The weight of student loan debt in the USA is a significant societal and economic challenge, impacting millions of individuals and shaping the national financial landscape. This pervasive issue affects not only borrowers but also the broader economy, influencing everything from homeownership rates to retirement savings and entrepreneurial endeavors. Understanding the complexities of student loans, from federal programs to private lending options, is crucial for navigating this intricate system.

This comprehensive guide delves into the current state of student loan debt in the US, examining its growth, impact, and potential solutions. We’ll explore the different types of loans available, the various repayment plans, and the government policies designed to address this escalating crisis. Furthermore, we’ll provide practical strategies for managing and repaying student loans, empowering readers to take control of their financial futures.

The Current State of Student Loan Debt in the USA

The burden of student loan debt in the United States has reached staggering proportions, significantly impacting individuals’ financial well-being and the overall economy. Understanding the scale of this debt, its distribution, and its demographic impact is crucial for developing effective solutions.

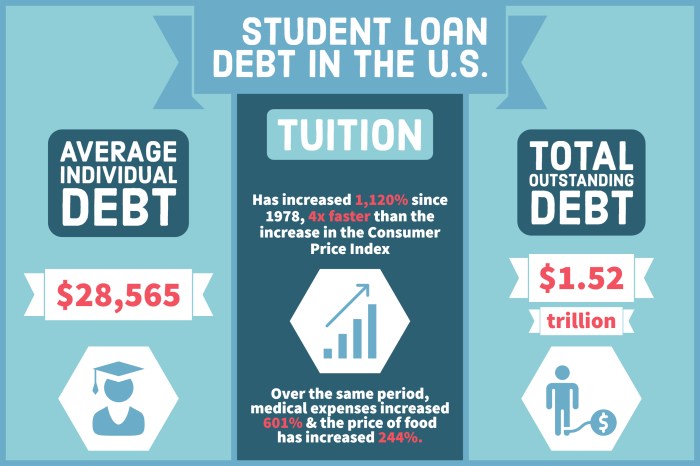

Total Student Loan Debt

The total amount of student loan debt outstanding in the US is currently in the trillions of dollars. While the precise figure fluctuates, it consistently ranks as one of the largest sources of consumer debt in the nation. This massive debt represents a significant financial obligation for millions of Americans, impacting their ability to save for retirement, purchase homes, and start families. The sheer magnitude of this debt underscores the urgent need for comprehensive policy solutions.

Breakdown of Student Loan Debt by Loan Type

Student loan debt is primarily categorized into federal and private loans. Federal student loans are offered by the government and typically come with more favorable repayment options and protections for borrowers. Private student loans, on the other hand, are provided by banks and other private lenders, often carrying higher interest rates and less flexible repayment terms. A substantial portion of the total student loan debt is comprised of federal loans, reflecting the government’s significant role in financing higher education. However, the increasing reliance on private loans, especially among borrowers who do not qualify for federal aid, is a growing concern.

Average Student Loan Debt Per Borrower

The average amount of student loan debt per borrower is a substantial figure, reflecting the rising cost of tuition and fees at many colleges and universities. This average varies depending on factors such as the borrower’s degree level, field of study, and the type of institution attended. This high average debt significantly impacts borrowers’ financial stability for many years after graduation, often delaying major life milestones such as homeownership and family formation.

Demographics Most Affected by Student Loan Debt

Student loan debt disproportionately affects certain demographic groups. Borrowers from lower socioeconomic backgrounds often face greater challenges in repaying their loans due to limited financial resources and fewer opportunities. Similarly, minority groups are often overrepresented among borrowers with high levels of student loan debt. These disparities highlight the need for targeted interventions and policies to address the inequitable impact of student loan debt.

