Pursuing a postgraduate degree often requires significant financial investment. Securing funding can be a crucial step in realizing academic aspirations. This guide explores the landscape of student loans specifically designed for postgraduate studies, offering insights into various loan types, eligibility criteria, repayment strategies, and alternative funding options. Understanding these financial tools empowers prospective students to make informed decisions and navigate the complexities of funding their advanced education.

We’ll delve into the specifics of different loan programs, comparing interest rates, repayment terms, and application processes across various countries. We will also discuss the importance of careful financial planning and budgeting to manage loan repayments effectively and minimize long-term debt burdens. Finally, we’ll examine alternative funding sources like scholarships and grants to help you create a comprehensive funding strategy for your postgraduate journey.

Types of Postgraduate Student Loans

Securing funding for postgraduate studies can be a significant hurdle, but various loan options exist to help aspiring students achieve their academic goals. The availability and specifics of these loans vary considerably depending on the country and the student’s circumstances. This section will explore several common types of postgraduate student loans, outlining their eligibility criteria, interest rates, repayment terms, and application processes.

Postgraduate Student Loan Options in the United Kingdom

The UK government offers postgraduate loans through the Postgraduate Master’s Loan scheme. This loan covers tuition fees and living costs for eligible students undertaking master’s degrees at participating universities. Eligibility is based on residency, course type, and household income. Interest accrues while studying and during the grace period, and repayment begins after graduation once income surpasses a certain threshold. The loan amount varies depending on the course and living costs in the student’s location. The Student Loans Company is the primary lender.

Postgraduate Student Loans in the United States

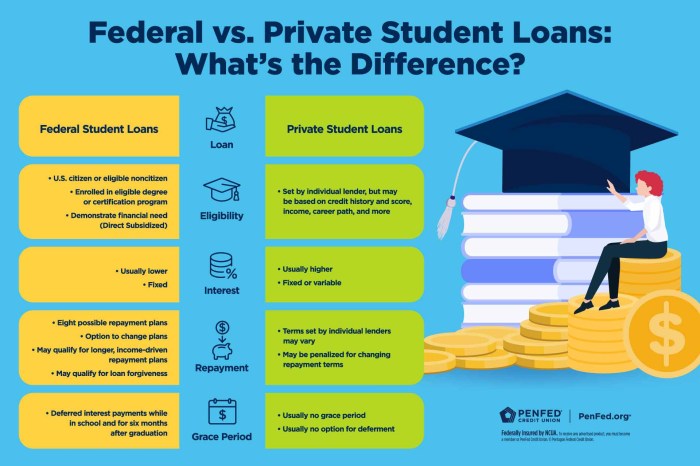

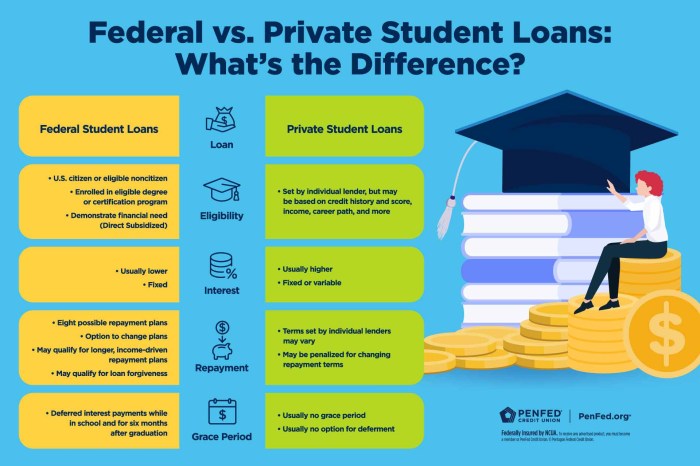

In the US, federal student loans are a common source of funding for postgraduate studies. These include Federal Direct Graduate PLUS Loans, which are available to graduate students regardless of credit history. Eligibility is determined by enrollment status and completion of the Free Application for Federal Student Aid (FAFSA). Interest rates are fixed, and repayment begins six months after graduation. Private lenders also offer postgraduate loans, often with variable interest rates and stricter eligibility requirements, including credit checks and co-signers. Loan amounts are usually capped at the total cost of attendance.

