning and attention to detail. Understanding the steps involved and gathering necessary information beforehand significantly streamlines the application.

The primary vehicle for applying for federal student aid is the Free Application for Federal Student Aid, or FAFSA. This application collects information about your financial situation and uses it to determine your eligibility for various federal aid programs. Submitting a complete and accurate FAFSA is essential to receiving the maximum financial aid you qualify for.

The FAFSA Application Process

The FAFSA application process involves several key steps. First, you’ll need to create an FSA ID, a username and password that you’ll use to access your FAFSA application and other federal student aid websites. Next, you’ll gather the necessary information, including your Social Security number, tax information, and your parents’ tax information (if you are a dependent student). You will then carefully complete the online FAFSA form, ensuring accuracy in every field. After submitting the form, you’ll receive a Student Aid Report (SAR) which confirms the information you provided. Finally, you’ll need to monitor your application status and communicate with your chosen schools regarding your financial aid package.

Tips for Completing the FAFSA Accurately and Efficiently

Completing the FAFSA accurately and efficiently requires careful preparation and attention to detail. Begin by gathering all necessary tax documents well in advance of the application deadline. Double-check all entered information for accuracy, particularly Social Security numbers and tax information. Utilize the FAFSA’s online help features and resources if you encounter any questions or uncertainties. Consider using tax software to help gather and organize your financial information. Submitting your FAFSA early avoids potential processing delays and allows you ample time to address any issues or requests for further information. Keep a copy of your completed FAFSA for your records.

Required Documents for the FAFSA Application

Having the necessary documents readily available significantly simplifies the FAFSA application process. A checklist should include your Social Security number, your driver’s license or state identification card, your federal income tax returns (IRS Form 1040), your parents’ federal income tax returns (if you are a dependent student), and your Alien Registration Number (if applicable). Also, gather W-2 forms, records of untaxed income (such as child support), and bank statements. If you are a dependent student, you will need similar documentation for your parents. Keep in mind that the specific documents required may vary slightly depending on your individual circumstances. Preparing these documents in advance will allow for a smoother and more efficient FAFSA completion.

Understanding Loan Repayment

Successfully navigating student loan repayment is crucial for your financial well-being. Understanding the various repayment options and the potential consequences of defaulting are key to responsible loan management. This section will Artikel different repayment plans and the serious repercussions of failing to meet your repayment obligations.

Federal Student Loan Repayment Plans

Several repayment plans are available for federal student loans, each designed to cater to different financial situations and income levels. Choosing the right plan can significantly impact your monthly payments and overall repayment timeline. The availability of specific plans may depend on your loan type and lender.

- Standard Repayment Plan: This is the default plan for most federal student loans. Payments are typically fixed and spread over a 10-year period. This plan offers a predictable payment schedule, but monthly payments might be higher compared to income-driven repayment plans.

- Graduated Repayment Plan: Payments start low and gradually increase over time, typically every two years. This can ease the burden initially, but payments become substantially larger in later years.

- Extended Repayment Plan: This plan extends the repayment period beyond 10 years, lowering your monthly payment. However, you’ll pay more in interest over the life of the loan.

- Income-Driven Repayment (IDR) Plans: These plans (such as ICR, PAYE, REPAYE, and IBR) base your monthly payment on your income and family size. Your payments will be lower, but the repayment period could be extended to 20 or 25 years. Remaining loan balance may be forgiven after a specified period, but this forgiveness is considered taxable income.

Consequences of Defaulting on Federal Student Loans

Defaulting on your federal student loans has severe financial consequences. These consequences can significantly impact your credit score and future financial opportunities.

- Damaged Credit Score: A default will drastically lower your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future.

- Wage Garnishment: The government can garnish your wages to recover the defaulted loan amount. This means a portion of your paycheck will be directly deducted to repay the debt.

- Tax Refund Offset: Your federal and state tax refunds can be seized to repay the debt.

- Difficulty Obtaining Federal Benefits: Defaulting can impact your eligibility for federal benefits and programs.

- Collection Fees and Penalties: You’ll incur additional fees and penalties on top of the original loan amount.

