The weight of student loan debt is a significant concern for many recent graduates and current students. Understanding the complexities of repayment options, government programs, and financial planning strategies is crucial for navigating this financial landscape successfully. This guide provides a comprehensive overview of the various avenues available to manage and reduce the burden of student loan debt, empowering you to make informed decisions about your financial future.

From federal loan programs and income-driven repayment plans to private loan refinancing and budgeting strategies, we explore a range of practical solutions. We’ll also delve into the long-term financial implications of student loan debt, offering insights into how it can affect major life decisions and overall financial well-being. Ultimately, our aim is to equip you with the knowledge and resources necessary to effectively manage your student loans and achieve long-term financial stability.

Understanding Student Loan Debt

Navigating the complexities of student loan debt is a crucial step for many young adults entering the workforce. Understanding the different types of loans, the average debt burden, and the factors contributing to its rise is essential for informed financial planning and responsible repayment. This section provides an overview of these key aspects.

Types of Student Loans

Student loans in the US are broadly categorized into federal and private loans. Federal loans are offered by the government and generally offer more favorable repayment terms and protections for borrowers. These include subsidized and unsubsidized Stafford Loans (for undergraduate and graduate students), PLUS Loans (for parents and graduate students), and Perkins Loans (need-based loans with low interest rates). Private loans, on the other hand, are offered by banks and other financial institutions. They often have higher interest rates and less flexible repayment options than federal loans, making them a riskier option unless absolutely necessary. Borrowers should carefully weigh the pros and cons of each type before accepting any loan.

Average Student Loan Debt Burden

Recent data indicates that the average student loan debt for borrowers in the class of 2022 is approximately $37,000. This figure varies significantly depending on factors such as the degree pursued, the type of institution attended (public vs. private), and the length of the educational program. For example, students pursuing advanced degrees like medical or law school often accumulate substantially higher debt loads than those pursuing undergraduate degrees in less expensive institutions. This average represents a significant financial obligation that can impact borrowers’ ability to save for a down payment on a home, start a family, or invest for retirement.

Factors Contributing to Rising Student Loan Debt

Several interconnected factors have contributed to the steady increase in student loan debt over the past few decades. These include the rising cost of tuition and fees at both public and private institutions, which has outpaced inflation for many years. Additionally, the decreased availability of grants and scholarships has forced many students to rely more heavily on loans to finance their education. Finally, the increasing prevalence of for-profit colleges and universities, which often have high tuition costs and less stringent academic standards, has also contributed to the problem. The combination of these factors has created a perfect storm that has left many students with crippling levels of debt.

Student Loan Default Rates and Consequences

Student loan default rates represent a significant concern for both borrowers and the government. A default occurs when a borrower fails to make payments on their loans for a specified period. The consequences of defaulting on student loans can be severe, including damage to credit scores, wage garnishment, and tax refund offset. These consequences can make it extremely difficult to secure future loans, rent an apartment, or even obtain certain jobs. The most recent data from the Department of Education shows that default rates vary depending on loan type and borrower characteristics, but they remain a significant challenge for many individuals. For example, students who attended for-profit institutions have historically had higher default rates than those who attended public or private non-profit institutions.

Government Programs and Initiatives

Navigating the complexities of student loan repayment can be daunting, but understanding the various government programs and initiatives available can significantly ease the burden. These programs offer different avenues for managing debt, each with its own eligibility requirements and potential benefits. This section will Artikel key federal programs and their implications for borrowers.

Federal Student Loan Repayment Programs and Eligibility Criteria

The federal government offers a range of repayment plans designed to cater to diverse financial situations. Eligibility generally depends on the type of federal student loan you hold (Direct Loans, FFEL Program loans, etc.) and your income. Specific requirements can vary between programs, so careful review of the relevant government websites is crucial.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are designed to make monthly payments more manageable by basing them on your income and family size. These plans typically extend the repayment period, potentially lowering monthly payments but increasing the total interest paid over the life of the loan. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Each plan has its own formula for calculating monthly payments, considering factors such as discretionary income and loan balance. For example, REPAYE, generally considered the most generous plan, calculates payments based on 10% of discretionary income, with payments potentially being as low as $0 depending on the borrower’s income and family size. While these plans offer immediate financial relief, the extended repayment periods often lead to significantly higher overall interest costs.