Postgraduate Student Loans in Canada

Canada’s system offers a range of options, including federal student loans and provincial loan programs. Eligibility criteria vary by province, but generally involve demonstrating financial need and enrollment in an eligible program. Interest rates differ based on the loan type and lender. Repayment usually begins after a grace period, typically six months after graduation. The Canada Student Loans Program is a key source of federal funding, while provincial programs offer additional support. The amounts available vary depending on financial need and the chosen program.

Postgraduate Student Loans in Australia

Similar to other countries, Australia provides postgraduate student loans through the government’s Higher Education Loan Program (HELP). These loans cover tuition fees and may include living expenses. Eligibility depends on residency status, course of study, and enrolment at a participating institution. Interest accrues while studying and during a grace period. Repayment begins once income surpasses a specified threshold. The Australian Taxation Office manages the repayment process. Loan amounts are determined by the cost of the chosen postgraduate program.

Comparison of Postgraduate Student Loan Features

| Loan Type | Country | Eligibility | Application Process |

|---|---|---|---|

| Postgraduate Master’s Loan | United Kingdom | Residency, course type, household income | Application through the Student Loans Company |

| Federal Direct Graduate PLUS Loan | United States | Enrollment status, FAFSA completion | Application through the National Student Loan Data System (NSLDS) |

| Canada Student Loans Program | Canada | Financial need, enrollment in eligible program (criteria vary by province) | Application through the relevant provincial student aid office |

| Higher Education Loan Program (HELP) | Australia | Residency status, course of study, enrollment at a participating institution | Application through the chosen university or institution |

Eligibility Criteria and Application Process

Securing a postgraduate student loan often involves navigating specific eligibility requirements and a structured application process. Understanding these aspects is crucial for a successful application. This section details the typical criteria and steps involved in obtaining funding for postgraduate studies.

Eligibility for postgraduate student loans varies depending on the lender and the specific loan program. However, several common factors consistently influence eligibility.

Eligibility Requirements for Postgraduate Student Loans

Generally, lenders assess several key factors to determine eligibility. These include academic standing, demonstrating a strong academic record is often a prerequisite. A minimum GPA or equivalent academic achievement is typically required. Furthermore, credit history plays a significant role; a good credit score demonstrates financial responsibility and reduces lender risk. Finally, citizenship or residency status is often a key consideration, with loans often restricted to citizens or permanent residents of the lending country. Some programs may also consider factors such as the applicant’s chosen field of study, the program’s cost, and the applicant’s demonstrated need for financial assistance. Specific requirements will be Artikeld by the lender.

Application Process for Postgraduate Student Loans

The application process for postgraduate student loans typically involves several key steps. This process can vary depending on the lender, but common elements include completing an online application form, providing supporting documentation, and undergoing a credit check.

Step-by-Step Guide for Applying for a Postgraduate Student Loan

A well-organized approach significantly increases the chances of a successful application. Here’s a step-by-step guide outlining the typical process:

- Research Loan Options: Begin by researching different lenders and loan programs to compare interest rates, repayment terms, and eligibility criteria. Consider factors such as government-backed loans, private loans, and institutional loans offered by your university.

- Check Eligibility Requirements: Carefully review the eligibility requirements of each loan program you’re considering. Ensure you meet all the criteria before proceeding with the application.

- Gather Required Documentation: Compile all necessary documents, including proof of enrollment, academic transcripts, tax returns, and identification. Having these readily available streamlines the application process.

- Complete the Application Form: Fill out the loan application form accurately and completely. Double-check all information for accuracy to avoid delays or rejection.

- Submit the Application: Submit your completed application form along with all supporting documentation. Follow the lender’s instructions carefully.

- Credit Check and Approval: The lender will review your application and conduct a credit check. The approval process can take several weeks or even months depending on the lender and the volume of applications.

- Loan Disbursement: Once approved, the loan funds will be disbursed according to the lender’s disbursement schedule. This usually coincides with the start of your academic program.