Sample Repayment Schedule

This example demonstrates a simplified repayment schedule for a $30,000 federal student loan with a 5% interest rate under the standard 10-year repayment plan. Actual payments may vary based on interest rates and loan terms.

| Year | Beginning Balance | Annual Payment | Interest Paid | Principal Paid | Ending Balance |

|---|---|---|---|---|---|

| 1 | $30,000 | $3,762 | $1,500 | $2,262 | $27,738 |

| 2 | $27,738 | $3,762 | $1,387 | $2,375 | $25,363 |

| 3 | $25,363 | $3,762 | $1,268 | $2,494 | $22,869 |

| … | … | … | … | … | … |

| 10 | … | $3,762 | … | … | $0 |

Note: This is a simplified example. Actual repayment schedules will vary depending on the loan amount, interest rate, and repayment plan chosen. It is crucial to consult your loan servicer for a personalized repayment schedule.

Federal Student Loan Forgiveness Programs

Navigating the complexities of federal student loan repayment can be daunting, but understanding the available forgiveness programs is crucial for borrowers seeking relief. Several programs offer the possibility of partial or complete loan forgiveness based on specific criteria. These programs are designed to assist borrowers facing significant financial hardship or who have dedicated their careers to public service.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program is designed to forgive the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. Eligibility requires employment by a qualifying employer, consolidation of your federal student loans into a Direct Consolidation Loan, and consistent payments under an income-driven repayment plan. Failure to meet these requirements can result in ineligibility for forgiveness. The program’s intricacies necessitate careful planning and adherence to strict guidelines.

Teacher Loan Forgiveness Program

This program offers forgiveness of up to $17,500 on your federal student loans if you teach full-time for five complete and consecutive academic years in a low-income school or educational service agency. To qualify, you must have received a Direct Subsidized or Unsubsidized Loan, a Federal Stafford Loan, or a Federal Consolidation Loan. You must also meet specific requirements related to teaching location and the type of school or agency where you work. Verification of employment and service is essential for successful application.

Income-Driven Repayment (IDR) Plans and Forgiveness

Several income-driven repayment (IDR) plans, such as the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE) plans, offer the possibility of loan forgiveness after a set number of years, typically 20 or 25, depending on the plan. The remaining loan balance may be forgiven if you have made qualifying payments for the required duration. However, the forgiven amount is considered taxable income. Eligibility is based on income and family size, and consistent payments are crucial for reaching loan forgiveness.

Application Process Flowchart: Public Service Loan Forgiveness (PSLF)

A flowchart illustrating the PSLF application process would begin with the applicant verifying their eligibility (employment with a qualifying employer, consolidation into a Direct Consolidation Loan, and enrollment in an income-driven repayment plan). This would be followed by the applicant submitting the PSLF application form and required documentation (employment verification, loan details). The application is then reviewed by the Federal Student Aid processor. If approved, the applicant continues making qualifying payments. After 120 qualifying payments, the applicant reapplies for forgiveness. Upon final approval, the remaining loan balance is forgiven. If rejected at any stage, the applicant may appeal or seek assistance to address the identified deficiencies. The process is iterative and requires ongoing engagement and meticulous record-keeping.

Managing Student Loan Debt

Successfully navigating student loan debt requires proactive planning and consistent effort. Understanding your repayment options, budgeting effectively, and utilizing available resources are crucial steps in managing your loans responsibly and minimizing long-term financial strain. This section provides strategies and resources to help you develop a personalized plan for repayment.

Effective management of student loan debt hinges on a combination of careful budgeting and strategic planning. Creating a realistic budget that accounts for all income and expenses is the first critical step. This allows you to determine how much you can comfortably allocate towards your loan payments each month without compromising other essential needs.

Budgeting Strategies for Student Loan Repayment

Developing a comprehensive budget is paramount to successful student loan repayment. This involves carefully tracking all income sources and expenses, identifying areas where spending can be reduced, and prioritizing loan payments. A sample budget might include categories such as housing, transportation, food, utilities, loan payments, and entertainment. By meticulously monitoring spending and adjusting as needed, you can ensure consistent loan payments and avoid accumulating additional debt. Consider using budgeting apps or spreadsheets to simplify the process and track your progress. Remember, unexpected expenses should also be factored into your budget, creating a buffer for unforeseen circumstances.

