Navigating the complex world of graduate school often requires significant financial planning. Securing funding is a crucial step, and understanding the various options available for student loans is paramount. This guide delves into the intricacies of student loans specifically designed for graduate students, offering a clear and concise overview of the process, from application to repayment. We’ll explore different loan types, eligibility requirements, interest rates, and repayment plans, equipping you with the knowledge to make informed decisions about your graduate education funding.

We will also examine alternative funding sources such as scholarships and grants, providing a comprehensive approach to financial planning for graduate studies. Understanding your options and developing a sound financial strategy is key to successfully managing your educational expenses and setting yourself up for a strong financial future post-graduation.

Types of Graduate Student Loans

Securing funding for graduate school often requires navigating the complexities of student loans. Understanding the different types of loans available, their associated costs, and eligibility criteria is crucial for making informed financial decisions. This section will Artikel the key distinctions between federal and private graduate student loans, emphasizing the nuances of subsidized and unsubsidized options and their respective application processes.

Federal vs. Private Graduate Student Loans

Federal and private graduate student loans offer distinct advantages and disadvantages. Federal loans generally offer more favorable terms and greater borrower protections, while private loans may provide access to larger loan amounts but often come with higher interest rates and less flexible repayment options. The following table summarizes key differences:

| Loan Type | Interest Rate | Repayment Options | Eligibility Requirements |

|---|---|---|---|

| Federal Graduate PLUS Loan | Variable; determined annually by the government. Generally higher than subsidized federal loans. | Standard repayment, extended repayment, graduated repayment, income-driven repayment plans (IDR). | U.S. citizenship or eligible non-citizen status; accepted into a graduate program; satisfactory credit history (for PLUS loans). |

| Private Graduate Student Loan | Variable or fixed; determined by the lender based on creditworthiness. Generally higher than federal loan rates. | Various options offered by lenders; may include standard, graduated, and interest-only repayment. | Credit history check; co-signer may be required; proof of enrollment in a graduate program. |

| Federal Direct Unsubsidized Loan | Variable; determined annually by the government. | Standard repayment, extended repayment, graduated repayment, income-driven repayment plans (IDR). | U.S. citizenship or eligible non-citizen status; accepted into a graduate program; maintain satisfactory academic progress. |

| Federal Direct Stafford Loan (Unsubsidized) | Variable; determined annually by the government. | Standard repayment, extended repayment, graduated repayment, income-driven repayment plans (IDR). | U.S. citizenship or eligible non-citizen status; accepted into a graduate program; maintain satisfactory academic progress. May have annual and aggregate borrowing limits. |

Subsidized vs. Unsubsidized Graduate Student Loans

A key distinction within federal loans lies between subsidized and unsubsidized options. Subsidized loans, generally unavailable at the graduate level, have interest payments covered by the government while the student is enrolled at least half-time and during grace periods. Unsubsidized loans, conversely, accrue interest from the time the loan is disbursed, regardless of enrollment status. This means that borrowers of unsubsidized loans will owe a larger total amount upon graduation. The interest on unsubsidized loans can be capitalized, meaning it is added to the principal loan balance, increasing the total amount owed.

Application Process for Federal Graduate Student Loans

The application process for federal graduate student loans begins with completing the Free Application for Federal Student Aid (FAFSA). After submitting the FAFSA, students will receive a Student Aid Report (SAR) summarizing their eligibility for federal aid. Eligible students can then accept the offered loans through their school’s financial aid office. For PLUS loans, a credit check is conducted, and applicants with adverse credit history may need a co-signer.

Application Process for Private Graduate Student Loans

Applying for private graduate student loans typically involves comparing offers from multiple lenders. The application process requires providing personal and financial information, including credit history, income, and enrollment status. Lenders will assess creditworthiness and determine the interest rate and loan terms. A co-signer may be necessary to secure a loan if the applicant’s credit history is insufficient. It is crucial to carefully review the terms and conditions before accepting a private loan.

Loan Eligibility and Requirements

Securing a graduate student loan hinges on several key factors that lenders carefully assess to determine your eligibility. Understanding these factors can significantly improve your chances of loan approval and help you navigate the application process effectively. Lenders aim to minimize their risk while providing access to funding for your education.