Repayment Options and Strategies

Successfully navigating postgraduate studies often involves significant financial planning. Understanding your repayment options and developing a robust repayment strategy is crucial to minimizing the long-term burden of student loan debt. This section Artikels various repayment plans and offers practical strategies to effectively manage your postgraduate loans.

Postgraduate student loan repayment options vary depending on the lender and the specific loan terms. However, common approaches include income-driven repayment plans and deferred repayment options. Understanding these options and their implications is key to making informed financial decisions.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) link your monthly payments to your income and family size. These plans typically offer lower monthly payments than standard repayment plans, but they often extend the repayment period, leading to potentially higher overall interest payments. Several IDR plans exist, each with its own eligibility criteria and calculation methods. For example, the Income-Based Repayment (IBR) plan, the Pay As You Earn (PAYE) plan, and the Revised Pay As You Earn (REPAYE) plan are common examples. Choosing the right IDR plan depends on your individual financial circumstances and long-term goals. It’s advisable to compare the different plans carefully before making a decision.

Deferred Repayment

Deferred repayment allows you to temporarily postpone your loan payments for a specified period. This option can be beneficial during periods of unemployment or financial hardship. However, interest may still accrue during the deferment period, increasing the total amount owed upon repayment commencement. The length of the deferment period and the terms of the repayment resumption are usually Artikeld in the loan agreement. It’s important to understand that while deferment provides temporary relief, it doesn’t eliminate the debt; it simply postpones it. Using this option wisely is crucial to avoid accumulating excessive interest.

Strategies for Managing and Repaying Postgraduate Student Loans

Effective loan management involves proactive planning and disciplined financial habits. Creating a realistic budget, prioritizing loan repayments, and exploring options for additional income are all crucial steps. Consider automating your loan payments to ensure timely repayments and avoid late payment fees. Furthermore, actively monitoring your loan balance and interest accrual will keep you informed about your progress and help you identify any potential issues early on. Seeking professional financial advice can also provide valuable guidance in developing a personalized repayment strategy.

Repayment Scenarios and Long-Term Financial Implications

The following table illustrates various repayment scenarios and their long-term financial implications. Note that these are simplified examples and actual results may vary depending on interest rates, loan amounts, and individual repayment plans.

| Repayment Plan | Monthly Payment | Repayment Period (Years) | Total Interest Paid |

|---|---|---|---|

| Standard Repayment | $500 | 10 | $10,000 |

| Income-Driven Repayment (IBR) | $300 | 15 | $15,000 |

| Deferred Repayment (2 years, then Standard) | $500 | 12 | $12,000 |

| Aggressive Repayment (Extra $100/month) | $600 | 8 | $7,000 |

Impact of Postgraduate Loans on Career Choices

The availability of postgraduate student loans significantly shapes students’ decisions regarding their postgraduate studies and subsequent career paths. Access to funding can open doors to otherwise unattainable programs, potentially leading to higher-earning careers. Conversely, the burden of substantial loan debt can influence choices towards programs with quicker returns on investment, potentially limiting career exploration. A careful assessment of both the potential benefits and drawbacks is crucial for prospective postgraduate students.

The decision to pursue a postgraduate degree often involves a complex interplay of factors, with financing playing a pivotal role. While loans provide access to education, they also introduce significant financial risk. The choice of postgraduate program and subsequent career path are often directly influenced by the anticipated salary and the feasibility of loan repayment. Students need to consider not only their academic aspirations but also the long-term financial implications.

Influence of Postgraduate Loans on Program Selection

Postgraduate loan availability directly impacts program selection. Students with access to sufficient funding may feel more comfortable pursuing programs with higher tuition fees or longer durations, potentially leading to careers with higher earning potential but also requiring a longer repayment period. Conversely, limited funding might force students to choose less expensive or shorter programs, potentially limiting career options. This is especially true for fields like law, medicine, and engineering, where higher tuition costs are often coupled with higher potential salaries. For example, a student with ample loan access might choose a two-year MBA program, while another student with limited funding might opt for a shorter, more affordable online master’s program.

