Navigating the complexities of student loan repayment can be daunting, especially when unexpected life events arise. Student loan forbearance offers a temporary reprieve from loan payments, but understanding its implications is crucial. This guide provides a comprehensive overview of student loan forbearance in 2024, covering its various types, potential impacts on credit scores and finances, and viable alternatives. We’ll explore the application process, relevant government policies, and real-world scenarios to help you make informed decisions about your student loan debt.

From understanding eligibility requirements for different forbearance types to analyzing the long-term financial consequences of choosing forbearance over alternative repayment strategies, this guide aims to empower you with the knowledge needed to manage your student loans effectively. We will examine how forbearance affects your credit score and offer strategies to mitigate potential negative impacts. Finally, we’ll provide a step-by-step application process and discuss relevant government policies to ensure you’re fully prepared.

Student Loan Forbearance Definition and Types in 2024

Student loan forbearance is a temporary postponement of your student loan payments. It’s a crucial tool for borrowers facing financial hardship, allowing them to pause payments without immediately impacting their credit score (although there are exceptions, detailed below). However, it’s important to understand that interest may still accrue during forbearance, potentially increasing your overall loan balance. Choosing the right type of forbearance is critical to managing your debt effectively.

Student loan forbearance isn’t a one-size-fits-all solution. Several types exist, each with specific eligibility criteria and implications. Understanding these differences is essential for making informed decisions about your financial well-being.

Types of Student Loan Forbearance

Several types of forbearance are available, depending on your lender and circumstances. The specifics can vary slightly depending on whether your loans are federal or private. Always check with your loan servicer for the most up-to-date information. Common types include:

- General Forbearance: This is a broad category often granted for various reasons, such as unemployment, illness, or financial hardship. Eligibility usually requires documentation supporting your need for forbearance. The length of forbearance varies, typically ranging from a few months to a year, but can be extended depending on your circumstances and lender approval.

- Economic Hardship Forbearance: Designed specifically for borrowers experiencing significant economic setbacks, this type often requires more substantial documentation proving financial difficulty. This might include proof of unemployment, medical bills, or a significant decrease in income. The length is similar to general forbearance, and extensions may be possible.

- Forbearance for Military Service: Active-duty service members may qualify for forbearance during deployment or other military service-related situations. Documentation of military service is typically required. The length of forbearance is often tied to the duration of service.

Eligibility Requirements for Forbearance

Eligibility requirements vary depending on the type of forbearance and your lender. Generally, you’ll need to demonstrate a valid reason for needing forbearance, often with supporting documentation. This could include pay stubs showing reduced income, medical bills, or a letter from your employer. Contacting your loan servicer directly is crucial to determine your eligibility and the necessary documentation.

Comparison of Forbearance and Deferment

While both forbearance and deferment temporarily suspend your student loan payments, key differences exist.

| Type | Eligibility | Length | Impact on Credit |

|---|---|---|---|

| Forbearance | Financial hardship, unemployment, illness, or other documented reasons (varies by lender and loan type). | Varies, typically months to a year, potentially extendable. | May negatively impact credit score if payments are missed, though often less severely than default. |

| Deferment | Specific circumstances like returning to school, unemployment (federal loans), or economic hardship (in some cases). | Varies, often tied to the qualifying event (e.g., length of school enrollment). | Generally does not negatively impact credit score (for federal loans). |

Impact of Student Loan Forbearance on Credit Score

Entering into a student loan forbearance period can have a significant impact on your credit score, primarily because it alters your payment history. While forbearance temporarily suspends your payments, it’s reported to credit bureaus, signaling to lenders that you’re not meeting your financial obligations as agreed. This can lead to a decline in your creditworthiness, potentially making it more difficult to secure loans or other credit products in the future.

Forbearance negatively affects your credit score because it’s typically reported to credit bureaus as a missed or delayed payment. The length of time the negative impact persists depends on several factors, including the length of the forbearance period and your overall credit history. A shorter forbearance period with a strong credit history beforehand might result in a less significant and shorter-lived impact compared to a longer forbearance period for someone with a weaker credit history. Generally, the negative mark remains on your credit report for seven years from the date of the missed payment, though the impact gradually diminishes over time as newer positive payment information is added to your credit history.

Duration of Negative Credit Impact

The length of time a forbearance negatively impacts your credit score isn’t fixed. It depends on several interacting factors, including the length of the forbearance period itself (a longer period generally leads to a more significant and longer-lasting impact), your overall credit history (a strong history can mitigate the negative effect more effectively), and how quickly you resume making timely payments after the forbearance ends. For instance, someone with excellent credit who enters a three-month forbearance might see a minor, temporary dip, while someone with a poor credit history and a year-long forbearance could experience a more substantial and persistent decline. The impact gradually lessens over time, but the record of the forbearance remains on your credit report for seven years. Responsible credit management after the forbearance period concludes is crucial to rebuilding your credit.