Lenders employ a multifaceted approach to evaluating loan applications. This involves a comprehensive review of your financial profile, academic standing, and creditworthiness. The process is designed to ensure responsible lending practices and protect both the lender and the borrower.

Credit History and Co-signers

A strong credit history significantly impacts loan approval. Lenders view a positive credit history, characterized by consistent on-time payments and low credit utilization, as an indicator of responsible financial behavior. A favorable credit score increases your likelihood of approval and often results in more favorable interest rates. Conversely, a poor credit history, marked by late payments, defaults, or high debt levels, may make it challenging to secure a loan without a co-signer.

Co-signers play a crucial role for applicants with limited or damaged credit. A co-signer, typically a parent or other financially responsible individual, agrees to repay the loan if the borrower defaults. Their strong credit history essentially mitigates the lender’s risk. However, it’s important to note that involving a co-signer creates a shared financial responsibility, potentially impacting both parties’ credit scores. For example, if the borrower defaults, the co-signer’s credit score will be negatively affected.

Required Documents for Graduate Student Loan Applications

The specific documents required may vary slightly between lenders, but several are consistently requested. Providing complete and accurate documentation expedites the application process and demonstrates your commitment to responsible borrowing.

Generally, lenders require the following:

- Completed Loan Application: This form collects personal and financial information, including contact details, education history, and employment information.

- Proof of Enrollment: Acceptance letter from your graduate program, along with current transcripts demonstrating satisfactory academic standing.

- Federal Student Aid ID (FSA ID): This is a crucial identifier for accessing and managing your federal student aid information.

- Credit Report: Lenders will review your credit history to assess your creditworthiness. A higher credit score generally improves your chances of approval and secures better interest rates.

- Tax Returns (or other proof of income): Documentation of your income, which helps lenders determine your repayment capacity.

- Bank Statements: These provide evidence of your financial stability and ability to manage funds.

- Co-signer Information (if applicable): If using a co-signer, their personal and financial information, including their credit report and tax returns, will be required.

Interest Rates and Repayment Plans

Understanding the interest rates and repayment options for your graduate student loans is crucial for effective financial planning. These factors significantly impact the total cost of your education and your post-graduation financial burden. Careful consideration of these elements will help you make informed decisions about borrowing and repayment.

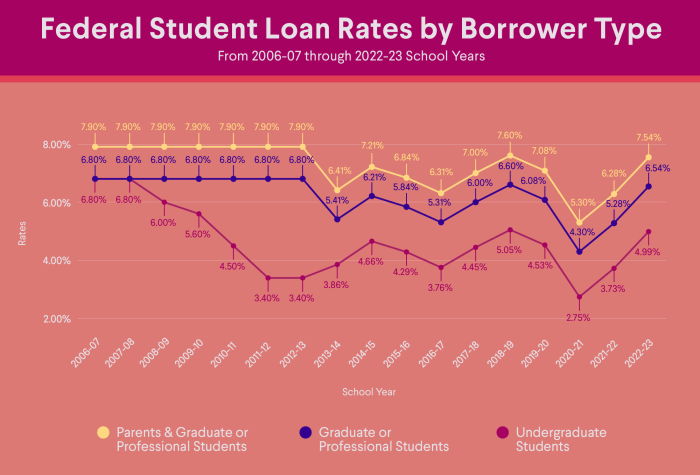

Graduate student loan interest rates are variable and depend on several factors. The primary determinant is usually the prevailing market interest rates at the time the loan is disbursed. This means rates can fluctuate, and the rate you receive might differ from those offered previously or subsequently. Other factors that influence the rate may include your credit history, the type of loan (federal versus private), and the lender’s specific policies. Federal graduate student loans often have lower interest rates than private loans due to government subsidies. It’s essential to compare offers from multiple lenders to secure the most favorable interest rate possible. Always check the loan’s terms and conditions carefully before accepting any loan offer.

Graduate Student Loan Repayment Plans

Several repayment plans are available to help graduate students manage their loan debt. Choosing the right plan depends on your individual financial situation and repayment preferences. Each plan offers a different approach to managing monthly payments and the overall repayment timeline.

- Standard Repayment Plan: This is the most common plan, requiring fixed monthly payments over a 10-year period. The payments are calculated based on the loan’s principal and interest rate.