Growth of Student Loan Debt Over the Past 10 Years

The following table illustrates the growth of student loan debt in the US over the past decade. The data highlights the dramatic increase in the total amount of debt, underscoring the need for effective strategies to manage and mitigate the long-term consequences. Note that these figures are approximations based on available data and may vary slightly depending on the source.

| Year | Total Student Loan Debt (Trillions USD) | Average Debt per Borrower (Thousands USD) | % Change from Previous Year |

|---|---|---|---|

| 2014 | 1.2 | 29 | – |

| 2015 | 1.3 | 30 | 8.3% |

| 2016 | 1.4 | 32 | 7.7% |

| 2017 | 1.5 | 34 | 7.1% |

| 2018 | 1.6 | 36 | 6.7% |

| 2019 | 1.7 | 38 | 6.3% |

| 2020 | 1.7 | 39 | 2.6% |

| 2021 | 1.75 | 40 | 2.9% |

| 2022 | 1.8 | 42 | 2.9% |

| 2023 | 1.85 | 44 | 2.8% |

Types of Student Loans Available

Navigating the world of student loans can feel overwhelming, but understanding the fundamental differences between loan types is crucial for making informed financial decisions. This section will clarify the distinctions between federal and private loans, outlining their respective features and implications.

Federal vs. Private Student Loans

Federal student loans are offered by the U.S. government through programs like the Federal Direct Loan Program. Private student loans, on the other hand, are offered by banks, credit unions, and other private lenders. Key differences lie in eligibility requirements, repayment options, and interest rates. Federal loans generally offer more borrower protections and flexible repayment plans.

Federal Student Loan Repayment Plans

Several repayment plans are available for federal student loans, each designed to cater to different financial situations. Choosing the right plan can significantly impact your monthly payments and overall repayment timeline.

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. It’s the default plan for most federal loans and offers the shortest repayment timeline, resulting in lower overall interest paid but higher monthly payments.

- Graduated Repayment Plan: Payments start low and gradually increase over time, making it initially more manageable but leading to higher payments later in the repayment period.

- Extended Repayment Plan: This plan extends the repayment period to up to 25 years, resulting in lower monthly payments but higher overall interest paid.

- Income-Driven Repayment (IDR) Plans: These plans, including Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE), base your monthly payment on your income and family size. Payments are typically lower, and any remaining balance may be forgiven after 20 or 25 years, depending on the plan, though this forgiveness is considered taxable income.

Interest Rates and Fees

Interest rates and fees vary significantly between federal and private loans, and even within federal loan programs. Federal student loans typically offer lower interest rates than private loans, especially for undergraduate students. Private loan interest rates are often variable and depend on creditworthiness. Fees, such as origination fees, may also apply to both federal and private loans. For example, a subsidized federal loan may have a lower interest rate than an unsubsidized federal loan because the government pays the interest while the student is in school. Private loans may charge higher fees and require a credit check, unlike subsidized federal loans.

Eligibility Requirements

Eligibility for federal student loans is generally determined by factors such as enrollment status, financial need (for some programs), and U.S. citizenship or eligible non-citizen status. Private student loans, on the other hand, typically require a credit check and may consider credit history, income, and co-signer availability. Some private lenders may offer loans to students with less-than-perfect credit, but these loans often come with higher interest rates.

Types of Student Loans: A Summary

- Federal Student Loans: Offered by the U.S. government, these loans generally offer lower interest rates, flexible repayment options, and borrower protections. Examples include Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans.

- Private Student Loans: Offered by private lenders, these loans often have higher interest rates and stricter eligibility requirements. They may require a credit check and a co-signer.

The Impact of Student Loan Debt on Individuals and the Economy

The burden of student loan debt extends far beyond the individual borrower, significantly impacting their financial well-being and creating ripple effects throughout the national economy. The sheer scale of this debt necessitates a thorough examination of its consequences on personal financial stability and broader economic growth. Delayed major life decisions and reduced consumer spending are just two of the many ramifications.

The effects of student loan debt are multifaceted and far-reaching, influencing various aspects of borrowers’ lives and the overall economic landscape. High levels of student loan debt often lead to significant financial strain, limiting opportunities and hindering economic progress both for individuals and the nation.

Effects on Major Life Decisions

Student loan debt significantly restricts borrowers’ ability to make crucial life decisions. The considerable monthly payments often leave little room for saving, forcing many to postpone or forgo major purchases and life milestones. For instance, the high cost of monthly loan repayments often makes homeownership unattainable for many young adults. The dream of a stable family life is also affected, as the financial burden of student loan repayments can delay marriage and starting a family, or even make it financially impossible for some. Furthermore, the prospect of retirement often seems distant, as the majority of disposable income is channeled towards loan repayments, leaving little or nothing for retirement savings. This can lead to a precarious financial future, especially considering the rising cost of living.

