Navigating the complex world of higher education can be daunting, especially for low-income students. The dream of a college degree often clashes with the harsh reality of limited financial resources. Securing funding becomes a crucial first step, and understanding the landscape of student loans specifically designed for low-income individuals is paramount. This exploration delves into the eligibility criteria, available aid, repayment options, and long-term implications, empowering students to make informed decisions about their financial future.

This guide provides a comprehensive overview of student loan programs tailored to meet the needs of low-income students. We will examine various federal and state programs, highlighting key eligibility requirements, such as income thresholds and necessary documentation. We will also explore the diverse range of financial aid options beyond loans, including grants, scholarships, and work-study programs, emphasizing how these resources can significantly alleviate the financial burden.

Eligibility Requirements for Low-Income Student Loan Programs

Securing financial aid for higher education is a crucial step for many students, and understanding the eligibility requirements for low-income student loan programs is paramount. These programs aim to make college accessible to individuals who might otherwise face significant financial barriers. This section details the criteria for accessing these vital resources.

Federal Low-Income Student Loan Program Eligibility

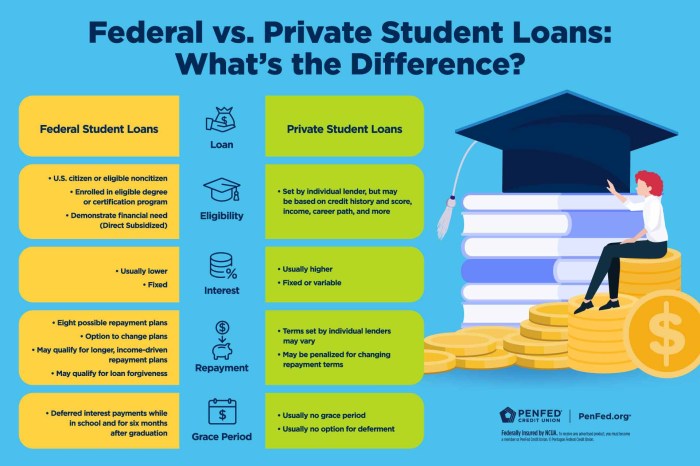

The federal government offers several loan programs designed to assist low-income students. Eligibility is primarily determined by demonstrated financial need, calculated using the Free Application for Federal Student Aid (FAFSA). The FAFSA considers factors such as parental income (if dependent), student income, assets, and family size. While there isn’t a specific “low-income” threshold published as a single number, a lower Expected Family Contribution (EFC) generally indicates greater financial need and thus higher eligibility for federal grants and subsidized loans. Supporting documentation includes tax returns, W-2s, and other income verification documents. Credit history is generally not a factor for federal student loans. Federal Pell Grants, for instance, are need-based and available to students with exceptional financial need, making them a cornerstone of federal aid for low-income students.

State Low-Income Student Loan Program Eligibility

State-sponsored loan programs vary considerably in their eligibility requirements. Each state establishes its own criteria, often reflecting its unique demographic and economic conditions. Some states may have specific income limits, while others might prioritize students from particular backgrounds or with specific academic goals. Eligibility often involves completing a state-specific application, which may include similar documentation to the FAFSA, such as tax returns and proof of residency. Some state programs might also consider credit history, although this is less common than income-based criteria. It’s crucial to check directly with the relevant state agency for precise eligibility requirements, as they can change frequently.

Comparison of Eligibility Criteria Across Programs

The eligibility criteria for low-income student loan programs differ significantly depending on the funding source (federal or state) and the specific program. Federal programs generally emphasize demonstrated financial need through the FAFSA, while state programs often incorporate additional factors such as residency requirements and potentially credit history. Understanding these nuances is critical for successful application.

| Program | Income Limits | Credit Score Requirement | Residency Restrictions |

|---|---|---|---|

| Federal Pell Grant | Based on FAFSA-calculated EFC; lower EFC indicates higher eligibility | None | US Citizenship or eligible non-citizen status |

| Federal Direct Subsidized Loan | Based on FAFSA-calculated EFC; lower EFC indicates higher eligibility | None | US Citizenship or eligible non-citizen status |

| California Grant (Example State Program) | Varies annually; based on family income and size; check California Student Aid Commission website for current limits | None | California residency |

Types of Financial Aid Available to Low-Income Students

Securing higher education shouldn’t be hindered by financial constraints. Numerous financial aid options exist specifically designed to support low-income students in pursuing their academic goals. Understanding these avenues is crucial for navigating the application process and maximizing available resources. This section details several key types of aid and their application procedures.