Strategies for Minimizing Negative Credit Impact

Proactive steps can lessen the adverse effects of student loan forbearance on your credit score. Before entering forbearance, it’s advisable to explore all available options, such as income-driven repayment plans, which may offer more sustainable long-term solutions. If forbearance is unavoidable, maintaining open communication with your loan servicer is essential. This demonstrates responsibility and can potentially mitigate negative reporting. After the forbearance period, resuming timely payments immediately is critical to rebuilding your credit. Consistent on-time payments, combined with responsible credit card usage and other positive credit activity, will help demonstrate your creditworthiness to lenders. Regularly monitoring your credit report for accuracy is also a vital step, allowing you to address any errors promptly. Finally, considering credit counseling can provide valuable guidance in managing your finances and improving your credit health.

Financial Implications of Student Loan Forbearance

Choosing student loan forbearance can seem like a quick fix for short-term financial hardship, but it’s crucial to understand the significant long-term financial consequences. While forbearance temporarily suspends your monthly payments, it doesn’t erase your debt; instead, it typically leads to a considerable increase in your overall loan balance and repayment costs. This is primarily due to the accumulation of interest during the forbearance period.

Interest continues to accrue on your loan balance even when you’re not making payments. This accumulated interest can significantly impact your total loan amount, potentially adding thousands of dollars to your overall debt. Understanding how interest capitalization works and the potential impact on your repayment plan is essential to making informed decisions.

Interest Capitalization and its Effects

Interest capitalization occurs when the accumulated interest during the forbearance period is added to your principal loan balance. This increases the principal amount on which future interest is calculated, leading to a snowball effect of accumulating debt. The longer you’re in forbearance, the more interest capitalizes, and the larger your final loan balance becomes. This can dramatically increase the total amount you ultimately pay back, extending your repayment timeline and increasing your overall cost. For example, a small loan with a low interest rate may still accrue substantial interest over a lengthy forbearance period, resulting in a surprisingly large increase in the total debt owed. The frequency of capitalization (e.g., annually, semi-annually) also influences the final amount. More frequent capitalization results in a larger final loan balance.

Hypothetical Example: Forbearance vs. Repayment

The following example illustrates the significant difference in long-term costs between choosing forbearance and consistently making loan payments. This example assumes a simple scenario to highlight the core concept. Real-world scenarios can be far more complex, depending on factors like interest rates, loan types, and the length of the forbearance period.

| Forbearance Scenario | Repayment Scenario |

|---|---|

| Initial Loan Balance: $20,000 Interest Rate: 5% Forbearance Period: 3 years Interest Accrued (not capitalized): $3,000 (approximate) Capitalized Interest Added to Principal: $3,000 New Loan Balance: $23,000 Repayment over 10 years (after forbearance): Higher monthly payments due to increased principal |

Initial Loan Balance: $20,000 Interest Rate: 5% Consistent Monthly Payments: Based on a standard 10-year repayment plan Total Repaid: Lower than the Forbearance Scenario, due to no capitalized interest. |

Alternatives to Student Loan Forbearance in 2024

Forbearance, while offering temporary relief, isn’t always the best long-term solution for managing student loan debt. It pauses payments but doesn’t address the underlying debt, and can negatively impact your credit score. Fortunately, several alternatives exist that can provide more sustainable and beneficial outcomes. Exploring these options carefully can help you find a repayment strategy that aligns with your financial situation.

Understanding the differences between forbearance and other repayment strategies is crucial for making informed decisions. While forbearance simply postpones payments, other options offer more proactive solutions to managing your debt. Let’s delve into some viable alternatives.

Income-Driven Repayment Plans Compared to Forbearance

Income-driven repayment (IDR) plans calculate your monthly payment based on your income and family size. Unlike forbearance, IDR plans still count towards loan forgiveness programs (after making payments for a specified period, depending on the plan). Forbearance, on the other hand, offers temporary payment relief but doesn’t reduce your principal balance and may not count towards loan forgiveness. Choosing an IDR plan can lead to lower monthly payments and potential loan forgiveness, making it a significantly more advantageous strategy compared to the temporary reprieve of forbearance. For example, a borrower with a high debt burden and a low income might find an IDR plan significantly more manageable than forbearance, avoiding the potential credit score damage and ensuring progress towards loan forgiveness.

Student Loan Refinancing Options

Refinancing involves replacing your existing student loans with a new loan from a private lender, often at a lower interest rate. This can lead to lower monthly payments and faster debt repayment. However, refinancing typically removes federal protections, such as income-driven repayment plans and potential loan forgiveness programs. Therefore, careful consideration is needed to weigh the benefits of a lower interest rate against the loss of federal benefits. For instance, a borrower with excellent credit and a stable income might find refinancing advantageous, potentially saving thousands of dollars in interest over the life of the loan. Conversely, a borrower with fluctuating income might be better served by retaining their federal loan protections.

