Navigating the complex landscape of student loans in California can feel overwhelming. From understanding the diverse programs available to managing repayment, the journey requires careful planning and informed decision-making. This guide aims to demystify the process, providing a clear overview of California’s student loan system, its associated challenges, and the resources available to borrowers.

We’ll explore the various loan programs offered by the state, examining eligibility criteria, repayment options, and associated costs. We will also delve into repayment assistance programs, including income-driven plans and loan forgiveness opportunities, offering practical advice and actionable steps. Finally, we will analyze the broader economic impact of student loan debt on California’s residents and its influence on key aspects of the state’s economy.

California Student Loan Programs

California offers a variety of student loan programs to help residents finance their higher education. Understanding the nuances of each program is crucial for making informed decisions about borrowing and repayment. This information Artikels the key features of several prominent California student loan programs.

California Student Loan Programs Overview

Several state and federal programs provide student loans to California residents. These programs differ in their eligibility requirements, repayment options, and associated interest rates and fees. Careful consideration of these factors is essential for selecting the most suitable loan option.

California’s Cal Grant Program

The Cal Grant program is a state-funded grant program, not a loan program. While not a loan, it’s crucial to mention because it significantly reduces the need for borrowing. Cal Grants are awarded based on financial need and academic merit and can be used to cover tuition, fees, and other educational expenses at eligible California colleges and universities. Repayment is not required as it’s a grant, not a loan. Eligibility is determined by the California Student Aid Commission (CSAC) based on the student’s financial need and academic performance.

Federal Student Loan Programs in California

California residents are also eligible for federal student loan programs, including Federal Direct Subsidized and Unsubsidized Loans, and Federal Direct PLUS Loans. These programs are administered by the federal government and offer various loan amounts and repayment plans. Eligibility for federal loans is based on financial need (for subsidized loans) and enrollment status. Repayment options include standard repayment plans, graduated repayment plans, and income-driven repayment plans.

Comparison of California Student Loan Programs

The following table compares key features of various California student loan programs. Note that interest rates and fees are subject to change. This information is for illustrative purposes and should not be considered financial advice. Always consult the official program websites for the most up-to-date information.

| Program Name | Eligibility | Repayment Options | Interest Rate & Fees |

|---|---|---|---|

| Cal Grant (Grant, not loan) | Financial need and academic merit; California residency | N/A (Grant, not loan) | N/A (Grant, not loan) |

| Federal Direct Subsidized Loan | Financial need; enrollment in eligible program | Standard, Graduated, Income-Driven | Variable; Origination fees apply |

| Federal Direct Unsubsidized Loan | Enrollment in eligible program | Standard, Graduated, Income-Driven | Variable; Origination fees apply |

| Federal Direct PLUS Loan (Parent/Graduate) | Parent or graduate student; credit check required | Standard, Graduated, Income-Driven | Variable; Origination fees apply |

Repayment Assistance Programs in California

Navigating student loan repayment can be challenging, but California offers several programs designed to alleviate the burden for borrowers. These programs provide various forms of assistance, from modified payment plans to potential loan forgiveness, depending on individual circumstances and eligibility. Understanding these options is crucial for effective debt management.

Income-Driven Repayment Plans in California

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. This ensures that your payments are affordable, preventing overwhelming debt. Several federal IDR plans are available to California borrowers, including the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE) plans. Eligibility requirements vary slightly between plans, but generally involve demonstrating financial need based on income and family size. The application process typically involves completing a detailed financial information form through the student loan servicer’s website.

- Gather necessary financial documentation, such as tax returns and pay stubs.

- Access your student loan servicer’s website and locate the IDR application.

- Complete the application accurately and thoroughly, providing all requested information.

- Submit the application and supporting documentation to your loan servicer.

- Monitor your account for updates and confirmation of your enrollment in the chosen IDR plan.

California-Specific Loan Forgiveness Programs

While California doesn’t have its own standalone loan forgiveness program, participation in federal programs like Public Service Loan Forgiveness (PSLF) is available to California residents. PSLF forgives the remaining balance of your federal student loans after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. Meeting the eligibility criteria, including working for a qualifying employer and making consistent payments under an IDR plan, is essential.

- Confirm your employment qualifies under PSLF guidelines.

- Ensure your loans are federal Direct Loans.

- Complete the PSLF employment certification form annually.

- Make consistent, on-time payments under an IDR plan for 120 months.

- Submit the necessary documentation to your loan servicer for review and forgiveness consideration.

Other Repayment Assistance Programs

Beyond IDR plans and loan forgiveness, other repayment assistance options might be available. These may include deferment or forbearance, which temporarily suspend or reduce your payments. Deferment is generally granted for specific reasons like unemployment or enrollment in school, while forbearance is often granted due to financial hardship. Eligibility and application processes vary depending on your lender and circumstances. It’s important to contact your loan servicer directly to explore these options and understand the potential implications on your loan repayment.