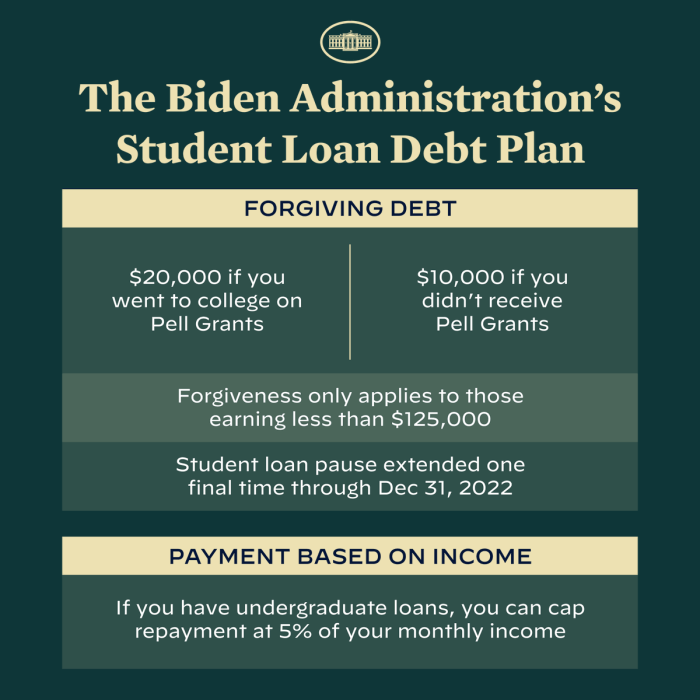

Student Loan Forgiveness Programs

Student loan forgiveness programs offer the possibility of having a portion or all of your student loan debt cancelled. These programs often target specific professions (e.g., teachers, public service workers) or borrowers who meet certain income thresholds and repayment plan requirements. For instance, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of Direct Loans after 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying government or non-profit organization. While these programs offer a significant benefit to eligible borrowers, they often have stringent eligibility criteria and can be complex to navigate. Furthermore, the availability and structure of these programs are subject to change based on political and economic considerations. The long processing times associated with applications can also cause considerable stress and uncertainty for borrowers.

Potential Reforms to Improve Student Loan Accessibility and Affordability

Several potential reforms could enhance the accessibility and affordability of higher education and subsequent loan repayment. These include simplifying the application process for IDR plans and forgiveness programs, increasing transparency regarding program requirements and eligibility, and exploring options for more generous income-driven repayment plans that reduce the overall interest burden. Additionally, reforming the interest rate calculation methods for student loans and exploring options for loan refinancing could potentially offer more flexibility and lower overall costs for borrowers. A broader discussion around the rising cost of tuition and the need for increased government investment in higher education is also necessary to address the root causes of student loan debt.

Private Loan Options and Refinancing

Navigating the world of student loan repayment can be complex, particularly when considering private loan options and the possibility of refinancing. Understanding the differences between federal and private loans, as well as the process and implications of refinancing, is crucial for making informed financial decisions. This section will explore these key aspects to help you make the best choices for your unique situation.

Private student loans differ significantly from federal student loans in several key aspects. Federal loans are backed by the government, offering borrowers various protections and benefits not typically found with private loans. Conversely, private loans are offered by banks, credit unions, and other financial institutions, and their terms and conditions vary widely depending on the lender and the borrower’s creditworthiness.

Comparison of Federal and Private Student Loans

Federal student loans generally offer more favorable terms, including lower interest rates, flexible repayment plans, and deferment or forbearance options during periods of financial hardship. These programs are designed to be accessible to a wider range of students, regardless of credit history. In contrast, private student loans typically require a good credit history and often come with higher interest rates and less flexible repayment options. The application process for federal loans is generally simpler than for private loans, which often involve a more rigorous credit check and financial assessment. Defaults on federal loans have specific consequences, but typically involve more extensive government-mandated processes before collection agencies are involved. Defaults on private loans may be handled more aggressively and quickly by private lenders.

Refinancing Student Loans: A Step-by-Step Guide

Refinancing your student loans involves taking out a new loan to pay off your existing student loan debt. This can be beneficial if you qualify for a lower interest rate, resulting in potential savings over the life of the loan. The process typically involves several steps:

- Check your credit score: Lenders will review your creditworthiness before offering a refinance loan. A higher credit score typically leads to better interest rates.

- Shop around for lenders: Compare interest rates, fees, and repayment terms from multiple lenders to find the best option. Consider both large national banks and smaller, regional lenders.

- Gather necessary documents: This may include your credit report, proof of income, and details of your existing student loans.

- Complete the application: Fill out the application completely and accurately to avoid delays in the process.

- Review the loan terms: Carefully review the loan agreement before signing to ensure you understand the terms and conditions.

- Close the loan: Once approved, the lender will disburse the funds to pay off your existing student loans.

Advantages and Disadvantages of Refinancing Student Loans

Refinancing can offer several advantages, including lower monthly payments, a lower overall interest rate, and a shorter repayment period. However, it’s important to consider the potential disadvantages. For example, refinancing federal loans into private loans means losing access to federal loan forgiveness programs and other benefits. Additionally, if your credit score declines after refinancing, you might face difficulties in managing your loan payments. Also, some private lenders might charge prepayment penalties.