Decision-Making Flowchart for Choosing the Best Option

The optimal approach depends heavily on individual circumstances. The following flowchart provides a simplified guide to help borrowers navigate their options.

Start: Are you facing temporary financial hardship?

Yes: Consider a short-term forbearance only if absolutely necessary. Explore options like emergency savings or temporary part-time work first. Consider the impact on your credit score.

No: Assess your income and debt-to-income ratio.

High Debt-to-Income Ratio & Low Income: Explore income-driven repayment plans. These offer lower monthly payments and potential loan forgiveness.

Low Debt-to-Income Ratio & Stable Income & Excellent Credit: Explore student loan refinancing to potentially lower your interest rate and shorten your repayment period.

Other Circumstances: Consult with a financial advisor for personalized guidance.

The Application Process for Student Loan Forbearance

Applying for student loan forbearance involves navigating the specific procedures of your loan servicer. The process generally includes contacting your servicer, completing an application, and providing necessary documentation. While the exact steps may vary, the core elements remain consistent across most servicers.

Step-by-Step Forbearance Application Process

The application process typically follows a structured sequence. First, you’ll need to contact your loan servicer directly – this can usually be done via phone, mail, or through their online portal. They will guide you through the specific requirements for your loan type and circumstances. Next, you’ll need to complete the forbearance application form, which will request details about your financial hardship and the desired forbearance period. Finally, you may need to provide supporting documentation to verify your situation. The servicer will then review your application and notify you of their decision.

Required Documentation for Forbearance Applications

The specific documents required will vary depending on the type of forbearance and the loan servicer. However, common supporting documentation may include proof of income, proof of unemployment, medical bills, or other evidence of financial hardship. For example, if applying for forbearance due to unemployment, you might need to provide a layoff notice or unemployment benefit statement. If applying due to a medical emergency, you may need to provide medical bills and a doctor’s note outlining the nature and expected duration of your medical hardship. For income-driven repayment (IDR) plans, tax returns or pay stubs may be necessary. Always check with your specific servicer for their exact requirements.

Examples of Forbearance Application Procedures with Different Servicers

While the general steps are similar, each servicer may have its own online portal, application forms, and specific requirements. For instance, FedLoan Servicing (now managed by MOHELA) might require online submission of your application, while Nelnet may allow for both online and mailed applications. Navient may have a slightly different application process than Aidvantage. Each servicer’s website provides detailed instructions and contact information to guide borrowers through their specific procedures. It’s crucial to consult your servicer’s website or contact them directly for precise instructions tailored to your situation. Failing to follow their specific guidelines can delay or even prevent the approval of your forbearance request.

Government Policies and Student Loan Forbearance in 2024

The landscape of student loan forbearance is significantly shaped by government policies and programs. Understanding these policies is crucial for borrowers navigating repayment options and potential challenges. Changes in these policies can directly impact the availability and terms of forbearance, influencing borrowers’ financial decisions.

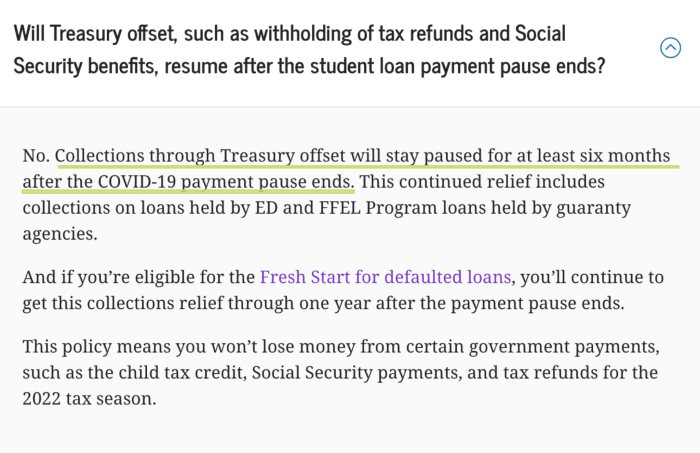

The primary influence on student loan forbearance in 2024 stems from the ongoing federal student loan repayment pause and the eventual resumption of payments. While the exact details of the transition out of the pause are subject to change, the government’s approach will significantly determine the accessibility and conditions of forbearance programs for borrowers. This includes the potential for extended forbearance periods for specific groups or the introduction of new forbearance programs designed to support the transition back into repayment.

The Impact of the Resumption of Student Loan Repayments

The end of the federal student loan repayment pause has introduced uncertainty for many borrowers. The government’s policies regarding the transition back into repayment will largely dictate the availability and usage of forbearance. For example, a gradual return to repayment might involve extended grace periods or increased flexibility in forbearance programs. Conversely, a swift resumption of payments could limit access to forbearance and increase the financial strain on borrowers unprepared for immediate repayment. This uncertainty necessitates careful monitoring of government announcements and proactive planning by borrowers.

