Navigating the world of student loans can feel overwhelming, especially when faced with the choice between fixed and variable interest rates. Understanding the implications of a fixed interest rate on your student loan debt is crucial for long-term financial planning. This guide will demystify the process, providing you with the knowledge to make informed decisions about your repayment strategy and ultimately, your financial future.

This exploration delves into the mechanics of fixed interest rates, highlighting their advantages and disadvantages compared to variable rates. We’ll examine how factors like credit history and loan type influence the interest rate you’ll receive, offering practical examples and strategies for managing your debt effectively. Ultimately, our aim is to empower you with the tools and information necessary to navigate this crucial aspect of student loan repayment confidently.

Understanding Fixed Interest Rates for Student Loans

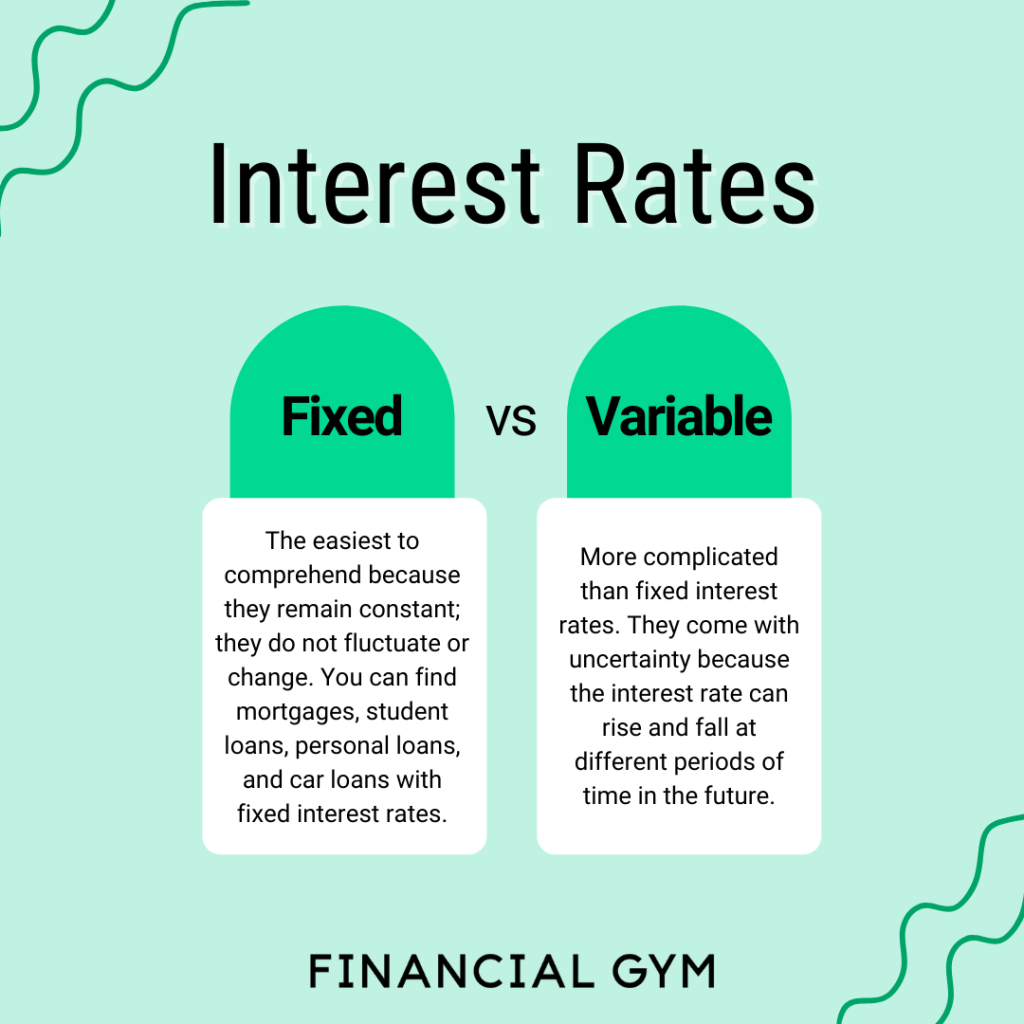