Navigating the financial aid landscape can seem daunting, but with careful planning and research, students can access a range of resources to fund their education. Federal grant programs, scholarships, and work-study opportunities all play vital roles in lessening the financial burden and making higher education attainable.

Federal Grant Programs for Low-Income Students

Several federal grant programs offer direct financial assistance to eligible low-income students. These grants don’t need to be repaid, unlike loans. The application process typically involves completing the Free Application for Federal Student Aid (FAFSA). Award amounts vary based on financial need and the specific program.

The Pell Grant is a prime example. It’s awarded to undergraduate students demonstrating exceptional financial need. The maximum Pell Grant award amount is determined annually by Congress and is adjusted based on factors like cost of attendance and expected family contribution (EFC). Students apply for Pell Grants by completing the FAFSA. The Department of Education then determines eligibility and the award amount. Another example is the Federal Supplemental Educational Opportunity Grant (FSEOG), which provides additional grant aid to undergraduate students with exceptional financial need. Similar to the Pell Grant, eligibility is determined through the FAFSA, prioritizing students with the lowest EFC.

The Role of Scholarships in Reducing Loan Burden

Scholarships represent another significant source of financial aid for low-income students. Unlike grants, which are typically need-based and awarded by government agencies, scholarships can be merit-based, need-based, or based on specific criteria such as ethnicity, major, or extracurricular involvement. Numerous organizations, including colleges, universities, private foundations, and corporations, offer scholarships. The application processes vary widely, often involving essays, transcripts, and letters of recommendation. Securing scholarships can significantly reduce reliance on loans, alleviating long-term financial stress after graduation. For instance, a student receiving a $5,000 scholarship would have $5,000 less in student loan debt to repay after graduation.

Types of Financial Aid

Understanding the various types of financial aid available is essential for effective financial planning. Each option offers a different approach to funding education, and a combination of these options is often necessary to cover the full cost.

- Grants: Federal and state grants, as well as grants from private organizations, provide money that does not need to be repaid. Eligibility is typically based on financial need.

- Scholarships: These awards are usually based on merit, talent, or specific criteria, and they do not require repayment.

- Work-Study Programs: These federally funded programs allow students to work part-time jobs on campus to earn money for educational expenses.