Available Resources for Student Loan Management

Numerous resources are available to assist borrowers in managing their student loans effectively. The Federal Student Aid website (studentaid.gov) offers a wealth of information on repayment plans, loan forgiveness programs, and other relevant resources. Additionally, many non-profit organizations and credit counseling agencies provide free or low-cost guidance on managing student loan debt. These organizations can offer personalized advice tailored to your specific financial situation and help you navigate complex repayment options. Your loan servicer is another valuable resource, providing information about your specific loans, payment options, and any available assistance programs.

Creating a Personal Student Loan Repayment Plan

A personalized repayment plan is essential for effectively managing your student loan debt. This plan should Artikel your repayment strategy, including the type of repayment plan you’ve chosen (standard, graduated, income-driven, etc.), your monthly payment amount, and your anticipated repayment timeline. It’s crucial to consider your current financial situation, income projections, and long-term financial goals when developing this plan. For example, a borrower with a lower income might opt for an income-driven repayment plan, while a borrower with a higher income might choose a standard repayment plan to pay off their loans faster. Regularly reviewing and adjusting your plan as your circumstances change ensures it remains relevant and effective throughout the repayment process. Consider consulting a financial advisor for personalized guidance in creating a comprehensive repayment plan.

The Impact of Federal Student Aid on Higher Education

Federal student aid plays a crucial role in shaping the landscape of higher education in the United States. By providing financial assistance to millions of students, it significantly increases access to college and university education, impacting not only individual lives but also the nation’s economic prosperity and social mobility. Without substantial federal support, many aspiring students would be unable to afford the costs associated with pursuing higher education.

Federal student aid’s impact on accessibility is undeniable. It allows students from diverse socioeconomic backgrounds, including low-income families and first-generation college students, to pursue higher education opportunities that might otherwise be unattainable. This increased access leads to a more diverse and representative student body across various institutions, enriching the learning environment and fostering innovation. The availability of grants, loans, and work-study programs levels the playing field, enabling individuals to focus on their studies rather than being overwhelmed by financial burdens.

Differential Impact of Federal Student Aid Across Demographics

The impact of federal student aid varies significantly across different demographic groups. While it undeniably expands access for many, disparities persist. Studies consistently show that students from lower socioeconomic backgrounds and minority groups often face greater challenges in navigating the financial aid system and accumulating higher levels of student loan debt compared to their more affluent peers. This disparity can be attributed to several factors, including limited awareness of financial aid opportunities, complex application processes, and a lack of access to adequate financial literacy resources. For instance, research indicates that Black and Hispanic students are disproportionately more likely to borrow larger loan amounts and experience higher rates of loan default compared to white students. This highlights the need for targeted initiatives to improve financial aid access and support for underserved populations.

Long-Term Effects of Student Loan Debt on Individuals and the Economy

The accumulation of student loan debt has profound and long-lasting consequences for individuals and the broader economy. High levels of debt can significantly impact post-graduation life choices, delaying major life milestones such as homeownership, marriage, and starting a family. Furthermore, the burden of repayment can constrain career choices, potentially pushing graduates towards higher-paying but less fulfilling jobs, rather than pursuing careers aligned with their passions or societal needs. On a macroeconomic level, high student loan debt can stifle economic growth by reducing consumer spending and hindering entrepreneurial activity. The weight of repayment obligations can limit individuals’ ability to invest in businesses, purchase homes, or contribute to the overall economy. For example, the rise in student loan debt has been linked to decreased homeownership rates among young adults, impacting the housing market and overall economic activity. Moreover, high default rates on student loans place a significant burden on taxpayers, as the government is forced to cover losses incurred by lenders.