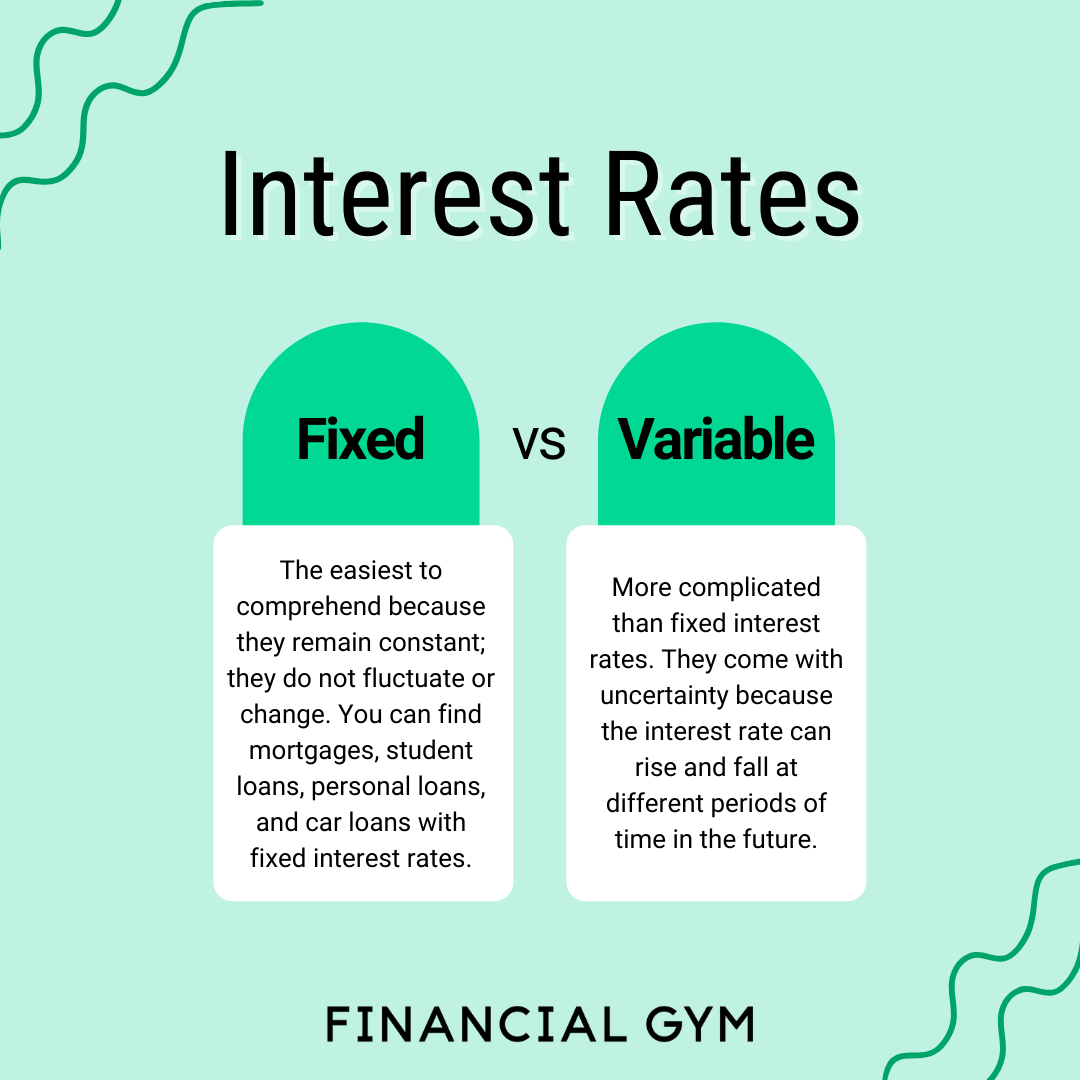

Choosing the right student loan is a crucial decision impacting your financial future. A key aspect to consider is the interest rate, specifically whether it’s fixed or variable. This section explains the mechanics of fixed interest rates and their advantages.

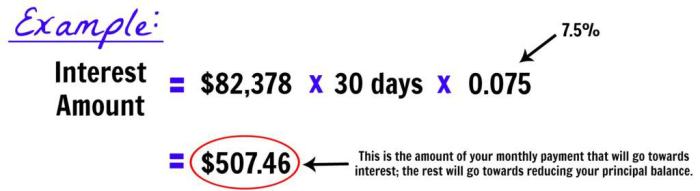

A fixed interest rate on a student loan means the interest rate remains constant throughout the loan’s repayment period. This rate is determined at the time you take out the loan and doesn’t fluctuate based on market conditions. The lender calculates your monthly payment based on this fixed rate, the loan principal (the original amount borrowed), and the loan term (the length of the repayment period). Each monthly payment consists of a portion applied to the principal and a portion covering the interest accrued. As you make payments, the principal balance decreases, and consequently, the portion of your payment allocated to interest also decreases over time.