Economic Consequences of High Student Loan Debt

High student loan debt has profound economic consequences, both for individuals and the broader economy. At the individual level, it can lead to reduced consumer spending, hindering economic growth. When a significant portion of income is dedicated to loan repayment, less money is available for other goods and services, thereby dampening overall economic activity. This decreased consumer spending can trigger a domino effect, impacting businesses and potentially leading to job losses. On a national scale, high levels of student loan debt can contribute to slower economic growth and increased financial instability. The inability of borrowers to participate fully in the economy restricts potential economic gains. For example, delayed home purchases decrease housing market activity, while postponed family planning affects the birth rate and future workforce size.

Correlation Between Student Loan Debt and Delayed Life Milestones

A strong correlation exists between the level of student loan debt and the postponement of significant life milestones. Research consistently shows that individuals with substantial student loan debt are more likely to delay marriage, homeownership, and starting a family. They may also postpone further education or career advancement opportunities due to financial constraints. For example, a recent study by the Federal Reserve found that individuals with high student loan debt were significantly less likely to own a home compared to their peers without such debt. This delay in achieving key life goals not only impacts individual well-being but also contributes to broader economic trends.

Impact of Student Loan Debt on Various Aspects of Life

| Aspect of Life | Impact of High Student Loan Debt | Example | Potential Long-Term Consequences |

|---|---|---|---|

| Homeownership | Delayed or prevented due to high monthly payments and limited savings | A young couple postpones buying a house for several years due to substantial student loan repayments. | Reduced wealth accumulation, potential for renting indefinitely. |

| Retirement Savings | Significantly reduced or non-existent due to prioritization of loan repayments | An individual allocates minimal funds to retirement accounts, prioritizing student loan payments. | Financial insecurity in retirement, dependence on social security. |

| Family Planning | Delayed or forgone due to financial constraints | A young couple decides to postpone having children until their student loan debt is significantly reduced. | Reduced birth rate, potential for decreased workforce participation in the future. |

| Consumer Spending | Reduced due to limited disposable income | An individual restricts spending on non-essential goods and services to manage student loan payments. | Reduced economic activity, potential for slower economic growth. |

Government Policies and Initiatives Related to Student Loans

The US government plays a significant role in the student loan system, acting as both a lender and a regulator. Its policies directly impact the accessibility, affordability, and ultimately, the burden of student loan debt on borrowers. Understanding these policies is crucial to comprehending the current state of the crisis and potential solutions.

Current government policies attempt to balance the need for accessible higher education with the growing concern over unsustainable debt levels. This involves a complex interplay of loan programs, repayment plans, and forgiveness initiatives, each with its own strengths and limitations.

Current Government Policies Addressing Student Loan Debt

The federal government offers various programs aimed at managing and mitigating student loan debt. These range from income-driven repayment plans, which tie monthly payments to a borrower’s income, to loan forgiveness programs for specific professions or situations. Significant efforts are also made to improve financial literacy and promote responsible borrowing practices among students. However, the effectiveness of these measures is a subject of ongoing debate.

Recent Changes and Proposed Changes to Student Loan Repayment Programs

Recent years have witnessed significant shifts in student loan repayment policies. For example, the pause on federal student loan payments implemented during the COVID-19 pandemic offered temporary relief to millions of borrowers. While this pause has ended, its impact on borrowers’ financial situations and the long-term implications for repayment strategies are still being analyzed. Proposed changes often center around expanding income-driven repayment options, increasing loan forgiveness amounts for specific professions like teachers and public service workers, and simplifying the application process for these programs. The debate frequently revolves around the cost of these programs to taxpayers versus the benefits to borrowers.

Comparison of Government Initiatives to Reduce Student Loan Debt

Several government initiatives aim to reduce student loan debt. These include: Income-Driven Repayment (IDR) plans, which adjust monthly payments based on income; Public Service Loan Forgiveness (PSLF), which forgives remaining debt after 10 years of qualifying public service; and Targeted Loan Forgiveness programs, offering debt relief for specific circumstances, such as borrowers defrauded by their educational institution. A direct comparison highlights the varying eligibility criteria, forgiveness timelines, and overall impact on different borrower demographics. For instance, PSLF has faced criticism for its stringent eligibility requirements, while IDR plans have been praised for their flexibility but criticized for potentially extending repayment periods significantly.