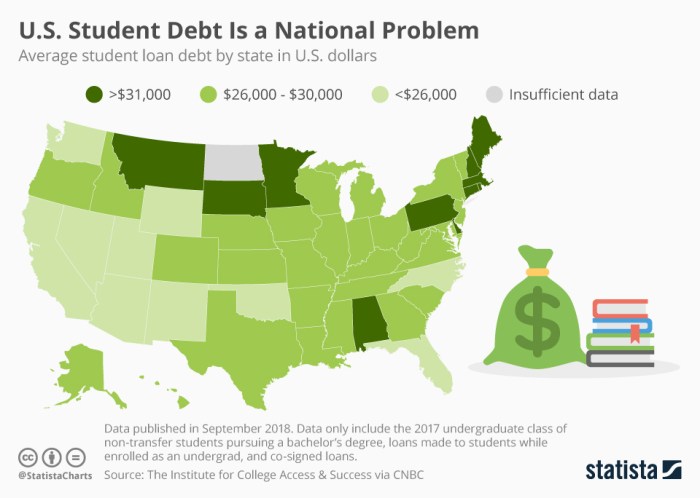

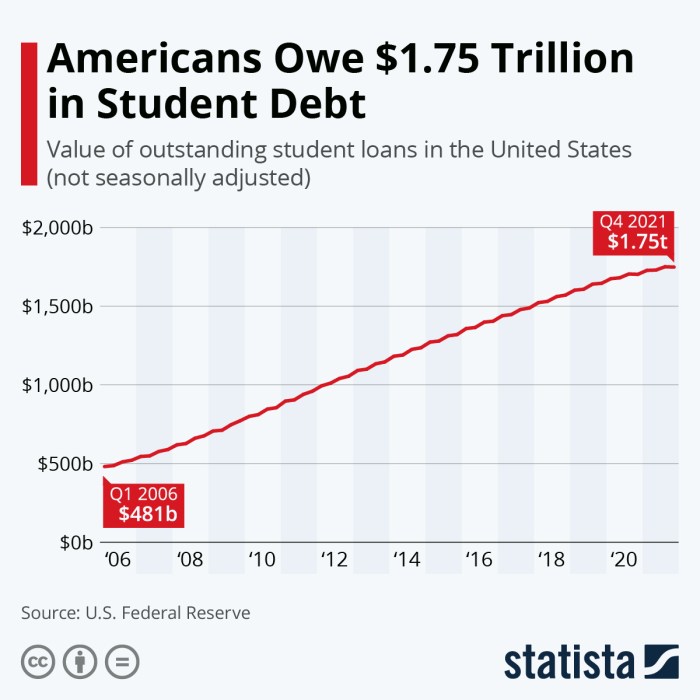

The Impact of Student Loan Debt on California’s Economy

The burgeoning student loan debt crisis in California casts a long shadow over the state’s economic landscape. The high cost of higher education, coupled with stagnant wage growth and increasing living expenses, has created a situation where many Californians struggle to manage their debt, impacting various facets of the state’s economic well-being. This section explores the significant consequences of this debt burden.

Economic Consequences of High Student Loan Debt on California Residents

High student loan debt significantly impacts California residents’ financial health and economic opportunities. Many graduates find themselves burdened with substantial monthly payments, limiting their ability to save for retirement, purchase a home, or invest in their businesses. This debt can lead to delayed major life milestones, such as marriage and starting a family, further impacting the overall economic vitality of the state. The constant pressure of debt repayment can also lead to increased stress and reduced overall well-being, impacting productivity and economic participation. For example, a recent study showed that California residents with high student loan debt were more likely to delay or forgo major purchases, such as vehicles and home improvements, negatively impacting related industries.

Effect of Student Loan Debt on Homeownership Rates in California

Student loan debt is a major impediment to homeownership in California, a state already grappling with a severe housing shortage and high housing costs. The significant monthly payments required for student loans reduce the amount of money available for a down payment, closing costs, and ongoing mortgage payments. This makes it difficult for many young Californians to enter the housing market, contributing to a decline in homeownership rates, especially among younger generations. This situation exacerbates the housing crisis and limits opportunities for wealth building through home equity. For instance, a comparison of homeownership rates between similarly situated graduates with and without significant student loan debt would likely reveal a substantial difference.

Relationship Between Student Loan Debt and Entrepreneurship in California

The high levels of student loan debt can also stifle entrepreneurship in California, a state known for its innovative and entrepreneurial spirit. The financial burden of student loan repayments can deter individuals from taking the risk of starting their own businesses, as the financial safety net is diminished. This loss of potential entrepreneurial activity could negatively impact job creation and economic growth within the state. Furthermore, those who do start businesses might be forced to prioritize debt repayment over business expansion or innovation, hindering their potential for success and economic contribution. A compelling case study would be comparing the startup rates of entrepreneurs with and without significant student loan debt.