- Graduated Repayment Plan: This plan features lower initial monthly payments that gradually increase over time. This can be helpful for recent graduates with potentially lower incomes in their early career years, but it ultimately leads to paying more interest over the life of the loan.

- Extended Repayment Plan: This plan stretches the repayment period beyond the standard 10 years, reducing monthly payments but increasing the total interest paid. It’s usually available for loans exceeding a certain amount.

- Income-Driven Repayment (IDR) Plans: These plans base your monthly payments on your income and family size. Several IDR plans exist, each with different eligibility requirements and payment calculation methods. They typically offer lower monthly payments but can result in longer repayment periods and higher overall interest costs. Examples include Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE).

Calculating the Total Cost of a Graduate Student Loan

Calculating the total cost of a graduate student loan involves understanding both the principal amount borrowed and the accumulated interest. Accurate calculation is vital for budgeting and long-term financial planning.

A simple way to estimate the total cost is to use an online loan amortization calculator. These calculators require inputting the loan amount, interest rate, and loan term. The output will show a detailed breakdown of monthly payments, total interest paid, and the total amount repaid over the loan’s lifetime.

For example, let’s say you borrow $50,000 at a 7% annual interest rate over a 10-year repayment period. Using a loan amortization calculator, you’d find the monthly payment, the total interest paid over 10 years, and the total amount repaid (principal + interest). The total repaid would significantly exceed the initial $50,000 borrowed due to the accumulated interest. Different interest rates and repayment terms would, of course, result in different total costs.

Loan Forgiveness and Deferment Options

Navigating the complexities of graduate student loans often involves understanding the possibilities of loan forgiveness and deferment. These options can significantly impact your repayment journey, offering potential relief or temporary pauses depending on your circumstances. Careful consideration of eligibility criteria and application processes is crucial.

Loan forgiveness programs offer the potential to eliminate a portion or all of your student loan debt. Eligibility requirements vary significantly depending on the specific program. Some programs target specific professions, such as teaching, public service, or healthcare, while others may be based on income or employment location. The application process typically involves demonstrating compliance with the program’s requirements, which may include maintaining employment in a qualifying field for a specified period, meeting certain income thresholds, or completing required service hours. It is vital to thoroughly research available programs and understand their specific criteria.

Loan Forgiveness Program Criteria

Several federal and state loan forgiveness programs exist, each with unique eligibility criteria. For example, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of federal Direct Loans after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. Other programs, such as the Teacher Loan Forgiveness program, target specific professions and have their own set of requirements. These programs often require detailed documentation of employment history, loan type, and repayment history to verify eligibility. The application process can be complex, and it’s advisable to seek guidance from your loan servicer or a financial aid professional.

Loan Deferment and Forbearance Application Process

Deferment and forbearance are temporary pauses in loan repayment. Deferment typically requires demonstrating financial hardship or enrollment in school, while forbearance is often granted based on temporary financial difficulty. The application process usually involves contacting your loan servicer and providing supporting documentation. This might include proof of enrollment, financial statements, or a letter explaining your circumstances. The approval process varies depending on the servicer and the type of deferment or forbearance requested. It’s important to note that interest may still accrue during deferment or forbearance periods, potentially increasing your overall loan balance.

Implications of Defaulting on a Graduate Student Loan

Defaulting on a graduate student loan has serious consequences. It can lead to damaged credit scores, wage garnishment, tax refund offset, and difficulty obtaining future loans. Furthermore, default can negatively impact your ability to secure employment, particularly in professions requiring security clearances or professional licenses. Recovering from a default is challenging and often requires significant effort to rehabilitate your credit and repay the outstanding debt with added fees and interest. It’s crucial to actively manage your loans and explore available options before reaching the point of default.

Budgeting and Financial Planning for Graduate Students with Loans

Managing finances during graduate school, especially while juggling student loan debt, requires careful planning and budgeting. A well-structured financial plan can significantly reduce stress and improve your long-term financial well-being. This section will Artikel a sample budget and provide a step-by-step guide to creating your own personalized financial plan.