Effectiveness of Past and Current Government Policies in Mitigating the Student Loan Debt Problem

The effectiveness of past and current government policies is a complex issue. While programs like IDR plans offer short-term relief by lowering monthly payments, they often result in a longer repayment period and increased total interest paid over the loan’s lifetime. Loan forgiveness programs, while offering complete debt relief for qualifying borrowers, can be costly for taxpayers and may not reach those most in need. The long-term impact of these policies requires further analysis, considering factors such as changes in higher education costs, borrower behavior, and the overall economic climate. Data on default rates, repayment completion rates, and borrower satisfaction are key indicators used to assess the success of these initiatives.

Summary of Government Initiatives

The following is a summary of key government initiatives related to student loans:

- Income-Driven Repayment (IDR) Plans: Adjust monthly payments based on income and family size.

- Public Service Loan Forgiveness (PSLF): Forgives remaining debt after 10 years of qualifying public service.

- Targeted Loan Forgiveness Programs: Offer debt relief for specific circumstances (e.g., borrower defense to repayment).

- Federal Student Aid Programs: Provide grants, loans, and work-study opportunities to eligible students.

- Financial Literacy Initiatives: Aim to educate students about responsible borrowing and financial planning.

Strategies for Managing and Repaying Student Loans

Successfully navigating student loan repayment requires a proactive and informed approach. Understanding various repayment options and employing effective budgeting strategies are crucial for minimizing stress and achieving financial stability. This section Artikels practical steps and resources to help borrowers manage and repay their student loans efficiently.

Effective Repayment Strategies

Several strategies can help borrowers manage and repay their student loans effectively. These strategies often involve choosing the right repayment plan and sticking to a disciplined budget. The most suitable approach depends on individual circumstances, including income, loan amount, and financial goals. Common strategies include the standard repayment plan (fixed monthly payments over 10 years), extended repayment plan (longer repayment period, lower monthly payments), graduated repayment plan (payments increase over time), and income-driven repayment plans (payments based on income and family size). Income-driven plans, while offering lower monthly payments, often result in a higher total interest paid over the life of the loan.

Benefits and Drawbacks of Repayment Strategies

The standard repayment plan offers predictability and a shorter repayment period, but higher monthly payments may be challenging for some borrowers. Extended repayment plans reduce monthly payments but increase the total interest paid. Graduated repayment plans offer lower initial payments, increasing over time, which can be helpful for those anticipating income growth. Income-driven repayment plans offer the lowest monthly payments based on income, but they often extend the repayment period significantly, leading to higher overall interest costs and potential for loan forgiveness after 20-25 years, depending on the plan. Careful consideration of long-term financial implications is crucial when choosing a repayment strategy. For example, a borrower with a high income might prefer a standard repayment plan to minimize total interest paid, while a borrower with a lower income might benefit from an income-driven plan to manage monthly expenses.

Budgeting Techniques for Managing Student Loan Payments

Effective budgeting is paramount for successful student loan repayment. Creating a detailed budget that tracks income and expenses is essential. This involves categorizing expenses (housing, food, transportation, entertainment, etc.) and identifying areas for potential savings. The 50/30/20 rule, allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment, can be a helpful guideline. Tracking expenses using budgeting apps or spreadsheets allows for monitoring progress and identifying areas for improvement. For example, reducing dining out expenses or finding cheaper transportation options can free up funds for loan repayment. Prioritizing loan payments and automating payments can also contribute to consistent repayment and avoid late fees.

Importance of Financial Literacy in Managing Student Loan Debt

Financial literacy plays a critical role in effectively managing student loan debt. Understanding basic financial concepts such as budgeting, saving, investing, and credit scores is crucial. This knowledge empowers borrowers to make informed decisions regarding repayment strategies, avoid financial pitfalls, and plan for long-term financial well-being. Resources such as online courses, workshops, and financial counseling services can enhance financial literacy. For example, understanding the implications of different repayment plans and the impact of interest rates allows borrowers to choose the most suitable option based on their individual circumstances.

Resources for Managing Student Loans

A range of resources are available to assist borrowers in managing their student loans.

- National Student Loan Data System (NSLDS): Provides access to student loan information.

- Federal Student Aid (FSA): Offers information and resources on federal student loans.

- StudentAid.gov: The official U.S. Department of Education website for student aid.

- Your Loan Servicer: Provides personalized support and information about your specific loans.