Finding the Best Refinancing Options

To find the best refinancing option, consider your credit score, income, debt-to-income ratio, and the interest rates offered by different lenders. Using online comparison tools can help you quickly compare various options and identify the most suitable lender for your financial circumstances. It is strongly recommended to compare offers from at least three to five different lenders to ensure you are getting the most competitive interest rate. Don’t hesitate to contact multiple lenders directly to discuss your individual needs and eligibility. Remember to carefully review the terms and conditions of each offer before making a decision. Consider seeking professional financial advice if you’re unsure which path is best for your specific situation.

Budgeting and Financial Planning for Loan Repayment

Successfully navigating student loan repayment requires a well-structured budget and a realistic financial plan. This involves understanding your income, expenses, and developing strategies to manage your debt alongside other financial responsibilities. A proactive approach to budgeting and planning will significantly reduce stress and increase your chances of timely repayment.

Sample Budget Allocation for Student Loan Repayment

Creating a budget is crucial for effective student loan repayment. This involves carefully tracking income and expenses to determine how much can be allocated towards loan payments. A sample budget demonstrates how to incorporate this. Consider this example: Assume a monthly net income of $3,000. Allocating 20% to loan repayment ($600) leaves $2,400 for other expenses. This allocation may need adjustment based on individual circumstances.

| Category | Amount ($) |

|---|---|

| Student Loan Payment | 600 |

| Housing (Rent/Mortgage) | 800 |

| Food | 400 |

| Transportation | 200 |

| Utilities | 150 |

| Insurance | 100 |

| Savings | 150 |

Realistic Repayment Plan

Developing a realistic repayment plan involves considering your income, expenses, and loan terms. Factors such as interest rates and loan types influence the repayment strategy. For example, an individual earning $40,000 annually with a $30,000 student loan at 7% interest might opt for a 10-year repayment plan, prioritizing higher payments in the initial years to reduce the overall interest paid. This strategy balances affordability with faster debt reduction. Alternatively, an income-driven repayment plan might be more suitable if income is lower or expenses are higher.

Managing Student Loan Debt Alongside Other Financial Obligations

Balancing student loan repayment with other financial responsibilities, such as rent, utilities, and credit card payments, requires careful prioritization and budgeting. Creating a comprehensive budget, allocating funds for essential expenses first, and then allocating the remaining funds to loan payments is a key strategy. Consider using budgeting apps or spreadsheets to track expenses and ensure that loan payments are consistently made. It’s also wise to explore options like budgeting apps or financial counseling services for personalized guidance.

Tracking Loan Payments and Monitoring Progress

Regularly tracking loan payments and monitoring progress towards debt elimination is essential for maintaining motivation and ensuring timely repayment. Using online portals provided by loan servicers, spreadsheets, or budgeting apps allows for easy tracking of payments and interest accrued. Regularly reviewing the loan balance and projected repayment date provides a clear picture of progress and allows for necessary adjustments to the repayment plan. Celebrating milestones along the way can help maintain motivation throughout the repayment process.

Resources and Support for Borrowers

Navigating the complexities of student loan debt can be overwhelming. Fortunately, numerous resources and support systems exist to guide borrowers through repayment and potentially alleviate financial strain. Understanding these options is crucial for successful debt management.

Reputable Organizations Offering Student Loan Counseling and Assistance

Several reputable organizations offer valuable counseling and assistance to student loan borrowers. These services often include personalized guidance on repayment plans, debt management strategies, and consolidation options. They provide a crucial support network for those facing financial challenges related to student loans. Many of these organizations are non-profit, ensuring unbiased and ethical guidance.

Services Provided by Non-profit Organizations Dedicated to Student Loan Debt Relief

Non-profit organizations play a vital role in providing support and resources for individuals struggling with student loan debt. Their services often extend beyond simple counseling, encompassing advocacy, educational resources, and in some cases, direct assistance with debt reduction programs. These organizations work to empower borrowers and ensure fair treatment within the student loan system. They are often a crucial bridge between borrowers and the complex regulatory landscape of student loan repayment.

Contact Information for Relevant Government Agencies and Departments

Accessing information and assistance from government agencies is crucial for understanding your rights and options regarding student loans. These agencies provide crucial information on repayment plans, eligibility for programs, and other critical details. Staying informed about updates and changes in government policies is also essential for effective debt management.