Sample Graduate Student Budget

The following budget is an example and should be adjusted to reflect your individual income, expenses, and loan payments. Remember that unexpected expenses can arise, so building a small emergency fund is crucial.

| Income | Amount |

|---|---|

| Graduate Assistantship/Stipend | $2000 |

| Part-time Job Income | $1000 |

| Total Income | $3000 |

| Expenses | Amount |

| Rent | $1200 |

| Utilities (Electricity, Water, Internet) | $200 |

| Groceries | $300 |

| Transportation | $150 |

| Student Loan Payment | $300 |

| Books and Supplies | $100 |

| Personal Care | $50 |

| Entertainment/Social Activities | $100 |

| Savings/Emergency Fund | $200 |

| Total Expenses | $3000 |

Creating a Realistic Financial Plan

Developing a comprehensive financial plan requires a systematic approach. This plan should integrate your student loan repayment strategy into your overall financial goals.

- Track your income and expenses: Use budgeting apps, spreadsheets, or a notebook to meticulously record all your income and expenses for at least a month. This provides a clear picture of your current financial situation.

- Determine your loan repayment amount: Understand your loan terms, including interest rates and repayment plans. Prioritize high-interest loans for faster repayment to minimize long-term costs. Explore options like income-driven repayment plans if needed.

- Allocate funds for essential expenses: Prioritize housing, food, utilities, and transportation. Minimize non-essential expenses to free up funds for loan repayment and savings.

- Build an emergency fund: Aim for 3-6 months’ worth of living expenses in a readily accessible savings account. This acts as a safety net for unexpected costs, preventing you from falling behind on loan payments.

- Establish a loan repayment schedule: Create a realistic repayment plan that aligns with your budget. Consider making extra payments when possible to accelerate repayment and reduce interest costs.

- Review and adjust your plan regularly: Life circumstances change, so review your budget and financial plan at least once a quarter. Adjust your plan as needed to accommodate any changes in income or expenses.

Strategies for Minimizing the Impact of Student Loan Debt

Careful financial management can lessen the long-term effects of student loan debt. Strategies include aggressive repayment, investing wisely, and planning for future financial goals.

- Prioritize high-interest loans: Focus on paying down loans with the highest interest rates first to minimize the total interest paid over the life of the loans. This is often referred to as the avalanche method.

- Explore refinancing options: Refinancing might lower your interest rate, resulting in lower monthly payments and reduced total interest paid. However, carefully compare offers and ensure it aligns with your financial situation.

- Increase your income: Seek opportunities for additional income through part-time jobs, freelance work, or side hustles. This allows for larger loan payments and faster debt reduction.

- Save for retirement: Even with student loan debt, start saving for retirement early. Contribute to retirement accounts like 401(k)s or IRAs to take advantage of tax benefits and build long-term wealth.

- Plan for major purchases: Avoid taking on additional debt for major purchases like cars or homes until your student loans are under control. This prevents accumulating more debt and ensures financial stability.

Alternatives to Traditional Loans

Securing funding for graduate school can feel daunting, but thankfully, traditional loans aren’t the only option. Exploring alternative funding sources can significantly reduce your reliance on debt and potentially ease the financial burden of postgraduate studies. This section will Artikel various alternatives, compare them to loans, and provide resources to aid your search.

Many graduate students successfully fund their education without relying heavily on loans. By proactively seeking out and applying for these alternative funding options, you can potentially minimize your debt load and graduate with greater financial freedom.

Types of Alternative Funding

Several avenues exist beyond traditional student loans to finance your graduate education. These options can significantly reduce your reliance on borrowed funds, offering a more manageable financial future after graduation.

- Scholarships: Merit-based or need-based awards offered by universities, organizations, and private foundations. These are generally non-repayable and can cover tuition, fees, or living expenses.

- Grants: Similar to scholarships, grants are typically awarded based on financial need or specific criteria. They are usually provided by government agencies or private organizations and do not require repayment.

- Assistantships: These positions offer financial support in exchange for work within the university, such as teaching, research, or administrative assistance. Assistantships often include tuition waivers and a stipend.

- Fellowships: Prestigious awards, often highly competitive, provided by universities, professional organizations, or government agencies. These usually cover tuition and provide a living stipend.