Potential Changes to Income-Driven Repayment Plans

Government policies regarding income-driven repayment (IDR) plans also indirectly impact forbearance. IDR plans adjust monthly payments based on income, and changes to these plans could affect the need for forbearance. For instance, improvements to IDR calculations leading to lower monthly payments might reduce the number of borrowers seeking forbearance. Conversely, stricter eligibility criteria or limitations on IDR plan enrollment could increase the demand for forbearance among those who struggle to afford their payments. The government’s commitment to streamlining and improving IDR plans will directly influence the need for and utilization of forbearance options.

Government Support Programs and Their Influence on Forbearance

The government may implement additional support programs to aid borrowers during the transition back to repayment. These could include targeted forbearance programs for specific vulnerable populations or financial literacy initiatives to educate borrowers about available options. The availability and effectiveness of these programs would directly influence the overall need for and usage of standard forbearance options. For instance, a program offering temporary, reduced payments might decrease the need for full forbearance, allowing borrowers to avoid the negative credit impact.

Illustrative Scenarios of Student Loan Forbearance

Understanding how forbearance works in practice can be helpful. The following scenarios illustrate how different life events can necessitate forbearance and its subsequent impact on a borrower’s financial health. It’s important to remember that these are simplified examples and individual experiences may vary.

Scenario 1: Job Loss and Forbearance

Sarah, a recent graduate with $30,000 in student loan debt, secured a marketing position. Her monthly payment was $300. After six months, she was laid off due to company restructuring. Facing unemployment, Sarah immediately contacted her loan servicer and requested forbearance. She was granted a six-month forbearance period, during which her payments were suspended. However, interest continued to accrue on her loan, increasing her total debt. After six months, Sarah found a new job, albeit with a lower salary. Resuming payments, she now faced a slightly higher monthly payment due to the accumulated interest. The long-term effect was an increase in her total debt and a slightly extended repayment period. Her credit score was also likely impacted negatively, although the extent depends on her credit history and the reporting practices of her lender.

Scenario 2: Medical Emergency and Forbearance

Mark, a nurse with $50,000 in student loan debt, experienced a serious medical emergency requiring extensive surgery and rehabilitation. His monthly student loan payment was $500. The medical bills, coupled with lost income during recovery, left him financially strained. He applied for and received a 12-month forbearance period. During this time, his payments were suspended, but interest continued to accrue. The medical expenses significantly impacted his finances, and upon resuming payments, he had to carefully budget to manage both his loan repayment and ongoing medical costs. The long-term effect was an increased total debt burden, impacting his ability to save and invest for the future. His credit score likely took a hit as well, but responsible post-forbearance management could mitigate the damage over time.

Scenario 3: Unexpected Home Repair and Forbearance

Maria, a teacher with $40,000 in student loan debt, faced an unexpected and significant home repair. Her monthly payment was $400. A burst pipe caused extensive water damage, resulting in a large and unforeseen repair bill. Unable to afford both the repairs and her student loan payments, Maria requested a three-month forbearance. This allowed her to focus on repairing her home without immediately defaulting on her loans. Interest accrued during the forbearance period, adding to her overall debt. After the forbearance, Maria resumed payments, but her budget remained tight due to the unexpected expenses. The long-term effect was a slight increase in her overall debt and a potential strain on her financial stability, although less severe than in the previous scenarios. Her credit score might have experienced a minor negative impact, but the short forbearance period and subsequent responsible repayment likely minimized the effect.

End of Discussion

Successfully managing student loan debt requires careful planning and a thorough understanding of available options. While student loan forbearance can provide temporary relief, it’s vital to weigh its short-term benefits against its potential long-term financial consequences. This guide has provided a framework for understanding the intricacies of forbearance, empowering you to make informed decisions that align with your financial goals. Remember to explore alternative repayment plans and carefully consider the impact on your credit score before opting for forbearance. Proactive financial planning is key to achieving long-term financial stability.

FAQ Section

What happens to my interest during forbearance?

Interest typically continues to accrue on your loan during forbearance, increasing your overall loan balance. The way this interest is handled (capitalized or not) depends on your loan type and servicer.

Can I extend my forbearance period?

The length of forbearance varies depending on the type and your loan servicer. You may be able to request an extension, but this is not guaranteed and will depend on your circumstances and your lender’s policies.

How does forbearance affect my federal student aid eligibility?

Forbearance may impact your eligibility for certain federal student aid programs in the future. It’s advisable to check with your servicer and the federal government to understand the potential consequences.

What if I can’t afford forbearance payments either?

If you’re struggling to make payments even during forbearance, contact your loan servicer immediately to discuss options like income-driven repayment plans or loan consolidation.