Comparison of Student Loan Repayment Resources

The following table compares various student loan repayment resources, highlighting their services and contact information. This information can help you choose the resource most appropriate for your individual needs and circumstances.

| Organization Name | Contact Information | Services Offered | Website URL |

|---|---|---|---|

| National Foundation for Credit Counseling (NFCC) | (800) 388-2227; Website search for local member agency | Credit counseling, budgeting assistance, debt management plans | nfcc.org |

| Student Loan Borrower Assistance (SLBA) | (Information available through website) | Information and advocacy for student loan borrowers; assistance with navigating repayment options | (Example: A hypothetical website address would be placed here. Actual URLs for specific non-profit organizations should be researched and verified.) |

| Federal Student Aid (FSA) | studentaid.gov (website resources) | Information on federal student loan programs, repayment plans, and loan forgiveness options | studentaid.gov |

| Consumer Financial Protection Bureau (CFPB) | consumerfinance.gov (website resources) | Information on consumer rights and protections related to student loans; resources for resolving disputes | consumerfinance.gov |

Long-Term Financial Implications of Student Loan Debt

Student loan debt can cast a long shadow, influencing major life decisions and long-term financial well-being for years after graduation. Understanding these potential impacts is crucial for effective financial planning and mitigating negative consequences. The weight of student loan repayments can significantly affect your ability to achieve key financial milestones and build wealth over time.

Impact on Major Life Decisions

Student loan debt frequently delays or alters major life decisions. The monthly payments can reduce disposable income, making it challenging to save for a down payment on a home. Similarly, the financial burden can postpone starting a family, as raising children is expensive, and managing student loan payments alongside childcare costs can be overwhelming. For example, a couple burdened with $100,000 in student loan debt might delay homeownership by several years, potentially missing out on opportunities for property appreciation. Furthermore, the financial strain can impact decisions about career choices, as individuals may prioritize higher-paying jobs over personal fulfillment, potentially leading to career dissatisfaction.

Effects on Credit Scores and Future Borrowing Capacity

Consistent on-time student loan payments positively impact credit scores. However, missed or late payments can severely damage creditworthiness, making it harder to secure loans for mortgages, cars, or even credit cards in the future. A low credit score can result in higher interest rates on future loans, increasing the overall cost of borrowing. For instance, someone with a poor credit score due to student loan delinquency might face significantly higher interest rates on a mortgage, increasing their monthly housing costs and potentially limiting their home-buying options.

Impact on Long-Term Financial Stability and Wealth Accumulation

Student loan debt can significantly hinder long-term financial stability and wealth accumulation. A substantial portion of monthly income allocated to loan repayments reduces the amount available for investing, saving for retirement, or building an emergency fund. This can lead to a slower rate of wealth accumulation and potentially delay retirement plans. For example, an individual with significant student loan debt might postpone contributing to a retirement account, resulting in a smaller nest egg by retirement age. The reduced ability to save and invest can have a compounding effect over time, resulting in a considerably smaller net worth compared to someone without substantial student loan debt.

Visual Representation of Long-Term Repayment Strategies

Imagine a bar graph. The horizontal axis represents time (in years, from 0 to 30). The vertical axis represents cumulative debt (in dollars). Three bars represent different repayment strategies: (1) Standard Repayment: This bar shows a relatively slow decline in debt over time, with the debt remaining high for a considerable period. (2) Accelerated Repayment: This bar shows a much steeper decline, reaching zero significantly faster. (3) Income-Driven Repayment: This bar demonstrates a more variable decline, initially slower but potentially longer repayment periods. The difference in the area under each bar visually represents the total interest paid under each strategy, highlighting the significant cost savings of faster repayment. The graph clearly illustrates how choosing an aggressive repayment strategy minimizes the long-term financial impact of student loan debt, leading to quicker debt elimination and greater financial freedom.

Final Review

Successfully managing student loan debt requires proactive planning, informed decision-making, and a commitment to long-term financial health. By understanding the available options, utilizing available resources, and implementing effective budgeting strategies, you can significantly reduce the burden of student loan repayment and pave the way for a more secure financial future. Remember, seeking guidance from financial professionals and utilizing the numerous support resources available can make a significant difference in your journey towards debt freedom.

Question & Answer Hub

What happens if I can’t make my student loan payments?

Contact your loan servicer immediately. They can explore options like deferment or forbearance to temporarily suspend payments or modify your repayment plan. Ignoring the issue can lead to serious consequences, including damage to your credit score and potential legal action.

Can I deduct student loan interest from my taxes?

Possibly. The Student Loan Interest Deduction allows you to deduct the amount you paid in student loan interest during the tax year, up to a certain limit. Eligibility requirements apply, and it’s best to consult the IRS website or a tax professional for the most up-to-date information.

What is the difference between a subsidized and unsubsidized loan?

Subsidized loans don’t accrue interest while you’re in school (at least half-time), during grace periods, and during deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

How long does it take to repay student loans?

The repayment period depends on your loan type, loan amount, and repayment plan. Standard repayment plans typically last 10 years, but other plans can extend the repayment period.