Advantages of Fixed Interest Rates

Fixed interest rates offer significant advantages over variable rates, providing borrowers with predictability and financial stability. The primary benefit is the certainty it offers regarding monthly payments. Knowing your payment will remain consistent simplifies budgeting and long-term financial planning. This eliminates the risk of unexpected increases in your monthly payment due to market fluctuations, a risk inherent in variable-rate loans. Furthermore, a fixed rate can offer peace of mind, especially during periods of economic uncertainty.

Fixed Interest Rate Impact on Total Loan Repayment

The fixed interest rate directly impacts the total cost of your loan. A higher fixed interest rate will result in a higher total interest paid over the life of the loan. Conversely, a lower fixed interest rate will reduce the total interest paid.

For example, consider two scenarios: Scenario A involves a $20,000 student loan with a 5% fixed interest rate over 10 years. Scenario B involves the same loan amount but with a 7% fixed interest rate over the same period. While the monthly payment in Scenario B will be higher than in Scenario A, the difference in total interest paid over 10 years would be substantial, significantly increasing the overall cost of the loan in Scenario B. This difference highlights the importance of securing the lowest possible fixed interest rate.

Comparison of Fixed and Variable Interest Rates

The following table illustrates the potential differences between fixed and variable interest rates on student loans. Note that these are illustrative examples, and actual rates and payments will vary depending on the lender, loan terms, and prevailing market conditions.

| Loan Amount | Interest Rate Type | Monthly Payment (Estimate) | Total Interest Paid (Estimate) |

|---|---|---|---|

| $20,000 | Fixed (5%) | $212.74 | $4,529.60 |

| $20,000 | Variable (Initial Rate 4%, Potential Increase to 7%) | $202.86 (Initial), Potentially Higher | Potentially Higher than $4,529.60 |

Factors Influencing Fixed Interest Rates

Securing a student loan with a favorable fixed interest rate is crucial for managing long-term repayment costs. Several interconnected factors influence the interest rate you’ll receive, impacting your overall borrowing experience. Understanding these factors empowers you to make informed decisions and potentially negotiate better terms.

Several key factors determine the fixed interest rate applied to your student loan. These factors work in concert to establish the final rate, and understanding their individual roles provides clarity on the overall process.

Credit History’s Influence on Interest Rates

A strong credit history significantly improves your chances of securing a lower fixed interest rate on student loans. Lenders view a positive credit history—demonstrated through consistent on-time payments, low credit utilization, and minimal negative marks—as an indicator of responsible financial behavior. Individuals with excellent credit scores often qualify for the most competitive interest rates, while those with limited or poor credit history may face higher rates or even loan denials. For example, a borrower with a FICO score above 750 might qualify for a rate several percentage points lower than a borrower with a score below 600. This difference can translate to substantial savings over the loan’s repayment period.

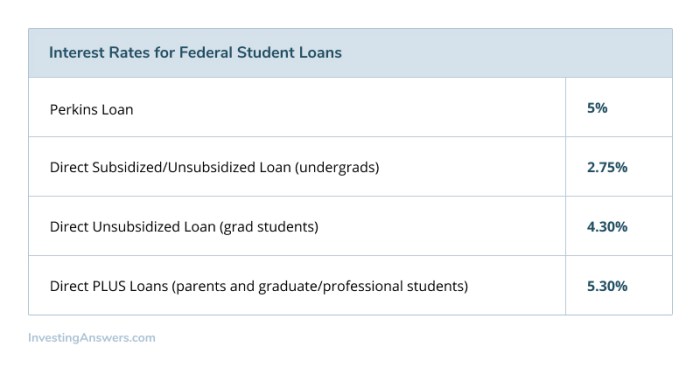

Loan Type: Federal vs. Private

The type of student loan—federal or private—substantially impacts the interest rate. Federal student loans generally offer fixed interest rates set by the government, which are typically lower than those offered by private lenders. These rates are influenced by prevailing market conditions but tend to be more predictable and stable. Private student loans, on the other hand, are subject to more market fluctuations and are often based on the borrower’s creditworthiness. Consequently, private loan interest rates can vary widely among lenders and borrowers, sometimes exceeding those of federal loans, especially for borrowers with less-than-perfect credit.

Interest Rate Comparison Among Lenders

Interest rates for fixed-rate student loans vary significantly across different lenders. Private lenders, including banks, credit unions, and online lending platforms, each have their own lending criteria and rate structures. For instance, one lender might offer a lower rate to borrowers with high credit scores and co-signers, while another might prioritize borrowers with specific academic achievements. Comparing offers from multiple lenders is essential to secure the most favorable interest rate. This requires researching and comparing terms and conditions from various sources, paying close attention to fees, repayment options, and overall loan costs beyond the stated interest rate. It is crucial to compare the Annual Percentage Rate (APR) as it includes fees and other charges, offering a more holistic view of the true cost of borrowing.