Drawbacks and Benefits of Postgraduate Loan Debt

Taking on significant student loan debt for postgraduate education presents both benefits and drawbacks. A key benefit is the increased earning potential associated with advanced degrees, allowing graduates to repay their loans more readily. However, the substantial debt can create significant financial stress, potentially delaying major life decisions such as homeownership or starting a family. The risk of defaulting on loans is also a concern, potentially leading to negative credit scores and impacting future financial opportunities. Conversely, foregoing postgraduate education due to financial constraints might limit career advancement and earning potential.

Career Paths and Expected Salary Ranges

The feasibility of repaying postgraduate loans is directly linked to the chosen career path and its associated salary. The following examples illustrate the potential salary ranges for various career paths requiring postgraduate degrees. These ranges are approximate and can vary based on experience, location, and employer.

- Physician (MD/DO): Requires a medical degree (MD or DO) and residency. Expected salary range: $200,000 – $500,000+ annually. Loan repayment is typically feasible due to high earning potential, though repayment can still take many years.

- Lawyer (JD): Requires a Juris Doctor (JD) degree. Expected salary range: $60,000 – $200,000+ annually. Loan repayment feasibility varies significantly depending on specialization and location. High-paying corporate law firms offer higher salaries facilitating faster repayment.

- Software Engineer (MS): Requires a master’s degree in computer science or a related field. Expected salary range: $80,000 – $150,000+ annually. Loan repayment is generally feasible, especially in high-demand tech hubs.

- University Professor (PhD): Requires a doctoral degree (PhD). Expected salary range: $60,000 – $120,000+ annually. Loan repayment can be challenging depending on the institution and research funding.

Alternatives to Traditional Student Loans

Securing funding for postgraduate studies can be a significant hurdle. While student loans are a common route, exploring alternative financing options can lead to a more manageable debt burden or even eliminate the need for borrowing altogether. This section will examine several viable alternatives to traditional student loans, comparing their advantages and disadvantages to help you make an informed decision.

Several avenues exist beyond traditional student loans for funding postgraduate education. These alternatives offer varying levels of financial support and come with different application processes and requirements. Careful consideration of your individual circumstances and the specific opportunities available is crucial for successful funding.

Scholarships

Scholarships are merit-based awards that do not require repayment. They are often granted based on academic achievement, extracurricular involvement, or demonstrated financial need. Many scholarships are offered by universities, professional organizations, and private foundations. The application processes vary widely, but generally involve submitting an application, transcripts, and letters of recommendation. Funding amounts range significantly, from covering a small portion of tuition to fully funding a postgraduate degree. Securing a scholarship can significantly reduce or eliminate the need for student loans.

Grants

Similar to scholarships, grants are awarded based on merit or financial need and do not require repayment. However, grants are often more narrowly focused than scholarships, targeting specific fields of study, demographics, or research areas. Government agencies, non-profit organizations, and private foundations are common grant providers. Competition for grants can be fierce, and the application processes are often rigorous. Successful applicants may receive funding to cover tuition, fees, living expenses, or research costs.

Fellowships

Fellowships are typically awarded to advanced students pursuing research or professional development in a specific field. They often provide a stipend in addition to tuition coverage. Fellowships are highly competitive and are often awarded by universities, research institutions, and government agencies. Fellowship applications frequently require a detailed research proposal, letters of recommendation, and evidence of prior academic success. The funding amount varies widely depending on the fellowship and the institution providing it.

Assistantships

Assistantships involve working part-time for a university or research institution in exchange for tuition remission and a stipend. These positions often involve teaching, research, or administrative tasks. Assistantships can significantly reduce the financial burden of postgraduate studies while providing valuable professional experience. The availability of assistantships varies depending on the university and the specific department. Competition for assistantships can be high, especially in popular fields of study.