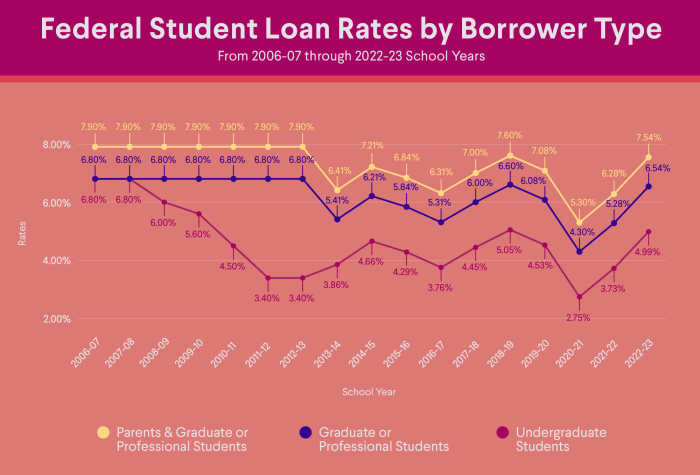

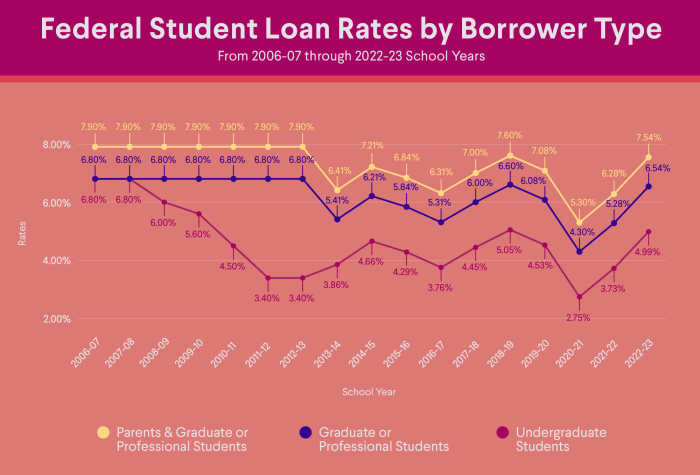

- Loans: Federal and private student loans provide money that must be repaid with interest after graduation. There are various loan programs with different repayment options and interest rates.

Repayment Options and Forgiveness Programs

Navigating student loan repayment can be challenging, especially for low-income borrowers. Fortunately, several repayment options and forgiveness programs exist to make the process more manageable and potentially eliminate debt entirely. Understanding these options is crucial for effective financial planning.

Income-driven repayment plans are designed to make monthly payments more affordable by basing them on your income and family size. These plans offer lower monthly payments than standard repayment plans, potentially preventing delinquency and default. However, it’s important to understand that while payments are lower, the overall repayment period is typically longer, leading to a higher total amount paid over the life of the loan.

Income-Driven Repayment Plans

Several income-driven repayment (IDR) plans are available, each with its own calculation method and eligibility requirements. These include the Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR) plans. The specific plan that offers the lowest monthly payment will vary depending on individual circumstances. The key difference lies in how income and family size are factored into the monthly payment calculation. For example, REPAYE considers both undergraduate and graduate loans, while IBR might only consider graduate loans in certain circumstances. Choosing the right plan requires careful consideration of your individual financial situation and long-term goals.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program offers complete loan forgiveness after 120 qualifying monthly payments under an income-driven repayment plan. To qualify, borrowers must work full-time for a qualifying government or non-profit organization. The application process involves carefully documenting employment and loan repayment history. It’s crucial to ensure that your loans are eligible for PSLF and that your payments are being correctly counted toward forgiveness. Failure to meet all requirements, even a single missed payment or incorrect loan type, can significantly impact eligibility. Therefore, meticulous record-keeping and regular communication with your loan servicer are essential.

Comparison of Income-Driven Repayment Plans

| Plan | Payment Calculation | Maximum Repayment Period | Forgiveness Eligibility |

|---|---|---|---|

| Income-Based Repayment (IBR) | 10-15% of discretionary income | 25 years | Remaining balance forgiven after 25 years |

| Pay As You Earn (PAYE) | 10% of discretionary income | 20 years | Remaining balance forgiven after 20 years |

| Revised Pay As You Earn (REPAYE) | 10% of discretionary income | 20 or 25 years (depending on loan type) | Remaining balance forgiven after 20 or 25 years |

| Income-Contingent Repayment (ICR) | 20% of discretionary income, or a fixed payment amount | 25 years | Remaining balance forgiven after 25 years |

The Impact of Student Loans on Low-Income Families

Student loan debt presents significant challenges for low-income families, potentially hindering their long-term financial stability and impacting major life decisions. The burden of repayment can be overwhelming, diverting resources from essential needs and delaying or preventing the achievement of key financial milestones. Understanding these implications is crucial for developing effective strategies to support low-income students and families navigating the complexities of higher education financing.

The long-term financial implications of student loan debt for low-income families are substantial. Repayment obligations often consume a significant portion of monthly income, leaving little room for savings, investments, or addressing unexpected expenses. This can create a cycle of debt, making it difficult to build wealth and achieve financial security. The impact extends beyond individual finances, affecting family stability and future generations.