Repayment Strategies with Fixed Interest Rates

Understanding how to manage your student loan repayment is crucial for long-term financial health. A fixed interest rate provides predictability, but strategic planning is still essential to minimize costs and accelerate debt elimination. This section Artikels various repayment strategies and resources to help you navigate this process effectively.

Sample Repayment Plan

Let’s illustrate a sample repayment plan for a $30,000 student loan with a 6% fixed annual interest rate. We’ll consider three common repayment options: Standard, Accelerated, and Income-Driven Repayment. Note that actual repayment amounts and timelines will vary based on your individual loan terms and lender.

| Repayment Plan | Monthly Payment (approx.) | Loan Term (years) | Total Interest Paid (approx.) |

|---|---|---|---|

| Standard (10-year) | $330 | 10 | $10,000 |

| Accelerated (5-year) | $600 | 5 | $5,000 |

| Income-Driven (Variable) | Variable (based on income) | 20-25 | Variable (potentially higher) |

This table demonstrates that while an accelerated plan requires higher monthly payments, it significantly reduces the total interest paid over the life of the loan. Income-driven repayment plans offer lower monthly payments but extend the repayment period, leading to potentially higher overall interest costs.

Strategies for Minimizing Interest Payments

Several strategies can help borrowers minimize interest payments on fixed-rate student loans. Making extra payments, even small ones, can significantly reduce the principal balance and shorten the repayment period. Another effective approach is to prioritize paying off higher-interest loans first. This is particularly beneficial if you have multiple student loans with varying interest rates. For example, if you have a loan with a 7% interest rate and another with a 4% interest rate, aggressively paying down the 7% loan first will save you more money in the long run.

Refinancing Options for Fixed-Rate Student Loans

Refinancing your student loans might be an option to lower your interest rate, especially if interest rates have decreased since you initially took out your loans. Refinancing involves obtaining a new loan from a different lender to pay off your existing student loans. Before refinancing, carefully compare offers from multiple lenders to ensure you secure the best possible interest rate and terms. Consider factors such as fees, repayment terms, and the lender’s reputation. However, remember that refinancing might not always be advantageous; it’s essential to weigh the potential benefits against any potential drawbacks.

Resources for Managing Student Loan Debt

Several resources can assist borrowers in managing their fixed-rate student loan debt effectively. The National Foundation for Credit Counseling (NFCC) provides free and low-cost credit counseling services, including guidance on student loan repayment strategies. Your loan servicer can also provide valuable information about your loan terms, repayment options, and available assistance programs. Finally, many online resources and financial advisors offer helpful tools and advice on student loan management. Exploring these options can empower borrowers to make informed decisions and develop effective repayment plans.

The Impact of Fixed Interest Rates on Long-Term Financial Planning

Understanding the implications of a fixed interest rate on your student loan is crucial for long-term financial success. A fixed rate provides predictability, allowing you to accurately budget and plan for the future, but it also means you’ll pay the same interest rate throughout the loan’s life, regardless of market fluctuations. This predictability, while beneficial, needs to be carefully considered within the context of your broader financial goals.

A fixed interest rate on your student loan directly impacts your ability to achieve significant long-term financial goals like homeownership and retirement. The consistent monthly payments, coupled with the accumulating interest, represent a significant outflow of funds. This outflow reduces the amount of disposable income available for savings, investments, and down payments on a house or contributions to retirement accounts. For example, a larger student loan balance with a higher interest rate could mean delaying homeownership by several years, or requiring a smaller, less desirable home. Similarly, it could significantly reduce the amount you can contribute to retirement savings, potentially impacting your retirement lifestyle.

Consequences of Missed or Late Payments on Fixed-Rate Student Loans

Failure to make timely payments on a fixed-rate student loan has serious consequences. Late payments immediately begin to negatively impact your credit score, making it more difficult and expensive to secure loans in the future, such as a mortgage or auto loan. Late payments can also lead to increased fees and penalties, adding to your overall debt burden. Lenders will view your payment history as a significant indicator of your creditworthiness, and consistent late payments will significantly reduce your chances of obtaining favorable loan terms. In some cases, lenders may even pursue legal action to recover the outstanding debt.

Effects of Defaulting on a Fixed-Rate Student Loan

Defaulting on a student loan, meaning failing to make payments for an extended period, has severe and long-lasting repercussions. Default results in an immediate and substantial drop in your credit score, making it extremely challenging to obtain credit for years to come. This can severely limit your options for securing housing, financing a car, or even obtaining a credit card. Furthermore, the government can garnish wages, seize tax refunds, and even pursue legal action to collect the debt. The impact of default can extend far beyond the financial realm, affecting your ability to secure employment in certain fields and potentially impacting your personal relationships.