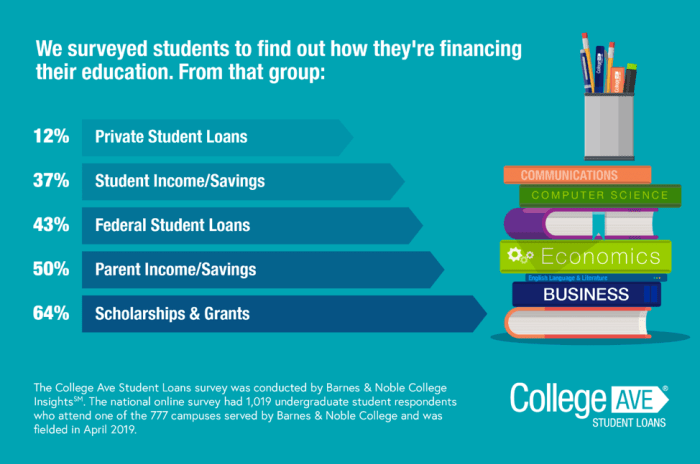

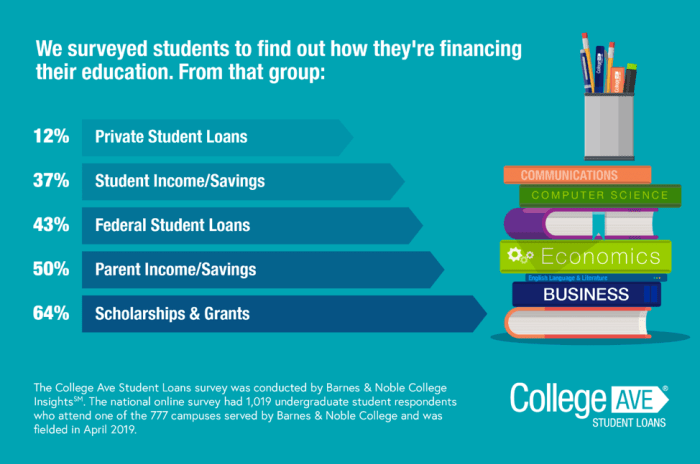

Alternatives to Federal Student Loans

Securing funding for higher education involves exploring options beyond federal student loans. While federal loans offer a readily accessible pathway, understanding alternative funding sources is crucial for minimizing long-term debt and maximizing financial aid opportunities. These alternatives can significantly reduce reliance on loans, potentially leading to greater financial freedom after graduation.

Exploring alternative funding options can involve a significant amount of research and effort, but the potential payoff in reduced debt and increased financial flexibility makes it a worthwhile endeavor. Many students successfully navigate the financial landscape of higher education using a combination of federal aid and these supplementary funding mechanisms.

Scholarships and Grants

Scholarships and grants represent a crucial element of non-loan-based financial aid. Unlike loans, they do not require repayment. Scholarships are typically awarded based on merit, talent, or specific achievements, while grants are often need-based. Numerous organizations, including colleges, universities, private foundations, and corporations, offer scholarships and grants to students pursuing higher education. A thorough search, utilizing online scholarship databases and networking with college financial aid offices, is essential for identifying suitable opportunities. Successful applicants often demonstrate a strong academic record, compelling personal narratives, and a clear articulation of their educational goals.

Comparison of Federal Student Loans and Alternative Funding

Federal student loans provide a reliable and accessible source of funding, but they come with the obligation of repayment, including interest accumulation. Alternative funding sources, such as scholarships and grants, offer a debt-free pathway to financing education. However, these alternatives are often more competitive to obtain and may not cover the full cost of tuition and expenses. The optimal approach often involves a combination of federal loans and alternative funding to create a balanced financial plan for higher education. For example, a student might secure a partial scholarship and then use federal loans to cover the remaining expenses, resulting in a smaller loan burden compared to relying solely on loans.

Funding Options and Application Processes

| Funding Option | Description | Application Process | Benefits | Drawbacks |

|---|---|---|---|---|

| Federal Student Loans | Loans provided by the federal government | Complete the FAFSA (Free Application for Federal Student Aid) | Accessible, relatively low interest rates (compared to private loans) | Requires repayment with interest, can lead to significant debt |

| Scholarships | Merit-based awards | Vary widely depending on the scholarship provider; typically involve applications and essays | No repayment required, can significantly reduce tuition costs | Highly competitive, requires significant effort to find and apply for |

| Grants | Need-based awards | Complete the FAFSA (Free Application for Federal Student Aid) | No repayment required, can help cover tuition and living expenses | Limited funding availability, eligibility requirements vary |

| Work-Study Programs | Part-time jobs offered through the college or university | Apply through the college’s financial aid office | Earns money to help pay for education, provides valuable work experience | Limited hours available, may not cover all expenses |

Current Trends and Issues in Federal Student Aid

The federal student loan system is currently navigating a complex landscape of rising tuition costs, evolving borrower demographics, and significant policy debates. These factors combine to create a dynamic environment characterized by both challenges and opportunities for reform. Understanding these trends and issues is crucial for policymakers, institutions of higher education, and prospective borrowers alike.