Comparison of Traditional Loans and Alternative Funding

Understanding the key differences between traditional loans and alternative funding sources is crucial for making informed financial decisions. This comparison highlights the advantages and disadvantages of each approach.

| Feature | Traditional Loans | Alternative Funding (Scholarships, Grants, Assistantships) |

|---|---|---|

| Funding Source | Banks, credit unions, government programs | Universities, organizations, government agencies |

| Repayment | Required with interest | Generally not required |

| Impact on Credit | Affects credit score | No direct impact on credit score |

| Application Process | Relatively straightforward | Can be highly competitive |

| Availability | Widely available | Limited availability; requires research and application |

Resources for Finding Scholarships and Grants

Numerous resources exist to help graduate students locate and apply for scholarships and grants. These resources offer a centralized platform to search for funding opportunities based on your field of study, background, and financial need.

- University Financial Aid Offices: Your university’s financial aid office is a primary resource for information on internal scholarships and grants, as well as external opportunities.

- Federal Government Websites: Websites like the Federal Student Aid website (studentaid.gov) provide information on federal grant programs.

- Professional Organizations: Many professional organizations offer scholarships and grants to students pursuing graduate degrees in their respective fields.

- Private Scholarship Databases: Several online databases, such as Fastweb and Scholarships.com, compile information on a wide range of scholarships and grants.

Impact of Graduate Student Loans on Career Choices

The substantial debt incurred by many graduate students significantly impacts their career choices post-graduation. The pressure to repay loans often influences decisions regarding salary expectations, job location, and even the specific field of work. This can lead to compromises that may not align perfectly with individual passions or long-term career goals.

The weight of student loan debt can affect career decisions in several key ways. High loan balances might incentivize graduates to prioritize higher-paying jobs, even if those positions are less fulfilling or require relocation away from family and friends. Conversely, some graduates may choose careers they are passionate about, even if the salary is lower, accepting a longer repayment period and potentially increased financial strain. The decision-making process becomes a complex balancing act between financial security and personal fulfillment.

Strategies for Managing Student Loan Debt While Starting a Career

Effective management of student loan debt during the initial stages of a career is crucial. This requires careful budgeting, exploring repayment options, and potentially negotiating salary expectations. Creating a realistic budget that incorporates loan payments, living expenses, and savings goals is essential. Understanding different repayment plans, such as income-driven repayment (IDR) plans, which tie monthly payments to income, can significantly alleviate short-term financial pressure. Negotiating a higher starting salary can also make a substantial difference in the speed and ease of loan repayment. For example, a graduate with $100,000 in student loan debt might find a $70,000 job manageable with an IDR plan, but a $90,000 position would significantly reduce repayment time.

Career Paths Offering Better Opportunities for Repaying Student Loan Debt

Certain career paths inherently offer better prospects for faster student loan repayment due to higher earning potentials. High-demand fields like engineering, medicine, law, and finance often come with lucrative starting salaries. For instance, a software engineer graduating with significant debt might find their salary allows for aggressive repayment strategies, potentially paying off their loans within a few years. Conversely, careers in the non-profit sector or arts, while personally rewarding, often offer lower salaries, leading to potentially longer repayment periods. The choice between a financially stable, potentially less fulfilling career, and a personally rewarding but financially challenging one, is a personal decision heavily influenced by the burden of student loan debt.

Concluding Remarks

Successfully financing your graduate education requires careful consideration of numerous factors. This guide has provided a foundational understanding of student loans for graduate students, covering loan types, eligibility, repayment options, and alternative funding strategies. By thoughtfully weighing the advantages and disadvantages of each option, and proactively planning your finances, you can confidently pursue your graduate degree without undue financial burden. Remember to research specific lenders and programs to find the best fit for your individual circumstances.

Query Resolution

What is the difference between a subsidized and unsubsidized graduate student loan?

With subsidized loans, the government pays the interest while you’re in school (under certain conditions). Unsubsidized loans accrue interest from the time the loan is disbursed, even while you’re still studying.

Can I refinance my graduate student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, it’s important to compare offers carefully and understand the terms before refinancing.

What happens if I default on my graduate student loans?

Defaulting can have severe consequences, including damage to your credit score, wage garnishment, and tax refund offset. It’s crucial to contact your lender immediately if you’re struggling to make payments to explore options like deferment or forbearance.

How long does it take to get approved for a graduate student loan?

Processing times vary depending on the lender and the complexity of your application. It’s generally advisable to apply well in advance of needing the funds.