Potential Financial Hardships from High Student Loan Interest Rates

High student loan interest rates can create significant financial strain. The compounding nature of interest means that the longer the loan takes to repay, the more interest accrues, leading to a substantially larger total repayment amount. This can significantly impact your ability to save for other goals.

The following are potential financial hardships resulting from high student loan interest rates:

- Difficulty saving for a down payment on a home.

- Inability to contribute adequately to retirement savings.

- Limited access to credit for other purchases or emergencies.

- Increased financial stress and anxiety.

- Reduced disposable income for daily living expenses.

- Potential need to delay major life events, such as marriage or starting a family.

Government Regulations and Fixed Interest Rates on Student Loans

Government regulations play a significant role in shaping the landscape of student loan interest rates, particularly for federal loans. These regulations influence not only the initial interest rate set but also the potential for rate adjustments over the life of the loan. Understanding this regulatory framework is crucial for borrowers to navigate the complexities of student loan repayment.

The federal government, through agencies like the Department of Education, directly influences the interest rates on federal student loans. These rates are often tied to market indices, such as the 10-year Treasury note, but are subject to legislative adjustments. Congress can pass laws that set specific interest rates or adjust the formula used to calculate them. This allows for some degree of control over the cost of borrowing for students, though market forces still exert a considerable influence.

Impact of Interest Rate Changes on Student Loan Debt Burden

Changes in student loan interest rates have a direct and substantial impact on the overall student loan debt burden. A rise in interest rates increases the total amount borrowers must repay, leading to higher monthly payments and a longer repayment period. Conversely, lower interest rates reduce the total cost of borrowing and can make repayment more manageable. This impact is magnified by the significant amount of outstanding student loan debt in many countries. For example, a 1% increase in the interest rate on a $50,000 loan could add thousands of dollars to the total repayment cost over the life of the loan, significantly affecting a borrower’s long-term financial well-being.

Potential Implications of Government Policies Related to Student Loan Interest Rates

Government policies related to student loan interest rates have far-reaching implications for individuals, the economy, and higher education. Policies that aim to keep interest rates low can increase access to higher education and reduce the financial burden on students. However, these policies can also lead to increased government spending and potential long-term budgetary challenges. Conversely, policies that allow interest rates to fluctuate with market conditions can reduce government subsidies but may make higher education less accessible for some borrowers. The government must carefully balance these competing considerations when formulating student loan interest rate policies. For instance, a sudden, significant increase in interest rates could trigger a surge in loan defaults, potentially impacting the financial stability of the government and the economy as a whole.

Visual Representation of Government Policies and Student Loan Interest Rates

A line graph could effectively illustrate the relationship between government policies and student loan interest rates over time. The horizontal axis would represent time (e.g., years), and the vertical axis would represent the interest rate (e.g., percentage). Different colored lines could represent different types of federal student loans (e.g., subsidized, unsubsidized). Key policy changes, such as legislative adjustments to interest rate formulas or the introduction of new loan programs, could be marked on the graph with annotations. The graph would likely show periods of relatively stable interest rates punctuated by sharp increases or decreases resulting from legislative action or significant shifts in market conditions. Trends could reveal the influence of economic factors, political priorities, and broader societal concerns on the cost of higher education.

Last Recap

Securing a favorable fixed interest rate on your student loans is a significant step towards responsible debt management. By understanding the factors that influence your rate, employing effective repayment strategies, and proactively planning for the long term, you can mitigate the financial burden of student loan debt and pave the way for a brighter financial future. Remember to utilize the available resources and seek professional advice when needed to navigate this important financial journey.

Quick FAQs

What happens if I miss a payment on a fixed-rate student loan?

Missing payments will negatively impact your credit score and may lead to late fees, increased interest charges, and even default, which has serious long-term financial consequences.

Can I refinance a fixed-rate student loan?

Yes, refinancing may be an option to lower your interest rate, potentially saving you money over the life of the loan. However, carefully compare offers from different lenders and understand the terms before refinancing.

How does a fixed interest rate differ from a variable interest rate?

A fixed interest rate remains constant throughout the loan term, providing predictable monthly payments. A variable rate fluctuates based on market conditions, leading to potentially unpredictable payments.

What are some resources available to help manage student loan debt?

Numerous resources exist, including government websites (like studentaid.gov), non-profit credit counseling agencies, and financial advisors specializing in student loan debt management.