Homeownership Challenges

The high cost of student loan repayment significantly impacts the ability of low-income individuals to purchase a home. Mortgage lenders consider student loan debt when assessing creditworthiness, and high debt-to-income ratios can disqualify borrowers. Even if approved for a mortgage, the monthly payments combined with student loan repayments can create an unsustainable financial burden, potentially leading to foreclosure. For example, a family struggling to repay $500 per month in student loans might find it impossible to afford a mortgage payment, property taxes, and insurance, effectively barring them from homeownership, a cornerstone of financial stability for many families.

Delayed Major Life Decisions

Student loan debt frequently postpones major life decisions such as starting a family, pursuing further education, or changing careers. The financial strain of repayment can make it difficult to save for a down payment on a house, afford childcare, or invest in further training or education that could lead to higher-paying jobs. A young couple burdened with significant student loan debt might delay having children due to the increased financial strain, or forgo a career change, even if it offered better earning potential, due to the fear of accumulating more debt.

Impact on Future Financial Stability

Student loan debt can significantly impact the long-term financial stability of low-income individuals. High debt burdens can lead to credit score damage, hindering access to credit for purchasing a car, starting a business, or consolidating debt at a lower interest rate. The inability to save adequately for retirement can lead to financial insecurity in later life, increasing reliance on social security and potentially impacting the ability to provide for future generations. For instance, an individual struggling with student loan repayment may be unable to contribute to a retirement savings plan, leading to a significantly smaller nest egg during retirement and increased financial vulnerability.

Resources and Support for Low-Income Students

Navigating the complexities of higher education financing can be particularly challenging for low-income students. Fortunately, numerous resources and support systems are available to help them access financial aid, manage debt, and ultimately achieve their educational goals. Understanding these resources and implementing effective strategies is crucial for success.

Securing financial aid and managing student loan debt requires proactive planning and utilization of available support. This section will highlight key organizations, practical strategies, and online resources designed to assist low-income students in their financial journey through higher education.

Organizations Providing Financial Aid Counseling and Support

Several organizations and government agencies offer invaluable financial aid counseling and support services specifically tailored to low-income students. These services often include assistance with the FAFSA application process, scholarship searches, and debt management strategies. Effective utilization of these resources can significantly improve a student’s financial outlook.

- The National College Access Network (NCAN): NCAN is a non-profit organization dedicated to increasing access to and success in higher education for all students, with a particular focus on underserved populations. They provide resources and training for college access professionals, as well as direct support to students navigating the financial aid process. Their website offers numerous tools and guides, including FAFSA completion assistance and scholarship search engines.

- The United States Department of Education: The federal government, through the Department of Education, plays a significant role in providing financial aid to students. Their website offers comprehensive information on federal student aid programs, including grants, loans, and work-study opportunities. They also provide resources and tools to help students understand their repayment options and manage their debt.

- Sallie Mae: While a private company, Sallie Mae offers a range of resources for students, including financial aid planning tools, scholarship search engines, and articles on managing student loan debt. While their services are not exclusively for low-income students, they offer valuable information and resources that can benefit all students, including those from low-income backgrounds.

Practical Tips and Strategies for Managing Student Loan Debt

Effective management of student loan debt is paramount for long-term financial well-being. Low-income students often face unique challenges in this area, making proactive strategies even more crucial. Understanding repayment options and exploring available forgiveness programs are key components of responsible debt management.

- Create a Budget: Developing a realistic budget that tracks income and expenses is essential. This allows students to identify areas where they can reduce spending and allocate funds towards loan repayment.

- Explore Repayment Plans: Federal student loans offer various repayment plans, including income-driven repayment plans, which adjust monthly payments based on income and family size. These plans can significantly reduce monthly payments, making them more manageable for low-income borrowers.

- Prioritize High-Interest Loans: Focus on repaying loans with the highest interest rates first to minimize the total interest paid over the life of the loans. This strategy can save significant money in the long run.

- Consider Loan Consolidation: Consolidating multiple loans into a single loan can simplify repayment and potentially lower the overall interest rate. However, it’s crucial to carefully evaluate the terms of the consolidation loan before making a decision.

Online Resources for Student Loans and Financial Aid

The internet provides a wealth of information on student loans and financial aid. However, it’s important to utilize reliable sources to avoid misinformation. Several reputable websites offer comprehensive and accurate information to guide students through the financial aid process.