The increasing cost of higher education is a major driver of the current challenges. Tuition inflation has outpaced the rate of inflation for many years, leading to a substantial increase in student loan debt. This has resulted in longer repayment periods and, for some borrowers, an inability to manage their debt effectively. Simultaneously, the composition of the student loan borrower population is changing, with a growing number of older and non-traditional students seeking higher education and facing unique financial circumstances.

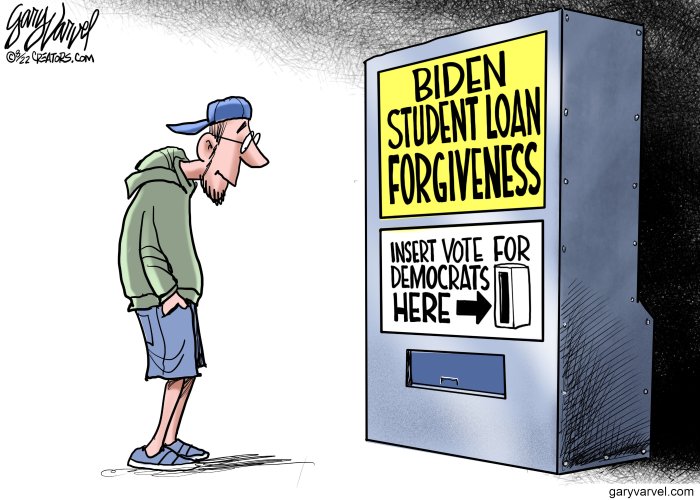

Student Loan Debt Relief and Reform Proposals

Numerous proposals for student loan debt relief and system reform are currently under consideration. These range from broad-based debt cancellation initiatives to more targeted approaches focused on specific borrower groups or loan types. Debates center around the economic impact of debt forgiveness, its fairness to taxpayers, and the potential long-term effects on the affordability and accessibility of higher education. For example, some proposals suggest targeted forgiveness for borrowers in specific fields like public service, while others advocate for more comprehensive reforms that address the root causes of rising tuition costs. The effectiveness of these proposals remains a subject of ongoing debate, with economic models offering differing projections of their impact.

The Political Climate Surrounding Student Loan Policy

The political climate surrounding student loan policy is highly partisan. Discussions often involve disagreements over the appropriate role of the federal government in higher education financing, the optimal balance between access and affordability, and the most effective mechanisms for addressing student loan debt. Different political ideologies hold contrasting views on the extent to which the government should intervene in the market for higher education, and the appropriate balance between public and private funding. These differing viewpoints often translate into contrasting policy proposals, leading to protracted legislative battles and uncertainty for borrowers. For instance, proposals for widespread debt forgiveness have faced significant political opposition, highlighting the complexities of navigating this issue within the current political landscape. The ongoing debate reflects fundamental disagreements on the role of government in addressing socioeconomic inequality and the long-term sustainability of the student loan system.

Conclusive Thoughts

Securing a higher education often involves leveraging federal student aid, a powerful tool that can unlock opportunities but also presents financial responsibilities. By understanding the various loan types, application processes, repayment options, and available resources, students can effectively manage their financial future. Remember to explore all available resources and plan strategically to minimize long-term debt burdens and maximize the benefits of federal student aid. Proactive planning and informed decision-making are key to success.

Query Resolution

What happens if I don’t repay my federal student loans?

Failure to repay your federal student loans can result in serious consequences, including damage to your credit score, wage garnishment, and tax refund offset.

Can I consolidate my federal student loans?

Yes, you can consolidate multiple federal student loans into a single loan with a potentially lower monthly payment. This simplifies repayment but may not always reduce the total interest paid.

Are there income-driven repayment plans available?

Yes, several income-driven repayment plans adjust your monthly payments based on your income and family size. These plans can lower your monthly payments, but may extend the repayment period.

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, and deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.