- Nonprofit Credit Counseling Agencies: Offer free or low-cost financial counseling services.

The Future of Student Loans in the USA

Predicting the future of student loans in the USA is complex, involving interwoven factors like economic conditions, government policies, and evolving societal attitudes towards higher education. Several key trends and potential policy shifts will likely shape the landscape in the coming years.

Potential Future Trends in Student Loan Debt and Repayment

The overall trajectory of student loan debt hinges on several interconnected elements. Increased tuition costs, coupled with stagnant wage growth, could lead to a continued rise in borrowing. Conversely, increased awareness of the financial burden of student loans, along with a greater emphasis on vocational training and alternative educational pathways, might temper the growth rate. Repayment trends will likely be influenced by evolving government programs, the implementation of income-driven repayment plans, and the potential for widespread loan forgiveness initiatives. For example, a scenario where inflation outpaces wage growth could make repayment significantly more challenging for borrowers, potentially leading to higher default rates. Conversely, a strong economy with robust job growth could improve repayment rates and reduce the overall burden of student loan debt.

Potential Policy Changes Impacting Student Loan Debt

Several policy changes could dramatically alter the student loan landscape. These include adjustments to income-driven repayment plans, making them more accessible and forgiving; modifications to the interest rates charged on federal loans, potentially lowering them to reflect market conditions; and the implementation of broader loan forgiveness programs, potentially targeting specific demographics or loan types. For instance, a hypothetical policy change might involve tying student loan repayment amounts to a percentage of discretionary income, adjusting annually based on inflation. This could significantly alleviate the burden for low- and middle-income borrowers. Conversely, a shift towards stricter eligibility criteria for federal student aid could reduce overall borrowing but potentially limit access to higher education for some students.

Potential Solutions to Address the Growing Problem of Student Loan Debt

Addressing the growing problem requires a multifaceted approach. Increased investment in affordable higher education, including expanding grant programs and tuition control mechanisms, could reduce reliance on loans. Promoting financial literacy among prospective students and their families, enabling them to make informed borrowing decisions, is crucial. Furthermore, exploring alternative financing models, such as income-share agreements, could provide a less burdensome path to funding education. For example, a state could implement a program offering tuition-free community college, thereby reducing the need for student loans for a significant portion of its residents. Simultaneously, a national campaign could be launched to educate high school students on the importance of budgeting and responsible borrowing practices, including the long-term implications of student loan debt.

Hypothetical Scenario: The Future of Student Loans in 2035

Imagine the year 2035. Tuition costs have risen, but at a slower rate than in previous decades, due to increased government funding and a shift towards more affordable online and hybrid learning models. Income-driven repayment plans have been significantly improved, with more generous terms and automatic adjustments based on inflation and individual income. Loan forgiveness programs have been implemented, targeting borrowers in specific fields deemed essential to the national economy, such as healthcare and education. As a result, while student loan debt remains a significant factor in the economy, its overall impact on individuals and the national economy is considerably lessened. The number of borrowers facing extreme financial hardship due to student loan debt has decreased substantially. This positive shift reflects a concerted effort by government, educational institutions, and individuals to address the challenges of higher education financing in a more sustainable and equitable manner.

Ending Remarks

The student loan debt crisis in the USA demands a multifaceted approach, encompassing individual financial responsibility, effective government policies, and a renewed focus on affordable higher education. While the path to resolving this complex issue is not straightforward, a combination of informed decision-making, proactive repayment strategies, and potential policy reforms can pave the way towards a more sustainable and equitable future. By understanding the landscape of student loans and employing the strategies discussed, borrowers can significantly improve their financial well-being and contribute to a healthier national economy.

Clarifying Questions

What happens if I default on my student loans?

Defaulting on your student loans can lead to serious consequences, including wage garnishment, tax refund offset, and damage to your credit score, making it difficult to obtain loans or credit in the future.

Can I consolidate my federal student loans?

Yes, you can consolidate multiple federal student loans into a single loan with a new repayment plan. This can simplify payments but may not always lower your interest rate.

Are there any income-driven repayment plans for private student loans?

Generally, income-driven repayment plans are only available for federal student loans, not private loans. However, some private lenders may offer alternative repayment options.

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, or deferment. Unsubsidized loans accrue interest from the time they’re disbursed.