Comparison of Funding Options

The following table compares traditional student loans with alternative funding sources. Note that funding amounts and application processes can vary significantly depending on the specific program and institution.

| Funding Option | Funding Amount | Application Process | Repayment Required |

|---|---|---|---|

| Traditional Student Loan | Varies widely, potentially covering full tuition and living expenses | Application through lender, credit check often required | Yes, with interest |

| Scholarship | Varies widely, from partial to full tuition | Application to specific scholarship providers, often competitive | No |

| Grant | Varies widely, often covering specific expenses | Application to specific grant providers, often competitive | No |

| Fellowship | Often includes stipend and tuition coverage | Highly competitive application process, often requires research proposal | No |

| Assistantship | Tuition remission and stipend | Application to university department, often requires relevant skills/experience | No |

Financial Planning and Budgeting for Postgraduate Students

Pursuing a postgraduate degree is a significant investment, both academically and financially. Effective financial planning and budgeting are crucial for navigating the expenses associated with tuition, living costs, and loan repayments, ensuring a smoother and less stressful postgraduate experience. This section Artikels strategies for creating a realistic financial plan and managing your finances effectively throughout your studies and beyond.

Creating a comprehensive budget is the cornerstone of successful financial management for postgraduate students. This involves carefully estimating all income and expenses, allowing for unforeseen costs, and tracking spending regularly to stay on track. A well-structured budget can help avoid accumulating debt and promote financial stability during and after your studies.

Sample Postgraduate Student Budget

The following is a sample budget for a postgraduate student in a major metropolitan area. Remember that these figures are estimates and will vary significantly depending on location, lifestyle, and the specific program. This budget assumes a monthly income of $2,500 (part-time job or family support) and tuition fees are paid upfront. Adjust the figures to reflect your own circumstances.

| Category | Monthly Amount ($) |

|---|---|

| Tuition Fees (paid upfront) | 10000 (annual) |

| Rent | 1200 |

| Utilities (electricity, water, internet) | 200 |

| Groceries | 300 |

| Transportation | 150 |

| Books and Supplies | 100 |

| Healthcare | 50 |

| Personal Care | 50 |

| Entertainment and Social Activities | 200 |

| Loan Repayments (estimated) | 250 |

| Savings | 100 |

| Emergency Fund | 100 |

| Total Expenses | 2700 |

Creating a Realistic Financial Plan

Developing a realistic financial plan involves more than just creating a budget; it necessitates a long-term perspective, encompassing the entire duration of the postgraduate program and extending into the post-graduation phase. This involves proactive steps to manage expenses and loan repayments effectively.

- Set clear financial goals: Define short-term (e.g., covering monthly expenses) and long-term (e.g., paying off loans) goals. This provides focus and motivation.

- Track income and expenses meticulously: Use budgeting apps, spreadsheets, or notebooks to monitor your spending habits and identify areas for potential savings.

- Prioritize essential expenses: Focus on necessities like rent, food, and transportation before allocating funds to discretionary spending.

- Explore scholarship and grant opportunities: Actively seek additional funding to reduce your reliance on loans.

- Develop a loan repayment strategy: Understand your repayment options and choose a plan that aligns with your post-graduation income expectations. Consider strategies like accelerated repayment to minimize interest costs.

- Build an emergency fund: Set aside a portion of your income to cover unforeseen expenses, preventing unexpected debt accumulation.

- Seek financial guidance: Consult with a financial advisor to personalize your financial plan and receive tailored advice.

Effective Budgeting Techniques and Financial Management Strategies

Implementing effective budgeting techniques and financial management strategies is crucial for postgraduate students to maintain financial stability throughout their studies and beyond. These strategies are designed to help navigate the unique financial challenges faced during this period.

- The 50/30/20 rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-based budgeting: Allocate every dollar of your income to a specific expense category, ensuring that income equals expenses.

- Envelope system: Allocate cash to different expense categories in physical envelopes to track spending and prevent overspending.

- Regularly review and adjust your budget: Your financial situation may change over time, so it’s essential to review and adjust your budget periodically.

- Negotiate bills: Contact service providers to negotiate lower rates for utilities, internet, or phone services.

- Take advantage of student discounts: Many businesses offer discounts to students on various goods and services.

- Explore part-time job opportunities: Supplement your income with a part-time job to help cover expenses and reduce your reliance on loans.