Impact of Student Loan Debt on California’s Workforce

Student loan debt can significantly impact California’s workforce by influencing career choices and limiting geographic mobility. Graduates may be forced to accept jobs that offer higher salaries, even if they are not aligned with their career aspirations, simply to manage their debt. This can lead to a mismatch between skills and job requirements, reducing overall workforce efficiency. Furthermore, the high cost of living in California, coupled with student loan debt, may restrict geographic mobility, preventing individuals from moving to areas with better job opportunities. This limitation can stifle economic growth and innovation within the state by restricting talent flow. For example, a study might show a correlation between high student loan debt and a higher incidence of underemployment among recent graduates in California.

Resources and Support for California Student Loan Borrowers

Navigating the complexities of student loan debt can be overwhelming, but California offers a range of resources and support systems designed to help borrowers manage their debt effectively and avoid financial hardship. Understanding these options and knowing where to seek assistance is crucial for maintaining financial well-being. This section provides an overview of available resources categorized for easy access.

Counseling Services for Student Loan Borrowers

Access to professional guidance is essential for developing a personalized repayment strategy. Several organizations offer free or low-cost counseling services to help borrowers understand their options and create a manageable repayment plan. These services often include budget counseling, exploring income-driven repayment plans, and guidance on consolidating loans.

- The California Student Aid Commission (CSAC): CSAC provides information and resources on various student loan programs and repayment options. They don’t directly offer counseling but serve as a valuable resource for finding relevant information and connecting borrowers with appropriate services. Contact information can be found on their website.

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization with certified credit counselors who can provide guidance on managing student loan debt. They offer services such as budget analysis, debt management planning, and exploring options like income-driven repayment plans. Contact information can be found on their website.

- Consumer Credit Counseling Services (CCCS): Similar to the NFCC, CCCS offers credit counseling services that often include assistance with student loan debt management. They can help borrowers create a budget, negotiate with lenders, and explore consolidation options. Contact information is available on their website.

Debt Management and Repayment Assistance Programs

Beyond counseling, several programs offer direct assistance with managing and repaying student loans. These programs often provide options for lower monthly payments or loan forgiveness under specific circumstances.

- Income-Driven Repayment (IDR) Plans: Federal student loan borrowers can apply for IDR plans, which adjust monthly payments based on income and family size. These plans can significantly lower monthly payments and potentially lead to loan forgiveness after a set period. Information on IDR plans is available on the Federal Student Aid website.

- Public Service Loan Forgiveness (PSLF): This program offers loan forgiveness to borrowers who work full-time for qualifying government or non-profit organizations and make 120 qualifying monthly payments under an IDR plan. Detailed eligibility requirements and application procedures are available on the Federal Student Aid website.

- California’s Student Loan Programs: The California Student Aid Commission (CSAC) administers various state-funded student loan programs that may offer specific repayment assistance or benefits to eligible borrowers. Details about these programs are available on the CSAC website.

Legal Assistance for Student Loan Borrowers

In some cases, borrowers may need legal assistance to navigate complex legal issues related to their student loans, such as loan modifications, disputes with lenders, or potential loan scams.

- Legal Aid Organizations: Several non-profit legal aid organizations offer free or low-cost legal services to low-income individuals, including assistance with student loan issues. These organizations often have specific eligibility requirements. Contact information can be found through online searches or legal aid directories.

- National Consumer Law Center (NCLC): The NCLC provides resources and advocacy for consumer rights, including information and legal support related to student loan debt. Their website provides valuable information and resources.

Navigating the Process of Seeking Help

Seeking help with student loan debt involves several key steps. First, gather all relevant information about your loans, including loan balances, interest rates, and repayment schedules. Next, research available resources and choose the options that best suit your situation. Contact the chosen organization or agency and schedule a consultation. Be prepared to discuss your financial situation honestly and openly to receive the most effective guidance. Finally, follow the advice and instructions provided by your counselor or agency to develop and implement a sustainable repayment plan.

Ending Remarks

Successfully managing student loan debt in California requires proactive engagement and a thorough understanding of the available resources. By leveraging the information presented in this guide, borrowers can make informed choices, optimize their repayment strategies, and navigate the complexities of the student loan system with confidence. Remember, seeking professional guidance and exploring available assistance programs are crucial steps in achieving financial well-being. Proactive planning and informed decision-making are key to overcoming the challenges of student loan debt.

FAQ Compilation

What happens if I can’t repay my student loans in California?

Contact your loan servicer immediately. They can discuss options like deferment, forbearance, or income-driven repayment plans to help manage your payments.

Are there any penalties for late student loan payments in California?

Yes, late payments can result in late fees, negatively impact your credit score, and potentially lead to wage garnishment or tax refund offset.

Can I consolidate my federal and private student loans in California?

You can consolidate federal student loans through the federal government’s Direct Consolidation Loan program. Private loans typically cannot be consolidated with federal loans.

Where can I find free credit counseling related to student loans in California?

The National Foundation for Credit Counseling (NFCC) and other non-profit credit counseling agencies offer free or low-cost credit counseling services. Check their websites for locations and services in California.