- Federal Student Aid (FSA): This website, run by the U.S. Department of Education, is the official source for information on federal student aid programs. It provides detailed information on eligibility requirements, application procedures, and repayment options.

- StudentAid.gov: This website is a portal for managing federal student loans. Students can access their loan information, make payments, and explore repayment options.

- NCAN (National College Access Network): As mentioned previously, NCAN’s website offers valuable resources and tools for navigating the financial aid process.

The Role of Education in Improving Socioeconomic Status

Higher education plays a crucial role in breaking the cycle of poverty and improving the long-term financial well-being of individuals from low-income backgrounds. Access to higher education equips individuals with the knowledge, skills, and credentials necessary to secure higher-paying jobs, leading to increased earning potential and improved quality of life. This, in turn, can positively impact their families and communities.

Higher education significantly enhances long-term financial prospects for low-income individuals. Studies consistently demonstrate a strong correlation between educational attainment and higher lifetime earnings. A college degree, for instance, often translates to a substantially higher median income compared to individuals with only a high school diploma. This increased earning power allows individuals to accumulate wealth, improve their living standards, and achieve greater financial security. Furthermore, higher education often opens doors to career advancement opportunities that would otherwise be inaccessible.

Challenges and Barriers to Higher Education Access for Low-Income Students

Numerous obstacles hinder low-income students from accessing and completing higher education. Financial constraints are a primary barrier, with tuition fees, living expenses, and other associated costs often posing insurmountable challenges. Many low-income students lack access to adequate financial aid, scholarships, or grants to cover these expenses. Additionally, these students may need to balance work and studies, leading to increased stress and potentially impacting academic performance. Furthermore, systemic inequalities within the education system, including disparities in access to quality K-12 education and limited college preparation resources, disproportionately affect low-income students. Finally, lack of awareness about financial aid opportunities and navigating the complex application processes can also present significant hurdles.

Visual Representation: Higher Education and Increased Earning Potential

Imagine a bar graph. The horizontal axis represents educational attainment levels: High School Diploma, Associate’s Degree, Bachelor’s Degree, and Graduate Degree. The vertical axis represents median annual income. The bar representing High School Diploma would be significantly shorter than the others, illustrating a lower median income. The bar for an Associate’s Degree would be taller, showing a noticeable increase in income. The bar for a Bachelor’s Degree would be even taller, reflecting a further substantial increase. Finally, the bar for a Graduate Degree would be the tallest, clearly demonstrating the highest median annual income. The graph visually represents the progressive increase in earning potential associated with higher levels of educational attainment, particularly beneficial for individuals from low-income backgrounds who might otherwise be trapped in a cycle of low wages. For example, the difference between the High School Diploma bar and the Bachelor’s Degree bar could be labeled with a percentage or dollar amount, highlighting the significant financial advantage gained through higher education. This visual clearly shows that even a modest increase in education levels can have a profound impact on long-term financial security.

Conclusive Thoughts

Securing a higher education while managing financial constraints requires careful planning and a thorough understanding of available resources. Low-income students face unique challenges, but with diligent research and strategic planning, accessing higher education and managing student loan debt becomes achievable. By leveraging the information provided in this guide, students can confidently navigate the complexities of financial aid, build a strong financial foundation, and achieve their academic and career aspirations.

Questions and Answers

What happens if my income changes during repayment?

Most income-driven repayment plans allow for adjustments based on changes in income. You’ll typically need to recertify your income annually or as required by the specific plan.

Can I consolidate my student loans?

Yes, consolidating federal student loans can simplify repayment by combining multiple loans into a single loan with one monthly payment. However, be aware that this may affect your interest rate and repayment term.

What if I can’t afford my student loan payments?

Contact your loan servicer immediately. They can help explore options such as deferment, forbearance, or an income-driven repayment plan to temporarily reduce or suspend your payments.

Are there any penalties for defaulting on student loans?

Yes, defaulting on federal student loans has serious consequences, including damage to your credit score, wage garnishment, and tax refund offset.