Potential Risks and Challenges of Postgraduate Student Loans

Embarking on postgraduate studies often requires significant financial investment. While postgraduate degrees can enhance career prospects and earning potential, the substantial debt incurred through student loans presents potential risks and challenges that require careful consideration and proactive management. Understanding these risks is crucial for making informed decisions about financing your education.

Postgraduate student loans, while offering access to higher education, can lead to considerable financial strain if not managed responsibly. The potential for long-term financial repercussions underscores the importance of a well-defined borrowing strategy and a realistic understanding of repayment obligations.

Defaulting on Student Loan Repayments

Defaulting on student loan repayments has serious consequences. It can severely damage your credit score, making it difficult to secure loans, mortgages, or even rent an apartment in the future. Furthermore, default can lead to wage garnishment, tax refund offset, and even legal action. The impact extends beyond immediate financial hardship; it can hinder long-term financial stability and limit future opportunities. For example, a graduate might find their ability to purchase a home significantly impaired due to a poor credit rating stemming from loan default. This highlights the importance of meticulous planning and budgeting.

Long-Term Financial Strain

The burden of significant student loan debt can extend far beyond graduation. Monthly repayments can consume a substantial portion of your income, limiting your ability to save for other important life goals, such as purchasing a home, starting a family, or investing for retirement. A realistic budget, incorporating loan repayments alongside living expenses, is crucial. For instance, a graduate with a high loan balance might find it challenging to save for a down payment on a house, delaying this significant life milestone.

Understanding Loan Terms and Conditions

Before signing any student loan agreement, it is imperative to thoroughly understand the terms and conditions. This includes:

- The total amount borrowed.

- The interest rate and how it’s calculated (fixed vs. variable).

- The repayment period and schedule.

- Any fees or charges associated with the loan.

- The consequences of defaulting on the loan.

- Grace periods (if applicable) before repayment begins.

- Deferment or forbearance options in case of financial hardship.

Failing to understand these details can lead to unexpected costs and financial difficulties down the line. Carefully reviewing the loan agreement and seeking clarification on any unclear points is crucial before committing to the loan.

Strategies for Mitigating Risks

Several strategies can help mitigate the risks associated with postgraduate student loans:

- Borrow only what you need: Carefully assess your financial needs and explore all available funding options before borrowing the maximum amount possible.

- Explore alternative funding sources: Consider scholarships, grants, and part-time employment to reduce your reliance on loans.

- Create a realistic budget: Develop a detailed budget that incorporates loan repayments, living expenses, and other financial commitments.

- Choose a repayment plan that suits your circumstances: Research different repayment options and select the one that best aligns with your financial situation.

- Maintain good credit: A good credit score can help you secure better loan terms and interest rates in the future.

- Seek professional financial advice: Consult with a financial advisor to create a personalized financial plan and address any concerns.

Epilogue

Successfully navigating the financing of postgraduate education requires careful consideration of various factors. From understanding eligibility criteria and application processes to exploring alternative funding and developing effective repayment strategies, a well-informed approach is essential. By thoughtfully weighing the benefits and risks associated with student loans, and proactively exploring all available funding options, prospective postgraduate students can confidently pursue their academic goals while minimizing potential financial strain.

Essential Questionnaire

What is the average interest rate on postgraduate student loans?

Interest rates vary significantly depending on the lender, the loan type, and the country. It’s crucial to compare offers from multiple lenders to find the most favorable terms.

Can I consolidate my postgraduate student loans?

Loan consolidation may be an option, allowing you to combine multiple loans into a single payment. Check with your lender or a financial advisor to see if this is a suitable strategy for your situation.

What happens if I default on my postgraduate student loan?

Defaulting on a student loan can have severe consequences, including damage to your credit score, wage garnishment, and potential legal action. It’s crucial to prioritize repayment and contact your lender if you anticipate difficulties.

Are there any tax benefits associated with postgraduate student loan interest?

Tax laws regarding student loan interest deductions vary by country. Consult a tax professional or refer to your country’s tax regulations for specific details.